|

|

市場調査レポート

商品コード

1295486

POC (ポイントオブケア) 分子診断の世界市場:製品別 (アッセイ・キット、装置、ソフトウェア)・用途別 (呼吸器疾患、院内感染、がん、性感染症、肝炎)・技術別 (RT-PCR、INAAT)・エンドユーザー別 (診療所、病院・ICU) の将来予測 (2028年まで)Point of Care Molecular Diagnostics Market by Product (Assays, Kits, Instruments, Software), Application (Respiratory Diseases, HAIs, Cancer, STDs, Hepatitis), Technology (RT-PCR, INAAT), End User (Clinics, Hospitals, ICUs) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| POC (ポイントオブケア) 分子診断の世界市場:製品別 (アッセイ・キット、装置、ソフトウェア)・用途別 (呼吸器疾患、院内感染、がん、性感染症、肝炎)・技術別 (RT-PCR、INAAT)・エンドユーザー別 (診療所、病院・ICU) の将来予測 (2028年まで) |

|

出版日: 2023年06月14日

発行: MarketsandMarkets

ページ情報: 英文 207 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のPOC (ポイントオブケア) 分子診断の市場規模は、2023年の20億米ドルから、2028年には34億米ドルに達すると予測され、予測期間中のCAGRは10.6%と見込まれています。

市場成長の原動力は、感染症やがんの有病率の増加、分散型診断への注目の高まり、研究開発資金の増加、感染症の早期発見に対する意識の高まり、POC診断検査の利用拡大などの要因です。一方、製品上市サイクルを大幅に増加させる厳しく時間のかかる規制方針は、製品化後の市場成長に影響を与える可能性があります。

"製品・サービス別では、アッセイ・キットが予測期間中に最も高い成長率を達成する"

POC分子診断市場を製品・サービス別に見ると、2022年にはアッセイ・キット市場が最も高い成長率で成長しました。装置に比べてアッセイ・キットが大量に必要とされることが、このセグメントの高い成長率に寄与している主な要因です。機器に比べてアッセイ・キットが繰り返し購入されていることも、市場の成長要因の一つです。

"病院・ICUセグメントが最も高いCAGRを達成する"

POC分子診断市場をエンドユーザー別に見ると、2022年には病院・ICUのセグメントが最も大きな成長率を達成しました。病院や臨床現場でPOC分子検査を利用する主な利点の1つは、従来のPOC検査とは異なり、納期が迅速で精度も向上していることです。病院・ICU分野の市場シェアが高いのは、病院数の増加や、これらの医療施設における診断用製品に対する需要の高さに起因しています。

"アジア太平洋:POC分子診断市場で最も急成長している地域"

世界のPOC分子診断市場を地域別に見ると、アジア太平洋が予測期間を通じて最も高いCAGRを示すと予測されています。アジア太平洋市場の著しい成長は、いくつかの要因によるものと考えられます。これには、疾病の早期発見に関する意識を高め、定期的な健康診断を促進するための各国政府による積極的な取り組み、同地域における医療費の増加、インドや中国などの国々における病院や臨床診断検査室の数の増加、インド・中国・日本における診断手順の研究能力の強化などが含まれます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- PESTLE分析

- 規制分析

- 貿易分析

- 技術分析

- 主要な会議とイベント (2023年~2024年)

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

第6章 POC分子診断市場:製品・サービス別

- イントロダクション

- アッセイ・キット

- 測定・分析装置

- ソフトウェア・サービス

第7章 POC分子診断市場:技術別

- イントロダクション

- RT-PCR

- INAAT

- その他の技術

第8章 POC分子診断市場:用途別

- イントロダクション

- 呼吸器疾患

- 性感染症

- 院内感染

- がん

- 肝炎

- 胃腸障害

- その他の用途

- COVID-19

第9章 POC分子診断市場:エンドユーザー別

- イントロダクション

- 開業医

- 病院・ICU

- 研究機関

- その他のエンドユーザー

第10章 POC分子診断市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業の戦略

- 上位企業の収益シェア分析

- 市場シェア分析

- 企業評価クアドラント

- 新興企業/中小企業の競合リーダーシップマッピング (2022年)

- 競合ベンチマーキング

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- ABBOTT LABORATORIES

- F. HOFFMANN-LA ROCHE LTD.

- BIOMERIEUX SA

- DANAHER CORPORATION

- QIAGEN N.V.

- QUIDELORTHO CORPORATION

- CO-DIAGNOSTICS, INC.

- BIOCARTIS NV

- MERIDIAN BIOSCIENCE, INC.

- THERMO FISHER SCIENTIFIC INC.

- その他の企業

- LUCIRA HEALTH, INC.

- CUE HEALTH

- OPGEN, INC.

- BINX HEALTH, INC.

- MOLBIO DIAGNOSTICS PVT. LTD.

- GENOMADIX

- VISBY MEDICAL, INC.

- QUIKPATH PTE. LTD.

- MD-BIO

- QUANTUMDX GROUP LTD.

- AIDIAN OY

- GENESTAT MOLECULAR DIAGNOSTICS, LLC.

- LABSYSTEMS DIAGNOSTICS OY

- AKONNI BIOSYSTEMS

- CURETIS N.V.

第13章 付録

The global point-of-care molecular diagnostics market size is projected to reach USD 3.4 billion by 2028 from USD 2.0 billion in 2023, at a CAGR of 10.6% during the forecast period. Market growth is driven by factors such as the increasing prevalence of infectious diseases and cancer, rising focus on decentralized diagnostics and increasing R&D funding, increasing awareness on the early detection of infectious diseases, and the increasing use of POC diagnostic tests. On the other hand, stringent and time-consuming regulatory policies that significantly increase the product launch cycle may challenge market growth post their commercialization.

"The assays & kits accounted for the highest growth rate in the point-of-care molecular diagnostics market, by product & service, during the forecast period"

The point-of-care molecular diagnostics market is segmented into assays & kits, instruments & analyzers and software and services. The assays & kits segment accounted for the highest growth rate in the point-of-care molecular diagnostics market in 2022. The requirement assays & kits in large numbers compared to instruments is the main factor contributing to this segment's high growth rate. This segment's market growth can also be attributed to repeat purchases of assays & kits compared to instruments.

"Hospitals & ICUs segment accounted for the highest CAGR"

The point-of-care molecular diagnostics market is divided into various end-user segments, including physicians' offices, hospitals & ICUs, research institutes, and other end users. In 2022, the hospitals & ICUs segment experienced the most significant growth rate. One of the primary advantages of utilizing point-of-care molecular tests in hospitals or clinical settings, as opposed to traditional point-of-care tests, is their ability to provide faster turnaround times and increased accuracy. The hospitals & ICUs segment's substantial market share can be attributed to the growing number of hospitals and the high demand for diagnostic products within these healthcare facilities.

"Asia Pacific: The fastest-growing region point-of-care molecular diagnostics market"

The global market for point-of-care molecular diagnostics is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these regions, the Asia Pacific region is anticipated to exhibit the highest compound annual growth rate (CAGR) throughout the forecast period. The remarkable growth in the Asia Pacific market can be attributed to several factors. These include the proactive efforts by governments to raise awareness about early disease detection and promote regular health check-ups, the increasing healthcare expenditure in the region, the rising number of hospitals and clinical diagnostic laboratories in countries like India and China, and the strengthening research capabilities in diagnostic procedures across India, China, and Japan.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18% and Latin America 6% and Middle East & Africa 4%

Prominent companies Abbott Laboratories (US), F. Hoffmann-La Roche Ltd. (Switzerland), bioMerieux SA (France), Danaher Corporation (US), QIAGEN N.V. (Netherlands), QuidelOrtho Corporation (US), Co-Diagnostics, Inc. (US), Biocartis NV (Belgium), Meridian Bioscience, Inc. (US), Thermo Fisher Scientific, Inc. (US), Lucira Health, Inc. (US), Cue Health (US), OpGen, Inc. (US), Binx Health, Inc. (US), Molbio Diagnostics Pct. Ltd. (India), Genomadix (Canada), Visby Medical, Inc. (US), QuikPath PTE Ltd. (Singapore), MD-Bio (US), QuantuMDx Group Ltd. (UK), Aidian Oy (Finland), GeneSTAT Molecular Diagnostics, LLC. (US), Labsystems Diagnostics Oy (Finland), Akonni Biosystems (US) and Curetis N.V. (Germany).

Research Coverage:

This research report categorizes the point of care molecular diagnostics market by product & service, technology, application, end user and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the point-of-care molecular diagnostics market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the point of care molecular diagnostics market. Competitive analysis of upcoming startups in the point of care molecular diagnostics market ecosystem is covered in this report.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall point-of-care molecular diagnostics market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the point of care molecular diagnostics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the point of care molecular diagnostics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the point of care molecular diagnostics market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the point of care molecular diagnostics market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies and service offerings of leading players like Abbott Laboratories (US), F. Hoffmann-La Roche Ltd. (Switzerland), bioMerieux SA (France), Danaher Corporation (US), and QIAGEN N.V. (Netherlands), among others in the point of care molecular diagnostics market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKETS COVERED

- 1.3.1 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STUDY LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- FIGURE 1 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

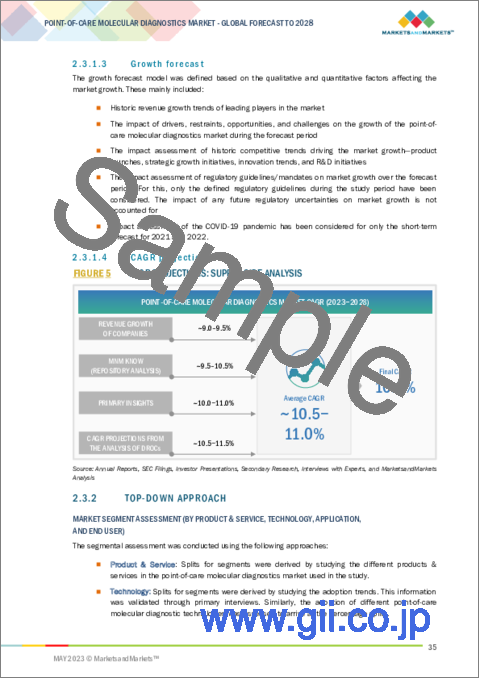

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

- 2.8.1 RISK ASSESSMENT: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- 2.9 RECESSION IMPACT: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET OVERVIEW

- FIGURE 13 RISING ADOPTION OF POC DIAGNOSTICS TO SUPPORT MARKET GROWTH DURING FORECAST PERIOD

- 4.2 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE, BY PRODUCT & SERVICE, 2023 VS. 2028

- FIGURE 14 ASSAYS & KITS SEGMENT TO CONTINUE TO DOMINATE MARKET IN 2028

- 4.3 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE, BY TECHNOLOGY, 2023 VS. 2028

- FIGURE 15 RT-PCR SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE, BY APPLICATION, 2023 VS. 2028

- FIGURE 16 RESPIRATORY DISEASES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE, BY END USER, 2023 VS. 2028

- FIGURE 17 PHYSICIANS' OFFICES SEGMENT TO CONTINUE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- 4.6 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 18 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of infectious diseases and cancer

- 5.2.1.2 Rising focus on decentralized diagnostics and increasing R&D funding

- 5.2.1.3 Growing awareness of the early detection of infectious diseases

- 5.2.1.4 Increasing use of POC diagnostic tests

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable reimbursement scenario

- 5.2.2.2 High capital investments and low cost-benefit ratio

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing R&D activities in point-of-care molecular diagnostics testing

- 5.2.3.2 Growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent and time-consuming regulatory policies that significantly increase product launch cycle

- 5.2.4.2 Introduction of alternative technologies

- 5.3 PRICING ANALYSIS

- TABLE 1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT

- 5.4 PATENT ANALYSIS

- FIGURE 20 PATENT ANALYSIS FOR POINT-OF-CARE MOLECULAR DIAGNOSTICS (JANUARY 2013-DECEMBER 2022)

- 5.4.1 LIST OF KEY PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASE

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 22 POINT-OF-CARE MOLECULAR DIAGNOSTICS: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 23 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: ECOSYSTEM ANALYSIS

- 5.7.1 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: ROLE IN ECOSYSTEM

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PESTLE ANALYSIS

- 5.10 REGULATORY ANALYSIS

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.1 North America

- 5.10.1.1.1 US

- 5.10.1.1.2 Canada

- 5.10.1.2 Europe

- 5.10.1.3 Asia Pacific

- 5.10.1.3.1 China

- 5.10.1.3.2 Japan

- 5.10.1.3.3 India

- 5.10.1.4 Latin America

- 5.10.1.4.1 Brazil

- 5.10.1.4.2 Mexico

- 5.10.1.5 Middle East

- 5.10.1.6 Africa

- 5.10.1.1 North America

- 5.11 TRADE ANALYSIS

- TABLE 8 IMPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 9 EXPORT DATA FOR DIAGNOSTIC AND LABORATORY REAGENTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 TECHNOLOGY ANALYSIS

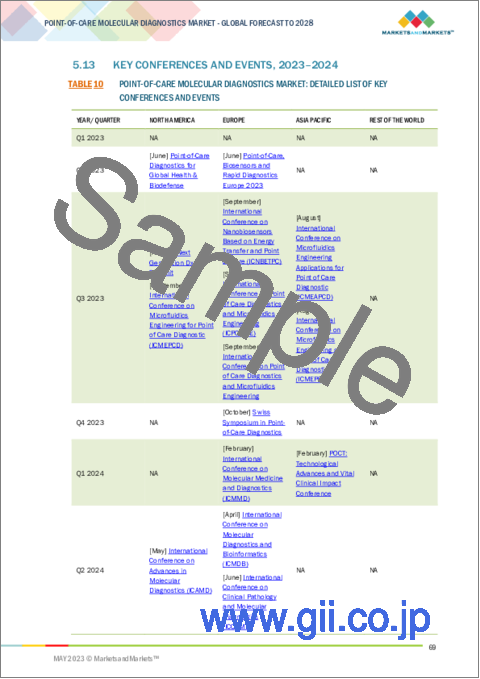

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 10 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE SHIFT IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF POINT-OF-CARE MOLECULAR DIAGNOSTICS PRODUCTS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF POINT-OF-CARE MOLECULAR DIAGNOSTICS PRODUCTS

- 5.15.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR POINT-OF-CARE MOLECULAR DIAGNOSTICS PRODUCTS

- TABLE 12 KEY BUYING CRITERIA FOR POINT-OF-CARE MOLECULAR DIAGNOSTIC PRODUCTS

6 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- TABLE 13 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- 6.2 ASSAYS & KITS

- 6.2.1 RECURRENT PURCHASES OF ASSAYS & KITS TO DRIVE GROWTH

- TABLE 14 KEY ASSAYS & KITS AVAILABLE IN MARKET

- TABLE 15 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR ASSAYS & KITS, BY REGION, 2021-2028 (USD MILLION)

- 6.3 INSTRUMENTS & ANALYZERS

- 6.3.1 INCREASING ADOPTION OF POC TECHNOLOGIES TO DRIVE GROWTH IN MARKET

- TABLE 16 KEY INSTRUMENTS & ANALYZERS AVAILABLE IN MARKET

- TABLE 17 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR INSTRUMENTS & ANALYZERS, BY REGION, 2021-2028 (USD MILLION)

- 6.4 SOFTWARE & SERVICES

- 6.4.1 GROWING UPTAKE OF ADVANCED INSTRUMENTS TO DRIVE DEMAND

- TABLE 18 KEY SOFTWARE & SERVICES AVAILABLE IN MARKET

- TABLE 19 POINT-OF-CARE DIAGNOSTICS MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021-2028 (USD MILLION)

7 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 20 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 RT-PCR

- 7.2.1 GROWING PREVALENCE OF INFECTIOUS DISEASES TO DRIVE MARKET GROWTH

- TABLE 21 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR RT-PCR, BY REGION, 2021-2028 (USD MILLION)

- 7.3 INAAT

- 7.3.1 COST BENEFITS OF INAAT TO BOOST DEMAND

- TABLE 22 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR INAAT, BY REGION, 2021-2028 (USD MILLION)

- 7.4 OTHER TECHNOLOGIES

- TABLE 23 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021-2028 (USD MILLION)

8 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 24 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2 RESPIRATORY DISEASES

- 8.2.1 RISING DEMAND FOR EARLY DIAGNOSIS AND DETECTION OF RESPIRATORY DISEASES TO DRIVE GROWTH

- TABLE 25 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR RESPIRATORY DISEASES, BY REGION, 2021-2028 (USD MILLION)

- 8.3 SEXUALLY TRANSMITTED DISEASES

- 8.3.1 TECHNOLOGICAL ADVANCEMENTS FOR DETECTION OF STDS TO FAVOR MARKET GROWTH

- TABLE 26 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR SEXUALLY TRANSMITTED DISEASES, BY REGION, 2021-2028 (USD MILLION)

- 8.4 HOSPITAL-ACQUIRED INFECTIONS

- 8.4.1 RISING BURDEN OF MRSA TO SUPPORT GROWTH

- TABLE 27 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITAL-ACQUIRED INFECTIONS, BY REGION, 2021-2028 (USD MILLION)

- 8.5 CANCER

- 8.5.1 RISING PREVALENCE OF CANCER AND GROWING FUNDING FOR CANCER RESEARCH TO DRIVE MARKET

- TABLE 28 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR CANCER, BY REGION, 2021-2028 (USD MILLION)

- 8.6 HEPATITIS

- 8.6.1 INCREASING CASES OF HEPATITIS AMONG HIGH-RISK SUBGROUP POPULATIONS TO BOOST GROWTH

- TABLE 29 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HEPATITIS, BY REGION, 2021-2028 (USD MILLION)

- 8.7 GASTROINTESTINAL DISORDERS

- 8.7.1 GROWING INCIDENCE OF GASTROINTESTINAL DISORDERS TO PROPEL MARKET

- TABLE 30 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 8.8 OTHER APPLICATIONS

- TABLE 31 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 8.9 COVID-19

- 8.9.1 DECLINING CASES OF COVID-19 TO HINDER MARKET GROWTH

- TABLE 32 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR COVID-19, BY REGION, 2021-2028 (USD MILLION)

9 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 33 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 PHYSICIANS' OFFICES

- 9.2.1 FASTER RESULTS ASSOCIATED WITH POINT-OF-CARE MOLECULAR ASSAYS TO DRIVE GROWTH

- TABLE 34 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR PHYSICIANS' OFFICES, BY REGION, 2021-2028 (USD MILLION)

- 9.3 HOSPITALS & ICUS

- TABLE 35 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS & ICUS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 36 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR HOSPITALS & ICUS, BY DISEASE TYPE, 2021-2028 (USD MILLION)

- 9.3.1 SEPSIS

- 9.3.1.1 Growing need for quick diagnosis and treatment to favor market growth

- 9.3.2 GASTROENTERITIS

- 9.3.2.1 Growing incidence of gastroenteritis cases in emergency departments to propel growth

- 9.3.3 MENINGOENCEPHALITIS

- 9.3.3.1 Severity of disease and need for early detection to drive demand

- 9.3.4 OTHER DISEASES

- 9.4 RESEARCH INSTITUTES

- 9.4.1 INCREASING USE OF POC MOLECULAR DIAGNOSTIC TESTS IN GENOMICS RESEARCH TO CONTRIBUTE TO MARKET GROWTH

- TABLE 37 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- 9.5 OTHER END USERS

- TABLE 38 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

10 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 39 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 RECESSION IMPACT: NORTH AMERICA

- FIGURE 27 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SNAPSHOT

- TABLE 40 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Growing prevalence of infectious diseases to drive market

- TABLE 45 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 46 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 47 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 48 US: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Rising government initiatives to propel market growth in coming years

- TABLE 49 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 50 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 51 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 52 CANADA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT: EUROPE

- TABLE 53 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 55 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 56 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 57 EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Increasing healthcare expenditure to drive market growth in Germany

- TABLE 58 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 59 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 60 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 61 GERMANY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Increasing prevalence of infectious diseases to fuel growth

- TABLE 62 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 63 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 64 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 65 UK: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Rising R&D expenditure in France to boost market

- TABLE 66 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 67 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 68 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 69 FRANCE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Adoption of advanced diagnostic technologies to favor growth

- TABLE 70 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 71 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 72 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 73 ITALY: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Growing demand for genetic testing in Spain to create major growth opportunities for market players

- TABLE 74 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 75 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 76 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 77 SPAIN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 78 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 79 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 80 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 81 REST OF EUROPE: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT: ASIA PACIFIC

- FIGURE 28 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SNAPSHOT

- TABLE 82 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Growing public access to modern healthcare to drive market growth

- TABLE 87 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 88 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 89 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 90 CHINA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Universal healthcare reimbursement policy to drive market growth in Japan

- TABLE 91 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 92 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 93 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 94 JAPAN: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Increasing private & public investments in healthcare system to support market growth

- TABLE 95 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 96 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 97 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 98 INDIA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC (ROAPAC)

- TABLE 99 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 LOW PER CAPITA HEALTH SPENDING TO RESTRAIN MARKET GROWTH

- 10.5.2 RECESSION IMPACT: LATIN AMERICA

- TABLE 103 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 104 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 LACK OF SKILLED RESOURCES TO RESTRICT MARKET GROWTH

- 10.6.2 RECESSION IMPACT: MIDDLE EAST & AFRICA

- TABLE 107 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY PRODUCT & SERVICE, 2021-2028 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES OF KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- TABLE 111 OVERVIEW OF STRATEGIES DEPLOYED BY KEY POINT-OF-CARE MOLECULAR DIAGNOSTICS MANUFACTURING COMPANIES

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 29 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET (2018-2022)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 30 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE, BY KEY PLAYER (2022)

- TABLE 112 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET SHARE: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 LIST OF EVALUATED VENDORS

- 11.5.2 STARS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PERVASIVE PLAYERS

- 11.5.5 PARTICIPANTS

- FIGURE 31 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- 11.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2022)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 32 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2022

- 11.7 COMPETITIVE BENCHMARKING

- 11.7.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

- FIGURE 33 PRODUCT & SERVICE AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET

- TABLE 113 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPANY REGIONAL FOOTPRINT

- TABLE 114 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: COMPANY PRODUCT & SERVICE FOOTPRINT

- TABLE 115 POINT-OF-CARE MOLECULAR DIAGNOSTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 116 KEY PRODUCT LAUNCHES & APPROVALS

- 11.8.2 DEALS

- TABLE 117 KEY DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 ABBOTT LABORATORIES

- TABLE 118 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- FIGURE 34 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

- 12.1.2 F. HOFFMANN-LA ROCHE LTD.

- TABLE 119 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- FIGURE 35 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- 12.1.3 BIOMERIEUX SA

- TABLE 120 BIOMERIEUX SA: BUSINESS OVERVIEW

- FIGURE 36 BIOMERIEUX SA: COMPANY SNAPSHOT (2022)

- 12.1.4 DANAHER CORPORATION

- TABLE 121 DANAHER CORPORATION: BUSINESS OVERVIEW

- FIGURE 37 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.5 QIAGEN N.V.

- TABLE 122 QIAGEN N.V.: BUSINESS OVERVIEW

- FIGURE 38 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

- 12.1.6 QUIDELORTHO CORPORATION

- TABLE 123 QUIDELORTHO CORPORATION: BUSINESS OVERVIEW

- FIGURE 39 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.7 CO-DIAGNOSTICS, INC.

- TABLE 124 CO-DIAGNOSTICS INC.: BUSINESS OVERVIEW

- FIGURE 40 CO-DIAGNOSTICS, INC.: COMPANY SNAPSHOT (2022)

- 12.1.8 BIOCARTIS NV

- TABLE 125 BIOCARTIS NV: BUSINESS OVERVIEW

- FIGURE 41 BIOCARTIS NV: COMPANY SNAPSHOT (2022)

- 12.1.9 MERIDIAN BIOSCIENCE, INC.

- TABLE 126 MERIDIAN BIOSCIENCE, INC.: BUSINESS OVERVIEW

- FIGURE 42 MERIDIAN BIOSCIENCE, INC.: COMPANY SNAPSHOT (2022)

- 12.1.10 THERMO FISHER SCIENTIFIC INC.

- TABLE 127 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- FIGURE 43 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 LUCIRA HEALTH, INC.

- 12.2.2 CUE HEALTH

- 12.2.3 OPGEN, INC.

- 12.2.4 BINX HEALTH, INC.

- 12.2.5 MOLBIO DIAGNOSTICS PVT. LTD.

- 12.2.6 GENOMADIX

- 12.2.7 VISBY MEDICAL, INC.

- 12.2.8 QUIKPATH PTE. LTD.

- 12.2.9 MD-BIO

- 12.2.10 QUANTUMDX GROUP LTD.

- 12.2.11 AIDIAN OY

- 12.2.12 GENESTAT MOLECULAR DIAGNOSTICS, LLC.

- 12.2.13 LABSYSTEMS DIAGNOSTICS OY

- 12.2.14 AKONNI BIOSYSTEMS

- 12.2.15 CURETIS N.V.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS