|

|

市場調査レポート

商品コード

1545412

試験・計測機器の世界市場:自動試験装置・スペクトラムアナライザー・オシロスコープ・BERT・モジュール型計測器・NDT装置・マシンビジョン検査システム・機械状態監視システム - 予測(~2029年)Test and Measurement Equipment Market by Automated Test Equipment, Spectrum Analyzers, Oscilloscopes, BERT, Modular Instruments, NDT Equipment, Machine Vision Inspection Systems and Machine Condition Monitoring System - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 試験・計測機器の世界市場:自動試験装置・スペクトラムアナライザー・オシロスコープ・BERT・モジュール型計測器・NDT装置・マシンビジョン検査システム・機械状態監視システム - 予測(~2029年) |

|

出版日: 2024年08月28日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

試験・計測機器の市場規模は、2024年の389億1,000万米ドルから、予測期間中は3.9%のCAGRで推移し、2029年には470億1,000万米ドルの規模に成長すると予測されています。

通信とインターネットはあらゆる経済の主要な構造であり、これらの産業における技術の変化は多くの市場に影響を与えます。スマートデバイスの出現、モビリティ、モバイルデータトラフィックなどの要因により、ワイヤレス技術も需要が高まっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント | 自動試験装置・製品タイプ・サービスタイプ・産業・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

先進技術、ネットワーク、ヘッドセットやコネクタを含む関連コンポーネントのシームレスな運用を保証するためには試験が必要であり、そのためには、信号発生器、ロジックアナライザー、ネットワークアナライザーなど、さまざまな試験・計測機器が必要です。ネットワークと通信技術の急速な成長により、スペクトラム評価、アンテナ評価、基地局トライアル、無線パラメータ検証、アンテナアライメント、干渉検出、見通し検証、干渉ハンチングなどのプログラム用の機器アナライザの需要が加速しています。

”試験オートメーションとロボティクスの統合が市場を牽引”

試験オートメーションとロボティクスの試験・計測システムへの統合・組み込みが一般的になりつつあり、製造・ラボ環境における生産性、再現性、汎用性が大幅に向上しています。

ロボット支援試験は、迅速で正確な分析が要求される大量生産製品試験において特に有用です。ロボットシステムを組立ラインに組み込むことで、製造業者は作業を合理化し、ダウンタイムを削減し、一貫した品質を確保することができます。このシステムは、部品の配置、アライメント、検査などの複雑な作業を正確かつ迅速に行うことができるため、品質管理用途に最適です。

実験室システムでは、ロボットを使用して反復的で労働集約的な作業を管理することで、専門家はより複雑な研究作業に集中することができます。これにより、試験プロセスの効率を向上させ、結果の正確性と信頼性を高めることができます。さらに、これらの自動システムを使用して収集された情報は、リアルタイムの評価と報告のために、デジタルデータベースに簡単に供給することができます。

試験オートメーションとロボティクスの統合は、さらに、スマート生産と相互接続システムが不可欠なインダストリー4.0構想の展開を促進します。これらの優れた技術を採用することで、企業はオペレーションの俊敏性を高め、コストを削減し、マーケットプレースでの競合を維持することができます。驚異的で信頼性の高い製品を求める声が高まるにつれ、製品の卓越性を確保するためのチェックオートメーションとロボティクスの機能は、ますます不可欠になっています。

当レポートでは、世界の試験・計測機器の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 顧客ビジネスに影響を与える動向/ディスラプション

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 貿易分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 価格分析

- ケーススタディ分析

- 関税と規制状況

- 主な会議とイベント

- 生成AI/AIが試験・計測機器市場に与える影響

第6章 試験・計測機器市場:製品タイプ別

- 汎用試験装置

- オシロスコープ

- 信号発生器

- マルチメーター

- ロジックアナライザー

- スペクトラムアナライザー

- BERTソリューション

- ネットワークアナライザー

- パワーメーター

- 電子カウンター

- モジュール型計測器

- 自動試験装置

- 電源

- 機械試験装置

- NDT装置

- マシンビジョン検査システム

- 機械状態監視システム

第7章 試験・計測機器市場:サービスタイプ別

- 校正サービス

- 修理・アフターサービス

- その他

- 資産運用管理

- コンサルティング&トレーニング

- 気候製品試験

- 環境製品試験

- 衝撃試験

- 延長保証/保証サービス

第8章 試験・計測機器市場:産業別

- 自動車・輸送

- 航空宇宙・防衛

- IT・通信

- 教育・政府

- エレクトロニクス・半導体

- 工業用

- ヘルスケア

第9章 試験・計測機器市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他

第10章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- KEYSIGHT TECHNOLOGIES

- FORTIVE

- AMETEK.INC.

- ROHDE & SCHWARZ

- NATIONAL INSTRUMENTS CORP.

- TELEDYNE TECHNOLOGIES INCORPORATED

- VIAVI SOLUTIONS INC.

- ANRITSU

- YOKOGAWA ELECTRIC CORPORATION

- ADVANTEST CORPORATION

- その他の企業

- EXFO INC.

- FUJIAN LILLIPUT OPTOELECTRONICS TECHNOLOGY CO., LTD

- IKM INSTRUTEK

- UNI-TREND TECHNOLOGY (CHINA) CO., LTD.

- PARTICLE MEASURING SYSTEMS

- MEXTECH TECHNOLOGIES INDIA PRIVATE LIMITED

- RIGOL TECHNOLOGIES, CO. LTD.

- GOOD WILL INSTRUMENT CO., LTD.

- ADLINK TECHNOLOGY INC.

- LEADER ELECTRONICS CORPORATION

- CRYSTAL INSTRUMENTS CORPORATION

- ASTRONICS CORPORATION

- VAUNIX TECHNOLOGY CORPORATION

- DS INSTRUMENTS

- SALUKI TECHNOLOGY

- INSPLORION

第12章 付録

List of Tables

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN TEST AND MEASUREMENT EQUIPMENT ECOSYSTEM

- TABLE 3 TEST AND MEASUREMENT EQUIPMENT MARKET: MAJOR PATENTS, 2023-2024

- TABLE 4 IMPACT ANALYSIS OF PORTER'S FIVE FORCES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 VERTICALS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- TABLE 7 AVERAGE SELLING PRICE TREND OF KEY GENERAL-PURPOSE TEST EQUIPMENT (OSCILLOSCOPES) OFFERED BY MAJOR PLAYERS, 2020-2023 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF KEY GENERAL-PURPOSE TEST EQUIPMENT (SPECTRUM ANALYZERS) OFFERED BY MAJOR PLAYERS, 2020-2023 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF KEY GENERAL-PURPOSE TEST EQUIPMENT (SIGNAL GENERATORS) OFFERED BY MAJOR PLAYERS, 2020-2023 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF OSCILLOSCOPES, BY REGION, 2020-2023 (USD)

- TABLE 11 MFN TARIFF FOR HS CODE 9030-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 17 ENHANCING AI APPLICATIONS THROUGH RESEARCH AND COMPLIANCE

- TABLE 18 USING AI-SUPPORTED PREDICTIVE MAINTENANCE SYSTEM TO A VOID UNPLANNED DOWNTIME

- TABLE 19 TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 20 TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 21 PRODUCT TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 22 PRODUCT TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 23 PRODUCT TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 PRODUCT TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 25 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 26 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 27 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 28 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 29 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 30 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 31 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 32 GENERAL-PURPOSE TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 MECHANICAL TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 34 MECHANICAL TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 35 MECHANICAL TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 36 MECHANICAL TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 37 MECHANICAL TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 MECHANICAL TEST EQUIPMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 40 TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 41 SERVICE TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 42 SERVICE TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 43 SERVICE TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 SERVICE TYPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 CALIBRATION SERVICES: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 46 CALIBRATION SERVICES: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 47 REPAIR/AFTER-SALES SERVICES: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 48 REPAIR/AFTER-SALES SERVICES: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 49 OTHER SERVICES: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 50 OTHER SERVICES: TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 51 TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 52 TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 53 AUTOMOTIVE & TRANSPORTATION: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 54 AUTOMOTIVE & TRANSPORTATION: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 55 AUTOMOTIVE & TRANSPORTATION: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 56 AUTOMOTIVE & TRANSPORTATION: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 57 AUTOMOTIVE & TRANSPORTATION: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 58 AUTOMOTIVE & TRANSPORTATION: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 59 AEROSPACE & DEFENSE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 60 AEROSPACE & DEFENSE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 61 AEROSPACE & DEFENSE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 62 AEROSPACE & DEFENSE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 63 AEROSPACE & DEFENSE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 64 AEROSPACE & DEFENSE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 65 IT & TELECOMMUNICATIONS: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 66 IT & TELECOMMUNICATIONS: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 67 IT & TELECOMMUNICATIONS: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 68 IT & TELECOMMUNICATIONS: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 69 IT & TELECOMMUNICATIONS: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 70 IT & TELECOMMUNICATIONS: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 71 EDUCATION & GOVERNMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 72 EDUCATION & GOVERNMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 73 EDUCATION & GOVERNMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 74 EDUCATION & GOVERNMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 75 EDUCATION & GOVERNMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 76 EDUCATION & GOVERNMENT: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 77 ELECTRONICS & SEMICONDUCTOR: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 78 ELECTRONICS & SEMICONDUCTOR: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 79 ELECTRONICS & SEMICONDUCTOR: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 80 ELECTRONICS & SEMICONDUCTOR: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 81 ELECTRONICS & SEMICONDUCTOR: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 82 ELECTRONICS & SEMICONDUCTOR: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 83 INDUSTRIAL: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 84 INDUSTRIAL: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 85 INDUSTRIAL: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 86 INDUSTRIAL: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 87 INDUSTRIAL: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 88 INDUSTRIAL: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 89 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 90 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 91 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 92 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 93 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 94 HEALTHCARE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 95 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 96 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 98 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 99 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 100 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 101 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 102 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 103 EUROPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 104 EUROPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 105 EUROPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 106 EUROPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 107 EUROPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 108 EUROPE: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 110 ASIA PACIFIC: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 111 ASIA PACIFIC: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 112 ASIA PACIFIC: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 113 ASIA PACIFIC: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 114 ASIA PACIFIC: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 115 ROW: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 116 ROW: TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 117 ROW: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2020-2023 (USD MILLION)

- TABLE 118 ROW: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE & SERVICE TYPE, 2024-2029 (USD MILLION)

- TABLE 119 ROW: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 120 ROW: TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 121 SOUTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 122 SOUTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: TEST AND MEASUREMENT EQUIPMENT MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 125 TEST AND MEASUREMENT EQUIPMENT MARKET: KEY STRATEGIES ADOPTED BY LEADING PLAYERS, 2023-2024

- TABLE 126 TEST AND MEASUREMENT EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 127 TEST AND MEASUREMENT EQUIPMENT MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 128 TEST AND MEASUREMENT EQUIPMENT MARKET: SERVICE TYPE FOOTPRINT

- TABLE 129 TEST AND MEASUREMENT EQUIPMENT MARKET: VERTICAL FOOTPRINT

- TABLE 130 TEST AND MEASUREMENT EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 131 TEST AND MEASUREMENT EQUIPMENT MARKET: KEY STARTUPS/SMES

- TABLE 132 TEST AND MEASUREMENT EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 133 TEST AND MEASUREMENT EQUIPMENT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JUNE 2023-JULY 2024

- TABLE 134 TEST AND MEASUREMENT EQUIPMENT MARKET: DEALS, JUNE 2023-JULY 2024

- TABLE 135 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 136 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 138 KEYSIGHT TECHNOLOGIES: DEALS

- TABLE 139 FORTIVE: COMPANY OVERVIEW

- TABLE 140 FORTIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 FORTIVE: DEALS

- TABLE 142 AMETEK.INC.: COMPANY OVERVIEW

- TABLE 143 AMETEK.INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 AMETEK.INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 145 AMETEK.INC.: DEALS

- TABLE 146 ROHDE & SCHWARZ: COMPANY OVERVIEW

- TABLE 147 ROHDE & SCHWARZ: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 148 ROHDE & SCHWARZ: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 149 ROHDE & SCHWARZ: DEALS

- TABLE 150 NATIONAL INSTRUMENTS CORP.: COMPANY OVERVIEW

- TABLE 151 NATIONAL INSTRUMENTS CORP.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 152 NATIONAL INSTRUMENTS CORP.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 153 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 154 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 155 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 156 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 157 VIAVI SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 158 VIAVI SOLUTIONS INC.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 159 VIAVI SOLUTIONS INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 160 VIAVI SOLUTIONS INC.: DEALS

- TABLE 161 ANRITSU: COMPANY OVERVIEW

- TABLE 162 ANRITSU: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 163 ANRITSU: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 164 ANRITSU: DEALS

- TABLE 165 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 166 YOKOGAWA ELECTRIC CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 167 ADVANTEST CORPORATION: COMPANY OVERVIEW

- TABLE 168 ADVANTEST CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 169 ADVANTEST CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 170 ADVANTEST CORPORATION: DEALS

- TABLE 171 EXFO INC.: BUSINESS OVERVIEW

- TABLE 172 FUJIAN LILLIPUT OPTOELECTRONICS TECHNOLOGY CO., LTD: BUSINESS OVERVIEW

- TABLE 173 IKM INSTRUTEK: BUSINESS OVERVIEW

- TABLE 174 UNI-TREND TECHNOLOGY (CHINA) CO., LTD.: BUSINESS OVERVIEW

- TABLE 175 PARTICLE MEASURING SYSTEMS: BUSINESS OVERVIEW

- TABLE 176 MEXTECH TECHNOLOGIES INDIA PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 177 RIGOL TECHNOLOGIES, CO. LTD.: BUSINESS OVERVIEW

- TABLE 178 GOOD WILL INSTRUMENT CO., LTD.: BUSINESS OVERVIEW

- TABLE 179 ADLINK TECHNOLOGY INC.: BUSINESS OVERVIEW

- TABLE 180 LEADER ELECTRONICS CORPORATION: BUSINESS OVERVIEW

- TABLE 181 CRYSTAL INSTRUMENTS CORPORATION: BUSINESS OVERVIEW

- TABLE 182 ASTRONICS CORPORATION: BUSINESS OVERVIEW

- TABLE 183 VAUNIX TECHNOLOGY CORPORATION: BUSINESS OVERVIEW

- TABLE 184 DS INSTRUMENTS: BUSINESS OVERVIEW

- TABLE 185 SALUKI TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 186 INSPLORION: BUSINESS OVERVIEW

List of Figures

- FIGURE 1 TEST AND MEASUREMENT EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 TEST AND MEASUREMENT EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS IN TEST AND MEASUREMENT EQUIPMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN TEST AND MEASUREMENT EQUIPMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3 (DEMAND SIDE): TEST AND MEASUREMENT EQUIPMENT MARKET BASED ON REGION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 AUTOMATED TEST EQUIPMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF GENERAL-PURPOSE TEST AND MEASUREMENT EQUIPMENT MARKET IN 2029

- FIGURE 11 CALIBRATION SERVICES SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC DOMINATED TEST AND MEASUREMENT EQUIPMENT MARKET IN 2023

- FIGURE 13 INTEGRATION OF AI AND ML TECHNOLOGIES INTO TEST AND MEASUREMENT EQUIPMENT TO FUEL MARKET GROWTH

- FIGURE 14 GENERAL-PURPOSE TEST EQUIPMENT SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2024

- FIGURE 15 INDUSTRIAL SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2024

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL TEST AND MEASUREMENT EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 17 GENERAL-PURPOSE TEST EQUIPMENT AND CHINA HELD LARGEST SHARES OF TEST AND MEASUREMENT EQUIPMENT MARKET IN ASIA PACIFIC IN 2023

- FIGURE 18 TEST AND MEASUREMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 TEST AND MEASUREMENT MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 20 TEST AND MEASUREMENT MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 21 TEST AND MEASUREMENT MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 22 TEST AND MEASUREMENT MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 23 TEST AND MEASUREMENT EQUIPMENT VALUE CHAIN ANALYSIS

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 KEY PLAYERS IN TEST AND MEASUREMENT EQUIPMENT MARKET

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO FOR STARTUPS, 2017-2023

- FIGURE 27 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 28 IMPORT DATA FOR HS CODE 9030-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 29 EXPORT DATA FOR HS CODE 9030-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 30 TEST AND MEASUREMENT EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VERTICAL

- FIGURE 32 KEY BUYING CRITERIA, BY VERTICAL

- FIGURE 33 AVERAGE SELLING PRICE TREND OF MAJOR TYPES OF GENERAL-PURPOSE TEST EQUIPMENT PROVIDED BY KEY PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE TREND OF OSCILLOSCOPES, BY REGION, 2020-2023

- FIGURE 35 IMPACT OF AI ON TEST AND MEASUREMENT EQUIPMENT INDUSTRY

- FIGURE 36 GENERAL-PURPOSE TEST EQUIPMENT SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 37 AUTOMATED TEST EQUIPMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 38 NON-DESTRUCTIVE TEST EQUIPMENT SEGMENT TO RECORD HIGHEST CAGR IN MECHANICAL TEST EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 39 REPAIR/AFTER-SALES SERVICES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 INDUSTRIAL VERTICAL TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 41 MARKET SEGMENTATION, BY REGION

- FIGURE 42 ASIA PACIFIC TO RECORD HIGHEST CAGR IN TEST AND MEASUREMENT EQUIPMENT MARKET BETWEEN 2024 AND 2029

- FIGURE 43 NORTH AMERICA: TEST AND MEASUREMENT EQUIPMENT MARKET SNAPSHOT

- FIGURE 44 EUROPE: TEST AND MEASUREMENT EQUIPMENT MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: TEST AND MEASUREMENT EQUIPMENT MARKET SNAPSHOT

- FIGURE 46 SOUTH AMERICA TO DOMINATE TEST AND MEASUREMENT EQUIPMENT MARKET IN ROW THROUGHOUT FORECAST PERIOD

- FIGURE 47 REVENUE ANALYSIS OF KEY COMPANIES IN TEST AND MEASUREMENT EQUIPMENT MARKET, 2019-2023

- FIGURE 48 TEST AND MEASUREMENT EQUIPMENT MARKET SHARE ANALYSIS, 2023

- FIGURE 49 TEST AND MEASUREMENT EQUIPMENT MARKET: COMPANY VALUATION

- FIGURE 50 TEST AND MEASUREMENT EQUIPMENT MARKET: FINANCIAL METRICS

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 TEST AND MEASUREMENT EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 TEST AND MEASUREMENT EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 54 TEST AND MEASUREMENT EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 56 FORTIVE: COMPANY SNAPSHOT

- FIGURE 57 AMETEK.INC.: COMPANY SNAPSHOT

- FIGURE 58 ROHDE & SCHWARZ: COMPANY SNAPSHOT

- FIGURE 59 NATIONAL INSTRUMENTS CORP.: COMPANY SNAPSHOT

- FIGURE 60 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 61 VIAVI SOLUTIONS INC.: COMPANY SNAPSHOT

- FIGURE 62 ANRITSU: COMPANY SNAPSHOT

- FIGURE 63 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 ADVANTEST CORPORATION: COMPANY SNAPSHOT

The test and measurement equipment market is expected to reach USD 47.01 billion by 2029 from USD 38.91 billion in 2024, at a CAGR of 3.9% during the 2024-2029 period. Telecommunication and Internet are the primary structures of any economy, and technological changes in these industries affect numerous markets. Wireless technologies are also on demand due to factors like the emergence of smart devices, mobility factors and the mobile data traffic factor.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Segments | By Automated Test Equipment, Product Type, Service Type, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

To ensure the seamless operation of advanced technology, network and associated components including headsets and connectors through testing is necessary. This require a range of test and measurement equipment including signal generator, logic analyzer, network analyzer and many others. The speedy growth of networking and communications technologies has brought accelerated demand of equipment analyzers for programs like spectrum evaluation, antenna evaluation, base station trying, radio parameter verification, antenna alignment, interference detection, line-of-sight verification, and interference hunting.

"Incorporation of test automation and robotics is driving the market"

Integration/ incorporation of test automation and robotics into test and calibration systems is becoming more common, greatly increasing productivity, repeatability and versatility in production and lab environments

Robot-assisted testing is especially valuable in high-volume product testing, where rapid and accurate analysis is required. By integrating robotic systems into assembly lines, manufacturers can streamline operations, reduce downtime, and ensure consistent quality. This system can perform complex tasks such as component placement, alignment and inspection with accuracy and speed, making it ideal for quality control applications

Experimental laboratory systems use robots to manage repetitive, labor-intensive tasks, releasing skilled workers to focus on more complex research tasks. This helps to improve the efficiency of testing process also enhance the accuracy and reliability of the result. Additionally, the information collected by using these automatic systems may be effortlessly fed into digital databases for real-time evaluation and reporting, allowing higher selection-making and progressed response time.

The integration of test automation and robotics additionally facilitates the deployment of industry 4.0 initiatives, where smart production and interconnected systems are essential. By adopting those superior technologies, agencies can attain extra operational agility, lessen expenses, and maintain a competitive facet in the marketplace. As the call for incredible and reliable products maintains to develop, the function of check automation and robotics in making sure product excellence becomes more and more essential.

"General-purpose test equipment projected to have the highest market share during the forecast period."

General Purpose Test Equipment (GPTE) are equipment that are used for measuring different electronic parameters including voltage, frequency, and power, etc. Some of the examples of GPTE include oscilloscope, signal generator, digital multimeter, logic analyzer, spectrum analyzer and network analyzer etc. As the demand rises for small, flexible and efficient test and measurement equipment the companies started focusing on developing single equipment with multiple functionality.

Advancements of the test and measurement technology has introduced equipment that provide high bandwidth, accuracy, and resolution in comparison with conventional equipment of testing. These equipment are used in different applications such as IT & telecommunications, healthcare, automotive and industrial applications.

The break-up of the profile of primary participants in the test and measurement equipment market-

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, Tier 3 - 20%

- By Designation Type: C Level - 25%, Director Level - 35%, Others - 40%

- By Region Type: Asia Pacific - 25%, North America -35 %, Europe- 30%, RoW - 10%,

The major players in the test and measurement equipment market are Keysight Technologies (US), Fortive (US), AMETEK.Inc. (US), Rohde & Schwarz (Germany), NATIONAL INSTRUMENTS CORP. (US), Teledyne Technologies (US), VIAVI Solutions Inc. (US), Anritsu (Japan), Yokogawa Electric Corporation (Japan), Advantest Corporation (Japan), EXFO Inc. (Canada), Fujian Lilliput Optoelectronics Technology Co., Ltd (OWON) (China), IKM Instrutek (Norway), Uni-Trend Technology (China) Co., Ltd. (China), Particle Measuring Systems is a Spectris Company (US), Mextech Technologies India Private Limited (India), RIGOL TECHNOLOGIES, Co. LTD. (China), Good Will Instrument Co., Ltd. (Taiwan), ADLINK Technology Inc. (Taiwan), Leader Electronics Corporation (Japan), Crystal Instruments Corporation (US), Astronics Corporation (US), Vaunix Technology Corporation (US), DS Instruments (US), Saluki Technology (Taiwan), and Insplorion (Sweden).

Research Coverage

The report segments the test and measurement equipment market and forecasts its size based and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall test and measurement equipment market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Incorporation of test automation and robotics is driving the market), restraints (Elevated installation and ownership costs and need for skilled professionals), opportunities (Growing emphasis on environmental and electromagnetic compatibility (EMC) testing), and challenges (Challenges in adapting test equipment to rapid technological advancements)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the test and measurement equipment market

- Market Development: Comprehensive information about lucrative markets - the report analyses the test and measurement equipment market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the test and measurement equipment market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Keysight Technologies (US), Fortive (US), AMETEK.Inc. (US), Rohde & Schwarz (Germany), and NATIONAL INSTRUMENTS CORP. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 Key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key participants in primary interviews

- 2.1.2.3 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RISK ASSESSMENT

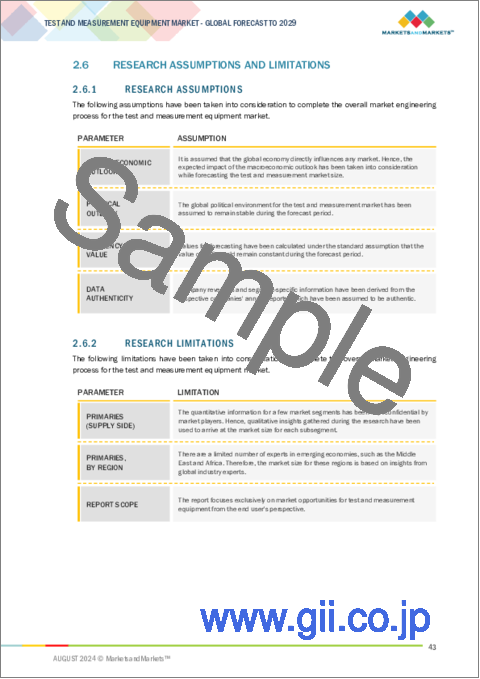

- 2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.6.1 RESEARCH ASSUMPTIONS

- 2.6.2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN TEST AND MEASUREMENT EQUIPMENT MARKET

- 4.2 TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE

- 4.3 TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL

- 4.4 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION

- 4.5 TEST AND MEASUREMENT EQUIPMENT MARKET IN ASIA PACIFIC, BY PRODUCT TYPE AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 TEST AND MEASUREMENT MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of AI and ML into test and measurement equipment

- 5.2.1.2 Stringent government regulations for product safety and environmental protection

- 5.2.1.3 Rapid expansion of advanced networking and communication technologies

- 5.2.1.4 Implementation of automation and robotics into test and measurement processes

- 5.2.1.5 Inclination toward portable and field-deployable test instruments

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and ownership costs and need for skilled professionals

- 5.2.2.2 Increasing utilization of test and measurement equipment on rental basis

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing emphasis on environmental and EMC testing

- 5.2.3.2 Deployment of 5G and proliferation of high-speed data interfaces

- 5.2.4 CHALLENGES

- 5.2.4.1 Keeping pace with rapid technological advancements and managing technology obsolescence

- 5.2.4.2 Complexity, calibration, and irregularity in antenna arrays

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 IoT-based testing tools

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Cloud-based testing platforms

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Robotics and automation systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 9030)

- 5.9.2 EXPORT SCENARIO (HS CODE 9030)

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GENERAL-PURPOSE TEST EQUIPMENT TYPE

- 5.12.2 AVERAGE SELLING PRICE TREND OF OSCILLOSCOPES, BY REGION

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 VODAFONE ENHANCES 5G USER EXPERIENCE WITH KEYSIGHT'S NETWORK VISIBILITY SOLUTIONS

- 5.13.2 SSIR STREAMLINES 5G WORKFLOW WITH KEYSIGHT'S S-FTL SOLUTION

- 5.13.3 EMITECH ADOPTS ROHDE & SCHWARZ'S T&M SOLUTIONS TO TEST ADAS SOLUTIONS AND ENSURE COMPLIANCE WITH STANDARDS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.16 IMPACT OF GEN AI/AI ON TEST AND MEASUREMENT EQUIPMENT MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 CASE STUDIES

- 5.16.2.1 LNE and Inria's strategic initiative in AI evaluation

- 5.16.2.2 AI-driven predictive maintenance enhances efficiency at BMW Group's Regensburg plant

- 5.16.3 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 TEST AND MEASUREMENT EQUIPMENT MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 GENERAL-PURPOSE TEST EQUIPMENT

- 6.2.1 OSCILLOSCOPES

- 6.2.1.1 Increasing demand for miniature electronic devices to fuel market growth

- 6.2.2 SIGNAL GENERATORS

- 6.2.2.1 Ability to generate diverse, precise, and stable signals to boost demand

- 6.2.3 MULTIMETERS

- 6.2.3.1 Portability and versatility to boost adoption in fields and testing labs

- 6.2.4 LOGIC ANALYZERS

- 6.2.4.1 Comprehensive use in troubleshooting digital circuits and communication systems to foster market growth

- 6.2.5 SPECTRUM ANALYZERS

- 6.2.5.1 Ability to provide detailed insights into frequency content, power, and modulation of signals to accelerate demand

- 6.2.6 BERT SOLUTIONS

- 6.2.6.1 Pressing need to make informed choices about product development, process improvements, and resource allocation to stimulate demand

- 6.2.7 NETWORK ANALYZERS

- 6.2.7.1 Strong focus on improving reliability and efficiency of electronic networks to contribute to market growth

- 6.2.8 POWER METERS

- 6.2.8.1 Increasing adoption to test output power in IT & telecommunications sector to fuel segmental growth

- 6.2.9 ELECTRONIC COUNTERS

- 6.2.9.1 Ability to handle complex counting, positioning, and measurement tasks to accelerate demand

- 6.2.10 MODULAR INSTRUMENTS

- 6.2.10.1 Increasing technology convergence and device complexity to stimulate demand

- 6.2.11 AUTOMATED TEST EQUIPMENT

- 6.2.11.1 Rising focus on shortening manufacturing time and reducing product recall rate to augment demand

- 6.2.12 POWER SUPPLIES

- 6.2.12.1 Elevating demand for precise load control system framework to support market growth

- 6.2.1 OSCILLOSCOPES

- 6.3 MECHANICAL TEST EQUIPMENT

- 6.3.1 NON-DESTRUCTIVE TEST EQUIPMENT

- 6.3.1.1 Significant focus of manufacturing firms on enhancing brand reputation to create opportunities

- 6.3.2 MACHINE VISION INSPECTION SYSTEMS

- 6.3.2.1 Escalating demand for quality inspection and automation to fuel segmental growth

- 6.3.3 MACHINE CONDITION MONITORING SYSTEMS

- 6.3.3.1 Transition from preventive to predictive maintenance approach to contribute to market growth

- 6.3.1 NON-DESTRUCTIVE TEST EQUIPMENT

7 TEST AND MEASUREMENT EQUIPMENT MARKET, BY SERVICE TYPE

- 7.1 INTRODUCTION

- 7.2 CALIBRATION SERVICES

- 7.2.1 NEED TO ALIGN ACTUAL PERFORMANCE WITH STANDARD BENCHMARKS TO DRIVE SEGMENTAL GROWTH

- 7.3 REPAIR/AFTER-SALES SERVICES

- 7.3.1 REQUIREMENT TO MAINTAIN PRODUCT QUALITY TO BOOST SEGMENTAL GROWTH

- 7.4 OTHER SERVICES

- 7.4.1 ASSET MANAGEMENT

- 7.4.2 CONSULTING & TRAINING

- 7.4.3 CLIMATIC PRODUCT TESTING

- 7.4.4 ENVIRONMENTAL PRODUCT TESTING

- 7.4.5 SHOCK TESTING

- 7.4.6 EXTENDED WARRANTY/GUARANTEE SERVICES

8 TEST AND MEASUREMENT EQUIPMENT MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.2 AUTOMOTIVE & TRANSPORTATION

- 8.2.1 INTEGRATION OF ADVANCED ELECTRONIC SYSTEMS IN VEHICLES TO DRIVE MARKET

- 8.3 AEROSPACE & DEFENSE

- 8.3.1 GROWING FOCUS ON AIR TRAFFIC CONTROL TO BOOST DEMAND

- 8.4 IT & TELECOMMUNICATIONS

- 8.4.1 RISING ADOPTION OF WIRELESS TECHNOLOGIES TO CONTRIBUTE TO MARKET GROWTH

- 8.5 EDUCATION & GOVERNMENT

- 8.5.1 INCREASING FOCUS ON PRACTICAL EDUCATION AND SMART CITY INITIATIVES TO ACCELERATE DEMAND

- 8.6 ELECTRONICS & SEMICONDUCTOR

- 8.6.1 PROLIFERATION OF SMART DEVICES TO FUEL MARKET GROWTH

- 8.7 INDUSTRIAL

- 8.7.1 SIGNIFICANT FOCUS ON REDUCING RISK OF COSTLY RECALLS TO SPIKE DEMAND

- 8.8 HEALTHCARE

- 8.8.1 ELEVATING DEMAND FOR HIGHLY ACCURATE AND RELIABLE MEDICAL DEVICES TO DRIVE MARKET

9 TEST AND MEASUREMENT EQUIPMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rising adoption by IT & telecom and aerospace & defense companies to fuel market growth

- 9.2.3 CANADA

- 9.2.3.1 Extensive manufacturing base to create opportunities

- 9.2.4 MEXICO

- 9.2.4.1 Escalating demand for automobiles and electronic products to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Government initiatives boosting EV purchases to support market growth

- 9.3.3 UK

- 9.3.3.1 Rising adoption for testing hybrid and electric vehicle parts to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Growing production of high-tech aircraft and components to accelerate demand

- 9.3.5 ITALY

- 9.3.5.1 Presence of several test and measurement equipment manufacturers to contribute to market growth

- 9.3.6 SPAIN

- 9.3.6.1 Government's aim to achieve leading position in microelectronics market to spur demand

- 9.3.7 NETHERLANDS

- 9.3.7.1 Robust presence of semiconductor industry and RF power technology providers to foster market growth

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Government-led subsidy and R&D initiatives supporting semiconductor companies to support market growth

- 9.4.3 JAPAN

- 9.4.3.1 Surging demand for consumer goods, medical devices, and telecom solutions to drive market

- 9.4.4 INDIA

- 9.4.4.1 Government focus on enhancing semiconductor supply chain resiliency and diversity to support market growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Rising requirement from electronics and semiconductor manufacturers to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Evolving standards for next-generation telecommunications equipment to fuel market growth

- 9.4.7 SINGAPORE

- 9.4.7.1 Increasing emphasis on manufacturing quality products to boost demand

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 SOUTH AMERICA

- 9.5.2.1 Brazil

- 9.5.2.1.1 Expanding semiconductor industry to boost demand

- 9.5.2.2 Argentina

- 9.5.2.2.1 Increasing deployment of wireless communication technologies to propel market

- 9.5.2.3 Rest of South America

- 9.5.2.1 Brazil

- 9.5.3 AFRICA

- 9.5.3.1 Focus on infrastructure development with increasing urbanization to support market growth

- 9.5.4 MIDDLE EAST

- 9.5.4.1 Increasing demand for wireless testing solutions and presence of test and equipment providers to contribute to market growth

- 9.5.4.2 GCC countries

- 9.5.4.3 Rest of Middle East

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2024

- 10.3 REVENUE ANALYSIS, 2019-2023

- 10.4 MARKET SHARE ANALYSIS, 2023

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 10.7.5.1 Company footprint

- 10.7.5.2 Product type footprint

- 10.7.5.3 Service type footprint

- 10.7.5.4 Vertical footprint

- 10.7.5.5 Region footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2023

- 10.8.5.1 Detailed list of startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- 11.2.1 KEYSIGHT TECHNOLOGIES

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches/Developments

- 11.2.1.3.2 Deals

- 11.2.1.4 MnM view

- 11.2.1.4.1 Key strengths/Right to win

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses/Competitive threats

- 11.2.2 FORTIVE

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Deals

- 11.2.2.4 MnM view

- 11.2.2.4.1 Key strengths/Right to win

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses/Competitive threats

- 11.2.3 AMETEK.INC.

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches/Developments

- 11.2.3.3.2 Deals

- 11.2.3.4 MnM view

- 11.2.3.4.1 Key strengths/Right to win

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses/Competitive threats

- 11.2.4 ROHDE & SCHWARZ

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Services/Solutions offered

- 11.2.4.3 Recent developments

- 11.2.4.3.1 Product launches/Developments

- 11.2.4.3.2 Deals

- 11.2.4.4 MnM view

- 11.2.4.4.1 Key strengths/Right to win

- 11.2.4.4.2 Strategic choices

- 11.2.4.4.3 Weaknesses/Competitive threats

- 11.2.5 NATIONAL INSTRUMENTS CORP.

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Services/Solutions offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Product launches/Developments

- 11.2.5.4 MnM view

- 11.2.5.4.1 Key strengths/Right to win

- 11.2.5.4.2 Strategic choices

- 11.2.5.4.3 Weaknesses/Competitive threats

- 11.2.6 TELEDYNE TECHNOLOGIES INCORPORATED

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Services/Solutions offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Product launches/Developments

- 11.2.6.3.2 Deals

- 11.2.7 VIAVI SOLUTIONS INC.

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Services/Solutions offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product launches/Developments

- 11.2.7.3.2 Deals

- 11.2.8 ANRITSU

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Services/Solutions offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches/Developments

- 11.2.8.3.2 Deals

- 11.2.9 YOKOGAWA ELECTRIC CORPORATION

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Services/Solutions offered

- 11.2.10 ADVANTEST CORPORATION

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Services/Solutions offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product launches/Developments

- 11.2.10.3.2 Deals

- 11.2.1 KEYSIGHT TECHNOLOGIES

- 11.3 OTHER PLAYERS

- 11.3.1 EXFO INC.

- 11.3.2 FUJIAN LILLIPUT OPTOELECTRONICS TECHNOLOGY CO., LTD

- 11.3.3 IKM INSTRUTEK

- 11.3.4 UNI-TREND TECHNOLOGY (CHINA) CO., LTD.

- 11.3.5 PARTICLE MEASURING SYSTEMS

- 11.3.6 MEXTECH TECHNOLOGIES INDIA PRIVATE LIMITED

- 11.3.7 RIGOL TECHNOLOGIES, CO. LTD.

- 11.3.8 GOOD WILL INSTRUMENT CO., LTD.

- 11.3.9 ADLINK TECHNOLOGY INC.

- 11.3.10 LEADER ELECTRONICS CORPORATION

- 11.3.11 CRYSTAL INSTRUMENTS CORPORATION

- 11.3.12 ASTRONICS CORPORATION

- 11.3.13 VAUNIX TECHNOLOGY CORPORATION

- 11.3.14 DS INSTRUMENTS

- 11.3.15 SALUKI TECHNOLOGY

- 11.3.16 INSPLORION

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS