|

|

市場調査レポート

商品コード

1298014

自律型ラストマイル配送の世界市場:プラットフォーム別 (航空配送ドローン、地上配送車 (配送用ロボット、自動運転バン・トラック))・ソリューション別・用途別・種類別・積載量別・航続距離別・地域別の将来予測 (2030年まで)Autonomous Last Mile Delivery Market by Platform (Aerial Delivery Drones, Ground Delivery Vehicles (Delivery Bots, Self-Driving Vans & Trucks)), Solution, Application, Type, Payload Weight, Range, Duration and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自律型ラストマイル配送の世界市場:プラットフォーム別 (航空配送ドローン、地上配送車 (配送用ロボット、自動運転バン・トラック))・ソリューション別・用途別・種類別・積載量別・航続距離別・地域別の将来予測 (2030年まで) |

|

出版日: 2023年06月16日

発行: MarketsandMarkets

ページ情報: 英文 414 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自律型ラストマイル配送の市場規模は、2023年に9億米ドル、2030年には42億米ドルに達し、その間に22.7%のCAGRで成長すると予測されています。

拡大し続けるeコマース産業とオムニチャネル流通の展開により、航空・地上モードを通じたラストマイル配送への圧力が高まっています。ラストマイル配送は、企業にとって経済的・環境的に大きな課題を生み出すサプライチェーンのセグメントです。IoTソリューションとAIの能力により、配送の「ウーバー化」 (効果的な配送のためのモバイル技術を通じた消費者間の即時接触に基づくオンデマンド・ビジネスモデルへの移転) という最近の動向は持続すると思われます。しかし、配送 (フォワーディング) ビジネスモデルの見直しに加え、ラストマイル物流はより高度な自動化の対象となると思われます。積み替えやフルフィルメントセンター、物流ハブにおけるラストマイルの自動化提案のひとつは、「無秩序」な倉庫の動的管理、出荷の自動化、輸送管理システムとの統合 (例えば、Warehouse Execution Systemsを通じて) の適用です。ラストマイルの配送自動化スキームには、顧客の行動パターンをシミュレートして予測し、資材の流れや物流ルートを予測する予測モデルに機械学習を採用する高度な分析も含まれます。

"航空プラットフォーム別では、配送用ドローンは予測期間中に最も高いCAGRで成長する"

プラットフォーム別に見ると、配送用ドローン市場は予測期間中、より高いCAGRで成長すると予測されています。これは、食品・小売分野における自律型配送ソリューションのニーズが高まっているためです。現在、ドローン配送サービスでよく知られている民間企業には、Flytrex (イスラエル)、Wing (米国)、UPS Flight Forward (米国)、Wingcopter (ドイツ) などがあります。

"地上プラットフォーム別では、自動運転バン・トラックが予測期間中に最も高いCAGRで成長する"

地上配送車セグメントをプラットフォーム別に見ると、自動運転バン・トラック市場が予測期間中により高いCAGRで成長すると予測されます。自律型・自動運転式の配達バン・トラックは、配達用ロボットよりも大きな貨物処理能力を有します。これらの配送バン・トラックは、交通渋滞が深刻な問題となっている都市にとって重要です。これらの車両は積載量が大きく、1回の充電で12時間稼働できます。自動運転システムは、赤外線レーダー、LiDAR、高度なカメラ、最新式モーショ・センサー、高精細センサー、そしてトラックの自動運転を可能にする非常に重要な複雑なアルゴリズムを採用しています。交通渋滞の解消は、自動運転トラック市場にとって大きなチャンスです。

"航続距離別では、航空配送/地上配送セグメントは短距離 (20km以下) と長距離 (20km以上) で構成される"

航続距離別に見ると、長距離セグメント (20km以上) が航空配送/地上配送自律型ラストマイル配送市場を独占し、予測期間を通じてより高いCAGRを示すと予測されます。これは、ドローン航空配送サービスに関連する高い可搬性、効率性の向上、運用コストの削減など、いくつかの要因によるものと考えられます。長距離自律配送ソリューションの需要は、大都市における公害懸念に対処する必要性から生じています。長距離の航空ドローンや地上ロボットを活用することで、二酸化炭素排出量を大幅に削減できるため、この市場セグメントは業界の主要な 促進要因となっています。長距離自律型配送サービスの利点は、環境上の利点だけに限りません。これらのソリューションは、柔軟性とアクセシビリティを強化し、長距離での効率的な商品輸送を可能にします。遠隔地やサービスが行き届いていない地域に容易に到達できる能力は、長距離セグメントの成長にさらに貢献しています。さらに、持続可能性の重視と環境への影響に対する意識の高まりが、長距離自律配送オプションの採用を後押ししています。企業も消費者も同様にエコフレンドリーな代替手段を積極的に求めており、長距離セグメントは彼らのニーズを満たす魅力的な選択肢となっています。利便性、効率性、エコフレンドリーを併せ持つ長距離セグメントは、航空配送/地上配送自律型ラストマイル配送市場において、予測可能な将来において大きな成長を遂げることが期待されます。

"ソリューション別では、航空配送ドローン/地上配送車市場は、ハードウェア・ソフトウェア・インフラに分類される"

インフラソリューション分野は、航空・地上両分野で最も高い成長を遂げる見通しです。この成長は、継続的な技術進歩がドローン・地上ロボット運用のためのインフラソリューションの需要を促していることに起因しています。これらの進歩により、既存の機体や自律型配送車両に高度なセンサーやAI技術を統合することが可能になり、飛行制御、性能、全体的な運用効率が改善されます。

"北米が最も高い市場シェアを占める"

北米は2023年に自律型ラストマイル配送市場をリードすると予測されています。米国は北米における自律型ラストマイル配送の最大市場です。米国の政府機関がドローン/自律型地上車両の更新のために支出を増やしていること、民間企業が自律型ラストマイル配送ソリューションの展開とともに支出を増やしていることが、北米の市場を牽引すると予想される主な要因です。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学:自律型ラストマイル配送市場 (航空配送ドローン)

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場力学:自動運転ラストマイル配送市場 (地上配送車)

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- バリューチェーン分析

- 市場エコシステムマップ

- ボリューム分析

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 貿易データ統計

- 関税と規制状況

- 主要な利害関係者と購入基準

- 自律型ラストマイル配送市場の技術進歩

- 主要な会議とイベント (2023年~2024年)

