|

|

市場調査レポート

商品コード

1620872

治療薬物モニタリング(TDM)の世界市場:製品別、技術別、薬剤クラス別、治療領域別、検体別、エンドユーザー別 - 予測(~2029年)Therapeutic Drug Monitoring Market by Product (Equipments,Consumables), Technology (Immunoassays), Drug Class (Anti-Epileptic Drugs,Anti-Arrhythmic Drugs), Therapeutic Area (Oncology, Cardiology), Specimen (Blood), End user - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 治療薬物モニタリング(TDM)の世界市場:製品別、技術別、薬剤クラス別、治療領域別、検体別、エンドユーザー別 - 予測(~2029年) |

|

出版日: 2024年12月18日

発行: MarketsandMarkets

ページ情報: 英文 381 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の治療薬物モニタリング(TDM)の市場規模は、2024年の23億米ドルから2029年までに34億4,000万米ドルに達すると予測され、CAGRで8.4%の健全な成長が見込まれます。

イムノアッセイ技術の進歩は依然としてこの成長の主な促進要因であり、この部門の軌道にプラスの影響を与えています。これらの技術は、増強化学発光、ELISA、蛍光増強など、投薬モニタリングの精度、速度、特異性の向上を目指しています。一方、医療従事者は、治療成績の向上におけるTDMの重要性をより認識するようになり、臨床現場へのTDMの導入につながっています。教育やトレーニングの取り組みにより、TDMの利点に対する臨床医の理解が深まり、日常診療への導入が容易になっています。これらの要素が総体的に、ダイナミックに成長する市場環境に影響を与えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 米ドル |

| セグメント | 製品、技術、薬剤クラス、治療領域、検体、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ、GCC諸国 |

「製品別では、消耗品セグメントが予測期間にもっとも高いCAGRで成長する見込みです。」

治療薬物モニタリング(TDM)では消耗品セグメントがもっとも高いCAGRを有しています。試薬、アッセイキット、キャリブレーターなどの消耗品は、がん、心血管疾患、神経疾患など、慢性的な一方で治療が複雑な疾患の治療薬のルーチンモニタリングに不可欠であるため、TDM市場で非常に重要な役割を担っています。オーダーメイド治療への注目が高まり、正確な薬物レベルの評価の必要性が高まった結果、高品質な消耗品への需要が高まっています。さらに、研究所や病院が製造する先進のTDMシステムに資金を費やすことで、その関連商品の需要が高まり、市場の拡大を後押しする可能性があります。

「検体別では、血液セグメントが予測期間に市場で最大のシェアを占める見込みです。」

血液はTDMにもっとも使用される検体であり、血漿や血清中の薬物濃度を正確かつ直接測定できることから市場を牽引しています。血液の採取と処理には確立されたプロトコルがあり、信頼性と一貫性が確保されています。また、イムノアッセイやLC-MS/MSなどの最先端技術と互換性があり、薬物を正確に定量することができるため、治療モニタリングにおける最新の要求に応えることができます。また、血液を用いたTDMを支持する規制ガイドラインや臨床慣行にも支えられています。投与量の最適化に向けた薬物動態のモニタリングにおいてそのメリットが証明され、治療成績が向上しており、これらすべてが臨床現場での採用に有利に働いています。

「米国が北米の薬剤モニタリング市場でもっとも高いCAGRで成長します。」

米国では、心血管疾患、糖尿病、神経疾患、がんなどの慢性疾患の有病率が高まっており、TDMの需要に拍車をかけています。これらの疾患のいくつかは、有害事象を減らす対策を講じることで治療効果を最適化するために徹底的なモニタリングが必要であり、そのためTDM技術の採用ペースが高まっています。また、同国の医療枠組みは確立され、よく整備されているため、多数の病院、研究所、診断センターが存在し、これが先進のエンドの統合をさらに後押ししています。さらに、多数の製薬企業やバイオテクノロジー企業のプレゼンスに支えられたTDM技術の絶え間ない革新が、モニタリングツールの入手可能性と進歩を保証しています。これらすべての要因が合わさり、米国のTDM市場の急成長に拍車をかけています。

当レポートでは、世界の治療薬物モニタリング(TDM)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 治療薬物モニタリング(TDM)市場の概要

- アジア太平洋の治療薬物モニタリング(TDM)の市場シェア:薬剤クラス別、国別(2023年)

- 治療薬物モニタリング(TDM)市場:主要国別

- 治療薬物モニタリング(TDM)市場:地域の構成(2024年~2029年)

- 治療薬物モニタリング(TDM)市場:発展途上市場 vs. 先進市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 規制情勢

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東

- アフリカ

- 貿易分析

- 特許分析

- 主な会議とイベント(2025年・2026年)

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 投資と資金調達のシナリオ

- 治療薬物モニタリング(TDM)市場に対する生成AIの影響

第6章 治療薬物モニタリング(TDM)市場:製品別

- イントロダクション

- 消耗品

- 装置

- 免疫分析装置

- クロマトグラフィ・MS検出器

- 臨床化学分析装置

第7章 治療薬物モニタリング(TDM)市場:技術別

- イントロダクション

- イムノアッセイ

- ELISA

- 化学発光イムノアッセイ

- 蛍光イムノアッセイ

- 比色イムノアッセイ

- その他の免疫測定

- クロマトグラフィ - MS

- 液体クロマトグラフィ - 質数量分析

- ガスクロマトグラフィ - 質数量分析

- その他の技術

第8章 治療薬物モニタリング(TDM)市場:薬剤クラス別

- イントロダクション

- 抗てんかん薬

- 抗不整脈薬

- 免疫抑制薬

- 抗生物質

- 気管支拡張薬

- 向精神薬

- その他の薬剤

第9章 治療薬物モニタリング(TDM)市場:治療領域別

- イントロダクション

- 神経疾患

- 心臓病

- 感染症

- 腫瘍

- その他の治療領域

第10章 治療薬物モニタリング(TDM)市場:検体別

- イントロダクション

- 血液

- 唾液

- その他の検体

第11章 治療薬物モニタリング(TDM)市場:エンドユーザー別

- イントロダクション

- 病院検査室

- 商業・民間検査室

- その他のエンドユーザー

第12章 治療薬物モニタリング(TDM)市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 日本

- 中国

- インド

- オーストラリア

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- GCC諸国

第13章 競合情勢

- 概要

- 強み

- 主要企業が採用した戦略

- 収益分析

- 市場シェア分析

- 企業の評価マトリクス:主要企業

- 企業の評価マトリクス:スタートアップ/中小企業

- 企業の評価と財務指標

- 製品/ブランドの比較

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- ABBOTT

- THERMO FISHER SCIENTIFIC INC.

