|

|

市場調査レポート

商品コード

1611486

炭化ケイ素(SiC)の特許情勢の分析(2024年)Silicon Carbide (SiC) Patent Landscape Analysis 2024 |

||||||

|

|||||||

| 炭化ケイ素(SiC)の特許情勢の分析(2024年) |

|

出版日: 2024年12月11日

発行: KnowMade

ページ情報: 英文 PDF >170 slides, Excel file >19,000 Patent Families

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

SiC産業における最新のIPの進化と動向を解明。

SiCサプライチェーン全体の特許活動を調査。

SiC技術:複雑かつ急速に進化する情勢

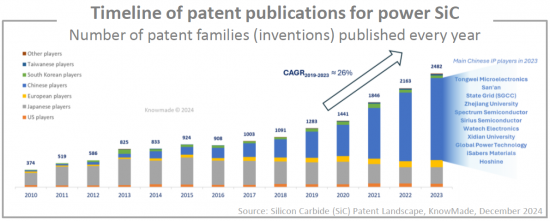

2022年の炭化ケイ素(SiC)特許情勢において、KnowMadeはSiCデバイスの知的財産(IP)活動が活発化していることを明らかにしました。歴史的なIP企業の多くは、この時期にSiC発明の保護範囲の拡大を目指しました。電気自動車(EV)がパワーSiC市場の台頭を促進していたため、SiC企業は欧州や中国など、この産業にとって戦略的な地域でより多くの特許を出願するようになっています。これと並行して、EVブームにより多くの新規参入企業がSiC技術の開発を加速させたため、若いSiC市場における早期のリーダーたちは、今後数年間の激しい競合に備え、IP活動を維持、あるいは加速させています。このような状況において、主要SiC企業は、市場シェアを守り、SiC産業への参入に必要な巨額の投資を確保するために、特許を活用する可能性があります。市場競合の激化は、すでにIP情勢に顕著に表れています。

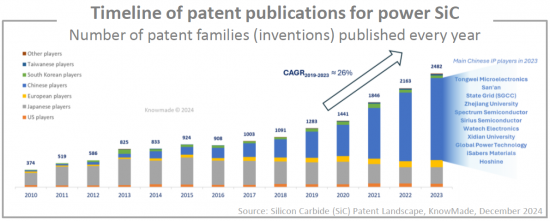

米国と中国の間の地政学的緊張も特許出願の増加を引き起こし、世界各地、特に中国におけるローカルな半導体エコシステムの形成を加速させています。2023年、中国企業がSiCサプライチェーン全体の特許公開の70%超を占め、新規参入企業の数も目覚ましく、その中にはSiCウエハー産業に関わる企業も多いです。このように多くの企業がSiCウエハーの開発に携わる中、中国はすでに供給不足の状況を食い止めることに成功しましたが、熾烈な価格競争により、多くのサプライヤーにとって経済的に不安定な時代が到来しました。このような新たな状況は、SiCウエハーサプライヤー間の特許訴訟に有利に働く可能性があります。

当レポートでは、世界の炭化ケイ素(SiC)産業について調査分析し、1万9,000件を超える特許のExcelデータベースに加え、世界の特許動向の解説や、主要企業のIPプロファイルなどを提供しています。

目次

イントロダクション

- レポートの背景

- レポートの目的

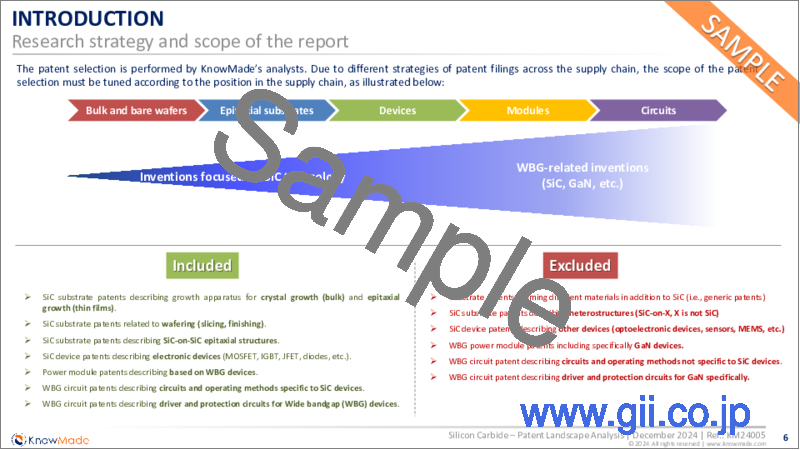

- 調査戦略と調査範囲

- リーディングガイド:レポートから適切な情報を見つける

- 特許検索、選択、分析の手法

- 特許分析の用語

Excelデータベース

- この調査のために選択されたすべての特許と、統計分析からの権利者ごとの完全なデータを含むExcelファイル。

エグゼクティブサマリー

- ハイライト

- SiC基板、SiCパワーデバイス、SiCパッケージング・モジュール、SiC回路の各サプライチェーンセグメントについて

- 主要IP企業のタイムライン

- 活動中のIP企業、活動を停止したIP企業、新規参入IP企業

- 主な特許出願者:サブセグメント別

- 主なIP企業:国別

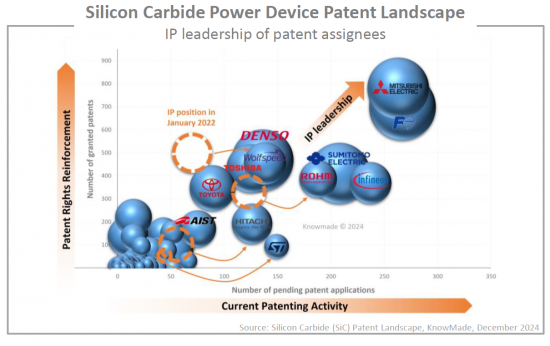

- 特許権者のIPリーダーシップ

特許情勢の分析

特許情勢の概要

- 主要動向

- 主な特許権者

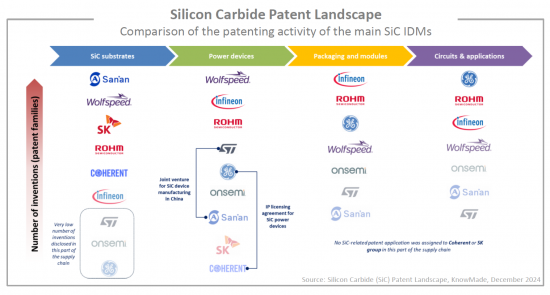

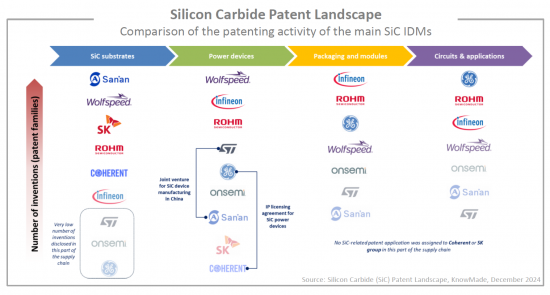

- サプライチェーン全体にわたる主要IP企業のポジショニング

- IP新規参入企業

- 近年のIP提携・特許取引

- 中国のIP企業に注目

- SiC特許情勢における主な中国企業

- 中国のIP新規参入企業

- 近年の中国のIP提携・特許取引

- 世界的なIP活動を展開する中国企業

SiC基板の特許情勢

- (バルク、エピウエハー、育成装置、仕上げ・スライシングに関する特許を含む)

- 特許公開の時系列変化:サブセグメント別

- 主な特許権者のランキング

- 主な特許権者:サブセグメント別

- 存続特許の地理的範囲

- 主な特許権者と特許出願者:国別

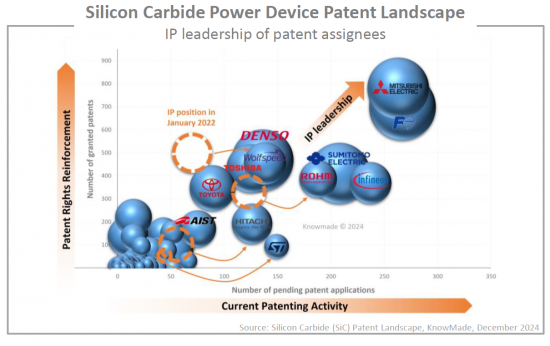

- 特許権者のIPリーダーシップ

- バルクSiCとベアSiCウエハーに注目

- SiCエピタキシャルウエハーに注目

SiCパワーデバイスの特許情勢

- (ダイオード、MOSFET、その他のデバイスと技術的側面に関連する特許を含む)

- 特許公開の時系列変化:サブセグメント別

- 主な特許権者のランキング

- 主な特許権者:サブセグメント別

- 存続特許の地理的範囲

- 主な特許権者と特許出願者:国別

- 特許権者のIPリーダーシップ

- SiCダイオードに注目

- SiC MOSFET(プレーナー、トレンチMOSFET)に注目

SiCパワーモジュールの特許情勢

- (パッケージング、モジュール、カプセル化、ダイアタッチ、寄生、熱問題などに関連する特許を含む)

- 主な特許権者のランキング

- 存続特許の地理的範囲

- 主な特許権者と特許出願者:国別

- 特許権者のIPリーダーシップ

SiC回路の特許情勢

- 主な特許権者のランキング

- 存続特許の地理的範囲

- 主な特許権者と特許出願者:国別

- 特許権者のIPリーダーシップ

主なSiC IDMのIPプロファイル

- 主なSiC IDMの比較

- 特許公開の時系列変化

- SiCサプライチェーン全体にわたる特許活動のレベルとIPポートフォリオの権利行使可能性

- SiCサプライチェーン全体にわたる特許権者のIPリーダーシップ

- SiC MOSFETの特許権者のIPリーダーシップ

- 有効な特許ポートフォリオの地理的範囲

- 世界中でのIPリーダーシップ

- IPプロファイル

- 各企業について:SiC特許ポートフォリオの概要(特許活動、特許の法的ステータス、地理的範囲、技術範囲)、最新のIP開発。

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- 各企業について:SiC特許ポートフォリオの概要(特許活動、特許の法的ステータス、地理的範囲、技術範囲)、最新のIP開発。

KnowMadeのプレゼンテーション

Figure out the latest IP evolutions and trends in the SiC industry.

Explore the patenting activities across the SiC supply chain.

Key features:

- PDF>170 slides

- Excel database containing all patents analyzed in the report (>19,000 patent families), including segmentations + hyperlink to updated online database (legal status, documents etc.)

- Describing the global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active/inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

- Providing a detailed picture of the Chinese SiC ecosystem focusing on the patenting activity of Chinese entities.

- Patents categorized in 5 main supply chain segments and 10 main sub-segments: bulk SiC & bare SiC wafers, epitaxial SiC substrates (incl. growth apparatus, finishing), SiC devices (diodes, planar MOSFETs, trench MOSFETs), SiC modules (thermal issues, parasitics, die-attach, encapsulation), circuits.

- IP profile of main players: Patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.)

SiC technology: A complex and fast-evolving landscape

In the Silicon Carbide (SiC) patent landscape 2022, KnowMade found out that the intellectual property (IP) activities were ramping up for SiC devices. Many historical IP players aimed to increase the perimeter of protection for their SiC inventions at this time. Electric vehicles (EV) had been driving the emergence of the power SiC market, prompting SiC companies to file more patents in strategic regions for this industry, such as Europe and China. In parallel, early leaders in the young SiC market have maintained or even accelerated their IP activities to prepare for a stronger competition in the next few years, since the EV boom led many new players to speed up the development of SiC technology. In this context, patents may be leveraged by leading SiC companies to protect their market share and thereby secure the large investments that have been required to enter the SiC industry. The growing competition in the market is already conspicuous in the IP landscape.

Geopolitical tensions between US and China have also triggered an increase in patent filings, accelerating the formation of local semiconductor ecosystems across the world, especially in China. In 2023, Chinese players were responsible for more than 70% of patent publications across the whole SiC supply chain, with an impressive number of newcomers, of which many companies involved in the SiC wafer industry. With such a high number of companies involved in SiC wafer developments, China has already succeeded in stopping the shortage situation but opened a period of economic instability for many suppliers due to a fierce price competition. This new context may favor patent litigations between SiC wafer suppliers.

Patent landscape overview

The first section of the Silicon Carbide (SiC) Patent Landscape report 2024 describes the global patent competition across the SiC supply chain by identifying the main IP players and newcomers and positioning their patent portfolios in each part of the SiC supply chain. The SiC patent portfolios are also analyzed geographically to highlight important markets in the IP strategy of SiC companies.

For SiC power devices, the patent analysis has been split into diodes, MOSFET and other SiC devices. What's more, for SiC MOSFET, the IP competitive analysis is available for planar MOSFET and trench MOSFET separately. It highlights the fact that most companies in the SiC patent landscape have integrated trench MOSFET in their technological roadmap, leading to an acceleration in patent filings in this area. As a result, trench MOSFET has become an increasingly competitive IP space in recent years.

Furthermore, a special focus is made on China which stands out by the explosion of the number of patent assignees in recent years, and an IP activity that is strongly dominated by domestic patent filings. Few players stand out by filing patent applications outside China. Interestingly, due to the very high patenting activity in China, patent analysis has become very relevant to describe such a dense ecosystem and make it less opaque to global competitors.

Eventually, the patent analysis highlights the IP activities of main market players, which are facing strong competition from many players in this landscape. They are either future market competitors, future integrators of SiC devices such as automotive Tiers-1 and OEM, or even potential suppliers (SiC equipment, materials). Indeed, patents may also be instrumental in negotiations and partnerships across the future SiC supply chain.

IP profiles of key players

The second section of the Silicon Carbide (SiC) Patent Landscape report 2024 focuses on the IP activities of main SiC device market players and/or companies investing significantly into building a vertically-integrated infrastructure for SiC. Such companies have adopted an IDM business model and look to integrate within the company every step of SiC manufacturing, from material growth, to device manufacturing and packaging. Interestingly, the comparison of their IP activities highlights quite differentiated IP strategies. While certain companies heavily rely on patents to assert their position in the market, other companies have not significantly developed their patent portfolio across the SiC supply chain. Regarding the geographic distribution of patent filings, there are also some discrepancies between players, showing the relative importance of the different markets for each company (US, Japan, Europe, China, South Korea and Taiwan).

This patent analysis provides a complete overview of the SiC patent portfolios held by Wolfspeed, Infineon, onsemi, Rohm, SK, STMicroelectronics, Coherent (and its licensor General Electric) and San'an. By focusing on the recent patenting activities of such players, it is possible to detect small signals, such as involvement in new technological areas (e.g., superjunction structures, trench MOSFET), or a strong IP activity in new regions. As such, it may provide some indications regarding the strategic plans of the company. Eventually, this review of the latest patent publications details the recent evolutions of SiC technology at every level of the supply chain.

Useful Excel patent database

This report includes an extensive Excel database with the 19,000+ patent families (inventions) analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and segments (bulk SiC, epitaxial SiC substrates, SiC diodes, planar SiC MOSFETs, trench SiC MOSFETs, SiC modules, circuits, etc.). Additionally, the Excel file comprises the complete data by assignee from the statistical analyses, including the number of patent families, timeline of patenting activity, number of granted patents and pending patent applications, and geographical coverage of patent portfolio.

Companies mentioned in the report (non-exhaustive)

Mitsubishi Electric, Sumitomo Electric, Denso, Fuji Electric, Toyota Group, Hitachi, Infineon, Toshiba, Rohm, Resonac, Panasonic , Wolfspeed, SICC, CETC, Nissan, State Grid (SGCC), General Electric, San'an, LG Corporation, CRRC, ABB, Hyundai, Siemens, Global Power Technology, Shindengen Electric Manufacturing, STMicroelectronics, CEC, FerroTec Holdings, Synlight Crystal, Onsemi, Bosch, Disco, Kansai Electric Power (KEPCO), TankeBlue, SK group, Tongwei Microelectronics, Midea, BASiC Semiconductor, TYSiC - Tianyu Semiconductor Technology, PN Junction Semiconductor, iSabers Materials, Spectrum Semiconductor, Shin-Etsu, KY Semiconductor, Sanken Electric, Gree Electric Appliances, Century Goldray (CENGOL), Sharp, Kyocera, Watech Electronics, Sirius Semiconductor, Huawei, Proterial (Hitachi Metals), Senic, Toyo Tanso, Shanghai Hestia Power, Coherent, YASC - Anhui Yangtze Advanced Semiconductor, GlobalWafers, BYD, Northrop Grumman, Microchip Technology, EpiWorld, Volkswagen Group, Sumitomo Metal Mining, JRC - Japan Radio, Semikron Danfoss, Chongqing Wattscience Electronic Technology, Hoshine, Power Integrations, Meidensha Electric Manufacturing, StarPower Semiconductor, United Nova Technology (UNT), Soitec, Delta Electronics, ZF, Guangzhou Summit Crystal Semiconductor (GZSC), Jiangsu Jixin Advanced Materials, Xiner, Huaxinwei Semiconductor Technology (Beijing) , Semisouth Lab, Beijing Microcore Technology, Hypersics Semiconductor, SiCentury, Macrocore Semiconductor, Daikin Industries, Nissin Electric, Raytheon Technologies, NCE Power, etc.

TABLE OF CONTENTS

INTRODUCTION

- Context of the report

- Objectives of the report

- Research strategy and scope of the report

- Reading guide: find the right information in the report

- Methodology for patent search, selection and analysis

- Terminology for patent analysis

EXCEL DATABASE

- Excel file that includes all patent selected for this study, along with the complete data by assignee from the statistical analyses.

EXECUTIVE SUMMARY

- Highlights

- For each supply chain segment SiC substrates, SiC power devices, SiC packaging & modules, and SiC circuits:

- Timeline of main IP players

- IP players still active, IP players no longer active, IP newcomers

- Leading patent assignees by sub-segments

- Leading IP players by country

- IP leadership of patent assignees

PATENT LANDSCAPE ANALYSIS

Patent Landscape Overview

- Main trends

- Main patent owners

- Position of main IP players across the supply chain

- IP newcomers

- Recent IP collaborations & patent transactions

- Focus on Chinese IP players

- Main Chinese companies in the SiC patent landscape

- Chinese IP newcomers

- Recent Chinese IP collaborations & patent transactions

- Chinese entities with global IP activities

SiC Substrate Patent Landscape

- (Includes patents related to bulk, epiwafers, growth apparatus, and finishing & slicing)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on Bulk SiC and bare SiC wafers

- Focus on SiC epitaxial wafers

SiC Power Devices Patent Landscape

- (Includes patents related to diodes, MOSFETs, other devices and technological aspects)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on SiC diodes

- Focus on SiC MOSFETs (planar and trench MOSFETs)

SiC Power Modules Patent Landscape

- (Includes patents related to packaging, modules, encapsulation, die-attach, parasitics, thermal issues, etc.)

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

SiC Circuits Patent Landscape

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

IP PROFILES OF MAIN SiC IDM

- Comparison between main SiC IDM

- Time evolution of patent publications

- Level of patenting activity and IP portfolio enforceability across the SiC supply chain

- IP leadership of patent assignees across the SiC supply chain

- IP leadership of patent assignees for SiC MOSFET

- Geographical coverage of alive patent portfolio

- IP leadership across the world

- IP profiles

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.