|

|

市場調査レポート

商品コード

1709521

バッテリー管理システムの世界市場規模、シェア、動向分析レポート:トポロジー別、バッテリータイプ別、用途別、地域別、展望と予測、2025年~2032年Global Battery Management System Market Size, Share & Trends Analysis Report By Topology, By Battery Type, By Application, By Regional Outlook and Forecast, 2025 - 2032 |

||||||

|

|||||||

| バッテリー管理システムの世界市場規模、シェア、動向分析レポート:トポロジー別、バッテリータイプ別、用途別、地域別、展望と予測、2025年~2032年 |

|

出版日: 2025年04月11日

発行: KBV Research

ページ情報: 英文 283 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

バッテリー管理システム市場規模は、予測期間中に22.6%のCAGRで市場成長し、2032年までに422億5,000万米ドルに達すると予想されています。

KBV Cardinal matrixに示された分析によると、Texas Instruments, Inc.はバッテリー管理システム市場の先駆者です。2023年1月、Texas Instruments, Inc.は、EVの航続距離の延長を可能にする、非常に高精度なEVバッテリー監視ICを発表しました。同社は、バッテリー管理システム(BMS)ポートフォリオの一部として、BQ79718-Q1バッテリーセル監視ICとBQ79731-Q1バッテリーパック監視ICをリリースしました。この2つのICは、電気自動車(EV)の航続距離を最大化することを目指しています。パナソニック工業株式会社、ロバート・ボッシュGmbH、NXPセミコンダクターズNVなどは、バッテリー管理システム市場における主要なイノベーターです。

市場成長要因

再生可能エネルギープロジェクトとスマートグリッドの世界の需要が高まるにつれ、高度なエネルギー貯蔵システムの必要性がますます高まっています。産業、商業、住宅の各セクターは、安定した電力供給と効率性を確保するためにESSへの投資を進めています。その結果、バッテリーの安全性、性能最適化、そしてより環境に優しいエネルギー源への移行におけるエネルギー管理の強化が不可欠となり、BMSソリューションの採用が大幅に増加しています。

最新のBMSソリューションは、高容量・軽量バッテリーに求められる充電サイクル、熱安定性、セルバランスを効率的に管理するための高度なアルゴリズムとリアルタイム監視機能を備えています。潜在的な故障の検知、放熱管理、エネルギー利用の最適化を図りながら、バッテリーパックの長寿命化を実現します。さらに、IoTおよびAI技術をBMSに統合することで、予知保全と早期故障検知が可能になり、安全性と運用効率が大幅に向上します。したがって、バッテリー技術の進化に伴い、信頼性と安全性を確保するBMSの役割はますます重要になり、これらの高度な管理システムは現代のエネルギー貯蔵ソリューションに不可欠なものとなっています。

市場抑制要因

コストの高さに対する認識は、購入段階だけにとどまりません。多くの企業は、設置時のダウンタイムや、新しいシステムを効果的に管理するためのスタッフトレーニングといった間接費も考慮に入れています。これらの追加コストは、導入を検討している企業にとって導入をためらわせる要因となります。企業は、バッテリーの性能と安全性の向上と、BMS導入に伴う費用負担のバランスを取らなければならないからです。そのため、初期コストの高さは、特にコスト感度が意思決定において重要な役割を果たす業界や地域において、依然として大きな障壁となっています。

バッテリータイプの展望

電池の種類に基づいて、市場はリチウムイオン電池、鉛蓄電池、ニッケル電池、フロー電池に分類されます。リチウムイオン電池セグメントは、2024年に市場の32%の収益シェアを獲得しました。リチウムイオン電池は、高いエネルギー密度、軽量構造、そして長寿命という特長から、効率的な電力管理と耐久性が求められる現代の用途に適しています。急速充電機能や強化された安全機能など、リチウムイオン技術の継続的な進歩は、その採用をさらに促進しています。さらに、電動モビリティと持続可能なエネルギーソリューションを促進する政府のインセンティブと規制は、自動車およびエネルギー分野におけるリチウムイオン電池ベースのBMSの需要を促進しています。

トポロジーの展望

トポロジーに基づいて、市場は集中型、分散型、モジュール型の3つに分類されます。分散型セグメントは、2024年に市場シェアの24%を記録しました。分散型BMSトポロジーでは、各バッテリーモジュールに制御ユニットがあり、中央コントローラーと通信します。この構造は拡張性と耐障害性を高め、電気バス、大規模エネルギー貯蔵システム、産業機器などの用途に最適です。個々のバッテリーモジュールを個別に監視できるため、信頼性とメンテナンス効率が向上します。さらに、電気商用車や大規模再生可能エネルギー貯蔵プロジェクトの導入増加も、分散型BMSセグメントの収益成長に大きく貢献しています。

用途の見通し

用途別に見ると、市場は自動車、民生用電子機器、エネルギー、防衛、その他に分類されています。自動車分野は2024年に市場の33%の収益シェアを獲得しました。自動車業界が電動化を変革するにつれ、EVの大型バッテリーパックを管理するために効率的なBMSソリューションの需要が重要になります。BMSは、バッテリー、熱管理、安全性の最適化に不可欠であり、車両性能の向上と乗員の保護に不可欠です。さらに、電動モビリティに対する政府のインセンティブと炭素排出量削減への取り組みは、自動車分野におけるBMSの採用拡大に大きく貢献しています。新しいバッテリー技術の開発と車両の航続距離の向上への重点の高まりは、現代のEVモデルへの高度なBMSの統合をさらに促進します。

地域展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAの4地域にまたがって分析されています。北米セグメントは2024年に市場の35%の収益シェアを獲得しました。この優位性に貢献している主な要因は、電気自動車(EV)メーカーの強力なプレゼンス、技術の進歩、そして持続可能なエネルギーソリューションを推進する政府の取り組みです。米国とカナダは、環境に優しい車に対する消費者の需要と厳格な排出規制に牽引され、EV導入の最前線に立っています。さらに、この地域の堅固な産業基盤と再生可能エネルギープロジェクトの統合増加が相まって、高度なBMSの需要を大幅に押し上げています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場要覧

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 市場シェア分析、2024年

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界市場:トポロジー別

- 世界の集中型市場:地域別

- 世界のモジュラー市場:地域別

- 世界の分散型市場:地域別

第6章 世界市場:バッテリータイプ別

- 世界の鉛蓄電池市場:地域別

- 世界のリチウムイオン電池市場:地域別

- 世界のニッケルベース市場:地域別

- 世界のフロー電池市場:地域別

第7章 世界市場:用途別

- 世界の消費者向け電子機器市場:地域別

- 世界の自動車市場:地域別

- 世界のエネルギー市場:地域別

- 世界の防衛・その他の市場:地域別

第8章 世界市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋地域

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第9章 企業プロファイル

- Elithion, Inc

- Texas Instruments, Inc

- Sensata Technologies Holdings PLC

- LG Energy Solution Ltd

- Analog Devices, Inc

- NXP Semiconductors NV

- Infineon Technologies AG

- Nuvation Energy

- Panasonic Industry Co, Ltd.(Panasonic Holdings Corporation)

- Robert Bosch GmbH

第10章 バッテリー管理システム市場の成功必須条件

LIST OF TABLES

- TABLE 1 Global Battery Management System Market, 2021 - 2024, USD Million

- TABLE 2 Global Battery Management System Market, 2025 - 2032, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Battery Management System Market

- TABLE 4 Product Launches And Product Expansions- Battery Management System Market

- TABLE 5 Global Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 6 Global Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 7 Global Centralized Market by Region, 2021 - 2024, USD Million

- TABLE 8 Global Centralized Market by Region, 2025 - 2032, USD Million

- TABLE 9 Global Modular Market by Region, 2021 - 2024, USD Million

- TABLE 10 Global Modular Market by Region, 2025 - 2032, USD Million

- TABLE 11 Global Distributed Market by Region, 2021 - 2024, USD Million

- TABLE 12 Global Distributed Market by Region, 2025 - 2032, USD Million

- TABLE 13 Global Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 14 Global Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 15 Global Lead-Acid Based Market by Region, 2021 - 2024, USD Million

- TABLE 16 Global Lead-Acid Based Market by Region, 2025 - 2032, USD Million

- TABLE 17 Global Lithium-Ion Based Market by Region, 2021 - 2024, USD Million

- TABLE 18 Global Lithium-Ion Based Market by Region, 2025 - 2032, USD Million

- TABLE 19 Global Nickel Based Market by Region, 2021 - 2024, USD Million

- TABLE 20 Global Nickel Based Market by Region, 2025 - 2032, USD Million

- TABLE 21 Global Flow Batteries Market by Region, 2021 - 2024, USD Million

- TABLE 22 Global Flow Batteries Market by Region, 2025 - 2032, USD Million

- TABLE 23 Global Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 24 Global Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 25 Global Consumer Electronics Market by Region, 2021 - 2024, USD Million

- TABLE 26 Global Consumer Electronics Market by Region, 2025 - 2032, USD Million

- TABLE 27 Global Automotive Market by Region, 2021 - 2024, USD Million

- TABLE 28 Global Automotive Market by Region, 2025 - 2032, USD Million

- TABLE 29 Global Energy Market by Region, 2021 - 2024, USD Million

- TABLE 30 Global Energy Market by Region, 2025 - 2032, USD Million

- TABLE 31 Global Defense & Others Market by Region, 2021 - 2024, USD Million

- TABLE 32 Global Defense & Others Market by Region, 2025 - 2032, USD Million

- TABLE 33 Global Battery Management System Market by Region, 2021 - 2024, USD Million

- TABLE 34 Global Battery Management System Market by Region, 2025 - 2032, USD Million

- TABLE 35 North America Battery Management System Market, 2021 - 2024, USD Million

- TABLE 36 North America Battery Management System Market, 2025 - 2032, USD Million

- TABLE 37 North America Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 38 North America Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 39 North America Centralized Market by Country, 2021 - 2024, USD Million

- TABLE 40 North America Centralized Market by Country, 2025 - 2032, USD Million

- TABLE 41 North America Modular Market by Country, 2021 - 2024, USD Million

- TABLE 42 North America Modular Market by Country, 2025 - 2032, USD Million

- TABLE 43 North America Distributed Market by Country, 2021 - 2024, USD Million

- TABLE 44 North America Distributed Market by Country, 2025 - 2032, USD Million

- TABLE 45 North America Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 46 North America Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 47 North America Lead-Acid Based Market by Country, 2021 - 2024, USD Million

- TABLE 48 North America Lead-Acid Based Market by Country, 2025 - 2032, USD Million

- TABLE 49 North America Lithium-Ion Based Market by Country, 2021 - 2024, USD Million

- TABLE 50 North America Lithium-Ion Based Market by Country, 2025 - 2032, USD Million

- TABLE 51 North America Nickel Based Market by Country, 2021 - 2024, USD Million

- TABLE 52 North America Nickel Based Market by Country, 2025 - 2032, USD Million

- TABLE 53 North America Flow Batteries Market by Country, 2021 - 2024, USD Million

- TABLE 54 North America Flow Batteries Market by Country, 2025 - 2032, USD Million

- TABLE 55 North America Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 56 North America Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 57 North America Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 58 North America Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 59 North America Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 60 North America Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 61 North America Energy Market by Country, 2021 - 2024, USD Million

- TABLE 62 North America Energy Market by Country, 2025 - 2032, USD Million

- TABLE 63 North America Defense & Others Market by Country, 2021 - 2024, USD Million

- TABLE 64 North America Defense & Others Market by Country, 2025 - 2032, USD Million

- TABLE 65 North America Battery Management System Market by Country, 2021 - 2024, USD Million

- TABLE 66 North America Battery Management System Market by Country, 2025 - 2032, USD Million

- TABLE 67 US Battery Management System Market, 2021 - 2024, USD Million

- TABLE 68 US Battery Management System Market, 2025 - 2032, USD Million

- TABLE 69 US Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 70 US Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 71 US Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 72 US Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 73 US Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 74 US Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 75 Canada Battery Management System Market, 2021 - 2024, USD Million

- TABLE 76 Canada Battery Management System Market, 2025 - 2032, USD Million

- TABLE 77 Canada Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 78 Canada Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 79 Canada Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 80 Canada Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 81 Canada Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 82 Canada Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 83 Mexico Battery Management System Market, 2021 - 2024, USD Million

- TABLE 84 Mexico Battery Management System Market, 2025 - 2032, USD Million

- TABLE 85 Mexico Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 86 Mexico Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 87 Mexico Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 88 Mexico Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 89 Mexico Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 90 Mexico Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 91 Rest of North America Battery Management System Market, 2021 - 2024, USD Million

- TABLE 92 Rest of North America Battery Management System Market, 2025 - 2032, USD Million

- TABLE 93 Rest of North America Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 94 Rest of North America Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 95 Rest of North America Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 96 Rest of North America Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 97 Rest of North America Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 98 Rest of North America Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 99 Europe Battery Management System Market, 2021 - 2024, USD Million

- TABLE 100 Europe Battery Management System Market, 2025 - 2032, USD Million

- TABLE 101 Europe Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 102 Europe Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 103 Europe Centralized Market by Country, 2021 - 2024, USD Million

- TABLE 104 Europe Centralized Market by Country, 2025 - 2032, USD Million

- TABLE 105 Europe Modular Market by Country, 2021 - 2024, USD Million

- TABLE 106 Europe Modular Market by Country, 2025 - 2032, USD Million

- TABLE 107 Europe Distributed Market by Country, 2021 - 2024, USD Million

- TABLE 108 Europe Distributed Market by Country, 2025 - 2032, USD Million

- TABLE 109 Europe Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 110 Europe Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 111 Europe Lead-Acid Based Market by Country, 2021 - 2024, USD Million

- TABLE 112 Europe Lead-Acid Based Market by Country, 2025 - 2032, USD Million

- TABLE 113 Europe Lithium-Ion Based Market by Country, 2021 - 2024, USD Million

- TABLE 114 Europe Lithium-Ion Based Market by Country, 2025 - 2032, USD Million

- TABLE 115 Europe Nickel Based Market by Country, 2021 - 2024, USD Million

- TABLE 116 Europe Nickel Based Market by Country, 2025 - 2032, USD Million

- TABLE 117 Europe Flow Batteries Market by Country, 2021 - 2024, USD Million

- TABLE 118 Europe Flow Batteries Market by Country, 2025 - 2032, USD Million

- TABLE 119 Europe Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 120 Europe Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 121 Europe Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 122 Europe Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 123 Europe Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 124 Europe Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 125 Europe Energy Market by Country, 2021 - 2024, USD Million

- TABLE 126 Europe Energy Market by Country, 2025 - 2032, USD Million

- TABLE 127 Europe Defense & Others Market by Country, 2021 - 2024, USD Million

- TABLE 128 Europe Defense & Others Market by Country, 2025 - 2032, USD Million

- TABLE 129 Europe Battery Management System Market by Country, 2021 - 2024, USD Million

- TABLE 130 Europe Battery Management System Market by Country, 2025 - 2032, USD Million

- TABLE 131 Germany Battery Management System Market, 2021 - 2024, USD Million

- TABLE 132 Germany Battery Management System Market, 2025 - 2032, USD Million

- TABLE 133 Germany Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 134 Germany Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 135 Germany Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 136 Germany Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 137 Germany Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 138 Germany Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 139 UK Battery Management System Market, 2021 - 2024, USD Million

- TABLE 140 UK Battery Management System Market, 2025 - 2032, USD Million

- TABLE 141 UK Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 142 UK Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 143 UK Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 144 UK Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 145 UK Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 146 UK Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 147 France Battery Management System Market, 2021 - 2024, USD Million

- TABLE 148 France Battery Management System Market, 2025 - 2032, USD Million

- TABLE 149 France Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 150 France Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 151 France Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 152 France Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 153 France Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 154 France Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 155 Russia Battery Management System Market, 2021 - 2024, USD Million

- TABLE 156 Russia Battery Management System Market, 2025 - 2032, USD Million

- TABLE 157 Russia Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 158 Russia Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 159 Russia Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 160 Russia Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 161 Russia Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 162 Russia Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 163 Spain Battery Management System Market, 2021 - 2024, USD Million

- TABLE 164 Spain Battery Management System Market, 2025 - 2032, USD Million

- TABLE 165 Spain Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 166 Spain Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 167 Spain Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 168 Spain Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 169 Spain Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 170 Spain Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 171 Italy Battery Management System Market, 2021 - 2024, USD Million

- TABLE 172 Italy Battery Management System Market, 2025 - 2032, USD Million

- TABLE 173 Italy Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 174 Italy Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 175 Italy Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 176 Italy Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 177 Italy Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 178 Italy Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 179 Rest of Europe Battery Management System Market, 2021 - 2024, USD Million

- TABLE 180 Rest of Europe Battery Management System Market, 2025 - 2032, USD Million

- TABLE 181 Rest of Europe Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 182 Rest of Europe Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 183 Rest of Europe Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 184 Rest of Europe Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 185 Rest of Europe Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 186 Rest of Europe Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 187 Asia Pacific Battery Management System Market, 2021 - 2024, USD Million

- TABLE 188 Asia Pacific Battery Management System Market, 2025 - 2032, USD Million

- TABLE 189 Asia Pacific Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 190 Asia Pacific Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 191 Asia Pacific Centralized Market by Country, 2021 - 2024, USD Million

- TABLE 192 Asia Pacific Centralized Market by Country, 2025 - 2032, USD Million

- TABLE 193 Asia Pacific Modular Market by Country, 2021 - 2024, USD Million

- TABLE 194 Asia Pacific Modular Market by Country, 2025 - 2032, USD Million

- TABLE 195 Asia Pacific Distributed Market by Country, 2021 - 2024, USD Million

- TABLE 196 Asia Pacific Distributed Market by Country, 2025 - 2032, USD Million

- TABLE 197 Asia Pacific Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 198 Asia Pacific Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 199 Asia Pacific Lead-Acid Based Market by Country, 2021 - 2024, USD Million

- TABLE 200 Asia Pacific Lead-Acid Based Market by Country, 2025 - 2032, USD Million

- TABLE 201 Asia Pacific Lithium-Ion Based Market by Country, 2021 - 2024, USD Million

- TABLE 202 Asia Pacific Lithium-Ion Based Market by Country, 2025 - 2032, USD Million

- TABLE 203 Asia Pacific Nickel Based Market by Country, 2021 - 2024, USD Million

- TABLE 204 Asia Pacific Nickel Based Market by Country, 2025 - 2032, USD Million

- TABLE 205 Asia Pacific Flow Batteries Market by Country, 2021 - 2024, USD Million

- TABLE 206 Asia Pacific Flow Batteries Market by Country, 2025 - 2032, USD Million

- TABLE 207 Asia Pacific Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 208 Asia Pacific Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 209 Asia Pacific Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 210 Asia Pacific Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 211 Asia Pacific Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 212 Asia Pacific Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 213 Asia Pacific Energy Market by Country, 2021 - 2024, USD Million

- TABLE 214 Asia Pacific Energy Market by Country, 2025 - 2032, USD Million

- TABLE 215 Asia Pacific Defense & Others Market by Country, 2021 - 2024, USD Million

- TABLE 216 Asia Pacific Defense & Others Market by Country, 2025 - 2032, USD Million

- TABLE 217 Asia Pacific Battery Management System Market by Country, 2021 - 2024, USD Million

- TABLE 218 Asia Pacific Battery Management System Market by Country, 2025 - 2032, USD Million

- TABLE 219 China Battery Management System Market, 2021 - 2024, USD Million

- TABLE 220 China Battery Management System Market, 2025 - 2032, USD Million

- TABLE 221 China Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 222 China Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 223 China Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 224 China Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 225 China Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 226 China Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 227 Japan Battery Management System Market, 2021 - 2024, USD Million

- TABLE 228 Japan Battery Management System Market, 2025 - 2032, USD Million

- TABLE 229 Japan Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 230 Japan Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 231 Japan Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 232 Japan Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 233 Japan Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 234 Japan Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 235 India Battery Management System Market, 2021 - 2024, USD Million

- TABLE 236 India Battery Management System Market, 2025 - 2032, USD Million

- TABLE 237 India Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 238 India Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 239 India Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 240 India Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 241 India Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 242 India Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 243 South Korea Battery Management System Market, 2021 - 2024, USD Million

- TABLE 244 South Korea Battery Management System Market, 2025 - 2032, USD Million

- TABLE 245 South Korea Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 246 South Korea Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 247 South Korea Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 248 South Korea Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 249 South Korea Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 250 South Korea Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 251 Singapore Battery Management System Market, 2021 - 2024, USD Million

- TABLE 252 Singapore Battery Management System Market, 2025 - 2032, USD Million

- TABLE 253 Singapore Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 254 Singapore Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 255 Singapore Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 256 Singapore Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 257 Singapore Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 258 Singapore Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 259 Malaysia Battery Management System Market, 2021 - 2024, USD Million

- TABLE 260 Malaysia Battery Management System Market, 2025 - 2032, USD Million

- TABLE 261 Malaysia Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 262 Malaysia Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 263 Malaysia Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 264 Malaysia Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 265 Malaysia Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 266 Malaysia Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 267 Rest of Asia Pacific Battery Management System Market, 2021 - 2024, USD Million

- TABLE 268 Rest of Asia Pacific Battery Management System Market, 2025 - 2032, USD Million

- TABLE 269 Rest of Asia Pacific Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 270 Rest of Asia Pacific Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 271 Rest of Asia Pacific Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 272 Rest of Asia Pacific Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 273 Rest of Asia Pacific Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 274 Rest of Asia Pacific Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 275 LAMEA Battery Management System Market, 2021 - 2024, USD Million

- TABLE 276 LAMEA Battery Management System Market, 2025 - 2032, USD Million

- TABLE 277 LAMEA Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 278 LAMEA Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 279 LAMEA Centralized Market by Country, 2021 - 2024, USD Million

- TABLE 280 LAMEA Centralized Market by Country, 2025 - 2032, USD Million

- TABLE 281 LAMEA Modular Market by Country, 2021 - 2024, USD Million

- TABLE 282 LAMEA Modular Market by Country, 2025 - 2032, USD Million

- TABLE 283 LAMEA Distributed Market by Country, 2021 - 2024, USD Million

- TABLE 284 LAMEA Distributed Market by Country, 2025 - 2032, USD Million

- TABLE 285 LAMEA Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 286 LAMEA Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 287 LAMEA Lead-Acid Based Market by Country, 2021 - 2024, USD Million

- TABLE 288 LAMEA Lead-Acid Based Market by Country, 2025 - 2032, USD Million

- TABLE 289 LAMEA Lithium-Ion Based Market by Country, 2021 - 2024, USD Million

- TABLE 290 LAMEA Lithium-Ion Based Market by Country, 2025 - 2032, USD Million

- TABLE 291 LAMEA Nickel Based Market by Country, 2021 - 2024, USD Million

- TABLE 292 LAMEA Nickel Based Market by Country, 2025 - 2032, USD Million

- TABLE 293 LAMEA Flow Batteries Market by Country, 2021 - 2024, USD Million

- TABLE 294 LAMEA Flow Batteries Market by Country, 2025 - 2032, USD Million

- TABLE 295 LAMEA Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 296 LAMEA Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 297 LAMEA Consumer Electronics Market by Country, 2021 - 2024, USD Million

- TABLE 298 LAMEA Consumer Electronics Market by Country, 2025 - 2032, USD Million

- TABLE 299 LAMEA Automotive Market by Country, 2021 - 2024, USD Million

- TABLE 300 LAMEA Automotive Market by Country, 2025 - 2032, USD Million

- TABLE 301 LAMEA Energy Market by Country, 2021 - 2024, USD Million

- TABLE 302 LAMEA Energy Market by Country, 2025 - 2032, USD Million

- TABLE 303 LAMEA Defense & Others Market by Country, 2021 - 2024, USD Million

- TABLE 304 LAMEA Defense & Others Market by Country, 2025 - 2032, USD Million

- TABLE 305 LAMEA Battery Management System Market by Country, 2021 - 2024, USD Million

- TABLE 306 LAMEA Battery Management System Market by Country, 2025 - 2032, USD Million

- TABLE 307 Brazil Battery Management System Market, 2021 - 2024, USD Million

- TABLE 308 Brazil Battery Management System Market, 2025 - 2032, USD Million

- TABLE 309 Brazil Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 310 Brazil Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 311 Brazil Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 312 Brazil Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 313 Brazil Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 314 Brazil Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 315 Argentina Battery Management System Market, 2021 - 2024, USD Million

- TABLE 316 Argentina Battery Management System Market, 2025 - 2032, USD Million

- TABLE 317 Argentina Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 318 Argentina Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 319 Argentina Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 320 Argentina Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 321 Argentina Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 322 Argentina Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 323 UAE Battery Management System Market, 2021 - 2024, USD Million

- TABLE 324 UAE Battery Management System Market, 2025 - 2032, USD Million

- TABLE 325 UAE Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 326 UAE Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 327 UAE Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 328 UAE Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 329 UAE Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 330 UAE Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 331 Saudi Arabia Battery Management System Market, 2021 - 2024, USD Million

- TABLE 332 Saudi Arabia Battery Management System Market, 2025 - 2032, USD Million

- TABLE 333 Saudi Arabia Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 334 Saudi Arabia Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 335 Saudi Arabia Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 336 Saudi Arabia Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 337 Saudi Arabia Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 338 Saudi Arabia Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 339 South Africa Battery Management System Market, 2021 - 2024, USD Million

- TABLE 340 South Africa Battery Management System Market, 2025 - 2032, USD Million

- TABLE 341 South Africa Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 342 South Africa Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 343 South Africa Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 344 South Africa Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 345 South Africa Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 346 South Africa Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 347 Nigeria Battery Management System Market, 2021 - 2024, USD Million

- TABLE 348 Nigeria Battery Management System Market, 2025 - 2032, USD Million

- TABLE 349 Nigeria Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 350 Nigeria Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 351 Nigeria Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 352 Nigeria Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 353 Nigeria Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 354 Nigeria Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 355 Rest of LAMEA Battery Management System Market, 2021 - 2024, USD Million

- TABLE 356 Rest of LAMEA Battery Management System Market, 2025 - 2032, USD Million

- TABLE 357 Rest of LAMEA Battery Management System Market by Topology, 2021 - 2024, USD Million

- TABLE 358 Rest of LAMEA Battery Management System Market by Topology, 2025 - 2032, USD Million

- TABLE 359 Rest of LAMEA Battery Management System Market by Battery Type, 2021 - 2024, USD Million

- TABLE 360 Rest of LAMEA Battery Management System Market by Battery Type, 2025 - 2032, USD Million

- TABLE 361 Rest of LAMEA Battery Management System Market by Application, 2021 - 2024, USD Million

- TABLE 362 Rest of LAMEA Battery Management System Market by Application, 2025 - 2032, USD Million

- TABLE 363 Key Information - Elithion, inc.

- TABLE 364 Key Information - Texas Instruments, Inc.

- TABLE 365 Key Information - Sensata Technologies Holdings PLC

- TABLE 366 key information - LG Energy Solution Ltd.

- TABLE 367 key information - Analog Devices, Inc.

- TABLE 368 Key Information - NXP Semiconductors N.V.

- TABLE 369 Key Information - Infineon Technologies AG

- TABLE 370 Key Information - Nuvation Energy

- TABLE 371 Key Information - Panasonic Industry Co., Ltd.

- TABLE 372 Key Information - Robert Bosch GmbH

LIST OF FIGURES

- FIG 1 Methodology for the research

- FIG 2 Global Battery Management System Market, 2021 - 2032, USD Million

- FIG 3 Key Factors Impacting Battery Management System Market

- FIG 4 KBV Cardinal Matrix

- FIG 5 Market Share Analysis, 2024

- FIG 6 Key Leading Strategies: Percentage Distribution (2020-2024)

- FIG 7 Key Strategic Move: (Product Launches and Product Expansions: 2020, Sep - 2025, Jan) Leading Players

- FIG 8 Porter's Five Forces Analysis - Battery Management System Market

- FIG 9 Global Battery Management System Market share by Topology, 2024

- FIG 10 Global Battery Management System Market share by Topology, 2032

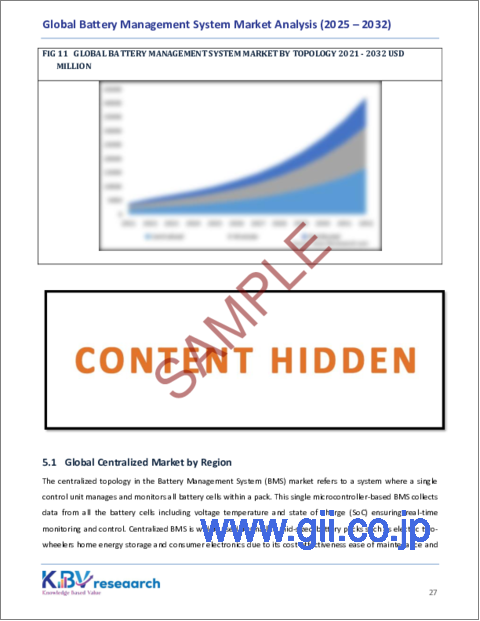

- FIG 11 Global Battery Management System Market by Topology, 2021 - 2032, USD Million

- FIG 12 Global Battery Management System Market share by Battery Type, 2024

- FIG 13 Global Battery Management System Market share by Battery Type, 2032

- FIG 14 Global Battery Management System Market by Battery Type, 2021 - 2032, USD Million

- FIG 15 Global Battery Management System Market share by Application, 2024

- FIG 16 Global Battery Management System Market share by Application, 2032

- FIG 17 Global Battery Management System Market by Application, 2021 - 2032, USD Million

- FIG 18 Global Battery Management System Market share by Region, 2024

- FIG 19 Global Battery Management System Market share by Region, 2032

- FIG 20 Global Battery Management System Market by Region, 2021 - 2032, USD Million

- FIG 21 North America Battery Management System Market, 2021 - 2032, USD Million

- FIG 22 North America Battery Management System Market share by Topology, 2024

- FIG 23 North America Battery Management System Market share by Topology, 2032

- FIG 24 North America Battery Management System Market by Topology, 2021 - 2032, USD Million

- FIG 25 North America Battery Management System Market share by Battery Type, 2024

- FIG 26 North America Battery Management System Market share by Battery Type, 2032

- FIG 27 North America Battery Management System Market by Battery Type, 2021 - 2032, USD Million

- FIG 28 North America Battery Management System Market share by Application, 2024

- FIG 29 North America Battery Management System Market share by Application, 2032

- FIG 30 North America Battery Management System Market by Application, 2021 - 2032, USD Million

- FIG 31 North America Battery Management System Market share by Country, 2024

- FIG 32 North America Battery Management System Market share by Country, 2032

- FIG 33 North America Battery Management System Market by Country, 2021 - 2032, USD Million

- FIG 34 Europe Battery Management System Market, 2021 - 2032, USD Million

- FIG 35 Europe Battery Management System Market share by Topology, 2024

- FIG 36 Europe Battery Management System Market share by Topology, 2032

- FIG 37 Europe Battery Management System Market by Topology, 2021 - 2032, USD Million

- FIG 38 Europe Battery Management System Market share by Battery Type, 2024

- FIG 39 Europe Battery Management System Market share by Battery Type, 2032

- FIG 40 Europe Battery Management System Market by Battery Type, 2021 - 2032, USD Million

- FIG 41 Europe Battery Management System Market share by Application, 2024

- FIG 42 Europe Battery Management System Market share by Application, 2032

- FIG 43 Europe Battery Management System Market by Application, 2021 - 2032, USD Million

- FIG 44 Europe Battery Management System Market share by Country, 2024

- FIG 45 Europe Battery Management System Market share by Country, 2032

- FIG 46 Europe Battery Management System Market by Country, 2021 - 2032, USD Million

- FIG 47 Asia Pacific Battery Management System Market, 2021 - 2032, USD Million

- FIG 48 Asia Pacific Battery Management System Market share by Topology, 2024

- FIG 49 Asia Pacific Battery Management System Market share by Topology, 2032

- FIG 50 Asia Pacific Battery Management System Market by Topology, 2021 - 2032, USD Million

- FIG 51 Asia Pacific Battery Management System Market share by Battery Type, 2024

- FIG 52 Asia Pacific Battery Management System Market share by Battery Type, 2032

- FIG 53 Asia Pacific Battery Management System Market by Battery Type, 2021 - 2032, USD Million

- FIG 54 Asia Pacific Battery Management System Market share by Application, 2024

- FIG 55 Asia Pacific Battery Management System Market share by Application, 2032

- FIG 56 Asia Pacific Battery Management System Market by Application, 2021 - 2032, USD Million

- FIG 57 Asia Pacific Battery Management System Market share by Country, 2024

- FIG 58 Asia Pacific Battery Management System Market share by Country, 2032

- FIG 59 Asia Pacific Battery Management System Market by Country, 2021 - 2032, USD Million

- FIG 60 LAMEA Battery Management System Market, 2021 - 2032, USD Million

- FIG 61 LAMEA Battery Management System Market share by Topology, 2024

- FIG 62 LAMEA Battery Management System Market share by Topology, 2032

- FIG 63 LAMEA Battery Management System Market by Topology, 2021 - 2032, USD Million

- FIG 64 LAMEA Battery Management System Market share by Battery Type, 2024

- FIG 65 LAMEA Battery Management System Market share by Battery Type, 2032

- FIG 66 LAMEA Battery Management System Market by Battery Type, 2021 - 2032, USD Million

- FIG 67 LAMEA Battery Management System Market share by Application, 2024

- FIG 68 LAMEA Battery Management System Market share by Application, 2032

- FIG 69 LAMEA Battery Management System Market by Application, 2021 - 2032, USD Million

- FIG 70 LAMEA Battery Management System Market share by Country, 2024

- FIG 71 LAMEA Battery Management System Market share by Country, 2032

- FIG 72 LAMEA Battery Management System Market by Country, 2021 - 2032, USD Million

- FIG 73 SWOT Analysis: Elithion, Inc.

- FIG 74 SWOT Analysis: Texas Instruments, Inc.

- FIG 75 SWOT Analysis: Sensata Technologies Holdings PLC

- FIG 76 Recent strategies and developments: LG Energy Solutions Ltd.

- FIG 77 SWOT Analysis: LG Energy Solutions Ltd.

- FIG 78 Recent strategies and developments: Analog Devices, Inc.

- FIG 79 SWOT Analysis: Analog Devices, Inc.

- FIG 80 Recent strategies and developments: NXP Semiconductors N.V.

- FIG 81 SWOT Analysis: NXP Semiconductors N.V.

- FIG 82 Recent strategies and developments: Infineon Technologies AG

- FIG 83 SWOT Analysis: Infineon Technologies AG

- FIG 84 SWOT Analysis: Panasonic Industry Co., Ltd.

- FIG 85 SWOT Analysis: Robert Bosch GmbH

The Global Battery Management System Market size is expected to reach $42.25 billion by 2032, rising at a market growth of 22.6% CAGR during the forecast period.

Electric vehicle production and usage are currently rising significantly in the region, especially in China, which has emerged as the worldwide hub for EV manufacture. Asia Pacific governments are investing heavily in electric mobility and renewable energy projects, creating a favorable environment for BMS adoption. Hence, the Asia Pacific segment acquired 28% revenue share in the market in 2024. Additionally, the consumer electronics industry, a major BMS application area, is flourishing in this region, further propelling market growth. The availability of affordable BMS solutions and the presence of numerous battery manufacturers make Asia Pacific a dynamic and rapidly growing market segment.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2025, LG Energy Solution, Ltd. unveiled an advanced EV battery management system to enhance performance, safety, and lifespan. The system optimizes energy efficiency and real-time monitoring, ensuring improved reliability. LGES aims to strengthen its position in the EV battery market by offering innovative solutions for next-generation electric vehicles. Additionally, In December, 2024, LG Energy Solution, Ltd. unveiled its own battery management system, aiming to enhance battery performance, safety, and lifespan. The solution integrates advanced monitoring and predictive analytics, optimizing efficiency for various applications. This move strengthens LGES's position in the energy sector, addressing growing demands for reliable and intelligent battery technology.

Based on the Analysis presented in the KBV Cardinal matrix; Texas Instruments, Inc. is the forerunner in the Battery Management System Market. In January, 2023, Texas Instruments, Inc. unveiled a pair of very precise EV battery monitoring ICs, which are expected to allow for greater EV ranges. The company released the BQ79718-Q1 battery cell monitor IC and BQ79731-Q1 battery pack monitor IC as part of its battery management systems (BMS) portfolio, a pair of ICs aimed at maximizing the driving range of electric vehicles (EVs). Companies such as Panasonic Industry Co., Ltd., Robert Bosch GmbH, and NXP Semiconductors N.V. are some of the key innovators in Battery Management System Market.

Market Growth Factors

As the global demand for renewable energy projects and smart grids grows, the need for advanced energy storage systems is becoming increasingly evident. Industrial, commercial, and residential sectors are investing in ESS to ensure consistent power availability and efficiency. Consequently, the adoption of BMS solutions is rising significantly, driven by the critical need for battery safety, performance optimization, and enhanced energy management in the transition to greener energy sources.

Modern BMS solutions have advanced algorithms and real-time monitoring capabilities to efficiently manage the charging cycles, thermal stability, and cell balancing required by high-capacity and lightweight batteries. They are designed to detect potential failures, manage heat dissipation, and optimize energy use while ensuring the longevity of the battery pack. Additionally, the integration of IoT and AI technologies in BMS allows for predictive maintenance and early fault detection, significantly enhancing safety and operational efficiency. Therefore, as battery technologies continue to evolve, the role of BMS in ensuring reliable and safe performance becomes even more critical, making these advanced management systems indispensable in modern energy storage solutions.

Market Restraining Factors

The perception of high costs is not limited to the purchasing phase alone. Many businesses also account for indirect expenses such as downtime during installation and the need for staff training to manage the new systems effectively. These additional costs create hesitation among potential adopters, as companies must balance the need for improved battery performance and safety with the financial implications of implementing a BMS. Consequently, the high initial cost remains a substantial barrier, particularly in industries and regions where cost sensitivity plays a crucial role in decision-making.

Battery Type Outlook

Based on battery type, the market is classified into lithium-ion based, lead-acid based, nickel based, and flow batteries. The lithium-ion based segment garnered 32% revenue share in the market in 2024. Lithium-ion batteries are preferred for modern applications that necessitate efficient power management and durability due to their high energy density, lightweight structure, and extended lifecycle. The ongoing advancements in lithium-ion technology, such as fast charging capabilities and enhanced safety features, further boost their adoption. Additionally, government incentives and regulations promoting electric mobility and sustainable energy solutions propel the demand for lithium-ion based BMS in the automotive and energy sectors.

Topology Outlook

On the basis of topology, the market is divided into centralized, distributed, and modular. The distributed segment recorded 24% revenue share in the market in 2024. In distributed BMS topology, each battery module has its control unit, which communicates with a central controller. This structure enhances scalability and fault tolerance, making it ideal for applications like electric buses, large energy storage systems, and industrial equipment. The ability to monitor individual battery modules independently improves reliability and maintenance efficiency. Moreover, the increasing adoption of electric commercial vehicles and large-scale renewable energy storage projects significantly contributes to the revenue growth of the distributed BMS segment.

Application Outlook

By application, the market is segmented into automotive, consumer electronics, energy, defense, and others. The automotive segment garnered 33% revenue share in the market in 2024. As the automotive industry transforms electrification, the demand for efficient BMS solutions becomes critical to managing the large battery packs in EVs. BMS is crucial for the optimization of batteries, thermal management, and safety, which is essential for the improvement of vehicle performance and the protection of passengers. Moreover, government incentives for electric mobility and the push towards reducing carbon emissions have significantly contributed to the growth of BMS adoption in the automotive sector. The increasing focus on developing new battery technologies and improving vehicle range further facilitates the integration of sophisticated BMS in contemporary EV models.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured 35% revenue share in the market in 2024. The strong presence of electric vehicle (EV) manufacturers, technological advancements, and government initiatives to promote sustainable energy solutions are the primary factors contributing to this dominance. The United States and Canada are at the forefront of EV adoption, driven by consumer demand for eco-friendly vehicles and stringent emission regulations. Additionally, the region's robust industrial base, coupled with the increasing integration of renewable energy projects, significantly boosts the demand for advanced BMS.

Recent Strategies Deployed in the Market

- Nov-2024: NXP Semiconductors N.V. unveiled the industry's first ultra-wideband (UWB) wireless battery management system, enhancing safety, efficiency, and scalability for electric vehicles. This innovation eliminates wired connections, improving reliability and flexibility. The breakthrough technology marks a significant step toward next-generation EV battery systems, offering superior performance and advanced monitoring capabilities.

- Sep-2024: LG Energy Solution, Ltd. unveiled 'B.around,' a comprehensive battery management solution offering advanced software and hardware services. The brand's slogan, "Be Around Your Side," reflects its commitment to enhancing battery safety and user experience through continuous monitoring and diagnostics.

- Jun-2024: LG Energy Solution, Ltd. signed an agreement with Analog Devices, Inc. to co-develop technology for precise internal temperature measurement of EV battery cells. This innovation aims to enhance safety and charging speed, advancing the clean energy ecosystem. LG Energy Solution seeks to provide differentiated customer value through its advanced battery management total solution.

- May-2024: Analog Devices, Inc. teamed up with VinFast to enhance electric vehicle (EV) solutions. This collaboration focuses on advancing EV technology, that improves battery performance and increases efficiency. By leveraging Analog Devices' expertise in semiconductor innovation, VinFast aims to develop smarter, more sustainable transportation solutions, reinforcing its position in the global EV market.

- May-2024: Infineon Technologies AG unveiled the PSoC 4 HVPA-144K microcontroller, integrating high-precision analog and high-voltage subsystems on a single chip for automotive 12 V lead-acid battery management. Compliant with ISO26262, it ensures accurate state-of-charge and state-of-health measurements, enhancing vehicle electrical system reliability.

List of Key Companies Profiled

- Elithion, Inc.

- Texas Instruments, Inc.

- Sensata Technologies Holdings PLC

- LG Energy Solution, Ltd.

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Nuvation Energy

- Panasonic Industry Co., Ltd. (Panasonic Holdings Corporation)

- Robert Bosch GmbH

Global Battery Management System Market Report Segmentation

By Topology

- Centralized

- Modular

- Distributed

By Battery Type

- Lead-Acid Based

- Lithium-Ion Based

- Nickel Based

- Flow Batteries

By Application

- Consumer Electronics

- Automotive

- Energy

- Defense & Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Battery Management System Market, by Topology

- 1.4.2 Global Battery Management System Market, by Battery Type

- 1.4.3 Global Battery Management System Market, by Application

- 1.4.4 Global Battery Management System Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.2.3 Market Opportunities

- 3.2.4 Market Challenges

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.3 Market Share Analysis, 2024

- 4.4 Top Winning Strategies

- 4.4.1 Key Leading Strategies: Percentage Distribution (2020-2024)

- 4.4.2 Key Strategic Move: (Product Launches and Product Expansions: 2020, Sep - 2025, Jan) Leading Players

- 4.5 Porter Five Forces Analysis

Chapter 5. Global Battery Management System Market by Topology

- 5.1 Global Centralized Market by Region

- 5.2 Global Modular Market by Region

- 5.3 Global Distributed Market by Region

Chapter 6. Global Battery Management System Market by Battery Type

- 6.1 Global Lead-Acid Based Market by Region

- 6.2 Global Lithium-Ion Based Market by Region

- 6.3 Global Nickel Based Market by Region

- 6.4 Global Flow Batteries Market by Region

Chapter 7. Global Battery Management System Market by Application

- 7.1 Global Consumer Electronics Market by Region

- 7.2 Global Automotive Market by Region

- 7.3 Global Energy Market by Region

- 7.4 Global Defense & Others Market by Region

Chapter 8. Global Battery Management System Market by Region

- 8.1 North America Battery Management System Market

- 8.1.1 North America Battery Management System Market by Topology

- 8.1.1.1 North America Centralized Market by Country

- 8.1.1.2 North America Modular Market by Country

- 8.1.1.3 North America Distributed Market by Country

- 8.1.2 North America Battery Management System Market by Battery Type

- 8.1.2.1 North America Lead-Acid Based Market by Country

- 8.1.2.2 North America Lithium-Ion Based Market by Country

- 8.1.2.3 North America Nickel Based Market by Country

- 8.1.2.4 North America Flow Batteries Market by Country

- 8.1.3 North America Battery Management System Market by Application

- 8.1.3.1 North America Consumer Electronics Market by Country

- 8.1.3.2 North America Automotive Market by Country

- 8.1.3.3 North America Energy Market by Country

- 8.1.3.4 North America Defense & Others Market by Country

- 8.1.4 North America Battery Management System Market by Country

- 8.1.4.1 US Battery Management System Market

- 8.1.4.1.1 US Battery Management System Market by Topology

- 8.1.4.1.2 US Battery Management System Market by Battery Type

- 8.1.4.1.3 US Battery Management System Market by Application

- 8.1.4.2 Canada Battery Management System Market

- 8.1.4.2.1 Canada Battery Management System Market by Topology

- 8.1.4.2.2 Canada Battery Management System Market by Battery Type

- 8.1.4.2.3 Canada Battery Management System Market by Application

- 8.1.4.3 Mexico Battery Management System Market

- 8.1.4.3.1 Mexico Battery Management System Market by Topology

- 8.1.4.3.2 Mexico Battery Management System Market by Battery Type

- 8.1.4.3.3 Mexico Battery Management System Market by Application

- 8.1.4.4 Rest of North America Battery Management System Market

- 8.1.4.4.1 Rest of North America Battery Management System Market by Topology

- 8.1.4.4.2 Rest of North America Battery Management System Market by Battery Type

- 8.1.4.4.3 Rest of North America Battery Management System Market by Application

- 8.1.4.1 US Battery Management System Market

- 8.1.1 North America Battery Management System Market by Topology

- 8.2 Europe Battery Management System Market

- 8.2.1 Europe Battery Management System Market by Topology

- 8.2.1.1 Europe Centralized Market by Country

- 8.2.1.2 Europe Modular Market by Country

- 8.2.1.3 Europe Distributed Market by Country

- 8.2.2 Europe Battery Management System Market by Battery Type

- 8.2.2.1 Europe Lead-Acid Based Market by Country

- 8.2.2.2 Europe Lithium-Ion Based Market by Country

- 8.2.2.3 Europe Nickel Based Market by Country

- 8.2.2.4 Europe Flow Batteries Market by Country

- 8.2.3 Europe Battery Management System Market by Application

- 8.2.3.1 Europe Consumer Electronics Market by Country

- 8.2.3.2 Europe Automotive Market by Country

- 8.2.3.3 Europe Energy Market by Country

- 8.2.3.4 Europe Defense & Others Market by Country

- 8.2.4 Europe Battery Management System Market by Country

- 8.2.4.1 Germany Battery Management System Market

- 8.2.4.1.1 Germany Battery Management System Market by Topology

- 8.2.4.1.2 Germany Battery Management System Market by Battery Type

- 8.2.4.1.3 Germany Battery Management System Market by Application

- 8.2.4.2 UK Battery Management System Market

- 8.2.4.2.1 UK Battery Management System Market by Topology

- 8.2.4.2.2 UK Battery Management System Market by Battery Type

- 8.2.4.2.3 UK Battery Management System Market by Application

- 8.2.4.3 France Battery Management System Market

- 8.2.4.3.1 France Battery Management System Market by Topology

- 8.2.4.3.2 France Battery Management System Market by Battery Type

- 8.2.4.3.3 France Battery Management System Market by Application

- 8.2.4.4 Russia Battery Management System Market

- 8.2.4.4.1 Russia Battery Management System Market by Topology

- 8.2.4.4.2 Russia Battery Management System Market by Battery Type

- 8.2.4.4.3 Russia Battery Management System Market by Application

- 8.2.4.5 Spain Battery Management System Market

- 8.2.4.5.1 Spain Battery Management System Market by Topology

- 8.2.4.5.2 Spain Battery Management System Market by Battery Type

- 8.2.4.5.3 Spain Battery Management System Market by Application

- 8.2.4.6 Italy Battery Management System Market

- 8.2.4.6.1 Italy Battery Management System Market by Topology

- 8.2.4.6.2 Italy Battery Management System Market by Battery Type

- 8.2.4.6.3 Italy Battery Management System Market by Application

- 8.2.4.7 Rest of Europe Battery Management System Market

- 8.2.4.7.1 Rest of Europe Battery Management System Market by Topology

- 8.2.4.7.2 Rest of Europe Battery Management System Market by Battery Type

- 8.2.4.7.3 Rest of Europe Battery Management System Market by Application

- 8.2.4.1 Germany Battery Management System Market

- 8.2.1 Europe Battery Management System Market by Topology

- 8.3 Asia Pacific Battery Management System Market

- 8.3.1 Asia Pacific Battery Management System Market by Topology

- 8.3.1.1 Asia Pacific Centralized Market by Country

- 8.3.1.2 Asia Pacific Modular Market by Country

- 8.3.1.3 Asia Pacific Distributed Market by Country

- 8.3.2 Asia Pacific Battery Management System Market by Battery Type

- 8.3.2.1 Asia Pacific Lead-Acid Based Market by Country

- 8.3.2.2 Asia Pacific Lithium-Ion Based Market by Country

- 8.3.2.3 Asia Pacific Nickel Based Market by Country

- 8.3.2.4 Asia Pacific Flow Batteries Market by Country

- 8.3.3 Asia Pacific Battery Management System Market by Application

- 8.3.3.1 Asia Pacific Consumer Electronics Market by Country

- 8.3.3.2 Asia Pacific Automotive Market by Country

- 8.3.3.3 Asia Pacific Energy Market by Country

- 8.3.3.4 Asia Pacific Defense & Others Market by Country

- 8.3.4 Asia Pacific Battery Management System Market by Country

- 8.3.4.1 China Battery Management System Market

- 8.3.4.1.1 China Battery Management System Market by Topology

- 8.3.4.1.2 China Battery Management System Market by Battery Type

- 8.3.4.1.3 China Battery Management System Market by Application

- 8.3.4.2 Japan Battery Management System Market

- 8.3.4.2.1 Japan Battery Management System Market by Topology

- 8.3.4.2.2 Japan Battery Management System Market by Battery Type

- 8.3.4.2.3 Japan Battery Management System Market by Application

- 8.3.4.3 India Battery Management System Market

- 8.3.4.3.1 India Battery Management System Market by Topology

- 8.3.4.3.2 India Battery Management System Market by Battery Type

- 8.3.4.3.3 India Battery Management System Market by Application

- 8.3.4.4 South Korea Battery Management System Market

- 8.3.4.4.1 South Korea Battery Management System Market by Topology

- 8.3.4.4.2 South Korea Battery Management System Market by Battery Type

- 8.3.4.4.3 South Korea Battery Management System Market by Application

- 8.3.4.5 Singapore Battery Management System Market

- 8.3.4.5.1 Singapore Battery Management System Market by Topology

- 8.3.4.5.2 Singapore Battery Management System Market by Battery Type

- 8.3.4.5.3 Singapore Battery Management System Market by Application

- 8.3.4.6 Malaysia Battery Management System Market

- 8.3.4.6.1 Malaysia Battery Management System Market by Topology

- 8.3.4.6.2 Malaysia Battery Management System Market by Battery Type

- 8.3.4.6.3 Malaysia Battery Management System Market by Application

- 8.3.4.7 Rest of Asia Pacific Battery Management System Market

- 8.3.4.7.1 Rest of Asia Pacific Battery Management System Market by Topology

- 8.3.4.7.2 Rest of Asia Pacific Battery Management System Market by Battery Type

- 8.3.4.7.3 Rest of Asia Pacific Battery Management System Market by Application

- 8.3.4.1 China Battery Management System Market

- 8.3.1 Asia Pacific Battery Management System Market by Topology

- 8.4 LAMEA Battery Management System Market

- 8.4.1 LAMEA Battery Management System Market by Topology

- 8.4.1.1 LAMEA Centralized Market by Country

- 8.4.1.2 LAMEA Modular Market by Country

- 8.4.1.3 LAMEA Distributed Market by Country

- 8.4.2 LAMEA Battery Management System Market by Battery Type

- 8.4.2.1 LAMEA Lead-Acid Based Market by Country

- 8.4.2.2 LAMEA Lithium-Ion Based Market by Country

- 8.4.2.3 LAMEA Nickel Based Market by Country

- 8.4.2.4 LAMEA Flow Batteries Market by Country

- 8.4.3 LAMEA Battery Management System Market by Application

- 8.4.3.1 LAMEA Consumer Electronics Market by Country

- 8.4.3.2 LAMEA Automotive Market by Country

- 8.4.3.3 LAMEA Energy Market by Country

- 8.4.3.4 LAMEA Defense & Others Market by Country

- 8.4.4 LAMEA Battery Management System Market by Country

- 8.4.4.1 Brazil Battery Management System Market

- 8.4.4.1.1 Brazil Battery Management System Market by Topology

- 8.4.4.1.2 Brazil Battery Management System Market by Battery Type

- 8.4.4.1.3 Brazil Battery Management System Market by Application

- 8.4.4.2 Argentina Battery Management System Market

- 8.4.4.2.1 Argentina Battery Management System Market by Topology

- 8.4.4.2.2 Argentina Battery Management System Market by Battery Type

- 8.4.4.2.3 Argentina Battery Management System Market by Application

- 8.4.4.3 UAE Battery Management System Market

- 8.4.4.3.1 UAE Battery Management System Market by Topology

- 8.4.4.3.2 UAE Battery Management System Market by Battery Type

- 8.4.4.3.3 UAE Battery Management System Market by Application

- 8.4.4.4 Saudi Arabia Battery Management System Market

- 8.4.4.4.1 Saudi Arabia Battery Management System Market by Topology

- 8.4.4.4.2 Saudi Arabia Battery Management System Market by Battery Type

- 8.4.4.4.3 Saudi Arabia Battery Management System Market by Application

- 8.4.4.5 South Africa Battery Management System Market

- 8.4.4.5.1 South Africa Battery Management System Market by Topology

- 8.4.4.5.2 South Africa Battery Management System Market by Battery Type

- 8.4.4.5.3 South Africa Battery Management System Market by Application

- 8.4.4.6 Nigeria Battery Management System Market

- 8.4.4.6.1 Nigeria Battery Management System Market by Topology

- 8.4.4.6.2 Nigeria Battery Management System Market by Battery Type

- 8.4.4.6.3 Nigeria Battery Management System Market by Application

- 8.4.4.7 Rest of LAMEA Battery Management System Market

- 8.4.4.7.1 Rest of LAMEA Battery Management System Market by Topology

- 8.4.4.7.2 Rest of LAMEA Battery Management System Market by Battery Type

- 8.4.4.7.3 Rest of LAMEA Battery Management System Market by Application

- 8.4.4.1 Brazil Battery Management System Market

- 8.4.1 LAMEA Battery Management System Market by Topology

Chapter 9. Company Profiles

- 9.1 Elithion, Inc.

- 9.1.1 Company Overview

- 9.1.2 SWOT Analysis

- 9.2 Texas Instruments, Inc.

- 9.2.1 Company Overview

- 9.2.2 Financial Analysis

- 9.2.3 Segmental and Regional Analysis

- 9.2.4 Research & Development Expense

- 9.2.5 Recent strategies and developments:

- 9.2.5.1 Product Launches and Product Expansions:

- 9.2.6 SWOT Analysis

- 9.3 Sensata Technologies Holdings PLC

- 9.3.1 Company Overview

- 9.3.2 Financial Analysis

- 9.3.3 Segmental and Regional Analysis

- 9.3.4 Research & Development Expense

- 9.3.5 Recent strategies and developments:

- 9.3.5.1 Product Launches and Product Expansions:

- 9.3.6 SWOT Analysis

- 9.4 LG Energy Solution Ltd.

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 Regional Analysis

- 9.4.4 Research & Development Expense

- 9.4.5 Recent strategies and developments:

- 9.4.5.1 Partnerships, Collaborations, and Agreements:

- 9.4.5.2 Product Launches and Product Expansions:

- 9.4.6 SWOT Analysis

- 9.5 Analog Devices, Inc.

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Regional Analysis

- 9.5.4 Research & Development Expenses

- 9.5.5 Recent strategies and developments:

- 9.5.5.1 Partnerships, Collaborations, and Agreements:

- 9.5.5.2 Product Launches and Product Expansions:

- 9.5.6 SWOT Analysis

- 9.6 NXP Semiconductors N.V.

- 9.6.1 Company Overview

- 9.6.2 Financial Analysis

- 9.6.3 Regional Analysis

- 9.6.4 Research & Development Expenses

- 9.6.5 Recent strategies and developments:

- 9.6.5.1 Partnerships, Collaborations, and Agreements:

- 9.6.5.2 Product Launches and Product Expansions:

- 9.6.6 SWOT Analysis

- 9.7 Infineon Technologies AG

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 Segmental and Regional Analysis

- 9.7.4 Research & Development Expense

- 9.7.5 Recent strategies and developments:

- 9.7.5.1 Partnerships, Collaborations, and Agreements:

- 9.7.5.2 Product Launches and Product Expansions:

- 9.7.6 SWOT Analysis

- 9.8 Nuvation Energy

- 9.8.1 Company Overview

- 9.8.2 Recent strategies and developments:

- 9.8.2.1 Product Launches and Product Expansions:

- 9.9 Panasonic Industry Co., Ltd. (Panasonic Holdings Corporation)

- 9.9.1 Company Overview

- 9.9.2 Financial Analysis

- 9.9.3 Segmental and Regional Analysis

- 9.9.4 Research & Development Expenses

- 9.9.5 Recent strategies and developments:

- 9.9.5.1 Product Launches and Product Expansions:

- 9.9.6 SWOT Analysis

- 9.10. Robert Bosch GmbH

- 9.10.1 Company Overview

- 9.10.2 Financial Analysis

- 9.10.3 Segmental and Regional Analysis

- 9.10.4 Research & Development Expense

- 9.10.5 SWOT Analysis