|

|

市場調査レポート

商品コード

1373669

バイオメトリックバンキングの世界市場規模、シェア、業界動向分析レポート:タイプ別、業界別、コンポーネント別、地域別展望と予測、2023年~2030年Global Biometric Banking Market Size, Share & Industry Trends Analysis Report By Type (Fingerprint, Facial Recognition, Hand Geometry, Iris Recognition and Others), By Vertical, By Component, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| バイオメトリックバンキングの世界市場規模、シェア、業界動向分析レポート:タイプ別、業界別、コンポーネント別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年09月30日

発行: KBV Research

ページ情報: 英文 281 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

バイオメトリックバンキング市場規模は2030年までに162億米ドルに達すると予測され、予測期間中のCAGRは16.6%の市場成長率で上昇する見込みです。

KBV Cardinalのマトリックスに示された分析によると、Apple, Inc.が同市場におけるトップランナーです。2023年6月、アップル社はHDFC銀行と提携し、インド市場への投資と製造を拡大しました。Google LLCやSamsung Electronics Co., Ltd.といった企業は、同市場における主要なイノベーターです。

市場成長要因

モバイルバンキングと非接触型決済の増加

COVID-19の大流行後、個人は非接触型の支払い方法を好むようになっています。サイバー脅威の高まりを考慮すると、安全で信頼できる決済ソリューションの確保は極めて重要です。さらに、COVID-19の大流行により、非接触型決済ソリューションの普及がさらに加速しました。これは、有害な細菌との接触を避けるため、決済機器との物理的な接触を最小限に抑えたいという消費者の願望によるものです。したがって、こうした要因が市場の拡大を後押ししています。

セキュリティの向上となりすまし詐欺の減少につながるバイオメトリクス利用の増加

バイオメトリクス認証は、PINやトークンなどの他の要素と組み合わせて多要素認証(MFA)システムを構築し、セキュリティをさらに強化することができます。従来のパスワードとは異なり、バイオメトリック・データは簡単に盗まれたり推測されたりすることがないため、不正アクセスのリスクを軽減することができます。バイオメトリック・データは否認防止を提供することができます。つまり、その人固有のバイオメトリック・データが認証に使用されたため、ユーザーは自分の行動を否定することができないです。その結果、これらの要因が市場を拡大すると予想されます。

市場抑制要因

セキュリティ上の懸念と高い導入コスト

セキュリティ上の懸念と高い導入コストは、市場が直面する2つの重要な課題です。倫理的配慮は、バイオメトリクス・データの収集と使用について、利用者からインフォームド・コンセントを得ることを中心に展開されます。銀行はデータの所有権や潜在的な監視の影響に関する懸念に対処しなければならないです。バイオメトリクス・データにアクセスできる銀行の従業員によるインサイダーの脅威は、不正アクセスやデータ漏洩につながる可能性があります。厳密なアクセス制御と監視を実施することが極めて重要です。また、銀行は、顧客がバイオメトリクス認証を理解し、問題があれば安全にトラブルシューティングできるように、ユーザー教育やトレーニング・プログラムに投資する必要があるかもしれないです。したがって、これらの要因が市場の成長を抑制すると予想されます。

タイプ別展望

タイプ別に見ると、市場は指紋、顔認証、ハンドジオメトリー、虹彩認証、その他に細分化されます。ハンドジオメンテーションセグメントは、2022年市場で顕著な収益シェアを記録しました。ハンドジオメトリー認識は、銀行の支店や銀行内の安全なエリアにおける物理的なアクセス制御に使用されています。ハンドジオメトリスキャンを使用することで、従業員や許可された担当者は制限区域、金庫室、データセンターにアクセスすることができます。この技術はセキュリティの強化に役立ち、許可された個人だけが機密エリアに入れるようにします。銀行は、従業員の勤怠管理にハンドジオメトリー認識を使用することができます。これにより、正確な勤務時間と勤怠記録が可能になり、給与処理と労働規制の遵守に不可欠です。

業界別展望

業界別では、小売、政府、運輸、ヘルスケア、ホスピタリティ、その他です。市場セグメンテーションでは、運輸部門がかなりの収益シェアを占めています。運輸業界では、セキュリティ強化、乗客体験の向上、業務の合理化のためにバイオメトリクス技術の採用が進んでいます。バイオメトリクスは、本人確認とアクセス制御が重要なこの分野で独自の利点を提供します。バイオメトリクス認証により、乗客はチェックインやセキュリティから搭乗や手荷物受取まで、旅のさまざまなタッチポイントをシームレスに移動できるようになるためです。

コンポーネントの展望

市場はコンポーネント別にハードウェア、ソフトウェア、サービスに区分されます。2022年には、ハードウェア・セグメントが最大の収益シェアで市場を独占しました。モバイル・バイオメトリクス・デバイスの開発、ハードウェアベースのセキュリティ能力の重視、消費者向け電子機器におけるバイオメトリクス技術の検証・識別用途での利用拡大が、バイオメトリクス技術の拡大を後押しする重要な要因となっています。信頼できる説明責任、優れた性能、信頼性、高いセキュリティと保証といったバイオメトリック・ハードウェアの利点が、この市場の拡大を後押ししています。数多くのベンダーが最先端技術の研究開発に投資し、ハードウェアの機能を強化し、中小企業のコストを削減しています。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、北米地域が市場で最大の収益シェアを占めました。米国では、バイオメトリクス技術は、政府、国土安全保障、商業、法制度を含む様々な分野で利用されています。世界のテロの脅威の高まりにより、バイオメトリック技術によって安全・安心のニーズが高まっています。技術インフラが高度に発達し、データ・セキュリティとプライバシー規制が重視される北米は、バイオメトリクス・バンキング導入の最前線であり続けています。米国とカナダの大手金融機関は、バイオメトリック・バンキング・システムに多額の投資を行っています。これらの製品は、顧客口座を保護し、不正アクセスを防止し、わかりやすく安全なバンキング体験を提供します。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBV Cardinal Matrix

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界の生体認証バンキング市場:タイプ別

- 世界の指紋市場:地域別

- 世界の顔認識市場:地域別

- 世界の手形状市場:地域別

- 世界の虹彩認識市場:地域別

- 世界のその他の市場:地域別

第6章 世界の市場:、業界別

- 世界の小売市場:地域別

- 世界の輸送市場:地域別

- 世界のホスピタリティ市場:地域別

- 世界の政府市場:地域別

- 世界のヘルスケア市場:地域別

- 世界のその他の市場:地域別

第7章 世界の市場:、コンポーネント別

- 世界のハードウェア市場:地域別

- 世界のソフトウェア市場:地域別

- 世界サービス市場:地域別

第8章 世界の市場:、地域別

- 北米の市場

- 北米の市場:タイプ別

- 国別の北米指紋市場

- 北米の国別顔認識市場

- 北米の国別ハンドジオメトリ市場

- 北米の国別虹彩認識市場

- 北米その他の国別市場

- 北米の市場:業界別

- 北米の国別小売市場

- 北米の国別輸送市場

- 北米の国別ホスピタリティ市場

- 北米の国別政府市場

- 北米の国別ヘルスケア市場

- 北米その他の国別市場

- 北米の市場:コンポーネント別

- 北米の国別ハードウェア市場

- 国別の北米ソフトウェア市場

- 国別の北米サービス市場

- 北米の市場:国別

- 米国の生体認証バンキング市場

- カナダの生体認証バンキング市場

- メキシコの生体認証バンキング市場

- 残りの北米の市場

- 北米の市場:タイプ別

- 欧州の市場

- 欧州の市場:タイプ別

- 国別の欧州の指紋市場

- 欧州の国別顔認識市場

- 欧州の国別ハンドジオメトリ市場

- 欧州の国別虹彩認識市場

- 欧州その他の国別市場

- 欧州の市場:業界別

- 欧州の国別小売市場

- 国別の欧州輸送市場

- 国別の欧州ホスピタリティ市場

- 国別の欧州政府市場

- 国別の欧州ヘルスケア市場

- 欧州その他の国別市場

- 欧州の市場:コンポーネント別

- 欧州の国別ハードウェア市場

- 国別欧州ソフトウェア市場

- 国別の欧州サービス市場

- 欧州の市場:国別

- ドイツの生体認証バンキング市場

- 英国の生体認証バンキング市場

- フランスの生体認証バンキング市場

- ロシアの生体認証バンキング市場

- スペインの生体認証バンキング市場

- イタリアの生体認証バンキング市場

- 残りの欧州の市場

- 欧州の市場:タイプ別

- アジア太平洋の市場

- アジア太平洋の市場:タイプ別

- アジア太平洋地域の国別指紋市場

- アジア太平洋地域の国別顔認識市場

- アジア太平洋地域の国別ハンドジオメトリ市場

- アジア太平洋地域の国別虹彩認識市場

- アジア太平洋地域その他の国別市場

- アジア太平洋の市場:業界別

- アジア太平洋地域の国別小売市場

- 国別のアジア太平洋輸送市場

- アジア太平洋地域の国別ホスピタリティ市場

- アジア太平洋地域の国別政府市場

- アジア太平洋地域の国別ヘルスケア市場

- アジア太平洋地域その他の国別市場

- アジア太平洋の市場:コンポーネント別

- アジア太平洋地域の国別ハードウェア市場

- アジア太平洋地域の国別ソフトウェア市場

- アジア太平洋地域の国別サービス市場

- アジア太平洋の市場:国別

- 中国の生体認証バンキング市場

- 日本のバイオメトリックバンキング市場

- インドの生体認証バンキング市場

- 韓国の生体認証バンキング市場

- シンガポールの生体認証バンキング市場

- マレーシアの生体認証バンキング市場

- 残りのアジア太平洋の市場

- アジア太平洋の市場:タイプ別

- ラテンアメリカ・中東・アフリカの市場

- ラテンアメリカ・中東・アフリカの市場:タイプ別

- 国別のLAMEA指紋市場

- 国別LAMEA顔認識市場

- 国別のLAMEAハンドジオメトリ市場

- 国別LAMEA虹彩認識市場

- 国別LAMEAその他市場

- ラテンアメリカ・中東・アフリカの市場:業界別

- 国別LAMEA小売市場

- 国別LAMEA輸送市場

- 国別LAMEAホスピタリティ市場

- 国別LAMEA政府市場

- 国別LAMEAヘルスケア市場

- 国別LAMEAその他市場

- ラテンアメリカ・中東・アフリカの市場:コンポーネント別

- 国別のLAMEAハードウェア市場

- 国別のLAMEAソフトウェア市場

- 国別のLAMEAサービス市場

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジルのバイオメトリックバンキング市場

- アルゼンチンの生体認証バンキング市場

- UAEのバイオメトリックバンキング市場

- サウジアラビアの生体認証バンキング市場

- 南アフリカの生体認証バンキング市場

- ナイジェリアの生体認証バンキング市場

- 残りのラテンアメリカ・中東・アフリカの市場

- ラテンアメリカ・中東・アフリカの市場:タイプ別

第9章 企業プロファイル

- Google, LLC(Kaggle Inc)

- NEC Corporation

- Apple Inc

- Alibaba Cloud(Alibaba Group Holding Limited)

- Mastercard, Inc

- Barclays PLC

- Visa, Inc

- PayPal Holdings, Inc

- Samsung Electronics Co, Ltd.(Samsung Group)

- Aliph Brands LLC(JawBone)

第10章 バイオメトリックバンキング市場の勝利の必須条件

LIST OF TABLES

- TABLE 1 Global Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 2 Global Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Biometric Banking Market

- TABLE 4 Product Launches And Product Expansions- Biometric Banking Market

- TABLE 5 Acquisition and Mergers- Biometric Banking Market

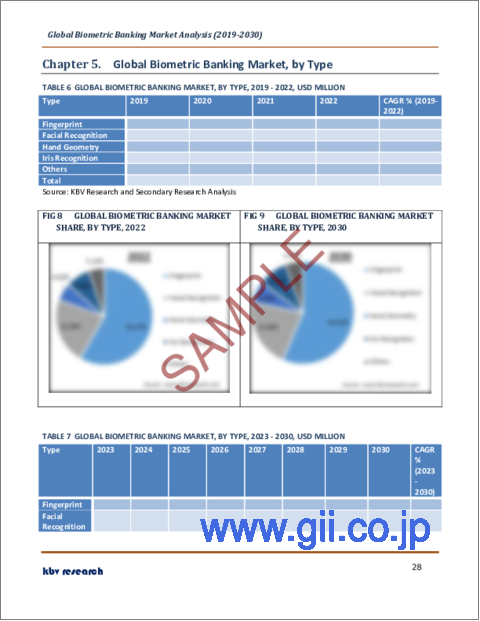

- TABLE 6 Global Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 7 Global Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 8 Global Fingerprint Market, by Region, 2019 - 2022, USD Million

- TABLE 9 Global Fingerprint Market, by Region, 2023 - 2030, USD Million

- TABLE 10 Global Facial Recognition Market, by Region, 2019 - 2022, USD Million

- TABLE 11 Global Facial Recognition Market, by Region, 2023 - 2030, USD Million

- TABLE 12 Global Hand Geometry Market, by Region, 2019 - 2022, USD Million

- TABLE 13 Global Hand Geometry Market, by Region, 2023 - 2030, USD Million

- TABLE 14 Global Iris Recognition Market, by Region, 2019 - 2022, USD Million

- TABLE 15 Global Iris Recognition Market, by Region, 2023 - 2030, USD Million

- TABLE 16 Global Others Market, by Region, 2019 - 2022, USD Million

- TABLE 17 Global Others Market, by Region, 2023 - 2030, USD Million

- TABLE 18 Global Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 19 Global Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 20 Global Retail Market, by Region, 2019 - 2022, USD Million

- TABLE 21 Global Retail Market, by Region, 2023 - 2030, USD Million

- TABLE 22 Global Transportation Market, by Region, 2019 - 2022, USD Million

- TABLE 23 Global Transportation Market, by Region, 2023 - 2030, USD Million

- TABLE 24 Global Hospitality Market, by Region, 2019 - 2022, USD Million

- TABLE 25 Global Hospitality Market, by Region, 2023 - 2030, USD Million

- TABLE 26 Global Government Market, by Region, 2019 - 2022, USD Million

- TABLE 27 Global Government Market, by Region, 2023 - 2030, USD Million

- TABLE 28 Global Healthcare Market, by Region, 2019 - 2022, USD Million

- TABLE 29 Global Healthcare Market, by Region, 2023 - 2030, USD Million

- TABLE 30 Global Others Market, by Region, 2019 - 2022, USD Million

- TABLE 31 Global Others Market, by Region, 2023 - 2030, USD Million

- TABLE 32 Global Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 33 Global Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 34 Global Hardware Market, by Region, 2019 - 2022, USD Million

- TABLE 35 Global Hardware Market, by Region, 2023 - 2030, USD Million

- TABLE 36 Global Software Market, by Region, 2019 - 2022, USD Million

- TABLE 37 Global Software Market, by Region, 2023 - 2030, USD Million

- TABLE 38 Global Services Market, by Region, 2019 - 2022, USD Million

- TABLE 39 Global Services Market, by Region, 2023 - 2030, USD Million

- TABLE 40 Global Biometric Banking Market, by Region, 2019 - 2022, USD Million

- TABLE 41 Global Biometric Banking Market, by Region, 2023 - 2030, USD Million

- TABLE 42 North America Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 43 North America Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 44 North America Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 45 North America Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 46 North America Fingerprint Market, by Country, 2019 - 2022, USD Million

- TABLE 47 North America Fingerprint Market, by Country, 2023 - 2030, USD Million

- TABLE 48 North America Facial Recognition Market, by Country, 2019 - 2022, USD Million

- TABLE 49 North America Facial Recognition Market, by Country, 2023 - 2030, USD Million

- TABLE 50 North America Hand Geometry Market, by Country, 2019 - 2022, USD Million

- TABLE 51 North America Hand Geometry Market, by Country, 2023 - 2030, USD Million

- TABLE 52 North America Iris Recognition Market, by Country, 2019 - 2022, USD Million

- TABLE 53 North America Iris Recognition Market, by Country, 2023 - 2030, USD Million

- TABLE 54 North America Others Market, by Country, 2019 - 2022, USD Million

- TABLE 55 North America Others Market, by Country, 2023 - 2030, USD Million

- TABLE 56 North America Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 57 North America Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 58 North America Retail Market, by Country, 2019 - 2022, USD Million

- TABLE 59 North America Retail Market, by Country, 2023 - 2030, USD Million

- TABLE 60 North America Transportation Market, by Country, 2019 - 2022, USD Million

- TABLE 61 North America Transportation Market, by Country, 2023 - 2030, USD Million

- TABLE 62 North America Hospitality Market, by Country, 2019 - 2022, USD Million

- TABLE 63 North America Hospitality Market, by Country, 2023 - 2030, USD Million

- TABLE 64 North America Government Market, by Country, 2019 - 2022, USD Million

- TABLE 65 North America Government Market, by Country, 2023 - 2030, USD Million

- TABLE 66 North America Healthcare Market, by Country, 2019 - 2022, USD Million

- TABLE 67 North America Healthcare Market, by Country, 2023 - 2030, USD Million

- TABLE 68 North America Others Market, by Country, 2019 - 2022, USD Million

- TABLE 69 North America Others Market, by Country, 2023 - 2030, USD Million

- TABLE 70 North America Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 71 North America Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 72 North America Hardware Market, by Country, 2019 - 2022, USD Million

- TABLE 73 North America Hardware Market, by Country, 2023 - 2030, USD Million

- TABLE 74 North America Software Market, by Country, 2019 - 2022, USD Million

- TABLE 75 North America Software Market, by Country, 2023 - 2030, USD Million

- TABLE 76 North America Services Market, by Country, 2019 - 2022, USD Million

- TABLE 77 North America Services Market, by Country, 2023 - 2030, USD Million

- TABLE 78 North America Biometric Banking Market, by Country, 2019 - 2022, USD Million

- TABLE 79 North America Biometric Banking Market, by Country, 2023 - 2030, USD Million

- TABLE 80 US Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 81 US Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 82 US Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 83 US Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 84 US Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 85 US Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 86 US Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 87 US Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 88 Canada Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 89 Canada Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 90 Canada Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 91 Canada Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 92 Canada Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 93 Canada Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 94 Canada Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 95 Canada Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 96 Mexico Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 97 Mexico Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 98 Mexico Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 99 Mexico Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 100 Mexico Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 101 Mexico Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 102 Mexico Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 103 Mexico Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 104 Rest of North America Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 105 Rest of North America Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 106 Rest of North America Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 107 Rest of North America Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 108 Rest of North America Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 109 Rest of North America Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 110 Rest of North America Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 111 Rest of North America Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 112 Europe Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 113 Europe Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 114 Europe Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 115 Europe Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 116 Europe Fingerprint Market, by Country, 2019 - 2022, USD Million

- TABLE 117 Europe Fingerprint Market, by Country, 2023 - 2030, USD Million

- TABLE 118 Europe Facial Recognition Market, by Country, 2019 - 2022, USD Million

- TABLE 119 Europe Facial Recognition Market, by Country, 2023 - 2030, USD Million

- TABLE 120 Europe Hand Geometry Market, by Country, 2019 - 2022, USD Million

- TABLE 121 Europe Hand Geometry Market, by Country, 2023 - 2030, USD Million

- TABLE 122 Europe Iris Recognition Market, by Country, 2019 - 2022, USD Million

- TABLE 123 Europe Iris Recognition Market, by Country, 2023 - 2030, USD Million

- TABLE 124 Europe Others Market, by Country, 2019 - 2022, USD Million

- TABLE 125 Europe Others Market, by Country, 2023 - 2030, USD Million

- TABLE 126 Europe Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 127 Europe Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 128 Europe Retail Market, by Country, 2019 - 2022, USD Million

- TABLE 129 Europe Retail Market, by Country, 2023 - 2030, USD Million

- TABLE 130 Europe Transportation Market, by Country, 2019 - 2022, USD Million

- TABLE 131 Europe Transportation Market, by Country, 2023 - 2030, USD Million

- TABLE 132 Europe Hospitality Market, by Country, 2019 - 2022, USD Million

- TABLE 133 Europe Hospitality Market, by Country, 2023 - 2030, USD Million

- TABLE 134 Europe Government Market, by Country, 2019 - 2022, USD Million

- TABLE 135 Europe Government Market, by Country, 2023 - 2030, USD Million

- TABLE 136 Europe Healthcare Market, by Country, 2019 - 2022, USD Million

- TABLE 137 Europe Healthcare Market, by Country, 2023 - 2030, USD Million

- TABLE 138 Europe Others Market, by Country, 2019 - 2022, USD Million

- TABLE 139 Europe Others Market, by Country, 2023 - 2030, USD Million

- TABLE 140 Europe Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 141 Europe Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 142 Europe Hardware Market, by Country, 2019 - 2022, USD Million

- TABLE 143 Europe Hardware Market, by Country, 2023 - 2030, USD Million

- TABLE 144 Europe Software Market, by Country, 2019 - 2022, USD Million

- TABLE 145 Europe Software Market, by Country, 2023 - 2030, USD Million

- TABLE 146 Europe Services Market, by Country, 2019 - 2022, USD Million

- TABLE 147 Europe Services Market, by Country, 2023 - 2030, USD Million

- TABLE 148 Europe Biometric Banking Market, by Country, 2019 - 2022, USD Million

- TABLE 149 Europe Biometric Banking Market, by Country, 2023 - 2030, USD Million

- TABLE 150 Germany Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 151 Germany Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 152 Germany Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 153 Germany Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 154 Germany Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 155 Germany Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 156 Germany Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 157 Germany Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 158 UK Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 159 UK Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 160 UK Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 161 UK Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 162 UK Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 163 UK Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 164 UK Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 165 UK Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 166 France Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 167 France Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 168 France Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 169 France Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 170 France Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 171 France Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 172 France Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 173 France Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 174 Russia Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 175 Russia Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 176 Russia Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 177 Russia Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 178 Russia Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 179 Russia Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 180 Russia Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 181 Russia Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 182 Spain Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 183 Spain Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 184 Spain Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 185 Spain Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 186 Spain Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 187 Spain Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 188 Spain Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 189 Spain Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 190 Italy Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 191 Italy Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 192 Italy Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 193 Italy Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 194 Italy Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 195 Italy Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 196 Italy Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 197 Italy Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 198 Rest of Europe Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 199 Rest of Europe Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 200 Rest of Europe Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 201 Rest of Europe Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 202 Rest of Europe Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 203 Rest of Europe Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 204 Rest of Europe Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 205 Rest of Europe Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 206 Asia Pacific Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 207 Asia Pacific Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 208 Asia Pacific Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 209 Asia Pacific Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 210 Asia Pacific Fingerprint Market, by Country, 2019 - 2022, USD Million

- TABLE 211 Asia Pacific Fingerprint Market, by Country, 2023 - 2030, USD Million

- TABLE 212 Asia Pacific Facial Recognition Market, by Country, 2019 - 2022, USD Million

- TABLE 213 Asia Pacific Facial Recognition Market, by Country, 2023 - 2030, USD Million

- TABLE 214 Asia Pacific Hand Geometry Market, by Country, 2019 - 2022, USD Million

- TABLE 215 Asia Pacific Hand Geometry Market, by Country, 2023 - 2030, USD Million

- TABLE 216 Asia Pacific Iris Recognition Market, by Country, 2019 - 2022, USD Million

- TABLE 217 Asia Pacific Iris Recognition Market, by Country, 2023 - 2030, USD Million

- TABLE 218 Asia Pacific Others Market, by Country, 2019 - 2022, USD Million

- TABLE 219 Asia Pacific Others Market, by Country, 2023 - 2030, USD Million

- TABLE 220 Asia Pacific Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 221 Asia Pacific Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 222 Asia Pacific Retail Market, by Country, 2019 - 2022, USD Million

- TABLE 223 Asia Pacific Retail Market, by Country, 2023 - 2030, USD Million

- TABLE 224 Asia Pacific Transportation Market, by Country, 2019 - 2022, USD Million

- TABLE 225 Asia Pacific Transportation Market, by Country, 2023 - 2030, USD Million

- TABLE 226 Asia Pacific Hospitality Market, by Country, 2019 - 2022, USD Million

- TABLE 227 Asia Pacific Hospitality Market, by Country, 2023 - 2030, USD Million

- TABLE 228 Asia Pacific Government Market, by Country, 2019 - 2022, USD Million

- TABLE 229 Asia Pacific Government Market, by Country, 2023 - 2030, USD Million

- TABLE 230 Asia Pacific Healthcare Market, by Country, 2019 - 2022, USD Million

- TABLE 231 Asia Pacific Healthcare Market, by Country, 2023 - 2030, USD Million

- TABLE 232 Asia Pacific Others Market, by Country, 2019 - 2022, USD Million

- TABLE 233 Asia Pacific Others Market, by Country, 2023 - 2030, USD Million

- TABLE 234 Asia Pacific Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 235 Asia Pacific Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 236 Asia Pacific Hardware Market, by Country, 2019 - 2022, USD Million

- TABLE 237 Asia Pacific Hardware Market, by Country, 2023 - 2030, USD Million

- TABLE 238 Asia Pacific Software Market, by Country, 2019 - 2022, USD Million

- TABLE 239 Asia Pacific Software Market, by Country, 2023 - 2030, USD Million

- TABLE 240 Asia Pacific Services Market, by Country, 2019 - 2022, USD Million

- TABLE 241 Asia Pacific Services Market, by Country, 2023 - 2030, USD Million

- TABLE 242 Asia Pacific Biometric Banking Market, by Country, 2019 - 2022, USD Million

- TABLE 243 Asia Pacific Biometric Banking Market, by Country, 2023 - 2030, USD Million

- TABLE 244 China Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 245 China Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 246 China Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 247 China Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 248 China Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 249 China Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 250 China Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 251 China Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 252 Japan Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 253 Japan Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 254 Japan Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 255 Japan Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 256 Japan Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 257 Japan Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 258 Japan Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 259 Japan Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 260 India Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 261 India Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 262 India Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 263 India Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 264 India Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 265 India Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 266 India Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 267 India Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 268 South Korea Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 269 South Korea Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 270 South Korea Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 271 South Korea Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 272 South Korea Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 273 South Korea Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 274 South Korea Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 275 South Korea Biometric Banking Market, by Component, 2023 - 2030, USD Million

- TABLE 276 Singapore Biometric Banking Market, 2019 - 2022, USD Million

- TABLE 277 Singapore Biometric Banking Market, 2023 - 2030, USD Million

- TABLE 278 Singapore Biometric Banking Market, by Type, 2019 - 2022, USD Million

- TABLE 279 Singapore Biometric Banking Market, by Type, 2023 - 2030, USD Million

- TABLE 280 Singapore Biometric Banking Market, by Vertical, 2019 - 2022, USD Million

- TABLE 281 Singapore Biometric Banking Market, by Vertical, 2023 - 2030, USD Million

- TABLE 282 Singapore Biometric Banking Market, by Component, 2019 - 2022, USD Million

- TABLE 283 Singapore Biometric Banking Market, by Component, 2023 - 2030, USD Million

The Global Biometric Banking Market size is expected to reach $16.2 billion by 2030, rising at a market growth of 16.6% CAGR during the forecast period.

In banks, fingerprint biometrics are commonly used for user authentication. Customers could use their biometrics to access their bank accounts, make transactions, and perform numerous banking operations. Therefore, fingerprint segment would generate $2,826.1 million revenue in the market in 2022. Some banks use fingerprint biometrics to control access to their physical branches, especially in high-security or restricted-access areas. The market has been evolving rapidly, with technological advancements significantly enhancing security, improving user experience, and expanding the range of applications. Integrating biometric authentication into payment cards enables users to authenticate transactions using their fingerprint or other biometric data directly at the point of sale (PoS) terminals.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Mastercard joined forces with Middle East Payment Services, a payment processor and card issuer, along with Zwipe, to unveil a range of biometric payment cards. Before this launch, MEPS collaborated extensively with Zwipe and Mastercard to conduct an extended pilot and testing phase for these new cards. Moreover, In March, 2023, Mastercard signed a partnership with Singtel Optus Pty Limited, to offer Optus customers a secure method for confirming their identity. Via the My Optus app, users can establish a reusable digital identity, eliminating the necessity for physical document submission when sharing information with consent.

Based on the Analysis presented in the KBV Cardinal matrix; Apple, Inc. is the forerunner in the Market. In June 2023, Apple, Inc. formed a partnership with HDFC Bank, to expand its investment and manufacturing the Indian market. Companies such as Google LLC and Samsung Electronics Co., Ltd. are some of the key innovators in the Market.

Market Growth Factors

Increase in mobile banking and contactless payments

After the COVID-19 pandemic, individuals began to favor contactless payment methods. Ensuring secure and dependable payment solutions is crucial in light of the growing cyber threats. Furthermore, the widespread use of contactless payment solutions has been further accelerated by the COVID-19 pandemic. This is due to consumers' desire to minimize physical contact with payment devices to save themselves from getting in touch with harmful bacteria. Therefore, these factors drive the expansion of the market.

Rising biometrics use in increasing security and reducing identity frauds

Biometric authentication can be combined with other factors like PINs or tokens to create a multi-factor authentication (MFA) system, further enhancing security. Unlike traditional passwords, biometric data cannot be easily stolen or guessed, reducing the risk of unauthorized access. Biometric data can provide non-repudiation, meaning the user cannot deny their actions since their unique biometric data was used for authentication. Consequently, these factors are anticipated to expand the market.

Market Restraining Factors

Security concerns and high implementation costs

Security concerns and high implementation costs are two significant challenges facing the market. Ethical considerations revolve around obtaining informed consent from users for collecting and using their biometric data. Banks must address concerns related to data ownership and potential surveillance implications. Insider threats from bank employees with access to biometric data can lead to unauthorized access or data breaches. Implementing strict access controls and monitoring is crucial. Also, banks may need to invest in user education and training programs to ensure customers understand biometric authentication and troubleshoot any issues securely. Therefore, it is anticipated that these factors will restrain the growth of the market.

Type Outlook

Based on type, the market is fragmented into fingerprint, facial recognition, hand geometry, iris recognition, and others. The hand geometry segment recorded a remarkable revenue share in the market 2022. Hand geometry recognition has been used for physical access control in bank branches and secure areas within banks. Using hand geometry scans, employees and authorized personnel can access restricted areas, vaults, and data centers. This technology helps enhance security and ensures that only authorized individuals can enter sensitive areas. Banks may use hand geometry recognition for time and attendance tracking of employees. This provides accurate work hours and attendance recording, crucial for payroll processing and compliance with labor regulations.

Vertical Outlook

By vertical, the market is retail, government, transportation, healthcare, hospitality, and others. The transportation segment covered a considerable revenue share in the market 2022. The transportation industry has increasingly adopted biometric technology to enhance security, improve passenger experience, and streamline operations. Biometrics offer unique benefits in this sector, where identity verification and access control are critical. It is attributed to biometric authentication enabling passengers to move seamlessly through various touchpoints of their travel journey, from check-in and security to boarding and baggage claim.

Component Outlook

On the basis of component, the market is segmented into hardware, software, and services. In 2022, the hardware segment dominated the market with the maximum revenue share. The development of mobile biometric devices, a greater emphasis on hardware-based security abilities, and the expanding use of biometric technologies in electronics for consumers for verification and identification applications are significant factors fueling the expansion of biometric technology. The benefits of biometric hardware, such as reliable accountability, excellent performance, dependability, and high security & assurance, help propel this market's expansion. Numerous vendors are investing in R&D for cutting-edge technologies to enhance hardware capabilities and reduce costs for small and medium-sized businesses.

Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region witnessed the largest revenue share in the market. In the United States, biometric technologies are utilized in various sectors, including government, homeland security, commerce, and the legal system. An increasing number of safety and security needs are being met by biometric technology due to the increased global threat of terrorism. Due to its highly developed technological infrastructure and strong emphasis on data security and privacy regulations, North America remains at the forefront of biometric banking implementation. Large financial institutions in the United States and Canada have substantially invested in biometric banking systems. These products safeguard client accounts, prevent unauthorized access, and provide a straightforward and secure banking experience.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Google LLC, NEC Corporation, Apple, Inc., The Charles Schwab Corporation, Mastercard Inc., Barclays Plc, Visa Inc., PayPal Holdings, Inc., Samsung Electronics Co. Ltd. and Aliph Brands.

Recent Strategies Deployed in Biometric Banking Market

Partnerships, Collaborations, and Agreements:

Jun-2023: Apple, Inc. formed a partnership with HDFC Bank, an Indian banking and financial services company to launch a credit card in India. Through this partnership, Apple would be able to expand its investment and manufacturing the Indian market.

Jun-2023: Mastercard forged a partnership with NAPS, a leading entity in the burgeoning Moroccan financial technology industry, to innovate pioneering payment alternatives for both individuals and enterprises. Additionally, Mastercard intends to accelerate the creation of digital payment innovations within Morocco, fortifying the nation's position as a prominent financial technology centre in the Arab region.

Jun-2023: Mastercard joined forces with Middle East Payment Services, a payment processor and card issuer, along with Zwipe, a biometric tech firm, to unveil a range of biometric payment cards. Before this launch, MEPS collaborated extensively with Zwipe and Mastercard to conduct an extended pilot and testing phase for these new cards. Additionally, the successful pilot phase achievement enables banks and issuers to introduce these cards swiftly and effectively.

Mar-2023: Mastercard signed a partnership with Singtel Optus Pty Limited, an Australian telecommunications company, to offer Optus customers a secure method for confirming their identity. Via the My Optus app, users can establish a reusable digital identity, eliminating the necessity for physical document submission when sharing information with consent. Additionally, this ID empowers customers to oversee and safeguard their data, employing top-tier technology to guarantee the safety and confidentiality of their personal information.

Feb-2023: Google LLC teamed up with Anthropic, an AI startup specializing in safety and research. Anthropic has chosen Google Cloud as its preferred cloud partner to access the computational resources needed for building dependable AI systems. Google Cloud also plans to construct advanced TPU and GPU clusters to support Anthropic's AI training and deployment needs.

Dec-2022: Apple, Inc. extended its partnership with Goldman Sachs Group Inc., an American multinational investment bank, to provide the services of a high-yield savings account to Apple cardholders. Through this partnership, Apple provided its customers the services of the "buy now, pay later" plans.

May-2022: Apple, Inc. formed a partnership with Google, LLC, an American multinational technology company, and Microsoft, an American multinational technology corporation, to expand their support towards the common passwordless sign-in, created by the FIDO Alliance and the World Wide Web Consortium. Through this partnership, the web users were given security and end-to-end passwordless option.

Oct-2021: Visa Inc. has collaborated with Callsign, a unique identifier for a transmitter station, for its behavioural biometric and device intelligence identity solutions. This collaboration entails Visa integrating Callsign's offerings into its network of financial institutions, payment service providers, and merchants throughout Europe.

Product Launches and Product Expansions:

Jun-2023: Google LLC introduced Anti Money Laundering AI, an AI-powered tool for financial institutions to enhance their money laundering detection. It offers a dynamic customer risk score based on machine learning, improving accuracy and operational efficiency.

Oct-2022: Mastercard unveils Crypto SourceTM, a novel initiative empowering financial institutions to offer secure cryptocurrency trading services to their clientele. With this, Mastercard is broadening its collaboration with Paxos Trust Company, a prominent regulated blockchain infrastructure provider. The partnership's objective is for Paxos to furnish cryptocurrency trading and custody solutions for banks, while Mastercard harnesses its technology to seamlessly incorporate these capabilities into the banks' interfaces.

Oct-2022: PayPal Holdings, Inc. announced the addition of passkeys as an easy and secure login method for PayPal accounts. This new login option was initially made available to iPhone, iPad, and Mac users on PayPal.com and later expanded to additional platforms as they added support for passkeys. Through this addition, customers able to enjoy a more seamless checkout experience, eliminating the risks associated with weak and reused credentials and alleviating the frustration of remembering a password while shopping online.

May-2022: Mastercard unveiled a retailer program, introducing biometric payment options such as facial and fingerprint authentication. Through this launch, users can verify their payment by presenting their face or palm at the checkout point, instead of swiping their card.

Jan-2022: Samsung Electronics Co. Ltd. unveiled its latest fingerprint security IC (integrated circuit), the S3B512C, featuring upgraded security capabilities. The S3B512C integrates a fingerprint sensor, a secure element (SE), and a secure processor, delivering an additional level of authentication and security for payment cards. Moreover, while the IC was primarily intended for payment cards, the S3B512C is also suitable for cards demanding highly secure authentication.

Acquisition and Mergers:

Sep-2021: PayPal Holdings, Inc. announced the acquisition of Paidy, a leading two-sided payments platform and provider of buy now, to expand its capabilities, distribution, and relevance in Japan. Under the acquisition, Paidy has sustained its ongoing operations and brand, with Paidy's president and CEO, along with founder and executive chairman, retained their positions.

Scope of the Study

Market Segments covered in the Report:

By Type

- Fingerprint

- Facial Recognition

- Hand Geometry

- Iris Recognition

- Others

By Vertical

- Retail

- Transportation

- Hospitality

- Government

- Healthcare

- Others

By Component

- Hardware

- Software

- Services

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Google LLC

- NEC Corporation

- Apple, Inc.

- The Charles Schwab Corporation

- Mastercard Inc.

- Barclays Plc

- Visa Inc.

- PayPal Holdings, Inc.

- Samsung Electronics Co. Ltd.

- Aliph Brands

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Biometric Banking Market, by Type

- 1.4.2 Global Biometric Banking Market, by Vertical

- 1.4.3 Global Biometric Banking Market, by Component

- 1.4.4 Global Biometric Banking Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market at a Glance

- 2.1 Key highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scnerio

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

Chapter 4. Competition Analysis - Global

- 4.1 KBV Cardinal Matrix

- 4.2 Recent Industry Wide Strategic Developments

- 4.2.1 Partnerships, Collaborations and Agreements

- 4.2.2 Product Launches and Product Expansions

- 4.2.3 Acquisition and Mergers

- 4.3 Top Winning Strategies

- 4.3.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 4.3.2 Key Strategic Move: (Partnerships, Collaborations, and Agreements: 2020, Jul - 2023, Jun) Leading Players