第6章 業界動向

- イントロダクション

- 技術動向

- 技術分析

- 自律型ラストマイル配送市場のケーススタディ分析:航空配送

- 自律型ラストマイル配送市場のケーススタディ分析:地上配送

- メガトレンドの影響

- イノベーションと特許登録

第7章 自律型ラストマイル配送市場:プラットフォーム別

- イントロダクション

- 航空配送ドローン

- 貨物用ドローン

- 配達用ドローン

- 地上配送車

- 配達用ロボット

- 自動運転バン・トラック

第8章 自律型ラストマイル配送市場:ソリューション別

- イントロダクション

- 航空配送ドローン

- ハードウェア

- インフラ

- ソフトウェア

- 地上配送車

第9章 自律型ラストマイル配送市場:用途別

- イントロダクション

- 航空配送ドローン

- 物流・輸送

- 医療・医薬品

- 小売・食品

- 地上配送車

- 物流・輸送

- 小売・食品

第10章 自律型ラストマイル配送市場:積載量別

- イントロダクション

- 航空配送ドローン

- 5kg未満

- 5~10kg

- 10kg超

- 地上配送車

第11章 自律型ラストマイル配送市場:航続距離別

- イントロダクション

- 航空配送ドローン

- 短距離 (20km以下)

- 長距離 (20km以上)

- 地上配送車

第12章 地域分析

- イントロダクション

- 景気後退の影響分析

- 北米

- PESTLE分析:北米

- 米国:航空配達

- 米国:地上配送

- カナダ:航空配達

- カナダ:地上配送

- 欧州

- PESTLE分析:欧州

- 英国:航空配達

- 英国:地上配送

- ドイツ:航空配達

- ドイツ:地上配送

- オーストリア:航空配送

- オーストリア:地上配送

- フランス:航空配達

- フランス:地上配送

- デンマーク:航空配達

- デンマーク:地上配送

- スイス:航空配達

- スイス:地上配送

- アジア太平洋

- PESTLE分析:アジア太平洋

- 中国:航空配達

- 中国:地上配送

- 日本:航空配達

- 日本:地上配送

- インド:航空配送

- インド:地上配送

- オーストラリア:航空配達

- オーストラリア:地上配送

- 韓国:航空配達

- 韓国:地上配送

- ニュージーランド:航空配達

- ニュージーランド:地上配送

- シンガポール:航空配達

- シンガポール:地上配送

- 中東

- PESTLE分析:中東

- アラブ首長国連邦:航空配達

- アラブ首長国連邦:地上配送

- イスラエル:航空配送

- イスラエル:地上配送

- ラテンアメリカ

- PESTLE分析:ラテンアメリカ

- ブラジル:航空配達

- ブラジル:地上配送

- メキシコ:航空配達

- メキシコ:地上配送

- アフリカ

- PESTLE分析:アフリカ

第13章 競合情勢

- イントロダクション

- 自律型ラストマイル配送市場の主要企業:地上配送

- 主要企業のランキング分析:地上配信 (2022年)

- 主要企業の収益分析:地上配送 (2022年)

- 市場シェア分析:地上配送車 (2022年)

- 自律型ラストマイル配送市場の主要企業:ドローン航空配送

- 主要企業の収益分析:ドローン航空配送 (2022年)

- 市場シェア分析:ドローン航空配送

- 地上配送

- 航空配達

- 競合評価クアドラント

- 自律型ラストマイル配送市場:競合リーダーシップマッピング (スタートアップ)

- 競合ベンチマーキング

- 競合シナリオ

- 主要な市場の発展

第14章 企業プロファイル:地上配送ロボット

- イントロダクション

- 主要企業

- NURO, INC.

- JD.COM, INC.

- STARSHIP TECHNOLOGIES

- KIWIBOT

- AMAZON.COM, INC.

- ALIBABA GROUP

- CATERPILLAR INC.

- CONTINENTAL AG

- PANASONIC CORPORATION

- TELERETAIL

- UNSUPERVISED.AI

- UDELV, INC.

- WAYMO LLC

- AETHON (ST ENGINEERING)

- BOXBOT

- その他の企業

- AUTOX

- NEOLIX

- ROBOMART

- ELIPORT

- CRUISE LLC

第15章 企業プロファイル:航空配送ドローン

- イントロダクション

- UNITED PARCEL SERVICE

- ZIPLINE

- WING

- MATTERNET, INC.

- FLIRTEY (SKYDROP)

- DEUTSCHE POST DHL GROUP

- AERODYNE GROUP

- DRONE DELIVERY CANADA CORP.

- WORKHOUSE GROUP INC.

- SKYCART INC.

- AIRBUS

- UBER TECHNOLOGIES, INC.

- WALMART

- GEOPOST (FORMERLY DPDGROUP)

- VOLOCOPTER GMBH

- その他の企業

- FLYTREX

- MANNA AERO

- WINGCOPTER GMBH

- ELROY AIR

- SWOOP AERO

第16章 付録

The autonomous last mile delivery market is valued at USD 0.9 billion in 2023 and is projected to reach USD 4.2 billion by 2030, at a CAGR of 22.7%. The ever-expanding e-commerce industry and deployment of omnichannel distribution put higher pressure on last mile logistics through aerial and ground modes. The last mile delivery is the segment of the supply chain that creates big economic and ecological challenges for firms. The recent trend of delivery 'Uberization' (relocation to the on-demand business model based on immediate contact between consumers through mobile technologies for effective delivery) would persist due to the capabilities of IoT solutions and AI. However, in addition to revising delivery (forwarding) business models, last mile logistics would be subjected to higher automation. One of the last mile automation proposals in trans-shipment and fulfillment centers and logistics hubs is the application of dynamic management of "chaotic" warehouses, shipping automation, and integration with Transportation Management Systems (for instance, through Warehouse Execution Systems). The last mile delivery automation scheme also includes advanced analytics that employs machine learning in predictive models to simulate and predict customer behavioral patterns and forecast material flows and logistics routes.

Based on the aerial platform segment, Delivery Drone is to grow at the highest CAGR during the forecast period.

Based on Platform, The market for delivery drones in the aerial segment is projected to grow with a higher CAGR during the forecast period. This is due to the increasing need for autonomous delivery solutions in the food and retail sectors. Some of the commercial market players well-known for drone delivery services at present are Flytrex (Israel), Wing (US), UPS Flight Forward (US), Wingcopter (Germany), and furthermore.

Based on the ground platform segment, Self-driving Vans & Trucks are to grow at the highest CAGR during the forecast period.

Based on Platform, The market for Self-driving Vans & Trucks in the ground segment is projected to grow with a higher CAGR during the forecast period. Autonomous self-driving delivery vans & trucks have larger cargo weight handling capacity than delivery bots. These delivery vans & trucks are critical for cities wherein traffic congestion is a serious problem. These vehicles have a large payload-carrying capacity and can operate for 12 hours on a single charge. The self-driving system employs infrared radar, LiDAR, advanced cameras, modern motion sensors, exceptionally accurate sensors, and very important complex algorithms that permit the truck to drive itself. Decongestion of traffic is an incredible self-driving truck market opportunity.

Based on Range, aerial and ground segments comprise Short Range (< Kilometers) and long-range segments (>20 Kilometers).

Based on Range, The long-range segment (>20 kilometers) is projected to dominate both the aerial and ground autonomous last mile delivery markets, displaying a higher CAGR throughout the forecast period. This can be attributed to several factors, including the high portability, improved efficiency, and reduced operating costs associated with aerial drone delivery services. The demand for long-range autonomous delivery solutions stems from the necessity to address pollution concerns in large cities. By utilizing long-range aerial drones and ground robots, carbon dioxide emissions can be significantly reduced, making this market segment a key driver in the industry. The advantages of long-range autonomous delivery services extend beyond environmental benefits. These solutions offer enhanced flexibility and accessibility, enabling the efficient transportation of goods over extended distances. The ability to reach remote and underserved areas with ease further contributes to the growth of the long-range segment. Moreover, the increasing emphasis on sustainability and the growing awareness of environmental impact drive the adoption of long-range autonomous delivery options. Businesses and consumers alike are actively seeking eco-friendly alternatives, making the long-range segment an attractive choice for meeting their needs. With its combination of convenience, efficiency, and environmental friendliness, the long-range segment in both aerial and ground autonomous last mile delivery markets is positioned to experience substantial growth in the foreseeable future.

Based on the solution, the aerial delivery drone/ground delivery vehicle market is classified into hardware, software, and infrastructure.

The infrastructure solution segment is poised to experience the highest growth in both the Aerial and Ground segments. This growth can be attributed to ongoing technological advancements that have fueled the demand for infrastructure solutions for drone and ground bot operations. These advancements enable the integration of sophisticated sensors and AI technology into existing airframes and autonomous delivery vehicles, resulting in improved flight control, performance, and overall operational efficiency.

" North America is expected to hold the highest market share."

North America is projected to lead the autonomous last mile delivery market in 2023. The US is the largest market for autonomous last mile delivery in North America. The growing spending by the US government organizations for drone/autonomous ground vehicle upgradation and private players, along with the deployment of autonomous last mile delivery solutions, are key factors expected to drive the market in North America.

The break-up of the profile of primary participants in the autonomous last mile delivery market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 55%, Europe - 27%, Asia Pacific - 9%, RoW - 9%

The major players in the autonomous last mile delivery market mainly resorted to contracts to drive their growth. They also entered new markets by launching technologically advanced and cost-effective products. Nuro (US), JD.com (China), Kiwibot (US), Starship Technologies (US), Amazon (US), United Parcel Service (UPS) (US), Zipline (US), Wing (US), Matternet, Inc. (US), Flirtey (SkyDrop) (US), Alibaba Group (China), are some of the leading players in the market who adopted this strategy. An increase in the demand for advanced autonomous last mile delivery products and the growth of emerging markets has encouraged companies to adopt this strategy to enter new regions.

Research Coverage:

Based on the platform, the autonomous last mile delivery market in the aerial segment is divided into Cargo Drone and Delivery Drones, and for the ground segment, the market is divided into Delivery Bots and Self Driving Trucks and Vans. Based on range, the autonomous last mile delivery market in the aerial and ground segments comprise Short Range (< Kilometers) and long-range segment (>20 Kilometers). By Payload Weight, Aerial and Ground segments are divided into <5 kilograms, 5-10 kilograms, and >10 kilograms. Based on application, the aerial delivery drone market has been segmented into logistics & transportation, healthcare & pharmacy, and retail & food. Based on application, the ground delivery vehicles market has been segmented into logistics & transportation and retail & food. Based on the solution, the aerial delivery drone/ground delivery vehicle market is classified into hardware, software, and infrastructure.

The autonomous last mile delivery market is segmented according to five key regions in this report, namely, North America, Europe, Asia Pacific, Middle East, Latin America, and Africa, along with their key countries. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the autonomous last mile delivery market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; agreements, collaborations, new product launches, contracts, expansion, acquisitions, and partnerships associated with the autonomous last mile delivery market.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall autonomous last mile delivery market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and there are several factors that could contribute to an increase in the autonomous last mile delivery market.

- Market Penetration: Comprehensive information on autonomous last mile delivery systems offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the autonomous last mile delivery market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the autonomous last mile delivery market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the autonomous last mile delivery market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the autonomous last mile delivery market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 AERIAL DELIVERY DRONES

- 1.2.2 GROUND DELIVERY VEHICLES

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 AUTONOMOUS LAST MILE DELIVERY MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 AUTONOMOUS LAST MILE DELIVERY MARKET: INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- 1.6 USD EXCHANGE RATES

- 1.7 LIMITATIONS

- 1.8 MARKET STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN- AERIAL DELIVERY DRONES MARKET

- FIGURE 4 RESEARCH DESIGN- GROUND DELIVERY VEHICLES MARKET

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.3 KEY PRIMARY SOURCES

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Autonomous last mile delivery market

- 2.3.1.2 Regional split of ALMD market

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 TRIANGULATION AND VALIDATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5.1 ASSUMPTIONS USED IN MARKET SIZING AND FORECAST

- 2.6 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 9 DELIVERY DRONES TO SHOWCASE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 SELF-DRIVING VANS AND TRUCKS SEGMENT TO EXHIBIT HIGHEST GROWTH (2021-2030)

- FIGURE 11 LONG RANGE TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- FIGURE 12 LONG RANGE SEGMENT TO HAVE HIGHER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 <5KG SEGMENT TO LEAD AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET DURING FORECAST PERIOD

- FIGURE 14 5-10 KG SEGMENT TO LEAD GROUND AUTONOMOUS LAST MILE DELIVERY MARKET DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN AUTONOMOUS LAST MILE DELIVERY MARKET

- FIGURE 16 USE OF AUTONOMOUS LAST MILE DELIVERY FOR MEDICAL AND RETAIL DELIVERIES TO DRIVE MARKET GROWTH

- 4.2 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM

- FIGURE 17 DELIVERY DRONES TO LEAD AERIAL PLATFORM MARKET DURING FORECAST PERIOD

- 4.3 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM

- FIGURE 18 SELF-DRIVING VANS AND TRUCKS TO DOMINATE GROUND PLATFORM SEGMENT DURING FORECAST PERIOD

- 4.4 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION

- FIGURE 19 LOGISTICS AND TRANSPORTATION SEGMENT TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY LOGISTICS AND TRANSPORTATION APPLICATION

- FIGURE 20 PACKAGE DELIVERY SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.6 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION

- FIGURE 21 LOGISTICS AND TRANSPORTATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.7 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY LOGISTICS AND TRANSPORTATION APPLICATION

- FIGURE 22 PACKAGE DELIVERY TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS: AUTONOMOUS LAST MILE DELIVERY MARKET (AERIAL DELIVERY DRONES)

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AUTONOMOUS LAST MILE DELIVERY MARKET (AERIAL DELIVERY DRONES)

- 5.2.1 DRIVERS

- 5.2.1.1 Rising use of sense and avoid systems in aerial delivery drones

- 5.2.1.2 Expansion of e-commerce industry

- FIGURE 24 GLOBAL RETAIL E-COMMERCE SALES WORLDWIDE FROM 2014 TO 2024 (BILLION USD)

- 5.2.1.3 Increased use of low-cost and light payload drones by startups for product delivery

- TABLE 2 COMPANY-WISE FUNDING RECEIVED FOR DRONE FOOD DELIVERY SERVICES

- 5.2.1.4 Environmental sustainability

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of required infrastructure to support operations in emerging economies

- 5.2.2.2 Limited bandwidth and battery life of aerial delivery drones

- 5.2.2.3 Lack of charging infrastructure hinders long-endurance delivery missions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in technological advancements in delivery drones

- 5.2.3.2 Growth opportunities for vendors at different levels of value chain

- 5.2.3.3 Incorporation of IoT in ecosystem

- 5.2.3.4 Rising demand for fast, efficient, and reliable delivery services

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to traffic management

- 5.2.4.2 Safety and security issues

- 5.2.4.3 Lack of risk management framework and insurance cover

- TABLE 3 INSURANCE COVERAGE OFFERED

- TABLE 4 COMPANIES PROVIDING DRONE INSURANCE

- 5.3 MARKET DYNAMICS: AUTONOMOUS LAST MILE DELIVERY MARKET (GROUND DELIVERY VEHICLES)

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR AUTONOMOUS LAST MILE DELIVERY MARKET (GROUND DELIVERY VEHICLES)

- 5.3.1 DRIVERS

- 5.3.1.1 Increased use of autonomous ground delivery vehicles in retail and food

- 5.3.1.2 Increased adoption of autonomous ground delivery vehicles

- 5.3.1.3 Venture funding for developing next-level ground delivery vehicles

- TABLE 5 LIST OF FUNDING RAISED BY VARIOUS COMPANIES IN AUTONOMOUS GROUND DELIVERY MARKET

- 5.3.2 RESTRAINTS

- 5.3.2.1 Formulation and stringent implementation of regulations

- 5.3.2.2 Performance issues in untested environments and lack of appropriate decision-making

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growing demand for AGVs in delivery of healthcare supplies

- 5.3.3.2 Rising e-commerce industry worldwide

- 5.3.4 CHALLENGES

- 5.3.4.1 Limited operational range

- 5.3.4.2 Vulnerability of ground delivery vehicles to cyber threats

- 5.3.4.3 Risk of operational malfunctioning in populated areas

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING OF AUTONOMOUS LAST MILE DELIVERY DRONES/ VEHICLES/SERVICES IN 2021-2022

- TABLE 6 AVERAGE PRICES OF AUTONOMOUS LAST MILE DELIVERY DRONES/ VEHICLES/ SERVICES IN 2021-2022

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 26 VALUE CHAIN ANALYSIS FOR AUTONOMOUS LAST MILE DELIVERY MARKET

- 5.6 MARKET ECOSYSTEM MAP

- FIGURE 27 MARKET ECOSYSTEM MAP FOR AUTONOMOUS LAST MILE DELIVERY MARKET

- 5.7 VOLUME ANALYSIS

- TABLE 7 DERIVED VOLUME OF AUTONOMOUS LAST MILE DELIVERY DRONES/VEHICLES FROM 2020-2030

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AUTONOMOUS LAST MILE DELIVERY MARKET

- FIGURE 28 REVENUE SHIFT CURVE FOR AUTONOMOUS LAST MILE DELIVERY MARKET

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS FOR AUTONOMOUS LAST MILE DELIVERY MARKET

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWERS OF SUPPLIERS

- 5.9.4 BARGAINING POWERS OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 TRADE DATA STATISTICS

- FIGURE 30 IMPORTERS FOR AUTONOMOUS GROUND ROBOTS/VEHICLES HS CODE 847950 INDUSTRIAL ROBOTS

- FIGURE 31 EXPORTERS FOR AUTONOMOUS GROUND ROBOTS/VEHICLES HS CODE 847950 INDUSTRIAL ROBOTS

- TABLE 8 COUNTRY-WISE IMPORTS FOR DRONES, 2020-2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORTS FOR DRONES, 2020-2022 (USD THOUSAND)

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- TABLE 10 LIST OF IMPORT RATES OF VEHICLES AND INDUSTRIAL ROBOTS

- TABLE 11 DRONE REGULATION AND APPROVALS FOR COMMERCIAL SECTOR, BY COUNTRY

- 5.11.1 GUIDELINES BY FEDERAL AVIATION ADMINISTRATION FOR DRONE OPERATIONS

- TABLE 12 US: RULES AND GUIDELINES BY FAA FOR OPERATION OF DRONES

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM

- TABLE 14 KEY BUYING CRITERIA FOR AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM

- 5.13 TECHNOLOGY EVOLUTION OF AUTONOMOUS LAST MILE DELIVERY MARKET

- FIGURE 34 TECHNOLOGY EVOLUTION ROADMAP

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 KEY CONFERENCES AND EVENTS, 2023-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 3D-PRINTED AERIAL AND GROUND ROBOTS

- 6.2.2 IMPROVEMENTS IN BATTERY TECHNOLOGY

- 6.2.3 CLOUD ROBOTICS TECHNOLOGY

- 6.2.4 WIRELESS CHARGING TECHNOLOGY

- 6.2.5 COMPUTER VISION

- 6.2.6 MULTI-SENSOR DATA FUSION FOR EFFECTIVE NAVIGATION

- 6.2.7 ADVANCED ALGORITHMS AND ANALYTICS

- FIGURE 35 ALGORITHMS AND ANALYTICS SUPPORTING AUTONOMOUS LAST MILE DELIVERY

- 6.2.8 MACHINE LEARNING-POWERED ANALYTICS

- 6.2.9 5G TECHNOLOGY

- 6.2.10 BLOCKCHAIN

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 SENSOR TECHNOLOGY

- 6.3.2 AI-BASED PERCEPTION

- 6.4 CASE STUDY ANALYSIS FOR AUTONOMOUS LAST MILE DELIVERY MARKET: AERIAL DELIVERY

- 6.4.1 USE OF ZIPLINE DRONES FOR MEDICAL DELIVERY IN GHANA

- 6.4.2 FLIRTEY TRANSFORMING MEDICAL SUPPLY DELIVERY WITH AUTONOMOUS DRONES

- 6.4.3 PROJECT WING BY ALPHABET TO DELIVER FOOD AND MEDICINES IN AUSTRALIA

- 6.5 CASE STUDY ANALYSIS FOR AUTONOMOUS LAST MILE DELIVERY MARKET: GROUND DELIVERY

- 6.5.1 USE OF AUTONOMOUS DELIVERY BY FOODPANDA IN SINGAPORE

- 6.5.2 DELIVERY FROM RESTAURANTS AND GROCERY STORES

- 6.5.3 JD.COM BOTS UTILIZED FOR INDOOR LAST MILE DELIVERY

- 6.5.4 AMAZON STARTED DELIVERING PARCELS USING GROUND DELIVERY ROBOTS NAMED SCOUT IN WASHINGTON

- 6.6 IMPACT OF MEGATRENDS

- 6.6.1 LAST MILE DELIVERY AUTOMATION

- 6.6.2 E-MOBILITY AND GREEN INITIATIVE

- 6.6.3 RAPID URBANIZATION AND MEGACITY LOGISTICS

- 6.7 INNOVATION AND PATENT REGISTRATIONS

- TABLE 16 AUTONOMOUS LAST MILE DELIVERY MARKET: KEY PATENTS (MAY 2019-MARCH 2022)

7 ALMD MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- TABLE 17 AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 18 AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 7.2 AERIAL DELIVERY DRONES

- FIGURE 36 DELIVERY DRONES TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 19 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 20 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 7.2.1 CARGO DRONES

- 7.2.1.1 Surging demand for same-day delivery and emergency supplies to drive segment

- 7.2.2 DELIVERY DRONES

- 7.2.2.1 Growing need for instantaneous delivery services to boost growth

- 7.3 GROUND DELIVERY VEHICLES

- FIGURE 37 SELF-DRIVING DELIVERY VANS AND TRUCKS TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- TABLE 21 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 22 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 7.3.1 DELIVERY BOTS

- 7.3.1.1 Growth of e-commerce to fuel segment

- 7.3.2 SELF-DRIVING VANS AND TRUCKS

- 7.3.2.1 Growing need for decongestion to lead to market growth

8 ALMD MARKET, BY SOLUTION

- 8.1 INTRODUCTION

- TABLE 23 AUTONOMOUS LAST MILE DELIVERY SOLUTION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 24 AUTONOMOUS LAST MILE DELIVERY SOLUTION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 8.2 AERIAL DELIVERY DRONES

- FIGURE 38 INFRASTRUCTURE SEGMENT TO HAVE HIGHER CAGR DURING FORECAST PERIOD

- TABLE 25 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 26 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 8.2.1 HARDWARE

- 8.2.1.1 Growing need for instantaneous delivery of food, medicine, and retail goods to increase demand

- 8.2.1.2 Airframe

- 8.2.1.3 Avionics

- 8.2.1.4 Propulsion system

- 8.2.1.5 Payload

- 8.2.2 INFRASTRUCTURE

- 8.2.2.1 Need for drone services in civil and commercial applications to drive segment

- 8.2.2.2 Ground control station (GCS)

- 8.2.2.3 Charging station

- 8.2.2.4 Vertiports/landing pad

- 8.2.2.5 Micro-fulfillment center

- 8.2.3 SOFTWARE

- 8.2.3.1 Ongoing technological upgrades and R&D to boost usage

- 8.2.3.2 Route planning and optimizing

- 8.2.3.3 Inventory management

- 8.2.3.4 Live tracking

- 8.2.3.5 Fleet management

- 8.2.3.6 Computer vision

- 8.3 GROUND DELIVERY VEHICLES

- FIGURE 39 INFRASTRUCTURE SEGMENT TO ACCOUNT FOR FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 27 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 28 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 8.3.1 HARDWARE

- 8.3.1.1 Growing need to curb traffic congestion in cities to drive segment

- 8.3.1.2 Navigation (GPS, LiDAR, sensors, radar, cameras)

- 8.3.1.3 Propulsion

- 8.3.1.4 Others

- 8.3.2 INFRASTRUCTURE

- 8.3.2.1 Technological evolution of autonomous ground vehicles to fuel segment growth

- 8.3.2.2 Ground control station (GCS)

- 8.3.2.3 Charging station

- 8.3.2.4 Micro-fulfillment center

- 8.3.3 SOFTWARE

- 8.3.3.1 Increasing demand for autonomous ground vehicles in warehouse automation to propel growth

- 8.3.3.2 Route planning and optimizing

- 8.3.3.3 Inventory management

- 8.3.3.4 Live tracking

- 8.3.3.5 Fleet management

- 8.3.3.6 Computer vision

9 ALMD MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 29 AUTONOMOUS LAST MILE DELIVERY APPLICATION MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 30 AUTONOMOUS LAST MILE DELIVERY APPLICATION MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 9.2 AERIAL DELIVERY DRONES

- FIGURE 40 FOOD AND RETAIL SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 31 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 32 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 9.2.1 LOGISTICS AND TRANSPORTATION

- 9.2.1.1 Increased demand for faster delivery to propel growth

- TABLE 33 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 34 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2023-2030 (USD MILLION)

- 9.2.1.2 Postal delivery

- 9.2.1.3 Package delivery

- 9.2.2 HEALTHCARE AND PHARMACEUTICALS

- 9.2.2.1 Rising need for fast and non-stop delivery of essential supplies to boost market

- TABLE 35 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR HEALTHCARE AND PHARMACEUTICALS, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 36 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR HEALTHCARE AND PHARMACEUTICALS, BY APPLICATION, 2023-2030 (USD MILLION)

- 9.2.2.2 Medicine supply

- 9.2.2.3 Blood supply

- 9.2.2.4 Organ transport

- 9.2.2.5 Equipment transport

- 9.2.3 RETAIL AND FOOD

- 9.2.3.1 Growing demand for instantaneous delivery of retail goods and food to drive segment

- TABLE 37 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR RETAIL AND FOOD, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 38 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET FOR RETAIL AND FOOD, BY APPLICATION, 2023-2030 (USD MILLION)

- 9.2.3.2 E-commerce

- 9.2.3.3 Grocery delivery

- 9.2.3.4 Food delivery

- 9.3 GROUND DELIVERY VEHICLES

- FIGURE 41 RETAIL AND FOOD SEGMENT TO REPORT FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 39 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 40 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 9.3.1 LOGISTICS AND TRANSPORTATION

- 9.3.1.1 Rising demand for autonomous deliveries due to flexibility of timing and distance to expand market growth

- TABLE 41 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 42 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR LOGISTICS AND TRANSPORTATION, BY APPLICATION, 2023-2030 (USD MILLION)

- 9.3.1.2 Postal delivery

- 9.3.1.3 Package delivery

- 9.3.2 RETAIL AND FOOD

- 9.3.2.1 Growing demand for affordable and fast delivery to drive market

- TABLE 43 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR FOOD AND RETAIL, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 44 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET FOR FOOD AND RETAIL, 2023-2030 (USD MILLION)

- 9.3.2.2 E-commerce

- 9.3.2.3 Grocery delivery

- 9.3.2.4 Food delivery

10 ALMD MARKET, BY PAYLOAD WEIGHT

- 10.1 INTRODUCTION

- TABLE 45 AUTONOMOUS LAST MILE DELIVERY PAYLOAD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 46 AUTONOMOUS LAST MILE DELIVERY PAYLOAD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

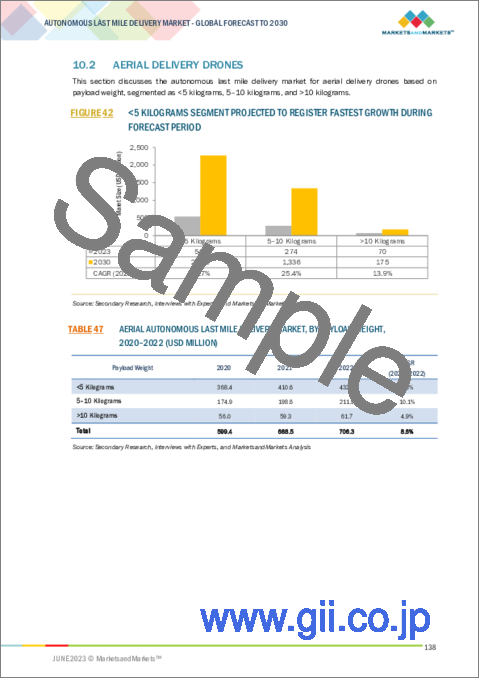

- 10.2 AERIAL DELIVERY DRONES

- FIGURE 42 <5 KILOGRAMS SEGMENT PROJECTED TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 47 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2020-2022 (USD MILLION)

- TABLE 48 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2023-2030 (USD MILLION)

- 10.2.1 <5 KILOGRAMS

- 10.2.1.1 Growing usage of drones in healthcare sector to drive segment

- 10.2.2 5-10 KILOGRAMS

- 10.2.2.1 Rising use in retail sector to fuel demand

- 10.2.3 >10 KILOGRAMS

- 10.2.3.1 Increased demand from e-commerce to drive segment

- 10.3 GROUND DELIVERY VEHICLES

- FIGURE 43 >10 KILOGRAMS SEGMENT TO HAVE FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 49 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2020-2022 (USD MILLION)

- TABLE 50 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY PAYLOAD WEIGHT, 2023-2030 (USD MILLION)

- 10.3.1 <5 KILOGRAMS

- 10.3.1.1 Growing demand for online food delivery services to drive segment

- 10.3.2 5-10 KILOGRAMS

- 10.3.2.1 New regulatory upgrades boost demand

- 10.3.3 >10 KILOGRAMS

- 10.3.3.1 Growth of logistics industry to fuel growth

11 ALMD MARKET, BY RANGE

- 11.1 INTRODUCTION

- TABLE 51 AUTONOMOUS LAST MILE DELIVERY RANGE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 52 AUTONOMOUS LAST MILE DELIVERY RANGE MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- 11.2 AERIAL DELIVERY DRONES

- FIGURE 44 LONG RANGE (>20 KILOMETERS) SEGMENT TO GROW AT FASTEST RATE DURING PROJECTED PERIOD

- TABLE 53 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY RANGE, 2020-2022 (USD MILLION)

- TABLE 54 AERIAL AUTONOMOUS LAST MILE DELIVERY MARKET, BY RANGE, 2023-2030 (USD MILLION)

- 11.2.1 SHORT RANGE (<20 KILOMETERS)

- 11.2.1.1 Growing usage of drones in civil and commercial applications to drive segment

- 11.2.2 LONG RANGE (>20 KILOMETERS)

- 11.2.2.1 Need for e-commerce services in remote locations to boost market segment

- 11.3 GROUND DELIVERY VEHICLES

- FIGURE 45 LONG RANGE (>20 KILOMETERS) SEGMENT PROJECTED TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 55 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY RANGE, 2020-2022 (USD MILLION)

- TABLE 56 GROUND AUTONOMOUS LAST MILE DELIVERY MARKET, BY RANGE, 2023-2030 (USD MILLION)

- 11.3.1 SHORT RANGE (<20 KILOMETERS)

- 11.3.1.1 Booming e-commerce industry to fuel growth

- 11.3.2 LONG RANGE (>20 KILOMETERS)

- 11.3.2.1 Need to curb pollution in big cities to drive segment

12 REGIONAL ANALYSIS

- 12.1 INTRODUCTION

- 12.2 RECESSION IMPACT ANALYSIS

- FIGURE 46 RECESSION IMPACT ANALYSIS

- FIGURE 47 NORTH AMERICA TO GROW AT HIGHEST CAGR FROM 2023 TO 2030

- TABLE 57 ALMD MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 58 ALMD MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.3 NORTH AMERICA

- 12.3.1 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 48 NORTH AMERICA: ALMD MARKET SNAPSHOT

- TABLE 59 NORTH AMERICA: ALMD MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: ALMD MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.2 US: AERIAL DELIVERY

- 12.3.2.1 Existence of major delivery drone manufacturers to drive market

- TABLE 71 US: ALMD MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 72 US: ALMD MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 US: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 74 US: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 75 US: AERIAL ALMD MARKET, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 76 US: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 77 US: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 78 US: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 79 US: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 80 US: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.3.3 US: GROUND DELIVERY

- 12.3.3.1 Presence of major ground delivery robot manufacturers to drive market

- TABLE 81 US: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 82 US: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 83 US: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 84 US: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 85 US: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 86 US: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.3.4 CANADA: AERIAL DELIVERY

- 12.3.4.1 Ease of acquiring drone certification to fuel market

- TABLE 87 CANADA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 88 CANADA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 89 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 90 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 CANADA: AERIAL ALMD MARKET, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 92 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 93 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 94 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 95 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 96 CANADA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.3.5 CANADA: GROUND DELIVERY

- 12.3.5.1 Increasing grants and funds by government to propel market

- TABLE 97 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 98 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 99 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 100 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 101 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 102 CANADA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4 EUROPE

- FIGURE 49 EUROPE: ALMD MARKET SNAPSHOT

- 12.4.1 PESTLE ANALYSIS: EUROPE

- TABLE 103 EUROPE: ALMD MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 104 EUROPE: ALMD MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 EUROPE: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 106 EUROPE: ALMD MARKET , BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 107 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 108 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 109 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 110 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 111 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 112 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 114 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 116 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 118 EUROPE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 120 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 121 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 122 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 123 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 124 EUROPE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.2 UK: AERIAL DELIVERY

- 12.4.2.1 Technological advancements by major drone delivery market players to drive market

- TABLE 125 UK: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 126 UK: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 127 UK: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 128 UK: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 129 UK: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 130 UK: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 131 UK: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 132 UK: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICAL APPLICATION, 2023-2030 (USD MILLION)

- TABLE 133 UK: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 134 UK: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.3 UK: GROUND DELIVERY

- 12.4.3.1 Significant use of autonomous ground delivery vehicles in food and beverage industry to drive market

- TABLE 135 UK: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 136 UK: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 137 UK: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 138 UK: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 139 UK: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 140 UK: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.4 GERMANY: AERIAL DELIVERY

- 12.4.4.1 Growing demand for faster deliveries to fuel market

- TABLE 141 GERMANY: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 142 GERMANY: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 143 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 144 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 145 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 146 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 147 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 148 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 149 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 150 GERMANY: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.5 GERMANY: GROUND DELIVERY

- 12.4.5.1 Introduction of new-age four-legged delivery robots to propel market growth

- TABLE 151 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 152 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 153 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 154 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 155 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 156 GERMANY: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.6 AUSTRIA: AERIAL DELIVERY

- 12.4.6.1 Availability of drone landing sites to drive market

- TABLE 157 AUSTRIA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 158 AUSTRIA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 159 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 160 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 162 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 163 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 164 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 165 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 166 AUSTRIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.7 AUSTRIA: GROUND DELIVERY

- 12.4.7.1 Continuous testing and innovations in autonomous driving technology to boost market

- TABLE 167 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 168 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 169 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 170 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 171 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 172 AUSTRIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.8 FRANCE: AERIAL DELIVERY

- 12.4.8.1 Support from government authorities to push market growth

- TABLE 173 FRANCE: ALMD MARKET IN, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 174 FRANCE: ALMD MARKET IN, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 175 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 176 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 177 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 178 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 179 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 180 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 181 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 182 FRANCE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.9 FRANCE: GROUND DELIVERY

- 12.4.9.1 Emergence of numerous startups for autonomous ground delivery robots to drive the market

- TABLE 183 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 184 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 185 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 186 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 187 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 188 FRANCE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.10 DENMARK: AERIAL DELIVERY

- 12.4.10.1 Rise in testing of package deliveries via drones to drive market

- TABLE 189 DENMARK: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 190 DENMARK: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 191 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 192 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 193 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 194 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 195 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 196 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 197 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 198 DENMARK: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.11 DENMARK: GROUND DELIVERY

- 12.4.11.1 Growing demand for time-saving automated transport in warehouses to drive market

- TABLE 199 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 200 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 201 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 202 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 203 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 204 DENMARK: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.12 SWITZERLAND: AERIAL DELIVERY

- 12.4.12.1 Partnerships in favor of drone delivery services to drive market

- TABLE 205 SWITZERLAND: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 206 SWITZERLAND: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 207 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 208 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 209 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 210 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 211 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 212 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 213 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 214 SWITZERLAND: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.4.13 SWITZERLAND: GROUND DELIVERY

- 12.4.13.1 Funding from intergovernmental organizations favoring advances in ground navigation systems to drive market

- TABLE 215 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 216 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 217 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 218 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 219 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 220 SWITZERLAND: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5 ASIA PACIFIC

- 12.5.1 PESTLE ANALYSIS: ASIA PACIFIC

- TABLE 221 ASIA PACIFIC: ALMD MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: ALMD MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 224 ASIA PACIFIC: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 226 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 227 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 228 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 229 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 230 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 231 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 232 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 233 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 234 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 235 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 236 ASIA PACIFIC: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 238 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 240 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 241 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 242 ASIA PACIFIC: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.2 CHINA: AERIAL DELIVERY

- 12.5.2.1 Investments by technology players to drive market

- TABLE 243 CHINA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 244 CHINA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 245 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 246 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 247 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 248 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 249 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 250 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 251 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 252 CHINA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.3 CHINA: GROUND DELIVERY

- 12.5.3.1 Adoption of ground delivery vehicles in e-commerce to drive market

- TABLE 253 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 254 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 255 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 256 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 257 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 258 CHINA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.4 JAPAN: AERIAL DELIVERY

- 12.5.4.1 Advanced technological capabilities to drive market

- TABLE 259 JAPAN: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 260 JAPAN: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 261 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 262 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 263 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 264 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 265 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 266 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 267 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 268 JAPAN: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.5 JAPAN: GROUND DELIVERY

- 12.5.5.1 Emergence of new initiatives for urban development to drive market

- TABLE 269 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 270 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 271 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 272 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 273 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD APPLICATION, 2020-2022 (USD MILLION)

- TABLE 274 JAPAN: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD APPLICATION, 2023-2030 (USD MILLION)

- 12.5.6 INDIA: AERIAL DELIVERY

- 12.5.6.1 Rising focus of government on initiating aerial delivery services to drive market

- TABLE 275 INDIA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 276 INDIA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 277 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 278 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 279 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 280 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 281 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 282 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 283 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 284 INDIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.7 INDIA: GROUND DELIVERY

- 12.5.7.1 Increasing investments by companies in last mile deliveries to drive market

- TABLE 285 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 286 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 287 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 288 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 289 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 290 INDIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.8 AUSTRALIA: AERIAL DELIVERY

- 12.5.8.1 Government support and technological advancements to drive market

- TABLE 291 AUSTRALIA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 292 AUSTRALIA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 293 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 294 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 295 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 296 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 297 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 298 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 299 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 300 AUSTRALIA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.9 AUSTRALIA: GROUND DELIVERY

- 12.5.9.1 Increasing demand for instant and same-day deliveries to drive market

- TABLE 301 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 302 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 303 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 304 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 305 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 306 AUSTRALIA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.10 SOUTH KOREA: AERIAL DELIVERY

- 12.5.10.1 Need to supply essentials to remote locations to boost market

- TABLE 307 SOUTH KOREA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 308 SOUTH KOREA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 309 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 310 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 311 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 312 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 313 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 314 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 315 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 316 SOUTH KOREA: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.11 SOUTH KOREA: GROUND DELIVERY VEHICLES

- 12.5.11.1 Demand from food and beverage industry to drive market

- TABLE 317 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 318 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 319 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 320 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 321 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 322 SOUTH KOREA: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.12 NEW ZEALAND: AERIAL DELIVERY

- 12.5.12.1 Growing demand for food delivery services to drive market

- TABLE 323 NEW ZEALAND: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 324 NEW ZEALAND: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 325 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 326 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 327 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 328 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 329 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 330 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 331 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 332 NEW ZEALAND: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.13 NEW ZEALAND: GROUND DELIVERY

- 12.5.13.1 Growth of autonomous last mile delivery ecosystem to drive market

- TABLE 333 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 334 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 335 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 336 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 337 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 338 NEW ZEALAND: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.14 SINGAPORE: AERIAL DELIVERY

- 12.5.14.1 Established regulatory framework for drone delivery to push market growth

- TABLE 339 SINGAPORE: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 340 SINGAPORE: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 341 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 342 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 343 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 344 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 345 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 346 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 347 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 348 SINGAPORE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.5.15 SINGAPORE: GROUND DELIVERY

- 12.5.15.1 Launch of new pilot schemes to enable on-demand food and grocery deliveries to drive market

- TABLE 349 SINGAPORE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 350 SINGAPORE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 351 SINGAPORE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 352 SINGAPORE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 353 SINGAPORE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 354 SINGAPORE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.6 MIDDLE EAST

- 12.6.1 PESTLE ANALYSIS: MIDDLE EAST

- TABLE 355 MIDDLE EAST: ALMD MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 356 MIDDLE EAST: ALMD MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 357 MIDDLE EAST: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 358 MIDDLE EAST: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 359 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 360 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 361 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 362 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 363 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 364 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 365 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 366 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 367 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 368 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 369 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 370 MIDDLE EAST: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- TABLE 371 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 372 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 373 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 374 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 375 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 376 MIDDLE EAST: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.6.2 UAE: AERIAL DELIVERY

- 12.6.2.1 Flexible drone regulations to drive market

- TABLE 377 UAE: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 378 UAE: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 379 UAE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 380 UAE: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 381 UAE: AERIAL ALMD MARKET, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 382 UAE: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATIONS, 2023-2030 (USD MILLION)

- TABLE 383 UAE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 384 UAE: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 385 UAE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 386 UAE: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.6.3 UAE: GROUND DELIVERY

- 12.6.3.1 Supportive government regulations to drive market

- TABLE 387 UAE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 388 UAE: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 389 UAE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 390 UAE: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 391 UAE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 392 UAE: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.6.4 ISRAEL: AERIAL DELIVERY

- 12.6.4.1 Growing interest by major players to offer services to expand market

- TABLE 393 ISRAEL: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 394 ISRAEL: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 395 ISRAEL: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 396 ISRAEL: ALMD MARKET FOR AERIAL DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 397 ISRAEL: AERIAL ALMD MARKET, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 398 ISRAEL: ALMD MARKET FOR AERIAL DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 399 ISRAEL: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2020-2022 (USD MILLION)

- TABLE 400 ISRAEL: ALMD MARKET FOR AERIAL DELIVERY, BY HEALTHCARE AND PHARMACEUTICALS, 2023-2030 (USD MILLION)

- TABLE 401 ISRAEL: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 402 ISRAEL: ALMD MARKET FOR AERIAL DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.6.5 ISRAEL: GROUND DELIVERY

- 12.6.5.1 Rising demand for autonomous logistics infrastructure in healthcare to drive market

- TABLE 403 ISRAEL: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 404 ISRAEL: ALMD MARKET FOR GROUND DELIVERY, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 405 ISRAEL: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2020-2022 (USD MILLION)

- TABLE 406 ISRAEL: ALMD MARKET FOR GROUND DELIVERY, BY LOGISTICS AND TRANSPORTATION, 2023-2030 (USD MILLION)

- TABLE 407 ISRAEL: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2020-2022 (USD MILLION)

- TABLE 408 ISRAEL: ALMD MARKET FOR GROUND DELIVERY, BY RETAIL AND FOOD, 2023-2030 (USD MILLION)

- 12.7 LATIN AMERICA

- 12.7.1 PESTLE ANALYSIS: LATIN AMERICA

- TABLE 409 LATIN AMERICA: ALMD MARKET BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 410 LATIN AMERICA: ALMD MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 411 LATIN AMERICA: ALMD MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 412 LATIN AMERICA: ALMD MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 413 LATIN AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 414 LATIN AMERICA: ALMD MARKET FOR AERIAL DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 415 LATIN AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 416 LATIN AMERICA: ALMD MARKET FOR GROUND DELIVERY, BY PLATFORM, 2023-2030 (USD MILLION)