- F. HOFFMANN-LA ROCHE LTD.

- SIEMENS HEALTHINEERS AG

- DANAHER CORPORATION

- BIO-RAD LABORATORIES, INC.

- BIOMERIEUX SA

- BIOSYNEX SA

- GRIFOLS, S.A.

- EXAGEN INC.

- ARK DIAGNOSTICS, INC.

- R-BIOPHARM AG

- RANDOX LABORATORIES LTD.

- その他の企業

- APDIA GROUP

- BBI SOLUTIONS

- EAGLE BIOSCIENCES, INC.

- JASEM LABORATORY SYSTEMS AND SOLUTIONS

- AALTO SCIENTIFIC, LTD.

- IMMUNDIAGNOSTIK AG

- UTAK

- SEKISUI MEDICAL CO., LTD.

- DIASYSTEM SCANDINAVIA AB

- CAMBRIDGE LIFE SCIENCES LIMITED

- CHROMSYSTEMS INSTRUMENTS & CHEMICALS GMBH

- BUHLMANN LABORATORIES AG

- SJK GLOBAL, LLC

- EPITOPE DIAGNOSTICS, INC.

- QED BIOSCIENCE INC.

- BODITECH MED INC.

- IMMUNODIAGNOSTIC SYSTEMS

第15章 付録

List of Tables

- TABLE 1 RISK ASSESSMENT: THERAPEUTIC DRUG MONITORING MARKET

- TABLE 2 CLASSES OF DRUGS THAT REQUIRE MONITORING

- TABLE 3 GLOBAL INCIDENCE OF INFECTIOUS DISEASES

- TABLE 4 AVERAGE SELLING PRICE OF THERAPEUTIC DRUG MONITORING PRODUCTS, BY TYPE

- TABLE 5 AVERAGE SELLING PRICE OF THERAPEUTIC DRUG MONITORING PRODUCTS, BY KEY PLAYER, 2022-2024

- TABLE 6 AVERAGE SELLING PRICE OF THERAPEUTIC DRUG MONITORING PRODUCTS, BY KEY REGION

- TABLE 7 THERAPEUTIC DRUG MONITORING MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 IMPORT DATA FOR INSTRUMENTS AND APPARATUS USED IN PHYSICAL AND CHEMICAL ANALYSIS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 13 EXPORT DATA FOR INSTRUMENTS AND APPARATUS USED IN PHYSICAL AND CHEMICAL ANALYSIS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 14 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 THERAPEUTIC DRUG MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 17 KEY BUYING CRITERIA FOR END USERS

- TABLE 18 AI APPLICATIONS IN THERAPEUTIC DRUG MONITORING

- TABLE 19 THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 20 THERAPEUTIC DRUG MONITORING CONSUMABLES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 21 NORTH AMERICA: THERAPEUTIC DRUG MONITORING CONSUMABLES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 22 EUROPE: THERAPEUTIC DRUG MONITORING CONSUMABLES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 23 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING CONSUMABLES MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 24 DRUGS MONITORED USING ANALYTICAL EQUIPMENT

- TABLE 25 THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 26 THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 27 NORTH AMERICA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 28 EUROPE: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 29 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 30 THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAY ANALYZERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 31 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAY ANALYZERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 32 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAY ANALYZERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 33 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAY ANALYZERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 34 CHROMATOGRAPHY & MS DETECTORS: PRODUCT LAUNCHES, BY COMPANY, 2020-2024

- TABLE 35 THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY & MS DETECTORS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 36 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY & MS DETECTORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 37 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY & MS DETECTORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 38 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY & MS DETECTORS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 39 THERAPEUTIC DRUG MONITORING MARKET FOR CLINICAL CHEMISTRY ANALYZERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 40 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR CLINICAL CHEMISTRY ANALYZERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 41 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR CLINICAL CHEMISTRY ANALYZERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 42 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR CLINICAL CHEMISTRY ANALYZERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 43 THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 44 THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 45 THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 46 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 47 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 48 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 49 THERAPEUTIC DRUG MONITORING MARKET FOR ENZYME-LINKED IMMUNOSORBENT ASSAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 50 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR ENZYME-LINKED IMMUNOSORBENT ASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 51 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR ENZYME-LINKED IMMUNOSORBENT ASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 52 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR ENZYME-LINKED IMMUNOSORBENT ASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 53 EXAMPLES OF CLIA SYSTEMS

- TABLE 54 LIST OF COMPOUNDS ANALYZED BY CHEMILUMINESCENCE IMMUNOASSAYS

- TABLE 55 THERAPEUTIC DRUG MONITORING MARKET FOR CHEMILUMINESCENCE IMMUNOASSAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR CHEMILUMINESCENCE IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 57 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR CHEMILUMINESCENCE IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 58 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR CHEMILUMINESCENCE IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

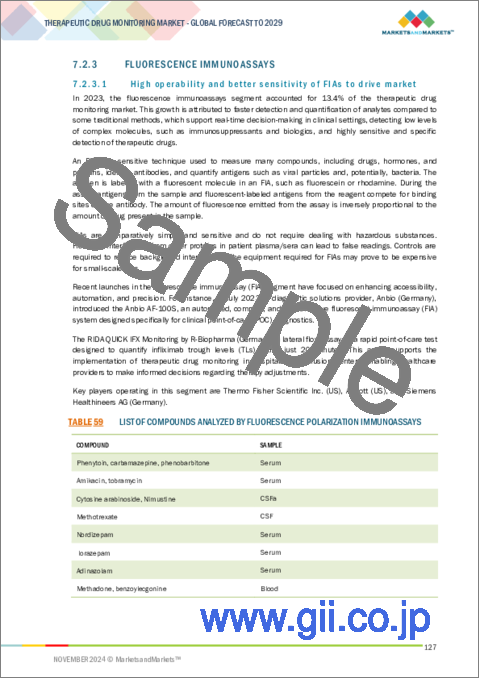

- TABLE 59 LIST OF COMPOUNDS ANALYZED BY FLUORESCENCE POLARIZATION IMMUNOASSAYS

- TABLE 60 THERAPEUTIC DRUG MONITORING MARKET FOR FLUORESCENCE IMMUNOASSAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 61 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR FLUORESCENCE IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 62 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR FLUORESCENCE IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 63 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR FLUORESCENCE IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 64 THERAPEUTIC DRUG MONITORING MARKET FOR COLORIMETRIC IMMUNOASSAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 65 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR COLORIMETRIC IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 66 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR COLORIMETRIC IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 67 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR COLORIMETRIC IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 68 THERAPEUTIC DRUG MONITORING MARKET FOR OTHER IMMUNOASSAYS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 69 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 70 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 71 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER IMMUNOASSAYS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 72 THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 73 THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 75 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 76 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 77 THERAPEUTIC DRUG MONITORING MARKET FOR LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 79 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 80 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 81 THERAPEUTIC DRUG MONITORING MARKET FOR GAS CHROMATOGRAPHY-MASS SPECTROMETRY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 82 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR GAS CHROMATOGRAPHY-MASS SPECTROMETRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 83 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR GAS CHROMATOGRAPHY-MASS SPECTROMETRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 84 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR GAS CHROMATOGRAPHY-MASS SPECTROMETRY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 85 THERAPEUTIC DRUG MONITORING MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 87 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 88 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 89 THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 90 DOSAGE GUIDELINES FOR NEW ANTIEPILEPTIC DRUGS IN ADOLESCENTS AND ADULTS

- TABLE 91 THERAPEUTIC DRUG MONITORING: LIMITATIONS FACED IN NEW ANTIEPILEPTIC DRUGS

- TABLE 92 THERAPEUTIC DRUG MONITORING MARKET FOR ANTIEPILEPTIC DRUGS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIEPILEPTIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 94 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIEPILEPTIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIEPILEPTIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 96 CLASSIFICATION OF ANTIARRHYTHMIC THERAPIES

- TABLE 97 THERAPEUTIC DRUG MONITORING MARKET FOR ANTIARRHYTHMIC DRUGS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIARRHYTHMIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 99 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIARRHYTHMIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIARRHYTHMIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 101 COMMONLY USED IMMUNOSUPPRESSANT DRUGS IN ORGAN TRANSPLANTS

- TABLE 102 THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOSUPPRESSANT DRUGS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOSUPPRESSANT DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 104 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOSUPPRESSANT DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOSUPPRESSANT DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 106 EXAMPLES OF ANTIBIOTIC DRUGS

- TABLE 107 COMPARISON OF DIFFERENT TECHNOLOGIES FOR DETERMINING ANTIMICROBIAL LEVELS IN BIOFLUIDS

- TABLE 108 THERAPEUTIC DRUG MONITORING MARKET FOR ANTIBIOTIC DRUGS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 109 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIBIOTIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 110 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIBIOTIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 111 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR ANTIBIOTIC DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 112 EXAMPLES OF BRONCHODILATOR DRUGS

- TABLE 113 THERAPEUTIC DRUG MONITORING MARKET FOR BRONCHODILATOR DRUGS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR BRONCHODILATOR DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 115 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR BRONCHODILATOR DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 116 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR BRONCHODILATOR DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 117 EXAMPLES OF PSYCHOACTIVE DRUGS

- TABLE 118 THERAPEUTIC DRUG MONITORING MARKET FOR PSYCHOACTIVE DRUGS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 119 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR PSYCHOACTIVE DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 120 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR PSYCHOACTIVE DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 121 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR PSYCHOACTIVE DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 122 EXAMPLES OF OTHER DRUGS

- TABLE 123 THERAPEUTIC DRUG MONITORING MARKET FOR OTHER DRUGS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 124 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 125 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 126 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER DRUGS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 127 THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 128 PREVALENCE OF NEUROLOGICAL DISORDERS

- TABLE 129 THERAPEUTIC DRUG MONITORING MARKET FOR NEUROLOGICAL DISORDERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 130 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 131 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 133 THERAPEUTIC DRUG MONITORING MARKET FOR CARDIOLOGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 134 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR CARDIOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 135 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR CARDIOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 136 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR CARDIOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 137 THERAPEUTIC DRUG MONITORING MARKET FOR INFECTIOUS DISEASES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 138 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 139 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 140 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR INFECTIOUS DISEASES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 141 INCREASING INCIDENCE OF CANCER, BY REGION, 2022 VS. 2030 VS. 2040 (MILLION)

- TABLE 142 THERAPEUTIC DRUG MONITORING MARKET FOR ONCOLOGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 143 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR ONCOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 144 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR ONCOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 145 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR ONCOLOGY, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 146 THERAPEUTIC DRUG MONITORING MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 147 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 148 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 149 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER THERAPEUTIC AREAS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 150 THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 151 THERAPEUTIC DRUG MONITORING MARKET FOR BLOOD SAMPLES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 152 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 153 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 154 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR BLOOD SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 155 THERAPEUTIC DRUG MONITORING MARKET FOR SALIVA SAMPLES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 156 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR SALIVA SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 157 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR SALIVA SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 158 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR SALIVA SAMPLES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 159 THERAPEUTIC DRUG MONITORING MARKET FOR OTHER SPECIMENS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 160 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER SPECIMENS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 161 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER SPECIMENS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 162 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER SPECIMENS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 163 THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 164 THERAPEUTIC DRUG MONITORING MARKET FOR HOSPITAL LABORATORIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 165 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 166 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 167 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR HOSPITAL LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 168 THERAPEUTIC DRUG MONITORING MARKET FOR COMMERCIAL & PRIVATE LABORATORIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 169 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR COMMERCIAL & PRIVATE LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 170 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR COMMERCIAL & PRIVATE LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 171 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR COMMERCIAL & PRIVATE LABORATORIES, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 172 THERAPEUTIC DRUG MONITORING MARKET FOR OTHER END USERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 173 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 174 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 175 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 176 THERAPEUTIC DRUG MONITORING MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 177 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 178 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 179 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 180 NORTH AMERICA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 181 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 182 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 183 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 184 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 185 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 186 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 187 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 188 FDA NOVEL DRUG THERAPY APPROVALS FOR 2023

- TABLE 189 NUMBER OF TESTS COVERED BY MEDICARE FOR EACH DRUG CLASS

- TABLE 190 US: NUMBER OF LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY TESTS, 2022-2029 (MILLION)

- TABLE 191 US: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 192 US: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 193 US: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 194 US: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 195 US: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 196 US: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 197 US: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 198 US: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 199 US: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 200 CANADA: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 201 CANADA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 202 CANADA: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 203 CANADA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 204 CANADA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 205 CANADA: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 206 CANADA: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 207 CANADA: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 208 CANADA: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 209 EUROPE: CANCER INCIDENCE, BY TYPE, 2022 VS. 2030

- TABLE 210 EUROPE: KEY MACROINDICATORS

- TABLE 211 EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 212 EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 213 EUROPE: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 214 EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 215 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 216 EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 217 EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 218 EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 219 EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 220 EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 221 GERMANY: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 222 GERMANY: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 223 GERMANY: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 224 GERMANY: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 225 GERMANY: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 226 GERMANY: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 227 GERMANY: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 228 GERMANY: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 229 GERMANY: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 230 UK: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 231 UK: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 232 UK: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 233 UK: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 234 UK: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 235 UK: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 236 UK: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 237 UK: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 238 UK: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 239 FRANCE: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 240 FRANCE: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 241 FRANCE: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 242 FRANCE: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 243 FRANCE: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 244 FRANCE: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 245 FRANCE: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 246 FRANCE: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 247 FRANCE: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 248 ITALY: CANCER INCIDENCE, BY TYPE, 2022 VS. 2030

- TABLE 249 ITALY: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 250 ITALY: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 251 ITALY: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 252 ITALY: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 253 ITALY: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 254 ITALY: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 255 ITALY: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 256 ITALY: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 257 ITALY: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 258 SPAIN: CANCER INCIDENCE, BY TYPE, 2022 VS. 2030

- TABLE 259 SPAIN: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 260 SPAIN: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 261 SPAIN: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 262 SPAIN: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 263 SPAIN: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 264 SPAIN: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 265 SPAIN: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 266 SPAIN: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 267 SPAIN: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 268 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 269 REST OF EUROPE: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 270 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 271 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 272 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 273 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 274 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 275 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 276 REST OF EUROPE: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 277 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 278 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 279 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 280 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 281 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 282 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 283 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 284 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 285 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 286 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 287 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 288 JAPAN: CANCER INCIDENCE, BY TYPE, 2022 VS. 2030

- TABLE 289 JAPAN: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 290 JAPAN: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 291 JAPAN: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 292 JAPAN: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 293 JAPAN: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 294 JAPAN: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 295 JAPAN: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 296 JAPAN: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 297 JAPAN: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 298 CHINA: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 299 CHINA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 300 CHINA: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 301 CHINA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 302 CHINA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 303 CHINA: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 304 CHINA: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 305 CHINA: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 306 CHINA: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 307 INDIA: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 308 INDIA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 309 INDIA: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 310 INDIA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 311 INDIA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 312 INDIA: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 313 INDIA: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 314 INDIA: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 315 INDIA: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 316 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 317 AUSTRALIA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 318 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 319 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 320 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 321 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 322 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 323 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 324 AUSTRALIA: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 325 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 326 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 327 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 328 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 329 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 330 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 331 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 332 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 333 REST OF ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 334 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 335 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 336 LATIN AMERICA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 337 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 338 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 339 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 340 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 341 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 342 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 343 LATIN AMERICA: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 344 MIDDLE EAST & AFRICA: CANCER INCIDENCE, BY COUNTRY, 2022 VS. 2045

- TABLE 345 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 346 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 347 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 348 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 349 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 352 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 355 GCC COUNTRIES: CANCER INCIDENCE, BY COUNTRY, 2022 VS. 2045

- TABLE 356 GCC COUNTRIES: KEY MACROINDICATORS

- TABLE 357 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2022-2029 (USD MILLION)

- TABLE 358 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING EQUIPMENT MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 359 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2022-2029 (USD MILLION)

- TABLE 360 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET FOR IMMUNOASSAYS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 361 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET FOR CHROMATOGRAPHY-MS, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 362 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2022-2029 (USD MILLION)

- TABLE 363 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 364 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2022-2029 (USD MILLION)

- TABLE 365 GCC COUNTRIES: THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 366 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-NOVEMBER 2024

- TABLE 367 THERAPEUTIC DRUG MONITORING MARKET: DEGREE OF COMPETITION

- TABLE 368 THERAPEUTIC DRUG MONITORING MARKET: REGION FOOTPRINT

- TABLE 369 THERAPEUTIC DRUG MONITORING MARKET: PRODUCT FOOTPRINT

- TABLE 370 THERAPEUTIC DRUG MONITORING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 371 THERAPEUTIC DRUG MONITORING MARKET: END-USER FOOTPRINT

- TABLE 372 THERAPEUTIC DRUG MONITORING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 373 THERAPEUTIC DRUG MONITORING MARKET: PRODUCT LAUNCHES, JANUARY 2021-NOVEMBER 2024

- TABLE 374 THERAPEUTIC DRUG MONITORING MARKET: DEALS, JANUARY 2021- NOVEMBER 2024

- TABLE 375 THERAPEUTIC DRUG MONITORING MARKET: EXPANSIONS, JANUARY 2021-NOVEMBER 2024

- TABLE 376 ABBOTT: COMPANY OVERVIEW

- TABLE 377 ABBOTT: PRODUCTS OFFERED

- TABLE 378 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 379 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 380 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 381 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 382 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW

- TABLE 383 CURRENCY CONVERSION FOR F. HOFFMANN-LA ROCHE LTD.

- TABLE 384 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS OFFERED

- TABLE 385 F. HOFFMANN-LA ROCHE LTD.: PRODUCT LAUNCHES, JANUARY 2021- OCTOBER 2024

- TABLE 386 F. HOFFMANN-LA ROCHE LTD.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 387 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 388 CURRENCY CONVERSION FOR SIEMENS HEALTHINEERS AG

- TABLE 389 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 390 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES, JANUARY 2021- OCTOBER 2024

- TABLE 391 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 392 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 393 DANAHER CORPORATION: PRODUCTS OFFERED

- TABLE 394 DANAHER CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 395 DANAHER CORPORATION: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 396 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 397 BIO-RAD LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 398 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES, JANUARY 2021- OCTOBER 2024

- TABLE 399 BIO-RAD LABORATORIES, INC.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 400 BIOMERIEUX SA: COMPANY OVERVIEW

- TABLE 401 CURRENCY CONVERSION FOR BIOMERIEUX SA

- TABLE 402 BIOMERIEUX SA: PRODUCTS OFFERED

- TABLE 403 BIOSYNEX SA: COMPANY OVERVIEW

- TABLE 404 CURRENCY CONVERSION FOR BIOSYNEX SA

- TABLE 405 BIOSYNEX SA: PRODUCTS OFFERED

- TABLE 406 BIOSYNEX SA: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 407 BIOSYNEX SA: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 408 GRIFOLS, S.A.: COMPANY OVERVIEW

- TABLE 409 GRIFOLS, S.A.: PRODUCTS OFFERED

- TABLE 410 GRIFOLS, S.A.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 411 EXAGEN INC.: COMPANY OVERVIEW

- TABLE 412 EXAGEN INC.: PRODUCTS OFFERED

- TABLE 413 EXAGEN INC.: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 414 ARK DIAGNOSTICS, INC.: COMPANY OVERVIEW

- TABLE 415 ARK DIAGNOSTICS, INC.: PRODUCTS OFFERED

- TABLE 416 R-BIOPHARM AG: COMPANY OVERVIEW

- TABLE 417 R-BIOPHARM AG: PRODUCTS OFFERED

- TABLE 418 R-BIOPHARM AG: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 419 RANDOX LABORATORIES LTD.: COMPANY OVERVIEW

- TABLE 420 RANDOX LABORATORIES LTD.: PRODUCTS OFFERED

- TABLE 421 APDIA GROUP: COMPANY OVERVIEW

- TABLE 422 BBI SOLUTIONS: COMPANY OVERVIEW

- TABLE 423 EAGLE BIOSCIENCES, INC.: COMPANY OVERVIEW

- TABLE 424 JASEM LABORATORY SYSTEMS AND SOLUTIONS: COMPANY OVERVIEW

- TABLE 425 AALTO SCIENTIFIC, LTD.: COMPANY OVERVIEW

- TABLE 426 IMMUNDIAGNOSTIK AG: COMPANY OVERVIEW

- TABLE 427 UTAK: COMPANY OVERVIEW

- TABLE 428 SEKISUI MEDICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 429 DIASYSTEM SCANDINAVIA AB: COMPANY OVERVIEW

- TABLE 430 CAMBRIDGE LIFE SCIENCES LIMITED: COMPANY OVERVIEW

- TABLE 431 CHROMSYSTEMS INSTRUMENTS & CHEMICALS GMBH: COMPANY OVERVIEW

- TABLE 432 BUHLMANN LABORATORIES AG: COMPANY OVERVIEW

- TABLE 433 SJK GLOBAL, LLC: COMPANY OVERVIEW

- TABLE 434 EPITOPE DIAGNOSTICS, INC.: COMPANY OVERVIEW

- TABLE 435 QED BIOSCIENCE INC.: COMPANY OVERVIEW

- TABLE 436 BODITECH MED INC.: COMPANY OVERVIEW

- TABLE 437 IMMUNODIAGNOSTIC SYSTEMS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 THERAPEUTIC DRUG MONITORING MARKET SEGMENTATION

- FIGURE 2 THERAPEUTIC DRUG MONITORING MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 6 ESTIMATING GLOBAL THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 THERAPEUTIC DRUG MONITORING MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF THERAPEUTIC DRUG MONITORING MARKET

- FIGURE 17 RISING PREFERENCE FOR PRECISION MEDICINE TO DRIVE MARKET

- FIGURE 18 ANTIEPILEPTIC DRUGS ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2023

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH FROM 2024 TO 2029

- FIGURE 20 ASIA PACIFIC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 22 THERAPEUTIC DRUG MONITORING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 UK: NUMBER OF DECEASED DONORS AND TRANSPLANTS, APRIL 1, 2020-MARCH 31, 2024

- FIGURE 24 PERSONALIZED MEDICINE APPROVALS BY US FDA, 2015-2022

- FIGURE 25 NUMBER OF RESEARCH PUBLICATIONS ON THERAPEUTIC DRUG MONITORING, 2015-2021

- FIGURE 26 INCIDENCE OF DIABETES, BY REGION, 2021 VS. 2030 VS. 2045 (MILLION)

- FIGURE 27 NUMBER OF US ADULTS WITH ACTIVE EPILEPSY, BY AGE GROUP (THOUSAND)

- FIGURE 28 INCIDENCE OF CANCER, BY REGION, 2022 VS. 2030 VS. 2045 (MILLION)

- FIGURE 29 GROWTH IN CURRENT HEALTHCARE EXPENDITURE PER CAPITA IN BRICS COUNTRIES, 2014-2021

- FIGURE 30 VALUE CHAIN ANALYSIS: MAJOR VALUE-ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 31 DIRECT DISTRIBUTION-PREFERRED STRATEGY FOR PROMINENT COMPANIES

- FIGURE 32 THERAPEUTIC DRUG MONITORING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 33 PATENT ANALYSIS FOR THERAPEUTIC DRUG MONITORING, JANUARY 2015-DECEMBER 2023

- FIGURE 34 REVENUE SHIFT FOR THERAPEUTIC DRUG MONITORING

- FIGURE 35 THERAPEUTIC DRUG MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 37 KEY BUYING CRITERIA FOR END USERS

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO

- FIGURE 39 US: PATIENTS ON WAITING LIST VS. TRANSPLANTS PERFORMED, BY ORGAN, 2023

- FIGURE 40 NORTH AMERICA: THERAPEUTIC DRUG MONITORING MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET SNAPSHOT

- FIGURE 42 THERAPEUTIC DRUG MONITORING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2021-2023 (USD BILLION)

- FIGURE 43 THERAPEUTIC DRUG MONITORING MARKET SHARE ANALYSIS, 2023

- FIGURE 44 THERAPEUTIC DRUG MONITORING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 45 THERAPEUTIC DRUG MONITORING MARKET: COMPANY FOOTPRINT

- FIGURE 46 THERAPEUTIC DRUG MONITORING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 47 EV/EBITDA OF KEY VENDORS

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 49 THERAPEUTIC DRUG MONITORING MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 ABBOTT: COMPANY SNAPSHOT (2023)

- FIGURE 51 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- FIGURE 52 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2023)

- FIGURE 53 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2023)

- FIGURE 54 DANAHER CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 55 BIO-RAD LABORATORIES: COMPANY SNAPSHOT (2023)

- FIGURE 56 BIOMERIEUX SA: COMPANY SNAPSHOT (2023)

- FIGURE 57 BIOSYNEX SA: COMPANY SNAPSHOT (2023)

- FIGURE 58 GRIFOLS, S.A.: COMPANY SNAPSHOT (2023)

- FIGURE 59 EXAGEN INC.: COMPANY SNAPSHOT (2023)

It is anticipated that the therapeutic drug monitoring market will grow from USD 2.30 billion in 2024 to USD 3.44 billion by 2029, with a steady compound annual growth rate (CAGR) of 8.4%. Advancements in immunoassay techniques remain a key driver of this growth, influencing the sector's trajectory in a positive manner. These techniques aim to improve the accuracy, speed, and specificity of medication monitoring, including enhanced chemiluminescence, ELISA, and fluorescence enhancement. In the meantime, healthcare professionals are becoming more aware of the significance of TDM in improving therapeutic outcomes, leading to its incorporation into clinical settings. Education and training initiatives have raised clinicians' understanding of the advantages of TDM, making it easier for the technology to be implemented in everyday patient care. Collaboratively, these elements are influencing a dynamic and growing market environment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Product, Technology, Drug Class, Therapeutic Area, Specimen, End User, and Region |

| Regions covered | North America, Europe, APAC, Latin America, Middle East & Africa, and GCC Countries. |

"Consumables segment is expected to grow at the highest CAGR during the forecast period, by product."

The consumables segment holds the highest CAGR in the therapeutic drug monitoring. Consumables such as reagents, assay kits, and calibrators create a very important part in the TDM market as they are integral in routine monitoring of drugs for chronic but complex-to-cure conditions such as cancer, cardiovascular, and neurological disorders. Demand for high-quality consumables is growing as a result of the increased focus on customized therapy and the need for precise medication level evaluation. Additionally, spending money on advanced TDM systems produced by labs and hospitals would raise demand for its related goods, which would support market expansion.

"Blood segment is expected to hold the largest share of TDM market during the forecast period, by specimen."

Blood, as it is the most used specimen for TDM, fuels the market owing to its capability to provide precise and direct measurement of drug concentrations in plasma or serum. Well-established protocols in the collection and processing of blood ensure that it is reliable and consistent, while its wide clinical acceptance is well established. It is compatible with the most advanced technologies, including immunoassays and LC-MS/MS, by which drugs can be accurately quantified, meeting modern demands in therapeutic monitoring. Besides, this is supported by regulatory guidelines and clinical practices, which favor blood-based TDM; it has proved its merit in monitoring pharmacokinetics for the optimization of dose , which improves therapeutic outcomes, all combining to favor its adoption in a clinical setting.

"US to grow at the highest CAGR for North America therapeutic drug monitoring market"

The increasing prevalence in the US of chronic diseases of a cardiovascular nature, diabetes, neurological disorders, and cancer, among many others, significantly fuels this demand for TDM. Several of these disorders require thorough monitoring for the optimization of their treatment efficacy by taking measures to reduce adverse events, hence increasing the pace of adoption of TDM technologies. The well-established and well-developed healthcare framework of the country involves large numbers of hospitals, laboratories, and diagnostic centers, which further fortifies the integration of advanced end. Besides, continuous innovation in TDM technologies, supported by the presence of numerous pharmaceutical and biotech companies, ensures availability and advances in monitoring tools. These are all factors combined to spur the rapid growth of the TDM market in the US.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the therapeutic drug monitoringmarketplace.

- By Company Type: Tier 1 - 32%, Tier 2 - 44%, and Tier 3 - 24%

- By Designation: C-level Executives - 30%, Directors - 34%, and Others - 36%

- By Region: North America- 40%, Europe - 25%, Asia Pacific- 19%, Latin America- 8%, Middle East & Africa- 6% and GCC Countries- 2%

The companies included in Therapeutic Drug Monitoring market are Abbott (US), Thermo Fisher Scientific Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Siemens Healthineers AG (Germany), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US), bioMerieux SA (France), Biosynex SA (France), Grifols, S.A. (Spain), Exagen Inc. (US), ARK Diagnostics, Inc. (US), R-Biopharm AG (Germany), and Randox Laboratories Ltd. (UK), apDia Group (Belgium), BBI Solutions (UK), Eagle Biosciences, Inc. (US), Jasem Laboratory Systems and Solutions (Turkey), Aalto Scientific, Ltd. (US), Immundiagnostik AG (Germany), UTAK (US), Sekisui Medical Co., Ltd. (Japan), DiaSystem Scandinavia AB (Sweden), Cambridge Life Sciences Limited (UK), Chromsystems Instruments & Chemicals GmbH (Germany), BUHLMANN Laboratories AG (Switzerland), SJK Global, LLC (US), Epitope Diagnostics, Inc. (US), QED Bioscience Inc. (US), Boditech Med Inc. (South Korea), and Immunodiagnostic Systems (UK).

Research Coverage

This research report categorizes the therapeutic drug monitoring market by product (Equipment, and Consumables), by technology (Immunoassays, Chromatography-MS, and Other Technologies), by Drug Class (Anti-Epileptic Drugs, Anti-Arrhythmic Drugs, Immunosuppressant Drugs, Antibiotic Drugs, Bronchodilator Drugs, Psychoactive Drugs, and Other Drug Classes), by Therapeutic Area (Neurological Disorders , Cardiology, Infectious Diseases, Oncology, Other Therapeutic Areas), by Specimen (Blood, Saliva, and other samples), by End User (Hospital Laboratories, Commercial & Private Laboratories, and Other End Users) and by region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa and GCC Gountries). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the therapeutic drug monitoring market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the therapeutic drug monitoring market. Competitive analysis of upcoming startups in the therapeutic drug monitoring market ecosystem is covered in this report.

Reasons to buy this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall therapeutic drug monitoring market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

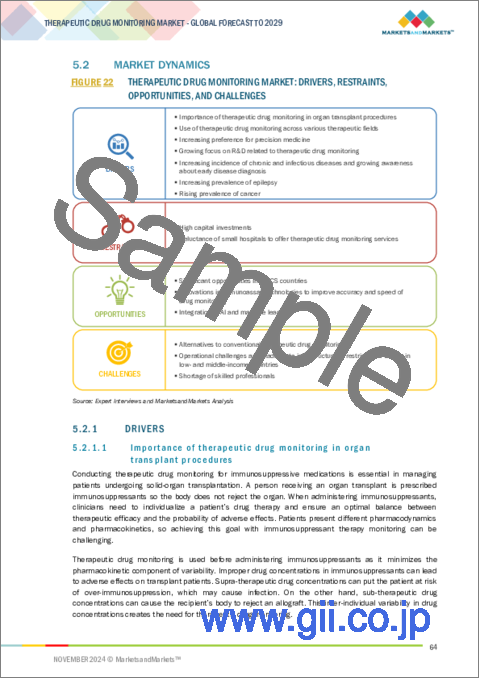

- Analysis of key drivers (Importance of therapeutic drug monitoring in organ transplant procedures, Use of therapeutic drug monitoring across various therapeutic fields, Increasing preferences for precision medicine, Growing focus on R&D related to therapeutic drug monitoring, Increasing incidence of chronic and infectious diseases and growing awareness about early disease diagnosis, Increase in prevalence of Epilepsy, Rising prevalence of cancer to drive adoption of Therapeutic Drug Monitoring in Oncology Treatments), restraints (High capital investments, Reluctance of small hospitals to offer therapeutic drug monitoring services), opportunities (Significant opportunities in BRICS countries, Innovations in immunoassay technologies to improve accuracy and speed of drug monitoring, Integration of AI and machine learning), and challenges (Alternatives to conventional therapeutic drug monitoring, Operational challenges and inadequate infrastructure to restrict TDM testing in low- and middle-income countries, Shortage of skilled professionals) influencing the growth of the therapeutic drug monitoring market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the therapeutic drug monitoring market

- Market Development: Comprehensive information about lucrative markets - the report analyses the therapeutic drug monitoring market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the therapeutic drug monitoring market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Abbott (US), Thermo Fisher Scientific Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Siemens Healthineers AG (Germany), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US), bioMerieux SA (France), Biosynex SA (France), Grifols, S.A. (Spain), Exagen Inc. (US), ARK Diagnostics, Inc. (US), R-Biopharm AG (Germany), and Randox Laboratories Ltd. (UK)) among others in therapeutic drug monitoring market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Lab-based analysis

- 2.2.1.3 Approach 3: Drug class-based analysis

- 2.2.1.4 Approach 4: Presentations of companies and primary interviews

- 2.2.1.5 Growth forecast

- 2.2.1.6 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SHARE ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 THERAPEUTIC DRUG MONITORING MARKET OVERVIEW

- 4.2 ASIA PACIFIC: THERAPEUTIC DRUG MONITORING MARKET SHARE, BY DRUG CLASS AND COUNTRY (2023)

- 4.3 THERAPEUTIC DRUG MONITORING MARKET, BY KEY COUNTRY

- 4.4 THERAPEUTIC DRUG MONITORING MARKET: REGIONAL MIX, 2024-2029

- 4.5 THERAPEUTIC DRUG MONITORING MARKET: DEVELOPING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Importance of therapeutic drug monitoring in organ transplant procedures

- 5.2.1.2 Use of therapeutic drug monitoring across various therapeutic fields

- 5.2.1.3 Increasing preference for precision medicine

- 5.2.1.4 Growing focus on R&D related to therapeutic drug monitoring

- 5.2.1.5 Increasing incidence of chronic and infectious diseases and growing awareness about early disease diagnosis

- 5.2.1.6 Increasing prevalence of epilepsy

- 5.2.1.7 Rising prevalence of cancer

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investments

- 5.2.2.2 Reluctance of small hospitals to offer therapeutic drug monitoring services

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Significant opportunities in BRICS countries

- 5.2.3.2 Innovations in immunoassay technologies to improve accuracy and speed of drug monitoring

- 5.2.3.3 Integration of AI and machine learning

- 5.2.4 CHALLENGES

- 5.2.4.1 Alternatives to conventional therapeutic drug monitoring

- 5.2.4.2 Operational challenges and inadequate infrastructure to restrict TDM testing in low- and middle-income countries

- 5.2.4.3 Shortage of skilled professionals

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- 5.7.1.2 Canada

- 5.7.2 EUROPE

- 5.7.3 ASIA PACIFIC

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.4 LATIN AMERICA

- 5.7.5 MIDDLE EAST

- 5.7.6 AFRICA

- 5.7.1 NORTH AMERICA

- 5.8 TRADE ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS IN 2025 AND 2026

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGY

- 5.12.1.1 Enzyme-linked immunosorbent assay

- 5.12.2 COMPLEMENTARY TECHNOLOGY

- 5.12.2.1 Liquid chromatography-mass spectrometry

- 5.12.3 ADJACENT TECHNOLOGY

- 5.12.3.1 Electrophoresis

- 5.12.1 KEY TECHNOLOGY

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 BARGAINING POWER OF SUPPLIERS

- 5.13.5 THREAT OF SUBSTITUTES

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF GENERATIVE ARTIFICIAL INTELLIGENCE (AI) ON THERAPEUTIC DRUG MONITORING MARKET

6 THERAPEUTIC DRUG MONITORING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 CONSUMABLES

- 6.2.1 REPEAT PURCHASES AND HIGH USAGE TO DRIVE MARKET

- 6.3 EQUIPMENT

- 6.3.1 IMMUNOASSAY ANALYZERS

- 6.3.1.1 High efficiency to drive adoption

- 6.3.2 CHROMATOGRAPHY & MS DETECTORS

- 6.3.2.1 Technological advancements to propel growth

- 6.3.3 CLINICAL CHEMISTRY ANALYZERS

- 6.3.3.1 Increasing incidence of chronic and complex diseases to drive market

- 6.3.1 IMMUNOASSAY ANALYZERS

7 THERAPEUTIC DRUG MONITORING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 IMMUNOASSAYS

- 7.2.1 ENZYME-LINKED IMMUNOSORBENT ASSAYS

- 7.2.1.1 Accurate measurement of target-specific proteins to drive market

- 7.2.2 CHEMILUMINESCENCE IMMUNOASSAYS

- 7.2.2.1 Rapid detection time and good specificity to support growth

- 7.2.3 FLUORESCENCE IMMUNOASSAYS

- 7.2.3.1 High operability and better sensitivity of FIAs to drive market

- 7.2.4 COLORIMETRIC IMMUNOASSAYS

- 7.2.4.1 Demand for colorimetric immunoassays to decline due to rising preference for advanced equipment

- 7.2.5 OTHER IMMUNOASSAYS

- 7.2.1 ENZYME-LINKED IMMUNOSORBENT ASSAYS

- 7.3 CHROMATOGRAPHY-MS

- 7.3.1 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY

- 7.3.1.1 High accuracy to drive demand for LC-MS

- 7.3.2 GAS CHROMATOGRAPHY-MASS SPECTROMETRY

- 7.3.2.1 Drawbacks of GC-MS to challenge market growth

- 7.3.1 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY

- 7.4 OTHER TECHNOLOGIES

8 THERAPEUTIC DRUG MONITORING MARKET, BY DRUG CLASS

- 8.1 INTRODUCTION

- 8.2 ANTIEPILEPTIC DRUGS

- 8.2.1 HIGH COMPLEXITY AND HETEROGENEITY OF EPILEPSY TO DRIVE GROWTH

- 8.3 ANTIARRHYTHMIC DRUGS

- 8.3.1 INCREASING INCIDENCE OF HEART DISORDERS TO BOOST DEMAND

- 8.4 IMMUNOSUPPRESSANT DRUGS

- 8.4.1 INCREASING NUMBER OF ORGAN TRANSPLANTATION PROCEDURES TO DRIVE MARKET

- 8.5 ANTIBIOTIC DRUGS

- 8.5.1 TECHNOLOGICAL ADVANCEMENTS TO PROPEL DEMAND

- 8.6 BRONCHODILATOR DRUGS

- 8.6.1 RISING PREVALENCE OF RESPIRATORY DISEASES TO ENSURE DEMAND FOR BRONCHODILATOR DRUG MONITORING

- 8.7 PSYCHOACTIVE DRUGS

- 8.7.1 RISING CASES OF MENTAL ILLNESS TO AUGMENT MARKET GROWTH

- 8.8 OTHER DRUGS

9 THERAPEUTIC DRUG MONITORING MARKET, BY THERAPEUTIC AREA

- 9.1 INTRODUCTION

- 9.2 NEUROLOGICAL DISORDERS

- 9.2.1 INCREASING PREVALENCE OF NEUROLOGICAL DISORDERS TO PROPEL MARKET

- 9.3 CARDIOLOGY

- 9.3.1 HIGH BURDEN OF CARDIOVASCULAR DISEASES TO DRIVE MARKET

- 9.4 INFECTIOUS DISEASES

- 9.4.1 INCREASING PREVALENCE OF TB AND HEPATITIS TO BOOST DEMAND

- 9.5 ONCOLOGY

- 9.5.1 RISING BURDEN OF CANCER AND GROWING EMPHASIS ON PERSONALIZED MEDICINE TO PROPEL MARKET

- 9.6 OTHER THERAPEUTIC AREAS

10 THERAPEUTIC DRUG MONITORING MARKET, BY SPECIMEN

- 10.1 INTRODUCTION

- 10.2 BLOOD

- 10.2.1 INNOVATIONS IN BLOOD SAMPLING TECHNIQUES TO DRIVE MARKET

- 10.3 SALIVA

- 10.3.1 DEVELOPMENTS IN IMMUNOASSAY-BASED SALIVA TESTS TO DRIVE MARKET

- 10.4 OTHER SAMPLES

11 THERAPEUTIC DRUG MONITORING MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 HOSPITAL LABORATORIES

- 11.2.1 INCREASING NUMBER OF SPECIALTY DIAGNOSTIC TESTS PERFORMED TO DRIVE MARKET

- 11.3 COMMERCIAL & PRIVATE LABORATORIES

- 11.3.1 EXTENSIVE TEST MENU OF COMMERCIAL & PRIVATE LABS TO SUSTAIN DEMAND FOR SERVICES

- 11.4 OTHER END USERS

12 THERAPEUTIC DRUG MONITORING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 Increasing awareness regarding precision medicine to propel market

- 12.2.3 CANADA

- 12.2.3.1 Availability of funding for research to offer growth opportunities

- 12.3 EUROPE

- 12.4 EUROPE: MACROECONOMIC OUTLOOK

- 12.4.1 GERMANY

- 12.4.1.1 Rising prevalence of chronic medical conditions such as cancer and diabetes to support market growth

- 12.4.2 UK

- 12.4.2.1 Increasing cases of chronic diseases to drive market

- 12.4.3 FRANCE

- 12.4.3.1 Rising awareness of benefits of therapeutic drug monitoring to accelerate demand

- 12.4.4 ITALY

- 12.4.4.1 Rising incidence of cancer to drive demand

- 12.4.5 SPAIN

- 12.4.5.1 Adoption of technologically advanced immunoassays to boost market

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 ASIA PACIFIC

- 12.6 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.6.1 JAPAN

- 12.6.1.1 High prevalence of chronic diseases and advanced healthcare infrastructure to drive market

- 12.6.2 CHINA

- 12.6.2.1 Rising number of organ transplants to boost market

- 12.6.3 INDIA

- 12.6.3.1 Rising incidence of cancer to propel market

- 12.6.4 AUSTRALIA

- 12.6.4.1 High healthcare expenditure and favorable government initiatives to propel market

- 12.6.5 REST OF ASIA PACIFIC

- 12.6.1 JAPAN

- 12.7 LATIN AMERICA

- 12.7.1 INCREASING BURDEN OF CHRONIC CONDITIONS AND EXPANDING HEALTHCARE INFRASTRUCTURE TO PROPEL MARKET

- 12.7.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.8 MIDDLE EAST & AFRICA

- 12.8.1 INCREASING NUMBER OF CANCER PATIENTS TO DRIVE MARKET

- 12.8.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.9 GCC COUNTRIES

- 12.9.1 GROWING HEALTHCARE INFRASTRUCTURE TO FUEL MARKET GROWTH

- 12.9.2 GCC COUNTRIES: MACROECONOMIC OUTLOOK

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 RIGHT TO WIN

- 13.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.4 REVENUE ANALYSIS

- 13.5 MARKET SHARE ANALYSIS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Product footprint

- 13.6.5.4 Technology footprint

- 13.6.5.5 End-user footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.8 COMPANY VALUATION & FINANCIAL METRICS

- 13.8.1 FINANCIAL METRICS

- 13.8.2 COMPANY VALUATION

- 13.9 PRODUCT/BRAND COMPARISON

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 PRODUCT LAUNCHES

- 13.10.2 DEALS

- 13.10.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ABBOTT

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Key strengths

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses and competitive threats

- 14.1.2 THERMO FISHER SCIENTIFIC INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 F. HOFFMANN-LA ROCHE LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 SIEMENS HEALTHINEERS AG

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 DANAHER CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 BIO-RAD LABORATORIES, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.7 BIOMERIEUX SA

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.8 BIOSYNEX SA

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.9 GRIFOLS, S.A.

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 EXAGEN INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.11 ARK DIAGNOSTICS, INC.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.12 R-BIOPHARM AG

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.13 RANDOX LABORATORIES LTD.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.1 ABBOTT

- 14.2 OTHER PLAYERS

- 14.2.1 APDIA GROUP

- 14.2.2 BBI SOLUTIONS

- 14.2.3 EAGLE BIOSCIENCES, INC.

- 14.2.4 JASEM LABORATORY SYSTEMS AND SOLUTIONS

- 14.2.5 AALTO SCIENTIFIC, LTD.

- 14.2.6 IMMUNDIAGNOSTIK AG

- 14.2.7 UTAK

- 14.2.8 SEKISUI MEDICAL CO., LTD.

- 14.2.9 DIASYSTEM SCANDINAVIA AB

- 14.2.10 CAMBRIDGE LIFE SCIENCES LIMITED

- 14.2.11 CHROMSYSTEMS INSTRUMENTS & CHEMICALS GMBH

- 14.2.12 BUHLMANN LABORATORIES AG

- 14.2.13 SJK GLOBAL, LLC

- 14.2.14 EPITOPE DIAGNOSTICS, INC.

- 14.2.15 QED BIOSCIENCE INC.

- 14.2.16 BODITECH MED INC.

- 14.2.17 IMMUNODIAGNOSTIC SYSTEMS

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS