|

|

市場調査レポート

商品コード

1452900

EPDMの世界市場:用途・製造プロセス・地域別 - 予測(~2028年)EPDM Market by Application, Manufacturing Process, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| EPDMの世界市場:用途・製造プロセス・地域別 - 予測(~2028年) |

|

出版日: 2024年03月14日

発行: MarketsandMarkets

ページ情報: 英文 227 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

EPDMの市場規模は、予測期間中に5.9%のCAGRで推移し、2023年の39億米ドルから、2028年には52億米ドルの規模に成長すると予測されています。

アジア太平洋地域における自動車セクターの成長が予測期間を通じてEPDM市場の成長を促進しています。また、EPDMの環境に優しい生産技術の進歩や、電気自動車やハイブリッド車の需要の増加もEPDM市場に新たな機会をもたらしています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製造プロセス・用途・地域 |

| 対象地域 | アジア太平洋・北米・欧州・南米・中東&アフリカ |

溶液重合プロセスはEPDM市場でもっとも急成長している製造プロセスです。溶液重合プロセスは、予測期間中にもっとも急速に拡大する製造プロセスとして浮上しています。溶液重合法は正確な設計要件に合わせて製品を調整できることから、EPDMで主に選ばれています。

自動車部門はEPDM市場でもっとも急成長している用途です。特に、中国、インド、日本、その他の南アジア諸国は、自動車生産において重要な役割を果たしています。自動車産業における技術の進歩と革新が市場の成長を後押しするものと思われます。アジアの自動車産業は2022年末までには回復すると予想されており、中国の自動車部門では顕著な進歩が見込まれています。China Association of Automobile Manufacturers (CAAM) によると、2021年の自動車生産台数は前年比3%増となり、2026年には新エネルギー自動車 (NEV) が販売台数の25%を占めると予測されています。規制状況の進展や電気自動車 (EV) を支援する政府の取り組みもEPDM市場の成長をさらに後押ししています。

アジア太平洋地域は、予測期間中にEPDM市場がもっとも急成長する地域として浮上しています。中国、日本、インド、韓国、インドネシア、マレーシアを含むアジア太平洋地域は、EPDMの生産と消費の重要な拠点となっています。特に自動車産業はEPDMの主要な消費産業であり、ウェザーシール、ホース、ガスケット、ボンネット部品などの幅広い用途にEPDMを使用しています。中国はEPDMの生産と消費の両面で世界の重要なプレーヤーであり、市場力学に大きく貢献しています。EPDM生産者の大半はアジア太平洋地域に位置しており、同地域のEPDM市場における優位性を確固たるものにしています。さらに、進行中の建設プロジェクトと自動車産業の一貫した成長が、同地域のEPDM市場を前進させる主要促進要因となっています。

当レポートでは、世界のEPDMの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- バリューチェーン分析

- 関税と規制状況

- 主な会議とイベント

- ケーススタディ分析

- マクロ経済の概要

- 技術分析

- 価格分析

- 貿易分析

- エコシステムマップ

- 顧客のビジネスに影響を与える動向/ディスラプション

- 特許分析

- 電線とケーブルの投資情勢

第6章 EPDM市場:製造プロセス別

- 溶液重合プロセス

- スラリー/サスペンションプロセス

- 気相重合プロセス

第7章 EPDM市場:用途別

- 自動車

- 建築・建設

- プラスチック改質

- タイヤ・チューブ

- ワイヤー・ケーブル

- 潤滑剤添加剤

- その他

第8章 EPDM市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第9章 競合情勢

- 概要

- 収益分析

- 市場シェア分析

- 企業評価と財務マトリクス

- 製品/ブランドの比較

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

第10章 企業プロファイル

- 主要企業

- EXXON MOBIL CORPORATION

- VERSALIS S.P.A

- DOW

- ARLANXEO

- PETROCHINA COMPANY LIMITED

- LION ELASTOMERS

- SK GEO CENTRIC CO., LTD

- KUMHO POLYCHEM

- ENEOS HOLDINGS, INC.

- MITSUI CHEMICALS, INC.

- CARLISLE COMPANIES INC.

- PETRO RABIGH

- SABIC

- その他の企業

- SHANGHAI SINOPEC MITSUI ELASTOMERS, CO., LTD.

- JIAXING RUNNING RUBBER & PLASTIC CO., LTD

- FIRESTONE BUILDING PRODUCTS

- DENKA ELASTLUTION CO., LTD.

- RADO GUMMI GMBH

- SUMITOMO BAKELITE COMPANY LIMITED

- BRP MANUFACTURING

- WEST AMERICAN RUBBER COMPANY LLC

- UNIRUBBER

- FAIRMONT INDUSTRIES SDN BHD

- ELJI INTERNATIONAL LLC

- CIKAUTXO GROUP

第11章 隣接市場および関連市場

第12章 付録

The EPDM market size is estimated to be USD 3.9 billion in 2023, and it is projected to reach USD 5.2 billion by 2028 at a CAGR of 5.9%. The growing automotive sector in the APAC region is fueling growth in the EPDM market throughout the forecast period. Additionally, advancements in eco-friendly production technologies for EPDM and the increasing demand for electric and hybrid vehicles present fresh opportunities within the EPDM market landscape.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Manufacturing Process, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, South America, and Middle East & Africa |

EPDM stands for Ethylene Propylene Diene Monomer. It is a synthetic rubber compound widely used in various applications due to its excellent resistance to weathering, ozone, heat, and chemicals. EPDM is commonly employed in automotive parts, electrical insulation, roofing membranes, seals, and gaskets, among other industrial and commercial uses.

" Solution Polymerization Process is the fastest growing manufacturing process segment of the EPDMs market."

The solution polymerization process emerges as the most rapidly expanding segment in EPDM manufacturing during the forecast period. EPDM is predominantly manufactured using a polymerization-in-solution technique, chosen for its capacity to tailor products to meet precise design requirements.

"Automotive is the fastest growing application segment of the EPDMs market."

In terms of application, the automotive sector is projected to witness the most rapid growth within the EPDM market throughout the forecast period. Notably, China, India, Japan, and other South Asian countries play significant roles in automotive production. Technological advancements and innovation in the automotive sector are poised to bolster market growth. The Asian automotive industry is anticipated to rebound by the conclusion of 2022, with notable progress expected in the Chinese automotive sector. According to the China Association of Automobile Manufacturers (CAAM), car production saw a 3% year-on-year increase in 2021, with New Energy Vehicles (NEVs) forecasted to represent 25% of sales by 2026. The evolving regulatory landscape and government initiatives supporting Electric Vehicles (EVs) are further propelling growth within the EPDM market.

"APAC is the fastest-growing market for EPDMs."

The Asia-Pacific region emerges as the fastest-growing EPDM market during the forecast period. Encompassing China, Japan, India, South Korea, Indonesia, and Malaysia, the APAC region stands as a key hub for EPDM production and consumption. Notably, the automotive industry serves as the primary consumer of EPDM, employing it in a range of applications such as weather-sealing, hoses, gaskets, and under-the-hood components. China, a significant global player in both EPDM production and consumption, contributes substantially to market dynamics. With a majority of EPDM producers situated in the Asia-Pacific, the region solidifies its dominance in the EPDM market. Furthermore, ongoing construction projects and consistent growth in the automotive sector serve as key drivers propelling the EPDM market forward in the region.

The breakdown of primary interviews is given below:

- By Company Type: Tier 1 - 25%, Tier 2 - 42%, and Tier 3 -33%

- By Designation: C-Level Executives - 20%, Directors - 30%, and Others - 50%

- By Region: North America - 20%, Europe - 10%, APAC - 40%, Middle East & Africa - 20%, and South America - 10%

The companies profiled in this market research report include are ARLANXEO (Netherlands), DOW (US), Exxon Mobil Corporation (US), Kumho Polychem (South Korea), PetroChina Company Limited (China), Versalis S.p. A. (Italy), SK geo centric Co., Ltd. (South Korea), ENEOS Holdings, Inc. (Japan), and Mitsui Chemicals, Inc. (Japan), and others.

Research Coverage

The EPDM market has been segmented based on manufacturing process, application, and region. This report covers the EPDM market and forecasts its market size until 2028. It also provides detailed information on company profiles and competitive strategies adopted by the key players to strengthen their position in the EPDM market. The report also provides insights into the drivers and restraints in the EPDM market along with opportunities and challenges. The report also includes profiles of top manufacturers in the EPDM market.

Reasons to Buy the Report

The report is expected to help market leaders/new entrants in the following ways:

1.This report segments the EPDM market and provides the closest approximations of revenue numbers for the overall market and its segments across different verticals and regions.

2.This report is expected to help stakeholders understand the pulse of the EPDM market and provide information on key market drivers, restraints, challenges, and opportunities influencing the market growth.

3.This report is expected to help stakeholders obtain an in-depth understanding of the competitive landscape of the EPDM market and gain insights to improve the position of their businesses. The competitive landscape section includes detailed information on strategies, such as acquisitions, expansions, new product developments, and partnerships/collaborations/agreements.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing automotive industry, and increasing use of EPDM polymer in the blended products), restraints (Availability of substitutes for EPDM), opportunities (Growth in electric vehicles expected to provide new revenue streams for EPDM manufacturers, and development of environment-friendly technology for EPDM production), and challenges (Anti-dumping duties imposed by china, and difficulties in recycling EPDM) influencing the growth of the EPDM market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EPDM market

- Market Development: Comprehensive information about lucrative markets - the report analyses the EPDM market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the EPDM market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ARLANXEO (Netherlands), DOW (US), Exxon Mobil Corporation (US), Kumho Polychem (South Korea), PetroChina Company Limited (China), Versalis S.p. A.(Italy), SK geo centric Co., Ltd. (South Korea), ENEOS Holdings, Inc. (Japan), and Mitsui Chemicals, Inc. (Japan) and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 EPDM: MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 EPDM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ESTIMATION: BASED ON SYNTHETIC RUBBER MARKET

- FIGURE 3 SUPPLY-SIDE ESTIMATION: BASED ON SYNTHETIC RUBBER MARKET

- 2.2.2 DEMAND-SIDE ESTIMATION: BASED ON TOTAL AUTOMOBILE PRODUCTION

- FIGURE 4 DEMAND-SIDE ESTIMATION: TOTAL AUTOMOBILE PRODUCTION (2022)

- 2.3 DATA TRIANGULATION

- FIGURE 5 EPDM MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.4.2 LIMITATIONS

- 2.5 RECESSION IMPACT

- 2.6 RISK ASSESSMENT

- 2.7 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 6 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 7 SOLUTION POLYMERIZATION PROCESS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 8 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

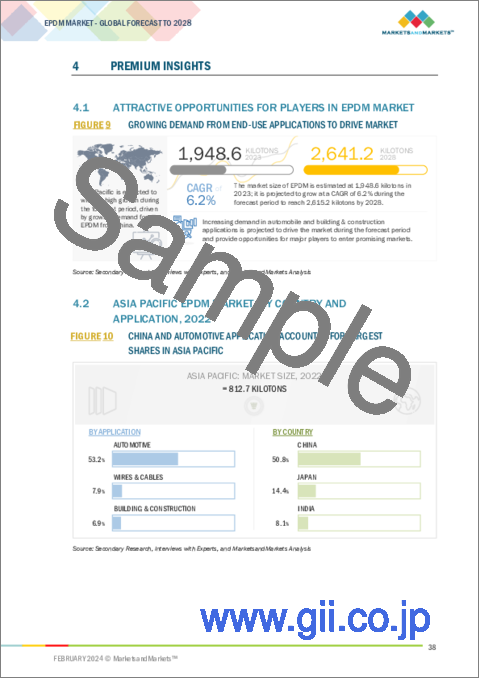

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EPDM MARKET

- FIGURE 9 GROWING DEMAND FROM END-USE APPLICATIONS TO DRIVE MARKET

- 4.2 ASIA PACIFIC EPDM MARKET, BY COUNTRY AND APPLICATION, 2022

- FIGURE 10 CHINA AND AUTOMOTIVE APPLICATION ACCOUNTED FOR LARGEST SHARES IN ASIA PACIFIC

- 4.3 EPDM MARKET, BY APPLICATION

- FIGURE 11 AUTOMOTIVE APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 EPDM MARKET, BY MANUFACTURING PROCESS

- FIGURE 12 SOLUTION POLYMERIZATION TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 GLOBAL EPDM MARKET, BY KEY COUNTRY

- FIGURE 13 CHINA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 EPDM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Expansion of global automotive sector

- 5.2.1.2 Increasing use of EPDM polymers in blended products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Use of thermoplastic elastomers as substitutes for EPDM

- TABLE 1 THERMOPLASTIC ELASTOMERS: TPV AND TPO

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for electric vehicles to provide new revenue streams for EPDM manufacturers

- TABLE 2 TYPES OF RUBBER PARTS USED IN ELECTRIC VEHICLES AND INTERNAL COMBUSTION ENGINES

- 5.2.3.2 Development of sustainable technologies for EPDM production

- 5.2.4 CHALLENGES

- 5.2.4.1 Anti-dumping duties imposed by China on EPDM import

- 5.2.4.2 Difficulties in recycling EPDM

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 EPDM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 EPDM MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 THREAT OF SUBSTITUTES

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 16 EPDM MARKET: SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 17 EPDM MARKET: VALUE CHAIN ANALYSIS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.6.1 TARIFFS RELATED TO EPDM MARKET

- TABLE 4 AVERAGE TARIFF RATES, BY COUNTRY, 2022

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 8 EPDM MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 EPDM ROOFING MEMBRANE IDEAL CHOICE FOR POOLING APPLICATION

- 5.8.2 EPDM ROOFING MEMBRANE IDEAL CHOICE FOR GREEN ROOF APPLICATION

- 5.9 MACROECONOMIC OVERVIEW

- 5.9.1 GLOBAL GDP OUTLOOK

- TABLE 9 GLOBAL GDP GROWTH PROJECTION, 2019-2026 (USD BILLION)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Ziegler-Natta catalyst

- 5.10.1.2 Metallocene catalysts

- 5.10.1.3 Ace technology

- 5.10.1.4 Advanced molecular catalyst technology

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Bio-based EPDM

- 5.10.2.2 Nanotechnology

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- TABLE 10 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TOP 3 APPLICATIONS (USD/KG)

- 5.11.2 PRICING ANALYSIS BASED ON REGION

- FIGURE 18 EPDM MARKET: AVERAGE SELLING PRICE, BY REGION (USD/KG)

- TABLE 11 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2022-2028 (USD/KG)

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO OF EPDM

- FIGURE 19 ETHYLENE-PROPYLENE DIENE RUBBER "EPDM," NON-CONJUGATED, IN PRIMARY FORMS OR IN PLATES, SHEETS, OR STRIP (400270) EXPORTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.12.2 MPORT SCENARIO OF EPDM

- FIGURE 20 ETHYLENE-PROPYLENE-DIENE RUBBER "EPDM", NON-CONJUGATED, IN PRIMARY FORMS OR IN PLATES, SHEETS, OR STRIP (400270) IMPORTS, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.13 ECOSYSTEM MAP

- TABLE 12 EPDM MARKET: ECOSYSTEM

- FIGURE 21 EPDM MARKET: ECOSYSTEM MAP

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 ELECTRIC & HYBRID VEHICLES AND ENVIRONMENT-FRIENDLY PRODUCTS TO ENHANCE FUTURE REVENUE MIX

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR EPDM FOR TOP APPLICATIONS

- 5.15 PATENT ANALYSIS

- FIGURE 25 NUMBER OF PATENTS GRANTED FOR EPDM, 2013-2023

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED FOR EPDM, 2013-2023

- TABLE 15 PATENTS IN EPDM MARKET, 2022-2023

- 5.16 WIRES AND CABLES INVESTMENT LANDSCAPE

- FIGURE 27 INVESTOR DEALS AND FUNDING IN WIRES AND CABLES SOARED IN 2019

6 EPDM MARKET, BY MANUFACTURING PROCESS

- 6.1 INTRODUCTION

- FIGURE 28 SOLUTION POLYMERIZATION PROCESS TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 16 EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (KILOTON)

- TABLE 17 EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 18 EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (USD MILLION)

- TABLE 19 EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- 6.2 SOLUTION POLYMERIZATION PROCESS

- 6.2.1 APPLICATION IN VARIOUS END-USE INDUSTRIES TO DRIVE MARKET

- TABLE 20 SOLUTION POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 21 SOLUTION POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 22 SOLUTION POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 23 SOLUTION POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 SLURRY/SUSPENSION PROCESS

- 6.3.1 REDUCED NEED FOR SOLVENT AND SOLVENT HANDLING EQUIPMENT TO DRIVE MARKET

- TABLE 24 SLURRY/SUSPENSION PROCESS: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 25 SLURRY/SUSPENSION PROCESS: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 26 SLURRY/SUSPENSION PROCESS: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 27 SLURRY/SUSPENSION PROCESS: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 GAS-PHASE POLYMERIZATION PROCESS

- 6.4.1 RISING DEMAND FOR ECOFRIENDLY PRODUCTS TO BOOST MARKET

- TABLE 28 GAS-PHASE POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 29 GAS-PHASE POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 30 GAS-PHASE POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 31 GAS-PHASE POLYMERIZATION PROCESS: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

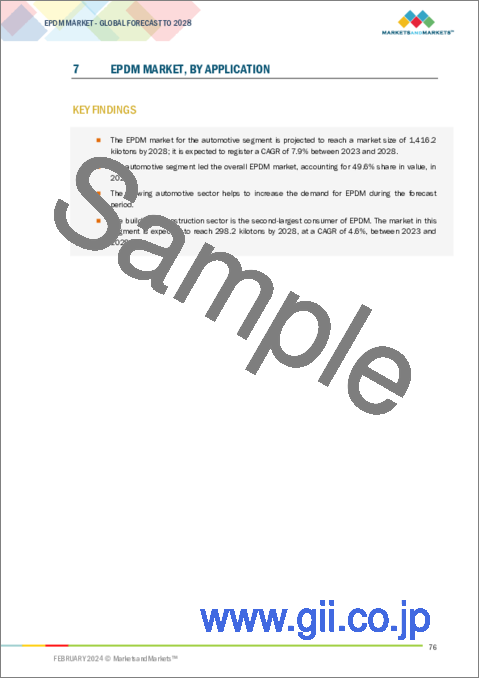

7 EPDM MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 32 APPLICATIONS OF EPDM

- FIGURE 29 AUTOMOTIVE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 33 EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 34 EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 35 EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 36 EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 AUTOMOTIVE

- 7.2.1 HIGH DEMAND FOR NEW ENERGY VEHICLES TO DRIVE MARKET

- TABLE 37 AUTOMOTIVE: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 38 AUTOMOTIVE: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 39 AUTOMOTIVE: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 40 AUTOMOTIVE: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 BUILDING & CONSTRUCTION

- 7.3.1 INCREASING USE OF EPDM IN ROOFING APPLICATIONS TO DRIVE MARKET

- TABLE 41 BUILDING & CONSTRUCTION: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 42 BUILDING & CONSTRUCTION: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 43 BUILDING & CONSTRUCTION: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 44 BUILDING & CONSTRUCTION: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 PLASTIC MODIFICATION

- 7.4.1 INCREASING DEMAND FROM AUTOMOTIVE AND CONSTRUCTION SECTORS TO DRIVE MARKET

- TABLE 45 PLASTIC MODIFICATIONS: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 46 PLASTIC MODIFICATIONS: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 47 PLASTIC MODIFICATIONS: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 48 PLASTIC MODIFICATIONS: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.5 TIRES & TUBES

- 7.5.1 RISING DEMAND FOR EPDM BLEND & TUBES TO DRIVE MARKET

- TABLE 49 TIRES & TUBES: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 50 TIRES & TUBES: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 51 TIRES & TUBES: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 52 TIRES & TUBES: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.6 WIRES & CABLES

- 7.6.1 PRESSING NEED IN HIGH-VOLTAGE APPLICATIONS TO DRIVE MARKET

- TABLE 53 WIRES & CABLES: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 54 WIRES & CABLES: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 55 WIRES & CABLES: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 56 WIRES & CABLES: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.7 LUBRICANT ADDITIVES

- 7.7.1 INCREASED USE IN AUTOMOTIVE APPLICATIONS TO DRIVE MARKET

- TABLE 57 LUBRICANT ADDITIVES: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 58 LUBRICANT ADDITIVES: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 59 LUBRICANT ADDITIVES: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 60 LUBRICANT ADDITIVES: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.8 OTHER APPLICATIONS

- TABLE 61 OTHER APPLICATIONS: EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 62 OTHER APPLICATIONS: EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 63 OTHER APPLICATIONS: EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 64 OTHER APPLICATIONS: EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

8 EPDM MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 30 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 65 EPDM MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 66 EPDM MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 67 EPDM MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 68 EPDM MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2 ASIA PACIFIC

- FIGURE 31 ASIA PACIFIC: EPDM MARKET SNAPSHOT

- TABLE 69 ASIA PACIFIC: EPDM MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 70 ASIA PACIFIC: EPDM MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 71 ASIA PACIFIC: EPDM MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 72 ASIA PACIFIC: EPDM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 74 ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 75 ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 76 ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (KILOTON)

- TABLE 78 ASIA PACIFIC: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 79 ASIA PACIFIC: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (USD MILLION)

- TABLE 80 ASIA PACIFIC: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- 8.2.1 CHINA

- 8.2.1.1 Imposition of anti-dumping duties by government to enhance domestic market

- TABLE 81 CHINA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 82 CHINA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 83 CHINA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 84 CHINA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2.2 INDIA

- 8.2.2.1 Growing automotive sector to drive EPDM market

- TABLE 85 INDIA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 86 INDIA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 87 INDIA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 88 INDIA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2.3 JAPAN

- 8.2.3.1 Steady increase in exports to drive EPDM market

- TABLE 89 JAPAN: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 90 JAPAN: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 91 JAPAN: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 92 JAPAN: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2.4 SOUTH KOREA

- 8.2.4.1 Technological development and innovation in automotive industry to drive growth

- TABLE 93 SOUTH KOREA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 94 SOUTH KOREA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 95 SOUTH KOREA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 96 SOUTH KOREA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2.5 THAILAND

- 8.2.5.1 Development in automotive sector to drive demand for EPDM

- TABLE 97 THAILAND: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 98 THAILAND: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 99 THAILAND: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 100 THAILAND: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2.6 INDONESIA

- 8.2.6.1 Government initiatives to boost demand

- TABLE 101 INDONESIA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 102 INDONESIA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 103 INDONESIA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION

- TABLE 104 INDONESIA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2.7 REST OF ASIA PACIFIC

- TABLE 105 REST OF ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 106 REST OF ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 107 REST OF ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.3 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: EPDM MARKET SNAPSHOT

- TABLE 109 NORTH AMERICA: EPDM MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 110 NORTH AMERICA: EPDM MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 111 NORTH AMERICA: EPDM MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 112 NORTH AMERICA: EPDM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 114 NORTH AMERICA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 115 NORTH AMERICA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 116 NORTH AMERICA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (KILOTON)

- TABLE 118 NORTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 119 NORTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (USD MILLION)

- TABLE 120 NORTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- 8.3.1 US

- 8.3.1.1 Automotive sector to be largest consumer of EPDM

- TABLE 121 US: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 122 US: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 123 US: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 124 US: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.3.2 CANADA

- 8.3.2.1 Growing automotive sector to provide new opportunities for EPDM market

- TABLE 125 CANADA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 126 CANADA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 127 CANADA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 128 CANADA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.3.3 MEXICO

- 8.3.3.1 Liberalization in trade policy to drive growth

- TABLE 129 MEXICO: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 130 MEXICO: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 131 MEXICO EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 132 MEXICO: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4 EUROPE

- TABLE 133 EUROPE: EPDM MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 134 EUROPE: EPDM MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 135 EUROPE: EPDM MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 136 EUROPE: EPDM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 137 EUROPE: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 138 EUROPE: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 139 EUROPE: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 140 EUROPE: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 141 EUROPE: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (KILOTON)

- TABLE 142 EUROPE: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 143 EUROPE: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (USD MILLION)

- TABLE 144 EUROPE: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- 8.4.1 GERMANY

- 8.4.1.1 Growth in demand for EVs to drive EPDM market

- TABLE 145 GERMANY: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 146 GERMANY: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 147 GERMANY: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 148 GERMANY: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.2 POLAND

- 8.4.2.1 Growth in FDI to enhance recovery of automotive sector

- TABLE 149 POLAND: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 150 POLAND: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 151 POLAND: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 152 POLAND: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.3 ITALY

- 8.4.3.1 Growth in end-use industries to drive demand for EPDM

- TABLE 153 ITALY: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 154 ITALY: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 155 ITALY: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 156 ITALY: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.4 TURKEY

- 8.4.4.1 Increasing investments in automotive sector to boost demand for EPDM

- TABLE 157 TURKEY: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 158 TURKEY: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 159 TURKEY: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 160 TURKEY: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.5 CZECH REPUBLIC

- 8.4.5.1 Increased focus on EVs and hybrid vehicles to drive demand for EPDM

- TABLE 161 CZECH REPUBLIC: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 162 CZECH REPUBLIC: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 163 CZECH REPUBLIC: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 164 CZECH REPUBLIC: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.6 SPAIN

- 8.4.6.1 Rising EV adoption to boost demand for EPDM

- TABLE 165 SPAIN: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 166 SPAIN: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 167 SPAIN: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 168 SPAIN: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.7 FRANCE

- 8.4.7.1 Government initiatives for EV transition to drive EPDM market

- TABLE 169 FRANCE: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 170 FRANCE: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 171 FRANCE: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 172 FRANCE: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.4.8 REST OF EUROPE

- TABLE 173 REST OF EUROPE: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 174 REST OF EUROPE: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 175 REST OF EUROPE: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 176 REST OF EUROPE: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5 MIDDLE EAST & AFRICA

- TABLE 177 MIDDLE EAST & AFRICA: EPDM MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: EPDM MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: EPDM MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: EPDM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 182 MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- 8.5.1 SAUDI ARABIA

- 8.5.1.1 Vision 2030 and other government plans to boost construction and automotive sectors to fuel market

- TABLE 189 SAUDI ARABIA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 190 SAUDI ARABIA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 191 SAUDI ARABIA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 192 SAUDI ARABIA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5.2 UAE

- 8.5.2.1 Increased investments in construction sector to drive market

- TABLE 193 UAE: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 194 UAE: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 195 UAE: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 196 UAE: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5.3 REST OF GCC

- TABLE 197 REST OF GCC: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 198 REST OF GCC: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 199 REST OF GCC: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 200 REST OF GCC: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5.4 SOUTH AFRICA

- 8.5.4.1 Strategic expansion of EPDM market in automotive and industrial sectors to drive demand

- TABLE 201 SOUTH AFRICA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 202 SOUTH AFRICA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 203 SOUTH AFRICA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 204 SOUTH AFRICA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 205 REST OF MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.6 SOUTH AMERICA

- TABLE 209 SOUTH AMERICA: EPDM MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 210 SOUTH AMERICA: EPDM MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 211 SOUTH AMERICA: EPDM MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 212 SOUTH AMERICA: EPDM MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 213 SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 214 SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 215 SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 216 SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 217 SOUTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (KILOTON)

- TABLE 218 SOUTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 219 SOUTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2017-2020 (USD MILLION)

- TABLE 220 SOUTH AMERICA: EPDM MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- 8.6.1 BRAZIL

- 8.6.1.1 Rising demand from automotive sector to support market growth

- FIGURE 33 BRAZIL: TOTAL VEHICLE PRODUCTION, 2010-2022 (UNITS)

- TABLE 221 BRAZIL: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 222 BRAZIL: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 223 BRAZIL: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 224 BRAZIL: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.6.2 ARGENTINA

- 8.6.2.1 Increasing production of vehicles to drive market

- TABLE 225 ARGENTINA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 226 ARGENTINA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 227 ARGENTINA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 228 ARGENTINA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.6.3 REST OF SOUTH AMERICA

- TABLE 229 REST OF SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 230 REST OF SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 231 REST OF SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 232 REST OF SOUTH AMERICA: EPDM MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- TABLE 233 OVERVIEW OF STRATEGIES ADOPTED BY KEY EPDM PLAYERS

- 9.2 REVENUE ANALYSIS

- FIGURE 34 REVENUE ANALYSIS FOR KEY PLAYERS IN PAST FIVE YEARS

- 9.3 MARKET SHARE ANALYSIS

- FIGURE 35 MARKET SHARE OF KEY PLAYERS, 2022

- TABLE 234 EPDM MARKET: DEGREE OF COMPETITION

- 9.4 COMPANY EVALUATION AND FINANCIAL MATRICES

- FIGURE 36 COMPANY VALUATION (USD BILLION)

- FIGURE 37 FINANCIAL MATRIX: EV/EBITDA RATIO

- 9.5 PRODUCT/BRAND COMPARISON

- FIGURE 38 PRODUCT COMPARISON

- 9.6 COMPANY EVALUATION MATRIX, 2022

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- FIGURE 39 EPDM MARKET: COMPANY EVALUATION MATRIX, 2022

- 9.6.5 COMPANY FOOTPRINT

- FIGURE 40 EPDM MARKET: COMPANY FOOTPRINT (13 COMPANIES)

- TABLE 235 EPDM MARKET: APPLICATION FOOTPRINT (13 COMPANIES)

- TABLE 236 REGION FOOTPRINT (13 COMPANIES)

- TABLE 237 EPDM MARKET: COMPANY FOOTPRINT (13 COMPANIES)

- 9.7 STARTUPS/SMES EVALUATION MATRIX

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 RESPONSIVE COMPANIES

- 9.7.3 DYNAMIC COMPANIES

- 9.7.4 STARTING BLOCKS

- FIGURE 41 STARTUPS/SMES EVALUATION MATRIX, 2022

- 9.7.5 COMPETITIVE BENCHMARKING

- TABLE 238 EPDM MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 239 EPDM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- 9.7.6 COMPETITIVE SCENARIO

- 9.7.6.1 Product launches

- TABLE 240 EPDM MARKET: PRODUCT LAUNCHES, 2019-2022

- 9.7.6.2 Deals

- TABLE 241 EPDM MARKET: DEALS, 2019-2022

10 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats)**

- 10.1 KEY PLAYERS

- 10.1.1 EXXON MOBIL CORPORATION

- TABLE 242 EXXON MOBIL CORPORATION: COMPANY OVERVIEW

- FIGURE 42 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 243 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.2 VERSALIS S.P.A

- TABLE 244 VERSALIS S.P.A.: COMPANY OVERVIEW

- FIGURE 43 VERSALIS S.P.A: COMPANY SNAPSHOT

- TABLE 245 VERSALIS S.P.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.3 DOW

- TABLE 246 DOW: COMPANY OVERVIEW

- FIGURE 44 DOW: COMPANY SNAPSHOT

- TABLE 247 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 DOW: PRODUCT LAUNCHES

- TABLE 249 DOW: OTHERS

- 10.1.4 ARLANXEO

- TABLE 250 ARLANXEO: COMPANY OVERVIEW

- TABLE 251 ARLANXEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 ARLANXEO: DEALS

- TABLE 253 ARLANXEO: EXPANSIONS

- 10.1.5 PETROCHINA COMPANY LIMITED

- TABLE 254 PETROCHINA COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 45 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT

- TABLE 255 PETROCHINA COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.6 LION ELASTOMERS

- TABLE 256 LION ELASTOMERS: COMPANY OVERVIEW

- TABLE 257 LION ELASTOMERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 LION ELASTOMERS: DEALS

- TABLE 259 LION ELASTOMERS: EXPANSIONS

- 10.1.7 SK GEO CENTRIC CO., LTD

- TABLE 260 SK GEO CENTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 261 SK GEO CENTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.8 KUMHO POLYCHEM

- TABLE 262 KUMHO POLYCHEM: COMPANY OVERVIEW

- TABLE 263 KUMHO POLYCHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.9 ENEOS HOLDINGS, INC.

- TABLE 264 ENEOS HOLDINGS, INC.: COMPANY OVERVIEW

- FIGURE 46 ENEOS HOLDINGS, INC.: COMPANY SNAPSHOT

- TABLE 265 ENEOS HOLDINGS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 ENEOS HOLDINGS INC.: DEALS

- 10.1.10 MITSUI CHEMICALS, INC.

- TABLE 267 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- FIGURE 47 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

- TABLE 268 MITSUI CHEMICALS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.11 CARLISLE COMPANIES INC.

- TABLE 269 TABLE 28 CARLISLE COMPANIES INC.: COMPANY OVERVIEW

- FIGURE 48 CARLISLE COMPANIES INC.: COMPANY SNAPSHOT

- TABLE 270 CARLISLE COMPANIES INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 CARLISLE COMPANIES INC.: PRODUCT LAUNCHES

- 10.1.12 PETRO RABIGH

- TABLE 272 PETRO RABIGH: COMPANY OVERVIEW

- FIGURE 49 PETRO RABIGH: COMPANY SNAPSHOT

- TABLE 273 PETRO RABIGH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 10.1.13 SABIC

- TABLE 274 SABIC: COMPANY OVERVIEW

- FIGURE 50 SABIC: COMPANY SNAPSHOT

- TABLE 275 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS

- 10.2.1 SHANGHAI SINOPEC MITSUI ELASTOMERS, CO., LTD.

- TABLE 276 SHANGHAI SINOPEC MITSUI ELASTOMERS, CO., LTD.: COMPANY OVERVIEW

- 10.2.2 JIAXING RUNNING RUBBER & PLASTIC CO., LTD

- TABLE 277 JIAXING RUNNING RUBBER & PLASTIC CO., LTD: COMPANY OVERVIEW

- 10.2.3 FIRESTONE BUILDING PRODUCTS

- TABLE 278 FIRESTONE BUILDING PRODUCTS: COMPANY OVERVIEW

- 10.2.4 DENKA ELASTLUTION CO., LTD.

- TABLE 279 DENKA ELASTLUTION CO., LTD.: COMPANY OVERVIEW

- 10.2.5 RADO GUMMI GMBH

- TABLE 280 RADO GUMMI GMBH: COMPANY OVERVIEW

- 10.2.6 SUMITOMO BAKELITE COMPANY LIMITED

- TABLE 281 SUMITOMO BAKELITE COMPANY LIMITED: COMPANY OVERVIEW

- 10.2.7 BRP MANUFACTURING

- TABLE 282 BRP MANUFACTURING: COMPANY OVERVIEW

- 10.2.8 WEST AMERICAN RUBBER COMPANY LLC

- TABLE 283 WEST AMERICAN RUBBER COMPANY LLC: COMPANY OVERVIEW

- 10.2.9 UNIRUBBER

- TABLE 284 UNIRUBBER: COMPANY OVERVIEW

- 10.2.10 FAIRMONT INDUSTRIES SDN BHD

- TABLE 285 FAIRMONT INDUSTRIES SDN BHD.: COMPANY OVERVIEW

- 10.2.11 ELJI INTERNATIONAL LLC

- TABLE 286 ELJI INTERNATIONAL LLC.: COMPANY OVERVIEW

- 10.2.12 CIKAUTXO GROUP

- TABLE 287 CIKAUTXO GROUP: COMPANY OVERVIEW

11 ADJACENT AND RELATED MARKETS

- 11.1 INTRODUCTION

- 11.2 SYNTHETIC RUBBER MARKET

- TABLE 288 SYNTHETIC RUBBER MARKET, BY REGION, 2020-2027 (KILOTON)

- TABLE 289 SYNTHETIC RUBBER MARKET, BY REGION, 2020-2027 (USD MILLION)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS