|

|

市場調査レポート

商品コード

1761502

動画加工プラットフォームの世界市場:オファリング別、コンテンツタイプ別、展開モード別、用途別、エンドユーザー別、地域別 - 2030年までの予測Video Processing Platform Market by Offering, Content Type, Application - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 動画加工プラットフォームの世界市場:オファリング別、コンテンツタイプ別、展開モード別、用途別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月30日

発行: MarketsandMarkets

ページ情報: 英文 361 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

動画加工プラットフォーム市場は急速に拡大しており、市場規模は2025年の75億米ドルから2030年には124億米ドルに拡大すると予測され、予測期間中のCAGRは10.6%になるとみられています。

短編動画コンテンツやプラットフォーム特化型動画コンテンツの急増により、ソーシャル・プラットフォームやモバイル・プラットフォームへの迅速な適応と配信が求められています。さらに、先進的な動画コーデックの採用により、圧縮効率が向上し、品質を損なうことなく帯域幅の使用量が削減されるため、動画トラフィック管理が大きく変化しています。同時に、OTTサービスの世界の拡大は、動画消費を加速し、視聴者のエンゲージメントを深めています。これらの動向が相まって、動画ワークフローが再構築され、業界全体でスケーラブルなリアルタイム処理機能に対する需要が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント | オファリング別、コンテンツタイプ別、展開モード別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

動画パーソナライゼーション&レコメンデーションエンジンは、テーラーメイドのコンテンツ体験に対する消費者需要の高まりにより、動画加工プラットフォーム市場で最も高い成長率を記録しています。ストリーミング・サービスが成長するにつれ、ユーザーは自分の嗜好に沿った、適切で魅力的なオンデマンド・コンテンツを期待しています。人工知能(AI)や機械学習(ML)を活用して視聴行動や文脈データを分析し、ユーザーエンゲージメント、リテンション、マネタイゼーションを高めるリアルタイムのレコメンデーションを可能にするプラットフォームが増えています。また、パーソナライズされた配信は、ユーザーの満足度を高め、混雑した市場においてプラットフォームが際立つのに役立ちます。コンテンツ・ライブラリが拡大するにつれ、効果的なコンテンツ・ディスカバリーが不可欠となり、パーソナライゼーションはビデオ・エコシステム全体の重要な戦略的優位性と位置付けられています。

ライブストリーミングは、エンターテインメント、スポーツ、ゲーム、企業コミュニケーション、イベントなど、リアルタイムコンテンツに対する需要の高まりにより、動画加工プラットフォーム市場で最も高い市場シェアを占めています。視聴者はライブ体験への即時アクセスをますます求めるようになっており、コンテンツプロバイダーは低遅延・高品質の配信を優先するようになっています。ソーシャルメディア・プラットフォーム、OTTサービス、企業は、エンゲージメントを高め、コミュニティを形成し、ブランドの存在感を高めるためにライブ動画を活用しています。さらに、仮想イベント、ウェビナー、ライブコマースの台頭により、採用がさらに拡大しています。スケーラブルなリアルタイム処理機能の必要性から、ライブストリーミングはプラットフォームの利用率と収益の伸びを牽引する主要なコンテンツタイプとなっています。

北米は、成熟したデジタルインフラ、クラウドとAI技術の早期導入、大手ストリーミングおよびテクノロジー企業の強力なプレゼンスによって、動画加工プラットフォーム市場をリードしています。この地域は、ブロードバンド普及率の高さ、OTTやライブストリーミングサービスへの堅調な投資、リアルタイムでマルチデバイスのビデオ体験を求める消費者の高度な需要といったメリットを享受しています。Akamai Technologies、MediaKind、Harmonicなどの主要企業は、AIを活用したエンコーディング、低遅延配信、コンテンツ・パーソナライゼーションにおける革新技術を活用し、ユーザーエンゲージメントと業務効率の向上を図っています。一方、アジア太平洋地域は最も急成長している市場であり、急速なデジタル化、インターネットアクセスの拡大、AI統合に対する政府の積極的な取り組みがその要因となっています。中国、インド、日本などの国々は、デジタルインフラ、モバイルファーストのビデオ消費、スマートコンテンツ配信システムに多額の投資を行っています。この地域のメディア環境は進化しており、スケーラブルな動画ソリューションへの需要が急増していることから、動画加工プラットフォームの重要な成長拠点として位置づけられています。

当レポートでは、世界の動画加工プラットフォーム市場について調査し、オファリング別、コンテンツタイプ別、展開モード別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 2025年の米国関税の影響- 動画加工プラットフォーム市場

- 動画加工プラットフォーム市場の進化

- サプライチェーン分析

- エコシステム分析

- 投資情勢と資金調達シナリオ

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 2025年~2026年の主な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向/混乱

第6章 動画加工プラットフォーム市場、オファリング別

- イントロダクション

- プラットフォーム

- サービス

第7章 動画加工プラットフォーム市場、コンテンツタイプ別

- イントロダクション

- ライブストリーミングビデオ

- ビデオオンデマンド

- 短編動画とソーシャルメディアコンテンツ

- インタラクティブで没入感のあるビデオ

第8章 動画加工プラットフォーム市場、展開モード別

- イントロダクション

- クラウド

- オンプレミス

第9章 動画加工プラットフォーム市場、用途別

- イントロダクション

- 動画の取り込みとキャプチャ

- 動画配信と配信

- 動画編集と強化

- 動画ホスティングと公開

- コンテンツ制作とポストプロダクション

- コンテンツ保護

- 動画分析とQOEモニタリング

- 動画パーソナライゼーション&レコメンデーションエンジン

- その他

第10章 動画加工プラットフォーム市場、エンドユーザー別

- イントロダクション

- 企業ユーザー

- 個人ユーザー

第11章 動画加工プラットフォーム市場、地域別

- イントロダクション

- 北米

- 北米:動画加工プラットフォーム市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:動画加工プラットフォーム市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:動画加工プラットフォーム市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリアとニュージーランド

- ASEAN

- その他

- 中東・アフリカ

- 中東・アフリカ:動画加工プラットフォーム市場促進要因

- 中東・アフリカ:マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:動画加工プラットフォーム市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 製品比較分析

- 企業評価と財務指標、2025年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- AKAMAI TECHNOLOGIES

- MEDIAKIND

- HARMONIC

- SYNAMEDIA

- BRIGHTCOVE

- ADOBE

- AVID TECHNOLOGY

- MICROSOFT

- IBM

- VIMEO

- ATEME

- CYBERLINK

- AMAGI

- HAIVISION

- SYNTHESIA

- WISTIA

- TECHSMITH

- VIDEOVERSE

- MUX

- WOWZA MEDIA SYSTEMS

- ANIMAKER

- その他の企業

- KALTURA

- WONDERSHARE

- AWS

- ENGHOUSE NETWORKS

- TELESTREAM

- PANOPTO

- KAPWING

- PIXELPOWER

- M2A MEDIA

- VANTRIX

- LIGHTCAST.COM

- BEAMR

- BITMOVIN

- VILLAGE TALKIES

- MEDIAMELON

- BASE MEDIA CLOUD

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 GLOBAL VIDEO PROCESSING PLATFORM MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 4 GLOBAL VIDEO PROCESSING PLATFORM MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 5 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 6 VIDEO PROCESSING PLATFORM MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PATENTS FILED, 2016-2025

- TABLE 13 LIST OF TOP PATENTS IN VIDEO PROCESSING PLATFORM MARKET, 2024-2025

- TABLE 14 AVERAGE SELLING PRICES OF VIDEO PROCESSING PLATFORMS, OFFERED BY KEY PLAYERS, BY OFFERING, 2025

- TABLE 15 AVERAGE SELLING PRICES, BY PLATFORM, 2025 (USD/MONTH)

- TABLE 16 VIDEO PROCESSING PLATFORM MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 PORTERS' FIVE FORCES' IMPACT ON VIDEO PROCESSING PLATFORM MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 20 VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 21 VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 22 VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 23 VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 24 PLATFORM: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 PLATFORM: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 VIDEO ENCODING & TRANSCODING SOFTWARE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 VIDEO ENCODING & TRANSCODING SOFTWARE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 VIDEO MANAGEMENT SOFTWARE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 VIDEO MANAGEMENT SOFTWARE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 CONTENT MANAGEMENT TOOLS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 CONTENT MANAGEMENT TOOLS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 OTHER PLATFORMS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 OTHER PLATFORMS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 35 VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 36 SERVICES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 SERVICES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

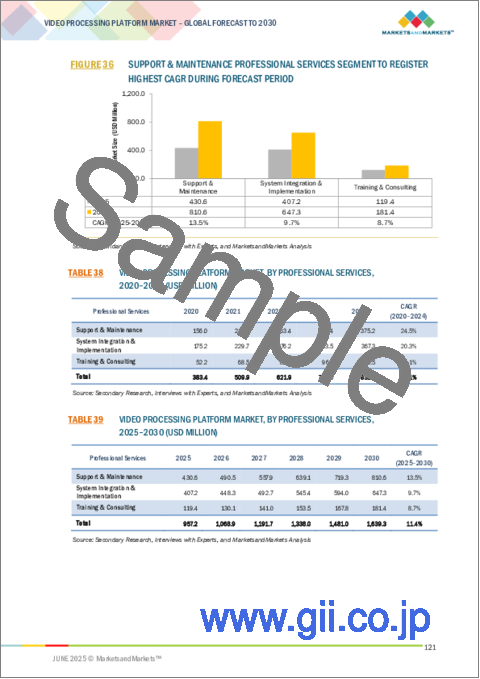

- TABLE 38 VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 39 VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 40 PROFESSIONAL SERVICES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 PROFESSIONAL SERVICES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 TRAINING & CONSULTING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 TRAINING & CONSULTING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SYSTEM INTEGRATION & IMPLEMENTATION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 SYSTEM INTEGRATION & IMPLEMENTATION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 SUPPORT & MAINTENANCE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 SUPPORT & MAINTENANCE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 MANAGED SERVICES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 MANAGED SERVICES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2020-2024 (USD MILLION)

- TABLE 51 VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2025-2030 (USD MILLION)

- TABLE 52 LIVE STREAMING VIDEO: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 LIVE STREAMING VIDEO: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 VIDEO ON DEMAND: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 VIDEO ON DEMAND: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 SHORT FORM VIDEO & SOCIAL MEDIA CONTENT: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 SHORT-FORM VIDEO & SOCIAL MEDIA CONTENT: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 INTERACTIVE AND IMMERSIVE VIDEO: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 INTERACTIVE AND IMMERSIVE VIDEO: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 61 VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 62 CLOUD: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 CLOUD: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 ON-PREMISES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 ON-PREMISES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 67 VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 68 VIDEO INGEST & CAPTURE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 VIDEO INGEST & CAPTURE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 VIDEO DELIVERY & DISTRIBUTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 VIDEO DELIVERY & DISTRIBUTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 VIDEO EDITING & ENHANCEMENT: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 VIDEO EDITING & ENHANCEMENT: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 VIDEO HOSTING & PUBLISHING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 VIDEO HOSTING & PUBLISHING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 CONTENT CREATION & POST-PRODUCTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 CONTENT CREATION & POST-PRODUCTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 CONTENT PROTECTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 CONTENT PROTECTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 VIDEO ANALYTICS & QOE MONITORING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 VIDEO ANALYTICS & QOE MONITORING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 VIDEO PERSONALIZATION & RECOMMENDATION ENGINES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 VIDEO PERSONALIZATION & RECOMMENDATION ENGINES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 OTHER APPLICATIONS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 OTHER APPLICATIONS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 87 VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 88 VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2020-2024 (USD MILLION)

- TABLE 89 VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2025-2030 (USD MILLION)

- TABLE 90 ENTERPRISE USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 ENTERPRISE USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT 2020-2024 (USD MILLION)

- TABLE 93 VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT, 2025-2030 (USD MILLION)