- 4.4 Porter's Five Forces Analysis

Chapter 5. Global Biometric Banking Market, by Type

- 5.1 Global Fingerprint Market, by Region

- 5.2 Global Facial Recognition Market, by Region

- 5.3 Global Hand Geometry Market, by Region

- 5.4 Global Iris Recognition Market, by Region

- 5.5 Global Others Market, by Region

Chapter 6. Global Biometric Banking Market, by Vertical

- 6.1 Global Retail Market, by Region

- 6.2 Global Transportation Market, by Region

- 6.3 Global Hospitality Market, by Region

- 6.4 Global Government Market, by Region

- 6.5 Global Healthcare Market, by Region

- 6.6 Global Others Market, by Region

Chapter 7. Global Biometric Banking Market, by Component

- 7.1 Global Hardware Market, by Region

- 7.2 Global Software Market, by Region

- 7.3 Global Services Market, by Region

Chapter 8. Global Biometric Banking Market, by Region

- 8.1 North America Biometric Banking Market

- 8.1.1 North America Biometric Banking Market, by Type

- 8.1.1.1 North America Fingerprint Market, by Country

- 8.1.1.2 North America Facial Recognition Market, by Country

- 8.1.1.3 North America Hand Geometry Market, by Country

- 8.1.1.4 North America Iris Recognition Market, by Country

- 8.1.1.5 North America Others Market, by Country

- 8.1.2 North America Biometric Banking Market, by Vertical

- 8.1.2.1 North America Retail Market, by Country

- 8.1.2.2 North America Transportation Market, by Country

- 8.1.2.3 North America Hospitality Market, by Country

- 8.1.2.4 North America Government Market, by Country

- 8.1.2.5 North America Healthcare Market, by Country

- 8.1.2.6 North America Others Market, by Country

- 8.1.3 North America Biometric Banking Market, by Component

- 8.1.3.1 North America Hardware Market, by Country

- 8.1.3.2 North America Software Market, by Country

- 8.1.3.3 North America Services Market, by Country

- 8.1.4 North America Biometric Banking Market, by Country

- 8.1.4.1 US Biometric Banking Market

- 8.1.4.1.1 US Biometric Banking Market, by Type

- 8.1.4.1.2 US Biometric Banking Market, by Vertical

- 8.1.4.1.3 US Biometric Banking Market, by Component

- 8.1.4.2 Canada Biometric Banking Market

- 8.1.4.2.1 Canada Biometric Banking Market, by Type

- 8.1.4.2.2 Canada Biometric Banking Market, by Vertical

- 8.1.4.2.3 Canada Biometric Banking Market, by Component

- 8.1.4.3 Mexico Biometric Banking Market

- 8.1.4.3.1 Mexico Biometric Banking Market, by Type

- 8.1.4.3.2 Mexico Biometric Banking Market, by Vertical

- 8.1.4.3.3 Mexico Biometric Banking Market, by Component

- 8.1.4.4 Rest of North America Biometric Banking Market

- 8.1.4.4.1 Rest of North America Biometric Banking Market, by Type

- 8.1.4.4.2 Rest of North America Biometric Banking Market, by Vertical

- 8.1.4.4.3 Rest of North America Biometric Banking Market, by Component

- 8.1.4.1 US Biometric Banking Market

- 8.1.1 North America Biometric Banking Market, by Type

- 8.2 Europe Biometric Banking Market

- 8.2.1 Europe Biometric Banking Market, by Type

- 8.2.1.1 Europe Fingerprint Market, by Country

- 8.2.1.2 Europe Facial Recognition Market, by Country

- 8.2.1.3 Europe Hand Geometry Market, by Country

- 8.2.1.4 Europe Iris Recognition Market, by Country

- 8.2.1.5 Europe Others Market, by Country

- 8.2.2 Europe Biometric Banking Market, by Vertical

- 8.2.2.1 Europe Retail Market, by Country

- 8.2.2.2 Europe Transportation Market, by Country

- 8.2.2.3 Europe Hospitality Market, by Country

- 8.2.2.4 Europe Government Market, by Country

- 8.2.2.5 Europe Healthcare Market, by Country

- 8.2.2.6 Europe Others Market, by Country

- 8.2.3 Europe Biometric Banking Market, by Component

- 8.2.3.1 Europe Hardware Market, by Country

- 8.2.3.2 Europe Software Market, by Country

- 8.2.3.3 Europe Services Market, by Country

- 8.2.4 Europe Biometric Banking Market, by Country

- 8.2.4.1 Germany Biometric Banking Market

- 8.2.4.1.1 Germany Biometric Banking Market, by Type

- 8.2.4.1.2 Germany Biometric Banking Market, by Vertical

- 8.2.4.1.3 Germany Biometric Banking Market, by Component

- 8.2.4.2 UK Biometric Banking Market

- 8.2.4.2.1 UK Biometric Banking Market, by Type

- 8.2.4.2.2 UK Biometric Banking Market, by Vertical

- 8.2.4.2.3 UK Biometric Banking Market, by Component

- 8.2.4.3 France Biometric Banking Market

- 8.2.4.3.1 France Biometric Banking Market, by Type

- 8.2.4.3.2 France Biometric Banking Market, by Vertical

- 8.2.4.3.3 France Biometric Banking Market, by Component

- 8.2.4.4 Russia Biometric Banking Market

- 8.2.4.4.1 Russia Biometric Banking Market, by Type

- 8.2.4.4.2 Russia Biometric Banking Market, by Vertical

- 8.2.4.4.3 Russia Biometric Banking Market, by Component

- 8.2.4.5 Spain Biometric Banking Market

- 8.2.4.5.1 Spain Biometric Banking Market, by Type

- 8.2.4.5.2 Spain Biometric Banking Market, by Vertical

- 8.2.4.5.3 Spain Biometric Banking Market, by Component

- 8.2.4.6 Italy Biometric Banking Market

- 8.2.4.6.1 Italy Biometric Banking Market, by Type

- 8.2.4.6.2 Italy Biometric Banking Market, by Vertical

- 8.2.4.6.3 Italy Biometric Banking Market, by Component

- 8.2.4.7 Rest of Europe Biometric Banking Market

- 8.2.4.7.1 Rest of Europe Biometric Banking Market, by Type

- 8.2.4.7.2 Rest of Europe Biometric Banking Market, by Vertical

- 8.2.4.7.3 Rest of Europe Biometric Banking Market, by Component

- 8.2.4.1 Germany Biometric Banking Market

- 8.2.1 Europe Biometric Banking Market, by Type

- 8.3 Asia Pacific Biometric Banking Market

- 8.3.1 Asia Pacific Biometric Banking Market, by Type

- 8.3.1.1 Asia Pacific Fingerprint Market, by Country

- 8.3.1.2 Asia Pacific Facial Recognition Market, by Country

- 8.3.1.3 Asia Pacific Hand Geometry Market, by Country

- 8.3.1.4 Asia Pacific Iris Recognition Market, by Country

- 8.3.1.5 Asia Pacific Others Market, by Country

- 8.3.2 Asia Pacific Biometric Banking Market, by Vertical

- 8.3.2.1 Asia Pacific Retail Market, by Country

- 8.3.2.2 Asia Pacific Transportation Market, by Country

- 8.3.2.3 Asia Pacific Hospitality Market, by Country

- 8.3.2.4 Asia Pacific Government Market, by Country

- 8.3.2.5 Asia Pacific Healthcare Market, by Country

- 8.3.2.6 Asia Pacific Others Market, by Country

- 8.3.3 Asia Pacific Biometric Banking Market, by Component

- 8.3.3.1 Asia Pacific Hardware Market, by Country

- 8.3.3.2 Asia Pacific Software Market, by Country

- 8.3.3.3 Asia Pacific Services Market, by Country

- 8.3.4 Asia Pacific Biometric Banking Market, by Country

- 8.3.4.1 China Biometric Banking Market

- 8.3.4.1.1 China Biometric Banking Market, by Type

- 8.3.4.1.2 China Biometric Banking Market, by Vertical

- 8.3.4.1.3 China Biometric Banking Market, by Component

- 8.3.4.2 Japan Biometric Banking Market

- 8.3.4.2.1 Japan Biometric Banking Market, by Type

- 8.3.4.2.2 Japan Biometric Banking Market, by Vertical

- 8.3.4.2.3 Japan Biometric Banking Market, by Component

- 8.3.4.3 India Biometric Banking Market

- 8.3.4.3.1 India Biometric Banking Market, by Type

- 8.3.4.3.2 India Biometric Banking Market, by Vertical

- 8.3.4.3.3 India Biometric Banking Market, by Component

- 8.3.4.4 South Korea Biometric Banking Market

- 8.3.4.4.1 South Korea Biometric Banking Market, by Type

- 8.3.4.4.2 South Korea Biometric Banking Market, by Vertical

- 8.3.4.4.3 South Korea Biometric Banking Market, by Component

- 8.3.4.5 Singapore Biometric Banking Market

- 8.3.4.5.1 Singapore Biometric Banking Market, by Type

- 8.3.4.5.2 Singapore Biometric Banking Market, by Vertical

- 8.3.4.5.3 Singapore Biometric Banking Market, by Component

- 8.3.4.6 Malaysia Biometric Banking Market

- 8.3.4.6.1 Malaysia Biometric Banking Market, by Type

- 8.3.4.6.2 Malaysia Biometric Banking Market, by Vertical

- 8.3.4.6.3 Malaysia Biometric Banking Market, by Component

- 8.3.4.7 Rest of Asia Pacific Biometric Banking Market

- 8.3.4.7.1 Rest of Asia Pacific Biometric Banking Market, by Type

- 8.3.4.7.2 Rest of Asia Pacific Biometric Banking Market, by Vertical

- 8.3.4.7.3 Rest of Asia Pacific Biometric Banking Market, by Component

- 8.3.4.1 China Biometric Banking Market

- 8.3.1 Asia Pacific Biometric Banking Market, by Type

- 8.4 LAMEA Biometric Banking Market

- 8.4.1 LAMEA Biometric Banking Market, by Type

- 8.4.1.1 LAMEA Fingerprint Market, by Country

- 8.4.1.2 LAMEA Facial Recognition Market, by Country

- 8.4.1.3 LAMEA Hand Geometry Market, by Country

- 8.4.1.4 LAMEA Iris Recognition Market, by Country

- 8.4.1.5 LAMEA Others Market, by Country

- 8.4.2 LAMEA Biometric Banking Market, by Vertical

- 8.4.2.1 LAMEA Retail Market, by Country

- 8.4.2.2 LAMEA Transportation Market, by Country

- 8.4.2.3 LAMEA Hospitality Market, by Country

- 8.4.2.4 LAMEA Government Market, by Country

- 8.4.2.5 LAMEA Healthcare Market, by Country

- 8.4.2.6 LAMEA Others Market, by Country

- 8.4.3 LAMEA Biometric Banking Market, by Component

- 8.4.3.1 LAMEA Hardware Market, by Country

- 8.4.3.2 LAMEA Software Market, by Country

- 8.4.3.3 LAMEA Services Market, by Country

- 8.4.4 LAMEA Biometric Banking Market, by Country

- 8.4.4.1 Brazil Biometric Banking Market

- 8.4.4.1.1 Brazil Biometric Banking Market, by Type

- 8.4.4.1.2 Brazil Biometric Banking Market, by Vertical

- 8.4.4.1.3 Brazil Biometric Banking Market, by Component

- 8.4.4.2 Argentina Biometric Banking Market

- 8.4.4.2.1 Argentina Biometric Banking Market, by Type

- 8.4.4.2.2 Argentina Biometric Banking Market, by Vertical

- 8.4.4.2.3 Argentina Biometric Banking Market, by Component

- 8.4.4.3 UAE Biometric Banking Market

- 8.4.4.3.1 UAE Biometric Banking Market, by Type

- 8.4.4.3.2 UAE Biometric Banking Market, by Vertical

- 8.4.4.3.3 UAE Biometric Banking Market, by Component

- 8.4.4.4 Saudi Arabia Biometric Banking Market

- 8.4.4.4.1 Saudi Arabia Biometric Banking Market, by Type

- 8.4.4.4.2 Saudi Arabia Biometric Banking Market, by Vertical

- 8.4.4.4.3 Saudi Arabia Biometric Banking Market, by Component

- 8.4.4.5 South Africa Biometric Banking Market

- 8.4.4.5.1 South Africa Biometric Banking Market, by Type

- 8.4.4.5.2 South Africa Biometric Banking Market, by Vertical

- 8.4.4.5.3 South Africa Biometric Banking Market, by Component

- 8.4.4.6 Nigeria Biometric Banking Market

- 8.4.4.6.1 Nigeria Biometric Banking Market, by Type

- 8.4.4.6.2 Nigeria Biometric Banking Market, by Vertical

- 8.4.4.6.3 Nigeria Biometric Banking Market, by Component

- 8.4.4.7 Rest of LAMEA Biometric Banking Market

- 8.4.4.7.1 Rest of LAMEA Biometric Banking Market, by Type

- 8.4.4.7.2 Rest of LAMEA Biometric Banking Market, by Vertical

- 8.4.4.7.3 Rest of LAMEA Biometric Banking Market, by Component

- 8.4.4.1 Brazil Biometric Banking Market

- 8.4.1 LAMEA Biometric Banking Market, by Type

Chapter 9. Company Profiles

- 9.1 Google, LLC (Kaggle Inc.)

- 9.1.1 Company Overview

- 9.1.2 Financial Analysis

- 9.1.3 Segmental and Regional Analysis

- 9.1.4 Research & Development Expenses

- 9.1.5 Recent strategies and developments:

- 9.1.5.1 Partnerships, Collaborations, and Agreements:

- 9.1.5.2 Product Launches and Product Expansions:

- 9.1.6 SWOT Analysis

- 9.2 NEC Corporation

- 9.2.1 Company Overview

- 9.2.2 Financial Analysis

- 9.2.3 Segmental and Regional Analysis

- 9.2.4 Research & Development Expenses

- 9.2.5 SWOT Analysis

- 9.3 Apple Inc.

- 9.3.1 Company Overview

- 9.3.2 Financial Analysis

- 9.3.3 Regional Analysis

- 9.3.4 Research & Development Expenses

- 9.3.5 Recent strategies and developments:

- 9.3.5.1 Partnerships, Collaborations, and Agreements:

- 9.3.6 SWOT Analysis

- 9.4 Alibaba Cloud (Alibaba Group Holding Limited)

- 9.4.1 Company Overview

- 9.4.2 Financial Analysis

- 9.4.3 Regional Analysis

- 9.4.4 Recent strategies and developments:

- 9.4.4.1 Partnerships, Collaborations, and Agreements:

- 9.4.5 SWOT Analysis

- 9.5 Mastercard, Inc.

- 9.5.1 Company Overview

- 9.5.2 Financial Analysis

- 9.5.3 Regional Analysis

- 9.5.4 Recent strategies and developments:

- 9.5.4.1 Partnerships, Collaborations, and Agreements:

- 9.5.4.2 Product Launches and Product Expansions:

- 9.5.5 SWOT Analysis

- 9.6 Barclays PLC

- 9.6.1 Company Overview

- 9.6.2 Financial Analysis

- 9.6.3 Segmental and Regional Analysis

- 9.6.4 Recent strategies and developments:

- 9.6.4.1 Product Launches and Product Expansions:

- 9.6.5 SWOT Analysis

- 9.7 Visa, Inc.

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 Recent strategies and developments:

- 9.7.3.1 Partnerships, Collaborations, and Agreements:

- 9.7.4 SWOT Analysis

- 9.8 PayPal Holdings, Inc.

- 9.8.1 Company Overview

- 9.8.2 Financial Analysis

- 9.8.3 Regional Analysis

- 9.8.4 Research & Development Expenses

- 9.8.5 Recent strategies and developments:

- 9.8.5.1 Product Launches and Product Expansions:

- 9.8.5.2 Acquisition and Mergers:

- 9.8.6 SWOT Analysis

- 9.9 Samsung Electronics Co., Ltd. (Samsung Group)

- 9.9.1 Company Overview

- 9.9.2 Financial Analysis

- 9.9.3 Segmental and Regional Analysis

- 9.9.4 Recent strategies and developments:

- 9.9.4.1 Product Launches and Product Expansions:

- 9.9.5 SWOT Analysis

- 9.10. Aliph Brands LLC (JawBone)

- 9.10.1 Company Overview

- 9.10.2 SWOT Analysis