|

|

市場調査レポート

商品コード

1395643

電動モーターの世界市場規模、シェア、産業動向分析レポート:出力電力別、タイプ別、エンドユーザー別、地域別展望と予測、2023年~2030年Global Electric Motor Market Size, Share & Industry Trends Analysis Report By Output Power (Fractional Horsepower (FHP), and Integral Horsepower (IHP)), By Type, By End User, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

| 電動モーターの世界市場規模、シェア、産業動向分析レポート:出力電力別、タイプ別、エンドユーザー別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年11月30日

発行: KBV Research

ページ情報: 英文 534 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

電動モーター市場規模は、予測期間中にCAGR 7.4%で成長し、2030年には2,363億米ドルに達すると予測されます。2022年の市場規模は2億5,631万5,900台、成長率は7.6%(2019年~2022年)。

KBVカーディナルマトリックスに掲載された分析によると、日立製作所、シーメンスAG、エマソン・エレクトリックCo.ABB Group、Robert Bosch GmbH、Denso Corporationなどの企業は、電動モーター市場における主要なイノベーターです。2022年11月、ABBグループは電動機、産業用ギアボックス、VSD、換気装置の輸入・卸売大手であるRMS(Rotating Machinery Supplies Ltd)と提携しました。この提携により、ABBグループはニュージーランドでソリューションとサービスを提供し、RMSをサポートします。

市場成長要因

エネルギー効率の高い電気モーターへの需要の増加

エネルギー効率の高い電気モーターは、より多くの電力を機械的動力に変換するように設計されており、その結果、エネルギー消費量が減少します。企業や産業界は、これらのモーターを使用することで、操業コストを大幅に削減することができます。多くの国が、エネルギー効率の高いモーターの使用を義務付ける規制や基準を導入しています。企業はこれらの規格に準拠することを余儀なくされるため、このようなモータの採用が促進されます。エネルギー効率の高いモーターに対する需要の高まりは、今後もモーター業界の技術革新を促進し、様々な分野での採用を促進すると思われます。エネルギー効率はビジネスや政策決定において重要な考慮事項であり続けるため、市場は拡大すると思われます。

技術の進歩

技術革新により、より高効率の電気モーターが開発されています。これらのモーターは、より多くの電気エネルギーを機械的動力に変換し、エネルギー消費と運転コストを削減します。VFDは高度なエレクトロニクスを使用して、これらのモーターの速度とトルクを制御します。このデータはモータの制御と診断に不可欠であり、よりスマートで効率的なモータの運転を可能にします。こうした技術の進歩は、エネルギー効率、性能、制御の課題に対処することで市場を拡大し、産業機械から電気自動車、スマート・ビルディングに至るまで、様々な産業やアプリケーションにこれらのモーターが不可欠な存在となっています。技術革新と持続可能性の継続的な追求は、市場の成長を促進すると予想されます。

市場抑制要因

電気モーターの初期コストの高さ

プレミアム効率モデルやエネルギー効率モデルなどの高効率電気モーターの初期購入価格は、標準的なモーターよりも著しく高くなる可能性があります。この初期費用は、購入者が最も効率的なオプションを選択することを躊躇させる可能性があります。例えば、ある種の工業プロセスでは、空気圧または油圧システムが電気モーターの代替品と見なされることがあります。消費者にとって価格が重要な要素である家電分野では、メーカーは製品コストを低く抑えるために標準的なモーターを選択することがあります。これは、よりエネルギー効率の高い電化製品の利用を制限する可能性があります。需要と供給の間にズレが生じ、その結果、部品メーカーが経済的損失を被ることになります。電気モーターの生産に使用される重要部品を米国ドルで購入すると、通常、部品コストが上昇します。以上の要因が市場成長の妨げとなります。

出力電力の見通し

出力に基づき、市場は分数馬力(FHP)と積分馬力(FHP)に細分化されます。2022年には、分数馬力(FHP)出力セグメントが市場で最大の収益シェアを生み出しました。ミキサー、フードプロセッサー、掃除機のような多くの家庭用電化製品は、分数馬力電気モーターを使用しています。これらのモーターは、過剰なエネルギーを消費することなく、特定の作業に十分な電力を供給するように設計されています。ベンチ・グラインダー、小型旋盤、バンド・ソーなどの小型機械や工具には、FHPモーターが使われています。これらのモーターは、趣味や小規模な用途に適しています。分数馬力ポンプは、ハイドロニック・ヒーティング・システムで温水を循環させたり、小型水槽で水を動かしたりするような用途に使われます。FHPモータの使用は、必要な電力が比較的低く、効率と費用対効果が優先される場合に一般的です。これらのモータには、1/4 hp、1/3 hp、1/2 hpなどさまざまな定格出力があり、設計者やエンジニアは特定の用途に適したモータサイズを選択できます。

タイプ別展望

タイプ別に見ると、市場はACモーター、DCモーター、密閉モーターに区分されます。DCモーターセグメントは2022年の市場で大きな収益シェアを獲得しました。DCモーターは、内燃機関自動車のスターターモーターとして一般的に使用され、エンジン始動に必要な初期回転力を提供します。旋盤やフライス盤などの多くの工作機械は、回転速度と切削作業を制御するためにDCモーターを使用しています。DCモーターはロボットアームやアクチュエーターによく使われ、精密で制御された動きを提供します。DCモーターは、掃除機、台所用品、電動工具の様々な機能に使用されています。DCモーターは、遠心分離機やシェーカーなど、回転の精密な制御が必要な複数の実験装置に使用されています。

ACモーターの展望

ACモーターのタイプでは、市場はさらに同期式と誘導式に分けられます。2022年には、誘導セグメントが市場で最も高い収益シェアを占めました。誘導モーターはファラデーの電磁誘導の法則に基づいて作動します。交流電圧が印加されると固定子(静止部)に回転磁界が発生し、電磁誘導によって回転子(回転部)に電流が誘導されます。回転磁界とロータ電流の相互作用により機械的回転が発生します。誘導ACモーターは、その自己始動能力、耐久性、効率により、多用途で広く使用されています。家庭用電化製品から重工業用機械まで幅広い用途に対応し、さまざまな産業で活躍し続けています。可変周波数ドライブを使用することで、その汎用性が拡大し、多くの用途で速度制御と省エネルギーが可能になりました。

DCモーターの展望

DCモーターのタイプでは、市場はブラシレスとブラシ付きに分類されます。2022年には、ブラシレスセグメントが市場で最も高い収益シェアを記録しました。BLDCモーターは、電子回路とセンサーを使ってモーターの巻線に流れる電流のタイミングを制御します。この精密な制御により、正確な速度と位置の調節が可能になります。BLDCモーターは高効率で知られています。摩擦が少ないため発熱が少なく、ブラシ付きDCモーターよりもエネルギー効率が高いです。この効率はバッテリー駆動のアプリケーションでは不可欠です。輸液ポンプや手術器具などの医療機器や装置にも使用されています。コンピュータのハードドライブ、DVDやブルーレイドライブ、電子機器の冷却ファンにも使用されています。BLDCモーターは回生ブレーキに使用することができ、減速時にエネルギーを回収して蓄える発電機として機能し、全体的な効率を向上させます。

エンドユーザーの展望

エンドユーザー別では、市場は自動車、産業機械、HVAC機器、家電製品、航空宇宙・輸送、その他に分類されます。2022年の市場では、暖房・換気・冷房(HVAC)機器分野が突出した収益シェアを予測しています。これらのファンは、建物全体に調整された空気を適切に分配します。空調装置のコンプレッサーとコンデンサーのファンを駆動します。これらのファンは熱交換に不可欠であり、冷凍サイクルが室内空間から熱を除去することを可能にします。HVAC機器のこれらのモーターは、快適で健康的な室内環境を維持するために不可欠なエネルギー効率、信頼性、および精密な制御のために設計されています。その使用は、エネルギー効率の改善、エネルギー消費の削減、住宅と商業施設の両方における暖房、冷房、換気技術の運用コストの削減に貢献しています。

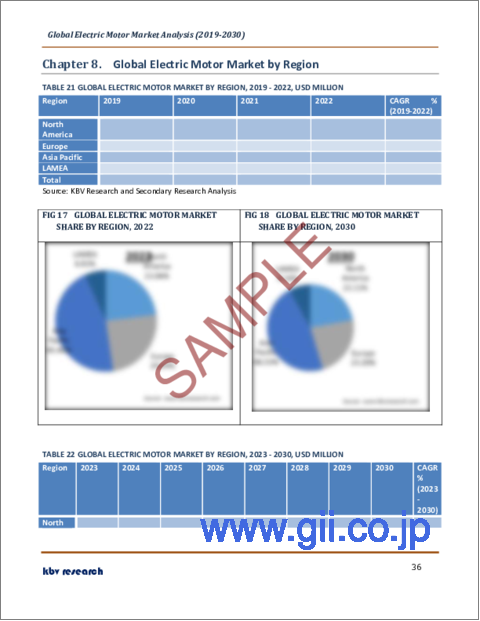

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、ラテンアメリカ・中東・アフリカで分析されます。2022年には、アジア太平洋地域が最大の収益シェアで市場を独占しました。アジア太平洋地域は、人口が最も急速に増加している発展著しい地域です。国連によると、世界人口の3分の2近くがアジア太平洋地域に居住しており、中国とインドだけで世界人口の3分の1を占めています。また、アジア太平洋地域の都市化率も高いです。このように、同地域では人口増加と都市化が進んでいるため、産業、自動車、家庭の各分野が急速に成長しています。そのため、これらの分野で広く使用されている電気モーターの需要は、今後数年間で増加すると予想されています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 地理的拡大

- 市場シェア分析、2022年

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターファイブフォース分析

第5章 世界の電動モーター市場:出力電力別

- 世界の分数馬力(FHP)市場:地域別

- 世界の統合馬力(IHP)市場:地域別

第6章 世界の電動モーター市場:タイプ別

- 世界のACモーター市場:地域別

- 世界の電動モーター市場:ACモータータイプ別

- 世界の誘導市場:地域別

- 世界の同期市場:地域別

- 世界のDCモーター市場:地域別

- 世界の電動モーター市場:DCモータータイプ別

- 世界のブラシレス市場:地域別

- 世界のブラッシュド市場:地域別

- ハーメチックモーターの世界市場:地域別

第7章 世界の電動モーター市場:エンドユーザー別

- 世界の自動車市場:地域別

- 世界の産業機械市場:地域別

- 世界のHVAC機器市場:地域別

- 世界の家電市場:地域別

- 世界の航空宇宙・輸送市場:地域別

- 世界のその他の市場:地域別

第8章 世界の電動モーター市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他の北米

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他の欧州

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他のアジア太平洋

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他のラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

第9章 企業プロファイル

- Robert Bosch GmbH

- General Electric Company

- Siemens AG

- Hitachi, Ltd

- Mitsubishi Electric Corporation

- ABB Group

- Denso Corporation

- Magna International, Inc

- Toshiba Corporation

- Emerson Electric Co

第10章 電動モーター市場の勝利は必須

LIST OF TABLES

- TABLE 1 Global Electric Motor Market, 2019 - 2022, USD Million

- TABLE 2 Global Electric Motor Market, 2023 - 2030, USD Million

- TABLE 3 Global Electric Motor Market, 2019 - 2022, Thousand Units

- TABLE 4 Global Electric Motor Market, 2023 - 2030, Thousand Units

- TABLE 5 Partnerships, Collaborations and Agreements- Electric Motor Market

- TABLE 6 Product Launches And Product Expansions- Electric Motor Market

- TABLE 7 Acquisition and Mergers- Electric Motor Market

- TABLE 8 geographical Expansions- Electric Motor Market

- TABLE 9 Global Electric Motor Market by Output Power, 2019 - 2022, USD Million

- TABLE 10 Global Electric Motor Market by Output Power, 2023 - 2030, USD Million

- TABLE 11 Global Electric Motor Market by Output Power, 2019 - 2022, Thousand Units

- TABLE 12 Global Electric Motor Market by Output Power, 2023 - 2030, Thousand Units

- TABLE 13 Global Fractional Horsepower (FHP) Market by Region, 2019 - 2022, USD Million

- TABLE 14 Global Fractional Horsepower (FHP) Market by Region, 2023 - 2030, USD Million

- TABLE 15 Global Fractional Horsepower (FHP) Market by Region, 2019 - 2022, Thousand Units

- TABLE 16 Global Fractional Horsepower (FHP) Market by Region, 2023 - 2030, Thousand Units

- TABLE 17 Global Integral Horsepower (IHP) Market by Region, 2019 - 2022, USD Million

- TABLE 18 Global Integral Horsepower (IHP) Market by Region, 2023 - 2030, USD Million

- TABLE 19 Global Integral Horsepower (IHP) Market by Region, 2019 - 2022, Thousand Units

- TABLE 20 Global Integral Horsepower (IHP) Market by Region, 2023 - 2030, Thousand Units

- TABLE 21 Global Electric Motor Market by Type, 2019 - 2022, USD Million

- TABLE 22 Global Electric Motor Market by Type, 2023 - 2030, USD Million

- TABLE 23 Global Electric Motor Market by Type, 2019 - 2022, Thousand Units

- TABLE 24 Global Electric Motor Market by Type, 2023 - 2030, Thousand Units

- TABLE 25 Global AC Motor Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global AC Motor Market by Region, 2023 - 2030, USD Million

- TABLE 27 Global AC Motor Market by Region, 2019 - 2022, Thousand Units

- TABLE 28 Global AC Motor Market by Region, 2023 - 2030, Thousand Units

- TABLE 29 Global Electric Motor Market by AC Motor Type, 2019 - 2022, USD Million

- TABLE 30 Global Electric Motor Market by AC Motor Type, 2023 - 2030, USD Million

- TABLE 31 Global Electric Motor Market by AC Motor Type, 2019 - 2022, Thousand Units

- TABLE 32 Global Electric Motor Market by AC Motor Type, 2023 - 2030, Thousand Units

- TABLE 33 Global Induction Market by Region, 2019 - 2022, USD Million

- TABLE 34 Global Induction Market by Region, 2023 - 2030, USD Million

- TABLE 35 Global Induction Market by Region, 2019 - 2022, Thousand Units

- TABLE 36 Global Induction Market by Region, 2023 - 2030, Thousand Units

- TABLE 37 Global Synchronous Market by Region, 2019 - 2022, USD Million

- TABLE 38 Global Synchronous Market by Region, 2023 - 2030, USD Million

- TABLE 39 Global Synchronous Market by Region, 2019 - 2022, Thousand Units

- TABLE 40 Global Synchronous Market by Region, 2023 - 2030, Thousand Units

- TABLE 41 Global DC Motor Market by Region, 2019 - 2022, USD Million

- TABLE 42 Global DC Motor Market by Region, 2023 - 2030, USD Million

- TABLE 43 Global DC Motor Market by Region, 2019 - 2022, Thousand Units

- TABLE 44 Global DC Motor Market by Region, 2023 - 2030, Thousand Units

- TABLE 45 Global Electric Motor Market by DC Motor Type, 2019 - 2022, USD Million

- TABLE 46 Global Electric Motor Market by DC Motor Type, 2023 - 2030, USD Million

- TABLE 47 Global Electric Motor Market by DC Motor Type, 2019 - 2022, Thousand Units

- TABLE 48 Global Electric Motor Market by DC Motor Type, 2023 - 2030, Thousand Units

- TABLE 49 Global Brushless Market by Region, 2019 - 2022, USD Million

- TABLE 50 Global Brushless Market by Region, 2023 - 2030, USD Million

- TABLE 51 Global Brushless Market by Region, 2019 - 2022, Thousand Units

- TABLE 52 Global Brushless Market by Region, 2023 - 2030, Thousand Units

- TABLE 53 Global Brushed Market by Region, 2019 - 2022, USD Million

- TABLE 54 Global Brushed Market by Region, 2023 - 2030, USD Million

- TABLE 55 Global Brushed Market by Region, 2019 - 2022, Thousand Units

- TABLE 56 Global Brushed Market by Region, 2023 - 2030, Thousand Units

- TABLE 57 Global Hermetic Motor Market by Region, 2019 - 2022, USD Million

- TABLE 58 Global Hermetic Motor Market by Region, 2023 - 2030, USD Million

- TABLE 59 Global Hermetic Motor Market by Region, 2019 - 2022, Thousand Units

- TABLE 60 Global Hermetic Motor Market by Region, 2023 - 2030, Thousand Units

- TABLE 61 Global Electric Motor Market by End User, 2019 - 2022, USD Million

- TABLE 62 Global Electric Motor Market by End User, 2023 - 2030, USD Million

- TABLE 63 Global Electric Motor Market by End User, 2019 - 2022, Thousand Units

- TABLE 64 Global Electric Motor Market by End User, 2023 - 2030, Thousand Units

- TABLE 65 Global Motor Vehicles Market by Region, 2019 - 2022, USD Million

- TABLE 66 Global Motor Vehicles Market by Region, 2023 - 2030, USD Million

- TABLE 67 Global Motor Vehicles Market by Region, 2019 - 2022, Thousand Units

- TABLE 68 Global Motor Vehicles Market by Region, 2023 - 2030, Thousand Units

- TABLE 69 Global Industrial Machinery Market by Region, 2019 - 2022, USD Million

- TABLE 70 Global Industrial Machinery Market by Region, 2023 - 2030, USD Million

- TABLE 71 Global Industrial Machinery Market by Region, 2019 - 2022, Thousand Units

- TABLE 72 Global Industrial Machinery Market by Region, 2023 - 2030, Thousand Units

- TABLE 73 Global HVAC Equipment Market by Region, 2019 - 2022, USD Million

- TABLE 74 Global HVAC Equipment Market by Region, 2023 - 2030, USD Million

- TABLE 75 Global HVAC Equipment Market by Region, 2019 - 2022, Thousand Units

- TABLE 76 Global HVAC Equipment Market by Region, 2023 - 2030, Thousand Units

- TABLE 77 Global Household Appliances Market by Region, 2019 - 2022, USD Million

- TABLE 78 Global Household Appliances Market by Region, 2023 - 2030, USD Million

- TABLE 79 Global Household Appliances Market by Region, 2019 - 2022, Thousand Units

- TABLE 80 Global Household Appliances Market by Region, 2023 - 2030, Thousand Units

- TABLE 81 Global Aerospace & Transportation Market by Region, 2019 - 2022, USD Million

- TABLE 82 Global Aerospace & Transportation Market by Region, 2023 - 2030, USD Million

- TABLE 83 Global Aerospace & Transportation Market by Region, 2019 - 2022, Thousand Units

- TABLE 84 Global Aerospace & Transportation Market by Region, 2023 - 2030, Thousand Units

- TABLE 85 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 86 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 87 Global Others Market by Region, 2019 - 2022, Thousand Units

- TABLE 88 Global Others Market by Region, 2023 - 2030, Thousand Units

- TABLE 89 Global Electric Motor Market by Region, 2019 - 2022, USD Million

- TABLE 90 Global Electric Motor Market by Region, 2023 - 2030, USD Million

- TABLE 91 Global Electric Motor Market by Region, 2019 - 2022, Thousand Units

- TABLE 92 Global Electric Motor Market by Region, 2023 - 2030, Thousand Units

- TABLE 93 North America Electric Motor Market, 2019 - 2022, USD Million

- TABLE 94 North America Electric Motor Market, 2023 - 2030, USD Million

- TABLE 95 North America Electric Motor Market, 2019 - 2022, Thousand Units

- TABLE 96 North America Electric Motor Market, 2023 - 2030, Thousand Units

- TABLE 97 North America Electric Motor Market by Output Power, 2019 - 2022, USD Million

- TABLE 98 North America Electric Motor Market by Output Power, 2023 - 2030, USD Million

- TABLE 99 North America Electric Motor Market by Output Power, 2019 - 2022, Thousand Units

- TABLE 100 North America Electric Motor Market by Output Power, 2023 - 2030, Thousand Units

- TABLE 101 North America Fractional Horsepower (FHP) Market by Region, 2019 - 2022, USD Million

- TABLE 102 North America Fractional Horsepower (FHP) Market by Region, 2023 - 2030, USD Million

- TABLE 103 North America Fractional Horsepower (FHP) Market by Region, 2019 - 2022, Thousand Units

- TABLE 104 North America Fractional Horsepower (FHP) Market by Region, 2023 - 2030, Thousand Units

- TABLE 105 North America Integral Horsepower (IHP) Market by Region, 2019 - 2022, USD Million

- TABLE 106 North America Integral Horsepower (IHP) Market by Region, 2023 - 2030, USD Million

- TABLE 107 North America Integral Horsepower (IHP) Market by Region, 2019 - 2022, Thousand Units

- TABLE 108 North America Integral Horsepower (IHP) Market by Region, 2023 - 2030, Thousand Units

- TABLE 109 North America Electric Motor Market by Type, 2019 - 2022, USD Million

- TABLE 110 North America Electric Motor Market by Type, 2023 - 2030, USD Million

- TABLE 111 North America Electric Motor Market by Type, 2019 - 2022, Thousand Units

- TABLE 112 North America Electric Motor Market by Type, 2023 - 2030, Thousand Units

- TABLE 113 North America AC Motor Market by Country, 2019 - 2022, USD Million

- TABLE 114 North America AC Motor Market by Country, 2023 - 2030, USD Million

- TABLE 115 North America AC Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 116 North America AC Motor Market by Country, 2023 - 2030, Thousand Units

- TABLE 117 North America Electric Motor Market by AC Motor Type, 2019 - 2022, USD Million

- TABLE 118 North America Electric Motor Market by AC Motor Type, 2023 - 2030, USD Million

- TABLE 119 North America Electric Motor Market by AC Motor Type, 2019 - 2022, Thousand Units

- TABLE 120 North America Electric Motor Market by AC Motor Type, 2023 - 2030, Thousand Units

- TABLE 121 North America Induction Market by Country, 2019 - 2022, USD Million

- TABLE 122 North America Induction Market by Country, 2023 - 2030, USD Million

- TABLE 123 North America Induction Market by Country, 2019 - 2022, Thousand Units

- TABLE 124 North America Induction Market by Country, 2023 - 2030, Thousand Units

- TABLE 125 North America Synchronous Market by Country, 2019 - 2022, USD Million

- TABLE 126 North America Synchronous Market by Country, 2023 - 2030, USD Million

- TABLE 127 North America Synchronous Market by Country, 2019 - 2022, Thousand Units

- TABLE 128 North America Synchronous Market by Country, 2023 - 2030, Thousand Units

- TABLE 129 North America DC Motor Market by Country, 2019 - 2022, USD Million

- TABLE 130 North America DC Motor Market by Country, 2023 - 2030, USD Million

- TABLE 131 North America DC Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 132 North America DC Motor Market by Country, 2023 - 2030, Thousand Units

- TABLE 133 North America Electric Motor Market by DC Motor Type, 2019 - 2022, USD Million

- TABLE 134 North America Electric Motor Market by DC Motor Type, 2023 - 2030, USD Million

- TABLE 135 North America Electric Motor Market by DC Motor Type, 2019 - 2022, Thousand Units

- TABLE 136 North America Electric Motor Market by DC Motor Type, 2023 - 2030, Thousand Units

- TABLE 137 North America Brushless Market by Country, 2019 - 2022, USD Million

- TABLE 138 North America Brushless Market by Country, 2023 - 2030, USD Million

- TABLE 139 North America Brushless Market by Country, 2019 - 2022, Thousand Units

- TABLE 140 North America Brushless Market by Country, 2023 - 2030, Thousand Units

- TABLE 141 North America Brushed Market by Country, 2019 - 2022, USD Million

- TABLE 142 North America Brushed Market by Country, 2023 - 2030, USD Million

- TABLE 143 North America Brushed Market by Country, 2019 - 2022, Thousand Units

- TABLE 144 North America Brushed Market by Country, 2023 - 2030, Thousand Units

- TABLE 145 North America Hermetic Motor Market by Country, 2019 - 2022, USD Million

- TABLE 146 North America Hermetic Motor Market by Country, 2023 - 2030, USD Million

- TABLE 147 North America Hermetic Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 148 North America Hermetic Motor Market by Country, 2023 - 2030, Thousand Units

- TABLE 149 North America Electric Motor Market by End User, 2019 - 2022, USD Million

- TABLE 150 North America Electric Motor Market by End User, 2023 - 2030, USD Million

- TABLE 151 North America Electric Motor Market by End User, 2019 - 2022, Thousand Units

- TABLE 152 North America Electric Motor Market by End User, 2023 - 2030, Thousand Units

- TABLE 153 North America Motor Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 154 North America Motor Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 155 North America Motor Vehicles Market by Country, 2019 - 2022, Thousand Units

- TABLE 156 North America Motor Vehicles Market by Country, 2023 - 2030, Thousand Units

- TABLE 157 North America Industrial Machinery Market by Country, 2019 - 2022, USD Million

- TABLE 158 North America Industrial Machinery Market by Country, 2023 - 2030, USD Million

- TABLE 159 North America Industrial Machinery Market by Country, 2019 - 2022, Thousand Units

- TABLE 160 North America Industrial Machinery Market by Country, 2023 - 2030, Thousand Units

- TABLE 161 North America HVAC Equipment Market by Country, 2019 - 2022, USD Million

- TABLE 162 North America HVAC Equipment Market by Country, 2023 - 2030, USD Million

- TABLE 163 North America HVAC Equipment Market by Country, 2019 - 2022, Thousand Units

- TABLE 164 North America HVAC Equipment Market by Country, 2023 - 2030, Thousand Units

- TABLE 165 North America Household Appliances Market by Country, 2019 - 2022, USD Million

- TABLE 166 North America Household Appliances Market by Country, 2023 - 2030, USD Million

- TABLE 167 North America Household Appliances Market by Country, 2019 - 2022, Thousand Units

- TABLE 168 North America Household Appliances Market by Country, 2023 - 2030, Thousand Units

- TABLE 169 North America Aerospace & Transportation Market by Country, 2019 - 2022, USD Million

- TABLE 170 North America Aerospace & Transportation Market by Country, 2023 - 2030, USD Million

- TABLE 171 North America Aerospace & Transportation Market by Country, 2019 - 2022, Thousand Units

- TABLE 172 North America Aerospace & Transportation Market by Country, 2023 - 2030, Thousand Units

- TABLE 173 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 174 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 175 North America Others Market by Country, 2019 - 2022, Thousand Units

- TABLE 176 North America Others Market by Country, 2023 - 2030, Thousand Units

- TABLE 177 North America Electric Motor Market by Country, 2019 - 2022, USD Million

- TABLE 178 North America Electric Motor Market by Country, 2023 - 2030, USD Million

- TABLE 179 North America Electric Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 180 North America Electric Motor Market by Country, 2023 - 2030, Thousand Units

- TABLE 181 US Electric Motor Market, 2019 - 2022, USD Million

- TABLE 182 US Electric Motor Market, 2023 - 2030, USD Million

- TABLE 183 US Electric Motor Market, 2019 - 2022, Thousand Units

- TABLE 184 US Electric Motor Market, 2023 - 2030, Thousand Units

- TABLE 185 US Electric Motor Market by Output Power, 2019 - 2022, USD Million

- TABLE 186 US Electric Motor Market by Output Power, 2023 - 2030, USD Million

- TABLE 187 US Electric Motor Market by Output Power, 2019 - 2022, Thousand Units

- TABLE 188 US Electric Motor Market by Output Power, 2023 - 2030, Thousand Units

- TABLE 189 US Electric Motor Market by Type, 2019 - 2022, USD Million

- TABLE 190 US Electric Motor Market by Type, 2023 - 2030, USD Million

- TABLE 191 US Electric Motor Market by Type, 2019 - 2022, Thousand Units

- TABLE 192 US Electric Motor Market by Type, 2023 - 2030, Thousand Units

- TABLE 193 US Electric Motor Market by AC Motor Type, 2019 - 2022, USD Million

- TABLE 194 US Electric Motor Market by AC Motor Type, 2023 - 2030, USD Million

- TABLE 195 US Electric Motor Market by AC Motor Type, 2019 - 2022, Thousand Units

- TABLE 196 US Electric Motor Market by AC Motor Type, 2023 - 2030, Thousand Units

- TABLE 197 US Electric Motor Market by DC Motor Type, 2019 - 2022, USD Million

- TABLE 198 US Electric Motor Market by DC Motor Type, 2023 - 2030, USD Million

- TABLE 199 US Electric Motor Market by DC Motor Type, 2019 - 2022, Thousand Units

- TABLE 200 US Electric Motor Market by DC Motor Type, 2023 - 2030, Thousand Units

- TABLE 201 US Electric Motor Market by End User, 2019 - 2022, USD Million

- TABLE 202 US Electric Motor Market by End User, 2023 - 2030, USD Million

- TABLE 203 US Electric Motor Market by End User, 2019 - 2022, Thousand Units

- TABLE 204 US Electric Motor Market by End User, 2023 - 2030, Thousand Units

- TABLE 205 Canada Electric Motor Market, 2019 - 2022, USD Million

- TABLE 206 Canada Electric Motor Market, 2023 - 2030, USD Million

- TABLE 207 Canada Electric Motor Market, 2019 - 2022, Thousand Units

- TABLE 208 Canada Electric Motor Market, 2023 - 2030, Thousand Units

- TABLE 209 Canada Electric Motor Market by Output Power, 2019 - 2022, USD Million

- TABLE 210 Canada Electric Motor Market by Output Power, 2023 - 2030, USD Million

- TABLE 211 Canada Electric Motor Market by Output Power, 2019 - 2022, Thousand Units

- TABLE 212 Canada Electric Motor Market by Output Power, 2023 - 2030, Thousand Units

- TABLE 213 Canada Electric Motor Market by Type, 2019 - 2022, USD Million

- TABLE 214 Canada Electric Motor Market by Type, 2023 - 2030, USD Million

- TABLE 215 Canada Electric Motor Market by Type, 2019 - 2022, Thousand Units

- TABLE 216 Canada Electric Motor Market by Type, 2023 - 2030, Thousand Units

- TABLE 217 Canada Electric Motor Market by AC Motor Type, 2019 - 2022, USD Million

- TABLE 218 Canada Electric Motor Market by AC Motor Type, 2023 - 2030, USD Million

- TABLE 219 Canada Electric Motor Market by AC Motor Type, 2019 - 2022, Thousand Units

- TABLE 220 Canada Electric Motor Market by AC Motor Type, 2023 - 2030, Thousand Units

- TABLE 221 Canada Electric Motor Market by DC Motor Type, 2019 - 2022, USD Million

- TABLE 222 Canada Electric Motor Market by DC Motor Type, 2023 - 2030, USD Million

- TABLE 223 Canada Electric Motor Market by DC Motor Type, 2019 - 2022, Thousand Units

- TABLE 224 Canada Electric Motor Market by DC Motor Type, 2023 - 2030, Thousand Units

- TABLE 225 Canada Electric Motor Market by End User, 2019 - 2022, USD Million

- TABLE 226 Canada Electric Motor Market by End User, 2023 - 2030, USD Million

- TABLE 227 Canada Electric Motor Market by End User, 2019 - 2022, Thousand Units

- TABLE 228 Canada Electric Motor Market by End User, 2023 - 2030, Thousand Units

- TABLE 229 Mexico Electric Motor Market, 2019 - 2022, USD Million

- TABLE 230 Mexico Electric Motor Market, 2023 - 2030, USD Million

- TABLE 231 Mexico Electric Motor Market, 2019 - 2022, Thousand Units

- TABLE 232 Mexico Electric Motor Market, 2023 - 2030, Thousand Units

- TABLE 233 Mexico Electric Motor Market by Output Power, 2019 - 2022, USD Million

- TABLE 234 Mexico Electric Motor Market by Output Power, 2023 - 2030, USD Million

- TABLE 235 Mexico Electric Motor Market by Output Power, 2019 - 2022, Thousand Units

- TABLE 236 Mexico Electric Motor Market by Output Power, 2023 - 2030, Thousand Units

- TABLE 237 Mexico Electric Motor Market by Type, 2019 - 2022, USD Million

- TABLE 238 Mexico Electric Motor Market by Type, 2023 - 2030, USD Million

- TABLE 239 Mexico Electric Motor Market by Type, 2019 - 2022, Thousand Units

- TABLE 240 Mexico Electric Motor Market by Type, 2023 - 2030, Thousand Units

- TABLE 241 Mexico Electric Motor Market by AC Motor Type, 2019 - 2022, USD Million

- TABLE 242 Mexico Electric Motor Market by AC Motor Type, 2023 - 2030, USD Million

- TABLE 243 Mexico Electric Motor Market by AC Motor Type, 2019 - 2022, Thousand Units

- TABLE 244 Mexico Electric Motor Market by AC Motor Type, 2023 - 2030, Thousand Units

- TABLE 245 Mexico Electric Motor Market by DC Motor Type, 2019 - 2022, USD Million

- TABLE 246 Mexico Electric Motor Market by DC Motor Type, 2023 - 2030, USD Million

- TABLE 247 Mexico Electric Motor Market by DC Motor Type, 2019 - 2022, Thousand Units

- TABLE 248 Mexico Electric Motor Market by DC Motor Type, 2023 - 2030, Thousand Units

- TABLE 249 Mexico Electric Motor Market by End User, 2019 - 2022, USD Million

- TABLE 250 Mexico Electric Motor Market by End User, 2023 - 2030, USD Million

- TABLE 251 Mexico Electric Motor Market by End User, 2019 - 2022, Thousand Units

- TABLE 252 Mexico Electric Motor Market by End User, 2023 - 2030, Thousand Units

- TABLE 253 Rest of North America Electric Motor Market, 2019 - 2022, USD Million

- TABLE 254 Rest of North America Electric Motor Market, 2023 - 2030, USD Million

- TABLE 255 Rest of North America Electric Motor Market, 2019 - 2022, Thousand Units

- TABLE 256 Rest of North America Electric Motor Market, 2023 - 2030, Thousand Units

- TABLE 257 Rest of North America Electric Motor Market by Output Power, 2019 - 2022, USD Million

- TABLE 258 Rest of North America Electric Motor Market by Output Power, 2023 - 2030, USD Million

- TABLE 259 Rest of North America Electric Motor Market by Output Power, 2019 - 2022, Thousand Units

- TABLE 260 Rest of North America Electric Motor Market by Output Power, 2023 - 2030, Thousand Units

- TABLE 261 Rest of North America Electric Motor Market by Type, 2019 - 2022, USD Million

- TABLE 262 Rest of North America Electric Motor Market by Type, 2023 - 2030, USD Million

- TABLE 263 Rest of North America Electric Motor Market by Type, 2019 - 2022, Thousand Units

- TABLE 264 Rest of North America Electric Motor Market by Type, 2023 - 2030, Thousand Units

- TABLE 265 Rest of North America Electric Motor Market by AC Motor Type, 2019 - 2022, USD Million

- TABLE 266 Rest of North America Electric Motor Market by AC Motor Type, 2023 - 2030, USD Million

- TABLE 267 Rest of North America Electric Motor Market by AC Motor Type, 2019 - 2022, Thousand Units

- TABLE 268 Rest of North America Electric Motor Market by AC Motor Type, 2023 - 2030, Thousand Units

- TABLE 269 Rest of North America Electric Motor Market by DC Motor Type, 2019 - 2022, USD Million

- TABLE 270 Rest of North America Electric Motor Market by DC Motor Type, 2023 - 2030, USD Million

- TABLE 271 Rest of North America Electric Motor Market by DC Motor Type, 2019 - 2022, Thousand Units

- TABLE 272 Rest of North America Electric Motor Market by DC Motor Type, 2023 - 2030, Thousand Units

- TABLE 273 Rest of North America Electric Motor Market by End User, 2019 - 2022, USD Million

- TABLE 274 Rest of North America Electric Motor Market by End User, 2023 - 2030, USD Million

- TABLE 275 Rest of North America Electric Motor Market by End User, 2019 - 2022, Thousand Units

- TABLE 276 Rest of North America Electric Motor Market by End User, 2023 - 2030, Thousand Units

- TABLE 277 Europe Electric Motor Market, 2019 - 2022, USD Million

- TABLE 278 Europe Electric Motor Market, 2023 - 2030, USD Million

- TABLE 279 Europe Electric Motor Market, 2019 - 2022, Thousand Units

- TABLE 280 Europe Electric Motor Market, 2023 - 2030, Thousand Units

- TABLE 281 Europe Electric Motor Market by Output Power, 2019 - 2022, USD Million

- TABLE 282 Europe Electric Motor Market by Output Power, 2023 - 2030, USD Million

- TABLE 283 Europe Electric Motor Market by Output Power, 2019 - 2022, Thousand Units

- TABLE 284 Europe Electric Motor Market by Output Power, 2023 - 2030, Thousand Units

- TABLE 285 Europe Fractional Horsepower (FHP) Market by Country, 2019 - 2022, USD Million

- TABLE 286 Europe Fractional Horsepower (FHP) Market by Country, 2023 - 2030, USD Million

- TABLE 287 Europe Fractional Horsepower (FHP) Market by Country, 2019 - 2022, Thousand Units

- TABLE 288 Europe Fractional Horsepower (FHP) Market by Country, 2023 - 2030, Thousand Units

- TABLE 289 Europe Integral Horsepower (IHP) Market by Country, 2019 - 2022, USD Million

- TABLE 290 Europe Integral Horsepower (IHP) Market by Country, 2023 - 2030, USD Million

- TABLE 291 Europe Integral Horsepower (IHP) Market by Country, 2019 - 2022, Thousand Units

- TABLE 292 Europe Integral Horsepower (IHP) Market by Country, 2023 - 2030, Thousand Units

- TABLE 293 Europe Electric Motor Market by Type, 2019 - 2022, USD Million

- TABLE 294 Europe Electric Motor Market by Type, 2023 - 2030, USD Million

- TABLE 295 Europe Electric Motor Market by Type, 2019 - 2022, Thousand Units

- TABLE 296 Europe Electric Motor Market by Type, 2023 - 2030, Thousand Units

- TABLE 297 Europe AC Motor Market by Country, 2019 - 2022, USD Million

- TABLE 298 Europe AC Motor Market by Country, 2023 - 2030, USD Million

- TABLE 299 Europe AC Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 300 Europe AC Motor Market by Country, 2023 - 2030, Thousand Units

- TABLE 301 Europe Electric Motor Market by AC Motor Type, 2019 - 2022, USD Million

- TABLE 302 Europe Electric Motor Market by AC Motor Type, 2023 - 2030, USD Million

- TABLE 303 Europe Electric Motor Market by AC Motor Type, 2019 - 2022, Thousand Units

- TABLE 304 Europe Electric Motor Market by AC Motor Type, 2023 - 2030, Thousand Units

- TABLE 305 Europe Induction Market by Country, 2019 - 2022, USD Million

- TABLE 306 Europe Induction Market by Country, 2023 - 2030, USD Million

- TABLE 307 Europe Induction Market by Country, 2019 - 2022, Thousand Units

- TABLE 308 Europe Induction Market by Country, 2023 - 2030, Thousand Units

- TABLE 309 Europe Synchronous Market by Country, 2019 - 2022, USD Million

- TABLE 310 Europe Synchronous Market by Country, 2023 - 2030, USD Million

- TABLE 311 Europe Synchronous Market by Country, 2019 - 2022, Thousand Units

- TABLE 312 Europe Synchronous Market by Country, 2023 - 2030, Thousand Units

- TABLE 313 Europe DC Motor Market by Country, 2019 - 2022, USD Million

- TABLE 314 Europe DC Motor Market by Country, 2023 - 2030, USD Million

- TABLE 315 Europe DC Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 316 Europe DC Motor Market by Country, 2023 - 2030, Thousand Units

- TABLE 317 Europe Electric Motor Market by DC Motor Type, 2019 - 2022, USD Million

- TABLE 318 Europe Electric Motor Market by DC Motor Type, 2023 - 2030, USD Million

- TABLE 319 Europe Electric Motor Market by DC Motor Type, 2019 - 2022, Thousand Units

- TABLE 320 Europe Electric Motor Market by DC Motor Type, 2023 - 2030, Thousand Units

- TABLE 321 Europe Brushless Market by Country, 2019 - 2022, USD Million

- TABLE 322 Europe Brushless Market by Country, 2023 - 2030, USD Million

- TABLE 323 Europe Brushless Market by Country, 2019 - 2022, Thousand Units

- TABLE 324 Europe Brushless Market by Country, 2023 - 2030, Thousand Units

- TABLE 325 Europe Brushed Market by Country, 2019 - 2022, USD Million

- TABLE 326 Europe Brushed Market by Country, 2023 - 2030, USD Million

- TABLE 327 Europe Brushed Market by Country, 2019 - 2022, Thousand Units

- TABLE 328 Europe Brushed Market by Country, 2023 - 2030, Thousand Units

- TABLE 329 Europe Hermetic Motor Market by Country, 2019 - 2022, USD Million

- TABLE 330 Europe Hermetic Motor Market by Country, 2023 - 2030, USD Million

- TABLE 331 Europe Hermetic Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 332 Europe Hermetic Motor Market by Country, 2023 - 2030, Thousand Units

- TABLE 333 Europe Electric Motor Market by End User, 2019 - 2022, USD Million

- TABLE 334 Europe Electric Motor Market by End User, 2023 - 2030, USD Million

- TABLE 335 Europe Electric Motor Market by End User, 2019 - 2022, Thousand Units

- TABLE 336 Europe Electric Motor Market by End User, 2023 - 2030, Thousand Units

- TABLE 337 Europe Motor Vehicles Market by Country, 2019 - 2022, USD Million

- TABLE 338 Europe Motor Vehicles Market by Country, 2023 - 2030, USD Million

- TABLE 339 Europe Motor Vehicles Market by Country, 2019 - 2022, Thousand Units

- TABLE 340 Europe Motor Vehicles Market by Country, 2023 - 2030, Thousand Units

- TABLE 341 Europe Industrial Machinery Market by Country, 2019 - 2022, USD Million

- TABLE 342 Europe Industrial Machinery Market by Country, 2023 - 2030, USD Million

- TABLE 343 Europe Industrial Machinery Market by Country, 2019 - 2022, Thousand Units

- TABLE 344 Europe Industrial Machinery Market by Country, 2023 - 2030, Thousand Units

- TABLE 345 Europe HVAC Equipment Market by Country, 2019 - 2022, USD Million

- TABLE 346 Europe HVAC Equipment Market by Country, 2023 - 2030, USD Million

- TABLE 347 Europe HVAC Equipment Market by Country, 2019 - 2022, Thousand Units

- TABLE 348 Europe HVAC Equipment Market by Country, 2023 - 2030, Thousand Units

- TABLE 349 Europe Household Appliances Market by Country, 2019 - 2022, USD Million

- TABLE 350 Europe Household Appliances Market by Country, 2023 - 2030, USD Million

- TABLE 351 Europe Household Appliances Market by Country, 2019 - 2022, Thousand Units

- TABLE 352 Europe Household Appliances Market by Country, 2023 - 2030, Thousand Units

- TABLE 353 Europe Aerospace & Transportation Market by Country, 2019 - 2022, USD Million

- TABLE 354 Europe Aerospace & Transportation Market by Country, 2023 - 2030, USD Million

- TABLE 355 Europe Aerospace & Transportation Market by Country, 2019 - 2022, Thousand Units

- TABLE 356 Europe Aerospace & Transportation Market by Country, 2023 - 2030, Thousand Units

- TABLE 357 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 358 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 359 Europe Others Market by Country, 2019 - 2022, Thousand Units

- TABLE 360 Europe Others Market by Country, 2023 - 2030, Thousand Units

- TABLE 361 Europe Electric Motor Market by Country, 2019 - 2022, USD Million

- TABLE 362 Europe Electric Motor Market by Country, 2023 - 2030, USD Million

- TABLE 363 Europe Electric Motor Market by Country, 2019 - 2022, Thousand Units

- TABLE 364 Europe Electric Motor Market by Country, 2023 - 2030, Thousand Units

The Global Electric Motor Market size is expected to reach $236.3 billion by 2030, rising at a market growth of 7.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 2,56,315.9 thousand units, experiencing a growth of 7.6% (2019-2022).

In fully electric vehicles (battery-electric vehicles or BEVs), electric motors provide the primary source of propulsion. Therefore, the Motor Vehicles segment acquired $46,102.4 million revenue in 2022. They convert electrical energy from the vehicle's battery into mechanical energy to drive the wheels. This eliminates the necessity for a traditional internal combustion engine, resulting in zero tailpipe emissions. They are used in EPS systems to assist with steering, providing variable levels of assistance based on driving conditions. This technology enhances driver comfort and control while reducing fuel consumption compared to hydraulic power steering. The growing popularity of electric vehicles and the continued development of hybrid and electric technologies drive the widespread use of these motors in motor vehicles. These motors are essential for achieving cleaner, more energy-efficient transportation options reducing greenhouse gas emissions and dependency on fossil fuels.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2023, ABB Group came into partnership with SMS Group. Through this partnership, ABB Group would provide an electric powertrain system and medium voltage motors in Hazira, Gujarat. Additionally, In April, 2023, Mitsubishi Electric Corporation came into partnership with SolidCAM, with this partnership, Mitsubishi Electric Corporation would enhance the CNC control system for providing machining needs to its customers.

Based on the Analysis presented in the KBV Cardinal matrix; Hitachi, Ltd., Siemens AG and Emerson Electric Co. are the forerunners in the Market. Companies such as ABB Group, Robert Bosch GmbH, Denso Corporation are some of the key innovators in the Electric Motor Market. In November, 2022, ABB Group came into partnership with RMS (Rotating Machinery Supplies Ltd), a leading importer and wholesaler of electric motors, industrial gearboxes, VSD, and ventilation equipment. Through this partnership, ABB Group provide solution and services in New Zealand to support RMS.

Market Growth Factors

Increase in demand for energy-efficient electric motors

Energy-efficient electric motors are designed to convert more electrical power into mechanical power, resulting in lower energy consumption. Businesses and industries can significantly reduce their operating costs by using these motors, which is a strong incentive for their adoption. Many countries have implemented regulations and standards that require the use of energy-efficient motors. Businesses are compelled to comply with these standards, which encourages the adoption of such motors. The increased demand for energy-efficient motors will likely continue to drive innovation in the motor industry and promote their adoption across various sectors. As energy efficiency remains a critical consideration in business and policy decisions, the market will expand.

Growing advancements in technology

Technology innovations have led to the development of higher-efficiency electric motors. These motors convert more electrical energy into mechanical power, reducing energy consumption and operational cost savings. VFDs use advanced electronics to control the speed and torque of these motors. This data is crucial for motor control and diagnostics, enabling smarter and more efficient motor operation. These technology advancements have expanded the market by addressing energy efficiency, performance, and control challenges, making these motors an integral part of various industries and applications, from industrial machinery to electric vehicles to smart buildings. The ongoing pursuit of innovation and sustainability is expected to drive the growth of the market.

Market Restraining Factors

High initial cost of electric motors

The initial purchase price of high-efficiency electric motors, such as premium-efficiency or energy-efficient models, can be notably higher than standard motors. This upfront cost can deter some buyers from choosing the most efficient options. For example, pneumatic or hydraulic systems may be considered alternatives to electric motors in certain industrial processes. In the consumer appliance sector, where price is a significant factor for consumers, manufacturers may choose standard motors to keep product costs low. This can limit the availability of more energy-efficient appliances. A misalignment between supply and demand occurs, resulting in manufacturers of components or parts incurring financial losses. Purchasing critical components utilized in producing electric motors in US dollars typically results in increased component costs. The above factors will hamper the market growth.

Output Power Outlook

Based on output power, the market is fragmented into fractional horsepower (FHP) and integral horsepower (FHP). In 2022, the fractional horsepower (FHP) output segment generated the largest revenue share in the market. Many household appliances, like blenders, food processors, and vacuum cleaners, use fractional horsepower electric motors. These motors are designed to provide sufficient power for the specific task without consuming excessive energy. Some small machinery and tools, including bench grinders, small lathes, and band saws, use FHP motors. These motors are suitable for hobbyists and small-scale applications. Fractional horsepower pumps are used in applications like circulating hot water in hydronic heating systems or moving water in small aquariums. The use of FHP motors is common in situations where the power requirements are relatively low and where efficiency and cost-effectiveness are priorities. These motors are available in various power ratings, like 1/4 hp, 1/3 hp, and 1/2 hp, allowing designers and engineers to select the appropriate motor size for the specific application.

Type Outlook

On the basis of type, the market is segmented into AC motor, DC motor, hermetic motor. The DC motor segment garnered a significant revenue share in the market in 2022. DC motors are commonly used as starter motors in internal combustion engine vehicles, providing the initial rotational force needed to start the engine. Many machine tools, such as lathes and milling machines, use DC motors to control rotational speeds and cutting operations. DC motors are often used in robotic arms and actuators, providing precise and controlled movements. DC motors are used in vacuum cleaners, kitchen appliances, and power tools for various functions. DC motors are used in multiple laboratory devices, such as centrifuges and shakers, where precise control over rotation is required.

AC Motor Outlook

Under AC motor type, the market is further divided into synchronous and induction. In 2022, the induction segment held the highest revenue share in the market. Induction motors operate based on Faraday's law of electromagnetic induction. They induce a rotating magnetic field in the stator (the stationary part) when AC voltage is applied, which induces currents in the rotor (the rotating part) by electromagnetic induction. The interaction between the rotating magnetic field and the rotor currents generates mechanical rotation. Induction AC motors are versatile and widely used due to their self-starting capability, durability, and efficiency. They serve a broad spectrum of applications, from household appliances to heavy industrial machinery, and continue to be a workhorse in various industries. Using variable frequency drives has expanded their versatility, allowing for speed control and energy savings in many applications.

DC Motor Outlook

Under DC motor type, the market is categorized into brushless and brushed. In 2022, the brushless segment registered the highest revenue share in the market. BLDC motors use electronic circuits and sensors to control the timing of the current in the motor's windings. This precise control allows for accurate speed and position regulation. BLDC motors are known for their high efficiency. They generate less heat due to reduced friction and are more energy-efficient than brushed DC motors. This efficiency is essential in battery-powered applications. They are used in medical instruments and devices, such as infusion pumps and surgical tools. They are found in computer hard drives, DVD and Blu-ray drives, and cooling fans for electronic devices. BLDC motors can be used for regenerative braking, acting as generators to recover and store energy during deceleration, improving overall efficiency.

End User Outlook

By end user, the market is classified into motor vehicles, industrial machinery, HVAC equipment, household appliances, aerospace & transportation, and others. The heating, ventilating, and cooling (HVAC) equipment segment projected a prominent revenue share in the market in 2022. These fans ensure the proper distribution of conditioned air throughout the building. They drive the compressor and condenser fans in air conditioning units. These fans are crucial for heat exchange, allowing the refrigeration cycle to remove heat from indoor spaces. These motors in HVAC equipment are designed for energy efficiency, reliability, and precise control, essential for maintaining a comfortable and healthy indoor environment. Their use contributes to improved energy efficiency, reduced energy consumption, and lower operational costs in heating, cooling, and ventilation techniques in both residential and commercial settings.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region dominated the market with the maximum revenue share. Asia-Pacific is a highly developing region with the fastest-growing population. According to the United Nations, nearly two-thirds of the world population resides in Asia-Pacific, with China and India alone accounting for one-third of the global population. In addition, the rate of urbanization in Asia-Pacific is also high. Thus, owing to high population growth and urbanization in the region, the industrial, automotive, and household sectors have witnessed a rapid rise. Therefore, demand for electric motors, extensively used in these sectors, is anticipated to rise in the coming years.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Robert Bosch GmbH, General Electric Company, Siemens AG, Hitachi, Ltd., Mitsubishi Electric Corporation, ABB Group, Denso Corporation, Magna International, Inc., Toshiba Corporation, Emerson Electric Co.

Recent Strategies deployed in Electric Motor Market

Mergers & Acquisition:

May-2023: ABB Group took over Siemens's low voltage NEMA motor business. Through this acquisition, ABB Group would enhance its business position as a leading industrial NEMA motor manufacturer.

Feb-2023: Mitsubishi Electric Corporation took over Scibreak AB, a company that develops direct current circuit breakers (DCCBs) in Sweden. Through this acquisition, Mitsubishi Electric Corporation would enhance the competitiveness of their combined enterprise.

Product Launches:

Sep-2020: Denso Corporation unveiled Electric Power Steering Motor Control Unit (EPS-MCU), an electronic component that controls and manages the operation of an electric power steering system in a vehicle. Additionally, it would enhance vehicle control and safety.

Partnerships, Collaborations & Agreements:

Sep-2023: ABB Group came into partnership with SMS Group, an industrial machinery manufacturing company in India. Through this partnership, ABB Group would provide an electric powertrain system and medium voltage motors in Hazira, Gujarat.

Apr-2023: Mitsubishi Electric Corporation came into partnership with SolidCAM, a leading Integrated CAM software company that runs directly inside SOLIDWORKS and Autodesk Inventor. Through this partnership, Mitsubishi Electric Corporation would enhance the CNC control system for providing machining needs to its customers.

Nov-2022: ABB Group came into partnership with RMS (Rotating Machinery Supplies Ltd), a leading importer and wholesaler of electric motors, industrial gearboxes, VSD, and ventilation equipment. Through this partnership, ABB Group provide solution and services in New Zealand to support RMS.

Oct-2022: Denso Corporation came into partnership with NTT Communications Corporation (NTT Com), a Japanese telecommunications company. Through this partnership, Denso Corporation would be able to offer vehicle security services.

Aug-2022: General Electric (GE) Co. came into partnership with Sulzer Electromechanical Services, an electro-mechanical services company in Texas. Through this partnership, General Electric (GE) Co would provide custom-built synchronous motors with 20% higher capacity.

May-2022: Denso Corporation came into partnership with Honeywell, an American publicly traded, multinational conglomerate corporation headquartered in Charlotte, North Carolina. Through this partnership, both companies would work together to incorporate the electric motor into the aircraft engines developed by Lilium.

Jan-2022: Robert Bosch GmbH came into partnership with IRP Systems, a Motor Vehicle Manufacturing company in Israel. Through this partnership, both companies would enhance their manufacturing capabilities and would be able to offer durable, high-quality controllers at an affordable price for various personal mobility OEMs across Europe and globally.

Apr-2021: Magna International, Inc. came into partnership with REE Automotive Ltd, a commercial electric vehicle developer and manufacturer. Through this partnership, Magna International, Inc. would provide modular electric vehicles (MEVs) that empower business clients to tailor vehicles according to their specific requirements and corporate identity.

Expansion:

Dec-2022: Hitachi Ltd a prominent player in the field of electrification, will provide inverters and motors to JATCO Ltd (hereby referred to as JATCO). In turn, JATCO will deliver e-Axles for use in Nissan's upcoming e-POWER* and battery electric vehicles.

Scope of the Study

Market Segments covered in the Report:

By Output Power (Volume, Thousand Units, USD Billion, 2019-2030)

- Fractional Horsepower (FHP)

- Integral Horsepower (IHP)

By Type (Volume, Thousand Units, USD Billion, 2019-2030)

- AC Motor

- Induction

- Synchronous

- DC Motor

- Brushless

- Brushed

- Hermetic Motor

By End User (Volume, Thousand Units, USD Billion, 2019-2030)

- Motor Vehicles

- Industrial Machinery

- HVAC Equipment

- Household Appliances

- Aerospace & Transportation

- Others

By Geography (Volume, Thousand Units, USD Billion, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Robert Bosch GmbH

- General Electric Company

- Siemens AG

- Hitachi, Ltd.

- Mitsubishi Electric Corporation

- ABB Group

- Denso Corporation

- Magna International, Inc.

- Toshiba Corporation

- Emerson Electric Co.

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Electric Motor Market, by Output Power

- 1.4.2 Global Electric Motor Market, by Type

- 1.4.3 Global Electric Motor Market, by End User

- 1.4.4 Global Electric Motor Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.2.4 Geographical Expansions

- 4.3 Market Share Analysis, 2022

- 4.4 Top Winning Strategies

- 4.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.4.2 Key Strategic Move: (Partnerships, Collaborations & Agreements: 2021, Apr - 2023, Sep) Leading Players

- 4.5 Porter Five Forces Analysis

Chapter 5. Global Electric Motor Market by Output Power

- 5.1 Global Fractional Horsepower (FHP) Market by Region

- 5.2 Global Integral Horsepower (IHP) Market by Region

Chapter 6. Global Electric Motor Market by Type

- 6.1 Global AC Motor Market by Region

- 6.2 Global Electric Motor Market by AC Motor Type

- 6.2.1 Global Induction Market by Region

- 6.2.2 Global Synchronous Market by Region

- 6.3 Global DC Motor Market by Region

- 6.4 Global Electric Motor Market by DC Motor Type

- 6.4.1 Global Brushless Market by Region

- 6.4.2 Global Brushed Market by Region

- 6.5 Global Hermetic Motor Market by Region

Chapter 7. Global Electric Motor Market by End User

- 7.1 Global Motor Vehicles Market by Region

- 7.2 Global Industrial Machinery Market by Region

- 7.3 Global HVAC Equipment Market by Region

- 7.4 Global Household Appliances Market by Region

- 7.5 Global Aerospace & Transportation Market by Region

- 7.6 Global Others Market by Region

Chapter 8. Global Electric Motor Market by Region

- 8.1 North America Electric Motor Market

- 8.1.1 North America Electric Motor Market by Output Power

- 8.1.1.1 North America Fractional Horsepower (FHP) Market by Region

- 8.1.1.2 North America Integral Horsepower (IHP) Market by Region

- 8.1.2 North America Electric Motor Market by Type

- 8.1.2.1 North America AC Motor Market by Country

- 8.1.2.2 North America Electric Motor Market by AC Motor Type

- 8.1.2.2.1 North America Induction Market by Country

- 8.1.2.2.2 North America Synchronous Market by Country

- 8.1.2.3 North America DC Motor Market by Country

- 8.1.2.4 North America Electric Motor Market by DC Motor Type

- 8.1.2.4.1 North America Brushless Market by Country

- 8.1.2.4.2 North America Brushed Market by Country

- 8.1.2.5 North America Hermetic Motor Market by Country

- 8.1.3 North America Electric Motor Market by End User

- 8.1.3.1 North America Motor Vehicles Market by Country

- 8.1.3.2 North America Industrial Machinery Market by Country

- 8.1.3.3 North America HVAC Equipment Market by Country

- 8.1.3.4 North America Household Appliances Market by Country

- 8.1.3.5 North America Aerospace & Transportation Market by Country

- 8.1.3.6 North America Others Market by Country

- 8.1.4 North America Electric Motor Market by Country

- 8.1.4.1 US Electric Motor Market

- 8.1.4.1.1 US Electric Motor Market by Output Power

- 8.1.4.1.2 US Electric Motor Market by Type

- 8.1.4.1.3 US Electric Motor Market by End User

- 8.1.4.2 Canada Electric Motor Market

- 8.1.4.2.1 Canada Electric Motor Market by Output Power

- 8.1.4.2.2 Canada Electric Motor Market by Type

- 8.1.4.2.3 Canada Electric Motor Market by End User

- 8.1.4.3 Mexico Electric Motor Market

- 8.1.4.3.1 Mexico Electric Motor Market by Output Power

- 8.1.4.3.2 Mexico Electric Motor Market by Type

- 8.1.4.3.3 Mexico Electric Motor Market by End User

- 8.1.4.4 Rest of North America Electric Motor Market

- 8.1.4.4.1 Rest of North America Electric Motor Market by Output Power

- 8.1.4.4.2 Rest of North America Electric Motor Market by Type

- 8.1.4.4.3 Rest of North America Electric Motor Market by End User

- 8.1.4.1 US Electric Motor Market

- 8.1.1 North America Electric Motor Market by Output Power

- 8.2 Europe Electric Motor Market

- 8.2.1 Europe Electric Motor Market by Output Power

- 8.2.1.1 Europe Fractional Horsepower (FHP) Market by Country

- 8.2.1.2 Europe Integral Horsepower (IHP) Market by Country

- 8.2.2 Europe Electric Motor Market by Type

- 8.2.2.1 Europe AC Motor Market by Country

- 8.2.2.2 Europe Electric Motor Market by AC Motor Type

- 8.2.2.2.1 Europe Induction Market by Country

- 8.2.2.2.2 Europe Synchronous Market by Country

- 8.2.2.3 Europe DC Motor Market by Country

- 8.2.2.4 Europe Electric Motor Market by DC Motor Type

- 8.2.2.4.1 Europe Brushless Market by Country

- 8.2.2.4.2 Europe Brushed Market by Country

- 8.2.2.5 Europe Hermetic Motor Market by Country

- 8.2.3 Europe Electric Motor Market by End User

- 8.2.3.1 Europe Motor Vehicles Market by Country

- 8.2.3.2 Europe Industrial Machinery Market by Country

- 8.2.3.3 Europe HVAC Equipment Market by Country

- 8.2.3.4 Europe Household Appliances Market by Country

- 8.2.3.5 Europe Aerospace & Transportation Market by Country

- 8.2.3.6 Europe Others Market by Country

- 8.2.4 Europe Electric Motor Market by Country

- 8.2.4.1 Germany Electric Motor Market

- 8.2.4.1.1 Germany Electric Motor Market by Output Power

- 8.2.4.1.2 Germany Electric Motor Market by Type

- 8.2.4.1.3 Germany Electric Motor Market by End User

- 8.2.4.2 UK Electric Motor Market

- 8.2.4.2.1 UK Electric Motor Market by Output Power

- 8.2.4.2.2 UK Electric Motor Market by Type

- 8.2.4.2.3 UK Electric Motor Market by End User

- 8.2.4.3 France Electric Motor Market

- 8.2.4.3.1 France Electric Motor Market by Output Power

- 8.2.4.3.2 France Electric Motor Market by Type

- 8.2.4.3.3 France Electric Motor Market by End User

- 8.2.4.4 Russia Electric Motor Market

- 8.2.4.4.1 Russia Electric Motor Market by Output Power

- 8.2.4.4.2 Russia Electric Motor Market by Type

- 8.2.4.4.3 Russia Electric Motor Market by End User

- 8.2.4.5 Spain Electric Motor Market

- 8.2.4.5.1 Spain Electric Motor Market by Output Power

- 8.2.4.5.2 Spain Electric Motor Market by Type

- 8.2.4.5.3 Spain Electric Motor Market by End User

- 8.2.4.6 Italy Electric Motor Market

- 8.2.4.6.1 Italy Electric Motor Market by Output Power

- 8.2.4.6.2 Italy Electric Motor Market by Type

- 8.2.4.6.3 Italy Electric Motor Market by End User

- 8.2.4.7 Rest of Europe Electric Motor Market

- 8.2.4.7.1 Rest of Europe Electric Motor Market by Output Power

- 8.2.4.7.2 Rest of Europe Electric Motor Market by Type

- 8.2.4.7.3 Rest of Europe Electric Motor Market by End User

- 8.2.4.1 Germany Electric Motor Market

- 8.2.1 Europe Electric Motor Market by Output Power

- 8.3 Asia Pacific Electric Motor Market

- 8.3.1 Asia Pacific Electric Motor Market by Output Power

- 8.3.1.1 Asia Pacific Fractional Horsepower (FHP) Market by Country

- 8.3.1.2 Asia Pacific Integral Horsepower (IHP) Market by Country

- 8.3.2 Asia Pacific Electric Motor Market by Type

- 8.3.2.1 Asia Pacific AC Motor Market by Country

- 8.3.2.2 Asia Pacific Electric Motor Market by AC Motor Type

- 8.3.2.2.1 Asia Pacific Induction Market by Country

- 8.3.2.2.2 Asia Pacific Synchronous Market by Country

- 8.3.2.3 Asia Pacific DC Motor Market by Country

- 8.3.2.4 Asia Pacific Electric Motor Market by DC Motor Type

- 8.3.2.4.1 Asia Pacific Brushless Market by Country

- 8.3.2.4.2 Asia Pacific Brushed Market by Country

- 8.3.2.5 Asia Pacific Hermetic Motor Market by Country

- 8.3.3 Asia Pacific Electric Motor Market by End User

- 8.3.3.1 Asia Pacific Motor Vehicles Market by Country

- 8.3.3.2 Asia Pacific Industrial Machinery Market by Country

- 8.3.3.3 Asia Pacific HVAC Equipment Market by Country

- 8.3.3.4 Asia Pacific Household Appliances Market by Country

- 8.3.3.5 Asia Pacific Aerospace & Transportation Market by Country

- 8.3.3.6 Asia Pacific Others Market by Country

- 8.3.4 Asia Pacific Electric Motor Market by Country

- 8.3.4.1 China Electric Motor Market

- 8.3.4.1.1 China Electric Motor Market by Output Power

- 8.3.4.1.2 China Electric Motor Market by Type

- 8.3.4.1.3 China Electric Motor Market by End User

- 8.3.4.2 Japan Electric Motor Market

- 8.3.4.2.1 Japan Electric Motor Market by Output Power

- 8.3.4.2.2 Japan Electric Motor Market by Type

- 8.3.4.2.3 Japan Electric Motor Market by End User

- 8.3.4.3 India Electric Motor Market

- 8.3.4.3.1 India Electric Motor Market by Output Power

- 8.3.4.3.2 India Electric Motor Market by Type

- 8.3.4.3.3 India Electric Motor Market by End User

- 8.3.4.4 South Korea Electric Motor Market

- 8.3.4.4.1 South Korea Electric Motor Market by Output Power

- 8.3.4.4.2 South Korea Electric Motor Market by Type

- 8.3.4.4.3 South Korea Electric Motor Market by End User

- 8.3.4.5 Singapore Electric Motor Market

- 8.3.4.5.1 Singapore Electric Motor Market by Output Power

- 8.3.4.5.2 Singapore Electric Motor Market by Type

- 8.3.4.5.3 Singapore Electric Motor Market by End User

- 8.3.4.6 Malaysia Electric Motor Market

- 8.3.4.6.1 Malaysia Electric Motor Market by Output Power

- 8.3.4.6.2 Malaysia Electric Motor Market by Type

- 8.3.4.6.3 Malaysia Electric Motor Market by End User

- 8.3.4.7 Rest of Asia Pacific Electric Motor Market

- 8.3.4.7.1 Rest of Asia Pacific Electric Motor Market by Output Power

- 8.3.4.7.2 Rest of Asia Pacific Electric Motor Market by Type

- 8.3.4.7.3 Rest of Asia Pacific Electric Motor Market by End User

- 8.3.4.1 China Electric Motor Market

- 8.3.1 Asia Pacific Electric Motor Market by Output Power

- 8.4 LAMEA Electric Motor Market

- 8.4.1 LAMEA Electric Motor Market by Output Power

- 8.4.1.1 LAMEA Fractional Horsepower (FHP) Market by Country

- 8.4.1.2 LAMEA Integral Horsepower (IHP) Market by Country

- 8.4.2 LAMEA Electric Motor Market by Type

- 8.4.2.1 LAMEA AC Motor Market by Country

- 8.4.2.2 LAMEA Electric Motor Market by AC Motor Type

- 8.4.2.2.1 LAMEA Induction Market by Country

- 8.4.2.2.2 LAMEA Synchronous Market by Country

- 8.4.2.3 LAMEA DC Motor Market by Country

- 8.4.2.4 LAMEA Electric Motor Market by DC Motor Type

- 8.4.2.4.1 LAMEA Brushless Market by Country

- 8.4.2.4.2 LAMEA Brushed Market by Country

- 8.4.2.5 LAMEA Hermetic Motor Market by Country

- 8.4.3 LAMEA Electric Motor Market by End User

- 8.4.3.1 LAMEA Motor Vehicles Market by Country

- 8.4.3.2 LAMEA Industrial Machinery Market by Country

- 8.4.3.3 LAMEA HVAC Equipment Market by Country

- 8.4.3.4 LAMEA Household Appliances Market by Country

- 8.4.3.5 LAMEA Aerospace & Transportation Market by Country

- 8.4.3.6 LAMEA Others Market by Country

- 8.4.4 LAMEA Electric Motor Market by Country

- 8.4.4.1 Brazil Electric Motor Market

- 8.4.4.1.1 Brazil Electric Motor Market by Output Power

- 8.4.4.1.2 Brazil Electric Motor Market by Type

- 8.4.4.1.3 Brazil Electric Motor Market by End User

- 8.4.4.2 Argentina Electric Motor Market

- 8.4.4.2.1 Argentina Electric Motor Market by Output Power

- 8.4.4.2.2 Argentina Electric Motor Market by Type

- 8.4.4.2.3 Argentina Electric Motor Market by End User

- 8.4.4.3 UAE Electric Motor Market

- 8.4.4.3.1 UAE Electric Motor Market by Output Power

- 8.4.4.3.2 UAE Electric Motor Market by Type

- 8.4.4.3.3 UAE Electric Motor Market by End User

- 8.4.4.4 Saudi Arabia Electric Motor Market

- 8.4.4.4.1 Saudi Arabia Electric Motor Market by Output Power

- 8.4.4.4.2 Saudi Arabia Electric Motor Market by Type

- 8.4.4.4.3 Saudi Arabia Electric Motor Market by End User

- 8.4.4.5 South Africa Electric Motor Market

- 8.4.4.5.1 South Africa Electric Motor Market by Output Power

- 8.4.4.5.2 South Africa Electric Motor Market by Type

- 8.4.4.5.3 South Africa Electric Motor Market by End User

- 8.4.4.6 Nigeria Electric Motor Market

- 8.4.4.6.1 Nigeria Electric Motor Market by Output Power

- 8.4.4.6.2 Nigeria Electric Motor Market by Type

- 8.4.4.6.3 Nigeria Electric Motor Market by End User

- 8.4.4.7 Rest of LAMEA Electric Motor Market

- 8.4.4.7.1 Rest of LAMEA Electric Motor Market by Output Power

- 8.4.4.7.2 Rest of LAMEA Electric Motor Market by Type

- 8.4.4.7.3 Rest of LAMEA Electric Motor Market by End User

- 8.4.4.1 Brazil Electric Motor Market

- 8.4.1 LAMEA Electric Motor Market by Output Power

Chapter 9. Company Profiles

- 9.1 Robert Bosch GmbH

- 9.1.1 Company Overview

- 9.1.2 Financial Analysis

- 9.1.3 Segmental and Regional Analysis

- 9.1.4 Research & Development Expense

- 9.1.5 Recent strategies and developments:

- 9.1.5.1 Partnerships, Collaborations, and Agreements:

- 9.1.5.2 Acquisition and Mergers:

- 9.1.6 SWOT Analysis

- 9.2 General Electric Company

- 9.2.1 Company Overview

- 9.2.2 Financial Analysis

- 9.2.3 Segmental and Regional Analysis

- 9.2.4 Research & Development Expense

- 9.2.5 Recent strategies and developments:

- 9.2.5.1 Partnerships, Collaborations, and Agreements:

- 9.2.6 SWOT Analysis

- 9.3 Siemens AG

- 9.3.1 Company Overview

- 9.3.2 Financial Analysis

- 9.3.3 Segmental and Regional Analysis

- 9.3.4 Research & Development Expense

- 9.3.5 SWOT Analysis

- 9.4 Hitachi, Ltd.

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 Segmental and Regional Analysis

- 9.4.4 Research & Development Expenses

- 9.4.5 Recent strategies and developments:

- 9.4.5.1 Geographical Expansions:

- 9.4.6 SWOT Analysis

- 9.5 Mitsubishi Electric Corporation

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Segmental and Regional Analysis

- 9.5.4 Research & Development Expense

- 9.5.5 Recent strategies and developments:

- 9.5.5.1 Partnerships, Collaborations, and Agreements:

- 9.5.5.2 Acquisition and Mergers:

- 9.5.6 SWOT Analysis

- 9.6 ABB Group

- 9.6.1 Company Overview

- 9.6.2 Financial Analysis

- 9.6.3 Segmental and Regional Analysis

- 9.6.4 Research & Development Expense

- 9.6.5 Regional Analysis

- 9.6.6 Recent strategies and developments:

- 9.6.6.1 Partnerships, Collaborations, and Agreements:

- 9.6.6.2 Acquisition and Mergers:

- 9.6.7 SWOT Analysis

- 9.7 Denso Corporation

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 Regional Analysis

- 9.7.4 Recent strategies and developments:

- 9.7.4.1 Partnerships, Collaborations, and Agreements:

- 9.7.4.2 Product Launches and Product Expansions:

- 9.7.5 SWOT Analysis

- 9.8 Magna International, Inc.

- 9.8.1 Company Overview

- 9.8.2 Financial Analysis

- 9.8.3 Segmental and Regional Analysis

- 9.8.4 Research & Development Expenses

- 9.8.5 Recent strategies and developments:

- 9.8.5.1 Partnerships, Collaborations, and Agreements:

- 9.8.6 SWOT Analysis

- 9.9 Toshiba Corporation

- 9.9.1 Company Overview

- 9.9.2 Financial Analysis

- 9.9.3 Segmental and Regional Analysis

- 9.9.4 Research and Development Expense

- 9.9.5 SWOT Analysis

- 9.10. Emerson Electric Co.

- 9.10.1 Company Overview

- 9.10.2 Financial Analysis

- 9.10.3 Segmental and Regional Analysis

- 9.10.4 Research & Development Expense

- 9.10.5 Recent strategies and developments:

- 9.10.5.1 Acquisition and Mergers:

- 9.10.6 SWOT Analysis