- TABLE 94 MEDIA & ENTERTAINMENT: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 MEDIA & ENTERTAINMENT: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 GAMING & SPORTS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 97 GAMING & SPORTS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 98 BROADCASTING & STREAMING SERVICE PROVIDERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 BROADCASTING & STREAMING SERVICE PROVIDERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 FILM & VIDEO PRODUCTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 101 FILM & VIDEO PRODUCTION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 102 OTHER MEDIA & ENTERTAINMENT ENTERPRISE USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 OTHER MEDIA & ENTERTAINMENT ENTERPRISE USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 RETAIL & E-COMMERCE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 105 RETAIL & E-COMMERCE: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 106 ADVERTISING & MARKETING AGENCIES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 107 ADVERTISING & MARKETING AGENCIES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 108 HEALTHCARE & LIFE SCIENCES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 109 HEALTHCARE & LIFE SCIENCES: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 110 EDUCATION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 111 EDUCATION: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 BFSI: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 113 BFSI: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 114 MANUFACTURING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 115 MANUFACTURING: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 116 TRAVEL & HOSPITALITY: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 117 TRAVEL & HOSPITALITY: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 OTHER ENTERPRISE USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 119 OTHER ENTERPRISE USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 INDIVIDUAL USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 121 INDIVIDUAL USERS: VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 123 VIDEO PROCESSING PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 127 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2020-2024 USD MILLION)

- TABLE 129 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 130 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 132 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2020-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2025-2030 (USD MILLION)

- TABLE 134 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2020-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2025-2030 (USD MILLION)

- TABLE 142 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT ENTERPRISE USERS, 2020-2024 (USD MILLION)

- TABLE 143 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT ENTERPRISE USERS, 2025-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 146 US: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 147 US: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 148 CANADA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 149 CANADA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 150 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 151 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 153 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 154 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2020-2024 USD MILLION)

- TABLE 155 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 156 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 157 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 158 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2020-2024 (USD MILLION)

- TABLE 159 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2025-2030 (USD MILLION)

- TABLE 160 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 161 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 162 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 163 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 164 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 165 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 166 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2020-2024 (USD MILLION)

- TABLE 167 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2025-2030 (USD MILLION)

- TABLE 168 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT ENTERPRISE USERS, 2020-2024 (USD MILLION)

- TABLE 169 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT ENTERPRISE USERS, 2025-2030 (USD MILLION)

- TABLE 170 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 171 EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 UK: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 173 UK: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 174 GERMANY: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 175 GERMANY: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 176 FRANCE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 177 FRANCE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 178 ITALY: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 179 ITALY: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 180 SPAIN: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 181 SPAIN: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 182 REST OF EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 183 REST OF EUROPE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 185 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 186 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 187 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 188 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2020-2024 USD MILLION)

- TABLE 189 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 190 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 191 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 192 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2020-2024 (USD MILLION)

- TABLE 193 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2025-2030 (USD MILLION)

- TABLE 194 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 195 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 196 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 197 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 198 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 199 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 200 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2020-2024 (USD MILLION)

- TABLE 201 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2025-2030 (USD MILLION)

- TABLE 202 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT USER, 2020-2024 (USD MILLION)

- TABLE 203 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT USER, 2025-2030 (USD MILLION)

- TABLE 204 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 205 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 206 CHINA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 207 CHINA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 208 JAPAN: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 209 JAPAN: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 210 INDIA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 211 INDIA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 212 SOUTH KOREA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 213 SOUTH KOREA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 214 AUSTRALIA & NEW ZEALAND: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 215 AUSTRALIA & NEW ZEALAND: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 216 ASEAN: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 217 ASEAN: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 218 ASEAN: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 219 ASEAN: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2020-2024 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2025-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2020-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2025-2030 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT USER, 2020-2024 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT USER, 2025-2030 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY SUB-REGION, 2020-2024 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY SUB-REGION, 2025-2030 (USD MILLION)

- TABLE 244 MIDDLE EAST: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 245 MIDDLE EAST: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 246 SAUDI ARABIA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 247 SAUDI ARABIA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 248 UAE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 249 UAE: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 250 QATAR: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 251 QATAR: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 252 TURKEY: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 253 TURKEY: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 256 AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 257 AFRICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 258 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 259 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2020-2024 (USD MILLION)

- TABLE 261 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 262 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2020-2024 USD MILLION)

- TABLE 263 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 264 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 265 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 266 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2020-2024 (USD MILLION)

- TABLE 267 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE, 2025-2030 (USD MILLION)

- TABLE 268 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 269 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 270 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 271 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 272 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 273 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 274 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2020-2024 (USD MILLION)

- TABLE 275 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY ENTERPRISE USER, 2025-2030 (USD MILLION)

- TABLE 276 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT USER, 2020-2024 (USD MILLION)

- TABLE 277 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY MEDIA & ENTERTAINMENT USER, 2025-2030 (USD MILLION)

- TABLE 278 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 279 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 280 BRAZIL: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 281 BRAZIL: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 282 MEXICO: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 283 MEXICO: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 284 ARGENTINA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 285 ARGENTINA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 288 OVERVIEW OF STRATEGIES ADOPTED BY KEY VIDEO PROCESSING PLATFORM VENDORS, JANUARY 2021-MAY 2025

- TABLE 289 VIDEO PROCESSING PLATFORM MARKET: DEGREE OF COMPETITION

- TABLE 290 VIDEO PROCESSING PLATFORM MARKET: REGIONAL FOOTPRINT (19 PLAYERS)

- TABLE 291 VIDEO PROCESSING PLATFORM MARKET: PLATFORM FOOTPRINT (19 PLAYERS)

- TABLE 292 VIDEO PROCESSING PLATFORM MARKET: APPLICATION FOOTPRINT (19 PLAYERS)

- TABLE 293 VIDEO PROCESSING PLATFORM MARKET: ENTERPRISE USER FOOTPRINT (19 PLAYERS)

- TABLE 294 VIDEO PROCESSING PLATFORM MARKET: KEY STARTUPS/SMES, 2024

- TABLE 295 VIDEO PROCESSING PLATFORM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 296 VIDEO PROCESSING PLATFORM MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-MAY 2025

- TABLE 297 VIDEO PROCESSING PLATFORM MARKET: DEALS, JANUARY 2021- MAY 2025

- TABLE 298 AKAMAI TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 299 AKAMAI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 AKAMAI TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 301 AKAMAI TECHNOLOGIES: DEALS

- TABLE 302 MEDIAKIND: BUSINESS OVERVIEW

- TABLE 303 MEDIAKIND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 MEDIAKIND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 305 MEDIAKIND: DEALS

- TABLE 306 HARMONIC: BUSINESS OVERVIEW

- TABLE 307 HARMONIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 HARMONIC: PRODUCT ENHANCEMENTS

- TABLE 309 HARMONIC: DEALS

- TABLE 310 SYNAMEDIA: BUSINESS OVERVIEW

- TABLE 311 SYNAMEDIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 SYNAMEDIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 313 SYNAMEDIA: DEALS

- TABLE 314 BRIGHTCOVE: BUSINESS OVERVIEW

- TABLE 315 BRIGHTCOVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 BRIGHTCOVE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 317 BRIGHTCOVE: DEALS

- TABLE 318 ADOBE: BUSINESS OVERVIEW

- TABLE 319 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 ADOBE: PRODUCT ENHANCEMENTS

- TABLE 321 ADOBE: DEALS

- TABLE 322 AVID TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 323 AVID TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 AVID TECHNOLOGY: PRODUCT ENHANCEMENTS

- TABLE 325 AVID TECHNOLOGY: DEALS

- TABLE 326 MICROSOFT: BUSINESS OVERVIEW

- TABLE 327 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 MICROSOFT: DEALS

- TABLE 329 IBM: BUSINESS OVERVIEW

- TABLE 330 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 IBM: DEALS

- TABLE 332 KALTURA: BUSINESS OVERVIEW

- TABLE 333 KALTURA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 KALTURA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 335 KALTURA: DEALS

- TABLE 336 AI IMAGE AND VIDEO GENERATOR MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 337 AI IMAGE AND VIDEO GENERATOR MARKET, BY OFFERING, 2024-2030 (USD MILLION)

- TABLE 338 AI IMAGE AND VIDEO GENERATOR MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 339 AI IMAGE AND VIDEO GENERATOR MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 340 AI IMAGE AND VIDEO GENERATOR MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 341 AI IMAGE AND VIDEO GENERATOR MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 342 AI IMAGE AND VIDEO GENERATOR MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 343 AI IMAGE AND VIDEO GENERATOR MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 344 VIDEO ANALYTICS MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 345 VIDEO ANALYTICS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 346 VIDEO ANALYTICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 347 VIDEO ANALYTICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 348 VIDEO ANALYTICS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 349 VIDEO ANALYTICS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 350 VIDEO ANALYTICS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 351 VIDEO ANALYTICS MARKET, BY REGION, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 VIDEO PROCESSING PLATFORM: MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 VIDEO PROCESSING PLATFORM MARKET: RESEARCH DESIGN

- FIGURE 3 VIDEO PROCESSING PLATFORM: DATA TRIANGULATION

- FIGURE 4 VIDEO PROCESSING PLATFORM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM OFFERINGS IN VIDEO PROCESSING PLATFORM MARKET

- FIGURE 6 APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL COMPANIES IN VIDEO PROCESSING PLATFORM MARKET

- FIGURE 7 APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE ALL PLATFORM/SERVICES OF VIDEO PROCESSING PLATFORM MARKET

- FIGURE 8 APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF VIDEO PROCESSING PLATFORM THROUGH OVERALL IT SPENDING

- FIGURE 9 PLATFORMS OFFERING SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 LIVE STREAMING VIDEO CONTENT TYPE TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 11 VIDEO ANALYTICS & QOE MONITORING SEGMENT TO LEAD MARKET IN 2025

- FIGURE 12 MARKETING & ADVERTISING AGENCIES TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 RISING DEMAND FOR SHORT-FORM AND PLATFORM-SPECIFIC VIDEO CONTENT FOR IMMERSIVE USER EXPERIENCE TO DRIVE MARKET

- FIGURE 15 VIDEO PERSONALIZATION & RECOMMENDATION ENGINES APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 PLATFORM AND ENTERPRISE USERS SEGMENTS TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2025

- FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 18 VIDEO PROCESSING PLATFORM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 NON-VIDEO MARKETERS WHO PLAN TO START USING VIDEO IN 2025

- FIGURE 20 YOUTUBE VIDEO GROWTH OVER YEARS 2016-2025

- FIGURE 21 VIDEO PROCESSING PLATFORM MARKET EVOLUTION

- FIGURE 22 VIDEO PROCESSING PLATFORM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 KEY PLAYERS IN VIDEO PROCESSING PLATFORM ECOSYSTEM

- FIGURE 24 VIDEO PROCESSING PLATFORM MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 25 PATENTS APPLIED AND GRANTED IN LAST 10 YEARS, 2016-2025

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 27 AVERAGE SELLING PRICES, BY PLATFORM, 2025 (USD/MONTH)

- FIGURE 28 VIDEO PROCESSING PLATFORM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 31 VIDEO PROCESSING PLATFORM MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING VIDEO PROCESSING PLATFORM ACROSS KEY USE CASES

- FIGURE 33 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 CONTENT MANAGEMENT TOOLS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 SUPPORT & MAINTENANCE PROFESSIONAL SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 SHORT-FORM VIDEO & SOCIAL MEDIA CONTENT TYPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 ON-PREMISES DEPLOYMENT MODE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 VIDEO PERSONALIZATION & RECOMMENDATION ENGINES APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ENTERPRISE USERS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 MARKETING & ADVERTISING AGENCIES ENTERPRISE USERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA TO BE LARGEST REGIONAL MARKET IN 2025

- FIGURE 43 INDIA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN VIDEO PROCESSING PLATFORM MARKET, 2020-2024

- FIGURE 47 SHARE OF LEADING COMPANIES IN VIDEO PROCESSING PLATFORM MARKET, 2024

- FIGURE 48 PRODUCT COMPARATIVE ANALYSIS (OFFERING)

- FIGURE 49 PRODUCT COMPARATIVE ANALYSIS (OFFERING)

- FIGURE 50 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 52 VIDEO PROCESSING PLATFORM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 VIDEO PROCESSING PLATFORM MARKET: COMPANY FOOTPRINT (19 PLAYERS)

- FIGURE 54 VIDEO PROCESSING PLATFORM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 AKAMAI TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 56 HARMONIC: COMPANY SNAPSHOT

- FIGURE 57 ADOBE: COMPANY SNAPSHOT

- FIGURE 58 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 59 IBM: COMPANY SNAPSHOT

- FIGURE 60 KALTURA: COMPANY SNAPSHOT

The video processing platform market is expanding rapidly, with a projected market size rising from USD 7.50 billion in 2025 to USD 12.40 billion by 2030, at a CAGR of 10.6% during the forecast period. The surge in short-form and platform-specific video content demands rapid adaptation and delivery across social and mobile platforms. In additionally, the adoption of advanced video codecs is transforming video traffic management by enhancing compression efficiency and reducing bandwidth usage without compromising quality. Simultaneously, the global expansion of OTT services is accelerating video consumption and deepening viewer engagement. Together, these trends are reshaping video workflows and increasing demand for scalable, real-time processing capabilities across industries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | Offering, Content type, Deployment Mode, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"Video personalization & recommendation engines application segment to account for the highest growth rate during the forecast period"

Video personalization & recommendation engines are experiencing the highest growth rate in the video processing platform market due to rising consumer demand for tailored content experiences. As streaming services grow, users expect relevant, engaging, and on-demand content aligned with their preferences. Platforms increasingly leverage artificial intelligence (AI) and machine learning (ML) to analyze viewing behavior and contextual data, enabling real-time recommendations that enhance user engagement, retention, and monetization. Personalized delivery also strengthens user satisfaction and helps platforms stand out in a crowded market. As content libraries expand, effective content discovery becomes essential, positioning personalization as a key strategic advantage across the video ecosystem.

"Live streaming video content type segment to hold the largest market share during the forecast period"

Live streaming holds the highest market share in the video processing platform market due to the growing demand for real-time content across entertainment, sports, gaming, corporate communications, and events. Audiences increasingly seek instant access to live experiences, driving content providers to prioritize low-latency, high-quality delivery. Social media platforms, OTT services, and enterprises are leveraging live video to boost engagement, build communities, and enhance brand presence. In addition, the rise of virtual events, webinars, and live commerce has further expanded adoption. The need for scalable, real-time processing capabilities positions live streaming as the dominant content type driving platform utilization and revenue growth.

"North America leads with advanced infrastructure and early AI adoption, while Asia Pacific records fastest growth with digitalization and government AI initiatives"

North America leads the video processing platform market, driven by its mature digital infrastructure, early adoption of cloud and AI technologies, and strong presence of major streaming and technology companies. The region benefits from high broadband penetration, robust investment in OTT and live streaming services, and advanced consumer demand for real-time, multi-device video experiences. Key players, such as Akamai Technologies, MediaKind, and Harmonic, leverage innovations in AI-powered encoding, low-latency delivery, and content personalization to enhance user engagement and operational efficiency. Meanwhile, Asia Pacific is the fastest-growing market, fueled by rapid digitalization, expanding internet access, and supportive government initiatives for AI integration. Countries like China, India, and Japan are investing heavily in digital infrastructure, mobile-first video consumption, and smart content delivery systems. The region's evolving media landscape and surging demand for scalable video solutions position it as a significant growth hub for video processing platforms.

Breakdown of Primary Interviews

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the video processing platform market.

- By Company: Tier I - 25%, Tier II - 45%, and Tier III - 30%

- By Designation: C-Level Executives - 35%, D-Level Executives -40%, and others - 25%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 15%, Middle East & Africa - 10%, and Latin America - 5%

The report includes a study of key players offering video processing platform. It profiles major vendors in the video processing platform market. The major market players include Akamai Technologies (US), MediaKind (US), Harmonic (US), Synamedia (UK), Avid Technology (US), Brightcove (US), Kaltura (US), Adobe (US), IBM (US), Microsoft (US), Vimeo (US), Ateme (France), Amagi (India), CyberLink (Taiwan), AWS (US), Google (US), Wondershare (China), Haivision (US), Telestream (US), Wowza Media Systems (US), SeaChange (US), Mux (US), Bitmovin (US), Panopto (US), Wistia (US), MediaMelon (US), Vantrix (Canada), M2A Media (London), Pixelpower (UK), Kapwing (US), Beamr (Israel), Lightcast.com (US), Base Media Cloud (UK), Village Talkies (Australia), Synthesia (UK), TechSmith (US), VideoVerse (US), and Animaker (US).

Research Coverage

This research report categorizes the video processing platform market based on Offering [platform {video encoding & transcoding software, video management software, content management tools and other platforms (workflow automation & orchestration software, live production tools)) and services {professional services (training & consulting, system integration & implementation, and support & maintenance)} and managed services], Content type (live streaming video, video on demand (VOD), short form video & social media content, interactive and immersive video), Deployment mode (cloud & on-premises), Application [video ingest & capture, video delivery & distribution, video editing & enhancement, video hosting & publishing, content creation & post-production, content protection (DRM, watermarking), video analytics & QoE monitoring, video personalization & recommendation engines, and other applications {live production, broadcasting & playout, compliance & regulatory management for video content}], End User [enterprise {media & entertainment (gaming & sports, broadcasting & streaming service providers, film & video production, others (Digital Content Publishers & Social Media Platforms), retail & ecommerce, advertising & marketing agencies, healthcare & life sciences, education, BFSI, manufacturing, travel & hospitality, and other enterprise users (IT & telecom, real estate, government & defense)} and individual users}, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The scope of the report covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the video processing platform market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers & acquisitions; and recent developments associated with the market. This report also covered the competitive analysis of upcoming startups in the market ecosystem.

Key Benefits of Buying the Report

The report will provide the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall video processing platform market and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rise of short-form and platform-specific video content, OTT Expansion drives global video consumption and viewer engagement, and advanced codecs transforms video traffic management for high-resolution global streaming), restraints (Cost of implementation of video processing platform hindering market growth and rising competition restricts strategic differentiation and long-term scalability), opportunities (Growing adoption of edge computing infrastructure for real-time data processing, Rise in online education and e-learning to improve the learning experience and AI Enhances Real-Time Video Quality for Seamless Live Content Delivery), and challenges (Transforming shaky footage into smooth, stable video while preserving intentional movements, and integrating video processing platforms with existing systems).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the video processing platform market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the video processing platform market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the video processing platform market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Akamai Technologies (US), MediaKind (US), Harmonic (US), Synamedia (UK), Avid Technology (US), Brightcove (US), Kaltura (US), Adobe (US), IBM (US), Microsoft (US), Vimeo (US), Ateme (France), Amagi (India), CyberLink (Taiwan), AWS (US), Google (US), Wondershare (China), Haivision (US), Telestream (US), Wowza Media Systems (US), SeaChange (US), Mux (US), Bitmovin (US), Panopto (US), Wistia (US), MediaMelon (US), Vantrix (Canada), M2A Media (London), Pixelpower (UK), Kapwing (US), Beamr (Israel), Lightcast.com (US), Base Media Cloud (UK), Village Talkies (Australia), Synthesia (UK), TechSmith (US), VideoVerse (US), and Animaker (US). The report also helps stakeholders understand the pulse of the video processing platform market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary Interviews

- 2.1.2.2 Breakup of Primary Profiles

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VIDEO PROCESSING PLATFORM MARKET

- 4.2 VIDEO PROCESSING PLATFORM MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET, BY OFFERING AND END USER

- 4.4 VIDEO PROCESSING PLATFORM MARKET: BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for video content drives innovation in video processing

- 5.2.1.2 Advanced codecs transform video traffic management for high-resolution global streaming

- 5.2.1.3 Rise of short-form and platform-specific video content

- 5.2.1.4 OTT expansion drives global video consumption and viewer engagement

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cost of implementation of video processing platform hindering market growth

- 5.2.2.2 Rising competition and saturation restrain innovation and profitability in video processing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of edge computing infrastructure for real-time data processing

- 5.2.3.2 Rise in online education and e-learning to improve learning experience

- 5.2.3.3 AI enhances real-time video quality for seamless live content delivery

- 5.2.4 CHALLENGES

- 5.2.4.1 Transforming shaky footage into smooth, stable video while preserving intentional movements

- 5.2.4.2 Integrating video processing platforms with existing systems

- 5.2.1 DRIVERS

- 5.3 IMPACT OF 2025 US TARIFFS-VIDEO PROCESSING PLATFORM MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 KEY TARIFF RATES

- 5.3.3 PRICE IMPACT ANALYSIS

- 5.3.3.1 Strategic shifts and emerging trends

- 5.3.4 KEY IMPACT ON VARIOUS REGIONS/COUNTRIES

- 5.3.4.1 US

- 5.3.4.1.1 Strategic shifts and key observations

- 5.3.4.2 China

- 5.3.4.2.1 Strategic shifts and key observations

- 5.3.4.3 Europe

- 5.3.4.3.1 Strategic shifts and key observations

- 5.3.4.4 India

- 5.3.4.4.1 Strategic shifts and key observations

- 5.3.4.1 US

- 5.3.5 IMPACT ON END-USE INDUSTRIES

- 5.3.5.1 Media & Entertainment

- 5.3.5.2 Retail & e-commerce

- 5.3.5.3 Healthcare & life sciences

- 5.4 EVOLUTION OF VIDEO PROCESSING PLATFORM MARKET

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 PLATFORM PROVIDERS

- 5.6.1.1 Video encoding & transcoding software

- 5.6.1.2 Video management software

- 5.6.1.3 Content management tools

- 5.6.1.4 Workflow automation & orchestration software

- 5.6.1.5 Live production tools

- 5.6.1.6 Service providers

- 5.6.1 PLATFORM PROVIDERS

- 5.7 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 TAGHOS COMBATS ILLEGAL STREAMING AND BOOSTS NATIONWIDE VIDEO QUALITY WITH AKAMAI CDN

- 5.8.2 CFA INSTITUTE AND BRIGHTCOVE ENHANCE GLOBAL DIGITAL CONTENT SECURITY AND ENGAGEMENT SOLUTIONS

- 5.8.3 INSIGHT GLOBAL AND SYNTHESIA REVOLUTIONIZE NURSE TRAINING WITH 10X FASTER VIDEO PRODUCTION

- 5.8.4 UNIVERSITY OF DUNDEE AND PANOPTO TRANSFORM LEARNING EXPERIENCE USING PANOPTO VIDEO PLATFORM

- 5.8.5 BITMOVIN HELPS APA-TECH TO DELIVER SEAMLESS MULTI-DEVICE STREAMING WHILE REDUCING OPERATIONAL COMPLEXITY

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Video Encoding/Decoding

- 5.9.1.2 Video Transcoding

- 5.9.1.3 Adaptive Bitrate Streaming

- 5.9.1.4 Video Content Delivery Networks

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Cloud Computing

- 5.9.2.2 Artificial Intelligence

- 5.9.2.3 Dynamic Ad Insertion

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 VR/AR

- 5.9.3.2 Motion Capture Technology

- 5.9.3.3 Edge Computing

- 5.9.3.4 5G Connection & Networking

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 KEY REGULATIONS

- 5.10.2.1 North America

- 5.10.2.1.1 US

- 5.10.2.1.2 Canada

- 5.10.2.2 Europe

- 5.10.2.2.1 UK

- 5.10.2.2.2 France

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 Singapore

- 5.10.2.3.2 India

- 5.10.2.3.3 Thailand

- 5.10.2.3.4 South Korea

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 Middle East

- 5.10.2.4.2 South Africa

- 5.10.2.5 Latin America

- 5.10.2.5.1 Brazil

- 5.10.2.5.2 Mexico

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICES OF VIDEO PROCESSING PLATFORMS, OFFERED BY KEY PLAYERS, BY OFFERING, 2025

- 5.12.2 AVERAGE SELLING PRICES, BY PLATFORM, 2025 (USD/MONTH)

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16.1 IMPACT OF GENERATIVE AI ON VIDEO PROCESSING PLATFORM MARKET

- 5.16.1.1 Top use cases and market potential

- 5.16.1.2 Key Use Cases

- 5.16.1.2.1 Video upscaling

- 5.16.1.2.2 Multilingual dubbing and lip-syncing

- 5.16.1.2.3 Automated video editing

- 5.16.1.2.4 Synthetic human avatars

- 5.16.1.2.5 Scene generation

- 5.16.1.2.6 Virtual background replacement

- 5.16.1 IMPACT OF GENERATIVE AI ON VIDEO PROCESSING PLATFORM MARKET

6 VIDEO PROCESSING PLATFORM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 6.2 PLATFORM

- 6.2.1 VIDEO ENCODING & TRANSCODING SOFTWARE

- 6.2.1.1 Optimizing video compatibility and quality through efficient encoding and transcoding process to drive market

- 6.2.2 VIDEO MANAGEMENT SOFTWARE

- 6.2.2.1 Centralized video asset organization and control for seamless content operations to drive market

- 6.2.3 CONTENT MANAGEMENT TOOLS

- 6.2.3.1 Streamlining video content creation, publishing, and management across multiple channels to drive market

- 6.2.4 OTHER PLATFORMS

- 6.2.1 VIDEO ENCODING & TRANSCODING SOFTWARE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Optimizing video workflows through expert guidance for enhanced performance and faster deployment to drive market

- 6.3.1.2 Training & Consulting

- 6.3.1.3 System integration & implementation

- 6.3.1.4 Support & maintenance

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Streamlining video content management with scalable, monitored, and AI-enhanced managed services to drive market

- 6.3.1 PROFESSIONAL SERVICES

7 VIDEO PROCESSING PLATFORM MARKET, BY CONTENT TYPE

- 7.1 INTRODUCTION

- 7.1.1 CONTENT TYPE: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 7.2 LIVE STREAMING VIDEO

- 7.2.1 ENHANCING REAL-TIME AUDIENCE ENGAGEMENT THROUGH ADAPTIVE STREAMING AND INSTANT CONTENT DELIVERY TO DRIVE MARKET

- 7.3 VIDEO ON DEMAND

- 7.3.1 MEETING FLEXIBLE VIEWING DEMANDS WITH PERSONALIZED, SCALABLE, AND ON-DEMAND CONTENT DELIVERY TO DRIVE MARKET

- 7.4 SHORT-FORM VIDEO & SOCIAL MEDIA CONTENT

- 7.4.1 ACCELERATING TREND-DRIVEN CONTENT CREATION WITH RAPID EDITING AND MULTI-PLATFORM DISTRIBUTION TO DRIVE MARKET

- 7.5 INTERACTIVE & IMMERSIVE VIDEO

- 7.5.1 DEEPER VIEWER ENGAGEMENT THROUGH PERSONALIZED, INTERACTIVE, AND IMMERSIVE VIDEO EXPERIENCES TO DRIVE MARKET

8 VIDEO PROCESSING PLATFORM MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODE: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 8.2 CLOUD

- 8.2.1 SEAMLESS REMOTE COLLABORATION FOR DISTRIBUTED VIDEO PRODUCTION THROUGH CLOUD TO DRIVE MARKET

- 8.3 ON-PREMISES

- 8.3.1 ENSURING REGULATORY COMPLIANCE AND DATA PRIVACY WITH ON-PREMISES VIDEO PROCESSING PLATFORMS TO DRIVE MARKET

9 VIDEO PROCESSING PLATFORM MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATION: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 9.2 VIDEO INGEST & CAPTURE

- 9.2.1 STREAMLINING MULTI-SOURCE VIDEO INGEST FOR FASTER WORKFLOWS TO DRIVE MARKET

- 9.3 VIDEO DELIVERY & DISTRIBUTION

- 9.3.1 ENSURING SECURE AND SCALABLE VIDEO DELIVERY ACROSS DIVERSE DIGITAL PLATFORMS TO DRIVE MARKET

- 9.4 VIDEO EDITING & ENHANCEMENT

- 9.4.1 STREAMLINING CREATIVE WORKFLOW WITH VIDEO EDITING AND ENHANCEMENT FOR HIGH-QUALITY AND ENGAGING CONTENT TO DRIVE MARKET

- 9.5 VIDEO HOSTING & PUBLISHING

- 9.5.1 ACCELERATING CONTENT REACH WITH STREAMLINED VIDEO HOSTING AND PUBLISHING FOR VIEWER ENGAGEMENT TO DRIVE MARKET

- 9.6 CONTENT CREATION & POST-PRODUCTION

- 9.6.1 STREAMLINING CONTENT CREATION AND POST-PRODUCTION FOR FASTER DELIVERY AND CONSISTENT VIDEO QUALITY TO DRIVE MARKET

- 9.7 CONTENT PROTECTION

- 9.7.1 SECURING VIDEO CONTENT WITH DRM AND WATERMARKING TO PREVENT UNAUTHORIZED ACCESS

- 9.8 VIDEO ANALYTICS & QOE MONITORING

- 9.8.1 ENHANCING VIEWER ENGAGEMENT WITH VIDEO ANALYTICS AND MONITORING FOR VIEWER SATISFACTION TO DRIVE MARKET

- 9.9 VIDEO PERSONALIZATION & RECOMMENDATION ENGINES

- 9.9.1 MAXIMIZING USER ENGAGEMENT WITH INTELLIGENT STRATEGIES TO DRIVE MARKET

- 9.10 OTHER APPLICATIONS

10 VIDEO PROCESSING PLATFORM MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USER: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 10.2 ENTERPRISE USERS

- 10.2.1 MEDIA & ENTERTAINMENT

- 10.2.1.1 Video Processing to help optimize Post-production processes such as video rendering, compression, and format conversion

- 10.2.1.2 Gaming & Sports

- 10.2.1.3 Broadcasting & Streaming Service Providers

- 10.2.1.4 Film & Video Production

- 10.2.1.5 Other media & entertainment enterprise users

- 10.2.2 RETAIL & E-COMMERCE

- 10.2.2.1 Enabling interactive and personalized video experiences to drive customer engagement and sales

- 10.2.3 ADVERTISING & MARKETING AGENCIES

- 10.2.3.1 Leveraging interactive video campaigns and real-time analytics for targeted audience conversion to drive market

- 10.2.4 HEALTHCARE & LIFE SCIENCES

- 10.2.4.1 Video processing to ensure real-time communication, visual assessment, and remote patient monitoring

- 10.2.5 EDUCATION

- 10.2.5.1 Video processing to enable remote learning by providing access to pre-recorded lectures and instructional videos

- 10.2.6 BFSI

- 10.2.6.1 Increasing demand for secure, compliant, and scalable video processing solutions to drive market

- 10.2.7 MANUFACTURING

- 10.2.7.1 Enhancing manufacturing operations using cloud-based video processing and real-time analytics to drive market

- 10.2.8 TRAVEL & HOSPITALITY

- 10.2.8.1 Enhancing guest experience and operational efficiency with AI video analytics to drive market

- 10.2.9 OTHER ENTERPRISE USERS

- 10.2.9.1 Driving seamless communication and collaboration with centralized, secure enterprise video management across industries to drive market

- 10.2.1 MEDIA & ENTERTAINMENT

- 10.3 INDIVIDUAL USERS

11 VIDEO PROCESSING PLATFORM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Advancing video processing through AI-driven automation and immersive content to drive market

- 11.2.4 CANADA

- 11.2.4.1 Growing adoption of video-centric product marketing techniques to drive market

- 11.3 EUROPE

- 11.3.1 EUROPE: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 High demand for video content and streaming services to boost market

- 11.3.4 GERMANY

- 11.3.4.1 Growing emphasis on video content for communication across industry verticals to drive market

- 11.3.5 FRANCE

- 11.3.5.1 Increase in online video consumption and technological innovation to drive market growth

- 11.3.6 ITALY

- 11.3.6.1 Driving video processing growth through AI-powered personalization and analytics to drive market

- 11.3.7 SPAIN

- 11.3.7.1 Fueling video processing growth through social media and mobile demand to drive market

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Rising demand for high-quality video content to fuel innovation

- 11.4.4 JAPAN

- 11.4.4.1 Expanding OTT content creation and smart video editing in digital media sector to drive market

- 11.4.5 INDIA

- 11.4.5.1 Media growth through AI-enhanced video analytics and localization to drive market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Innovation in AI-powered video processing for immersive digital entertainment to drive market

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Rapid adoption of streaming services to drive market growth

- 11.4.8 ASEAN

- 11.4.8.1 Acceleration of cloud-based video processing to meet growing streaming demands to drive market

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Saudi Arabia

- 11.5.3.1.1 Development in broadband and internet services to fuel market growth

- 11.5.3.2 UAE

- 11.5.3.2.1 Growing technological advancements to support adoption of video processing platforms

- 11.5.3.3 Qatar

- 11.5.3.3.1 Accelerating digital transformation with AI-powered video processing and smart media infrastructure partnerships to drive market

- 11.5.3.4 Turkey

- 11.5.3.4.1 Innovation through analytics and urban content delivery solutions to drive market

- 11.5.3.5 Rest of Middle East

- 11.5.3.1 Saudi Arabia

- 11.5.4 AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: VIDEO PROCESSING PLATFORM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Widespread use of video processing platforms to drive market

- 11.6.4 MEXICO

- 11.6.4.1 Expanding Mexico's digital video frontier through AVOD and genre innovation to drive market

- 11.6.5 ARGENTINA

- 11.6.5.1 Growing security concerns and government initiative to drive market

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT COMPARATIVE ANALYSIS

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING (KEY PLAYERS)

- 12.5.1.1 Akamai Media Services Live (Akamai Technologies)

- 12.5.1.2 MK.IO platform (MediaKind)

- 12.5.1.3 VOS Media Software (Harmonic)

- 12.5.1.4 Video Streaming Platform (Synamedia)

- 12.5.1.5 Brightcove Marketing Studio (Brightcove)

- 12.5.2 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING (STARTUPS/SMES)

- 12.5.2.1 Haivision Media Platform (Haivision)

- 12.5.2.2 ARGUS platform (Telestream)

- 12.5.2.3 Panopto platform (Panopto)

- 12.5.2.4 Synthesia platform (Synthesia)

- 12.5.2.5 Wowza Video Platform (Wowza Media Systems)

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING (KEY PLAYERS)

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Application footprint

- 12.7.5.5 Enterprise User footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 AKAMAI TECHNOLOGIES

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 MEDIAKIND

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches and enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 HARMONIC

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product Enhancements

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 SYNAMEDIA

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches and enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 BRIGHTCOVE

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches and enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 ADOBE

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product Enhancements

- 13.2.6.3.2 Deals

- 13.2.7 AVID TECHNOLOGY

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product Enhancements

- 13.2.7.3.2 Deals

- 13.2.8 MICROSOFT

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Deals

- 13.2.9 IBM

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 VIMEO

- 13.2.11 ATEME

- 13.2.12 CYBERLINK

- 13.2.13 AMAGI

- 13.2.14 HAIVISION

- 13.2.15 SYNTHESIA

- 13.2.16 WISTIA

- 13.2.17 TECHSMITH

- 13.2.18 VIDEOVERSE

- 13.2.19 MUX

- 13.2.20 WOWZA MEDIA SYSTEMS

- 13.2.21 ANIMAKER

- 13.2.1 AKAMAI TECHNOLOGIES

- 13.3 OTHER PLAYERS

- 13.3.1 KALTURA

- 13.3.1.1 Business overview

- 13.3.1.2 Products/Solutions/Services offered

- 13.3.1.3 Recent developments

- 13.3.1.3.1 Product Launches and enhancements

- 13.3.1.3.2 Deals

- 13.3.2 GOOGLE

- 13.3.3 WONDERSHARE

- 13.3.4 AWS

- 13.3.5 ENGHOUSE NETWORKS

- 13.3.6 TELESTREAM

- 13.3.7 PANOPTO

- 13.3.8 KAPWING

- 13.3.9 PIXELPOWER

- 13.3.10 M2A MEDIA

- 13.3.11 VANTRIX

- 13.3.12 LIGHTCAST.COM

- 13.3.13 BEAMR

- 13.3.14 BITMOVIN

- 13.3.15 VILLAGE TALKIES

- 13.3.16 MEDIAMELON

- 13.3.17 BASE MEDIA CLOUD

- 13.3.1 KALTURA

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 AI IMAGE AND VIDEO GENERATOR MARKET-GLOBAL FORECAST TO 2030

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 AI image and video generator market, by offering

- 14.2.2.2 AI image and video generator market, by application

- 14.2.2.3 AI image and video generator, by end user

- 14.2.2.4 AI image and video generator market, by region

- 14.3 VIDEO ANALYTICS MARKET- GLOBAL FORECAST TO 2028

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 Video analytics market, by offering

- 14.3.2.2 Video analytics market, by application

- 14.3.2.3 Video analytics market, by vertical

- 14.3.2.4 Video analytics market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS