|

|

市場調査レポート

商品コード

1330299

空気質モニタリングシステムの世界市場:製品別、サンプリング別、汚染物質別、エンドユーザー別、地域別 - 予測(~2028年)Air Quality Monitoring System Market by Product (Indoor, Outdoor, Fixed, Portable, Wearable), Sampling, Pollutant (Chemical, Physical, Biological), End User (Govt, Petrochemical, Residential, Smart City), & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 空気質モニタリングシステムの世界市場:製品別、サンプリング別、汚染物質別、エンドユーザー別、地域別 - 予測(~2028年) |

|

出版日: 2023年08月01日

発行: MarketsandMarkets

ページ情報: 英文 254 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の空気質モニタリングシステムの市場規模は、2023年の49億米ドルから2028年までに69億米ドルに達し、予測期間中にCAGRで7.0%の成長が予測されています。

空気質モニタリングシステムにおける技術の進歩が、今後数年間の市場成長を促進する重大な要因の1つとなっています。

"屋内モニターが2022年に市場で最大のシェアを占めました。"

屋外モニターは、予測期間中にもっとも高いCAGRで成長すると予想されます。このセグメントの成長は、大気汚染モニタリングシステムの産業利用の増加、エンドユーザー基盤の拡大、固定式屋外モニターのエンドユーザー基盤の拡大、市場全体(特に新興国)で進行中しているAQMステーションの設置、手頃な価格で斬新な環境モニタリング製品の開発に向けた官民投資、小型化された可動式製品の利用可能性の向上などが主な要因です。しかし、固定式装置やAQMステーションの大きなメンテナンスコストや、新興国におけるAQM規制ガイドラインの導入の遅れなどが、市場の成長を抑制すると予想されます。

"予測期間中、可動式屋外モニターが市場の屋外モニターセグメントでもっとも高いCAGRで成長します。"

可動式屋外モニターセグメントの成長は、運用上の優位性、製品開発に向けた官民投資の増加、先進の環境モニタリングセンサーの入手可能性、小型化された可動式製品に起因する可能性があります。しかし、エンドユーザーが(特に新興国や後進国において)環境に優しい技術の採用に消極的であることが、可動式屋外モニター市場全体の成長を妨げています。

「厳しい環境規制の存在と政府投資が病院エンドユーザーセグメントの成長を牽引します。

AQM製品の主なエンドユーザーは政府機関と学術機関です。商業・住宅ユーザーセグメントは、2020年に市場で第2位のシェアを占めています。このエンドユーザーセグメントの成長は、屋内空気汚染の健康に対する影響に関する社会の意識の高まり、屋内または家庭の大気汚染レベルの上昇、屋内空気モニタリング技術の進歩(ウェアラブル機器やモバイルベースソフトウェアの使用など)が促進要因となっています。しかし、先進の空気質モニターの割高な価格設定により、予測期間中は商業・住宅ユーザーの需要が制限される見込みです。

"地域別では、アジア太平洋市場が予測期間(2023年~2028年)にもっとも高いCAGRを記録します。"

北米は市場で最大のシェアを占め、アジア太平洋は予測期間中に最高のCAGRを示しています。アジア太平洋市場の発展は、大規模な工業化、厳しい規制の実施、AQM製品の開発と商業化に対する政府の支援によって推進されています。市場の国々はGDPの成長を目の当たりにしており、産業と公共インフラの近代化や、各地域政府による空気質モニタリング活動への支出の増加につながっています。しかし、先進の機器の操作に熟練した専門家の不足や、予算の制約による汚染防止改革の遅滞、著名な製品メーカーが直面する価格圧力などが、アジア太平洋に大きな機会があるにもかかわらず、市場の成長を抑制する重大な要因となっています。

当レポートでは、世界の空気質モニタリングシステム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- 空気質モニタリングシステム市場の概要

- 欧州の空気質モニタリングシステム市場:サンプリング方法別、国別

- 空気質モニタリングシステム市場:汚染物質別

- 空気質モニタリングシステム市場の地理的スナップショット

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 規制分析

- エコシステムの範囲

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- 特許分析

第6章 空気質モニタリングシステム市場:サンプリング方法別

- イントロダクション

- アクティブ/持続的モニタリング

- 手動モニタリング

- パッシブモニタリング

- 断続的モニタリング

- スタックモニタリング

第7章 空気質モニタリングシステム市場:汚染物質別

- イントロダクション

- 化学汚染物質

- 窒素酸化物

- 硫黄酸化物

- 酸化炭素

- 揮発性有機化合物

- その他の化学汚染物質

- 物理汚染物質

- 生物汚染物質

第8章 空気質モニタリングシステム市場:製品別

- イントロダクション

- 屋内モニター

- 固定式屋内モニター

- 可動式屋内モニター

- 屋外モニター

- 可動式屋外モニター

- 固定式屋外モニター

- 粉塵・粒子状物質モニター

- AQMステーション

- ウェアラブルモニター

第9章 空気質モニタリングシステム市場:エンドユーザー別

- イントロダクション

- 政府機関・学術機関

- 商業・住宅ユーザー

- 石油化学産業

- 発電所

- スマートシティ当局

- 製薬産業

- その他のエンドユーザー

第10章 空気質モニタリングシステム市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州の不況の影響

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカの不況の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 市場企業上位5社の収益シェア分析

- 主要企業の市場シェアの分析

- 企業の評価マトリクス

- 主要企業の評価マトリクス(2022年)

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC, INC.

- SIEMENS AG

- TELEDYNE TECHNOLOGIES INCORPORATED

- EMERSON ELECTRIC CO.

- GE POWER

- 3M

- HORIBA, LTD.

- MERCK KGAA

- SPECTRIS

- TSI

- TESTO SE & CO. KGAA

- HONEYWELL INTERNATIONAL INC.

- AGILENT TECHNOLOGIES, INC.

- PERKINELMER INC.

- TISCH ENVIRONMENTAL, INC.

- その他の企業

- AEROQUAL

- FORBES MARSHALL

- PLUME LABS

- ATMOTECH, INC.

- HANGZHOU ZETIAN TECHNOLOGY

- SERVOMEX GROUP LIMITED

- VAISALA

- RICARDO

- BALL CORPORATION

- AMBEE

第13章 付録

The global air quality monitoring systems market is projected to reach USD 6.9 billion by 2028 from USD 4.9 billion in 2023, growing at a CAGR of 7.0% during the forecast period. The rise in technological advancements in air quality monitoring systems is one of the major factors anticipated to boost market growth in the forecasting years.

"Indoor monitors accounted for the largest share In the air quality monitoring systems market in 2022."

Based on the product, the air quality monitoring systems market is segmented into indoor monitors, outdoor monitors, and wearable monitors.The outdoor monitors is expected to grow at the highest CAGR during the forecast period. Growth in this segment is majorly driven by the rise in industrial use of air pollution monitoring systems, end-user base growth, end-user base expansion of fixed outdoor monitors, ongoing AQM stations installation across markets (especially in emerging countries), public-private investments for affordable and novel ambient monitoring products development, and rising availability of miniaturized and portable products. However, factors such as significant fixed devices and AQM stations maintenance costs, as well as the slow implementation of AQM regulatory guidelines across emerging countries are expected to restrain market growth.

"Portable outdoor monitors to grow with the highest CAGR of the outdoor monitors segment of air quality monitoring systems market in the forecast period"

The portable outdoor monitors segment grow with the highest CAGR of the outdoor air quality monitoring systems market. The growth of this segment can be attributed to their operational advantages, rise in public-private investments for product development, the availability of advanced ambient monitoring sensors and miniaturized & portable products. Though the reluctance among end users to adopt environment-friendly techniques (especially in emerging and less-developed countries) is hampering the overall growth of the portable outdoor monitors market.

"Presence of stringent environmental regulations and government investments to drive the segment growth of hospitals end user segment"

Based on end users, the air quality monitoring systems market is segmented into government agencies and academic institutes, the petrochemical industry, commercial and residential users power generation plants, the pharmaceutical industry, smart city authorities, and other end users. The major end users of AQM products are government agencies and academic institutes. The commercial and residential users segment accounted for the second-largest share of the air quality monitoring systems market in 2020. The growth of this end-user segment is driven by the rising public awareness on the health implications of indoor air pollution, increasing indoor or household air pollution levels, and technological advancements in indoor air monitoring (such as the use of wearable devices and mobile-based software). However, the premium pricing of advanced air quality monitors is expected to limit their demand among commercial and residential users during the forecast period.

"The Asia Pacific market, by region, to register highest CAGR in the forecast period(2023-28)"

On the basis of region, the air quality monitoring systems market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.North America holds the largest share of the Air quality systems monitoring market and Asia Pacific is witnessed to have the highest CAGR during the forecast period.. Growth in the APAC market is driven by large-scale industrialization, implementation of stringent regulations, and government support for AQM product development and commercialization. Countries in this market are witnessing growth in their GDPs and has led to modernization of industrial and public infrastructures and increased expenditure by various regional government on air quality monitoring activities. However, a dearth of skilled professionals for the operation of advanced instruments, slow implementation of pollution control reforms due to budgetary constraints, and pricing pressures faced by prominent product manufacturers are the key factors restraining the growth of the air quality monitoring systems market despite of the great opportunities available in the APAC region

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3- 30%

- By Designation: C-level-27%, Director-level-18%, and Others-55%

- By Region: North America-40%, Europe-30%, Asia Pacific-20%, Latin America-10%, and the Middle East & Africa-5%

The prominent players in the air quality monitoring systems market are Thermo Fisher Scientific (US), Emerson Electric (US), GE Healthcare (US), Siemens AG (Germany), Teledyne Technologies (US), PerkinElmer, Inc. (US), Agilent Technologies, Inc. (US), Spectris plc (UK), 3M Company (US), Honeywell International Inc (US), HORIBA, Ltd. (Japan), Merck KGaA (Germany), TSI Incorporated (US), Tisch Environmental (US), and Testo (Germany), among others.

Research Coverage

This report studies the air quality monitoring systems market based on sampling method, pollutant, product, end user and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (technological advancements in mass spectrometers, government initiatives for pollution control and environmental testing, increasing spending on pharmaceutical R&D, government regulations on drug safety, growing focus on the quality of food products, increase in crude and shale gas production), restraints (premium product pricing), opportunities (growth potential offered by emerging markets), and challenges (dearth of skilled professionals) influencing the growth of air quality monitoring systems market

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the air quality monitoring systems market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the air quality monitoring systems market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the air quality monitoring systems market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.2 PRIMARY RESEARCH

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- FIGURE 3 BREAKDOWN OF PRIMARIES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 PRODUCT-BASED MARKET ESTIMATION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.2 PRIMARY RESEARCH VALIDATION

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 GEOGRAPHICAL SNAPSHOT OF AIR QUALITY MONITORING SYSTEMS MARKET

4 PREMIUM INSIGHTS

- 4.1 AIR QUALITY MONITORING SYSTEMS MARKET OVERVIEW

- FIGURE 13 GOVERNMENT INITIATIVES FOR AIR POLLUTION CONTROL DUE TO RISING INDUSTRIALIZATION TO DRIVE MARKET

- 4.2 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD AND COUNTRY

- FIGURE 14 ACTIVE/CONTINUOUS MONITORING SEGMENT IN GERMANY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT

- FIGURE 15 NITROUS OXIDES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 GEOGRAPHICAL SNAPSHOT OF AIR QUALITY MONITORING SYSTEMS MARKET

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 AIR QUALITY MONITORING SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives for AQM due to rising industrialization and urbanization

- 5.2.1.2 Growing concerns over rising air pollution

- 5.2.1.3 Favorable public-private initiatives for environmental conservation

- 5.2.1.4 Supportive funding investments for effective air pollution control

- 5.2.2 RESTRAINTS

- 5.2.2.1 Premium product pricing

- 5.2.2.2 Technical limitations associated with AQM products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising technological advancements in AQM systems

- 5.2.3.2 Increasing R&D activities for environmental policies

- 5.2.4 CHALLENGES

- 5.2.4.1 Inadequate implementation of air pollution control reforms

- 5.2.4.2 Availability of alternative monitoring solutions

- 5.2.4.3 Challenges associated with identifying emerging pollutants

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 1 AIR QUALITY MONITORING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 REGULATORY ANALYSIS

- 5.4.1 WORLD HEALTH ORGANIZATION (WHO)

- 5.4.2 DEFINITION OF PARTICULATE MATTER BY WHO

- 5.4.2.1 Definition of ozone

- 5.4.2.2 Definition of nitrogen dioxide

- 5.4.2.3 Definition of sulfur dioxide

- TABLE 2 AIR QUALITY GUIDELINES

- 5.4.3 US

- 5.4.3.1 Office of Air Quality Planning and Standards (OAQPS)

- 5.4.3.2 Office of Atmospheric Programs (OAP)

- 5.4.3.3 Office of Transportation and Air Quality (OTAQ)

- 5.4.3.4 Office of Radiation and Indoor Air (ORIA)

- 5.4.4 EUROPEAN UNION

- 5.4.4.1 Existing air quality legislation in EU

- 5.4.4.2 EU and international air pollution policies

- 5.4.4.3 India

- 5.4.5 CHINA

- 5.5 ECOSYSTEM COVERAGE

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 SMALL & MEDIUM-SIZED ENTERPRISES

- FIGURE 18 SUPPLY CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

- TABLE 3 PRICING ANALYSIS FOR AIR QUALITY MONITORING SYSTEMS, 2022 (ASP IN USD)

- 5.9 PATENT ANALYSIS

- FIGURE 19 TOP 10 PATENT APPLICANTS IN AIR QUALITY MONITORING SYSTEMS MARKET

- FIGURE 20 TOP 10 PATENT OWNERS IN AIR QUALITY MONITORING SYSTEMS MARKET

- 5.9.1 PATENT DETAILS

6 AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD

- 6.1 INTRODUCTION

- TABLE 4 AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- 6.2 ACTIVE/CONTINUOUS MONITORING

- 6.2.1 INCREASING INSTALLATION OF CONTINUOUS MONITORING STATIONS TO DRIVE MARKET

- TABLE 5 ACTIVE/CONTINUOUS AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 MANUAL MONITORING

- 6.3.1 UTILIZATION IN SMALL-SCALE OPERATIONS TO SUPPORT MARKET GROWTH

- TABLE 6 MANUAL AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 PASSIVE MONITORING

- 6.4.1 WIDE UTILIZATION IN PHARMA COMPANIES OWING TO COST-EFFECTIVENESS TO PROPEL MARKET

- TABLE 7 PASSIVE AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.5 INTERMITTENT MONITORING

- 6.5.1 RISING PUBLIC EMPHASIS ON EFFECTIVE AIR POLLUTION MONITORING TO SUPPORT MARKET GROWTH

- TABLE 8 INTERMITTENT AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.6 STACK MONITORING

- 6.6.1 HIGH EFFICIENCY AND LOW OPERATIONAL COSTS TO DRIVE MARKET

- TABLE 9 STACK AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

7 AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT

- 7.1 INTRODUCTION

- TABLE 10 AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- 7.2 CHEMICAL POLLUTANTS

- TABLE 11 AIR QUALITY MONITORING SYSTEMS MARKET FOR CHEMICAL POLLUTANTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 12 AIR QUALITY MONITORING SYSTEMS MARKET FOR CHEMICAL POLLUTANTS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1 NITROGEN OXIDES

- 7.2.1.1 Rising activities in petrol & metal refining to drive market

- TABLE 13 AIR QUALITY MONITORING SYSTEMS MARKET FOR NITROGEN OXIDES, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 SULFUR OXIDES

- 7.2.2.1 Expansion of petrochemical and power generation industries to propel market

- TABLE 14 SULFUR DIOXIDE EMISSIONS FROM HOTSPOTS, 2021 (KT/YEAR)

- TABLE 15 AIR QUALITY MONITORING SYSTEMS MARKET FOR SULFUR OXIDES, BY REGION, 2021-2028 (USD MILLION)

- 7.2.3 CARBON OXIDES

- 7.2.3.1 Increasing vehicular emissions and energy consumption to support market growth

- TABLE 16 AIR QUALITY MONITORING SYSTEMS MARKET FOR CARBON OXIDES, BY REGION, 2021-2028 (USD MILLION)

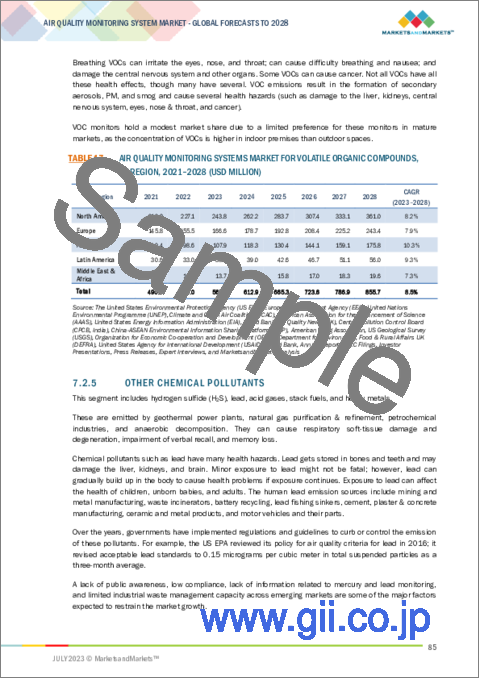

- 7.2.4 VOLATILE ORGANIC COMPOUNDS

- 7.2.4.1 Limited preference in mature markets to restrain market

- TABLE 17 AIR QUALITY MONITORING SYSTEMS MARKET FOR VOLATILE ORGANIC COMPOUNDS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.5 OTHER CHEMICAL POLLUTANTS

- TABLE 18 AIR QUALITY MONITORING SYSTEMS MARKET FOR OTHER CHEMICAL POLLUTANTS, BY REGION, 2021-2028 (USD MILLION)

- 7.3 PHYSICAL POLLUTANTS

- 7.3.1 RISING INDUSTRIALIZATION AND URBANIZATION TO PROPEL MARKET

- TABLE 19 AIR QUALITY MONITORING SYSTEMS MARKET FOR PHYSICAL POLLUTANTS, BY REGION, 2021-2028 (USD MILLION)

- 7.4 BIOLOGICAL POLLUTANTS

- 7.4.1 GROWTH IN PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES TO DRIVE MARKET

- TABLE 20 AIR QUALITY MONITORING SYSTEMS MARKET FOR BIOLOGICAL POLLUTANTS, BY REGION, 2021-2028 (USD MILLION)

8 AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT

- 8.1 INTRODUCTION

- TABLE 21 AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 8.2 INDOOR MONITORS

- TABLE 22 INDOOR MONITORS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 24 INDOOR MONITORS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 25 INDOOR MONITORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 26 INDOOR MONITORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2.1 FIXED INDOOR MONITORS

- 8.2.1.1 Rising need to maintain controlled indoor environment to drive market

- TABLE 27 FIXED INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 28 FIXED INDOOR MONITORS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 29 FIXED INDOOR MONITORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 30 FIXED INDOOR MONITORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2.2 PORTABLE INDOOR MONITORS

- 8.2.2.1 Advantages such as ease-of-use and portability to drive market

- TABLE 31 PORTABLE INDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 32 PORTABLE INDOOR MONITORS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 33 PORTABLE INDOOR MONITORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 34 PORTABLE INDOOR MONITORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 OUTDOOR MONITORS

- TABLE 35 OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 36 OUTDOOR MONITORS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 37 OUTDOOR MONITORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 38 OUTDOOR MONITORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.1 PORTABLE OUTDOOR MONITORS

- 8.3.1.1 Increasing public-private investments for product development to support market growth

- TABLE 39 PORTABLE OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 40 PORTABLE OUTDOOR MONITORS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 41 PORTABLE OUTDOOR MONITORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 42 PORTABLE OUTDOOR MONITORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.2 FIXED OUTDOOR MONITORS

- 8.3.2.1 Stringent government regulations to establish environmental-safe industries to support market growth

- TABLE 43 FIXED OUTDOOR MONITORS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 44 FIXED OUTDOOR MONITORS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 45 FIXED OUTDOOR MONITORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 46 FIXED OUTDOOR MONITORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.3 DUST & PARTICULATE MATTER MONITORS

- 8.3.3.1 Ability to provide accurate measurements of PM concentration in air samples to propel market

- TABLE 47 DUST & PARTICULATE MATTER MONITORS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 48 DUST & PARTICULATE MATTER MONITORS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 49 DUST & PARTICULATE MATTER MONITORS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 50 DUST & PARTICULATE MATTER MONITORS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3.4 AQM STATIONS

- 8.3.4.1 Increasing installation of AQM stations to propel market

- TABLE 51 AQM STATIONS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 52 AQM STATIONS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 53 AQM STATIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 54 AQM STATIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.4 WEARABLE MONITORS

- 8.4.1 CONTINUOUS REAL-TIME MONITORING BENEFITS TO DRIVE MARKET

- TABLE 55 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 56 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 57 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 58 WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

9 AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 59 AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 GOVERNMENT AGENCIES AND ACADEMIC INSTITUTES

- 9.2.1 RISING INVESTMENTS FOR EFFECTIVE AIR POLLUTION CONTROL TO DRIVE MARKET

- TABLE 60 AIR QUALITY MONITORING SYSTEMS MARKET FOR GOVERNMENT AGENCIES AND ACADEMIC INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- 9.3 COMMERCIAL AND RESIDENTIAL USERS

- 9.3.1 RISING TECHNOLOGICAL ADVANCEMENTS IN AIR QUALITY MONITORS TO DRIVE MARKET

- TABLE 61 AIR QUALITY MONITORING SYSTEMS MARKET FOR COMMERCIAL AND RESIDENTIAL USERS, BY REGION, 2021-2028 (USD MILLION)

- 9.4 PETROCHEMICAL INDUSTRY

- 9.4.1 GROWING DEMAND FOR CONTINUOUS AND INTERMITTENT AIR QUALITY MONITORS TO PROPEL MARKET

- TABLE 62 AIR QUALITY MONITORING SYSTEMS MARKET FOR PETROCHEMICAL INDUSTRY, BY REGION, 2021-2028 (USD MILLION)

- 9.5 POWER GENERATION PLANTS

- 9.5.1 EFFORTS BY NATIONAL & INTERNATIONAL AGENCIES TO CONTROL EMISSIONS FROM POWER PLANTS TO PROPEL MARKET

- TABLE 63 AIR QUALITY MONITORING SYSTEMS MARKET FOR POWER GENERATION PLANTS, BY REGION, 2021-2028 (USD MILLION)

- 9.6 SMART CITY AUTHORITIES

- 9.6.1 RISING USE OF AQM PRODUCTS IN SMART CITY PROJECTS TO SUPPORT MARKET GROWTH

- TABLE 64 AIR QUALITY MONITORING SYSTEMS MARKET FOR SMART CITY AUTHORITIES, BY REGION, 2021-2028 (USD MILLION)

- 9.7 PHARMACEUTICAL INDUSTRY

- 9.7.1 STRINGENT REGULATIONS FOR MICROBIAL CONTAMINATION ASSESSMENT IN PHARMACEUTICAL TESTING TO DRIVE MARKET

- TABLE 65 AIR QUALITY MONITORING SYSTEMS MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2021-2028 (USD MILLION)

- 9.8 OTHER END USERS

- TABLE 66 AIR QUALITY MONITORING SYSTEMS MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

10 AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 67 AIR QUALITY MONITORING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 21 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET SNAPSHOT

- TABLE 68 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 US

- 10.2.2.1 Large end-user base for industrial & indoor AQM products to drive market

- TABLE 74 EPA GRANTS OFFERED FOR AIR POLLUTION CONTROL AND RELATED EFFORTS (2020-2021)

- TABLE 75 US: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 76 US: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Active government participation in AQM to support growth

- TABLE 77 CANADA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 78 CANADA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- TABLE 79 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 81 EUROPE: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 83 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 84 EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 GERMANY

- 10.3.2.1 Germany to dominate AQM systems market in Europe

- TABLE 85 GERMANY: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 86 GERMANY: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Rapid technology adoption and government initiatives to support market growth

- TABLE 87 UK: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 88 UK: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 High pollution levels to drive adoption of AQM systems

- TABLE 89 FRANCE: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 90 FRANCE: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Need to curb air pollution to drive demand for AQM systems

- TABLE 91 ITALY: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 92 ITALY: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION

- 10.3.6 SPAIN

- 10.3.6.1 Rising public-private initiatives to boost growth

- TABLE 93 SPAIN: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 94 SPAIN: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 95 REST OF EUROPE: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 96 REST OF EUROPE: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 22 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET SNAPSHOT

- TABLE 97 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 JAPAN

- 10.4.2.1 Japan to dominate APAC AQM systems market

- TABLE 103 JAPAN: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 104 JAPAN: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Stringent government scrutiny on entry of private players to hamper market growth

- TABLE 105 CHINA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 106 CHINA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Active government involvement in air pollution monitoring and control to drive market

- TABLE 107 INDIA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 108 INDIA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increased air pollution due to bushfires to boost demand for pollution control

- TABLE 109 AUSTRALIA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 110 AUSTRALIA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Low awareness about air quality enhancement to hinder market growth

- TABLE 111 SOUTH KOREA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 112 SOUTH KOREA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 113 REST OF ASIA PACIFIC: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- TABLE 115 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 116 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 118 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 119 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.1 LATIN AMERICA: RECESSION IMPACT

- 10.5.2 BRAZIL

- 10.5.2.1 Shortage of skilled technicians to restrain market growth

- TABLE 121 BRAZIL: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 122 BRAZIL: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.5.3 MEXICO

- 10.5.3.1 Low adoption of advanced technologies to hinder market growth

- TABLE 123 MEXICO: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 124 MEXICO: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 125 REST OF LATIN AMERICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 126 REST OF LATIN AMERICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 SLOW IMPLEMENTATION OF GOVERNMENT REGULATIONS TO RESTRAIN MARKET GROWTH

- TABLE 127 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: INDOOR, OUTDOOR, AND WEARABLE AIR QUALITY MONITORING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY SAMPLING METHOD, 2021-2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY POLLUTANT, 2021-2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: AIR QUALITY MONITORING SYSTEMS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- TABLE 132 AIR QUALITY MONITORING SYSTEMS MARKET: KEY DEVELOPMENTS

- 11.2 REVENUE SHARE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 23 AIR QUALITY MONITORING SYSTEMS MARKET: REVENUE SHARE ANALYSIS (2022)

- 11.3 MARKET SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 24 AIR QUALITY MONITORING SYSTEMS MARKET: MARKET SHARE ANALYSIS (2022)

- 11.4 COMPANY EVALUATION MATRIX

- 11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 25 AIR QUALITY MONITORING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (2022)

- 11.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 26 AIR QUALITY MONITORING SYSTEMS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 11.7 COMPETITIVE SCENARIO AND TRENDS

- TABLE 133 AIR QUALITY MONITORING SYSTEMS MARKET: PRODUCT LAUNCHES (2019-2022)

- TABLE 134 AIR QUALITY MONITORING SYSTEMS MARKET: DEALS (2019-2022)

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 THERMO FISHER SCIENTIFIC, INC.

- TABLE 135 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- FIGURE 27 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- 12.1.2 SIEMENS AG

- TABLE 136 SIEMENS AG: BUSINESS OVERVIEW

- FIGURE 28 SIEMENS AG: COMPANY SNAPSHOT (2022)

- 12.1.3 TELEDYNE TECHNOLOGIES INCORPORATED

- TABLE 137 TELEDYNE TECHNOLOGIES INCORPORATED: BUSINESS OVERVIEW

- FIGURE 29 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT (2022)

- 12.1.4 EMERSON ELECTRIC CO.

- TABLE 138 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

- FIGURE 30 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT (2022)

- 12.1.5 GE POWER

- TABLE 139 GE POWER: BUSINESS OVERVIEW

- FIGURE 31 GE POWER: COMPANY SNAPSHOT (2022)

- 12.1.6 3M

- TABLE 140 3M: BUSINESS OVERVIEW

- FIGURE 32 3M: COMPANY SNAPSHOT (2022)

- 12.1.7 HORIBA, LTD.

- TABLE 141 HORIBA, LTD.: BUSINESS OVERVIEW

- FIGURE 33 HORIBA, LTD.: COMPANY SNAPSHOT (2022)

- 12.1.8 MERCK KGAA

- TABLE 142 MERCK KGAA: BUSINESS OVERVIEW

- FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 12.1.9 SPECTRIS

- TABLE 143 SPECTRIS: BUSINESS OVERVIEW

- FIGURE 35 SPECTRIS: COMPANY SNAPSHOT (2022)

- 12.1.10 TSI

- TABLE 144 TSI: BUSINESS OVERVIEW

- 12.1.11 TESTO SE & CO. KGAA

- TABLE 145 TESTO SE & CO. KGAA: BUSINESS OVERVIEW

- 12.1.12 HONEYWELL INTERNATIONAL INC.

- TABLE 146 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 36 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT (2022)

- 12.1.13 AGILENT TECHNOLOGIES, INC.

- TABLE 147 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 37 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- 12.1.14 PERKINELMER INC.

- TABLE 148 PERKINELMER INC.: BUSINESS OVERVIEW

- FIGURE 38 PERKINELMER INC.: COMPANY SNAPSHOT (2022)

- 12.1.15 TISCH ENVIRONMENTAL, INC.

- TABLE 149 TISCH ENVIRONMENTAL, INC.: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 AEROQUAL

- 12.2.2 FORBES MARSHALL

- 12.2.3 PLUME LABS

- 12.2.4 ATMOTECH, INC.

- 12.2.5 HANGZHOU ZETIAN TECHNOLOGY

- 12.2.6 SERVOMEX GROUP LIMITED

- 12.2.7 VAISALA

- 12.2.8 RICARDO

- 12.2.9 BALL CORPORATION

- 12.2.10 AMBEE

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS