|

|

市場調査レポート

商品コード

1295436

TSN (Time-Sensitive Networking) の世界市場:種類別 (IEEE 802.1 AS、IEEE 802.1 Qbv、IEEE 802.1 CB、IEEE 802.1 Qbu)・コンポーネント別・エンドユーザー別・地域別の将来予測 (2028年まで)Time-Sensitive Networking Market by Type (IEEE 802.1 AS, IEEE 802.1 Qbv, IEEE 802.1 CB, IEEE 802.1 Qbu), Component (Switches, Hubs Routers &Gateways, Controllers & Processors, Isolators & Convertors), End User, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| TSN (Time-Sensitive Networking) の世界市場:種類別 (IEEE 802.1 AS、IEEE 802.1 Qbv、IEEE 802.1 CB、IEEE 802.1 Qbu)・コンポーネント別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月13日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のTSN (Time-Sensitive Networking) の市場規模は、2023年に2億米ドル、2028年には17億米ドルに達すると予測され、予測期間中のCAGRは58.3%と見込まれています。

産業用途における自動化の需要は高まっており、TSNは、産業界の高まる要件を満たすためにますます重要になってきています。自動化はまた、生産性・効率性・安全性の向上を目指す産業にとって重要な手段となっています。産業オートメーション分野の企業は、機械とシステム間の通信と調整を改善するために、TSN技術の採用を増やしています。このような動向は、TSNソリューションに対する需要の増加をもたらし、TSN市場の成長につながっています。

"スイッチ分野が予測期間中に最も高いCAGRで成長する"

TSN市場では、産業オートメーション需要の増加により、スイッチ分野が最も高いCAGRで成長しています。TSN技術は、様々なデバイスやシステム間のリアルタイム通信や同期を可能にする産業オートメーション分野で特に関連性が高いです。産業界が効率と生産性を向上させるためにより多くの自動化ソリューションを採用するにつれ、TSN対応スイッチの需要が増加しています。このセグメントの成長の原動力はコスト効率です。TSNスイッチは時間の経過とともに手頃な価格になっており、より幅広い産業や用途で利用できるようになっています。

"電力・エネルギー分野がTSN市場を独占する"

電力・エネルギー分野は、IIoT (産業用モノのインターネット) の採用が拡大しているため、TSN市場で最大の市場シェアを占めています。電力・エネルギー産業は、自動化を強化し、リソース利用を最適化し、システム全体の効率を向上させるために、IIoTの採用を増やしています。TSNは、相互接続されたIIoTデバイス向けに信頼性の高い標準化された通信フレームワークを提供し、電力・エネルギーインフラ内のセンサー、アクチュエーター、その他のインテリジェントデバイスのシームレスな統合を促進します。これにより、効率的なデータ収集、分析、制御が可能になり、運用実績が向上します。このような要因が、電力・エネルギー分野におけるTSNコンポーネントの需要に拍車をかけています。

"アジア太平洋のTSN市場では、中国が最も高いCAGRで成長する"

TSN市場では、いくつかの要因から中国が最も高い成長率を示しています。中国は世界の製造業の中心国であり、経済のかなりの部分(約40%)を工業部門に依存しています。同国には、半導体・自動車・家電など、TSNを広く採用する強力な部門があります。中国は世界最大の製造国であり、これらの産業では急速な技術進歩や研究活動の活発化が常に推進されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 顧客のビジネスに影響を与える動向/混乱

- ケーススタディ分析

- 技術分析

- 平均販売価格分析

- 特許分析

- 貿易分析

- 料金分析

- 基準と規制状況

- 主要な会議とイベント (2022年~2023年)

第6章 TSN市場:種類別

- イントロダクション

- IEEE 802.1 AS

- IEEE 802.1 Qbv

- IEEE 802.1 CB

- IEEE 802.1 Qbu

- IEEE 802.1 Qcc

- その他

第7章 TSN市場:コンポーネント別

- イントロダクション

- スイッチ

- ハブ・ルータ・ゲートウェイ

- コントローラ・プロセッサ

- アイソレータ・コンバータ

第8章 TSN市場:エンドユーザー別

- イントロダクション

- 電力・エネルギー

- 自動車

- 交通機関

- 石油・ガス

- 通信・データセンター

- 医薬品

- 航空宇宙

- その他

第9章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要企業の戦略

- 企業収益分析 (2022年)

- 市場シェア分析 (2022年)

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- TSN市場:企業のフットプリント

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- BELDEN INC.

- CISCO SYSTEMS, INC.

- TEXAS INSTRUMENTS INCORPORATED

- SIEMENS

- MARVELL TECHNOLOGY GROUP LTD.

- NXP SEMICONDUCTORS N.V.

- MICROCHIP TECHNOLOGY INCORPORATED

- ANALOG DEVICES, INC.

- BROADCOM INC.

- RENESAS ELECTRONICS CORPORATION

- その他の企業

- KYLAND TECHNOLOGY CO., LTD.

- MOXA

- ADVANTECH CO., LTD.

- KONTRON

- PHOENIX CONTACT GMBH & CO. KG

- 3ONEDATA CO., LTD.

- TAILYN TECHNOLOGIES INC.

- NOKIA CORPORATION

- RIBBON COMMUNICATIONS US LLC

- CAST

- WINSYSTEMS INC

- RELYUM

- B&R INDUSTRIAL AUTOMATION GMBH

- NATIONAL INSTRUMENTS

- TTTECH COMPUTERTECHNIK AG

第12章 付録

The global time-sensitive networking market was valued at USD 0. 2 billion in 2023 and is estimated to reach USD 1.7 billion by 2028, registering a CAGR of 58.3% during the forecast period. The demand for automation in industrial applications is rising, and time-sensitive networking (TSN) is becoming increasingly crucial to meet the growing requirements of the industry. Automation has also become a key enabler for industries seeking to increase productivity, efficiency, and safety. Companies in the industrial automation sector are increasingly adopting TSN technology to improve communication and coordination between machines and systems. These trends have resulted in an increasing demand for time-sensitive networking solutions, leading to the growth of the time-sensitive networking market.

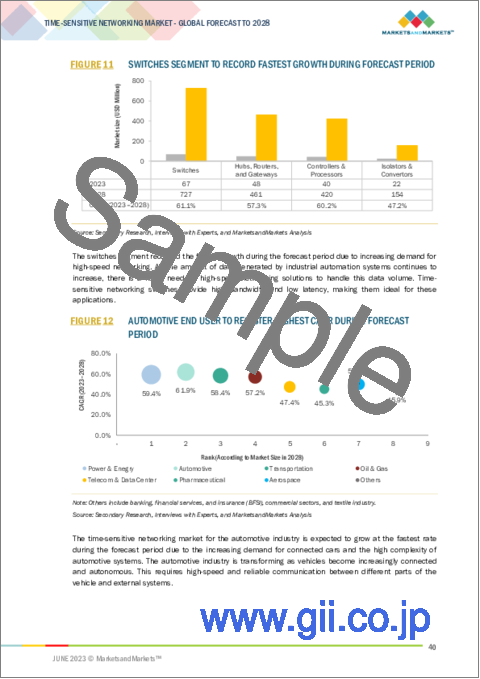

"Switches segment is expected to grow at the highest CAGR during the forecast period."

The switches segment is growing at the highest CAGR in the time-sensitive networking market due increasing demand for industrial automation. TSN technology is particularly relevant in the field of industrial automation, where it enables real-time communication and synchronization between various devices and systems. As industries adopt more automation solutions to improve efficiency and productivity, the demand for TSN-enabled switches increases. The segment's growth is driven by cost effectiveness. TSN switches have become more affordable over time, making them accessible to a wider range of industries and applications.

"Power and Energy segment is projected to dominate the time-sensitive networking market."

Power and Energy segment are having the largest market share in the time-sensitive networking market due to the growing adoption of the industrial internet of things. The power and energy industries are increasingly embracing the Industrial Internet of Things (IIoT) to enhance automation, optimize resource utilization, and improve overall system efficiency. TSN provides a reliable and standardized communication framework for interconnected IIoT devices, facilitating the seamless integration of sensors, actuators, and other intelligent devices within the power and energy infrastructure. This enables efficient data collection, analysis, and control, improving operational performance. These factors are fueling the demand of time-sensitive networking components in power and energy sector.

"China to grow at the highest CAGR for Asia Pacific time-sensitive networking market"

China is experiencing the highest growth rate in the time-sensitive networking market due to several factors. China is a major player in global manufacturing, with a significant portion of its economy, approximately 40%, dependent on the industrial sector. The country has a robust base of sectors, including semiconductor, automotive, and consumer electronics, which widely adopt TSN. With China being the world's largest manufacturer, there is a constant push towards rapid technological advancements and increased research activities in these industries.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the time-sensitive networking marketplace.

- By Company Type: Tier 1 - 25%, Tier 2 - 35%, and Tier 3 - 40%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America- 25%, Europe - 42%, Asia Pacific- 21% and RoW- 12%

Belden Inc (US); Cisco Systems Inc. (US); Texas Instruments Incorporated (US); Siemens (Germany); Marvell Technology Group Ltd. (US); NXP Semiconductor N.V. (Netherlands); Microchip Technology Inc. (US); Analog Devices, Inc., (US); Broadcom Inc. (US); Renesas Electronics Corporation (US); are some of the key players in the time-sensitive networking market.

The study includes an in-depth competitive analysis of these key players in the time-sensitive networking market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the time-sensitive networking market by type (IEEE 802.1 AS, IEEE 802.1 Qbv, IEEE 802.1 CB, IEEE 802.1 Qbu, IEEE 802.1 Qcc, and Others), by component (Switches, Hubs Routers and Gateways, Controllers and Processors, Isolators and Converters), by end user (Power and Energy, Automotive, Transportation, Oil & Gas, Telecom and Data Center, Pharmaceutical, Aerospace and Others), and by region (North America, Europe, Asia Pacific, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the time-sensitive networking market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the time-sensitive networking market. Competitive analysis of upcoming startups in the time-sensitive networking market ecosystem is covered in this report.

Reasons to buy this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall time-sensitive networking market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for automation in industrial application, Rapid digitization across the globe, Increasing demand for deterministic ethernet in real time applications, increasing adoption of edge computing), restraints (Limited standardization of time-sensitive networking, High complexity in designing, maintaining and implementing TSN networks), opportunities (Increasing demand for industrial IoT, Emergence of 5G technology, Rising smart city initiatives across the globe), and challenges (Increasing security concerns across industries, Rising integration challenges in TSN networks) influencing the growth of the time-sensitive networking market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the time-sensitive networking market

- Market Development: Comprehensive information about lucrative markets - the report analyses the time-sensitive networking market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the time-sensitive networking market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Belden Inc (US), Cisco Systems Inc. (US), Texas Instruments Incorporated (US), Siemens (Germany), Marvell Technology Group Ltd. (US), NXP Semiconductor N.V. (Netherlands), Microchip Technology Inc. (US), Analog Devices, Inc., (US), Broadcom Inc. (US), Renesas Electronics Corporation (US) among others in the time-sensitive networking market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 TIME-SENSITIVE NETWORKING MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 RECESSION IMPACT

- FIGURE 2 PROJECTIONS FOR TIME-SENSITIVE NETWORKING MARKET

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 TIME-SENSITIVE NETWORKING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary participants

- 2.1.1.2 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)-REVENUE GENERATED BY COMPANIES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)-ILLUSTRATIVE EXAMPLE OF COMPANIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Arrive at market size using bottom-up approach

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Arrive at market share using top-down approach (supply side)

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION: TIME-SENSITIVE NETWORKING MARKET

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 PARAMETERS CONSIDERED FOR ANALYZING RECESSION IMPACT

- TABLE 1 RECESSION IMPACT ANALYSIS

- 2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 IEEE 802.1 SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 SWITCHES SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 AUTOMOTIVE END USER TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TIME-SENSITIVE NETWORKING MARKET

- FIGURE 14 RISING ADOPTION OF INDUSTRY 4.0 TO FUEL DEMAND FOR TIME-SENSITIVE NETWORKING SOLUTIONS

- 4.2 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT

- FIGURE 15 SWITCHES TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.3 TIME-SENSITIVE NETWORKING MARKET, BY END USER AND REGION

- FIGURE 16 POWER & ENERGY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.4 TIME-SENSITIVE NETWORKING MARKET, BY COUNTRY

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.5 TIME-SENSITIVE NETWORKING MARKET SHARE, BY REGION

- FIGURE 18 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN TIME-SENSITIVE NETWORKING MARKET

- 5.2.1 DRIVERS

- FIGURE 20 TIME-SENSITIVE NETWORKING MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.1.1 Rising demand for automation in industrial applications

- 5.2.1.2 Rapid global digitization

- 5.2.1.3 Increasing demand for deterministic Ethernet in real-time applications

- 5.2.1.4 Increasing adoption of edge computing

- 5.2.2 RESTRAINTS

- FIGURE 21 TIME-SENSITIVE NETWORKING MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.2.1 Limited standardization of time-sensitive networking

- 5.2.2.2 High complexity in designing, maintaining, and implementing time-sensitive networking networks

- 5.2.3 OPPORTUNITIES

- FIGURE 22 TIME-SENSITIVE NETWORKING MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.3.1 Increasing demand for Industrial IoT

- 5.2.3.2 Emergence of 5G technology

- 5.2.3.3 Rising smart city initiatives globally

- 5.2.4 CHALLENGES

- FIGURE 23 TIME-SENSITIVE NETWORKING MARKET CHALLENGES: IMPACT ANALYSIS

- 5.2.4.1 Increasing security concerns across industries

- 5.2.4.2 Rising integration challenges for time-sensitive networking networks

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS: TIME-SENSITIVE NETWORKING

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 25 KEY PLAYERS IN TIME-SENSITIVE NETWORKING MARKET

- TABLE 2 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 TIME-SENSITIVE NETWORKING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS: TIME-SENSITIVE NETWORKING MARKET

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 THREAT OF NEW ENTRANTS

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 THREAT OF SUBSTITUTES

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- 5.6.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 REVENUE SHIFT FOR PLAYERS IN TIME-SENSITIVE NETWORKING MARKET

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 TTTECH INDUSTRIAL COLLABORATED WITH SIEMENS TO IMPLEMENT TIME-SENSITIVE NETWORKING IN ENERGY AUTOMATION APPLICATION

- 5.8.2 TTTECH PARTNERED WITH CISCO TO IMPLEMENT TIME-SENSITIVE NETWORKING IN INDUSTRIAL AUTOMATION APPLICATION

- 5.8.3 AVNU ALLIANCE, A CONSORTIUM OF COMPANIES PROMOTING TIME-SENSITIVE NETWORKING TECHNOLOGY, WORKED WITH AUDI TO USE TIME-SENSITIVE NETWORKING IN AUTOMOTIVE APPLICATION

- 5.8.4 ROCKWELL AUTOMATION COLLABORATED WITH CISCO TO DEMONSTRATE USE OF TIME-SENSITIVE NETWORKING IN A DISCRETE MANUFACTURING APPLICATION

- 5.8.5 NXP SEMICONDUCTORS IMPLEMENTED TIME-SENSITIVE NETWORKING IN A SMART BUILDING APPLICATION

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 COMPLEMENTARY TECHNOLOGIES

- 5.9.1.1 Precision time protocol (PTP)

- 5.9.1.2 Stream reservation protocol (SRP)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 LAN technology

- 5.9.2.2 Token-ring technology

- 5.9.1 COMPLEMENTARY TECHNOLOGIES

- 5.10 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 30 AVERAGE SELLING PRICES OF TIME-SENSITIVE NETWORKING COMPONENTS, BY END USER

- 5.10.1 AVERAGE SELLING PRICES OF TIME-SENSITIVE NETWORKING COMPONENTS, BY KEY END USER

- TABLE 6 AVERAGE SELLING PRICES OF TIME-SENSITIVE NETWORKING COMPONENTS, BY KEY END USER (USD)

- 5.10.2 AVERAGE SELLING PRICE TRENDS

- FIGURE 31 AVERAGE SELLING PRICE ANALYSIS

- 5.11 PATENT ANALYSIS

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS (2013-2023)

- FIGURE 33 PATENTS GRANTED WORLDWIDE (2013-2023)

- TABLE 7 TOP 20 PATENT OWNERS IN US FROM 2013 TO 2023

- TABLE 8 LIST OF PATENTS IN TIME-SENSITIVE NETWORKING MARKET, 2021-2023

- 5.12 TRADE ANALYSIS

- TABLE 9 IMPORT DATA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 10 EXPORT DATA, BY COUNTRY, 2018-2021 (USD MILLION)

- 5.13 TARIFF ANALYSIS

- TABLE 11 MFN TARIFFS FOR HS CODE: 854231 EXPORTED BY CHINA

- TABLE 12 MFN TARIFFS FOR HS CODE: 854231 EXPORTED BY US

- TABLE 13 MFN TARIFF FOR HS CODE: 854231 EXPORTED BY GERMANY

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.1 North America: list of regulatory bodies, government agencies, and other organizations

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.2 Europe: list of regulatory bodies, government agencies, and other organizations

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.3 Asia Pacific: list of regulatory bodies, government agencies, and other organizations

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.4 Rest of the World: list of regulatory bodies, government agencies, and other organizations

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS & REGULATIONS RELATED TO TIME-SENSITIVE NETWORKING MARKET

- 5.14.3 IEEE STD 802.1Q - BRIDGES AND BRIDGED NETWORKS

- 5.14.3.1 Supports virtual LANs (VLANs) on IEEE 802.3 Ethernet networks

- 5.14.4 IEEE STD 802.1AB - STATION AND MEDIA ACCESS CONTROL CONNECTIVITY DISCOVERY

- 5.14.4.1 Discovers physical topology from adjacent stations in IEEE 802(R) LANs

- 5.14.5 IEEE STD 802.1AS - TIMING AND SYNCHRONIZATION FOR TIME-SENSITIVE APPLICATIONS

- 5.14.5.1 Ensures synchronization requirements are met for time-sensitive applications

- 5.14.6 IEEE STD 802.1AX - LINK AGGREGATION

- 5.14.6.1 Provides general information relevant to specific MAC types

- 5.14.7 IEEE STD 802.1BA - AUDIO-VIDEO BRIDGING (AVB) SYSTEMS

- 5.14.7.1 Specifies defaults and profiles for manufacturers of LAN equipment

- 5.14.8 IEEE STD 802.1CB - FRAME REPLICATION AND ELIMINATION FOR RELIABILITY

- 5.14.8.1 Provides fault tolerance without failover

- 5.14.9 IEEE STD 802.1CM - TIME-SENSITIVE NETWORKING FOR FRONTHAUL

- 5.14.9.1 Supports fronthaul interfaces

- 5.14.10 IEEE STD 802.1CS - LINK-LOCAL REGISTRATION PROTOCOL

- 5.14.10.1 Replicates registration database

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

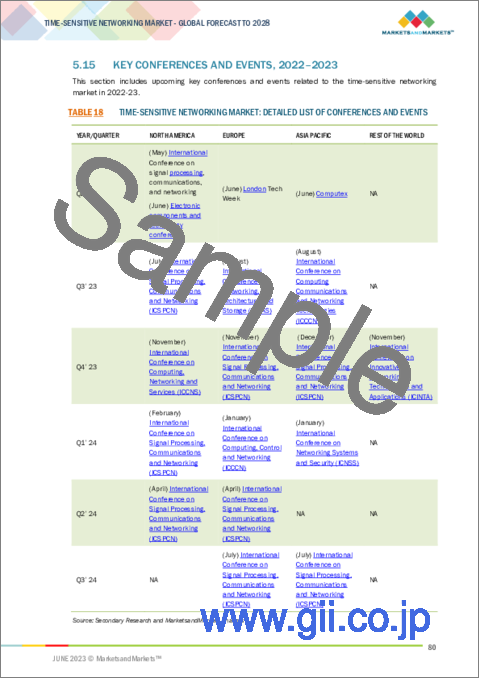

- 5.15 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 18 TIME-SENSITIVE NETWORKING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 TIME-SENSITIVE NETWORKING MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 34 TIME-SENSITIVE NETWORKING MARKET, BY TYPE

- FIGURE 35 IEEE 802.1 AS SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 19 TIME-SENSITIVE NETWORKING MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 20 TIME-SENSITIVE NETWORKING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 IEEE 802.1 AS

- 6.2.1 TIME-SENSITIVE NETWORKING COMPONENTS SUPPORTING IEEE 802.1AS FOR CRITICAL APPLICATIONS

- 6.3 IEEE 802.1 QBV

- 6.3.1 IEEE 802.1QBV SPECIFIES PROCEDURES TO DRAIN TIME-AWARE QUEUE

- 6.4 IEEE 802.1 CB

- 6.4.1 802.1 CB USE RISING DUE TO NEED FOR LARGER AND MORE COMPLEX NETWORKS

- 6.5 IEEE 802.1 QBU

- 6.5.1 INCREASING DEMAND IN APPLICATIONS REQUIRING REAL-TIME COMMUNICATION

- 6.6 IEEE 802.1 QCC

- 6.6.1 GROWING DEMAND FOR NETWORK-BASED SERVICES TO ENHANCE UTILIZATION OF 802.1 QCC

- 6.7 OTHERS

7 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 36 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT

- FIGURE 37 SWITCHES SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- TABLE 21 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 22 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 23 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT, 2019-2022 (THOUSAND UNITS)

- TABLE 24 TIME-SENSITIVE NETWORKING MARKET, BY COMPONENT, 2023-2028 (THOUSAND UNITS)

- 7.2 SWITCHES

- 7.2.1 SWITCHES ENABLE WIRED DEVICES TO COMMUNICATE ON NETWORKS

- 7.3 HUBS, ROUTERS, AND GATEWAYS

- 7.3.1 DEMAND FOR RELIABLE INDUSTRIAL AUTOMATION SYSTEMS TO DRIVE MARKET

- 7.4 CONTROLLERS & PROCESSORS

- 7.4.1 CONTROLLERS & PROCESSORS TO BE CRITICAL COMPONENTS OF COMMUNICATION SYSTEMS

- 7.5 ISOLATORS & CONVERTERS

- 7.5.1 ISOLATORS & CONVERTERS USED ELECTRICALLY TO INSULATE AND CONVERT MEDIA FROM ONE FORM TO ANOTHER

8 TIME-SENSITIVE NETWORKING MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 38 TIME-SENSITIVE NETWORKING MARKET, BY END USER

- FIGURE 39 AUTOMOTIVE INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 25 TIME-SENSITIVE NETWORKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 26 TIME-SENSITIVE NETWORKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.2 POWER & ENERGY

- 8.2.1 NORTH AMERICA TO BE LARGEST AND FASTEST-GROWING MARKET

- TABLE 27 TIME-SENSITIVE NETWORKING MARKET FOR POWER & ENERGY, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 TIME-SENSITIVE NETWORKING MARKET FOR POWER & ENERGY, BY REGION, 2023-2028 (USD MILLION)

- 8.3 AUTOMOTIVE

- 8.3.1 ETHERNET IN AUTOMOTIVE TO REDUCE CACOPHONY OF NETWORKS

- TABLE 29 TIME-SENSITIVE NETWORKING MARKET FOR AUTOMOTIVE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 TIME-SENSITIVE NETWORKING MARKET FOR AUTOMOTIVE, BY REGION, 2023-2028 (USD MILLION)

- 8.4 TRANSPORTATION

- 8.4.1 ADOPTION OF TIME-SENSITIVE NETWORKING TO PROVIDE EXACT, REAL-TIME TRAIN POSITIONING INFORMATION

- TABLE 31 TIME-SENSITIVE NETWORKING MARKET FOR TRANSPORTATION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 TIME-SENSITIVE NETWORKING MARKET FOR TRANSPORTATION, BY REGION, 2023-2028 (USD MILLION)

- 8.5 OIL & GAS

- 8.5.1 RISING NEED FOR TIMELY COMMUNICATION FOR PROCESS CONTROL TO BOOST DEMAND FOR TIME-SENSITIVE NETWORKING

- TABLE 33 TIME-SENSITIVE NETWORKING MARKET FOR OIL & GAS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 34 TIME-SENSITIVE NETWORKING MARKET FOR OIL & GAS, BY REGION, 2023-2028 (USD MILLION)

- 8.6 TELECOM & DATA CENTER

- 8.6.1 INCREASING DEMAND FOR HIGH-PERFORMANCE NETWORKING SOLUTIONS TO BOOST ADOPTION OF TIME-SENSITIVE NETWORKING

- TABLE 35 TIME-SENSITIVE NETWORKING MARKET FOR TELECOM & DATA CENTER, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 TIME-SENSITIVE NETWORKING MARKET FOR TELECOM & DATA CENTER, BY REGION, 2023-2028 (USD MILLION)

- 8.7 PHARMACEUTICAL

- 8.7.1 STRINGENT REGULATORY STANDARDS TO INCREASE USAGE OF TIME-SENSITIVE NETWORKING COMPONENTS

- TABLE 37 TIME-SENSITIVE NETWORKING MARKET FOR PHARMACEUTICAL, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 TIME-SENSITIVE NETWORKING MARKET FOR PHARMACEUTICAL, BY REGION, 2023-2028 (USD MILLION)

- 8.8 AEROSPACE

- 8.8.1 TIME-SENSITIVE NETWORKING MEETS STRINGENT AEROSPACE NETWORK REQUIREMENTS

- TABLE 39 TIME-SENSITIVE NETWORKING MARKET FOR AEROSPACE, BY REGION, 2019-2022 (USD MILLION)

- TABLE 40 TIME-SENSITIVE NETWORKING MARKET FOR AEROSPACE, BY REGION, 2023-2028 (USD MILLION)

- 8.9 OTHERS

- TABLE 41 TIME-SENSITIVE NETWORKING MARKET FOR OTHERS, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 TIME-SENSITIVE NETWORKING MARKET FOR OTHERS, BY REGION, 2023-2028 (USD MILLION)

9 GEOGRAPHIC ANALYSIS

- 9.1 INTRODUCTION

- FIGURE 40 NORTH AMERICA TO HOLD LARGEST SHARE IN TIME-SENSITIVE NETWORKING MARKET FROM 2023 TO 2028

- TABLE 43 TIME-SENSITIVE NETWORKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 44 TIME-SENSITIVE NETWORKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SNAPSHOT

- 9.2.1 NORTH AMERICA: IMPACT OF RECESSION

- TABLE 45 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN ENERGY & POWER, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN ENERGY & POWER, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Industrial automation trend to offers lucrative growth opportunities for market players

- TABLE 65 US: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 66 US: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Growth in manufacturing sector and increased investments in advanced technologies to support market growth

- TABLE 67 CANADA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 68 CANADA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.2.4 MEXICO

- 9.2.4.1 Advances in manufacturing industry and high adoption of maquiladora business model to promote market

- TABLE 69 MEXICO: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 70 MEXICO: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- FIGURE 42 EUROPE: TIME-SENSITIVE NETWORKING MARKET SNAPSHOT

- TABLE 71 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 72 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.3.1 EUROPE: IMPACT OF RECESSION

- TABLE 73 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 74 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 75 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN POWER & ENERGY, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 76 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN POWER & ENERGY, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 77 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 78 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 79 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 81 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 82 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 83 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 84 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 86 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 89 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 90 EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Growing deployment of safety-critical systems and adoption of robotics technology in automobile industry to boost market

- TABLE 91 GERMANY: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 92 GERMANY: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Surging adoption of automation in aerospace and manufacturing companies to propel market growth

- TABLE 93 UK: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 94 UK: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Booming manufacturing, automotive, and aerospace industries to fuel demand

- TABLE 95 FRANCE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 96 FRANCE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Growing focus on facilitating real-time communication in manufacturing industry to fuel market growth

- TABLE 97 ITALY: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 98 ITALY: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 99 REST OF EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 100 REST OF EUROPE: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- TABLE 103 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN ENERGY & POWER, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN ENERGY & POWER, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Increasing focus on factory automation to fuel demand for time-sensitive networking technology

- TABLE 121 CHINA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 122 CHINA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Flourishing automotive industry to propel market growth

- TABLE 123 JAPAN: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 124 JAPAN: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Accelerating growth in automotive and consumer electronics to boost demand for time-sensitive networking components

- TABLE 125 SOUTH KOREA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 126 SOUTH KOREA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 127 REST OF ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.5 REST OF WORLD

- TABLE 129 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 130 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.5.1 REST OF WORLD: IMPACT OF RECESSION

- TABLE 131 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 132 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 133 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN POWER & ENERGY, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 134 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN POWER & ENERGY, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 135 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 136 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN AUTOMOTIVE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 137 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 138 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN TRANSPORTATION, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 139 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 140 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN OIL & GAS, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 141 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 142 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN TELECOM & DATA CENTER, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 143 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 144 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN PHARMACEUTICAL, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 145 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 146 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN AEROSPACE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 147 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 148 REST OF WORLD: TIME-SENSITIVE NETWORKING MARKET SIZE IN OTHERS, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.5.2 MIDDLE EAST & AFRICA

- TABLE 149 MIDDLE EAST & AFRICA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

- 9.5.3 SOUTH AMERICA

- TABLE 151 SOUTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2019-2022 (USD MILLION)

- TABLE 152 SOUTH AMERICA: TIME-SENSITIVE NETWORKING MARKET SIZE, BY END USER, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES OF KEY MARKET PLAYERS

- 10.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY TIME-SENSITIVE NETWORKING COMPANIES

- 10.3 COMPANY REVENUE ANALYSIS, 2022

- FIGURE 44 TIME-SENSITIVE NETWORKING REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 10.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 45 SHARE OF MAJOR PLAYERS IN TIME-SENSITIVE NETWORKING MARKET, 2022

- 10.4.1 TIME-SENSITIVE NETWORKING MARKET: DEGREE OF COMPETITION

- TABLE 153 TIME-SENSITIVE NETWORKING MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION QUADRANT

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- FIGURE 46 TIME-SENSITIVE NETWORKING MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.6 STARTUP/SME EVALUATION QUADRANT

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 47 TIME-SENSITIVE NETWORKING MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.6.5 STARTUPS: TIME-SENSITIVE NETWORKING MARKET

- 10.6.5.1 Detailed list of key startups

- TABLE 154 STARTUPS: TIME-SENSITIVE NETWORKING MARKET

- TABLE 155 STARTUP MATRIX: TIME-SENSITIVE NETWORKING MARKET

- TABLE 156 TIME-SENSITIVE NETWORKING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY COMPONENT

- TABLE 157 TIME-SENSITIVE NETWORKING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY REGION

- 10.7 TIME-SENSITIVE NETWORKING MARKET: COMPANY FOOTPRINT

- TABLE 158 COMPANY FOOTPRINT

- TABLE 159 END USER FOOTPRINT OF COMPANIES

- TABLE 160 COMPONENT FOOTPRINT OF COMPANIES

- TABLE 161 REGIONAL FOOTPRINT OF COMPANIES

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 DEALS

- TABLE 162 TIME-SENSITIVE NETWORKING MARKET: DEALS, 2018-2023

- 10.8.2 PRODUCT LAUNCHES

- TABLE 163 TIME-SENSITIVE NETWORKING MARKET: PRODUCT LAUNCHES, 2018-2023

- 10.8.3 OTHERS

- TABLE 164 TIME-SENSITIVE NETWORKING MARKET: OTHERS, 2018-2023

11 COMPANY PROFILES

- 11.1 KEY COMPANIES

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 BELDEN INC.

- TABLE 165 BELDEN INC.: COMPANY OVERVIEW

- FIGURE 48 BELDEN INC.: COMPANY SNAPSHOT

- TABLE 166 BELDEN INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 167 BELDEN INC.: PRODUCT LAUNCHES

- TABLE 168 BELDEN INC.: DEALS

- 11.1.2 CISCO SYSTEMS, INC.

- TABLE 169 CISCO SYSTEMS INC.: COMPANY OVERVIEW

- FIGURE 49 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 170 CISCO SYSTEMS INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 171 CISCO SYSTEMS INC.: DEALS

- 11.1.3 TEXAS INSTRUMENTS INCORPORATED

- TABLE 172 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- FIGURE 50 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- TABLE 173 TEXAS INSTRUMENTS INCORPORATED: SOLUTIONS/SERVICES OFFERINGS

- TABLE 174 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 175 TEXAS INSTRUMENTS INCORPORATED: OTHERS

- 11.1.4 SIEMENS

- TABLE 176 SIEMENS: COMPANY OVERVIEW

- FIGURE 51 SIEMENS: COMPANY SNAPSHOT

- TABLE 177 SIEMENS: SOLUTIONS/SERVICES OFFERINGS

- TABLE 178 SIEMENS: PRODUCT LAUNCHES

- 11.1.5 MARVELL TECHNOLOGY GROUP LTD.

- TABLE 179 MARVELL TECHNOLOGY GROUP LTD.: COMPANY OVERVIEW

- FIGURE 52 MARVELL TECHNOLOGY GROUP LTD.: COMPANY SNAPSHOT

- TABLE 180 MARVELL TECHNOLOGY GROUP LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 181 MARVELL TECHNOLOGY GROUP LTD.: PRODUCT LAUNCHES

- 11.1.6 NXP SEMICONDUCTORS N.V.

- TABLE 182 NXP SEMICONDUCTORS N.V.: COMPANY OVERVIEW

- FIGURE 53 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

- TABLE 183 NXP SEMICONDUCTORS N.V.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 184 NXP SEMICONDUCTORS N.V.: PRODUCT LAUNCHES

- 11.1.7 MICROCHIP TECHNOLOGY INCORPORATED

- TABLE 185 MICROCHIP TECHNOLOGY INCORPORATED: COMPANY OVERVIEW

- FIGURE 54 MICROCHIP TECHNOLOGY INCORPORATED: COMPANY SNAPSHOT

- TABLE 186 MICROCHIP TECHNOLOGY INCORPORATED: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 187 MICROCHIP TECHNOLOGY INCORPORATED: PRODUCT LAUNCHES

- TABLE 188 MICROCHIP TECHNOLOGY INCORPORATED: DEALS

- TABLE 189 MICROCHIP TECHNOLOGY INCORPORATED: OTHERS

- 11.1.8 ANALOG DEVICES, INC.

- TABLE 190 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- FIGURE 55 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- TABLE 191 ANALOG DEVICES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 192 ANALOG DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 193 ANALOG DEVICES, INC.: DEALS

- 11.1.9 BROADCOM INC.

- TABLE 194 BROADCOM INC.: COMPANY OVERVIEW

- FIGURE 56 BROADCOM INC.: COMPANY SNAPSHOT

- TABLE 195 BROADCOM INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 196 BROADCOM INC.: PRODUCT LAUNCHES

- TABLE 197 BROADCOM INC.: DEALS

- 11.1.10 RENESAS ELECTRONICS CORPORATION

- TABLE 198 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 57 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 199 RENESAS ELECTRONICS CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 200 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 KYLAND TECHNOLOGY CO., LTD.

- 11.2.2 MOXA

- 11.2.3 ADVANTECH CO., LTD.

- 11.2.4 KONTRON

- 11.2.5 PHOENIX CONTACT GMBH & CO. KG

- 11.2.6 3ONEDATA CO., LTD.

- 11.2.7 TAILYN TECHNOLOGIES INC.

- 11.2.8 NOKIA CORPORATION

- 11.2.9 RIBBON COMMUNICATIONS US LLC

- 11.2.10 CAST

- 11.2.11 WINSYSTEMS INC

- 11.2.12 RELYUM

- 11.2.13 B&R INDUSTRIAL AUTOMATION GMBH

- 11.2.14 NATIONAL INSTRUMENTS

- 11.2.15 TTTECH COMPUTERTECHNIK AG

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATIONS OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS