|

|

市場調査レポート

商品コード

1838150

バイオプラスチックとバイオポリマーの世界市場:原材料別、製品タイプ別、最終用途産業別、地域別 - 2030年までの予測Bioplastics & Biopolymers Market by Product Type (Biodegradable, Non-biodegradable), End-use Industry (Packaging, Automotive, Textile, Consumer Goods, Agriculture), Raw Material (Sugarcane, Wheat, Corn Starch), & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| バイオプラスチックとバイオポリマーの世界市場:原材料別、製品タイプ別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月27日

発行: MarketsandMarkets

ページ情報: 英文 275 Pages

納期: 即納可能

|

概要

バイオプラスチックとバイオポリマーの市場規模は、2025年の175億8,000万米ドルから2030年には450億4,000万米ドルに達し、予測期間中のCAGRは20.07%になると予想されています。

この市場を牽引しているのは、環境問題への関心の高まり、使い捨てプラスチックに対する政府の厳しい規制、持続可能な選択肢を求める消費者の需要の高まりです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 原材料別、製品タイプ別、最終用途産業別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

サトウキビ、トウモロコシ、キャッサバなどの再生可能な原材料が入手可能であることと、製品性能を向上させる技術の進歩が相まって、包装、農業、自動車、消費財などの分野での採用がさらに進んでいます。しかし、従来のプラスチックに比べて製造コストが高いこと、堆肥化やリサイクルのための大規模なインフラが限られていること、原料をめぐる食用作物との競合といった課題に直面しています。

"キャッサバは、予測期間中、バイオプラスチックとバイオポリマー市場で最も急成長しているセグメントです。"

キャッサバは、でんぷん含有量が高く、熱帯地域で広く入手可能で、栽培コストが比較的低いため、バイオプラスチックとバイオポリマー市場で急成長している原料です。生分解性プラスチックを生産するための効率的な原料として役立ち、石油ベースの原料に代わる魅力的な選択肢となっています。タイやインドネシアといった国々が生産をリードしており、政府のイニシアティブと環境に優しいパッケージング・ソリューションに対する需要の高まりに支えられています。持続可能な原材料に対する世界的な注目が高まる中、キャッサバを原料とするバイオプラスチックは、拡張可能で費用対効果の高い選択肢として人気を集めています。

"予測期間中、バイオプラスチックとバイオポリマー市場では生分解性プラスチック分野が最大となります。"

生分解性プラスチックは、微生物の活動によって水、二酸化炭素、バイオマスに自然に分解するように設計されたプラスチックの一種であり、従来のプラスチックに比べて環境への害がはるかに少ないです。生分解性プラスチックは、でんぷん、サトウキビ、キャッサバなどの再生可能資源や植物由来の原料から作られることが多いが、石油化学製品に生分解性添加物を加えて製造されるものもあります。主な種類には、PLA(ポリ乳酸)、PHA(ポリヒドロキシアルカノエート)、デンプン混合物、PBS(ポリブチレンサクシネート)などがあり、それぞれに明確な性能上の利点があります。生分解性プラスチックは、機能性と持続可能性を兼ね備えているため、包装材、農業用フィルム、使い捨てカトラリー、消費者製品、さらには医療用途でますます使用されるようになっています。市場拡大の原動力となっているのは、政府による使い捨てプラスチックの禁止強化、企業の持続可能性への強いコミットメント、環境に優しい製品に対する消費者の需要の高まりです。

"アジア太平洋市場は予測期間中、バイオプラスチックとバイオポリマーの最大市場になると予測されています。"

アジア太平洋は、戦略的、経済的、環境的要因が混在しているため、バイオプラスチックとバイオポリマー市場で主導的地位を占めています。中国、インド、日本のような国々における急速な工業化と都市の成長は、従来のプラスチックに代わる持続可能な代替品への需要を高めています。その他の特典として、この地域はバイオプラスチックの生産に不可欠なデンプン、サトウキビ、セルロースといった豊富な原材料に恵まれています。環境の持続可能性を支援する政府の強力なイニシアチブと政策が、研究開発への多額の投資とともに市場の成長をさらに加速させています。さらに、この地域には大手メーカーやサプライヤーが存在するため、競争上の優位性があり、コスト効率の高い生産と流通が可能となっています。環境汚染に対する消費者の意識の高まりと、環境に優しいパッケージング・ソリューションの採用の増加も、アジア太平洋が世界のバイオプラスチックとバイオポリマー市場で主導的な役割を維持するのに役立っています。

当レポートでは、世界のバイオプラスチックとバイオポリマー市場について調査し、原材料別、製品タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- バリューチェーン分析

- 原材料分析

- エコシステム分析

- 規制状況

- 価格分析

- 貿易分析

- 技術分析

- 特許分析

- マクロ経済指標

- 顧客ビジネスに影響を与える動向と混乱

- 主要な会議とイベント

- ケーススタディ分析

- 主要な利害関係者と購入基準

- 投資と資金調達のシナリオ

第6章 バイオプラスチックとバイオポリマー市場(原材料別)

- イントロダクション

- サトウキビ/サトウダイコン

- ジャガイモ/タピオカ

- コーンスターチ

- スイッチグラス

- 植物油

- キャッサバ

- 小麦

- その他

第7章 バイオプラスチックとバイオポリマー市場(製品タイプ別)

- イントロダクション

- 生分解性

- 非生分解性/バイオベース

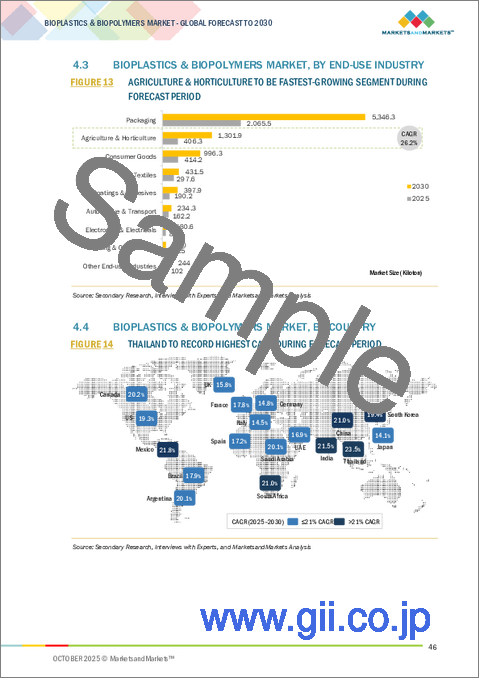

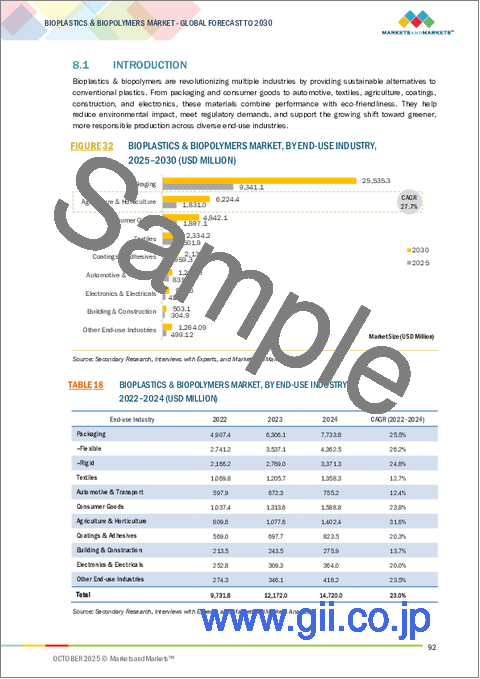

第8章 バイオプラスチックとバイオポリマー市場(最終用途産業別)

- イントロダクション

- 包装

- 繊維

- 消費財

- 自動車・輸送

- 農業・園芸

- 建築・建設

- コーティング剤・接着剤

- エレクトロニクス・電気機器

- その他

第9章 バイオプラスチックとバイオポリマー市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- スペイン

- 英国

- イタリア

- ギリシャ

- その他

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- タイ

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2022年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:新興企業/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- NATUREWORKS LLC

- BRASKEM

- BASF SE

- TOTALENERGIES CORBION

- VERSALIS S.P.A

- BIOME BIOPLASTICS LTD

- MITSUBISHI CHEMICAL GROUP CORPORATION

- BIOTEC BIOLOGISCHE NATURVERPACKUNGEN GMBH & CO. KG

- PLANTIC TECHNOLOGIES

- TORAY INDUSTRIES

- その他の企業

- LYONDELLBASEL

- FKUR

- AVANTIUM

- LOTTE CHEMICAL

- GREEN DOT BIOPLASTICS

- SABIC

- CARDIA BIOPLASTICS

- INEOS STYROLUTION

- KINGFA SCI. CO. LTD

- BIO-ON

- JIN HUI LONG HIGH TECHNOLOGY CO. LTD

- TEKNOR APEX

- PARSA POLYMER SHARIF

- KANEKA CORPORATION

- ARCTIC BIOMATERIALS