|

|

市場調査レポート

商品コード

1785251

世界のVideo as a Sensor市場規模、シェア、業界分析レポート(提供内容別、製品別、最終用途別、用途別、地域別展望・予測、2025年~2032年)Global Video As A Sensor Market Size, Share & Industry Analysis Report By Offering, By Product, By End-Use, By Application, By Regional Outlook and Forecast, 2025 - 2032 |

||||||

|

|||||||

| 世界のVideo as a Sensor市場規模、シェア、業界分析レポート(提供内容別、製品別、最終用途別、用途別、地域別展望・予測、2025年~2032年) |

|

出版日: 2025年07月08日

発行: KBV Research

ページ情報: 英文 534 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のVideo as a Sensor(映像センサー)市場規模は、予測期間中に8.1%のCAGRで市場成長し、2032年までに1,317億3,000万米ドルに達すると予想されています。

主なハイライト:

- 2024年の世界のVideo as a Sensor市場は北米市場が支配的となり、2024年には34.2%の収益シェアを占めました。

- 米国市場は北米におけるリーダーシップを維持し、2032年までに市場規模が310億米ドルに達すると予測されています。

- さまざまな製品の中で、ハードウェアセグメントが世界市場を独占し、2024年には収益シェアの53.9%を占めました。

- 製品面では、ビデオ監視セグメントが2032年までに42.9%の収益シェアを獲得し、世界市場をリードすると予想されています。

- 商業部門は2024年に主要な最終用途として浮上し、収益シェアの45.4%を獲得し、予測期間中もその優位性を維持すると予測されています。

- 用途におけるセキュリティおよび監視部門は、2032年に36.1%の収益シェアで市場で成長する見込みであり、予測期間を通じてその支配的な地位を維持すると予測されています。

映像をセンサーとして利用するという概念は、過去1世紀の間に大きく進化し、基本的な監視システムから始まり、インテリジェントなセンシングソリューションへと進化してきました。初期のCCTVシステムは主に受動的な監視を目的としており、その起源は1927年に機械式監視装置が機密区域の監視に使用されていたことに遡ります。

20世紀半ばまでに、Vericonシステムのような商用ソリューションによって、民間の有線監視が可能になりました。しかし、真の転換はネットワーク化されたビデオシステムの登場、特に1996年にAxis Communicationsが最初のIPカメラを導入したことで起こりました。この革新は、インターネットプロトコルを介してビデオを伝送するという概念を導入し、リモートアクセス、高解像度、そして拡張性を可能にしたため、画期的な出来事となりました。

時が経つにつれ、これらのシステムはより高度化し、組み込みLinuxの導入、カメラ内処理の実現、そして最終的にはエッジ分析の実現へと進みました。2008年にAxis、Bosch、SonyがONVIFコンソーシアムを設立したことで、相互運用性とインターフェースの標準化が促進され、技術革新はさらに加速しました。同時に、各国政府はAIを映像システムに統合する検討を開始しました。

米国運輸省とエネルギー省のプログラムは、交通監視、公共安全、インフラセキュリティといった用途のためのリアルタイム映像分析に投資しました。これらの取り組みは、シカゴの「オペレーション・バーチャル・シールド」やニューヨークの「ドメイン・アウェアネス・システム」といった都市全体をカバーするネットワークを生み出しました。これらのネットワークは、数千台のカメラとデータフィードを相互接続し、予測的な警察活動や緊急対応機能を提供しました。

同時に、NVIDIAなどのOEMはJetson AIプラットフォームを発表し、カメラをクラウドへの常時アクセスを必要とせずに物体認識や異常検知が可能なインテリジェントエッジデバイスへと変貌させました。その結果、ビデオシステムはアクティブセンサーとして機能し始め、動きを検知し、物体を識別し、行動を分析し、より広範なモノのインターネット(IoT)エコシステムにデータを送信できるようになりました。

KBV Cardinal matrix - Video as a Sensor市場競争分析

KBV Cardinal matrixの分析によると、杭州ハイクビジョンデジタルテクノロジー株式会社は、Video as a Sensor市場の先駆者です。2025年5月、杭州ハイクビジョンデジタルテクノロジー株式会社は、バッテリー内蔵のワイヤレスカメラと太陽光発電オプションを備えた、ケーブル不要の新世代ビデオセキュリティ製品を発表しました。これらのソリューションは、遠隔地や配線が困難な場所でも柔軟かつ簡単に設置できる監視を提供し、最小限のインフラ要件でセキュリティを強化します。ソニーセミコンダクタソリューションズ株式会社、ハネウェルインターナショナル株式会社、ジョンソンコントロールズインターナショナルPLCなどは、Video as a Sensor市場における主要なイノベーターです。

市場統合分析:

人工知能、コンピュータービジョン、IoT技術の急速な進化は、ビデオ監視とセンサーインテリジェンスの情勢を根本的に再定義し、世界のVideo as a Sensor(VaaS)市場を生み出しました。かつては受動的な視覚監視だったものが、スマートシティ、製造、小売分析、自律システムといった分野におけるリアルタイムの意思決定を支えるインテリジェントなデータ抽出へと変貌を遂げました。しかし、この変革はオープンな環境や均等に分散された環境では起こりませんでした。むしろ、ハードウェア・ソフトウェア・スタック、データパイプライン、クラウドインフラといった重要なレイヤーを統括するテクノロジー企業で構成される統合エコシステムによって形作られてきました。

本章では、Video as a Sensor(VaaS)セクターにおける市場統合のダイナミクスを詳細に分析します。競争の激化、イノベーション障壁、ベンダー集中度に影響を与える構造的・戦略的要因を体系的に評価します。実際のニュース、OEM出版物、公開技術フレームワーク、規制データに基づき、本分析では、イノベーションの集中度やサプライチェーンへの依存度から、地政学的影響や技術標準化に至るまで、主要な統合指標に測定可能な評価を与えています。

パラメータ別市場統合分析

1.革新性のレベル - ★★★★★(5/5)

Video as a Sensor市場におけるイノベーションは、特にAIベースの物体認識、行動分析、リアルタイムアラートシステムの分野で急速に進歩しています。Bosch、Hikvision、NVIDIA(Jetsonプラットフォーム)といったリーダー企業は、独自のハードウェア・ソフトウェアスタックで市場を席巻しています。これらの企業は、高い研究開発投資によってイノベーションのハードルを常に引き上げており、スタートアップ企業がそのペースに追いつくのは困難です。

根拠:

イノベーションは主に、垂直統合された製品ラインとデータパイプラインの制御を持つ大手ベンダーに集中しており、水平参入者の余地は大幅に制限されています。

製品ライフサイクル分析:

現在の導入パターン、技術の進歩、そして様々なセクターにおける導入規模に基づくと、Video as a Sensor市場は製品ライフサイクルの成長段階と成熟段階の間に位置しています。この技術は初期の概念実証段階を過ぎ、現在ではスマートシティインフラ、交通管理、産業オートメーション、小売分析といった分野において、特に先進地域や急速に都市化が進む地域で広く導入されています。Bosch、Axis Communications、Hikvisionといった大手企業は、統合分析機能を備えたAI駆動型ビデオセンサーを主流化しており、公共監視や商業施設といった分野で成熟が進んでいることを示しています。

しかしながら、エッジコンピューティング、5G統合、AIモデリングにおける継続的なイノベーション、特に自律走行モビリティ、ヘルスケア診断、精密製造といった新興アプリケーションにおけるイノベーションは、継続的な成長を反映しています。市場はまだ飽和状態には至っておらず、特にLAMEAおよびアジア太平洋地域の一部において、地理的にも機能的にも拡大を続けており、成長後期から成熟初期への転換点にあることを示唆しています。

ビデオ技術の進化は、従来の監視・モニタリング機能の枠を超えています。今日では、人工知能(AI)、機械学習(ML)、エッジコンピューティングの統合により、ビデオシステムは、視覚データをリアルタイムで解釈し、それに基づいて行動できるインテリジェントセンサーへと変貌を遂げています。このパラダイムシフトにより、「Video as a Sensor(VaaS)」市場と呼ばれる新たな分野が生まれています。

本章では、Video as a Sensor市場における包括的な製品ライフサイクル(PLC)分析を提示し、市場がイントロダクション、成長期、成熟期、衰退期という主要なフェーズを経てどのように発展してきたかを示します。技術、ユースケース、競争戦略の進化を分析することで、本分析は市場の開発軌道と戦略的な変曲点をより深く理解することを可能にします。

1.イントロダクション段階

この初期段階において、Video as a Sensor技術は主に防衛や重要インフラといった特殊な分野で活用されています。導入は試験的な段階であり、研究開発費は高額で市場浸透は限定的です。

例えば:

- ゴースト・ロボティクスの国境警備隊配備(2022年):米国国土安全保障省は、国境監視用に映像センサーを搭載した四足歩行ロボットを試験運用しました。これらのロボットは、屋外での歩哨任務や列車の車両検査などの任務に試験的に使用されました。

- SynecticsのCOEX 4Kカメラシリーズ(2020年):Synecticsは、石油・ガス施設などの危険な環境向けに設計されたCOEX 4Kカメラシリーズを導入し、過酷な状況でも高解像度の監視を実現します。

2.成長段階

この段階では、セキュリティ強化とAI技術の統合の必要性が高まり、様々な分野でAIの導入が急速に進みます。政府機関や企業は大規模な導入を開始します。

例えば:

- ファーウェイのセーフシティプロジェクト(2014年~2019年):ファーウェイはセルビア政府と協力してベオグラードに1,000台以上の監視カメラを配備し、公共の安全と交通管理を強化しました。

- Cisco Merakiのビデオ分析の開始(2017年):Cisco Merakiは、モーションヒートマップや人物検出などのビデオ分析機能を導入し、企業が物理的な空間に関する洞察を得られるようになりました。

3.成熟段階

テクノロジーは主流となり、商業、工業、住宅の各分野で広く採用されるようになります。焦点は機能強化、統合能力、そしてコスト最適化へと移ります。

例えば:

- HikvisionのAcuSeek NVRの発売(2025年6月):Hikvisionは、大規模なAIモデルを統合し、自然言語クエリによる迅速なビデオ検索を可能にして、インシデント調査の効率を高めるAcuSeek NVRを発表しました。

- BoschのBVMSとPromise Technologyの統合(2020年):Bosch Security SystemsはPromise Technologyと連携して、企業の監視ニーズに合わせてストレージと拡張性を最適化した統合ビデオ管理ソリューションを提供しました。

- Motorola SolutionsによるAvigilonのセキュリティスイート(2023年):Motorola Solutionsは、さまざまな組織の規模と要件に合わせてカスタマイズされたスケーラブルなビデオセキュリティおよびアクセス制御ソリューションを提供するAvigilonセキュリティスイートをリリースしました。

4.衰退期

デジタル技術とAI技術の進歩により、従来のアナログシステムは陳腐化の危機に瀕しています。市場では、IPベースおよびクラウド統合型ソリューションへの移行が進んでいます。

例えば:

- アナログCCTV市場の減少(2020年):世界のCCTVカメラ市場は、パンデミックとデジタル監視システムへの移行により、2019年と比較して2020年に4.6%減少しました。

- MotorolaによるAvigilonの買収(2018年):Motorola Solutionsは、高度なビデオ監視および分析機能によってポートフォリオを強化するためにAvigilonを買収し、統合デジタルソリューションへの戦略的移行を示しました。

市場成長要因

世界各国の政府は、公共安全、防犯、交通管制、防災管理の強化を目的とした監視インフラへの大規模な投資を通じて、ビデオセンサー技術の導入促進に大きく貢献してきました。アナログ監視からIPおよびAIを活用したシステムへの移行は、公共部門の取り組みによって大きく加速しています。ビデオセンサーは今や、単なるセキュリティツールとしてではなく、スマートシティや国家安全保障システムに組み込まれたリアルタイムデータ生成装置として認識されています。各国政府がリアルタイム監視、インシデント検知、緊急対応システムへの資金提供を継続する中で、世界のVideo as a Sensor市場の規模と高度化を加速させる重要な原動力となっています。

さらに、世界のVideo as a Sensor市場における最も魅力的な促進要因の一つは、スマートシティの交通とインフラ最適化におけるビデオ活用システムの広範な導入です。エッジAIを搭載したカメラが、都市のモビリティ、渋滞管理、そして公共サービスを変革しています。インド、オーストラリア、米国、そして欧州の都市では、大規模なパイロットプログラムや本格的なプログラムが開始されており、ビデオセンサーが受動的な録画装置から能動的なリアルタイム交通管理装置へと進化していることが浮き彫りになっています。世界中の政府が公共の安全、気候変動対策、通勤効率向上のためにこうしたソリューションを採用していることが、世界のVideo as a Sensor市場への持続的かつ拡大する投資を支えています。

市場抑制要因

Video as a Sensor市場が直面する最大の制約は、公共空間および私的空間における監視と映像分析に対する監視の厳しさです。エッジカメラやAI搭載カメラの普及に伴い、政府や規制当局はプライバシー権保護のため、より厳格な規則を課しており、導入の遅延やコンプライアンスコストの増加につながっています。例えば米国では、セキュリティ業界協会(SIAA)が発行した「監視カメラプライバシー実践規範」において、データアクセスの管理、暗号化の適用、そして現地の法律や社会の期待に沿ったデータ保存期間の制限が重視されています。これにより、複雑さ、時間、コストが増加し、多くの場合、プロジェクト予算の増加や調達サイクルの遅延に直結します。

バリューチェーン分析

Video as a Sensor市場のバリューチェーンは、画像処理、センサー、動画処理技術の高度化に重点を置いた研究開発と技術開発から始まります。次に、センサーやカメラなどの必須ハードウェアを製造する部品製造が続きます。次の段階はシステム統合で、ハードウェアとソフトウェアを組み合わせて完全なソリューションを構築します。ソフトウェアと分析の開発は、ビデオ分析やデータ解釈などのインテリジェントな機能でこれらのシステムを強化します。その後、製品は流通・販売チャネルを通じて配布され、顧客サイトでの導入と設置が行われます。運用とサービスはシステムの機能と保守を確保し、エンドユーザーアプリケーションはセキュリティ、交通、スマートシティなどの分野での実用化を推進し、継続的な改善のためのフィードバックを提供します。

市場シェア分析

提供内容の見通し

提供内容に基づいて、市場はハードウェア、ソフトウェア、およびサービスに分類されます。

ハードウェア - エッジAIスマートカメラと特殊センサー

イントロダクション:

ハードウェアは、高度なスマートカメラ、AIを組み込んだセンサー、専用推論チップなどで構成される、Video as a Sensor(VaaS)エコシステムの基盤であり続けています。これらのデバイスは、エッジで初期データキャプチャと超低遅延処理を実行し、クラウド接続への依存を軽減しながら、イベントの即時検知を可能にし、プライバシーを強化します。

主な動向と動向:

- トレンド:AI機能を統合したスマートセンサーが標準になりつつあり、デバイスが生のビデオを送信せずに動き、音、環境の異常などの特定の状況を自律的に検出できるようになり、データ効率とプライバシーが向上します。

- ニュース:CES 2025で、Bosch SensortecはエッジAI機能を備えた次世代MEMSセンサーを発表し、クラウドへの生データの継続的なストリーミングを必要としないリアルタイム検出機能を実演しました。

ソフトウェア - 予測的およびコンテキストビデオ分析

イントロダクション:

ソフトウェアは、物体検出、行動モデリング、異常予測といった分析ツールを用いて、生の視覚データを実用的なインテリジェンスへと変換します。このレイヤーにより、VaaSシステムは、単に受動的に記録するだけでなく、インシデントを検知・予測できるようになります。

主な動向と動向:

- トレンド:AIを活用した分析プラットフォームは予測的な行動検出に移行しており、暴力、健康危機、安全リスクを示すパターンを識別して、インシデントが拡大する前に早期に警告を発することができます。

- ニュース:2025年6月、ラウドン郡(バージニア州)は、いじめ、喧嘩、生徒の苦痛の兆候をリアルタイムで検出し、人間によるレビューを通じてアラートをトリアージしてより正確な対応を行うVOLT AI搭載の学校用カメラを導入しました。

製品の見通し

製品に基づいて、市場はビデオ監視、マシンビジョンとモニタリング、サーマルイメージング、およびハイパースペクトルイメージングに分類されます。

ビデオ監視

ビデオ監視はVaaSエコシステムの中核アプリケーションであり続け、従来のCCTVを、自律性と分析機能の向上を伴うインテリジェントなリアルタイムセンサーへと変革します。これらのシステムは、スマートシティ、交通網、小売業、そして重要インフラにおいて、セキュリティ脅威の検知、行動動向の監視、そして公共の安全管理に活用されています。

- 傾向:

AI駆動型エッジ分析 - 監視カメラには、物体検出、動作分析、イベントトリガーのためのカメラ内分析機能が組み込まれているため、継続的なクラウドストリーミングの必要性が軽減されます。

例えば:

CES 2025におけるBosch Sensortecに関するFierce Electronicsのレポートでは、エッジでAI推論を実行するMEMSセンサーが、ジェスチャー検出や転倒アラートなどのスマート監視機能をカメラモジュール上で直接可能にすると説明されています。

ハイパースペクトルイメージング

ハイパースペクトルイメージングセンサーは、広範囲の視覚情報をキャプチャし、VaaSソリューションで化学特性、材料特性、植物の健康状態、環境異常を検出できるようにします。これは、農業、防衛、鉱業、環境監視にとって重要です。

- 傾向:

宇宙ベースの機能 - 小型化されたハイパースペクトルセンサーパッケージが、地球規模の監視用の小型衛星に搭載されるようになりました。

例えば:

インドの宇宙技術企業Pixxelは、地球観測用のハイパースペクトルCubeSatを打ち上げる契約を2024年9月にNASAから獲得しました。これは政府と民間部門の投資を象徴するものです。

最終用途の見通し

最終用途に基づいて、市場は商業、工業、政府、およびその他の最終用途に分類されます。

政府

VaaSの政府機関による最終用途は、公共安全、法執行、国境管理、インフラ監視など多岐にわたります。世界中の政府機関は、エッジAIを搭載したインテリジェントビデオシステムを導入し、脅威検知の自動化、状況認識の向上、緊急対応の改善に取り組んでいます。これらのソリューションは、監視ネットワーク、交通ハブ、そして重要な公共資産に統合され、増大するセキュリティ課題や公共安全上の義務に対応しています。

主な動向と動向:

- トレンド:リアルタイムの行動と脅威の検出、犯罪の削減、対応時間の改善が可能なAI搭載の公共監視ネットワークの拡大。

例えば、ロンドンは2025年3月、各行政区のCCTVネットワークをAI搭載カメラでアップグレードするために3,040万ポンドを投資しました。これは、反社会的行動、武器、群衆の異常を特定することを目的としています。ハマースミス&フラム地区の2,500台のカメラを含むこのシステムは、予防的な警察活動を支援するように設計されています。

商業

商業におけるVaaSの最終用途は、オフィスビル、キャンパス、ショッピングモール、ホテル、交通ハブなど多岐にわたります。商業施設におけるVaaSは、セキュリティ、施設管理、占有状況の追跡、運用効率の向上に活用されており、リアルタイムのビジュアルインテリジェンスを活用したスマートビルディングやESG(環境・社会・ガバナンス)イニシアチブの重要な推進力となりつつあります。

- トレンド:占有率、スペース利用率、エネルギー効率を監視するために、ビデオセンサーがビル管理システムに統合されています。

例えば、2023年のCBREレポートによると、オフィスの平均稼働率は35%に低下し、商業不動産業界ではVaaSシステムの導入が加速しています。スマートビルディング分析プラットフォームは、ESG目標達成のために、稼働率とHVAC(暖房換気空調)および照明を連携させています。

用途の見通し

用途に基づいて、市場はセキュリティと監視、交通管理、小売分析、ヘルスケア、製造、マッピング、およびその他の用途に分類されます。

セキュリティと監視

セキュリティおよび監視アプリケーションは、世界中でVideo as a Sensor(VaaS)テクノロジーの導入を促進する主要な使用事例であり続けています。都市化の進展、地政学的緊張、そして様々な地域における犯罪率の上昇に伴い、エッジ分析とリアルタイム警報システムを統合したスマート監視ソリューションへの需要が高まっています。従来のCCTVシステムからAIを活用したセンサー駆動型ビデオネットワークへの移行は、公共部門と民間部門の両方のセキュリティインフラに変革をもたらしています。

- トレンド:AIを活用したビデオ分析は、受動的な監視をプロアクティブな脅威検知に置き換えつつあり、セキュリティシステムは異常な行動、不審な物体、境界侵入をリアルタイムで特定できます。これらのシステムは現在、都市監視、空港、重要インフラなどで広く導入されています。

例えば、2025年3月、シンガポールのチャンギ空港は、乗客の不規則な動きを認識し、当局に即座に警告を発することができる次世代AIベースのビデオ監視システムを導入しました。これにより、スループットを損なうことなく航空の安全性が向上します。

交通管理

Video as a Sensor(VaaS)技術は、交通システムのリアルタイム監視、予測分析、自律制御を可能にすることで、交通管理に革命をもたらしています。世界の都市化と車両密度の増加に伴い、従来の交通管理ソリューションはもはや通用しなくなっています。スマートシティでは、渋滞管理、道路安全の向上、公共交通ネットワークの最適化のために、ビデオベースのセンサーとAI駆動型プラットフォームを統合しています。これらのシステムにより、当局は事故検知、車両の流れの監視、交通規則の施行、動的なルート案内などを行うことができます。

主な動向と動向:

- トレンド:AIを活用したビデオ分析システムは、信号無視、スピード違反、逆走などの交通違反をリアルタイムで検出するためにますます利用されており、これにより法執行機関への依存が減り、規則の遵守が向上します。

たとえば、2025年2月、マドリードは違反を自動的に検出して映像を市当局に送信する高度なAI交通監視システムを導入し、処理時間を70%削減しました。

地域の見通し

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAの4地域にまたがって分析されています。北米セグメントは、2024年のVideo as a Sensor市場において34.2%の収益シェアを記録しました。高度な監視技術の普及とセキュリティインフラへの投資増加が、この地域全体の市場成長を牽引しています。防衛、輸送、重要インフラなど、多くの業界では、監視と状況認識を強化するために、ビデオベースのセンサー技術が活用されています。

市場競争と特性

Video as a Sensor市場は、革新的なスタートアップ企業や地域企業による健全な競合が繰り広げられています。これらの企業は、交通監視、スマートシティ、産業監視といった特殊なアプリケーションに注力しています。市場はAIを活用したビデオ分析、エッジコンピューティング、リアルタイムデータ処理といった技術革新を促進し、機敏でニッチな分野に特化した企業が存在感を確立するための成長機会を生み出しています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ:

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 市場動向世界のVideo as a Sensor市場

第5章 競合の状況世界のVideo as a Sensor市場

第6章 Video as a Sensor市場における市場統合分析

第7章 製品ライフサイクル分析 - Video as a Sensor市場

第8章 競合分析 - 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 市場シェア分析 2024年

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターファイブフォース分析

第9章 Video as a Sensor市場におけるバリューチェーン分析

- 研究開発と技術開発

- 部品製造

- システム統合

- ソフトウェアと分析開発

- 流通・販売

- 展開とインストール

- オペレーションとサービス

- 最終用途アプリケーション

第10章 主な顧客基準 - 世界のVideo as a Sensor市場

第11章 世界のVideo as a Sensor市場:提供内容別

- 世界のハードウェア市場:地域別

- 世界のソフトウェア市場:地域別

- 世界のサービス市場:地域別

第12章 世界のVideo as a Sensor市場:製品別

- 世界のビデオ監視市場:地域別

- 世界のマシンビジョンとモニタリング市場:地域別

- 世界のサーマルイメージング市場:地域別

- 世界のハイパースペクトルイメージング市場:地域別

第13章 世界のVideo as a Sensor市場:最終用途別

- 世界の商業市場:地域別

- 世界の産業市場:地域別

- 世界の政府市場:地域別

- 世界のその他の最終用途市場:地域別

第14章 世界のVideo as a Sensor市場:用途別

- 世界のセキュリティおよび監視市場:地域別

- 世界の交通管理市場:地域別

- 世界の小売分析市場:地域別

- 世界のヘルスケア市場:地域別

- 世界の製造市場:地域別

- 世界のマッピング市場:地域別

- 世界のその他の用途市場:地域別

第15章 世界のVideo as a Sensor市場:地域別

- 北米

- 影響を与える主な要因

- 北米の市場動向

- 北米における競合の現状

- 主要顧客基準-北米

- 北米のVideo as a Sensor市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米のVideo as a Sensor市場:国別

- 欧州

- 影響を与える主な要因

- 欧州の主要市場動向

- 欧州における競合の現状

- 主要顧客基準 - 欧州

- 欧州のVideo as a Sensor市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州のVideo as a Sensor市場:国別

- アジア太平洋地域

- 影響を与える主な要因

- アジア太平洋地域の主要市場動向

- アジア太平洋地域の競合状況

- 主要顧客基準 - アジア太平洋地域

- アジア太平洋のVideo as a Sensor市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋のVideo as a Sensor市場:国別

- ラテンアメリカ・中東・アフリカ

- 影響を与える主な要因

- LAMEAにおける主要な市場動向

- LAMEAにおける競合の現状

- 主要顧客基準-LAMEA

- ラテンアメリカ・中東・アフリカのVideo as a Sensor市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカのVideo as a Sensor市場:国別

第16章 企業プロファイル

- Axis Communications AB(Canon, Inc)

- Motorola Solutions, Inc

- Hangzhou Hikvision Digital Technology Co, Ltd.

- Bosch Sicherheitssysteme GmbH(Robert Bosch GmbH)

- Zhejiang Dahua Technology Co, Ltd.

- Sony Semiconductor Solutions Corporation(Sony Corporation)

- Honeywell International, Inc

- Johnson Controls International PLC

- OmniVision Technologies, Inc

- i-PRO Co, Ltd.

第17章 Video as a Sensor市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 2 Global Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 3 Evaluation of Parameters: Video As A Sensor Market

- TABLE 4 Partnerships, Collaborations and Agreements- Video As A Sensor Market

- TABLE 5 Product Launches And Product Expansions- Video As A Sensor Market

- TABLE 6 Acquisition and Mergers- Video As A Sensor Market

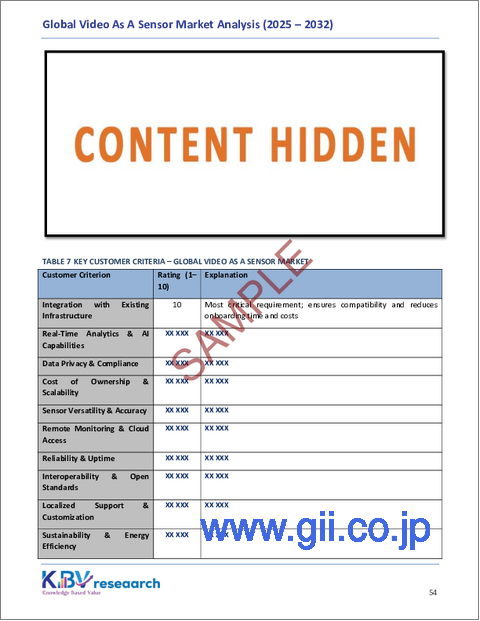

- TABLE 7 Key Customer Criteria - Global Video As A Sensor Market

- TABLE 8 Global Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 9 Global Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 10 Global Hardware Market by Region, 2021 - 2024, USD Million

- TABLE 11 Global Hardware Market by Region, 2025 - 2032, USD Million

- TABLE 12 Global Software Market by Region, 2021 - 2024, USD Million

- TABLE 13 Global Software Market by Region, 2025 - 2032, USD Million

- TABLE 14 Global Services Market by Region, 2021 - 2024, USD Million

- TABLE 15 Global Services Market by Region, 2025 - 2032, USD Million

- TABLE 16 Global Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 17 Global Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 18 Global Video Surveillance Market by Region, 2021 - 2024, USD Million

- TABLE 19 Global Video Surveillance Market by Region, 2025 - 2032, USD Million

- TABLE 20 Global Machine Vision & Monitoring Market by Region, 2021 - 2024, USD Million

- TABLE 21 Global Machine Vision & Monitoring Market by Region, 2025 - 2032, USD Million

- TABLE 22 Global Thermal Imaging Market by Region, 2021 - 2024, USD Million

- TABLE 23 Global Thermal Imaging Market by Region, 2025 - 2032, USD Million

- TABLE 24 Global Hyperspectral Imaging Market by Region, 2021 - 2024, USD Million

- TABLE 25 Global Hyperspectral Imaging Market by Region, 2025 - 2032, USD Million

- TABLE 26 Global Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 27 Global Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 28 Global Commercial Market by Region, 2021 - 2024, USD Million

- TABLE 29 Global Commercial Market by Region, 2025 - 2032, USD Million

- TABLE 30 Global Industrial Market by Region, 2021 - 2024, USD Million

- TABLE 31 Global Industrial Market by Region, 2025 - 2032, USD Million

- TABLE 32 Global Government Market by Region, 2021 - 2024, USD Million

- TABLE 33 Global Government Market by Region, 2025 - 2032, USD Million

- TABLE 34 Global Other End-Use Market by Region, 2021 - 2024, USD Million

- TABLE 35 Global Other End-Use Market by Region, 2025 - 2032, USD Million

- TABLE 36 Global Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 37 Global Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 38 Global Security & Surveillance Market by Region, 2021 - 2024, USD Million

- TABLE 39 Global Security & Surveillance Market by Region, 2025 - 2032, USD Million

- TABLE 40 Global Traffic Management Market by Region, 2021 - 2024, USD Million

- TABLE 41 Global Traffic Management Market by Region, 2025 - 2032, USD Million

- TABLE 42 Global Retail Analytics Market by Region, 2021 - 2024, USD Million

- TABLE 43 Global Retail Analytics Market by Region, 2025 - 2032, USD Million

- TABLE 44 Global Healthcare Market by Region, 2021 - 2024, USD Million

- TABLE 45 Global Healthcare Market by Region, 2025 - 2032, USD Million

- TABLE 46 Global Manufacturing Market by Region, 2021 - 2024, USD Million

- TABLE 47 Global Manufacturing Market by Region, 2025 - 2032, USD Million

- TABLE 48 Global Mapping Market by Region, 2021 - 2024, USD Million

- TABLE 49 Global Mapping Market by Region, 2025 - 2032, USD Million

- TABLE 50 Global Other Application Market by Region, 2021 - 2024, USD Million

- TABLE 51 Global Other Application Market by Region, 2025 - 2032, USD Million

- TABLE 52 Global Video As A Sensor Market by Region, 2021 - 2024, USD Million

- TABLE 53 Global Video As A Sensor Market by Region, 2025 - 2032, USD Million

- TABLE 54 North America Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 55 North America Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 56 Key Customer Criteria - North America Video As A Sensor Market

- TABLE 57 North America Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 58 North America Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 59 North America Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 60 North America Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 61 North America Software Market by Country, 2021 - 2024, USD Million

- TABLE 62 North America Software Market by Country, 2025 - 2032, USD Million

- TABLE 63 North America Services Market by Country, 2021 - 2024, USD Million

- TABLE 64 North America Services Market by Country, 2025 - 2032, USD Million

- TABLE 65 North America Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 66 North America Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 67 North America Video Surveillance Market by Region, 2021 - 2024, USD Million

- TABLE 68 North America Video Surveillance Market by Region, 2025 - 2032, USD Million

- TABLE 69 North America Machine Vision & Monitoring Market by Region, 2021 - 2024, USD Million

- TABLE 70 North America Machine Vision & Monitoring Market by Region, 2025 - 2032, USD Million

- TABLE 71 North America Thermal Imaging Market by Region, 2021 - 2024, USD Million

- TABLE 72 North America Thermal Imaging Market by Region, 2025 - 2032, USD Million

- TABLE 73 North America Hyperspectral Imaging Market by Region, 2021 - 2024, USD Million

- TABLE 74 North America Hyperspectral Imaging Market by Region, 2025 - 2032, USD Million

- TABLE 75 North America Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 76 North America Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 77 North America Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 78 North America Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 79 North America Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 80 North America Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 81 North America Government Market by Country, 2021 - 2024, USD Million

- TABLE 82 North America Government Market by Country, 2025 - 2032, USD Million

- TABLE 83 North America Other End-Use Market by Country, 2021 - 2024, USD Million

- TABLE 84 North America Other End-Use Market by Country, 2025 - 2032, USD Million

- TABLE 85 North America Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 86 North America Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 87 North America Security & Surveillance Market by Country, 2021 - 2024, USD Million

- TABLE 88 North America Security & Surveillance Market by Country, 2025 - 2032, USD Million

- TABLE 89 North America Traffic Management Market by Country, 2021 - 2024, USD Million

- TABLE 90 North America Traffic Management Market by Country, 2025 - 2032, USD Million

- TABLE 91 North America Retail Analytics Market by Country, 2021 - 2024, USD Million

- TABLE 92 North America Retail Analytics Market by Country, 2025 - 2032, USD Million

- TABLE 93 North America Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 94 North America Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 95 North America Manufacturing Market by Country, 2021 - 2024, USD Million

- TABLE 96 North America Manufacturing Market by Country, 2025 - 2032, USD Million

- TABLE 97 North America Mapping Market by Country, 2021 - 2024, USD Million

- TABLE 98 North America Mapping Market by Country, 2025 - 2032, USD Million

- TABLE 99 North America Other Application Market by Country, 2021 - 2024, USD Million

- TABLE 100 North America Other Application Market by Country, 2025 - 2032, USD Million

- TABLE 101 North America Video As A Sensor Market by Country, 2021 - 2024, USD Million

- TABLE 102 North America Video As A Sensor Market by Country, 2025 - 2032, USD Million

- TABLE 103 US Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 104 US Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 105 US Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 106 US Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 107 US Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 108 US Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 109 US Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 110 US Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 111 US Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 112 US Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 113 Canada Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 114 Canada Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 115 Canada Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 116 Canada Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 117 Canada Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 118 Canada Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 119 Canada Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 120 Canada Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 121 Canada Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 122 Canada Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 123 Mexico Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 124 Mexico Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 125 Mexico Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 126 Mexico Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 127 Mexico Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 128 Mexico Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 129 Mexico Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 130 Mexico Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 131 Mexico Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 132 Mexico Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 133 Rest of North America Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 134 Rest of North America Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 135 Rest of North America Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 136 Rest of North America Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 137 Rest of North America Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 138 Rest of North America Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 139 Rest of North America Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 140 Rest of North America Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 141 Rest of North America Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 142 Rest of North America Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 143 Europe Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 144 Europe Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 145 Key Customer Criteria - Europe Video As A Sensor Market

- TABLE 146 Europe Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 147 Europe Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 148 Europe Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 149 Europe Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 150 Europe Software Market by Country, 2021 - 2024, USD Million

- TABLE 151 Europe Software Market by Country, 2025 - 2032, USD Million

- TABLE 152 Europe Services Market by Country, 2021 - 2024, USD Million

- TABLE 153 Europe Services Market by Country, 2025 - 2032, USD Million

- TABLE 154 Europe Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 155 Europe Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 156 Europe Video Surveillance Market by Country, 2021 - 2024, USD Million

- TABLE 157 Europe Video Surveillance Market by Country, 2025 - 2032, USD Million

- TABLE 158 Europe Machine Vision & Monitoring Market by Country, 2021 - 2024, USD Million

- TABLE 159 Europe Machine Vision & Monitoring Market by Country, 2025 - 2032, USD Million

- TABLE 160 Europe Thermal Imaging Market by Country, 2021 - 2024, USD Million

- TABLE 161 Europe Thermal Imaging Market by Country, 2025 - 2032, USD Million

- TABLE 162 Europe Hyperspectral Imaging Market by Country, 2021 - 2024, USD Million

- TABLE 163 Europe Hyperspectral Imaging Market by Country, 2025 - 2032, USD Million

- TABLE 164 Europe Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 165 Europe Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 166 Europe Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 167 Europe Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 168 Europe Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 169 Europe Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 170 Europe Government Market by Country, 2021 - 2024, USD Million

- TABLE 171 Europe Government Market by Country, 2025 - 2032, USD Million

- TABLE 172 Europe Other End-Use Market by Country, 2021 - 2024, USD Million

- TABLE 173 Europe Other End-Use Market by Country, 2025 - 2032, USD Million

- TABLE 174 Europe Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 175 Europe Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 176 Europe Security & Surveillance Market by Country, 2021 - 2024, USD Million

- TABLE 177 Europe Security & Surveillance Market by Country, 2025 - 2032, USD Million

- TABLE 178 Europe Traffic Management Market by Country, 2021 - 2024, USD Million

- TABLE 179 Europe Traffic Management Market by Country, 2025 - 2032, USD Million

- TABLE 180 Europe Retail Analytics Market by Country, 2021 - 2024, USD Million

- TABLE 181 Europe Retail Analytics Market by Country, 2025 - 2032, USD Million

- TABLE 182 Europe Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 183 Europe Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 184 Europe Manufacturing Market by Country, 2021 - 2024, USD Million

- TABLE 185 Europe Manufacturing Market by Country, 2025 - 2032, USD Million

- TABLE 186 Europe Mapping Market by Country, 2021 - 2024, USD Million

- TABLE 187 Europe Mapping Market by Country, 2025 - 2032, USD Million

- TABLE 188 Europe Other Application Market by Country, 2021 - 2024, USD Million

- TABLE 189 Europe Other Application Market by Country, 2025 - 2032, USD Million

- TABLE 190 Europe Video As A Sensor Market by Country, 2021 - 2024, USD Million

- TABLE 191 Europe Video As A Sensor Market by Country, 2025 - 2032, USD Million

- TABLE 192 Germany Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 193 Germany Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 194 Germany Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 195 Germany Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 196 Germany Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 197 Germany Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 198 Germany Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 199 Germany Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 200 Germany Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 201 Germany Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 202 UK Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 203 UK Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 204 UK Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 205 UK Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 206 UK Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 207 UK Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 208 UK Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 209 UK Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 210 UK Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 211 UK Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 212 France Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 213 France Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 214 France Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 215 France Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 216 France Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 217 France Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 218 France Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 219 France Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 220 France Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 221 France Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 222 Russia Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 223 Russia Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 224 Russia Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 225 Russia Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 226 Russia Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 227 Russia Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 228 Russia Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 229 Russia Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 230 Russia Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 231 Russia Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 232 Spain Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 233 Spain Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 234 Spain Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 235 Spain Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 236 Spain Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 237 Spain Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 238 Spain Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 239 Spain Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 240 Spain Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 241 Spain Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 242 Italy Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 243 Italy Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 244 Italy Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 245 Italy Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 246 Italy Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 247 Italy Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 248 Italy Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 249 Italy Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 250 Italy Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 251 Italy Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 252 Rest of Europe Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 253 Rest of Europe Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 254 Rest of Europe Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 255 Rest of Europe Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 256 Rest of Europe Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 257 Rest of Europe Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 258 Rest of Europe Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 259 Rest of Europe Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 260 Rest of Europe Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 261 Rest of Europe Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 262 Asia Pacific Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 263 Asia Pacific Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 264 Key Customer Criteria - Asia Pacific Video As A Sensor Market

- TABLE 265 Asia Pacific Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 266 Asia Pacific Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 267 Asia Pacific Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 268 Asia Pacific Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 269 Asia Pacific Software Market by Country, 2021 - 2024, USD Million

- TABLE 270 Asia Pacific Software Market by Country, 2025 - 2032, USD Million

- TABLE 271 Asia Pacific Services Market by Country, 2021 - 2024, USD Million

- TABLE 272 Asia Pacific Services Market by Country, 2025 - 2032, USD Million

- TABLE 273 Asia Pacific Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 274 Asia Pacific Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 275 Asia Pacific Video Surveillance Market by Country, 2021 - 2024, USD Million

- TABLE 276 Asia Pacific Video Surveillance Market by Country, 2025 - 2032, USD Million

- TABLE 277 Asia Pacific Machine Vision & Monitoring Market by Country, 2021 - 2024, USD Million

- TABLE 278 Asia Pacific Machine Vision & Monitoring Market by Country, 2025 - 2032, USD Million

- TABLE 279 Asia Pacific Thermal Imaging Market by Country, 2021 - 2024, USD Million

- TABLE 280 Asia Pacific Thermal Imaging Market by Country, 2025 - 2032, USD Million

- TABLE 281 Asia Pacific Hyperspectral Imaging Market by Country, 2021 - 2024, USD Million

- TABLE 282 Asia Pacific Hyperspectral Imaging Market by Country, 2025 - 2032, USD Million

- TABLE 283 Asia Pacific Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 284 Asia Pacific Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 285 Asia Pacific Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 286 Asia Pacific Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 287 Asia Pacific Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 288 Asia Pacific Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 289 Asia Pacific Government Market by Country, 2021 - 2024, USD Million

- TABLE 290 Asia Pacific Government Market by Country, 2025 - 2032, USD Million

- TABLE 291 Asia Pacific Other End-Use Market by Country, 2021 - 2024, USD Million

- TABLE 292 Asia Pacific Other End-Use Market by Country, 2025 - 2032, USD Million

- TABLE 293 Asia Pacific Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 294 Asia Pacific Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 295 Asia Pacific Security & Surveillance Market by Country, 2021 - 2024, USD Million

- TABLE 296 Asia Pacific Security & Surveillance Market by Country, 2025 - 2032, USD Million

- TABLE 297 Asia Pacific Traffic Management Market by Country, 2021 - 2024, USD Million

- TABLE 298 Asia Pacific Traffic Management Market by Country, 2025 - 2032, USD Million

- TABLE 299 Asia Pacific Retail Analytics Market by Country, 2021 - 2024, USD Million

- TABLE 300 Asia Pacific Retail Analytics Market by Country, 2025 - 2032, USD Million

- TABLE 301 Asia Pacific Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 302 Asia Pacific Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 303 Asia Pacific Manufacturing Market by Country, 2021 - 2024, USD Million

- TABLE 304 Asia Pacific Manufacturing Market by Country, 2025 - 2032, USD Million

- TABLE 305 Asia Pacific Mapping Market by Country, 2021 - 2024, USD Million

- TABLE 306 Asia Pacific Mapping Market by Country, 2025 - 2032, USD Million

- TABLE 307 Asia Pacific Other Application Market by Country, 2021 - 2024, USD Million

- TABLE 308 Asia Pacific Other Application Market by Country, 2025 - 2032, USD Million

- TABLE 309 Asia Pacific Video As A Sensor Market by Country, 2021 - 2024, USD Million

- TABLE 310 Asia Pacific Video As A Sensor Market by Country, 2025 - 2032, USD Million

- TABLE 311 China Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 312 China Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 313 China Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 314 China Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 315 China Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 316 China Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 317 China Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 318 China Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 319 China Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 320 China Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 321 Japan Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 322 Japan Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 323 Japan Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 324 Japan Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 325 Japan Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 326 Japan Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 327 Japan Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 328 Japan Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 329 Japan Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 330 Japan Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 331 India Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 332 India Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 333 India Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 334 India Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 335 India Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 336 India Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 337 India Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 338 India Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 339 India Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 340 India Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 341 South Korea Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 342 South Korea Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 343 South Korea Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 344 South Korea Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 345 South Korea Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 346 South Korea Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 347 South Korea Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 348 South Korea Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 349 South Korea Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 350 South Korea Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 351 Singapore Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 352 Singapore Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 353 Singapore Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 354 Singapore Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 355 Singapore Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 356 Singapore Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 357 Singapore Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 358 Singapore Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 359 Singapore Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 360 Singapore Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 361 Malaysia Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 362 Malaysia Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 363 Malaysia Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 364 Malaysia Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 365 Malaysia Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 366 Malaysia Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 367 Malaysia Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 368 Malaysia Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 369 Malaysia Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 370 Malaysia Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 371 Rest of Asia Pacific Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 372 Rest of Asia Pacific Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 373 Rest of Asia Pacific Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 374 Rest of Asia Pacific Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 375 Rest of Asia Pacific Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 376 Rest of Asia Pacific Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 377 Rest of Asia Pacific Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 378 Rest of Asia Pacific Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 379 Rest of Asia Pacific Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 380 Rest of Asia Pacific Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 381 LAMEA Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 382 LAMEA Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 383 Key Customer Criteria - LAMEA Video As A Sensor Market

- TABLE 384 LAMEA Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 385 LAMEA Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 386 LAMEA Hardware Market by Country, 2021 - 2024, USD Million

- TABLE 387 LAMEA Hardware Market by Country, 2025 - 2032, USD Million

- TABLE 388 LAMEA Software Market by Country, 2021 - 2024, USD Million

- TABLE 389 LAMEA Software Market by Country, 2025 - 2032, USD Million

- TABLE 390 LAMEA Services Market by Country, 2021 - 2024, USD Million

- TABLE 391 LAMEA Services Market by Country, 2025 - 2032, USD Million

- TABLE 392 LAMEA Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 393 LAMEA Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 394 LAMEA Video Surveillance Market by Country, 2021 - 2024, USD Million

- TABLE 395 LAMEA Video Surveillance Market by Country, 2025 - 2032, USD Million

- TABLE 396 LAMEA Machine Vision & Monitoring Market by Country, 2021 - 2024, USD Million

- TABLE 397 LAMEA Machine Vision & Monitoring Market by Country, 2025 - 2032, USD Million

- TABLE 398 LAMEA Thermal Imaging Market by Country, 2021 - 2024, USD Million

- TABLE 399 LAMEA Thermal Imaging Market by Country, 2025 - 2032, USD Million

- TABLE 400 LAMEA Hyperspectral Imaging Market by Country, 2021 - 2024, USD Million

- TABLE 401 LAMEA Hyperspectral Imaging Market by Country, 2025 - 2032, USD Million

- TABLE 402 LAMEA Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 403 LAMEA Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 404 LAMEA Commercial Market by Country, 2021 - 2024, USD Million

- TABLE 405 LAMEA Commercial Market by Country, 2025 - 2032, USD Million

- TABLE 406 LAMEA Industrial Market by Country, 2021 - 2024, USD Million

- TABLE 407 LAMEA Industrial Market by Country, 2025 - 2032, USD Million

- TABLE 408 LAMEA Government Market by Country, 2021 - 2024, USD Million

- TABLE 409 LAMEA Government Market by Country, 2025 - 2032, USD Million

- TABLE 410 LAMEA Other End-Use Market by Country, 2021 - 2024, USD Million

- TABLE 411 LAMEA Other End-Use Market by Country, 2025 - 2032, USD Million

- TABLE 412 LAMEA Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 413 LAMEA Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 414 LAMEA Security & Surveillance Market by Country, 2021 - 2024, USD Million

- TABLE 415 LAMEA Security & Surveillance Market by Country, 2025 - 2032, USD Million

- TABLE 416 LAMEA Traffic Management Market by Country, 2021 - 2024, USD Million

- TABLE 417 LAMEA Traffic Management Market by Country, 2025 - 2032, USD Million

- TABLE 418 LAMEA Retail Analytics Market by Country, 2021 - 2024, USD Million

- TABLE 419 LAMEA Retail Analytics Market by Country, 2025 - 2032, USD Million

- TABLE 420 LAMEA Healthcare Market by Country, 2021 - 2024, USD Million

- TABLE 421 LAMEA Healthcare Market by Country, 2025 - 2032, USD Million

- TABLE 422 LAMEA Manufacturing Market by Country, 2021 - 2024, USD Million

- TABLE 423 LAMEA Manufacturing Market by Country, 2025 - 2032, USD Million

- TABLE 424 LAMEA Mapping Market by Country, 2021 - 2024, USD Million

- TABLE 425 LAMEA Mapping Market by Country, 2025 - 2032, USD Million

- TABLE 426 LAMEA Other Application Market by Country, 2021 - 2024, USD Million

- TABLE 427 LAMEA Other Application Market by Country, 2025 - 2032, USD Million

- TABLE 428 LAMEA Video As A Sensor Market by Country, 2021 - 2024, USD Million

- TABLE 429 LAMEA Video As A Sensor Market by Country, 2025 - 2032, USD Million

- TABLE 430 Brazil Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 431 Brazil Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 432 Brazil Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 433 Brazil Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 434 Brazil Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 435 Brazil Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 436 Brazil Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 437 Brazil Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 438 Brazil Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 439 Brazil Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 440 Argentina Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 441 Argentina Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 442 Argentina Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 443 Argentina Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 444 Argentina Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 445 Argentina Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 446 Argentina Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 447 Argentina Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 448 Argentina Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 449 Argentina Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 450 UAE Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 451 UAE Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 452 UAE Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 453 UAE Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 454 UAE Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 455 UAE Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 456 UAE Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 457 UAE Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 458 UAE Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 459 UAE Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 460 Saudi Arabia Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 461 Saudi Arabia Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 462 Saudi Arabia Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 463 Saudi Arabia Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 464 Saudi Arabia Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 465 Saudi Arabia Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 466 Saudi Arabia Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 467 Saudi Arabia Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 468 Saudi Arabia Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 469 Saudi Arabia Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 470 South Africa Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 471 South Africa Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 472 South Africa Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 473 South Africa Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 474 South Africa Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 475 South Africa Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 476 South Africa Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 477 South Africa Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 478 South Africa Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 479 South Africa Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 480 Nigeria Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 481 Nigeria Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 482 Nigeria Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 483 Nigeria Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 484 Nigeria Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 485 Nigeria Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 486 Nigeria Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 487 Nigeria Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 488 Nigeria Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 489 Nigeria Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 490 Rest of LAMEA Video As A Sensor Market, 2021 - 2024, USD Million

- TABLE 491 Rest of LAMEA Video As A Sensor Market, 2025 - 2032, USD Million

- TABLE 492 Rest of LAMEA Video As A Sensor Market by Offering, 2021 - 2024, USD Million

- TABLE 493 Rest of LAMEA Video As A Sensor Market by Offering, 2025 - 2032, USD Million

- TABLE 494 Rest of LAMEA Video As A Sensor Market by Product, 2021 - 2024, USD Million

- TABLE 495 Rest of LAMEA Video As A Sensor Market by Product, 2025 - 2032, USD Million

- TABLE 496 Rest of LAMEA Video As A Sensor Market by End-Use, 2021 - 2024, USD Million

- TABLE 497 Rest of LAMEA Video As A Sensor Market by End-Use, 2025 - 2032, USD Million

- TABLE 498 Rest of LAMEA Video As A Sensor Market by Application, 2021 - 2024, USD Million

- TABLE 499 Rest of LAMEA Video As A Sensor Market by Application, 2025 - 2032, USD Million

- TABLE 500 Key Information - Axis Communications AB

- TABLE 501 Key Information - Motorola Solutions, Inc.

- TABLE 502 Key Information - Hangzhou Hikvision Digital Technology Co., Ltd.

- TABLE 503 Key Information - Bosch Sicherheitssysteme GmbH

- TABLE 504 Key Information - Zhejiang Dahua Technology Co., Ltd.

- TABLE 505 Key Information - Sony Semiconductor Solutions Corporation

- TABLE 506 Key Information - Honeywell International, Inc.

- TABLE 507 Key Information - Johnson Controls International PLC

- TABLE 508 Key Information - OmniVision Technologies, Inc.

- TABLE 509 Key Information - i-PRO Co., Ltd.

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Video As A Sensor Market, 2021 - 2032, USD Million

- FIG 3 Key Factors Impacting in Global Video As A Sensor Market

- FIG 4 Market Consolidation Analysis

- FIG 5 Product Life Cycle Analysis - Video as a Sensor Market

- FIG 6 KBV Cardinal Matrix

- FIG 7 Market Share Analysis, 2024

- FIG 8 Key Leading Strategies: Percentage Distribution (2021-2025)

- FIG 9 Key Strategic Move: (Product Launches and Product Expansions: 2021, Feb - 2025, Jun) Leading Players

- FIG 10 Porter's Five Forces Analysis - Video As A Sensor Market

- FIG 11 Value Chain Analysis of Video As A Sensor Market

- FIG 12 Key Customer Criteria - Global Video As A Sensor Market

- FIG 13 Global Video As A Sensor Market share by Offering, 2024

- FIG 14 Global Video As A Sensor Market share by Offering, 2032

- FIG 15 Global Video As A Sensor Market by Offering, 2021 - 2032, USD Million

- FIG 16 Global Video As A Sensor Market share by Product, 2024

- FIG 17 Global Video As A Sensor Market share by Product, 2032

- FIG 18 Global Video As A Sensor Market by Product, 2021 - 2032, USD Million

- FIG 19 Global Video As A Sensor Market share by End-Use, 2024

- FIG 20 Global Video As A Sensor Market share by End-Use, 2032

- FIG 21 Global Video As A Sensor Market by End-Use, 2021 - 2032, USD Million

- FIG 22 Global Video As A Sensor Market share by Application, 2024

- FIG 23 Global Video As A Sensor Market share by Application, 2032

- FIG 24 Global Video As A Sensor Market by Application, 2021 - 2032, USD Million

- FIG 25 Global Video As A Sensor Market share by Region, 2024

- FIG 26 Global Video As A Sensor Market share by Region, 2032

- FIG 27 Global Video As A Sensor Market by Region, 2021 - 2032, USD Million

- FIG 28 North America Video As A Sensor Market, 2021 - 2032, USD Million

- FIG 29 Key Factors Impacting in North America Video As A Sensor Market

- FIG 30 Key Customer Criteria - North America Video As A Sensor Market

- FIG 31 North America Video As A Sensor Market share by Offering, 2024

- FIG 32 North America Video As A Sensor Market share by Offering, 2032

- FIG 33 North America Video As A Sensor Market by Offering, 2021 - 2032, USD Million

- FIG 34 North America Video As A Sensor Market share by Product, 2024

- FIG 35 North America Video As A Sensor Market share by Product, 2032

- FIG 36 North America Video As A Sensor Market by Product, 2021 - 2032, USD Million

- FIG 37 North America Video As A Sensor Market share by End-Use, 2024

- FIG 38 North America Video As A Sensor Market share by End-Use, 2032

- FIG 39 North America Video As A Sensor Market by End-Use, 2021 - 2032, USD Million

- FIG 40 North America Video As A Sensor Market share by Application, 2024

- FIG 41 North America Video As A Sensor Market share by Application, 2032

- FIG 42 North America Video As A Sensor Market by Application, 2021 - 2032, USD Million

- FIG 43 North America Video As A Sensor Market share by Country, 2024

- FIG 44 North America Video As A Sensor Market share by Country, 2032

- FIG 45 North America Video As A Sensor Market by Country, 2021 - 2032, USD Million

- FIG 46 Europe Video As A Sensor Market, 2021 - 2032, USD Million

- FIG 47 Key Factors Impacting in Europe Video As A Sensor Market

- FIG 48 Key Customer Criteria - Europe Video As A Sensor Market

- FIG 49 Europe Video As A Sensor Market share by Offering, 2024

- FIG 50 Europe Video As A Sensor Market share by Offering, 2032

- FIG 51 Europe Video As A Sensor Market by Offering, 2021 - 2032, USD Million

- FIG 52 Europe Video As A Sensor Market share by Product, 2024

- FIG 53 Europe Video As A Sensor Market share by Product, 2032

- FIG 54 Europe Video As A Sensor Market by Product, 2021 - 2032, USD Million

- FIG 55 Europe Video As A Sensor Market share by End-Use, 2024

- FIG 56 Europe Video As A Sensor Market share by End-Use, 2032

- FIG 57 Europe Video As A Sensor Market by End-Use, 2021 - 2032, USD Million

- FIG 58 Europe Video As A Sensor Market share by Application, 2024

- FIG 59 Europe Video As A Sensor Market share by Application, 2032

- FIG 60 Europe Video As A Sensor Market by Application, 2021 - 2032, USD Million

- FIG 61 Europe Video As A Sensor Market share by Country, 2024

- FIG 62 Europe Video As A Sensor Market share by Country, 2032

- FIG 63 Europe Video As A Sensor Market by Country, 2021 - 2032, USD Million

- FIG 64 Asia Pacific Video As A Sensor Market, 2021 - 2032, USD Million

- FIG 65 Key Factors Impacting in Asia Pacific Video As A Sensor Market

- FIG 66 Key Customer Criteria - Asia Pacific Video As A Sensor Market

- FIG 67 Asia Pacific Video As A Sensor Market share by Offering, 2024

- FIG 68 Asia Pacific Video As A Sensor Market share by Offering, 2032

- FIG 69 Asia Pacific Video As A Sensor Market by Offering, 2021 - 2032, USD Million

- FIG 70 Asia Pacific Video As A Sensor Market share by Product, 2024

- FIG 71 Asia Pacific Video As A Sensor Market share by Product, 2032

- FIG 72 Asia Pacific Video As A Sensor Market by Product, 2021 - 2032, USD Million

- FIG 73 Asia Pacific Video As A Sensor Market share by End-Use, 2024

- FIG 74 Asia Pacific Video As A Sensor Market share by End-Use, 2032

- FIG 75 Asia Pacific Video As A Sensor Market by End-Use, 2021 - 2032, USD Million

- FIG 76 Asia Pacific Video As A Sensor Market share by Application, 2024

- FIG 77 Asia Pacific Video As A Sensor Market share by Application, 2032

- FIG 78 Asia Pacific Video As A Sensor Market by Application, 2021 - 2032, USD Million

- FIG 79 Asia Pacific Video As A Sensor Market share by Country, 2024

- FIG 80 Asia Pacific Video As A Sensor Market share by Country, 2032

- FIG 81 Asia Pacific Video As A Sensor Market by Country, 2021 - 2032, USD Million

- FIG 82 LAMEA Video As A Sensor Market, 2021 - 2032, USD Million

- FIG 83 Key Factors Impacting in LAMEA Video As A Sensor Market

- FIG 84 Key Customer Criteria - LAMEA Video As A Sensor Market

- FIG 85 LAMEA Video As A Sensor Market share by Offering, 2024

- FIG 86 LAMEA Video As A Sensor Market share by Offering, 2032

- FIG 87 LAMEA Video As A Sensor Market by Offering, 2021 - 2032, USD Million

- FIG 88 LAMEA Video As A Sensor Market share by Product, 2024

- FIG 89 LAMEA Video As A Sensor Market share by Product, 2032

- FIG 90 LAMEA Video As A Sensor Market by Product, 2021 - 2032, USD Million

- FIG 91 LAMEA Video As A Sensor Market share by End-Use, 2024

- FIG 92 LAMEA Video As A Sensor Market share by End-Use, 2032

- FIG 93 LAMEA Video As A Sensor Market by End-Use, 2021 - 2032, USD Million

- FIG 94 LAMEA Video As A Sensor Market share by Application, 2024

- FIG 95 LAMEA Video As A Sensor Market share by Application, 2032

- FIG 96 LAMEA Video As A Sensor Market by Application, 2021 - 2032, USD Million

- FIG 97 LAMEA Video As A Sensor Market share by Country, 2024

- FIG 98 LAMEA Video As A Sensor Market share by Country, 2032

- FIG 99 LAMEA Video As A Sensor Market by Country, 2021 - 2032, USD Million

- FIG 100 Recent strategies and developments: Axis Communications AB

- FIG 101 SWOT Analysis: Axis Communications AB

- FIG 102 Recent strategies and developments: Motorola Solutions, Inc.

- FIG 103 Swot Analysis: Motorola Solutions, Inc.

- FIG 104 Recent strategies and developments: Hangzhou Hikvision Digital Technology Co., Ltd.

- FIG 105 SWOT Analysis: Hangzhou Hikvision Digital Technology Co., Ltd.

- FIG 106 Recent strategies and developments: Bosch Sicherheitssysteme GmbH

- FIG 107 SWOT Analysis: Zhejiang Dahua Technology Co., Ltd.

- FIG 108 SWOT Analysis: Honeywell international, inc.

- FIG 109 SWOT Analysis: Johnson Controls International PLC

- FIG 110 SWOT Analysis: OmniVision Technologies, Inc.

The Global Video as a Sensor Market size is expected to reach $131.73 billion by 2032, rising at a market growth of 8.1% CAGR during the forecast period.

Key Highlights:

- The North America market dominated the Global Video as a Sensor Market in 2024, accounting for a 34.2% revenue share in 2024.

- The U.S. market is projected to maintain its leadership in North America, reaching a market size of USD 31 billion by 2032.

- Among the various Offering, the Hardware segment dominated the global market, contributing a revenue share of 53.9% in 2024.

- In terms of Product, Video Surveillance segment are expected to lead the global market, with a projected revenue share of 42.9% by 2032.

- The Commercial sector emerged as the leading end-use in 2024, capturing a 45.4% revenue share, and is projected to retain its dominance during the forecast period.

- The Security & Surveillance sector in Application is poised to grow at the market in 2032 with a revenue share of 36.1% and is projected to maintain its dominant position throughout the forecast period.

The concept of using video as a sensor has evolved significantly over the past century, starting from basic surveillance systems and transforming into intelligent sensing solutions. Early CCTV systems were primarily used for passive observation, with origins dating back to 1927 when mechanical surveillance was used to monitor sensitive areas.

By the mid-20th century, commercial solutions like the Vericon system enabled wired monitoring in civilian settings. However, the true shift occurred with the advent of networked video systems, particularly following Axis Communications' introduction of the first IP camera in 1996. This innovation marked a pivotal moment, as it introduced the idea of transmitting video over internet protocols, allowing for remote access, better resolution, and scalability.

Over time, these systems became more sophisticated, incorporating embedded Linux, enabling in-camera processing, and eventually facilitating edge analytics. The formation of the ONVIF consortium by Axis, Bosch, and Sony in 2008 further accelerated progress by promoting interoperability and standardized interfaces. Simultaneously, governments began exploring the integration of AI into video systems.

U.S. Department of Transportation and Department of Energy programs invested in real-time video analysis for applications like traffic monitoring, public safety, and infrastructure security. These efforts gave rise to city-wide networks such as Chicago's Operation Virtual Shield and New York's Domain Awareness System, which interconnected thousands of cameras and data feeds to provide predictive policing and emergency response capabilities.

Concurrently, OEMs such as NVIDIA launched the Jetson AI platform, transforming cameras into intelligent edge devices capable of object recognition and anomaly detection without requiring constant cloud access. As a result, video systems began to function as active sensors, detecting motion, identifying objects, analyzing behaviors, and feeding data into broader Internet of Things (IoT) ecosystems.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2025, Honeywell International Inc. unveiled a new line of CCTV cameras manufactured in India, incorporating AI-driven analytics for enhanced surveillance. These cameras are designed to deliver high-resolution video feeds, enabling real-time monitoring and intelligent data analysis. This initiative supports the growing demand for advanced video surveillance solutions in India. Moreover, In May, 2025, Axis Communications AB unveiled a new D6210 Air Quality Sensor that integrates with existing IP-based surveillance infrastructure using portcast technology. It overlays air quality data onto live video streams, enabling real-time detection of environmental issues like vaping or smoking. This fusion of environmental sensing with video analytics exemplifies the VaaS market's evolution.

KBV Cardinal Matrix - Video as a Sensor Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Hangzhou Hikvision Digital Technology Co., Ltd. is the forerunner in the Video As A Sensor Market. In May, 2025, Hangzhou Hikvision Digital Technology Co., Ltd. unveiled a new generation of cable-free video security products, featuring wireless cameras with built-in batteries and solar-powered options. These solutions offer flexible, easy-to-install surveillance for remote or hard-to-wire locations, enhancing security with minimal infrastructure requirements. Companies such as Sony Semiconductor Solutions Corporation, Honeywell International Inc., and Johnson Controls International PLC are some of the key innovators in Video As A Sensor Market.

Market Consolidation Analysis:

The rapid evolution of artificial intelligence, computer vision, and IoT technologies has fundamentally redefined the landscape of video surveillance and sensory intelligence, giving rise to the global Video as a Sensor (VaaS) Market. What was once passive visual monitoring has transformed into intelligent data extraction-powering real-time decisions across domains such as smart cities, manufacturing, retail analytics, and autonomous systems. However, this transformation has not unfolded in an open or evenly distributed environment. Instead, it is shaped by a consolidated ecosystem of technology incumbents who control critical layers of the hardware-software stack, data pipelines, and cloud infrastructure.

This chapter presents a detailed analysis of market consolidation dynamics within the Video as a Sensor sector. It systematically evaluates structural and strategic factors that influence competitive intensity, innovation barriers, and vendor concentration. Drawing from real-world news, OEM publications, public technology frameworks, and regulatory data, the analysis assigns measurable ratings to key consolidation indicators-ranging from innovation concentration and supply chain dependency to geopolitical influences and technological standardization.

Market Consolidation Analysis by Parameter

1. Level of Innovation - ★★★★★ (5/5)

Innovation in the Video-as-a-Sensor market is advancing rapidly, especially with AI-based object recognition, behavioral analytics, and real-time alert systems. Leaders like Bosch, Hikvision, and NVIDIA (Jetson platform) dominate with proprietary hardware-software stacks. These firms continuously raise the innovation threshold through high R&D intensity, making it difficult for startups to keep pace.

Justification:

The innovation is largely centralized among major vendors who have vertically integrated product lines and control of data pipelines, significantly limiting the room for horizontal entrants.

Product Life Cycle Analysis:

Based on current adoption patterns, technological advancements, and deployment scale across sectors, the Video as a Sensor Market is positioned between the Growth and Maturity stages of the Product Life Cycle. The technology has moved beyond early proof-of-concept deployments and is now widely implemented in smart city infrastructure, traffic management, industrial automation, and retail analytics, particularly in developed and rapidly urbanizing regions. Major players like Bosch, Axis Communications, and Hikvision have mainstreamed AI-driven video sensors with integrated analytics, indicating maturity in sectors such as public surveillance and commercial facilities.

However, continued innovation in edge computing, 5G integration, and AI modeling-especially in emerging applications like autonomous mobility, healthcare diagnostics, and precision manufacturing-reflects ongoing growth. The market is not yet saturated and is still expanding geographically and functionally, especially across LAMEA and parts of Asia Pacific, suggesting that it is at a late growth to early maturity inflection point.

The evolution of video technology has progressed beyond traditional surveillance and monitoring functions. Today, with the integration of artificial intelligence (AI), machine learning (ML), and edge computing, video systems are transforming into intelligent sensors capable of interpreting and acting on visual data in real time. This paradigm shift is giving rise to the emergent field known as the Video-as-a-Sensor (VaaS) Market.

This chapter presents a comprehensive Product Life Cycle (PLC) analysis of the Video-as-a-Sensor Market, illustrating the market's progression through its key phases: Introduction, Growth, Maturity, and Decline. By examining the evolution of technologies, use cases, and competitive strategies, this analysis enables a deeper understanding of the market's development trajectory and strategic inflection points.

1. Introduction Stage

In this nascent phase, video-as-a-sensor technologies are primarily utilized in specialized sectors such as defense and critical infrastructure. Deployments are experimental, with high R&D investments and limited market penetration.

For instance:

- Ghost Robotics' Border Patrol Deployment (2022): The U.S. Department of Homeland Security tested quadrupedal robots equipped with video sensors for border surveillance. These robots were trialed for tasks like outdoor sentry duty and inspecting train cars.

- Synectics' COEX 4K Camera Range (2020): Synectics introduced the COEX 4K camera range designed for hazardous environments, such as oil and gas facilities, offering high-resolution surveillance in extreme conditions.

2. Growth Stage

This stage is marked by rapid adoption across various sectors, driven by the need for enhanced security and the integration of AI technologies. Governments and enterprises begin large-scale implementations.

For instance:

- Huawei's Safe City Projects (2014-2019): Huawei collaborated with the Serbian government to deploy over 1,000 surveillance cameras in Belgrade, enhancing public safety and traffic management.

- Cisco Meraki's Video Analytics Launch (2017): Cisco Meraki introduced video analytics features, including motion heatmaps and people detection, enabling businesses to gain insights into physical spaces.

3. Maturity Stage

Technology becomes mainstream, with widespread adoption in commercial, industrial, and residential sectors. The focus shifts to feature enhancements, integration capabilities, and cost optimization.

For instance:

- Hikvision's AcuSeek NVR Launch (June 2025): Hikvision unveiled the AcuSeek NVR, integrating large-scale AI models to enable rapid video retrieval through natural language queries, enhancing efficiency in incident investigations.

- Bosch's BVMS Integration with Promise Technology (2020): Bosch Security Systems collaborated with Promise Technology to offer integrated video management solutions, optimizing storage and scalability for enterprise surveillance needs.

- Avigilon's Security Suite by Motorola Solutions (2023): Motorola Solutions launched the Avigilon security suite, providing scalable video security and access control solutions tailored for various organizational sizes and requirements.

4. Decline Stage

Traditional analog systems face obsolescence due to advancements in digital and AI-driven technologies. The market sees a shift towards IP-based and cloud-integrated solutions.

For instance:

- Decline in Analog CCTV Market (2020): The global CCTV camera market experienced a 4.6% decline in 2020 compared to 2019, attributed to the pandemic and the transition towards digital surveillance systems.

- Motorola's Acquisition of Avigilon (2018): Motorola Solutions acquired Avigilon to enhance its portfolio with advanced video surveillance and analytics capabilities, signaling a strategic move towards integrated digital solutions.

Market Growth Factors