|

|

市場調査レポート

商品コード

1353369

ルテインの世界市場規模、シェア、産業動向分析レポート:形態別、供給源別、用途別、地域別の展望と予測、2023年~2030年Global Lutein Market Size, Share & Industry Trends Analysis Report By Form (Powder & Crystalline, Beadlet, Emulsion, and Oil Suspension), By Source (Synthetic, and Natural), By Application, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| ルテインの世界市場規模、シェア、産業動向分析レポート:形態別、供給源別、用途別、地域別の展望と予測、2023年~2030年 |

|

出版日: 2023年08月31日

発行: KBV Research

ページ情報: 英文 325 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

ルテイン市場規模は、予測期間中にCAGR 6.2%で成長し、2030年には5億3,160万米ドルに達すると予測されます。2022年の市場規模は3,985.2トンで、成長率は3.2%(2019-2022年)です。

しかし、ヘルスケアにおける抗酸化物質の機能に焦点を当てた出版物「医療科学における酸化物質と抗酸化物質、2022年」によると、特に特定の健康問題を抱えている人や薬を摂取している人に対して、そのサプリメントがもたらす可能性のある危険性や副作用が強調されています。ルテインサプリメントの購入をためらう顧客は、サプリメントの品質に対する信頼がないため、代わりに自然食品源のルテインを探すように説得されるかもしれないです。その結果、市場は予測期間を通じて緩やかに増加すると予想されます。

形態の展望

形態によって、市場は粉末・結晶、オイルサスペンション、ビーズレット、エマルジョンに細分化されます。2022年には、粉末&結晶セグメントが市場で最大の収益シェアを示しました。他の形態に比べ、粉末と結晶のルテインは製造が比較的簡単です。ルテインは簡単に結合され、カプセル化されるため、製造手順が簡単です。製造の複雑さやコストが低いため、製剤が単純であることが、その需要の高さを説明するのに役立つと思われます。ルテインは、結晶と粉末の形をしており、簡単に組み合わせることができるため、様々な方法で使用することができます。その汎用性から、飲料、機能性食品、栄養補助食品など、さまざまな商品に最適です。

供給源の展望

ソース別では、市場は天然と合成に区分されます。天然セグメントは2022年の市場でかなりの収益シェアを獲得しました。マリーゴールドの花などの植物に由来する天然ルテインは、天然で植物由来のサプリメントのより魅力的な代替品と見なすことができます。顧客は、クリーンラベル製品への嗜好が高まるにつれて、成分の明確性を求めています。天然ルテインはこのような需要に応える可能性があり、化学的な変化を受けていない健康的な物質として宣伝することができます。

用途別展望

用途別では、市場は食品、飲食品、栄養補助食品、飼料、その他の用途に分類されます。2022年には、栄養補助食品分野が市場で最も高い収益シェアを占めました。今後数年間で、栄養補助食品に対する消費者の需要は急増すると思われます。果物や野菜は抗酸化物質のカロテノイド、ルテインによって黄色く着色されるため、カロテノイド市場の一部となっています。健康的な食生活は視力の良し悪しに影響するかもしれないです。栄養状態が悪いと、加齢とともに視力が悪化する可能性があります。必須ミネラル、ビタミン、脂肪酸を含む栄養補助食品は、人々が健康を維持し、危険な病気を避けるのに役立ちます。このような利点から、栄養補助食品としてのルテインの利用が増加しており、市場の成長に拍車をかけています。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、アジア太平洋地域が最大の収益シェアを獲得して市場をリードしました。アジア太平洋地域、特に中国やインドのような国々は、マリーゴールドの花のようなルテインを豊富に含むソースを栽培するための重要な農業部門と気候条件を持っています。その結果、ルテインは安定的に供給され、アジア太平洋地域は重要な生産地としての地位を維持し、ルテインの信頼できる供給源となっています。アジア太平洋地域の栄養補助食品と栄養補助食品事業には、多額の投資が行われています。この地域のベンダーは、製品革新、研究開発、マーケティングに積極的に注力し、ルテインと関連製品の需要増に応えています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

第4章 世界のルテイン市場:形態別

- 世界の粉末および結晶市場:地域別

- 世界のビーズレット市場:地域別

- 世界のエマルジョン市場:地域別

- 世界のオイルサスペンション市場:地域別

第5章 世界のルテイン市場:ソース別

- 世界の合成市場:地域別

- 世界の自然市場:地域別

第6章 世界のルテイン市場:用途別

- 世界の栄養補助食品市場:地域別

- 世界の飲料市場:地域別

- 世界の食品市場:地域別

- 世界の動物飼料市場:地域別

- 世界のその他の市場:地域別

第7章 世界のルテイン市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第8章 企業プロファイル

- BASF SE

- Kemin Industries, Inc

- EI.D. Parry Limited(Murugappa Group)

- Merck KGaA

- Piveg, Inc

- Synthite Industries Pvt Ltd.

- Dohler GmbH

- Sabinsa Corporation(Sami-Sabinsa Group Ltd)

- Fenchem Biotek Ltd

- India Glycols Limited

第9章 ルテイン市場の勝利は必須

LIST OF TABLES

- TABLE 1 Global Lutein Market, 2019 - 2022, USD Thousands

- TABLE 2 Global Lutein Market, 2023 - 2030, USD Thousands

- TABLE 3 Global Lutein Market, 2019 - 2022, Tonnes

- TABLE 4 Global Lutein Market, 2023 - 2030, Tonnes

- TABLE 5 Global Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 6 Global Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 7 Global Powder & Crystalline Market by Region, 2019 - 2022, USD Thousands

- TABLE 8 Global Powder & Crystalline Market by Region, 2023 - 2030, USD Thousands

- TABLE 9 Global Beadlet Market by Region, 2019 - 2022, USD Thousands

- TABLE 10 Global Beadlet Market by Region, 2023 - 2030, USD Thousands

- TABLE 11 Global Emulsion Market by Region, 2019 - 2022, USD Thousands

- TABLE 12 Global Emulsion Market by Region, 2023 - 2030, USD Thousands

- TABLE 13 Global Oil Suspension Market by Region, 2019 - 2022, USD Thousands

- TABLE 14 Global Oil Suspension Market by Region, 2023 - 2030, USD Thousands

- TABLE 15 Global Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 16 Global Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 17 Global Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 18 Global Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 19 Global Synthetic Market by Region, 2019 - 2022, USD Thousands

- TABLE 20 Global Synthetic Market by Region, 2023 - 2030, USD Thousands

- TABLE 21 Global Synthetic Market by Region, 2019 - 2022, Tonnes

- TABLE 22 Global Synthetic Market by Region, 2023 - 2030, Tonnes

- TABLE 23 Global Natural Market by Region, 2019 - 2022, USD Thousands

- TABLE 24 Global Natural Market by Region, 2023 - 2030, USD Thousands

- TABLE 25 Global Natural Market by Region, 2019 - 2022, Tonnes

- TABLE 26 Global Natural Market by Region, 2023 - 2030, Tonnes

- TABLE 27 Global Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 28 Global Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 29 Global Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 30 Global Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 31 Global Dietary Supplements Market by Region, 2019 - 2022, USD Thousands

- TABLE 32 Global Dietary Supplements Market by Region, 2023 - 2030, USD Thousands

- TABLE 33 Global Dietary Supplements Market by Region, 2019 - 2022, Tonnes

- TABLE 34 Global Dietary Supplements Market by Region, 2023 - 2030, Tonnes

- TABLE 35 Global Beverages Market by Region, 2019 - 2022, USD Thousands

- TABLE 36 Global Beverages Market by Region, 2023 - 2030, USD Thousands

- TABLE 37 Global Beverages Market by Region, 2019 - 2022, Tonnes

- TABLE 38 Global Beverages Market by Region, 2023 - 2030, Tonnes

- TABLE 39 Global Food Market by Region, 2019 - 2022, USD Thousands

- TABLE 40 Global Food Market by Region, 2023 - 2030, USD Thousands

- TABLE 41 Global Food Market by Region, 2019 - 2022, Tonnes

- TABLE 42 Global Food Market by Region, 2023 - 2030, Tonnes

- TABLE 43 Global Animal Feed Market by Region, 2019 - 2022, USD Thousands

- TABLE 44 Global Animal Feed Market by Region, 2023 - 2030, USD Thousands

- TABLE 45 Global Animal Feed Market by Region, 2019 - 2022, Tonnes

- TABLE 46 Global Animal Feed Market by Region, 2023 - 2030, Tonnes

- TABLE 47 Global Others Market by Region, 2019 - 2022, USD Thousands

- TABLE 48 Global Others Market by Region, 2023 - 2030, USD Thousands

- TABLE 49 Global Others Market by Region, 2019 - 2022, Tonnes

- TABLE 50 Global Others Market by Region, 2023 - 2030, Tonnes

- TABLE 51 Global Lutein Market by Region, 2019 - 2022, USD Thousands

- TABLE 52 Global Lutein Market by Region, 2023 - 2030, USD Thousands

- TABLE 53 Global Lutein Market by Region, 2019 - 2022, Tonnes

- TABLE 54 Global Lutein Market by Region, 2023 - 2030, Tonnes

- TABLE 55 North America Lutein Market, 2019 - 2022, USD Thousands

- TABLE 56 North America Lutein Market, 2023 - 2030, USD Thousands

- TABLE 57 North America Lutein Market, 2019 - 2022, Tonnes

- TABLE 58 North America Lutein Market, 2023 - 2030, Tonnes

- TABLE 59 North America Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 60 North America Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 61 North America Powder & Crystalline Market by Country, 2019 - 2022, USD Thousands

- TABLE 62 North America Powder & Crystalline Market by Country, 2023 - 2030, USD Thousands

- TABLE 63 North America Beadlet Market by Country, 2019 - 2022, USD Thousands

- TABLE 64 North America Beadlet Market by Country, 2023 - 2030, USD Thousands

- TABLE 65 North America Emulsion Market by Country, 2019 - 2022, USD Thousands

- TABLE 66 North America Emulsion Market by Country, 2023 - 2030, USD Thousands

- TABLE 67 North America Oil Suspension Market by Country, 2019 - 2022, USD Thousands

- TABLE 68 North America Oil Suspension Market by Country, 2023 - 2030, USD Thousands

- TABLE 69 North America Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 70 North America Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 71 North America Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 72 North America Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 73 North America Synthetic Market by Country, 2019 - 2022, USD Thousands

- TABLE 74 North America Synthetic Market by Country, 2023 - 2030, USD Thousands

- TABLE 75 North America Synthetic Market by Country, 2019 - 2022, Tonnes

- TABLE 76 North America Synthetic Market by Country, 2023 - 2030, Tonnes

- TABLE 77 North America Natural Market by Country, 2019 - 2022, USD Thousands

- TABLE 78 North America Natural Market by Country, 2023 - 2030, USD Thousands

- TABLE 79 North America Natural Market by Country, 2019 - 2022, Tonnes

- TABLE 80 North America Natural Market by Country, 2023 - 2030, Tonnes

- TABLE 81 North America Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 82 North America Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 83 North America Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 84 North America Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 85 North America Dietary Supplements Market by Country, 2019 - 2022, USD Thousands

- TABLE 86 North America Dietary Supplements Market by Country, 2023 - 2030, USD Thousands

- TABLE 87 North America Dietary Supplements Market by Country, 2019 - 2022, Tonnes

- TABLE 88 North America Dietary Supplements Market by Country, 2023 - 2030, Tonnes

- TABLE 89 North America Beverages Market by Country, 2019 - 2022, USD Thousands

- TABLE 90 North America Beverages Market by Country, 2023 - 2030, USD Thousands

- TABLE 91 North America Beverages Market by Country, 2019 - 2022, Tonnes

- TABLE 92 North America Beverages Market by Country, 2023 - 2030, Tonnes

- TABLE 93 North America Food Market by Country, 2019 - 2022, USD Thousands

- TABLE 94 North America Food Market by Country, 2023 - 2030, USD Thousands

- TABLE 95 North America Food Market by Country, 2019 - 2022, Tonnes

- TABLE 96 North America Food Market by Country, 2023 - 2030, Tonnes

- TABLE 97 North America Animal Feed Market by Country, 2019 - 2022, USD Thousands

- TABLE 98 North America Animal Feed Market by Country, 2023 - 2030, USD Thousands

- TABLE 99 North America Animal Feed Market by Country, 2019 - 2022, Tonnes

- TABLE 100 North America Animal Feed Market by Country, 2023 - 2030, Tonnes

- TABLE 101 North America Others Market by Country, 2019 - 2022, USD Thousands

- TABLE 102 North America Others Market by Country, 2023 - 2030, USD Thousands

- TABLE 103 North America Others Market by Country, 2019 - 2022, Tonnes

- TABLE 104 North America Others Market by Country, 2023 - 2030, Tonnes

- TABLE 105 North America Lutein Market by Country, 2019 - 2022, USD Thousands

- TABLE 106 North America Lutein Market by Country, 2023 - 2030, USD Thousands

- TABLE 107 North America Lutein Market by Country, 2019 - 2022, Tonnes

- TABLE 108 North America Lutein Market by Country, 2023 - 2030, Tonnes

- TABLE 109 US Lutein Market, 2019 - 2022, USD Thousands

- TABLE 110 US Lutein Market, 2023 - 2030, USD Thousands

- TABLE 111 US Lutein Market, 2019 - 2022, Tonnes

- TABLE 112 US Lutein Market, 2023 - 2030, Tonnes

- TABLE 113 US Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 114 US Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 115 US Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 116 US Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 117 US Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 118 US Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 119 US Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 120 US Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 121 US Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 122 US Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 123 Canada Lutein Market, 2019 - 2022, USD Thousands

- TABLE 124 Canada Lutein Market, 2023 - 2030, USD Thousands

- TABLE 125 Canada Lutein Market, 2019 - 2022, Tonnes

- TABLE 126 Canada Lutein Market, 2023 - 2030, Tonnes

- TABLE 127 Canada Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 128 Canada Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 129 Canada Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 130 Canada Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 131 Canada Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 132 Canada Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 133 Canada Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 134 Canada Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 135 Canada Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 136 Canada Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 137 Mexico Lutein Market, 2019 - 2022, USD Thousands

- TABLE 138 Mexico Lutein Market, 2023 - 2030, USD Thousands

- TABLE 139 Mexico Lutein Market, 2019 - 2022, Tonnes

- TABLE 140 Mexico Lutein Market, 2023 - 2030, Tonnes

- TABLE 141 Mexico Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 142 Mexico Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 143 Mexico Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 144 Mexico Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 145 Mexico Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 146 Mexico Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 147 Mexico Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 148 Mexico Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 149 Mexico Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 150 Mexico Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 151 Rest of North America Lutein Market, 2019 - 2022, USD Thousands

- TABLE 152 Rest of North America Lutein Market, 2023 - 2030, USD Thousands

- TABLE 153 Rest of North America Lutein Market, 2019 - 2022, Tonnes

- TABLE 154 Rest of North America Lutein Market, 2023 - 2030, Tonnes

- TABLE 155 Rest of North America Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 156 Rest of North America Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 157 Rest of North America Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 158 Rest of North America Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 159 Rest of North America Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 160 Rest of North America Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 161 Rest of North America Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 162 Rest of North America Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 163 Rest of North America Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 164 Rest of North America Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 165 Europe Lutein Market, 2019 - 2022, USD Thousands

- TABLE 166 Europe Lutein Market, 2023 - 2030, USD Thousands

- TABLE 167 Europe Lutein Market, 2019 - 2022, Tonnes

- TABLE 168 Europe Lutein Market, 2023 - 2030, Tonnes

- TABLE 169 Europe Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 170 Europe Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 171 Europe Powder & Crystalline Market by Country, 2019 - 2022, USD Thousands

- TABLE 172 Europe Powder & Crystalline Market by Country, 2023 - 2030, USD Thousands

- TABLE 173 Europe Beadlet Market by Country, 2019 - 2022, USD Thousands

- TABLE 174 Europe Beadlet Market by Country, 2023 - 2030, USD Thousands

- TABLE 175 Europe Emulsion Market by Country, 2019 - 2022, USD Thousands

- TABLE 176 Europe Emulsion Market by Country, 2023 - 2030, USD Thousands

- TABLE 177 Europe Oil Suspension Market by Country, 2019 - 2022, USD Thousands

- TABLE 178 Europe Oil Suspension Market by Country, 2023 - 2030, USD Thousands

- TABLE 179 Europe Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 180 Europe Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 181 Europe Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 182 Europe Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 183 Europe Synthetic Market by Country, 2019 - 2022, USD Thousands

- TABLE 184 Europe Synthetic Market by Country, 2023 - 2030, USD Thousands

- TABLE 185 Europe Synthetic Market by Country, 2019 - 2022, Tonnes

- TABLE 186 Europe Synthetic Market by Country, 2023 - 2030, Tonnes

- TABLE 187 Europe Natural Market by Country, 2019 - 2022, USD Thousands

- TABLE 188 Europe Natural Market by Country, 2023 - 2030, USD Thousands

- TABLE 189 Europe Natural Market by Country, 2019 - 2022, Tonnes

- TABLE 190 Europe Natural Market by Country, 2023 - 2030, Tonnes

- TABLE 191 Europe Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 192 Europe Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 193 Europe Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 194 Europe Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 195 Europe Dietary Supplements Market by Country, 2019 - 2022, USD Thousands

- TABLE 196 Europe Dietary Supplements Market by Country, 2023 - 2030, USD Thousands

- TABLE 197 Europe Dietary Supplements Market by Country, 2019 - 2022, Tonnes

- TABLE 198 Europe Dietary Supplements Market by Country, 2023 - 2030, Tonnes

- TABLE 199 Europe Beverages Market by Country, 2019 - 2022, USD Thousands

- TABLE 200 Europe Beverages Market by Country, 2023 - 2030, USD Thousands

- TABLE 201 Europe Beverages Market by Country, 2019 - 2022, Tonnes

- TABLE 202 Europe Beverages Market by Country, 2023 - 2030, Tonnes

- TABLE 203 Europe Food Market by Country, 2019 - 2022, USD Thousands

- TABLE 204 Europe Food Market by Country, 2023 - 2030, USD Thousands

- TABLE 205 Europe Food Market by Country, 2019 - 2022, Tonnes

- TABLE 206 Europe Food Market by Country, 2023 - 2030, Tonnes

- TABLE 207 Europe Animal Feed Market by Country, 2019 - 2022, USD Thousands

- TABLE 208 Europe Animal Feed Market by Country, 2023 - 2030, USD Thousands

- TABLE 209 Europe Animal Feed Market by Country, 2019 - 2022, Tonnes

- TABLE 210 Europe Animal Feed Market by Country, 2023 - 2030, Tonnes

- TABLE 211 Europe Others Market by Country, 2019 - 2022, USD Thousands

- TABLE 212 Europe Others Market by Country, 2023 - 2030, USD Thousands

- TABLE 213 Europe Others Market by Country, 2019 - 2022, Tonnes

- TABLE 214 Europe Others Market by Country, 2023 - 2030, Tonnes

- TABLE 215 Europe Lutein Market by Country, 2019 - 2022, USD Thousands

- TABLE 216 Europe Lutein Market by Country, 2023 - 2030, USD Thousands

- TABLE 217 Europe Lutein Market by Country, 2019 - 2022, Tonnes

- TABLE 218 Europe Lutein Market by Country, 2023 - 2030, Tonnes

- TABLE 219 Germany Lutein Market, 2019 - 2022, USD Thousands

- TABLE 220 Germany Lutein Market, 2023 - 2030, USD Thousands

- TABLE 221 Germany Lutein Market, 2019 - 2022, Tonnes

- TABLE 222 Germany Lutein Market, 2023 - 2030, Tonnes

- TABLE 223 Germany Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 224 Germany Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 225 Germany Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 226 Germany Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 227 Germany Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 228 Germany Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 229 Germany Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 230 Germany Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 231 Germany Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 232 Germany Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 233 UK Lutein Market, 2019 - 2022, USD Thousands

- TABLE 234 UK Lutein Market, 2023 - 2030, USD Thousands

- TABLE 235 UK Lutein Market, 2019 - 2022, Tonnes

- TABLE 236 UK Lutein Market, 2023 - 2030, Tonnes

- TABLE 237 UK Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 238 UK Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 239 UK Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 240 UK Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 241 UK Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 242 UK Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 243 UK Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 244 UK Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 245 UK Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 246 UK Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 247 France Lutein Market, 2019 - 2022, USD Thousands

- TABLE 248 France Lutein Market, 2023 - 2030, USD Thousands

- TABLE 249 France Lutein Market, 2019 - 2022, Tonnes

- TABLE 250 France Lutein Market, 2023 - 2030, Tonnes

- TABLE 251 France Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 252 France Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 253 France Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 254 France Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 255 France Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 256 France Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 257 France Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 258 France Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 259 France Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 260 France Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 261 Russia Lutein Market, 2019 - 2022, USD Thousands

- TABLE 262 Russia Lutein Market, 2023 - 2030, USD Thousands

- TABLE 263 Russia Lutein Market, 2019 - 2022, Tonnes

- TABLE 264 Russia Lutein Market, 2023 - 2030, Tonnes

- TABLE 265 Russia Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 266 Russia Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 267 Russia Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 268 Russia Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 269 Russia Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 270 Russia Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 271 Russia Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 272 Russia Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 273 Russia Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 274 Russia Lutein Market by Application, 2023 - 2030, Tonnes

- TABLE 275 Spain Lutein Market, 2019 - 2022, USD Thousands

- TABLE 276 Spain Lutein Market, 2023 - 2030, USD Thousands

- TABLE 277 Spain Lutein Market, 2019 - 2022, Tonnes

- TABLE 278 Spain Lutein Market, 2023 - 2030, Tonnes

- TABLE 279 Spain Lutein Market by Form, 2019 - 2022, USD Thousands

- TABLE 280 Spain Lutein Market by Form, 2023 - 2030, USD Thousands

- TABLE 281 Spain Lutein Market by Source, 2019 - 2022, USD Thousands

- TABLE 282 Spain Lutein Market by Source, 2023 - 2030, USD Thousands

- TABLE 283 Spain Lutein Market by Source, 2019 - 2022, Tonnes

- TABLE 284 Spain Lutein Market by Source, 2023 - 2030, Tonnes

- TABLE 285 Spain Lutein Market by Application, 2019 - 2022, USD Thousands

- TABLE 286 Spain Lutein Market by Application, 2023 - 2030, USD Thousands

- TABLE 287 Spain Lutein Market by Application, 2019 - 2022, Tonnes

- TABLE 288 Spain Lutein Market by Application, 2023 - 2030, Tonnes

The Global Lutein Market size is expected to reach $531.6 million by 2030, rising at a market growth of 6.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 3,985.2 tonnes, experiencing a growth of 3.2% (2019-2022).

The increasing demand for lutein as a health supplement and its use as a natural colorant in food products. Therefore, Food Segment acquired $59.2 million in the market in 2022. The market is being driven by increased expenditure on superior lutein products due to rising consumer awareness of the advantages of consuming it and a rise in the proportion of health-conscious consumers. It protects both the skin's suppleness & moisture content. It has anti-inflammatory properties and is primarily found in plants & vegetables with green, leafy foliage. The rise in its demand can be related to the rise in health issues brought on by poor diet and people's contemporary lifestyles. Some factors impacting the market are increased traction on medical applications of lutein, growing ageing population, and adverse effects of high lutein dosage.

Animal feed, medicines, human food, cosmetics, and dietary supplements are just a few industries where lutein is used. Many people still lack an abundance of knowledge about the medical uses of lutein. Pharmaceutical companies have an opportunity to create goods that satisfy this need by targeting cognitive health with lutein-based supplements and formulations. As a result, it has a lot of potential in the pharmaceutical sector. The market will grow as people become more aware of its potential medical uses. A rise in the number of elderly persons globally is expected to boost demand for dietary supplements based on lutein during the projected period. As people age, illnesses and ailments like joint pain, poor vision, and bone brittleness become more prevalent. By 2050, the world's population of people aged 60 years and older will double (2.1 billion). As a result, the senior population segment is growing, which will increase the demand for dietary supplements based on lutein from this group of people. This will fuel the worldwide market's expansion throughout the forecast period.

However, according to the publication "Oxidants and Antioxidants in Medical Science, 2022," which focuses on the function of antioxidants in healthcare, the possible hazards and side effects of its supplementation are highlighted, especially for people with specific health issues or individuals consuming medications. Customers hesitant to buy lutein supplements may be persuaded to look for lutein in natural food sources instead due to a lack of faith in the supplements' quality. As a result, the market is expected to increase slowly throughout the forecast period.

Form Outlook

Based on form, the market is fragmented into powder & crystalline, oil suspension, beadlet, and emulsion. In 2022, the powder & crystalline segment witnessed the largest revenue share in the market. Compared to other forms, lutein in powder and crystals is comparatively simple to produce. It is easily combined and capsuled, making for simple production procedures. Due to lower manufacturing complexity and expenses, its simplicity in formulation may help explain its higher demand. Lutein can be used in various ways because of its crystalline and powder forms, which are easily combined. Due to its versatility, it is ideally suited for a wide variety of goods, such as beverages, functional meals, and nutritional supplements.

Source Outlook

By source, the market is segmented into natural and synthetic. The natural segment acquired a substantial revenue share in the market in 2022. Natural lutein derived from plants such as marigold flowers can be seen as a more appealing alternative to natural and plant-based supplements. Customers want ingredient clarity as their preference for clean-label products rises. Natural lutein may meet this demand, which can be advertised as a healthy substance that hasn't undergone any chemical alterations.

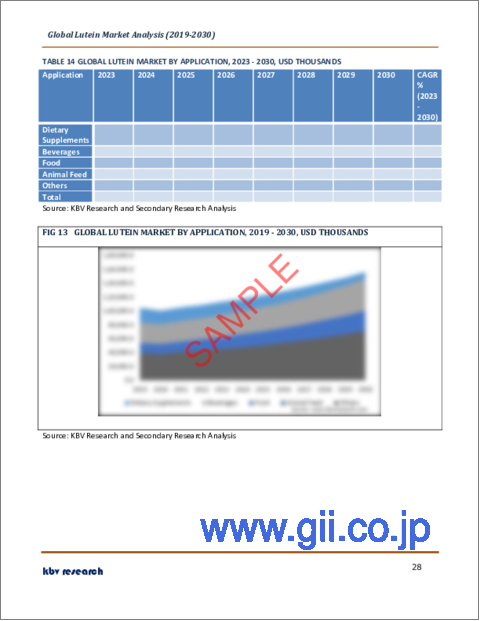

Application Outlook

On the basis of application, the market is classified into food, beverages, dietary supplements, animal feed, and other applications. In 2022, the dietary supplements segment held the highest revenue share in the market. Over the next few years, consumer demand for nutritional supplements will skyrocket. Fruits & vegetables are colored yellow by the antioxidant carotenoid lutein, making it a part of the market for carotenoids. A healthy diet may influence good vision. Poor nutrition could worsen eyesight as people age. Dietary supplements containing essential minerals, vitamins, and fatty acids help people stay healthy and avoid dangerous diseases. Due to these advantages, lutein use as a dietary supplement is increasing, fueling the market's growth.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the largest revenue share. The Asia Pacific, notably nations like China and India, has a significant agricultural sector and climatic conditions for growing lutein-rich sources such as marigold flowers. As a result, lutein can be supplied consistently, sustaining Asia Pacific's status as a significant producer and supplying a trustworthy source for the substance. Significant investments have been made in Asia Pacific's dietary supplement and nutraceutical businesses. Vendors in the region are aggressively concentrating on product innovation, R&D, and marketing to satisfy the growing demand for lutein along with related products.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include BASF SE, Kemin Industries, Inc., E.I.D. Parry Limited (Murugappa Group), Merck KGaA, Piveg, Inc., Synthite Industries Pvt. Ltd., Dohler GmbH, Sabinsa Corporation (Sami-Sabinsa Group Ltd.), Fenchem Biotek Ltd., and India Glycols Limited

Scope of the Study

Market Segments covered in the Report:

By Form

- Powder & Crystalline

- Beadlet

- Emulsion

- Oil Suspension

By Source (Volume, Tonnes, USD Thousand, 2019-2030)

- Synthetic

- Natural

By Application (Volume, Tonnes, USD Thousand, 2019-2030)

- Dietary Supplements

- Beverages

- Food

- Animal Feed

- Others

By Geography (Volume, Tonnes, USD Thousand, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- BASF SE

- Kemin Industries, Inc.

- E.I.D. Parry Limited (Murugappa Group)

- Merck KGaA

- Piveg, Inc.

- Synthite Industries Pvt. Ltd.

- Dohler GmbH

- Sabinsa Corporation (Sami-Sabinsa Group Ltd.)

- Fenchem Biotek Ltd.

- India Glycols Limited

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Lutein Market, by Form

- 1.4.2 Global Lutein Market, by Source

- 1.4.3 Global Lutein Market, by Application

- 1.4.4 Global Lutein Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market At a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.3 Porter's Five Forces Analysis

Chapter 4. Global Lutein Market by Form

- 4.1 Global Powder & Crystalline Market by Region

- 4.2 Global Beadlet Market by Region

- 4.3 Global Emulsion Market by Region

- 4.4 Global Oil Suspension Market by Region

Chapter 5. Global Lutein Market by Source

- 5.1 Global Synthetic Market by Region

- 5.2 Global Natural Market by Region

Chapter 6. Global Lutein Market by Application

- 6.1 Global Dietary Supplements Market by Region

- 6.2 Global Beverages Market by Region

- 6.3 Global Food Market by Region

- 6.4 Global Animal Feed Market by Region

- 6.5 Global Others Market by Region

Chapter 7. Global Lutein Market by Region

- 7.1 North America Lutein Market

- 7.1.1 North America Lutein Market by Form

- 7.1.1.1 North America Powder & Crystalline Market by Country

- 7.1.1.2 North America Beadlet Market by Country

- 7.1.1.3 North America Emulsion Market by Country

- 7.1.1.4 North America Oil Suspension Market by Country

- 7.1.2 North America Lutein Market by Source

- 7.1.2.1 North America Synthetic Market by Country

- 7.1.2.2 North America Natural Market by Country

- 7.1.3 North America Lutein Market by Application

- 7.1.3.1 North America Dietary Supplements Market by Country

- 7.1.3.2 North America Beverages Market by Country

- 7.1.3.3 North America Food Market by Country

- 7.1.3.4 North America Animal Feed Market by Country

- 7.1.3.5 North America Others Market by Country

- 7.1.4 North America Lutein Market by Country

- 7.1.4.1 US Lutein Market

- 7.1.4.1.1 US Lutein Market by Form

- 7.1.4.1.2 US Lutein Market by Source

- 7.1.4.1.3 US Lutein Market by Application

- 7.1.4.2 Canada Lutein Market

- 7.1.4.2.1 Canada Lutein Market by Form

- 7.1.4.2.2 Canada Lutein Market by Source

- 7.1.4.2.3 Canada Lutein Market by Application

- 7.1.4.3 Mexico Lutein Market

- 7.1.4.3.1 Mexico Lutein Market by Form

- 7.1.4.3.2 Mexico Lutein Market by Source

- 7.1.4.3.3 Mexico Lutein Market by Application

- 7.1.4.4 Rest of North America Lutein Market

- 7.1.4.4.1 Rest of North America Lutein Market by Form

- 7.1.4.4.2 Rest of North America Lutein Market by Source

- 7.1.4.4.3 Rest of North America Lutein Market by Application

- 7.1.4.1 US Lutein Market

- 7.1.1 North America Lutein Market by Form

- 7.2 Europe Lutein Market

- 7.2.1 Europe Lutein Market by Form

- 7.2.1.1 Europe Powder & Crystalline Market by Country

- 7.2.1.2 Europe Beadlet Market by Country

- 7.2.1.3 Europe Emulsion Market by Country

- 7.2.1.4 Europe Oil Suspension Market by Country

- 7.2.2 Europe Lutein Market by Source

- 7.2.2.1 Europe Synthetic Market by Country

- 7.2.2.2 Europe Natural Market by Country

- 7.2.3 Europe Lutein Market by Application

- 7.2.3.1 Europe Dietary Supplements Market by Country

- 7.2.3.2 Europe Beverages Market by Country

- 7.2.3.3 Europe Food Market by Country

- 7.2.3.4 Europe Animal Feed Market by Country

- 7.2.3.5 Europe Others Market by Country

- 7.2.4 Europe Lutein Market by Country

- 7.2.4.1 Germany Lutein Market

- 7.2.4.1.1 Germany Lutein Market by Form

- 7.2.4.1.2 Germany Lutein Market by Source

- 7.2.4.1.3 Germany Lutein Market by Application

- 7.2.4.2 UK Lutein Market

- 7.2.4.2.1 UK Lutein Market by Form

- 7.2.4.2.2 UK Lutein Market by Source

- 7.2.4.2.3 UK Lutein Market by Application

- 7.2.4.3 France Lutein Market

- 7.2.4.3.1 France Lutein Market by Form

- 7.2.4.3.2 France Lutein Market by Source

- 7.2.4.3.3 France Lutein Market by Application

- 7.2.4.4 Russia Lutein Market

- 7.2.4.4.1 Russia Lutein Market by Form

- 7.2.4.4.2 Russia Lutein Market by Source

- 7.2.4.4.3 Russia Lutein Market by Application

- 7.2.4.5 Spain Lutein Market

- 7.2.4.5.1 Spain Lutein Market by Form

- 7.2.4.5.2 Spain Lutein Market by Source

- 7.2.4.5.3 Spain Lutein Market by Application

- 7.2.4.6 Italy Lutein Market

- 7.2.4.6.1 Italy Lutein Market by Form

- 7.2.4.6.2 Italy Lutein Market by Source

- 7.2.4.6.3 Italy Lutein Market by Application

- 7.2.4.7 Rest of Europe Lutein Market

- 7.2.4.7.1 Rest of Europe Lutein Market by Form

- 7.2.4.7.2 Rest of Europe Lutein Market by Source

- 7.2.4.7.3 Rest of Europe Lutein Market by Application

- 7.2.4.1 Germany Lutein Market

- 7.2.1 Europe Lutein Market by Form

- 7.3 Asia Pacific Lutein Market

- 7.3.1 Asia Pacific Lutein Market by Form

- 7.3.1.1 Asia Pacific Powder & Crystalline Market by Country

- 7.3.1.2 Asia Pacific Beadlet Market by Country

- 7.3.1.3 Asia Pacific Emulsion Market by Country

- 7.3.1.4 Asia Pacific Oil Suspension Market by Country

- 7.3.2 Asia Pacific Lutein Market by Source

- 7.3.2.1 Asia Pacific Synthetic Market by Country

- 7.3.2.2 Asia Pacific Natural Market by Country

- 7.3.3 Asia Pacific Lutein Market by Application

- 7.3.3.1 Asia Pacific Dietary Supplements Market by Country

- 7.3.3.2 Asia Pacific Beverages Market by Country

- 7.3.3.3 Asia Pacific Food Market by Country

- 7.3.3.4 Asia Pacific Animal Feed Market by Country

- 7.3.3.5 Asia Pacific Others Market by Country

- 7.3.4 Asia Pacific Lutein Market by Country

- 7.3.4.1 China Lutein Market

- 7.3.4.1.1 China Lutein Market by Form

- 7.3.4.1.2 China Lutein Market by Source

- 7.3.4.1.3 China Lutein Market by Application

- 7.3.4.2 Japan Lutein Market

- 7.3.4.2.1 Japan Lutein Market by Form

- 7.3.4.2.2 Japan Lutein Market by Source

- 7.3.4.2.3 Japan Lutein Market by Application

- 7.3.4.3 India Lutein Market

- 7.3.4.3.1 India Lutein Market by Form

- 7.3.4.3.2 India Lutein Market by Source

- 7.3.4.3.3 India Lutein Market by Application

- 7.3.4.4 South Korea Lutein Market

- 7.3.4.4.1 South Korea Lutein Market by Form

- 7.3.4.4.2 South Korea Lutein Market by Source

- 7.3.4.4.3 South Korea Lutein Market by Application

- 7.3.4.5 Singapore Lutein Market

- 7.3.4.5.1 Singapore Lutein Market by Form

- 7.3.4.5.2 Singapore Lutein Market by Source

- 7.3.4.5.3 Singapore Lutein Market by Application

- 7.3.4.6 Malaysia Lutein Market

- 7.3.4.6.1 Malaysia Lutein Market by Form

- 7.3.4.6.2 Malaysia Lutein Market by Source

- 7.3.4.6.3 Malaysia Lutein Market by Application

- 7.3.4.7 Rest of Asia Pacific Lutein Market

- 7.3.4.7.1 Rest of Asia Pacific Lutein Market by Form

- 7.3.4.7.2 Rest of Asia Pacific Lutein Market by Source

- 7.3.4.7.3 Rest of Asia Pacific Lutein Market by Application

- 7.3.4.1 China Lutein Market

- 7.3.1 Asia Pacific Lutein Market by Form

- 7.4 LAMEA Lutein Market

- 7.4.1 LAMEA Lutein Market by Form

- 7.4.1.1 LAMEA Powder & Crystalline Market by Country

- 7.4.1.2 LAMEA Beadlet Market by Country

- 7.4.1.3 LAMEA Emulsion Market by Country

- 7.4.1.4 LAMEA Oil Suspension Market by Country

- 7.4.2 LAMEA Lutein Market by Source

- 7.4.2.1 LAMEA Synthetic Market by Country

- 7.4.2.2 LAMEA Natural Market by Country

- 7.4.3 LAMEA Lutein Market by Application

- 7.4.3.1 LAMEA Dietary Supplements Market by Country

- 7.4.3.2 LAMEA Beverages Market by Country

- 7.4.3.3 LAMEA Food Market by Country

- 7.4.3.4 LAMEA Animal Feed Market by Country

- 7.4.3.5 LAMEA Others Market by Country

- 7.4.4 LAMEA Lutein Market by Country

- 7.4.4.1 Brazil Lutein Market

- 7.4.4.1.1 Brazil Lutein Market by Form

- 7.4.4.1.2 Brazil Lutein Market by Source

- 7.4.4.1.3 Brazil Lutein Market by Application

- 7.4.4.2 Argentina Lutein Market

- 7.4.4.2.1 Argentina Lutein Market by Form

- 7.4.4.2.2 Argentina Lutein Market by Source

- 7.4.4.2.3 Argentina Lutein Market by Application

- 7.4.4.3 UAE Lutein Market

- 7.4.4.3.1 UAE Lutein Market by Form

- 7.4.4.3.2 UAE Lutein Market by Source

- 7.4.4.3.3 UAE Lutein Market by Application

- 7.4.4.4 Saudi Arabia Lutein Market

- 7.4.4.4.1 Saudi Arabia Lutein Market by Form

- 7.4.4.4.2 Saudi Arabia Lutein Market by Source

- 7.4.4.4.3 Saudi Arabia Lutein Market by Application

- 7.4.4.5 South Africa Lutein Market

- 7.4.4.5.1 South Africa Lutein Market by Form

- 7.4.4.5.2 South Africa Lutein Market by Source

- 7.4.4.5.3 South Africa Lutein Market by Application

- 7.4.4.6 Nigeria Lutein Market

- 7.4.4.6.1 Nigeria Lutein Market by Form

- 7.4.4.6.2 Nigeria Lutein Market by Source

- 7.4.4.6.3 Nigeria Lutein Market by Application

- 7.4.4.7 Rest of LAMEA Lutein Market

- 7.4.4.7.1 Rest of LAMEA Lutein Market by Form

- 7.4.4.7.2 Rest of LAMEA Lutein Market by Source

- 7.4.4.7.3 Rest of LAMEA Lutein Market by Application

- 7.4.4.1 Brazil Lutein Market

- 7.4.1 LAMEA Lutein Market by Form

Chapter 8. Company Profiles

- 8.1 BASF SE

- 8.1.1 Company Overview

- 8.1.2 Financial Analysis

- 8.1.3 Segmental and Regional Analysis

- 8.1.4 Research & Development Expense

- 8.1.5 Recent strategies and developments:

- 8.1.5.1 Acquisition and Mergers:

- 8.1.5.2 Expansions:

- 8.1.6 SWOT Analysis

- 8.2 Kemin Industries, Inc.

- 8.2.1 Company Overview

- 8.2.2 SWOT Analysis

- 8.3 E.I.D. Parry Limited (Murugappa Group)

- 8.3.1 Company Overview

- 8.3.2 Financial Analysis

- 8.3.3 Segmental and Regional Analysis

- 8.3.4 Research & Development Expenses

- 8.3.5 SWOT Analysis

- 8.4 Merck KGaA

- 8.4.1 Company Overview

- 8.4.2 Financial Analysis

- 8.4.3 Segmental and Regional Analysis

- 8.4.4 Research & Development Expense

- 8.4.5 SWOT Analysis

- 8.5 Piveg, Inc.

- 8.5.1 Company Overview

- 8.5.2 SWOT Analysis

- 8.6 Synthite Industries Pvt. Ltd.

- 8.6.1 Company Overview

- 8.6.2 SWOT Analysis

- 8.7 Dohler GmbH

- 8.7.1 Company Overview

- 8.7.2 SWOT Analysis

- 8.8 Sabinsa Corporation (Sami-Sabinsa Group Ltd.)

- 8.8.1 Company Overview

- 8.8.2 SWOT Analysis

- 8.9 Fenchem Biotek Ltd.

- 8.9.1 Company Overview

- 8.9.2 SWOT Analysis

- 8.10. India Glycols Limited

- 8.10.1 Company Overview

- 8.10.2 Financial Analysis

- 8.10.3 Segmental and Regional Analysis

- 8.10.4 Research & Development Expenses

- 8.10.5 SWOT Analysis