|

|

市場調査レポート

商品コード

1248053

建設用潤滑剤の世界市場:基油別 (鉱油、合成油)・種類別 (油圧油、エンジンオイル、ギアオイル、ATF、グリース、コンプレッサーオイル)・装置別 (土木機械、マテリアルハンドリング、建設重機)・地域別の将来予測 (2027年まで)Construction Lubricants Market by Base Oil (Mineral Oil, Synthetic Oil), Type (Hydraulic Fluid, Engine Oil, Gear Oil, ATF, Grease, Compressor Oil), Equipment (Earthmoving, Material Handling, Heavy Construction), and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 建設用潤滑剤の世界市場:基油別 (鉱油、合成油)・種類別 (油圧油、エンジンオイル、ギアオイル、ATF、グリース、コンプレッサーオイル)・装置別 (土木機械、マテリアルハンドリング、建設重機)・地域別の将来予測 (2027年まで) |

|

出版日: 2023年03月22日

発行: MarketsandMarkets

ページ情報: 英文 246 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の建設用潤滑剤の市場規模は、2022年の90億米ドルから、2027年には106億米ドルに達し、予測期間中に3.3%のCAGRで成長する見込みです。

建設用潤滑剤は、建設業や鉱業で広く使用されており、ブルドーザーやダンプカー、ドラッグライン、スクレーパー・ショベル、その他の重機といった各種の建設機械で使用されています。これらの潤滑剤は、汚れや水の混入、過度の摩耗や損傷など、過酷な条件下での大型機械の作業遂行を支援します。

"2021年には、鉱油セグメントが最大のシェアを占める"

その要因として、鉱油ベースの建設用潤滑剤が合成油ベースよりも安価であることにが挙げられます。鉱油のコストは合成油に比べ40%~50%低く、そのため、中東・アフリカやアジア太平洋、南米など、価格に敏感な地域で広く使用されています。しかし、先進国では、環境問題や政府規制の高まりから、鉱物油の成長は鈍化すると予測されています。

"建設用潤滑剤市場では、油圧油部門が第2位のシェアを占める"

建設用潤滑剤市場における油圧作動油セグメントの成長は、アジア太平洋地域や中東・アフリカ地域からの膨大な需要、建設産業の成長などに起因しています。また、中国・インド・韓国などの新興国では油圧作動油の消費量が増加しています。インフラ開発プロジェクトに対する民間・政府支出の増加は、市場を牽引する主要な要因の1つです。

"2021年には、北米が第2位の市場シェアを占める"

2021年の建設用潤滑剤市場は、北米が金額ベースで第2位となりました。この成長の背景には、高度インフラ建設と商業・住宅プロジェクトにおける政府の支援が挙げられます。メキシコと米国では建設プロジェクトが増加し、カナダではインフラの改修の必要性があることから、この地域の建設用潤滑剤の需要が高まると予想されます。また、建設機械メーカーの強固な足場が、北米の市場を牽引しています。

当レポートでは、世界の建設用潤滑剤の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、基油別・種類別・装置別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 建設用潤滑剤市場:現実的、悲観的、楽観的、COVID-19以降のシナリオ

- 価格分析

- マクロ経済指標

第6章 業界動向

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- コネクテッドマーケット:エコシステム

- 技術分析

- ケーススタディ

- 貿易統計データ

- 世界の規制枠組みと、建設用潤滑剤市場への影響

- 主な会議とイベント (2023年)

- 特許分析

第7章 建設用潤滑剤市場:基油別

- イントロダクション

- 鉱油

- 合成油

- ポリアルファオレフィン (PAO)

- ポリアルキレングリコール (PAG)

- エステル

- グループIII (ハイドロクラッキング)

第8章 建設用潤滑剤市場:種類別

- イントロダクション

- 油圧油

- エンジンオイル

- ギアオイル

- オートマチックトランスミッションフルード (ATF)

- グリース

- コンプレッサーオイル

- その他

第9章 建設用潤滑剤市場:装置別

- イントロダクション

- 土工機械

- 掘削機

- ローダー

- クローラードーザー

- モーターグレーダー

- その他

- マテリアルハンドリング装置

- 建設重機

- その他

- コンパクター・ロードローラー

- 舗装機械/アスファルトフィニッシャー

- その他の装置・機械

第10章 建設用潤滑剤市場:地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 市場シェア分析

- 主要企業のランキング (2021年)

- 主要企業の競合力

- 企業の製品フットプリント分析

- 企業評価クアドラント (ティア1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競合状況・動向

- 製品の発売

- 資本取引

- その他の動向

第12章 企業プロファイル

- 主要企業

- SHELL PLC

- CHEVRON CORPORATION

- BP P.L.C.

- TOTALENERGIES SE

- EXXON MOBIL CORPORATION

- FUCHS PETROLUB SE

- SINOPEC CORP.

- LUKOIL

- INDIAN OIL CORPORATION LIMITED

- PETRONAS

- その他の企業

- BEL-RAY COMPANY, LLC.

- MORRIS LUBRICANTS

- PENRITE OIL COMPANY

- LIQUI MOLY GMBH

- ENI S.P.A.

- ADDINOL LUBE OIL GMBH

- DYADE LUBRICANTS

- KLUBER LUBRICATION

- LUBRIPLATE LUBRICANTS COMPANY

- SASOL LIMITED

- PETRO-CANADA LUBRICANTS INC.

- PHILLIPS 66

- US LUBRICANTS

- PERTAMINA

- ENEOS HOLDINGS, INC.

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- 油圧油 (作動液) 市場

第14章 付録

The construction lubricants market is projected to grow from USD 9.0 Billion in 2022 to USD 10.6 Billion by 2027, at a CAGR of 3.3% during the forecast period. Construction lubricants are widely used in the construction and mining industries. It is used in various construction equipment, including bulldozers, dump trucks, draglines, scrapers & shovels, and other heavy equipment. It consists of additives and base oil that are mixed together. These lubricants help the bulky equipment carry out their tasks in extreme conditions, such as dirt & water contamination and excessive wear & tear.

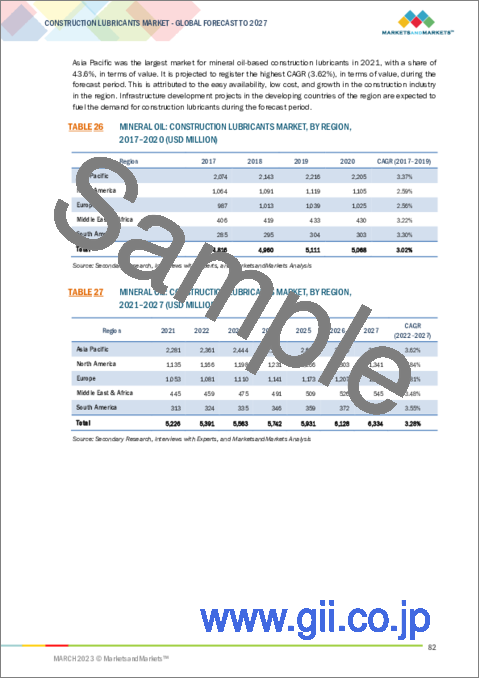

Mineral oil segment is expected to account for the largest share in 2021

This is attributed to the fact that mineral oil-based construction lubricants are cheaper than synthetic oil-based construction lubricants. Mineral oil costs are 40% - 50% less than synthetic oil. Thus, mineral oil is broadly used in price-sensitive regions like the Middle East & Africa, Asia Pacific, and South America. However, the mineral oil segment is projected to register slower growth in developed regions due to growing environmental concerns and government regulations.

The hydraulic fluid segment held the second-largest market share in the construction lubricants market

The growth of the hydraulic fluid segment in the construction lubricants market is attributed to the huge demand from the Asia Pacific and the Middle East & Africa region and its growing construction industry. This high growth is because of the increased consumption of hydraulic fluid in developing countries such as China, India, and South Korea. Rising private and government spending on infrastructural development projects is one of the major factors driving the market.

North America is expected to account for the second-largest market share in 2021

North America was the second-largest construction lubricants market, in terms of value, in 2021. The growth is attributed to the advanced infrastructural construction and government support in commercial and residential projects that fuel the construction lubricants market in North America. The growing number of construction projects in Mexico and the US and the need to renovate infrastructure in Canada is expected to boost the demand for construction lubricants in this region. The strong foothold of the construction equipment manufacturers is driving the market in North America.

The break-up of the profile of primary participants in the C4ISR market:

- By Company Type: Tier 1- 35%, Tier 2- 45%, and Tier 3- 20%

- By Designation: C Level- 35%, Director Level- 25%, Others- 40%

- By Region: North America- 40%, Europe- 20%, Asia Pacific- 30%, Middle East- 5%, and South America- 5%

The key players profiled in the report include Shell plc (UK), ExxonMobil Corporation(US), BP p.l.c. (UK), Chevron Corporation (US), TotalEnergies SE (France), Sinopec Corp. (China), FUCHS Petrolub SE (Germany), and Petronas (Malaysia), among others.

Research Coverage

This research report categorizes the construction lubricants market by base oil (mineral oil and synthetic oil), type (hydraulic fluid, engine oil, gear oil, automatic transmission fluid, grease, compressor oil, and others), equipment (earthmoving equipment, material handling equipment, heavy construction vehicles, and others), and region (Asia Pacific, North America, Europe, Middle East & Africa, and South America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the construction lubricants market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the construction lubricants market. Competitive analysis of upcoming startups in the construction lubricants market ecosystem is covered in this report.

Reasons to Buy this Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall construction lubricants market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (high growth in the construction industry in Asia Pacific & Middle East & Africa region, growing demand for high-quality lubricants, and rise in automation in the construction industry), restraints (technological advancements), opportunities (development of zinc-free (ashless) lubricants and leveraging E-commerce industry to increase customer reach), and challenges (rising raw material prices and maintaining product quality and stringent environmental norms by the government) influencing the growth of the construction lubricants market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the construction lubricants market

- Market Development: Comprehensive information about lucrative markets - the report analyses the construction lubricants market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the construction lubricants market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Shell plc (UK), ExxonMobil Corporation(US), BP p.l.c. (UK), Chevron Corporation (US), TotalEnergies SE (France), Sinopec Corp. (China), FUCHS Petrolub SE (Germany), and Petronas (Malaysia), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 CONSTRUCTION LUBRICANTS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.2.2 CONSTRUCTION LUBRICANTS MARKET: DEFINITION AND INCLUSIONS, BY BASE OIL

- 1.2.3 CONSTRUCTION LUBRICANTS MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.4 CONSTRUCTION LUBRICANTS MARKET: DEFINITION AND INCLUSIONS, BY EQUIPMENT TYPE

- 1.3 MARKET SCOPE

- FIGURE 1 CONSTRUCTION LUBRICANTS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 CONSTRUCTION LUBRICANTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP-DOWN

- 2.2.1.1 Base market calculation and validation approach using parent market - 2021

- 2.3 DATA TRIANGULATION

- FIGURE 7 CONSTRUCTION LUBRICANTS MARKET: DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

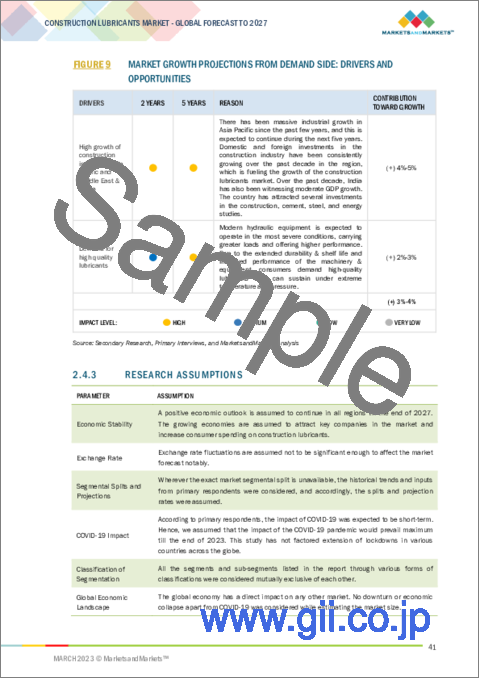

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

- 2.4.3 RESEARCH ASSUMPTIONS

- 2.5 IMPACT OF RECESSION

- 2.6 FACTOR ANALYSIS

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 CONSTRUCTION LUBRICANTS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 ENGINE OIL SEGMENT TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- FIGURE 11 MINERAL OIL SEGMENT TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC DOMINATED CONSTRUCTION LUBRICANTS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN CONSTRUCTION LUBRICANTS MARKET

- FIGURE 13 GROWING CONSTRUCTION INDUSTRY TO DRIVE CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- 4.2 CONSTRUCTION LUBRICANTS MARKET SIZE, BY REGION

- FIGURE 14 ASIA PACIFIC TO BE LARGEST MARKET FOR CONSTRUCTION LUBRICANTS DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY TYPE AND COUNTRY, 2021

- FIGURE 15 CHINA DOMINATED CONSTRUCTION LUBRICANTS MARKET IN ASIA PACIFIC

- 4.4 CONSTRUCTION LUBRICANTS MARKET SIZE, BY TYPE

- FIGURE 16 HYDRAULIC FLUID TO BE LARGEST TYPE SEGMENT OF CONSTRUCTION LUBRICANTS

- 4.5 CONSTRUCTION LUBRICANTS MARKET SIZE, BY BASE OIL

- FIGURE 17 MINERAL OIL SEGMENT IN CONSTRUCTION LUBRICANTS TO BE LARGEST IN OVERALL MARKET

- 4.6 CONSTRUCTION LUBRICANTS MARKET, BY KEY COUNTRIES

- FIGURE 18 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CONSTRUCTION LUBRICANTS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 High growth of construction industry in Asia Pacific and Middle East & Africa

- TABLE 2 ONGOING AND UPCOMING CONSTRUCTION PROJECTS

- 5.2.1.2 Growing demand for high-quality lubricants

- 5.2.1.3 Rise in automation in construction industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technological advancements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of zinc-free (ashless) lubricants

- 5.2.3.2 Leveraging e-commerce industry to increase customer reach

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising raw material prices

- TABLE 3 CRUDE OIL PRICE TRENDS (2019-2022)

- 5.2.4.2 Maintaining product quality and stringent government environmental norms

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 CONSTRUCTION LUBRICANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITION RIVALRY

- TABLE 4 CONSTRUCTION LUBRICANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONSTRUCTION INDUSTRY

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CONSTRUCTION INDUSTRY (%)

- 5.4.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR CONSTRUCTION INDUSTRY

- TABLE 6 KEY BUYING CRITERIA FOR CONSTRUCTION INDUSTRY

- 5.5 CONSTRUCTION LUBRICANTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- FIGURE 23 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

- TABLE 7 CONSTRUCTION LUBRICANTS MARKET FORECAST SCENARIO, 2019-2027 (USD MILLION)

- 5.5.1 NON-COVID-19 SCENARIO

- 5.5.2 OPTIMISTIC SCENARIO

- 5.5.3 PESSIMISTIC SCENARIO

- 5.5.4 REALISTIC SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- FIGURE 24 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE TYPES

- TABLE 8 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP THREE TYPES (USD/KG)

- 5.6.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 25 AVERAGE SELLING PRICES OF CONSTRUCTION LUBRICANTS, BY REGION, 2020-2027

- TABLE 9 AVERAGE SELLING PRICES OF CONSTRUCTION LUBRICANTS, BY REGION, 2020-2027 (USD/KG)

- 5.7 MACROECONOMIC INDICATORS

- 5.7.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 10 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2020-2027 (USD BILLION)

- TABLE 11 VALUE ADDED BY CONSTRUCTION INDUSTRY FOR KEY COUNTRIES, 2016-2020 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 26 CONSTRUCTION LUBRICANTS MARKET: SUPPLY CHAIN

- 6.1.1 RAW MATERIAL SUPPLIER

- 6.1.2 MANUFACTURER

- 6.1.3 DISTRIBUTION TO END USERS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.2.1 REVENUE SHIFT & REVENUE POCKETS FOR CONSTRUCTION LUBRICANTS MARKET

- FIGURE 27 CONSTRUCTION LUBRICANTS MARKET: FUTURE REVENUE MIX

- 6.3 CONNECTED MARKETS: ECOSYSTEM

- FIGURE 28 CONSTRUCTION LUBRICANTS MARKET: ECOSYSTEM

- TABLE 12 CONSTRUCTION LUBRICANTS MARKET: ECOSYSTEM

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 ADVANCED ADDITIVE TECHNOLOGY

- 6.4.2 IOT-ENABLED TECHNOLOGY

- 6.5 CASE STUDIES

- 6.5.1 SHELL PLC HELPED SUREWAY CONSTRUCTION TO SAVE USD 140,298 BY UPGRADING AND CONSOLIDATING ITS TRANSMISSION OIL PORTFOLIO

- 6.6 TRADE DATA STATISTICS

- 6.6.1 IMPORT SCENARIO OF CONSTRUCTION LUBRICANTS

- FIGURE 29 CONSTRUCTION LUBRICANTS IMPORT, BY KEY COUNTRY (2013-2021)

- TABLE 13 IMPORTS OF CONSTRUCTION LUBRICANTS, BY REGION, 2013-2021 (USD MILLION)

- 6.6.2 EXPORT SCENARIO OF CONSTRUCTION LUBRICANTS

- FIGURE 30 CONSTRUCTION LUBRICANTS EXPORT, BY KEY COUNTRY (2013-2021)

- TABLE 14 EXPORTS OF CONSTRUCTION LUBRICANTS, BY REGION, 2013-2021 (MILLION)

- 6.7 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON CONSTRUCTION LUBRICANTS MARKET

- 6.7.1 REGULATIONS RELATED TO CONSTRUCTION LUBRICANTS

- 6.8 KEY CONFERENCES & EVENTS IN 2023

- TABLE 15 CONSTRUCTION LUBRICANTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.9 PATENT ANALYSIS

- 6.9.1 APPROACH

- 6.9.2 DOCUMENT TYPE

- TABLE 16 PATENT APPLICATIONS ACCOUNTED FOR 57% OF TOTAL COUNT

- FIGURE 31 PATENTS REGISTERED IN CONSTRUCTION LUBRICANTS MARKET, 2011-2021

- FIGURE 32 PATENT PUBLICATION TRENDS, 2011-2021

- FIGURE 33 LEGAL STATUS OF PATENTS FILED IN CONSTRUCTION LUBRICANTS MARKET

- 6.9.3 JURISDICTION ANALYSIS

- FIGURE 34 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- 6.9.4 TOP APPLICANTS

- FIGURE 35 BASF SE REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2011 AND 2021

- TABLE 17 PATENTS BY BASF SE

- TABLE 18 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 19 TOP 10 PATENT OWNERS IN US, 2011-2021

7 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL

- 7.1 INTRODUCTION

- FIGURE 36 MINERAL OIL-BASED LUBRICANTS TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- TABLE 20 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (KILOTON)

- TABLE 21 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (KILOTON)

- TABLE 22 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (USD MILLION)

- TABLE 23 CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (USD MILLION)

- 7.2 MINERAL OIL

- 7.2.1 LOW COST AND EASY AVAILABILITY OF MINERAL OIL TO DRIVE MARKET

- FIGURE 37 ASIA PACIFIC TO BE LARGEST CONSTRUCTION LUBRICANTS MARKET IN MINERAL OIL SEGMENT

- TABLE 24 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 25 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 26 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 27 MINERAL OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 7.3 SYNTHETIC OIL

- 7.3.1 HIGH PERFORMANCE UNDER EXTREME CONDITIONS TO DRIVE SEGMENT

- FIGURE 38 EUROPE TO BE LARGEST CONSTRUCTION LUBRICANTS MARKET IN SYNTHETIC OIL SEGMENT

- TABLE 28 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 29 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 30 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 31 SYNTHETIC OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 7.3.2 POLYALPHAOLEFIN (PAO)

- 7.3.3 POLYALKYLENE GLYCOL (PAG)

- 7.3.4 ESTERS

- 7.3.5 GROUP III (HYDROCRACKING)

8 CONSTRUCTION LUBRICANTS MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 39 ENGINE OIL SEGMENT TO LEAD CONSTRUCTION LUBRICANTS MARKET DURING FORECAST PERIOD

- TABLE 32 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 33 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 34 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 35 CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 8.2 HYDRAULIC FLUID

- 8.2.1 HUGE DEMAND FROM ASIA PACIFIC REGION TO DRIVE MARKET

- FIGURE 40 ASIA PACIFIC TO BE LARGEST CONSTRUCTION LUBRICANTS MARKET IN HYDRAULIC FLUID SEGMENT

- TABLE 36 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 37 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 38 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 39 HYDRAULIC FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 8.3 ENGINE OIL

- 8.3.1 GROWING DEMAND FOR OFF-ROAD VEHICLES TO BOOST MARKET

- FIGURE 41 SOUTH AMERICA TO BE FASTEST-GROWING CONSTRUCTION LUBRICANTS MARKET IN ENGINE OIL SEGMENT

- TABLE 40 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 41 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 42 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 43 ENGINE OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 8.4 GEAR OIL

- 8.4.1 EXTENSIVE USE OF MINERAL-BASED GEAR OIL IN CONSTRUCTION INDUSTRY TO DRIVE MARKET

- FIGURE 42 MIDDLE EAST & AFRICA TO BE SECOND-FASTEST GROWING CONSTRUCTION LUBRICANTS MARKET IN GEAR OIL SEGMENT

- TABLE 44 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 45 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 46 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 47 GEAR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 8.5 AUTOMATIC TRANSMISSION FLUID

- 8.5.1 ASIA PACIFIC TO LEAD SEGMENT

- FIGURE 43 EUROPE TO BE SECOND-LARGEST CONSTRUCTION LUBRICANTS MARKET IN AUTOMATIC TRANSMISSION FLUID SEGMENT

- TABLE 48 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 49 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 50 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 51 AUTOMATIC TRANSMISSION FLUID: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 8.6 GREASE

- 8.6.1 ENHANCED WATER RESISTANCE AND DURABILITY OF MACHINES TO DRIVE MARKET

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN GREASE SEGMENT

- TABLE 52 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 53 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 54 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 55 GREASE: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 8.7 COMPRESSOR OIL

- 8.7.1 HIGH DEMAND FOR SYNTHETIC COMPRESSOR OIL TO SUPPORT MARKET GROWTH

- FIGURE 45 NORTH AMERICA TO BE SECOND-LARGEST CONSTRUCTION LUBRICANTS MARKET IN COMPRESSOR OIL SEGMENT

- TABLE 56 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 57 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 58 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 59 COMPRESSOR OIL: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 8.8 OTHERS

- FIGURE 46 NORTH AMERICA TO BE LARGEST MARKET IN OTHER CONSTRUCTION LUBRICANTS

- TABLE 60 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 61 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 62 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 63 OTHERS: CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

9 CONSTRUCTION LUBRICANTS MARKET, BY EQUIPMENT

- 9.1 INTRODUCTION

- 9.2 EARTHMOVING EQUIPMENT

- 9.2.1 EXCAVATORS

- 9.2.1.1 Crawler excavators

- 9.2.1.2 Mini excavators

- 9.2.1.3 Wheeled excavators

- 9.2.2 LOADERS

- 9.2.2.1 Crawler loaders

- 9.2.2.2 Wheeled loaders

- 9.2.2.3 Skid-steer loaders

- 9.2.2.4 Backhoe loaders

- 9.2.3 CRAWLER DOZERS

- 9.2.4 MOTOR GRADERS

- 9.2.5 OTHERS

- 9.2.1 EXCAVATORS

- 9.3 MATERIAL HANDLING EQUIPMENT

- 9.4 HEAVY CONSTRUCTION VEHICLES

- 9.5 OTHERS

- 9.5.1 COMPACTORS AND ROAD ROLLERS

- 9.5.2 PAVERS/ASPHALT FINISHERS

- 9.5.3 OTHER EQUIPMENT AND MACHINERY

10 CONSTRUCTION LUBRICANTS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 47 ASIA PACIFIC TO BE FASTEST-GROWING CONSTRUCTION LUBRICANTS MARKET BETWEEN 2022 AND 2027

- TABLE 64 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 65 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (KILOTON)

- TABLE 66 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 67 CONSTRUCTION LUBRICANTS MARKET, BY REGION, 2021-2027 (USD MILLION)

- 10.2 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET SNAPSHOT

- 10.2.1 IMPACT OF RECESSION

- 10.2.2 ASIA PACIFIC CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL

- TABLE 68 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (KILOTON)

- TABLE 69 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (KILOTON)

- TABLE 70 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (USD MILLION)

- TABLE 71 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (USD MILLION)

- 10.2.3 ASIA PACIFIC CONSTRUCTION LUBRICANTS MARKET, BY TYPE

- TABLE 72 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 73 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 74 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 75 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.2.4 ASIA PACIFIC CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY

- TABLE 76 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 77 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 78 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 79 ASIA PACIFIC: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.2.4.1 China

- 10.2.4.1.1 Growing demand for high-quality lubricants in China to drive market

- 10.2.4.1 China

- TABLE 80 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 81 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 82 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 83 CHINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.2.4.2 Japan

- 10.2.4.2.1 Government's heavy investment in reconstruction segment to drive market

- 10.2.4.2 Japan

- TABLE 84 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 85 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 86 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 87 JAPAN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.2.4.3 India

- 10.2.4.3.1 Favorable economic policies to drive market

- 10.2.4.3 India

- TABLE 88 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 89 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 90 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 91 INDIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.2.4.4 Australia

- 10.2.4.4.1 Development in manufacturing infrastructure to drive demand

- 10.2.4.4 Australia

- TABLE 92 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 93 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 94 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 95 AUSTRALIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.2.4.5 South Korea

- 10.2.4.5.1 Increasing investments in public infrastructures to generate high demand for construction lubricants

- 10.2.4.5 South Korea

- TABLE 96 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 97 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 98 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 99 SOUTH KOREA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.3 NORTH AMERICA

- FIGURE 49 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET SNAPSHOT

- 10.3.1 IMPACT OF RECESSION

- 10.3.2 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL

- TABLE 100 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (KILOTON)

- TABLE 101 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (KILOTON)

- TABLE 102 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (USD MILLION)

- TABLE 103 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (USD MILLION)

- 10.3.3 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE

- TABLE 104 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 105 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 106 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 107 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.3.4 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY

- TABLE 108 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 109 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 110 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 111 NORTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.3.4.1 US

- 10.3.4.1.1 Rise in automation in construction industry to drive market

- 10.3.4.1 US

- TABLE 112 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 113 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 114 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 115 US: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.3.4.2 Canada

- 10.3.4.2.1 Gradual rise in demand for construction lubricants to drive market

- 10.3.4.2 Canada

- TABLE 116 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 117 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 118 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 119 CANADA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.3.4.3 Mexico

- 10.3.4.3.1 Growth of infrastructural development to drive market

- 10.3.4.3 Mexico

- TABLE 120 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 121 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 122 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 123 MEXICO: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.4 EUROPE

- FIGURE 50 EUROPE: CONSTRUCTION LUBRICANTS MARKET SNAPSHOT

- 10.4.1 IMPACT OF RECESSION

- 10.4.2 EUROPE CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL

- TABLE 124 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (KILOTON)

- TABLE 125 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (KILOTON)

- TABLE 126 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (USD MILLION)

- TABLE 127 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (USD MILLION)

- 10.4.3 EUROPE CONSTRUCTION LUBRICANTS MARKET, BY TYPE

- TABLE 128 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 129 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 130 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 131 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.4.4 EUROPE CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY

- TABLE 132 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 133 EUROPE: CONSTRUCTION LUBRICANTS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 134 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 135 EUROPE: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.4.4.1 Germany

- 10.4.4.1.1 Transportation, infrastructure, and energy projects to generate demand for construction lubricants

- 10.4.4.1 Germany

- TABLE 136 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 137 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 138 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 139 GERMANY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.4.4.2 UK

- 10.4.4.2.1 Growth of manufacturing and construction industries to fuel market growth

- 10.4.4.2 UK

- TABLE 140 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 141 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 142 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 143 UK: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.4.4.3 France

- 10.4.4.3.1 Increase in investments for commercial and industrial projects to drive market

- 10.4.4.3 France

- TABLE 144 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 145 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 146 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 147 FRANCE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.4.4.4 Spain

- 10.4.4.4.1 Increased FDI and investor confidence to augment demand

- 10.4.4.4 Spain

- TABLE 148 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 149 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 150 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 151 SPAIN: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.4.4.5 Italy

- 10.4.4.5.1 Energy infrastructure projects to drive market

- 10.4.4.5 Italy

- TABLE 152 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 153 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 154 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 155 ITALY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 IMPACT OF RECESSION

- 10.5.2 MIDDLE EAST & AFRICA CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL

- TABLE 156 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (KILOTON)

- TABLE 158 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY BASE OIL, 2021-2027 (USD MILLION)

- 10.5.3 MIDDLE EAST & AFRICA CONSTRUCTION LUBRICANTS MARKET, BY TYPE

- TABLE 160 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 161 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.5.4 MIDDLE EAST & AFRICA CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY

- TABLE 164 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 165 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.5.4.1 Turkey

- 10.5.4.1.1 Rising domestic construction to drive market

- 10.5.4.1 Turkey

- TABLE 168 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 169 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 170 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 171 TURKEY: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.5.4.2 Saudi Arabia

- 10.5.4.2.1 Rising population and renewable energy infrastructure to drive market

- 10.5.4.2 Saudi Arabia

- TABLE 172 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 173 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 174 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 175 SAUDI ARABIA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.5.4.3 UAE

- 10.5.4.3.1 Growing infrastructure activities to drive market

- 10.5.4.3 UAE

- TABLE 176 UAE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 177 UAE CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 178 UAE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 179 UAE: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 IMPACT OF RECESSION

- 10.6.2 SOUTH AMERICA CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL

- TABLE 180 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (KILOTON)

- TABLE 181 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (KILOTON)

- TABLE 182 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2017-2020 (USD MILLION)

- TABLE 183 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY BASE OIL, 2021-2027 (USD MILLION)

- 10.6.3 SOUTH AMERICA CONSTRUCTION LUBRICANTS MARKET, BY TYPE

- TABLE 184 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 185 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 186 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 187 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.6.4 SOUTH AMERICA CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY

- TABLE 188 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 189 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 190 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 191 SOUTH AMERICA: CONSTRUCTION LUBRICANTS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- 10.6.4.1 Brazil

- 10.6.4.1.1 Rising middle-class population to boost demand

- 10.6.4.1 Brazil

- TABLE 192 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 193 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 194 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 195 BRAZIL: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

- 10.6.4.2 Argentina

- 10.6.4.2.1 Increase in infrastructure projects to drive demand

- 10.6.4.2 Argentina

- TABLE 196 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (KILOTON)

- TABLE 197 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (KILOTON)

- TABLE 198 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 199 ARGENTINA: CONSTRUCTION LUBRICANTS MARKET, BY TYPE, 2021-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY CONSTRUCTION LUBRICANT MANUFACTURERS

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 RANKING OF KEY MARKET PLAYERS, 2021

- FIGURE 51 RANKING OF TOP FIVE PLAYERS IN CONSTRUCTION LUBRICANTS MARKET, 2021

- 11.3.2 DEGREE OF COMPETITION OF KEY PLAYERS

- TABLE 200 CONSTRUCTION LUBRICANTS MARKET: DEGREE OF COMPETITION

- FIGURE 52 SHELL PLC ACCOUNTED FOR LARGEST SHARE OF CONSTRUCTION LUBRICANTS MARKET IN 2021

- FIGURE 53 REVENUE ANALYSIS OF KEY COMPANIES IN PAST FIVE YEARS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 54 CONSTRUCTION LUBRICANTS MARKET: COMPANY FOOTPRINT

- TABLE 201 CONSTRUCTION LUBRICANTS MARKET: TYPE FOOTPRINT

- TABLE 202 CONSTRUCTION LUBRICANTS MARKET: EQUIPMENT TYPE FOOTPRINT

- TABLE 203 CONSTRUCTION LUBRICANTS MARKET: COMPANY REGION FOOTPRINT

- 11.5 COMPANY EVALUATION QUADRANT (TIER 1)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PARTICIPANTS

- 11.5.4 PERVASIVE PLAYERS

- FIGURE 55 COMPANY EVALUATION QUADRANT FOR CONSTRUCTION LUBRICANTS MARKET (TIER 1)

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 204 CONSTRUCTION LUBRICANTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 205 CONSTRUCTION LUBRICANTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 STARTUP/SME EVALUATION QUADRANT

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 STARTING BLOCKS

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 56 STARTUPS/SMES EVALUATION QUADRANT FOR CONSTRUCTION LUBRICANTS MARKET

- 11.8 COMPETITIVE SITUATIONS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- TABLE 206 CONSTRUCTION LUBRICANTS MARKET: PRODUCT LAUNCHES (2019-2022)

- 11.8.2 DEALS

- TABLE 207 CONSTRUCTION LUBRICANTS MARKET: DEALS (2019-2022)

- 11.8.3 OTHER DEVELOPMENTS

- TABLE 208 CONSTRUCTION LUBRICANTS MARKET: OTHER DEVELOPMENTS (2019-2022)

12 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weakness and competitive threats)*

- 12.1 MAJOR PLAYERS

- 12.1.1 SHELL PLC

- FIGURE 57 SHELL PLC: COMPANY SNAPSHOT

- TABLE 209 SHELL PLC: COMPANY OVERVIEW

- 12.1.2 CHEVRON CORPORATION

- FIGURE 58 CHEVRON CORPORATION: COMPANY SNAPSHOT

- TABLE 210 CHEVRON CORPORATION: COMPANY OVERVIEW

- 12.1.3 BP P.L.C.

- FIGURE 59 BP P.L.C.: COMPANY SNAPSHOT

- TABLE 211 BP P.L.C.: COMPANY OVERVIEW

- 12.1.4 TOTALENERGIES SE

- FIGURE 60 TOTALENERGIES SE: COMPANY SNAPSHOT

- TABLE 212 TOTALENERGIES SE: COMPANY OVERVIEW

- 12.1.5 EXXON MOBIL CORPORATION

- FIGURE 61 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 213 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- 12.1.6 FUCHS PETROLUB SE

- FIGURE 62 FUCHS PETROLUB SE: COMPANY SNAPSHOT

- TABLE 214 FUCHS PETROLUB SE: COMPANY OVERVIEW

- 12.1.7 SINOPEC CORP.

- FIGURE 63 SINOPEC CORP.: COMPANY SNAPSHOT

- TABLE 215 SINOPEC CORP.: COMPANY OVERVIEW

- 12.1.8 LUKOIL

- FIGURE 64 LUKOIL: COMPANY SNAPSHOT

- TABLE 216 LUKOIL: COMPANY OVERVIEW

- 12.1.9 INDIAN OIL CORPORATION LIMITED

- FIGURE 65 INDIAN OIL CORPORATION LIMITED: COMPANY SNAPSHOT

- TABLE 217 INDIAN OIL CORPORATION LIMITED: COMPANY OVERVIEW

- 12.1.10 PETRONAS

- FIGURE 66 PETRONAS: COMPANY SNAPSHOT

- TABLE 218 PETRONAS: COMPANY OVERVIEW

- Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 12.2 OTHER KEY MARKET PLAYERS

- 12.2.1 BEL-RAY COMPANY, LLC.

- TABLE 219 BEL RAY COMPANY, LLC.: COMPANY OVERVIEW

- 12.2.2 MORRIS LUBRICANTS

- TABLE 220 MORRIS LUBRICANTS: COMPANY OVERVIEW

- 12.2.3 PENRITE OIL COMPANY

- TABLE 221 PENRITE OIL COMPANY: COMPANY OVERVIEW

- 12.2.4 LIQUI MOLY GMBH

- TABLE 222 LIQUI MOLY GMBH: COMPANY OVERVIEW

- 12.2.5 ENI S.P.A.

- TABLE 223 ENI S.P.A.: COMPANY OVERVIEW

- 12.2.6 ADDINOL LUBE OIL GMBH

- TABLE 224 ADDINOL LUBE OIL GMBH: COMPANY OVERVIEW

- 12.2.7 DYADE LUBRICANTS

- TABLE 225 DYADE LUBRICANTS: COMPANY OVERVIEW

- 12.2.8 KLUBER LUBRICATION

- TABLE 226 KLUBER LUBRICATION: COMPANY OVERVIEW

- 12.2.9 LUBRIPLATE LUBRICANTS COMPANY

- TABLE 227 LUBRIPLATE LUBRICANTS COMPANY: COMPANY OVERVIEW

- 12.2.10 SASOL LIMITED

- TABLE 228 SASOL LIMITED: COMPANY OVERVIEW

- 12.2.11 PETRO-CANADA LUBRICANTS INC.

- TABLE 229 PETRO-CANADA LUBRICANTS INC.: COMPANY OVERVIEW

- 12.2.12 PHILLIPS 66

- TABLE 230 PHILLIPS 66: COMPANY OVERVIEW

- 12.2.13 US LUBRICANTS

- TABLE 231 US LUBRICANTS: COMPANY OVERVIEW

- 12.2.14 PERTAMINA

- TABLE 232 PERTAMINA: COMPANY OVERVIEW

- 12.2.15 ENEOS HOLDINGS, INC.

- TABLE 233 ENEOS HOLDINGS, INC.: COMPANY OVERVIEW

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 HYDRAULIC FLUIDS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 234 HYDRAULIC FLUIDS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 235 HYDRAULIC FLUIDS MARKET, BY REGION, 2017-2020 (USD MILLION)

- 13.3.2.1 Asia Pacific

- TABLE 236 ASIA PACIFIC: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 237 ASIA PACIFIC: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- 13.3.2.2 Europe

- TABLE 238 EUROPE: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 239 EUROPE: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- 13.3.2.3 North America

- TABLE 240 NORTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 241 NORTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- 13.3.2.4 Middle East & Africa

- TABLE 242 MIDDLE EAST & AFRICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 243 MIDDLE EAST & AFRICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- 13.3.2.5 South America

- TABLE 244 SOUTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 245 SOUTH AMERICA: HYDRAULIC FLUIDS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS