|

|

市場調査レポート

商品コード

1718866

リスクアナリティクスの世界市場:オファリング別、リスクタイプ別、業界別、地域別 - 2030年までの予測Risk Analytics Market by Offering (GRC Software, ERM Software, Third-party Risk Management Tools, Consulting Services, Risk Advisory Services), Risk Type (Operational Risks, Financial Risks, Technology Risks), and Verticals - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| リスクアナリティクスの世界市場:オファリング別、リスクタイプ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月25日

発行: MarketsandMarkets

ページ情報: 英文 380 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

リスクアナリティクスの市場規模は、予測期間中に9.7%のCAGRで拡大し、2025年の322億5,000万米ドルから2030年には513億4,000万米ドルに成長すると予測されています。

リスクアナリティクス市場の成長は主に、ビジネス環境の複雑化により、様々なタイプのリスクを予測、評価、軽減するための高度なツールが必要になっていることが背景にあります。サイバーセキュリティの脅威の増加、データ量の増大、規制遵守要件などの要因が、企業にリスクアナリティクスの導入を促しています。さらに、金融やヘルスケアなどの業界では、より良い意思決定とリスク管理のためにこれらのソリューションを採用しています。しかし、導入コストの高さ、データ統合の課題、予測モデルの精度に関する懸念が市場抑制要因として作用し、市場の成長を鈍らせています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 米ドル(100万米ドル) |

| セグメント | オファリング別、リスクタイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

インシデントレスポンス・危機管理サービスは、サイバー攻撃、データ漏洩、業務妨害の頻度と複雑さの増加により、リスクアナリティクス市場で最も速い成長が見込まれています。企業がセキュリティ脅威の高まりと潜在的な財務的損失に直面する中、迅速で効果的な対応戦略の需要が急増しています。これらのサービスは、企業が損害を最小限に抑えながら、インシデントを迅速に特定し、封じ込め、回復するのを支援します。さらに、データ保護と災害復旧に関する規制要件の高まりと、事業継続計画の重要性の高まりが、市場の成長に拍車をかけています。企業が予測不可能な環境下での回復力を追求する中、インシデント対応と危機管理サービスは、リスク管理戦略の重要な要素となっています。

企業が様々な財務リスクを効果的に管理する必要性が高まっていることから、予測期間中、財務リスクタイプ別セグメントがリスクアナリティクス市場を独占すると予想されます。主な分野には、企業が資本構造の最適化に注力する資本管理、金融債務の履行に課題を抱える流動性リスク、借り手の債務不履行の可能性を評価する信用リスクなどがあります。さらに、マネーロンダリング防止(AML)および支払詐欺検知ソリューションは、金融犯罪に対抗する上で極めて重要です。金融機関が規制圧力やサイバー脅威の増大に直面する中、こうしたリスクを軽減するための高度なリスクアナリティクスへの需要が、この分野の大幅な市場成長を促すと思われます。

アジア太平洋は、急速なデジタルトランスフォーメーション、インターネット普及率の増加、先端技術の採用拡大が原動力となり、リスクアナリティクス市場で最も速い成長率を記録すると予測されます。新興国はビッグデータ、人工知能(AI)、機械学習(ML)を活用し、金融、サプライチェーン、ヘルスケア、サイバーセキュリティなどの部門全体でリスク評価と管理を最適化しています。デジタル金融やスマートインフラを支援する政府の取り組みは、革新的なリスクアナリティクスソリューションの需要をさらに高めています。さらに、各業界では、業務の効率化、脆弱性の削減、ダイナミックな環境におけるリアルタイムの意思決定を可能にするため、予測アナリティクスの導入が進んでいます。一方、北米は、確立された企業、デジタルトランスフォーメーションへの高額の投資、AI、クラウドコンピューティング、ブロックチェーンなどの最先端技術の早期導入に後押しされ、リスクアナリティクスで最大の市場シェアを維持すると予想されます。同地域の強固な規制フレームワークと、金融、製造、エネルギーなどの部門全体でデータ主導のリスク管理戦略に力を入れていることが、同地域のリーダーシップを強化しています。北米の組織は、財務リスクの管理、サプライチェーンの合理化、サイバーセキュリティの強化、意思決定プロセスの改善においてリスクアナリティクスツールへの依存を強めており、デジタルファーストでプロアクティブなリスク軽減が最前線であり続けることを保証しています。

当レポートでは、世界のリスクアナリティクス市場について調査し、オファリング別、リスクタイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 2025年の米国関税の影響- リスクアナリティクス市場

- リスクアナリティクス市場の進化

- サプライチェーン分析

- エコシステム分析

- 投資情勢と資金調達シナリオ

- 生成AIがリスクアナリティクス市場に与える影響

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 主要な会議とイベント(2025年~2026年)

- ポーターのファイブフォース分析

- 顧客ビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- リスクアナリティクス技術/ツール

- リスクアナリティクス市場(リスクステージ別)

第6章 リスクアナリティクス市場、オファリング別

- イントロダクション

- ソフトウェア

- サービス

第7章 リスクアナリティクス市場(リスクタイプ別)

- イントロダクション

- 戦略リスク

- 運用リスク

- 財務リスク

- テクノロジーリスク

- 環境、健康、安全リスク

- 規制およびコンプライアンスリスク

- その他

第8章 リスクアナリティクス市場(業界別)

- イントロダクション

- BFSI

- 小売・eコマース

- ヘルスケア・ライフサイエンス

- 電気通信

- メディア・エンターテインメント

- テクノロジー・ソフトウェアプロバイダー

- エネルギー・公益事業

- 製造

- 運輸・物流

- 政府と防衛

- 鉱業

- 建設・不動産

- その他

第9章 リスクアナリティクス市場(地域別)

- イントロダクション

- 北米

- 北米:リスクアナリティクス市場促進要因

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:リスクアナリティクス市場促進要因

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋:リスクアナリティクス市場促進要因

- アジア太平洋:マクロ経済見通し

- 中国

- インド

- 日本

- 韓国

- ASEAN

- オーストラリアとニュージーランド

- その他

- 中東・アフリカ

- 中東・アフリカ:リスクアナリティクス市場促進要因

- 中東・アフリカ:マクロ経済見通し

- アラブ首長国連邦

- サウジアラビア

- カタール

- イスラエル

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:リスクアナリティクス市場促進要因

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2022年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 市場ランキング分析

- 製品比較分析

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、リスクアナリティクスソフトウェア、2024年

- 企業評価マトリックス:主要参入企業、リスクアナリティクスサービス、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第11章 企業プロファイル

- イントロダクション

- 主要参入企業

- DELOITTE

- MOODY'S ANALYTICS

- IBM

- KPMG

- ORACLE

- MARSH MCLENNAN

- SAP

- FIS

- PWC

- EY

- AON

- WILLIS TOWERS WATSON PLC

- LOCKTON

- ACCENTURE

- VERISK ANALYTICS

- SAS INSTITUTE

- SERVICENOW

- MILLIMAN

- CRISIL

- DILIGENT

- ONETRUST

- METRICSTREAM

- INFOSYS

- CAPGEMINI

- PROTIVITI

- その他の企業

- RISKONNECT

- ARCHER

- Z2DATA

- FUSION RISK MANAGEMENT

- SAFETYCULTURE

- INTEROS

- RESOLVER

- PROCESSUNITY

- CUBELOGIC LIMITED

- QUANTEXA

- PROVENIR

- ONSPRING

- RISK EDGE SOLUTIONS

- LOGICMANAGER

- SPRINTO

- QUANTIFI

- ZESTY.AI

- RISKLOGIX

- KYVOS INSIGHTS

- SPIN ANALYTICS

- CENTRL

- ETIOMETRY

- RISKVILLE

第12章 隣接市場と関連市場

第13章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATE, 2020-2024

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 GLOBAL RISK ANALYTICS MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 5 GLOBAL RISK ANALYTICS MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 6 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 7 RISK ANALYTICS MARKET: ECOSYSTEM

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PATENTS FILED, 2016-2025

- TABLE 14 RISK ANALYTICS MARKET: KEY PATENTS, 2024-2025

- TABLE 15 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING, 2025

- TABLE 16 AVERAGE SELLING PRICE, BY RISK TYPE, 2025

- TABLE 17 RISK ANALYTICS MARKET: CONFERENCES & EVENTS, 2025-2026

- TABLE 18 PORTERS' FIVE FORCES' IMPACT ON RISK ANALYTICS MARKET

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 21 RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 22 RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 23 RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 24 RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 25 RISK CALCULATION ENGINES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 RISK CALCULATION ENGINES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 RISK REPORTING TOOLS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 RISK REPORTING TOOLS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 DASHBOARD ANALYTICS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 DASHBOARD ANALYTICS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 GOVERNANCE, RISK, AND COMPLIANCE SOFTWARE: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 GOVERNANCE, RISK, AND COMPLIANCE SOFTWARE: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 ENTERPRISE RISK MANAGEMENT SOFTWARE: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 ENTERPRISE RISK MANAGEMENT SOFTWARE: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 THIRD-PARTY RISK MANAGEMENT TOOLS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 THIRD-PARTY RISK MANAGEMENT TOOLS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 OTHERS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 OTHERS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 40 RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 41 CLOUD: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 CLOUD: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 ON-PREMISES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

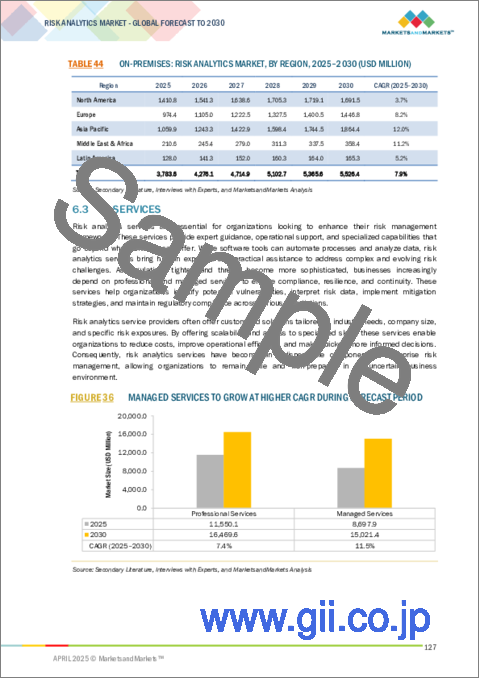

- TABLE 44 ON-PREMISES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 RISK ANALYTICS MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 46 RISK ANALYTICS MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 47 RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 48 RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 49 CONSULTING SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 CONSULTING SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 RISK ASSESSMENT & ADVISORY SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 RISK ASSESSMENT & ADVISORY SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 INCIDENT RESPONSE & CRISIS MANAGEMENT: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 INCIDENT RESPONSE & CRISIS MANAGEMENT: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 TRAINING & SUPPORT SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 TRAINING & SUPPORT SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2020-2024 (USD MILLION)

- TABLE 58 RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2025-2030 (USD MILLION)

- TABLE 59 MANAGED RISK ANALYTICS SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 MANAGED RISK ANALYTICS SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 COMPLIANCE & REGULATORY MANAGEMENT SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 COMPLIANCE & REGULATORY MANAGEMENT SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 CYBER & IT RISK MANAGEMENT SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 CYBER & IT RISK MANAGEMENT SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 FINANCE & ACCOUNTING SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 FINANCE & ACCOUNTING SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 LEGAL SERVICES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 LEGAL SERVICES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 RISK ANALYTICS MARKET, BY RISK TYPE, 2020-2024 (USD MILLION)

- TABLE 70 RISK ANALYTICS MARKET, BY RISK TYPE, 2025-2030 (USD MILLION)

- TABLE 71 STRATEGIC RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 STRATEGIC RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 OPERATIONAL RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 OPERATIONAL RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 FINANCIAL RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 FINANCIAL RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 TECHNOLOGY RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 TECHNOLOGY RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 ENVIRONMENT, HEALTH & SAFETY RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 ENVIRONMENT, HEALTH & SAFETY RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 REGULATORY & COMPLIANCE RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 REGULATORY & COMPLIANCE RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 OTHER RISK TYPE ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 OTHER RISK TYPE ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 RISK ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 86 RISK ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 87 BFSI: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 BFSI: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 RETAIL & E-COMMERCE: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 RETAIL & E-COMMERCE: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 HEALTHCARE & LIFE SCIENCES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 HEALTHCARE & LIFE SCIENCES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 TELECOMMUNICATIONS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 TELECOMMUNICATIONS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 MEDIA & ENTERTAINMENT: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 MEDIA & ENTERTAINMENT: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 TECHNOLOGY & SOFTWARE PROVIDERS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 TECHNOLOGY & SOFTWARE PROVIDERS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 ENERGY & UTILITIES: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 ENERGY & UTILITIES: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 MANUFACTURING: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 MANUFACTURING: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 TRANSPORTATION & LOGISTICS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 TRANSPORTATION & LOGISTICS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 GOVERNMENT & DEFENSE: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 106 GOVERNMENT & DEFENSE: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 MINING: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 108 MINING: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 109 CONSTRUCTION & REAL ESTATE: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 CONSTRUCTION & REAL ESTATE: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 OTHER VERTICALS: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 112 OTHER VERTICALS: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 114 RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: RISK ANALYTICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2020-2024 (USD MILLION)

- TABLE 126 NORTH AMERICA: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2025-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: RISK ANALYTICS MARKET, BY RISK TYPE, 2020-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: RISK ANALYTICS MARKET, BY RISK TYPE, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: RISK ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 130 NORTH AMERICA: RISK ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: RISK ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: RISK ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 US: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 134 US: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 135 CANADA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 136 CANADA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 138 EUROPE: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 140 EUROPE: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 142 EUROPE: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 143 EUROPE: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 144 EUROPE: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 146 EUROPE: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 147 EUROPE: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2020-2024 (USD MILLION)

- TABLE 148 EUROPE: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2025-2030 (USD MILLION)

- TABLE 149 EUROPE: RISK ANALYTICS MARKET, BY RISK TYPE, 2020-2024 (USD MILLION)

- TABLE 150 EUROPE: RISK ANALYTICS MARKET, BY RISK TYPE, 2025-2030 (USD MILLION)

- TABLE 151 EUROPE: RISK ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 152 EUROPE: RISK ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 153 EUROPE: RISK ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 154 EUROPE: RISK ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 UK: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 156 UK: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 157 GERMANY: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 158 GERMANY: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 FRANCE: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 160 FRANCE: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 161 ITALY: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 162 ITALY: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 163 SPAIN: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 164 SPAIN: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 166 REST OF EUROPE: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2020-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: RISK ANALYTICS MARKET, BY RISK TYPE, 2020-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: RISK ANALYTICS MARKET, BY RISK TYPE, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: RISK ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: RISK ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: RISK ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: RISK ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 CHINA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 186 CHINA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 INDIA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 188 INDIA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 189 JAPAN: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 190 JAPAN: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH KOREA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 192 SOUTH KOREA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 193 ASEAN: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 194 ASEAN: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 195 AUSTRALIA & NEW ZEALAND: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 196 AUSTRALIA & NEW ZEALAND: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2020-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2025-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY RISK TYPE, 2020-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY RISK TYPE, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 217 UAE: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 218 UAE: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 219 SAUDI ARABIA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 220 SAUDI ARABIA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 221 QATAR: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 222 QATAR: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 223 ISRAEL: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 224 ISRAEL: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 225 SOUTH AFRICA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 226 SOUTH AFRICA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 230 LATIN AMERICA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 232 LATIN AMERICA: RISK ANALYTICS MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 234 LATIN AMERICA: RISK ANALYTICS MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2020-2024 (USD MILLION)

- TABLE 236 LATIN AMERICA: RISK ANALYTICS MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 237 LATIN AMERICA: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 238 LATIN AMERICA: RISK ANALYTICS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 239 LATIN AMERICA: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2020-2024 (USD MILLION)

- TABLE 240 LATIN AMERICA: RISK ANALYTICS MARKET, BY MANAGED SERVICE, 2025-2030 (USD MILLION)

- TABLE 241 LATIN AMERICA: RISK ANALYTICS MARKET, BY RISK TYPE, 2020-2024 (USD MILLION)

- TABLE 242 LATIN AMERICA: RISK ANALYTICS MARKET, BY RISK TYPE, 2025-2030 (USD MILLION)

- TABLE 243 LATIN AMERICA: RISK ANALYTICS MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 244 LATIN AMERICA: RISK ANALYTICS MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 245 LATIN AMERICA: RISK ANALYTICS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 246 LATIN AMERICA: RISK ANALYTICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 247 BRAZIL: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 248 BRAZIL: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 249 MEXICO: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 250 MEXICO: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 251 ARGENTINA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 252 ARGENTINA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 253 REST OF LATIN AMERICA: RISK ANALYTICS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 254 REST OF LATIN AMERICA: RISK ANALYTICS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 255 OVERVIEW OF STRATEGIES ADOPTED BY KEY RISK ANALYTICS VENDORS, 2022-2025

- TABLE 256 RISK ANALYTICS MARKET: DEGREE OF COMPETITION

- TABLE 257 RISK ANALYTICS MARKET (SOFTWARE): REGIONAL FOOTPRINT (16 COMPANIES), 2024

- TABLE 258 RISK ANALYTICS MARKET (SOFTWARE): SOFTWARE FOOTPRINT (16 COMPANIES), 2024

- TABLE 259 RISK ANALYTICS MARKET (SOFTWARE): RISK TYPE FOOTPRINT (16 COMPANIES), 2024

- TABLE 260 RISK ANALYTICS MARKET (SOFTWARE): VERTICAL FOOTPRINT (16 COMPANIES), 2024

- TABLE 261 RISK ANALYSIS MARKET (SERVICES): REGIONAL FOOTPRINT (18 COMPANIES), 2024

- TABLE 262 RISK ANALYSIS MARKET (SERVICES): SERVICE FOOTPRINT (18 COMPANIES), 2024

- TABLE 263 RISK ANALYSIS MARKET (SERVICES): RISK TYPE FOOTPRINT (18 COMPANIES), 2024

- TABLE 264 RISK ANALYSIS MARKET (SERVICES): VERTICAL FOOTPRINT (18 COMPANIES), 2024

- TABLE 265 RISK ANALYTICS MARKET: KEY STARTUPS/SMES, 2024

- TABLE 266 RISK ANALYTICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 267 RISK ANALYTICS MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2022- 2025

- TABLE 268 RISK ANALYTICS MARKET: DEALS, 2022- 2025

- TABLE 269 DELOITTE: COMPANY OVERVIEW

- TABLE 270 DELOITTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 DELOITTE: DEALS

- TABLE 272 MOODY'S ANALYTICS: BUSINESS OVERVIEW

- TABLE 273 MOODY'S ANALYTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 MOODY'S ANALYTICS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 275 MOODY'S ANALYTICS: DEALS

- TABLE 276 IBM: BUSINESS OVERVIEW

- TABLE 277 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 279 IBM: DEALS

- TABLE 280 KPMG: COMPANY OVERVIEW

- TABLE 281 KPMG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 KPMG: DEALS

- TABLE 283 ORACLE: BUSINESS OVERVIEW

- TABLE 284 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 ORACLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 286 ORACLE: DEALS

- TABLE 287 MARSH MCLENNAN: BUSINESS OVERVIEW

- TABLE 288 MARSH MCLENNAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 MARSH MCLENNAN: DEALS

- TABLE 290 SAP: BUSINESS OVERVIEW

- TABLE 291 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 SAP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 293 SAP: DEALS

- TABLE 294 FIS: BUSINESS OVERVIEW

- TABLE 295 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 FIS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 297 PWC: COMPANY OVERVIEW

- TABLE 298 PWC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 PWC: DEALS

- TABLE 300 EY: COMPANY OVERVIEW

- TABLE 301 EY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 EY: DEALS

- TABLE 303 AON: BUSINESS OVERVIEW

- TABLE 304 AON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 AON: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 306 AON: DEALS

- TABLE 307 AI MODEL RISK MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 308 AI MODEL RISK MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 309 AI MODEL RISK MANAGEMENT MARKET, BY RISK TYPE, 2019-2023 (USD MILLION)

- TABLE 310 AI MODEL RISK MANAGEMENT MARKET, BY RISK TYPE, 2024-2029 (USD MILLION)

- TABLE 311 AI MODEL RISK MANAGEMENT MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 312 AI MODEL RISK MANAGEMENT MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 313 AI MODEL RISK MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 314 AI MODEL RISK MANAGEMENT MARKET, BY VERTICAL 2024-2029 (USD MILLION)

- TABLE 315 AI MODEL RISK MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 316 AI MODEL RISK MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 317 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2018-2023 (USD MILLION)

- TABLE 318 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2024-2029 (USD MILLION)

- TABLE 319 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 320 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 321 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 322 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 323 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 324 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 325 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 326 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 327 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 328 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 RISK ANALYTICS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 RISK ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM RISK ANALYTICS SOLUTIONS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL RISK ANALYTICS SOLUTIONS/SERVICES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL RISK ANALYTICS SOLUTIONS/SERVICES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF RISK ANALYTICS THROUGH OVERALL RISK ANALYTICS SPENDING

- FIGURE 8 SERVICES TO BE LARGEST OFFERING SEGMENT IN 2025

- FIGURE 9 GOVERNANCE, RISK, AND COMPLIANCE SOFTWARE TO HOLD MAJOR SHARE IN 2025

- FIGURE 10 CLOUD DEPLOYMENT MODE TO DOMINATE IN 2025

- FIGURE 11 PROFESSIONAL SERVICES - LEADING SEGMENT IN 2025

- FIGURE 12 CONSULTING TO BE DOMINANT AMONG PROFESSIONAL SERVICES IN 2025

- FIGURE 13 FINANCE & ACCOUNTING TO BE MAJOR MANAGED SERVICE SEGMENT IN 2025

- FIGURE 14 FINANCIAL RISKS TO ACCOUNT FOR MAJORITY OF MARKET, BY RISK TYPE, IN 2025

- FIGURE 15 BFSI VERTICAL TO LEAD IN TERMS OF MARKET SHARE

- FIGURE 16 ASIA PACIFIC TO REGISTER FASTEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 17 RISING REGULATORY PRESSURE AND GROWING CYBERSECURITY RISKS DRIVE DEMAND

- FIGURE 18 TECHNOLOGY RISKS TO HAVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 GOVERNANCE, RISK, AND COMPLIANCE SOFTWARE AND FINANCIAL RISKS - LARGEST SHAREHOLDERS IN NORTH AMERICA IN 2025

- FIGURE 20 NORTH AMERICA TO HOLD DOMINANT MARKET SHARE IN 2025

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: RISK ANALYTICS MARKET

- FIGURE 22 EVOLUTION OF RISK ANALYTICS MARKET

- FIGURE 23 RISK ANALYTICS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 KEY PLAYERS IN RISK ANALYTICS MARKET ECOSYSTEM

- FIGURE 25 RISK ANALYTICS MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 26 MARKET POTENTIAL OF GENERATIVE AI IN VARIOUS RISK ANALYTICS USE CASES

- FIGURE 27 NUMBER OF PATENTS GRANTED, 2016-2025

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 29 RISK ANALYTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY VERTICALS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 33 SOFTWARE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 THIRD-PARTY RISK MANAGEMENT TOOLS TO GROW FASTER DURING FORECAST PERIOD

- FIGURE 35 CLOUD-BASED DEPLOYMENT MODE TO DOMINATE IN 2025

- FIGURE 36 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 37 CONSULTING SERVICES - LARGEST SEGMENT IN 2025

- FIGURE 38 MANAGED RISK ANALYTICS SERVICES TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 TECHNOLOGY RISK SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 BFSI SEGMENT TO DOMINATE IN 2025

- FIGURE 41 NORTH AMERICA ACCOUNTS FOR LARGEST SHARE IN 2025

- FIGURE 42 INDIA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: RISK ANALYTICS MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: RISK ANALYTICS MARKET SNAPSHOT

- FIGURE 45 TOP FIVE PLAYERS DOMINATED MARKET IN LAST FIVE YEARS (USD MILLION)

- FIGURE 46 SHARE OF LEADING COMPANIES IN RISK ANALYTICS MARKET, 2024

- FIGURE 47 PRODUCT COMPARISON OF PROMINENT/LEADING VENDORS

- FIGURE 48 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 50 RISK ANALYTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS- SOFTWARE), 2024

- FIGURE 51 RISK ANALYTICS MARKET (SOFTWARE): COMPANY FOOTPRINT (16 COMPANIES), 2024

- FIGURE 52 RISK ANALYTICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS - SERVICES), 2024

- FIGURE 53 RISK ANALYSIS MARKET (SERVICES): COMPANY FOOTPRINT (18 COMPANIES), 2024

- FIGURE 54 RISK ANALYTICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 MOODY'S ANALYTICS: COMPANY SNAPSHOT

- FIGURE 56 IBM: COMPANY SNAPSHOT

- FIGURE 57 ORACLE: COMPANY SNAPSHOT

- FIGURE 58 MARSH MCLENNAN: COMPANY SNAPSHOT

- FIGURE 59 SAP: COMPANY SNAPSHOT

- FIGURE 60 FIS: COMPANY SNAPSHOT

- FIGURE 61 AON: COMPANY SNAPSHOT

The risk analytics market is projected to grow from USD 32.25 billion in 2025 to USD 51.34 billion by 2030 at a CAGR of 9.7% during the forecast period. The growth of the risk analytics market is primarily driven by the increasing complexity of business environments, which necessitates advanced tools to predict, assess, and mitigate various types of risks. Factors such as the rise in cybersecurity threats, the growing volume of data, and regulatory compliance requirements push organizations to adopt risk analytics. Additionally, industries like finance and healthcare are adopting these solutions for better decision-making and risk management. However, high implementation costs, data integration challenges, and concerns about the accuracy of predictive models act as restraints, slowing market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Risk Type, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"Incident response & crisis management services are expected to register the fastest growth rate during the forecast period."

Incident response & crisis management services are anticipated to see the fastest growth in the risk analytics market due to the increasing frequency and complexity of cyberattacks, data breaches, and operational disruptions. As organizations face heightened security threats and potential financial losses, the demand for rapid, effective response strategies has surged. These services help businesses quickly identify, contain, and recover from incidents while minimizing damage. Additionally, the rise of regulatory requirements for data protection and disaster recovery, along with the growing importance of business continuity planning, is fueling market growth. As businesses strive for resilience in an unpredictable environment, incident response & crisis management services are becoming critical components of their risk management strategies.

"Financial risk, by type, will have the largest market share during the forecast period."

The financial risk type segment is expected to dominate the risk analytics market during the forecast period due to the increasing need for organizations to manage various financial risks effectively. Key areas include capital management, where companies focus on optimizing their capital structure; liquidity risk, addressing challenges in meeting financial obligations; and credit risk, which helps assess the likelihood of borrower defaults. Additionally, anti-money laundering (AML) and payment fraud detection solutions are crucial in combating financial crimes. As financial institutions face growing regulatory pressure and cyber threats, the demand for advanced risk analytics to mitigate these risks will drive significant market growth in this segment.

"Asia Pacific will witness rapid growth fueled by innovation and emerging technologies, while North America will lead in market size."

The Asia Pacific region is projected to register the fastest growth rate in the risk analytics market, driven by rapid digital transformation, increasing internet penetration, and the expanding adoption of advanced technologies. Emerging economies are leveraging big data, artificial intelligence (AI), and machine learning (ML) to optimize risk assessment and management across sectors like finance, supply chain, healthcare, and cybersecurity. Government initiatives supporting digital finance and smart infrastructure are further enhancing the demand for innovative risk analytics solutions. Additionally, industries are adopting predictive analytics for operational efficiency, reducing vulnerabilities, and enabling real-time decision-making in dynamic environments. On the other hand, North America is expected to maintain the largest market share in risk analytics, fueled by established enterprises, high investments in digital transformation, and early adoption of cutting-edge technologies like AI, cloud computing, and blockchain. The region's robust regulatory framework, combined with a strong focus on data-driven risk management strategies across sectors such as finance, manufacturing, and energy, reinforces its leadership. North American organizations are increasingly relying on risk analytics tools to manage financial risks, streamline supply chains, enhance cybersecurity, and improve decision-making processes, ensuring that digital-first, proactive risk mitigation remains at the forefront.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the risk analytics market.

- By Company: Tier I - 35%, Tier II - 45%, and Tier III - 20%

- By Designation: C Level - 35%, Director Level - 25%, and others - 40%

- By Region: North America - 42%, Europe - 20%, Asia Pacific - 25%, Middle East & Africa - 8%, and Latin America - 5%

The report includes the study of key players offering risk analytics solutions and services. It profiles major vendors in the risk analytics market, which include Accenture (Ireland), Aon (UK), Capgemini (France), Crisil (India), Deloitte (UK), Diligent (US), EY (UK), FIS (US), IBM (US), Infosys (India), KPMG (Netherlands), Lockton (US), Marsh McLennan (US),Willis Tower Watson Plc (UK), MetricStream (US), Milliman (US), Moody's Analytics (US), OneTrust (US), Oracle (US), Protiviti (US), PwC (England), SAP (Germany), SAS Institute (US), ServiceNow (US), Verisk Analytics (US), Archer (US), Riskonnect (US), SafetyCulture (Australia), Quantexa (UK), Resolver (Canada), Fusion Risk Management (US), Z2Data (US), Provenir (US), Kyvos Insights (US), Interos (US), ProcessUnity (US), LogicManager (US), Sprinto (US), Centrl (US), Quantifi (US), Onspring (US), Zesty.Ai (US), Spin Analytics (UK), CubeLogic Limited (UK), Etiometry (US), RiskVille (Finland), RiskLogix (UK), and Risk Edge Solutions (India).

Research Coverage

This research report covers the risk analytics market, which has been segmented based on offering, risk type, and vertical. The offering segment consists of software and services. The software segment contains software by type [risk calculation engines, risk reporting tools, dashboard analytics, governance, risk, and compliance software, enterprise risk management software, third-party risk management tools, and others (portfolio management and blockchain-based risk tools)] and software by deployment mode (cloud and on-premises). The services segment consists of professional services (consulting services, risk assessment & advisory services, incident response & crisis management, and training & support services) and managed services (managed risk analytics services, compliance & regulatory management services, cyber & IT risk management services, finance and accounting services, and legal services). The risk type segment includes strategic risks [market dependence, product & service diversification, business model, and others (expansion strategy and joint ventures)], operational risks [real-time monitoring, equipment & infrastructure failures, human errors, supply chain disruptions, and others (model risk and internal fraud)], financial risks [(capital management, liquidity risk, credit risk, anti-money laundering, payment fraud detection and others (currency exchange risks and insurance liabilities)], technology risks ]cybersecurity threats, IT infrastructure failures, AI & automation risks, and others (legacy system risks and vendor dependencies)], environment, health & safety risks [climate change & natural disasters, public health risks, workplace health & safety, and others (toxic hazard risk assessment and human activities)], regulatory & compliance risks [(tariffs and trade policies, tax compliance risks, industry-specific regulatory challenges and others(minimum wage laws, and lack of awareness/training), and other risk types (political & economic risk, reputational & ethics risk, and governance risk.)] The vertical segment consists of BFSI, retail & e-commerce, healthcare & life sciences, telecommunications, media & entertainment, technology & software providers, energy & utilities (power generation, renewable energies, oil & gas, and others), manufacturing, transportation & logistics, government & defense, mining, construction & real estate, and others (travel & hospitality, education, and agriculture). The regional analysis of the risk analytics market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The report also contains a detailed analysis of investment & funding scenarios, case studies, regulatory landscape, ecosystem analysis, supply chain analysis, pricing analysis, and technology analysis.

Key Benefits of Buying the Report

The report will offer market leaders and new entrants valuable insights into the revenue figures for the overall risk analytics market and its subsegments. It will assist stakeholders in comprehending the competitive landscape, enabling them to better position their businesses and develop effective go-to-market strategies. Additionally, the report will help stakeholders gauge market trends by providing information on key drivers, restraints, challenges, and opportunities within the market.

Insights Provided in the Report

- Analysis of key drivers (rising cyber threats, compliance requirements with stringent industry regulations, and optimized operations with predictive risk intelligence), restraints (high implementation costs, technical complexity, and data privacy concerns), opportunities (adoption of AI and blockchain technology, rising demand for industry-specific risk models, and surging adoption of proactively assessing and mitigating potential risks in supply chain operations), and challenges (model risk & bias and scarcity of highly skilled professionals in the field of risk management)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the risk analytics market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the risk analytics market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the risk analytics market

- Competitive Assessment: In-depth assessment of market share, growth strategies and service offerings of leading players like Accenture (Ireland), Aon (UK), Capgemini (France), Crisil (India), Deloitte (UK), Diligent (US), EY (UK), FIS (US), IBM (US), Infosys (India), KPMG (Netherlands), Lockton (US), Marsh McLennan (US),Willis Tower Watson Plc (UK), MetricStream (US), Milliman (US), Moody's Analytics (US), OneTrust (US), Oracle (US), Protiviti (US), PwC (England), SAP (Germany), SAS Institute (US), ServiceNow (US), Verisk Analytics (US), Archer (US), Riskonnect (US), SafetyCulture (Australia), Quantexa (UK), Resolver (Canada), Fusion Risk Management (US), Z2Data (US), Provenir (US), Kyvos Insights (US), Interos (US), ProcessUnity (US), LogicManager (US), Sprinto (US), Centrl (US), Quantifi (US), Onspring (US), Zesty.Ai (US), Spin Analytics (UK), CubeLogic Limited (UK), Etiometry (US), RiskVille (Finland), RiskLogix (UK), and Risk Edge solutions (India), among others, in the risk analytics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN RISK ANALYTICS MARKET

- 4.2 RISK ANALYTICS MARKET: TOP THREE RISK TYPES

- 4.3 NORTH AMERICA: RISK ANALYTICS MARKET, BY SOFTWARE TYPE AND RISK TYPE

- 4.4 RISK ANALYTICS MARKET: BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising cyber threats

- 5.2.1.2 Requirement for compliance with stringent industry regulations

- 5.2.1.3 Optimized operational efficiency with risk intelligence

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs and technical complexity

- 5.2.2.2 Data privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of AI and blockchain technology

- 5.2.3.2 Rising demand for industry-specific risk models

- 5.2.3.3 Proactive assessment and mitigation of potential risks in supply chain operations

- 5.2.4 CHALLENGES

- 5.2.4.1 Model risk and bias

- 5.2.4.2 Scarcity of skilled professionals

- 5.2.1 DRIVERS

- 5.3 IMPACT OF 2025 US TARIFF - RISK ANALYTICS MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 KEY TARIFF RATES

- 5.3.3 PRICE IMPACT ANALYSIS

- 5.3.3.1 Strategic Shifts and Emerging Trends

- 5.3.4 IMPACT ON COUNTRY/REGION

- 5.3.4.1 US

- 5.3.4.2 Strategic shifts and key observations

- 5.3.4.3 Europe

- 5.3.4.4 Strategic shifts and key observations

- 5.3.4.5 China

- 5.3.4.6 Strategic shifts and key observations

- 5.3.5 IMPACT ON END-USE INDUSTRIES

- 5.3.5.1 BFSI

- 5.3.5.2 Energy & utilities

- 5.3.5.3 Retail and supply chain

- 5.3.5.4 Healthcare

- 5.3.5.5 Manufacturing

- 5.4 EVOLUTION OF RISK ANALYTICS MARKET

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 RISK CALCULATION ENGINES

- 5.6.2 RISK REPORTING TOOLS

- 5.6.3 DASHBOARD ANALYTICS

- 5.6.4 GOVERNANCE, RISK, AND COMPLIANCE SOFTWARE

- 5.6.5 ENTERPRISE RISK MANAGEMENT SOFTWARE

- 5.6.6 THIRD-PARTY RISK MANAGEMENT TOOLS

- 5.6.7 PROFESSIONAL SERVICE PROVIDERS

- 5.6.8 MANAGED SERVICE PROVIDERS

- 5.7 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.8 IMPACT OF GENERATIVE AI ON RISK ANALYTICS MARKET

- 5.8.1 INTELLIGENT RISK SCENARIO GENERATION

- 5.8.2 SYNTHETIC DATA FOR RARE EVENTS

- 5.8.3 REAL-TIME THREAT DETECTION

- 5.8.4 PERSONALIZED RISK SCORING

- 5.8.5 AUTOMATED RISK REPORTING & DOCUMENTATION

- 5.8.6 ADAPTIVE RISK MODELS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 ICON STANDARDIZES THIRD-PARTY RISK MANAGEMENT WITH PROCESSUNITY'S TPRM PLATFORM

- 5.9.2 MASTERCARD BUILDS SAFER PAYMENTS ECOSYSTEM WITH FOURTH-PARTY RISK MONITORING PROGRAM

- 5.9.3 PIRAEUS BANK USES QUANTIFI XVA SOLUTION TO MEET REGULATORY REQUIREMENTS

- 5.9.4 POWER MAPPING ELEMENT OF VERISK MAPLECROFT'S RISK ANALYSIS SERVICE USED TO INFORM BUSINESS DECISIONS

- 5.9.5 HEALTHCARE ORGANIZATION REDUCES SOCIAL MEDIA RISK WITH RESOLVER'S INCIDENT MANAGEMENT SOLUTION

- 5.9.6 FIDELITY BOOSTS OPERATIONAL RESILIENCE WITH FUSION RISK MANAGEMENT PLATFORM

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Artificial intelligence

- 5.10.1.2 Big data

- 5.10.1.3 Cybersecurity

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Cloud computing

- 5.10.2.2 Internet of Things

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 AR/VR

- 5.10.3.2 RPA

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY FRAMEWORK

- 5.11.2.1 North America

- 5.11.2.1.1 Gramm-Leach-Bliley Act (GLBA) (US

- 5.11.2.1.2 Health Insurance Portability and Accountability Act (HIPAA) (US)

- 5.11.2.1.3 Personal Information Protection and Electronic Documents Act (PIPEDA) (Canada)

- 5.11.2.1.4 Digital Charter Implementation Act (DCIA)/Consumer Privacy Protection Act (CPPA) (Canada)

- 5.11.2.2 Europe

- 5.11.2.2.1 General Data Protection Regulation (GDPR) (European Union)

- 5.11.2.2.2 Bundesdatenschutzgesetz (BDSG) (Germany)

- 5.11.2.2.3 French Data Protection Act (Loi Informatique et Libertes) (France)

- 5.11.2.2.4 Codice in materia di protezione dei dati personali (Italy)

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 Act on the Protection of Personal Information (APPI) (Japan)

- 5.11.2.3.2 Privacy Act 1988 & Australian Privacy Principles (APPs) (Australia)

- 5.11.2.3.3 Personal Data Protection Act (PDPA) (Singapore)

- 5.11.2.3.4 Digital Personal Data Protection Act (DPDPA), 2023 (India)

- 5.11.2.4 Middle East & Africa

- 5.11.2.4.1 Federal Decree-Law No. 45 of 2021 on the Protection of Personal Data (PDPL) (UAE)

- 5.11.2.4.2 Protection of Personal Information Act (POPIA) (South Africa)

- 5.11.2.4.3 Personal Data Protection Law (PDPL, 2021) (Saudi Arabia)

- 5.11.2.5 Latin America

- 5.11.2.5.1 Brazil - Lei Geral de Protecao de Dados (LGPD) (Brazil)

- 5.11.2.5.2 Federal Law on the Protection of Personal Data Held by Private Parties (LFPDPPP) (Mexico)

- 5.11.2.5.3 Personal Data Protection Law (Law No. 25.326) (Argentina)

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.12.3 INNOVATION AND PATENT APPLICATIONS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING, 2025

- 5.13.2 AVERAGE SELLING PRICE, BY RISK TYPE, 2025

- 5.14 KEY CONFERENCES AND EVENTS (2025-2026)

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 RISK ANALYTICS TECHNIQUES/TOOLS

- 5.18.1 FAILURE MODE AND EFFECTS ANALYSIS (FMEA)

- 5.18.2 RISK MATRIX

- 5.18.3 BOWTIE MODEL

- 5.18.4 DECISION TREE

- 5.19 RISK ANALYTICS MARKET, BY RISK STAGE

- 5.19.1 RISK IDENTIFICATION

- 5.19.2 RISK ASSESSMENT

- 5.19.3 RISK MITIGATION

- 5.19.4 RISK MONITORING

- 5.19.5 RISK REPORTING

6 RISK ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: RISK ANALYTICS MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 BY TYPE

- 6.2.1.1 Risk calculation engine

- 6.2.1.1.1 Growing reliance on data-driven insights to optimize risk mitigation efforts

- 6.2.1.2 Risk reporting tools

- 6.2.1.2.1 Offer organized, structured view of risks to quickly identify emerging issues and take corrective action

- 6.2.1.3 Dashboard analytics

- 6.2.1.3.1 Real-time monitoring of risk indicators for immediate visibility into changes in risk conditions

- 6.2.1.4 Governance, risk, and compliance software

- 6.2.1.4.1 Automated workflows and real-time tracking enhance efficiency

- 6.2.1.5 Enterprise risk management software

- 6.2.1.5.1 Improve organizational resilience in increasingly complex environments

- 6.2.1.6 Third-party risk management tools

- 6.2.1.6.1 Enhance compliance management with detailed reports and documentation

- 6.2.1.7 Others

- 6.2.1.1 Risk calculation engine

- 6.2.2 BY DEPLOYMENT MODE

- 6.2.2.1 Cloud

- 6.2.2.1.1 Supports collaboration across geographies to standardize risk frameworks and reporting

- 6.2.2.2 On-premises

- 6.2.2.2.1 Robust and secure risk analytics with on-premises deployment

- 6.2.2.1 Cloud

- 6.2.1 BY TYPE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Consulting services

- 6.3.1.1.1 Enable businesses to transform risk into strategic advantage and improve compliance

- 6.3.1.2 Risk assessment & advisory services

- 6.3.1.2.1 Ensure strategies remain proactive and aligned with evolving threats

- 6.3.1.3 Incident response & crisis management

- 6.3.1.3.1 Form an integrated approach to addressing and mitigating risks

- 6.3.1.4 Training & support services

- 6.3.1.4.1 Enhance overall value of risk analytics solutions for resilient risk management framework

- 6.3.1.1 Consulting services

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Managed risk analytics services

- 6.3.2.1.1 Enhance resilience and ensure strategic alignment with governance frameworks

- 6.3.2.2 Compliance & regulatory management services

- 6.3.2.2.1 Ability to demonstrate accountability and transparency to drive market

- 6.3.2.3 Cyber & IT risk management services

- 6.3.2.3.1 Use of external experts for cyber resilience, protection of critical data, and business continuity

- 6.3.2.4 Finance & accounting services

- 6.3.2.4.1 Enhanced financial resilience through expert finance risk management service

- 6.3.2.5 Legal services

- 6.3.2.5.1 Mitigation of legal risks with managed legal services

- 6.3.2.1 Managed risk analytics services

- 6.3.1 PROFESSIONAL SERVICES

7 RISK ANALYTICS MARKET, BY RISK TYPE

- 7.1 INTRODUCTION

- 7.1.1 RISK TYPE: RISK ANALYTICS MARKET DRIVERS

- 7.2 STRATEGIC RISKS

- 7.2.1 MARKET DEPENDENCE

- 7.2.1.1 Risk analytics mitigate market dependence and enhance diversification strategies

- 7.2.2 PRODUCT & SERVICE DIVERSIFICATION

- 7.2.2.1 Optimized product & service diversification through opportunity identification

- 7.2.3 BUSINESS MODEL

- 7.2.3.1 Evaluation and adaptation to resilience and innovation - key features

- 7.2.4 OTHERS

- 7.2.1 MARKET DEPENDENCE

- 7.3 OPERATIONAL RISKS

- 7.3.1 REAL-TIME MONITORING

- 7.3.1.1 Enhanced operational resilience with real-time monitoring and risk analytics

- 7.3.2 EQUIPMENT & INFRASTRUCTURE FAILURES

- 7.3.2.1 Mitigation of operational risks through predictive risk analytics

- 7.3.3 HUMAN ERRORS

- 7.3.3.1 Reduction in human error in operations through predictive risk analytics and targeted intervention

- 7.3.4 SUPPLY CHAIN DISRUPTIONS

- 7.3.4.1 Mitigating supply chain disruption risks with predictive risk analytics and contingency planning

- 7.3.5 OTHERS

- 7.3.1 REAL-TIME MONITORING

- 7.4 FINANCIAL RISKS

- 7.4.1 CAPITAL MANAGEMENT

- 7.4.1.1 Optimized capital management and mitigating financial risks through advanced risk analytics

- 7.4.2 LIQUIDITY RISK

- 7.4.2.1 Proactive management of liquidity risk with forecasting and stress testing through risk analytics

- 7.4.3 CREDIT RISK

- 7.4.3.1 Mitigation of credit risk with data-driven credit assessment and stress testing

- 7.4.4 ANTI-MONEY LAUNDERING

- 7.4.4.1 Detection of illicit transactions through advanced risk analytics

- 7.4.5 PAYMENT FRAUD DETECTION

- 7.4.5.1 Combating payment fraud with real-time detection and advanced risk analytics

- 7.4.6 OTHERS

- 7.4.1 CAPITAL MANAGEMENT

- 7.5 TECHNOLOGY RISKS

- 7.5.1 CYBERSECURITY THREATS

- 7.5.1.1 Enhanced cybersecurity resilience with advanced threat detection and risk analytics

- 7.5.2 IT INFRASTRUCTURE FAILURES

- 7.5.2.1 Mitigating IT infrastructure failures with predictive analytics and proactive risk management

- 7.5.3 AI & AUTOMATION RISKS

- 7.5.3.1 Managing AI and automation risks with predictive analytics, bias detection, and ethical oversight

- 7.5.4 OTHERS

- 7.5.1 CYBERSECURITY THREATS

- 7.6 ENVIRONMENT, HEALTH & SAFETY RISKS

- 7.6.1 CLIMATE CHANGE & NATURAL DISASTERS

- 7.6.1.1 Assessment and mitigation of climate change and natural disaster risks

- 7.6.2 PUBLIC HEALTH RISKS

- 7.6.2.1 Using risk analytics to monitor, predict, and mitigate public health risks and crises

- 7.6.3 WORKPLACE HEALTH & SAFETY

- 7.6.3.1 Enhanced workplace health and safety with predictive analytics and proactive risk mitigation

- 7.6.4 OTHERS

- 7.6.1 CLIMATE CHANGE & NATURAL DISASTERS

- 7.7 REGULATORY & COMPLIANCE RISKS

- 7.7.1 TARIFFS AND TRADE POLICIES

- 7.7.1.1 Navigating global trade risks with risk analytics for tariffs, trade policies, and compliance

- 7.7.2 TAX COMPLIANCE RISKS

- 7.7.2.1 Mitigating global tax compliance risks with data-driven analytics and automation

- 7.7.3 INDUSTRY-SPECIFIC REGULATORY CHALLENGES

- 7.7.3.1 Navigating industry-specific regulatory compliance risks with advanced risk analytics

- 7.7.4 OTHERS

- 7.7.1 TARIFFS AND TRADE POLICIES

- 7.8 OTHER RISK TYPES

8 RISK ANALYTICS MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: RISK ANALYTICS MARKET DRIVERS

- 8.2 BFSI

- 8.2.1 ENHANCED RISK MANAGEMENT IN BFSI WITH ADVANCED RISK AND COMPLIANCE SOLUTIONS

- 8.3 RETAIL & E-COMMERCE

- 8.3.1 LEVERAGED FOR FRAUD PREVENTION AND OPERATIONAL EFFICIENCY IN RETAIL AND E-COMMERCE

- 8.4 HEALTHCARE & LIFE SCIENCES

- 8.4.1 LEVERAGE RISK ANALYTICS TO ENHANCE HEALTHCARE OUTCOMES AND SAFEGUARD AGAINST CYBERSECURITY THREATS

- 8.5 TELECOMMUNICATIONS

- 8.5.1 ENHANCED RISK MANAGEMENT THROUGH ADVANCED ANALYTICS AND REGULATORY COMPLIANCE

- 8.6 MEDIA & ENTERTAINMENT

- 8.6.1 IMPROVED DIGITAL PROTECTION THROUGH RISK ANALYTICS

- 8.7 TECHNOLOGY & SOFTWARE PROVIDERS

- 8.7.1 ENHANCED RISK ANALYTICS AND CYBERSECURITY TO MITIGATE EMERGING THREATS

- 8.8 ENERGY & UTILITIES

- 8.8.1 POWER GENERATION

- 8.8.1.1 Enhanced resilience through advanced risk analytics

- 8.8.2 RENEWABLE ENERGIES

- 8.8.2.1 Mitigate volatility and uncertainty with predictive risk intelligence

- 8.8.3 OIL & GAS

- 8.8.3.1 De-risking operations through integrated asset and environmental intelligence

- 8.8.4 OTHERS

- 8.8.1 POWER GENERATION

- 8.9 MANUFACTURING

- 8.9.1 ENHANCED RESILIENCE THROUGH PREDICTIVE RISK ANALYTICS AND AI-DRIVEN INSIGHTS

- 8.10 TRANSPORTATION & LOGISTICS

- 8.10.1 ENHANCED SUPPLY CHAIN RESILIENCE THROUGH COMPREHENSIVE RISK ANALYTICS

- 8.11 GOVERNMENT & DEFENSE

- 8.11.1 ADOPTED TO STRENGTHEN GOVERNMENT & DEFENSE SECTOR RESILIENCE

- 8.12 MINING

- 8.12.1 ENHANCED RISK MANAGEMENT THROUGH ADVANCED RISK ANALYTICS

- 8.13 CONSTRUCTION & REAL ESTATE

- 8.13.1 LEVERAGES RISK ANALYTICS TO ENHANCE SAFETY AND SUSTAINABILITY

- 8.14 OTHERS

9 RISK ANALYTICS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RISK ANALYTICS MARKET DRIVERS

- 9.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.3 US

- 9.2.3.1 Swift IT evolution with industrial advancements to propel market

- 9.2.4 CANADA

- 9.2.4.1 Increased transition toward cloud-based deployment models to accelerate market growth

- 9.3 EUROPE

- 9.3.1 EUROPE: RISK ANALYTICS MARKET DRIVERS

- 9.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.3 UK

- 9.3.3.1 Proactive risk management strategies to navigate uncertainties and safeguard operations to boost market

- 9.3.4 GERMANY

- 9.3.4.1 Rise in tech advancements and growing demand for data-driven solutions to spur growth

- 9.3.5 FRANCE

- 9.3.5.1 Strategic collaborations among technology entities, research bodies, and startups to foster market growth

- 9.3.6 ITALY

- 9.3.6.1 Increasing regulatory complexity, demand for skilled professionals, and rising risk management needs to drive market

- 9.3.7 SPAIN

- 9.3.7.1 Government initiatives aimed at promoting digital transformation and innovation to accelerate adoption

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RISK ANALYTICS MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.3 CHINA

- 9.4.3.1 Integration of risk analytics solutions into operational frameworks to drive market

- 9.4.4 INDIA

- 9.4.4.1 Rising need for real-time analytics and industry-specific risk management requirements to boost market growth

- 9.4.5 JAPAN

- 9.4.5.1 Adoption of risk appetite frameworks and stress testing in banks to drive market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Rising adoption of geospatial analytics across diverse industries to boost market

- 9.4.7 ASEAN

- 9.4.7.1 Need to manage financial and operational risks, among others, to drive demand for risk analytics tools

- 9.4.8 AUSTRALIA & NEW ZEALAND

- 9.4.8.1 Rising uptake of cloud-based solutions and heightened awareness of cybersecurity threats to propel market

- 9.4.9 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: RISK ANALYTICS MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.3 UAE

- 9.5.3.1 Increasing competitiveness among regulating firms and latest technological developments to spike market growth

- 9.5.4 SAUDI ARABIA

- 9.5.4.1 Increasing adoption of IoT solutions and evolving cyber threat landscape to drive economic growth

- 9.5.5 QATAR

- 9.5.5.1 Growing emphasis on risk management across industries to drive market

- 9.5.6 ISRAEL

- 9.5.6.1 Increasing need for risk management in banking and financial services sector to accelerate market growth

- 9.5.7 SOUTH AFRICA

- 9.5.7.1 Government initiatives and substantial foreign investments to drive innovation

- 9.5.8 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: RISK ANALYTICS MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Significant growth and innovation due to increasing implementation of AI and ML technologies

- 9.6.4 MEXICO

- 9.6.4.1 Client needs, stricter regulations, and technological innovations to boost demand for risk analytics

- 9.6.5 ARGENTINA

- 9.6.5.1 Government initiatives to foster market growth

- 9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 MARKET RANKING ANALYSIS

- 10.6 PRODUCT COMPARATIVE ANALYSIS

- 10.6.1 PRODUCT COMPARISON OF PROMINENT/LEADING VENDORS

- 10.6.1.1 Archer IRM (Archer)

- 10.6.1.2 MetricStream Enterprise Risk Management (MetricStream)

- 10.6.1.3 LogicManager Risk Management Software (LogicManager)

- 10.6.1.4 Diligent One Platform (Diligent)

- 10.6.1.5 Governance, Risk, and Compliance (GRC) Suite (ServiceNow)

- 10.6.1 PRODUCT COMPARISON OF PROMINENT/LEADING VENDORS

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, RISK ANALYTICS SOFTWARE, 2024

- 10.8.1 STARS

- 10.8.2 EMERGING LEADERS

- 10.8.3 PERVASIVE PLAYERS

- 10.8.4 PARTICIPANTS

- 10.8.5 COMPANY FOOTPRINT: KEY PLAYERS, RISK ANALYTICS SOFTWARE, 2024

- 10.8.5.1 Company footprint

- 10.8.5.2 Regional footprint

- 10.8.5.3 Software footprint

- 10.8.5.4 Risk Type footprint

- 10.8.5.5 Vertical footprint

- 10.9 COMPANY EVALUATION MATRIX: KEY PLAYERS, RISK ANALYTICS SERVICES, 2024

- 10.9.1 STARS

- 10.9.2 EMERGING LEADERS

- 10.9.3 PERVASIVE PLAYERS

- 10.9.4 PARTICIPANTS

- 10.9.5 COMPANY FOOTPRINT: KEY PLAYERS, RISK ANALYTICS SERVICES, 2024

- 10.9.5.1 Company footprint

- 10.9.5.2 Regional footprint

- 10.9.5.3 Service footprint

- 10.9.5.4 Risk type footprint

- 10.9.5.5 Vertical footprint

- 10.10 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.10.1 PROGRESSIVE COMPANIES

- 10.10.2 RESPONSIVE COMPANIES

- 10.10.3 DYNAMIC COMPANIES

- 10.10.4 STARTING BLOCKS

- 10.10.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.10.5.1 Detailed list of key startups/SMEs

- 10.10.5.2 Competitive benchmarking of key startups/SMEs

- 10.11 COMPETITIVE SCENARIO AND TRENDS

- 10.11.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 10.11.2 DEALS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 DELOITTE

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Deals

- 11.2.1.4 MnM view

- 11.2.1.4.1 Key strengths

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 MOODY'S ANALYTICS

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches & enhancements

- 11.2.2.3.2 Deals

- 11.2.2.4 MnM view

- 11.2.2.4.1 Key strengths

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 IBM

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches & enhancements

- 11.2.3.3.2 Deals

- 11.2.3.4 MnM view

- 11.2.3.4.1 Key strengths

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 KPMG

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Deals

- 11.2.4.4 MnM view

- 11.2.4.4.1 Key strengths

- 11.2.4.4.2 Strategic choices

- 11.2.4.4.3 Weaknesses and competitive threats

- 11.2.5 ORACLE

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product launches & enhancements

- 11.2.5.3.2 Deals

- 11.2.5.4 MnM view

- 11.2.5.4.1 Key strengths

- 11.2.5.4.2 Strategic choices

- 11.2.5.4.3 Weaknesses and competitive threats

- 11.2.6 MARSH MCLENNAN

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Solutions/Services offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Deals

- 11.2.6.4 MnM view

- 11.2.6.4.1 Key strengths

- 11.2.6.4.2 Strategic choices

- 11.2.6.4.3 Weaknesses and competitive threats

- 11.2.7 SAP

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Solutions/Services offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product launches & enhancements

- 11.2.7.3.2 Deals

- 11.2.8 FIS

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Solutions/Services offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches & enhancements

- 11.2.9 PWC

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Solutions/Services offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Deals

- 11.2.10 EY

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Solutions/Services offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Deals

- 11.2.11 AON

- 11.2.11.1 Business overview

- 11.2.11.2 Products/Solutions/Services offered

- 11.2.11.3 Recent developments

- 11.2.11.3.1 Product launches & enhancements

- 11.2.11.3.2 Deals

- 11.2.12 WILLIS TOWERS WATSON PLC

- 11.2.13 LOCKTON

- 11.2.14 ACCENTURE

- 11.2.15 VERISK ANALYTICS

- 11.2.16 SAS INSTITUTE

- 11.2.17 SERVICENOW

- 11.2.18 MILLIMAN

- 11.2.19 CRISIL

- 11.2.20 DILIGENT

- 11.2.21 ONETRUST

- 11.2.22 METRICSTREAM

- 11.2.23 INFOSYS

- 11.2.24 CAPGEMINI

- 11.2.25 PROTIVITI

- 11.2.1 DELOITTE

- 11.3 OTHER KEY PLAYERS

- 11.3.1 RISKONNECT

- 11.3.2 ARCHER

- 11.3.3 Z2DATA

- 11.3.4 FUSION RISK MANAGEMENT

- 11.3.5 SAFETYCULTURE

- 11.3.6 INTEROS

- 11.3.7 RESOLVER

- 11.3.8 PROCESSUNITY

- 11.3.9 CUBELOGIC LIMITED

- 11.3.10 QUANTEXA

- 11.3.11 PROVENIR

- 11.3.12 ONSPRING

- 11.3.13 RISK EDGE SOLUTIONS

- 11.3.14 LOGICMANAGER

- 11.3.15 SPRINTO

- 11.3.16 QUANTIFI

- 11.3.17 ZESTY.AI

- 11.3.18 RISKLOGIX

- 11.3.19 KYVOS INSIGHTS

- 11.3.20 SPIN ANALYTICS

- 11.3.21 CENTRL

- 11.3.22 ETIOMETRY

- 11.3.23 RISKVILLE

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 AI MODEL RISK MANAGEMENT MARKET - GLOBAL FORECAST TO 2029

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 AI model risk management market, by offering

- 12.2.2.2 AI model risk management market, by risk type

- 12.2.2.3 AI model risk management market, by application

- 12.2.2.4 AI model risk management market, by vertical

- 12.2.2.5 AI model risk management market, by region

- 12.3 FRAUD DETECTION AND PREVENTION MARKET - GLOBAL FORECAST TO 2029

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 Fraud detection and prevention market, by fraud type

- 12.3.2.2 Fraud detection and prevention market, by offering

- 12.3.2.3 Fraud detection and prevention market, by deployment mode

- 12.3.2.4 Fraud detection and prevention market, by organization size

- 12.3.2.5 Fraud detection and prevention market, by vertical

- 12.3.2.6 Fraud detection and prevention market, by vertical

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS