|

|

市場調査レポート

商品コード

1314347

マイクロ電池の世界市場 (~2028年):タイプ (薄膜・プリント・固体チップ・ボタン)・容量 (10mAh未満・10~100mAh・100mAh超)・電池タイプ (一次電池・二次電池)・用途 (スマートカード・ワイヤレスセンサー)・地域別Micro Battery Market by Type (Thin Film, Printed, Solid-state Chip, Button), Capacity (Below 10 mAh, 10 to 100 mAh, Above 100 mAh), Battery Type (Primary, Secondary), Application (Smart cards, Wireless Sensors) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| マイクロ電池の世界市場 (~2028年):タイプ (薄膜・プリント・固体チップ・ボタン)・容量 (10mAh未満・10~100mAh・100mAh超)・電池タイプ (一次電池・二次電池)・用途 (スマートカード・ワイヤレスセンサー)・地域別 |

|

出版日: 2023年07月04日

発行: MarketsandMarkets

ページ情報: 英文 214 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のマイクロ電池の市場規模は、2023年の5億米ドルから、2023年から2028年にかけて22.4%のCAGRで推移し、2028年には13億米ドルの規模に成長すると予測されています。

薄膜電池は機器の軽量化と小型パッケージでのエネルギー貯蔵を可能にします。また、プリント電池は、体温のモニターのために患者の皮膚に直接貼る経皮医療パッチ用の優れた電源です。このような医療用パッチの需要は伸びており、これらのパッチに電力を供給する薄膜電池、プリント電池、フレキシブル電池の需要が増加しています。

タイプ別で見ると、ボタン電池の部門が予測期間中に大きなシェアを占めると予測されています。ボタン電池は、小さな円盤状で軽量、低電力のデバイスです。これらの電池は安価で、安全性が比較的高く、長い保存可能期間があります。また、液漏れ防止機能があり、重量対出力比が高く、高電圧用に積み重ねるのが簡単です。

用途別では、医療機器の部門が予測期間中に大きなCAGRで成長する見込みです。技術の進歩と医療分野におけるIoTの浸透が新しい電池技術の機会を生み出しています。埋め込み可能な医療機器には、安定した信頼性の高い電源を長期間供給できる電池が必要です。マイクロ電池の信頼性と性能は、神経刺激装置、ペースメーカー、除細動器などの埋め込み機器への応用に魅力的です。ペースメーカー、薬剤送達システム、医療用パッチ、医療診断用センサー、使い捨て医療機器など、その他の機器にも、フレキシブル電池や薄膜電池などの高度な電池を使用することができます。マイクロ電池のサイズと柔軟性は、これらの医療機器の要件に完全に適合しています。ボタン電池は、補聴器、インスリンポンプ、ネブライザー、血糖測定器など、さまざまな医療用途で広く使用されています。

地域別では、北米市場が予測期間中に大きなCAGRで成長すると予想されています。北米のパッケージング業界の先進化により、インタラクティブディスプレイ、RFIDタグ、スマートラベルのパッケージへの統合が進んでいます。このようなスマートパッケージは薄膜電池を必要とするため、同地域での需要が増加しています。また、マイクロ電池は効率的な電力貯蔵技術であり、フォームファクターを小さくでき、CE製品に柔軟な設計を提供します。さらに、スマートカード技術が不正取引を回避するために広く利用されています。銀行、通信業界、セキュリティの高い政府部門では、人員の識別やリソースの追跡のためにスマートカード技術を導入しています。これらのことから、薄膜電池とプリント電池の需要は予測期間中に大幅に増加すると予想されています。

当レポートでは、世界のマイクロ電池の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- 価格分析

- 顧客の事業に影響を与える動向/ディスラプション

- 技術分析

- 全固体電池

- 金属空気電池

- 液体金属電池

- 亜鉛マンガン電池

- バナジウムフロー電池

- リチウムシリコン電池

- リチウムコバルト酸化物電池

- ニッケルマンガンコバルト電池

- リチウム・ニッケル・コバルト・アルミニウム酸化物電池

- リチウム硫黄電池

- ポーターのファイブフォース分析

- 主なステークホルダー・購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主要な会議とイベント

- 関税・規制状況

第6章 マイクロ電池市場:コンポーネント別

- 電極

- カソード

- アノード

- 基板

- 電解質

- その他

第7章 マイクロ電池市場:材料別

- アルカリ

- 酸化銀

- リチウムイオン

- リチウムポリマー

- 亜鉛

第8章 マイクロ電池市場:タイプ別

- 薄膜電池

- プリント電池

- 全固体チップ電池

- ボタン電池

第9章 マイクロ電池市場:電池タイプ別

- 一次電池

- 二次電池

第10章 マイクロ電池市場:容量別

- 10mAh未満

- 10~100mAh

- 100mAh超

第11章 マイクロ電池市場:用途別

- CE製品

- 医療機器

- スマートパッケージング

- スマートカード

- ワイヤレスセンサー

- その他

第12章 マイクロ電池市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- 主要企業の採用戦略

- 上位5社の収益分析

- 市場シェア分析

- 企業評価マトリックス

- 中小企業の企業評価マトリックス

- 企業フットプリント

- 競合ベンチマーキング

- 競合状況・動向

第14章 企業プロファイル

- 主要企業

- PANASONIC HOLDINGS CORPORATION

- ENERGIZER HOLDINGS, INC.

- VARTA AG

- ULTRALIFE CORPORATION

- MOLEX, LLC

- ENFUCELL

- CYMBET CORPORATION

- DURACELL INC.

- MAXELL, LTD.

- MURATA MANUFACTURING CO., LTD.

- RENATA SA

- SEIKO INSTRUMENTS INC.

- SHENZHEN GREPOW BATTERY CO., LTD.

- STMICROELECTRONICS N.V.

- TDK CORPORATION

- その他の企業

- BRIGHTVOLT

- ENERGY DIAGNOSTICS

- EXCELLATRON SOLID STATE, LLC

- GMB CO., LTD.

- IMPRINT ENERGY

- ITEN

- JENAX INC.

- PROLOGIUM TECHNOLOGY CO., LTD.

- RIOT ENERGY

- YICHANG POWER GLORY TECHNOLOGY CO., LTD.

第15章 隣接市場および関連市場

第16章 付録

The global micro battery market size is expected to grow from USD 0.5 billion in 2023 to USD 1.3 billion by 2028, at a CAGR of 22.4% from 2023 to 2028. Thin-film batteries enable devices to be lightweight and store energy in small packages. Printed batteries are an excellent power source for transdermal medical patches that are applied directly to a patient's skin to monitor body temperature. The demand for these medical patches is growing, increasing the demand for thin-film, printed, and flexible batteries to power such patches.

" Button battery segment is projected to hold a substantial share during the forecast period"

Button batteries are tiny discs -shaped, lightweight, low-power devices. These batteries are inexpensive, reasonably safe, and have a long shelf life. They have high leak protection and a high weight-to-power ratio. These batteries are easy to stack for higher voltages. Lithium coin cells are available in a wide range of sizes and capacities. Some of the companies which are offering button batteries/cells include TDK Corporation (Japan), Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), VARTA AG (Germany), Renata SA (Switzerland), Duracell Inc. (US), Maxell, Ltd. (Japan), and STMicroelectronics International N.V. (Switzerland).

"Medical devices application is expected to grow at a significant CAGR during the forecast period"

Technological advancements and the penetration of IoT in the medical field have generated opportunities for new battery technologies. Implantable medical devices require batteries that can deliver a steady, reliable power source for a long. The reliability and performance of micro batteries make them attractive for applications in implantable devices such as neural stimulators, pacemakers, and defibrillators. Other devices such as pacemakers, drug delivery systems, medical patches, medical diagnosis sensors, and disposable medical devices can also use advanced batteries such as flexible and thin batteries. The micro battery's size and flexibility perfectly comply with these medical devices' requirements. For instance, button batteries are being used widely in several medical applications, including various medical devices such as hearing aids, insulin pumps, nebulizers, blood glucose meters, and more.

"The market in North America is expected to grow at a significant CAGR during the forecast period"

The advancements in the packaging industry of North America are leading to the integration of interactive displays, RFID tags, and smart labels in packages. Such smart packages require thin-film batteries, increasing demand in the region. Thus, the growth of the smart packaging market in North America is expected to drive the micro battery market during the forecast period. The micro battery is an efficient power storage technology that reduces the form factor and offers a flexible design for consumer electronics. Smart card technology is widely used to avoid fraudulent transactions. Banks, telecom industries, and high-security government departments are implementing smart card technology for personnel identification and resource tracking. As a result, the demand for thin-film and printed batteries is expected to increase significantly during the forecast period.

Breakdown of the profiles of primary participants:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, and RoW - 5%

Major players profiled in this report are as follows: Cymbet Corporation (US), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), TDK Corporation (Japan), Maxell, Ltd. (Japan), VARTA AG (Germany), Renata SA (Switzerland), and Duracell Inc. (US) among others.

Research Coverage

In this report, the micro battery market has been segmented based on type, material, capacity, battery type, application, and region. The micro battery market based on type has been segmented into thin film, printed, solid-state chip, and button batteries. Based on capacity, the market has been segmented into below 10 mAh, 10 to 100 mAh, and above 100 mAh. The market has been segmented into primary and secondary based on battery type. Based on application, the market has been segmented into consumer electronics, medical devices, wireless sensors, smart packaging, smart cards, and others. The study also forecasts the market size in four main regions-North America, Europe, Asia Pacific, and RoW.

Key Benefits of Buying the Report:

The report provides insights on the following pointers:

Analysis of key drivers ( Benefits of micro batteries over traditional batteries, Rising adoption of micro batteries in electronic and medical devices, Rising use of wearable devices, Miniaturization of electronic devices), restraints (High investment costs, Lack of standards), opportunities ( Rising micro battery's integration in smart textiles, Growing use of wireless sensors equipped with micro batteries), and challenges (Complexities in battery fabrication) influencing the growth of the micro battery market

Product Development/Innovation: Detailed insights on upcoming products, technologies, research & development activities, funding activities, industry partnerships, and new product launches in the micro battery market

Market Development: Comprehensive information about lucrative markets - the report analyses the micro battery market across regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Market Diversification: Exhaustive information about new products & technologies, untapped geographies, recent developments, and investments in the micro battery market

Competitive Assessment: In-depth assessment of market ranks, growth strategies, and product offerings of leading players like Cymbet Corporation (US), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), and TDK Corporation (Japan), among others in the micro battery market

Strategies: The report also helps stakeholders understand the pulse of the micro battery market and provides them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MICRO BATTERY MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- FIGURE 2 MICRO BATTERY MARKET: REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 3 MICRO BATTERY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 4 MICRO BATTERY MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 5 MICRO BATTERY MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- FIGURE 6 MICRO BATTERY MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MICRO BATTERY MARKET: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

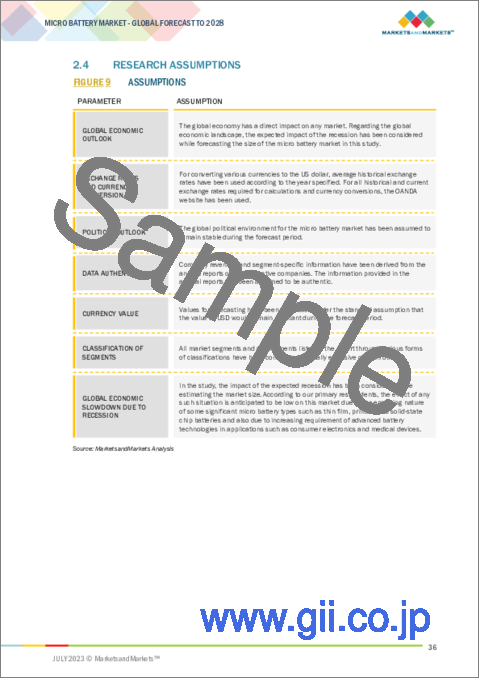

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 9 ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO UNDERSTAND RECESSION IMPACT ON MICRO BATTERY MARKET

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 MICRO BATTERY MARKET, 2019-2028 (USD MILLION)

- FIGURE 11 THIN FILM BATTERIES TO WITNESS HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 12 PRIMARY BATTERIES TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 10 TO 100 MAH SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 CONSUMER ELECTRONICS APPLICATION TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MICRO BATTERY MARKET

- FIGURE 16 INTEGRATION OF THIN FILM AND FLEXIBLE BATTERIES INTO CONSUMER ELECTRONICS TO DRIVE MARKET

- 4.2 MICRO BATTERY MARKET, BY TYPE

- FIGURE 17 THIN FILM BATTERIES TO CAPTURE LARGEST MARKET SHARE IN 2028

- 4.3 MICRO BATTERY MARKET, BY APPLICATION

- FIGURE 18 CONSUMER ELECTRONICS APPLICATION TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- 4.4 NORTH AMERICA MICRO BATTERY MARKET, BY APPLICATION AND COUNTRY

- FIGURE 19 MEDICAL DEVICES AND US TO BE LARGEST SHAREHOLDERS OF NORTH AMERICAN MARKET IN 2028

- 4.5 MICRO BATTERY MARKET, BY COUNTRY

- FIGURE 20 GERMANY TO BE FASTEST-GROWING MARKET FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 MICRO BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Advantages of micro batteries over traditional batteries

- 5.2.1.2 Growing adoption of micro batteries in medical devices

- 5.2.1.3 Increasing demand for wearables using thin and printed batteries

- 5.2.1.4 Growing adoption of specialized batteries in IoT applications

- 5.2.1.5 Rising focus on miniaturization of electronic devices

- FIGURE 22 MICRO BATTERY MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for high initial investment in creating manufacturing setup for advanced batteries

- 5.2.2.2 Lack of designing and manufacturing standards for micro batteries

- FIGURE 23 MICRO BATTERY MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for flexible batteries in smart textiles

- 5.2.3.2 Increasing adoption of wireless sensors

- FIGURE 24 MICRO BATTERY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex battery fabrication process

- FIGURE 25 MICRO BATTERY MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 26 MICRO BATTERY MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 27 MICRO BATTERY MARKET: ECOSYSTEM ANALYSIS

- TABLE 2 ROLE OF PLAYERS IN MICRO BATTERY ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND

- FIGURE 28 AVERAGE SELLING PRICE TREND FOR MICRO BATTERIES, 2022-2028

- 5.5.2 AVERAGE SELLING PRICE TREND, BY TYPE

- TABLE 3 MICRO BATTERY MARKET: AVERAGE SELLING PRICE AND VOLUME

- 5.5.3 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- FIGURE 29 AVERAGE SELLING PRICE OF MICRO BATTERIES OFFERED BY KEY PLAYERS

- TABLE 4 AVERAGE SELLING PRICE OF MICRO BATTERIES OFFERED BY MAJOR PLAYERS (USD)

- 5.5.4 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 5 AVERAGE SELLING PRICE FOR MICRO BATTERIES, BY REGION (USD)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MICRO BATTERY MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 SOLID-STATE BATTERIES

- 5.7.2 METAL-AIR BATTERIES

- 5.7.3 LIQUID-METAL BATTERIES

- 5.7.4 ZINC-MANGANESE BATTERIES

- 5.7.5 VANADIUM FLOW BATTERIES

- 5.7.6 LITHIUM-SILICON BATTERIES

- 5.7.7 LITHIUM-COBALT OXIDE BATTERIES

- 5.7.8 NICKEL-MANGANESE-COBALT BATTERIES

- 5.7.9 LITHIUM-NICKEL-COBALT-ALUMINUM OXIDE BATTERIES

- 5.7.10 LITHIUM-SULFUR BATTERIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON MICRO BATTERY MARKET

- FIGURE 31 MICRO BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 BARGAINING POWER OF SUPPLIERS

- 5.8.2 BARGAINING POWER OF BUYERS

- 5.8.3 THREAT OF NEW ENTRANTS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRIES

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.10 CASE STUDY ANALYSIS

- TABLE 9 USE OF THIN FILM BATTERIES IN SPORTS APPLICATIONS

- TABLE 10 UTILIZATION OF THIN FILM BATTERIES TO POWER SKIN PATCHES

- TABLE 11 DEVELOPMENT OF SAFE BED-EXIT SENSORS USING THIN FILM BATTERIES

- TABLE 12 INTEGRATION OF THIN FILM BATTERIES IN FLEXIBLE SENSOR TAGS TO TRACK SHIPMENTS

- TABLE 13 ADOPTION OF SMALL RECHARGEABLE BATTERIES BY BITKEY TO BUILD THIN SMART LOCK KEY

- 5.11 TRADE ANALYSIS

- FIGURE 34 IMPORT VALUE OF LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 35 EXPORT VALUE OF LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 36 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 14 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- FIGURE 37 NUMBER OF PATENTS GRANTED PER YEAR, 2013-2022

- TABLE 15 MICRO BATTERY MARKET: LIST OF PATENTS, 2019-2022

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 MICRO BATTERY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

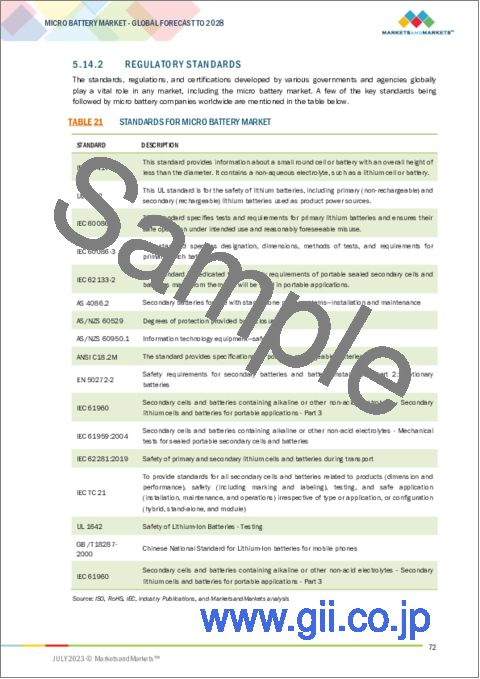

- 5.14.2 REGULATORY STANDARDS

- TABLE 21 STANDARDS FOR MICRO BATTERY MARKET

6 MICRO BATTERY MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- FIGURE 38 MICRO BATTERY MARKET, BY COMPONENT

- 6.2 ELECTRODES

- 6.2.1 CATHODE

- 6.2.1.1 Cathode material helps determine key battery characteristics

- 6.2.2 ANODE

- 6.2.2.1 Wide use of carbon-based materials in micro batteries

- 6.2.1 CATHODE

- 6.3 SUBSTRATES

- 6.3.1 IMPLEMENTATION OF POLYMER SUBSTRATES IN MICRO BATTERIES FOR COST EFFICIENCY

- 6.4 ELECTROLYTES

- 6.4.1 DEPLOYMENT OF SOLID ELECTROLYTES IN MICRO BATTERIES TO INCREASE BATTERY OUTPUT

- 6.5 OTHER COMPONENTS

7 MICRO BATTERY MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- FIGURE 39 MICRO BATTERY MARKET: BY MATERIAL

- 7.2 ALKALINE

- 7.2.1 DURABILITY AND AFFORDABILITY OF ALKALINE BATTERY TO DRIVE MARKET

- 7.3 SILVER OXIDE

- 7.3.1 HIGH ENERGY DENSITY AND STABILITY OF SILVER OXIDE BATTERIES TO BOOST DEMAND

- 7.4 LITHIUM-ION

- 7.4.1 RISING DEMAND FOR MINIATURIZED CONSUMER ELECTRONICS AND MEDICAL DEVICES TO BOOST ADOPTION OF LITHIUM-ION BATTERIES

- 7.5 LITHIUM POLYMER

- 7.5.1 HIGH DURABILITY OF LITHIUM POLYMER BATTERIES TO INCREASE ADOPTION IN CONSUMER DEVICES

- 7.6 ZINC

- 7.6.1 NEXT-GENERATION WEARABLE ELECTRONICS TO ADOPT ZINC-BASED FLEXIBLE PRINTED BATTERIES

8 MICRO BATTERY MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 40 MICRO BATTERY MARKET, BY TYPE

- FIGURE 41 THIN FILM BATTERIES TO EXHIBIT HIGHEST CAGR IN MICRO BATTERY MARKET DURING FORECAST PERIOD

- TABLE 22 MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 23 MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2 THIN FILM BATTERIES

- 8.2.1 INCREASED DEMAND FOR MINIATURE PRODUCTS TO BOOST ADOPTION OF THIN FILM BATTERIES

- TABLE 24 THIN FILM BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 25 THIN FILM BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 26 THIN FILM BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 27 THIN FILM BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 28 THIN FILM BATTERIES: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 THIN FILM BATTERIES: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 PRINTED BATTERIES

- 8.3.1 FLEXIBLE AND ECO-FRIENDLY FEATURES TO DRIVE DEMAND FOR PRINTED BATTERIES

- TABLE 30 PRINTED BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 31 PRINTED BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 32 PRINTED BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 33 PRINTED BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 34 PRINTED BATTERIES: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 35 PRINTED BATTERIES: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 SOLID-STATE CHIP BATTERIES

- 8.4.1 SAFETY CONCERNS IN DEVICES TO BOOST ADOPTION OF SOLID-STATE CHIP BATTERIES

- TABLE 36 SOLID-STATE CHIP BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 37 SOLID-STATE CHIP BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 38 SOLID-STATE CHIP BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 39 SOLID-STATE CHIP BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 40 SOLID-STATE CHIP BATTERIES: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 SOLID-STATE CHIP BATTERIES: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 BUTTON BATTERIES

- 8.5.1 INEXPENSIVE AND SAFE NATURE OF BUTTON BATTERIES TO DRIVE DEMAND IN NUMEROUS APPLICATIONS

- TABLE 42 BUTTON BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 43 BUTTON BATTERIES: MICRO BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- TABLE 44 BUTTON BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 45 BUTTON BATTERIES: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 46 BUTTON BATTERIES: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 BUTTON BATTERIES: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

9 MICRO BATTERY MARKET, BY BATTERY TYPE

- 9.1 INTRODUCTION

- FIGURE 42 MICRO BATTERY MARKET, BY BATTERY TYPE

- FIGURE 43 SECONDARY BATTERY TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 48 MICRO BATTERY MARKET, BY BATTERY TYPE, 2019-2022 (USD MILLION)

- TABLE 49 MICRO BATTERY MARKET, BY BATTERY TYPE, 2023-2028 (USD MILLION)

- 9.2 PRIMARY

- 9.2.1 USE OF DISPOSABLE BATTERIES IN MEDICAL DEVICES TO DRIVE DEMAND FOR PRIMARY BATTERIES

- TABLE 50 PRIMARY: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 51 PRIMARY: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.3 SECONDARY

- 9.3.1 USE OF COMPACT AND FLEXIBLE RECHARGEABLE BATTERIES TO DRIVE SEGMENTAL GROWTH

- TABLE 52 SECONDARY: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 53 SECONDARY: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

10 MICRO BATTERY MARKET, BY CAPACITY

- 10.1 INTRODUCTION

- FIGURE 44 MICRO BATTERY MARKET: BY CAPACITY

- FIGURE 45 10 TO 100 MAH SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 54 MICRO BATTERY MARKET, BY CAPACITY, 2019-2022 (USD MILLION)

- TABLE 55 MICRO BATTERY MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- 10.2 BELOW 10 MAH

- 10.2.1 DEMAND FOR LIGHTWEIGHT AND COMPACT BATTERIES TO BOOST ADOPTION OF BATTERIES BELOW 10 MAH

- 10.3 10 TO 100 MAH

- 10.3.1 INCREASED ADOPTION OF PORTABLE DEVICES TO DRIVE DEMAND FOR MODERATE CAPACITY BATTERIES

- 10.4 ABOVE 100 MAH

- 10.4.1 HIGH POWER APPLICATIONS TO DRIVE DEMAND FOR BATTERIES ABOVE 100 MAH

11 MICRO BATTERY MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 46 MICRO BATTERY MARKET, BY APPLICATION

- FIGURE 47 SMART PACKAGING SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- TABLE 56 MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 57 MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2 CONSUMER ELECTRONICS

- 11.2.1 MINIATURIZATION OF ELECTRONIC PRODUCTS TO DRIVE DEMAND FOR MICRO BATTERIES

- TABLE 58 CONSUMER ELECTRONICS: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 60 CONSUMER ELECTRONICS: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 CONSUMER ELECTRONICS: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 MEDICAL DEVICES

- 11.3.1 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL INDUSTRY TO BOOST ADOPTION OF MICRO BATTERIES

- TABLE 62 MEDICAL DEVICES: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 63 MEDICAL DEVICES: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 64 MEDICAL DEVICES: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 MEDICAL DEVICES: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 SMART PACKAGING

- 11.4.1 ADOPTION OF RFID TAGS TO DRIVE DEMAND FOR MICRO BATTERIES IN SMART PACKAGING INDUSTRY

- TABLE 66 SMART PACKAGING: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 67 SMART PACKAGING: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 68 SMART PACKAGING: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 SMART PACKAGING: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 SMART CARDS

- 11.5.1 RISING DEMAND FOR SELF-POWERED SMART CARDS TO BOOST ADOPTION OF THIN FILM BATTERIES

- TABLE 70 SMART CARDS: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 71 SMART CARDS: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 72 SMART CARDS: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 SMART CARDS: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 WIRELESS SENSORS

- 11.6.1 LONG SHELF LIFE OF MICRO BATTERIES TO INCREASE SUITABILITY FOR WIRELESS SENSORS

- TABLE 74 WIRELESS SENSORS: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 75 WIRELESS SENSORS: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 76 WIRELESS SENSORS: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 WIRELESS SENSORS: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 OTHERS

- TABLE 78 OTHERS: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 79 OTHERS: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 80 OTHERS: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 OTHERS: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

12 MICRO BATTERY MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 48 MICRO BATTERY MARKET, BY REGION

- FIGURE 49 GERMANY TO BE FASTEST-GROWING COUNTRY IN GLOBAL MICRO BATTERY MARKET FROM 2023 TO 2028

- TABLE 82 MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 IMPACT OF RECESSION ON MARKET IN NORTH AMERICA

- FIGURE 50 NORTH AMERICA: MICRO BATTERY MARKET SNAPSHOT

- FIGURE 51 US TO ACCOUNT FOR LARGEST SHARE OF MICRO BATTERY MARKET IN NORTH AMERICA FROM 2023 TO 2028

- TABLE 84 NORTH AMERICA: MICRO BATTERY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MICRO BATTERY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Rising adoption of smart packaging solutions to increase demand for micro batteries

- 12.2.3 CANADA

- 12.2.3.1 Adoption of IoT technology in medical sector to fuel demand for micro batteries

- 12.2.4 MEXICO

- 12.2.4.1 Growth of consumer electronics sector to support market growth

- 12.3 EUROPE

- 12.3.1 IMPACT OF RECESSION ON MARKET IN EUROPE

- FIGURE 52 EUROPE: MICRO BATTERY MARKET SNAPSHOT

- FIGURE 53 GERMANY TO DOMINATE EUROPEAN MARKET FOR MICRO BATTERIES DURING FORECAST PERIOD

- TABLE 90 EUROPE: MICRO BATTERY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 91 EUROPE: MICRO BATTERY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 92 EUROPE: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 93 EUROPE: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 95 EUROPE: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Increasing investments in R&D of advanced battery technologies to drive market

- 12.3.3 UK

- 12.3.3.1 Growing demand for wearable devices to drive adoption of micro batteries

- 12.3.4 FRANCE

- 12.3.4.1 Rising adoption of smart cards to drive demand for thin film and printed batteries

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 IMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

- FIGURE 54 ASIA PACIFIC: MICRO BATTERY MARKET SNAPSHOT

- FIGURE 55 CHINA TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC MARKET FROM 2023 TO 2028

- TABLE 96 ASIA PACIFIC: MICRO BATTERY MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MICRO BATTERY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Strong manufacturing capabilities to drive demand for micro batteries

- 12.4.3 JAPAN

- 12.4.3.1 Presence of major consumer electronics manufacturers to drive market

- 12.4.4 INDIA

- 12.4.4.1 Rising trend of digitalization and infrastructural development to drive demand for micro batteries

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 IMPACT OF RECESSION ON MARKET IN ROW

- FIGURE 56 MIDDLE EAST AND AFRICA TO REGISTER HIGHER CAGR IN MICRO BATTERY MARKET IN ROW DURING FORECAST PERIOD

- TABLE 102 ROW: MICRO BATTERY MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 103 ROW: MICRO BATTERY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 104 ROW: MICRO BATTERY MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 105 ROW: MICRO BATTERY MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 106 ROW: MICRO BATTERY MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 107 ROW: MICRO BATTERY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Rising demand for consumer electronics to support market growth

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Increasing foreign investments for infrastructure development to result in high adoption of micro batteries

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 108 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 REVENUE ANALYSIS FOR TOP 5 COMPANIES

- FIGURE 57 MICRO BATTERY MARKET: REVENUE ANALYSIS FOR TOP 5 PLAYERS, 2018-2022

- 13.4 MARKET SHARE ANALYSIS, 2022

- TABLE 109 MICRO BATTERY MARKET SHARE ANALYSIS (2022)

- FIGURE 58 SHARE OF KEY PLAYERS IN MICRO BATTERY MARKET, 2022

- 13.5 COMPANY EVALUATION MATRIX, 2022

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 59 MICRO BATTERY MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.6 COMPANY EVALUATION MATRIX FOR SMES, 2022

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 60 MICRO BATTERY MARKET: COMPANY EVALUATION MATRIX FOR SMES, 2022

- 13.7 MICRO BATTERY MARKET: COMPANY FOOTPRINT

- TABLE 110 COMPANY FOOTPRINT

- TABLE 111 APPLICATION: COMPANY FOOTPRINT

- TABLE 112 REGION: COMPANY FOOTPRINT

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 113 MICRO BATTERY MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 114 MICRO BATTERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE SITUATIONS AND TRENDS

- TABLE 115 MICRO BATTERY MARKET: PRODUCT LAUNCHES

- TABLE 116 MICRO BATTERY MARKET: DEALS

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.1 KEY PLAYERS

- 14.1.1 PANASONIC HOLDINGS CORPORATION

- TABLE 117 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 61 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 118 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- 14.1.2 ENERGIZER HOLDINGS, INC.

- TABLE 119 ENERGIZER HOLDINGS, INC.: COMPANY OVERVIEW

- FIGURE 62 ENERGIZER HOLDINGS, INC.: COMPANY SNAPSHOT

- TABLE 120 ENERGIZER HOLDINGS, INC.: PRODUCTS OFFERED

- 14.1.3 VARTA AG

- TABLE 121 VARTA AG: COMPANY OVERVIEW

- FIGURE 63 VARTA AG: COMPANY SNAPSHOT

- TABLE 122 VARTA AG: PRODUCTS OFFERED

- TABLE 123 VARTA AG: PRODUCT LAUNCHES

- TABLE 124 VARTA AG: DEALS

- TABLE 125 VARTA AG: OTHERS

- 14.1.4 ULTRALIFE CORPORATION

- TABLE 126 ULTRALIFE CORPORATION: COMPANY OVERVIEW

- FIGURE 64 ULTRALIFE CORPORATION: COMPANY SNAPSHOT

- TABLE 127 ULTRALIFE CORPORATION: PRODUCTS OFFERED

- TABLE 128 ULTRALIFE CORPORATION: DEALS

- 14.1.5 MOLEX, LLC

- TABLE 129 MOLEX, LLC: COMPANY OVERVIEW

- TABLE 130 MOLEX, LLC: PRODUCTS OFFERED

- 14.1.6 ENFUCELL

- TABLE 131 ENFUCELL: COMPANY OVERVIEW

- TABLE 132 ENFUCELL: PRODUCTS OFFERED

- TABLE 133 ENFUCELL: PRODUCT LAUNCHES

- 14.1.7 CYMBET CORPORATION

- TABLE 134 CYMBET CORPORATION: COMPANY OVERVIEW

- TABLE 135 CYMBET CORPORATION: PRODUCTS OFFERED

- TABLE 136 CYMBET CORPORATION: PRODUCT LAUNCHES

- TABLE 137 CYMBET CORPORATION: DEALS

- 14.1.8 DURACELL INC.

- TABLE 138 DURACELL INC.: COMPANY OVERVIEW

- TABLE 139 DURACELL INC.: PRODUCTS OFFERED

- 14.1.9 MAXELL, LTD.

- TABLE 140 MAXELL, LTD.: COMPANY OVERVIEW

- FIGURE 65 MAXELL, LTD.: COMPANY SNAPSHOT

- TABLE 141 MAXELL, LTD.: PRODUCTS OFFERED

- TABLE 142 MAXELL, LTD.: PRODUCT LAUNCHES

- 14.1.10 MURATA MANUFACTURING CO., LTD.

- TABLE 143 MURATA MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- FIGURE 66 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

- TABLE 144 MURATA MANUFACTURING CO., LTD.: PRODUCTS OFFERED

- TABLE 145 MURATA MANUFACTURING CO., LTD.: PRODUCT LAUNCHES

- 14.1.11 RENATA SA

- TABLE 146 RENATA SA: COMPANY OVERVIEW

- TABLE 147 RENATA SA: PRODUCTS OFFERED

- TABLE 148 RENATA SA: PRODUCT LAUNCHES

- 14.1.12 SEIKO INSTRUMENTS INC.

- TABLE 149 SEIKO INSTRUMENTS INC. COMPANY OVERVIEW

- TABLE 150 SEIKO INSTRUMENTS INC.: PRODUCTS OFFERED

- TABLE 151 SEIKO INSTRUMENTS INC.: PRODUCT LAUNCHES

- 14.1.13 SHENZHEN GREPOW BATTERY CO., LTD.

- TABLE 152 SHENZHEN GREPOW BATTERY CO., LTD.: COMPANY OVERVIEW

- TABLE 153 SHENZHEN GREPOW BATTERY CO., LTD.: PRODUCTS OFFERED

- TABLE 154 SHENZHEN GREPOW BATTERY CO., LTD.: DEALS

- TABLE 155 SHENZHEN GREPOW BATTERY CO., LTD.: OTHERS

- 14.1.14 STMICROELECTRONICS N.V.

- TABLE 156 STMICROELECTRONICS NV: COMPANY OVERVIEW

- FIGURE 67 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

- TABLE 157 STMICROELECTRONICS N.V.: PRODUCTS OFFERED

- 14.1.15 TDK CORPORATION

- TABLE 158 TDK CORPORATION: COMPANY OVERVIEW

- FIGURE 68 TDK CORPORATION: COMPANY SNAPSHOT

- TABLE 159 TDK CORPORATION: PRODUCTS OFFERED

- TABLE 160 TDK CORPORATION: PRODUCT LAUNCHES

- 14.2 OTHER COMPANIES

- 14.2.1 BRIGHTVOLT

- 14.2.2 ENERGY DIAGNOSTICS

- 14.2.3 EXCELLATRON SOLID STATE, LLC

- 14.2.4 GMB CO., LTD.

- 14.2.5 IMPRINT ENERGY

- 14.2.6 ITEN

- 14.2.7 JENAX INC.

- 14.2.8 PROLOGIUM TECHNOLOGY CO., LTD.

- 14.2.9 RIOT ENERGY

- 14.2.10 YICHANG POWER GLORY TECHNOLOGY CO., LTD.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 FLOW BATTERY MARKET: BY APPLICATION

- 15.2.1 INTRODUCTION

- TABLE 161 FLOW BATTERY MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 162 FLOW BATTERY MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 15.2.2 UTILITIES

- 15.2.2.1 Growing adoption of flow batteries in utilities to support market growth

- 15.2.3 COMMERCIAL & INDUSTRIAL

- 15.2.3.1 Commercial & industrial segment to hold significant market share during forecast period

- 15.2.4 EV CHARGING STATION

- 15.2.4.1 Growing need for fast recharging of vehicles to fuel adoption of flow batteries in charging stations

- 15.2.5 OTHERS

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS