|

|

市場調査レポート

商品コード

1455786

ルテイン食品の世界市場:2024~2031年Global Lutein Food Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ルテイン食品の世界市場:2024~2031年 |

|

出版日: 2024年03月26日

発行: DataM Intelligence

ページ情報: 英文 219 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

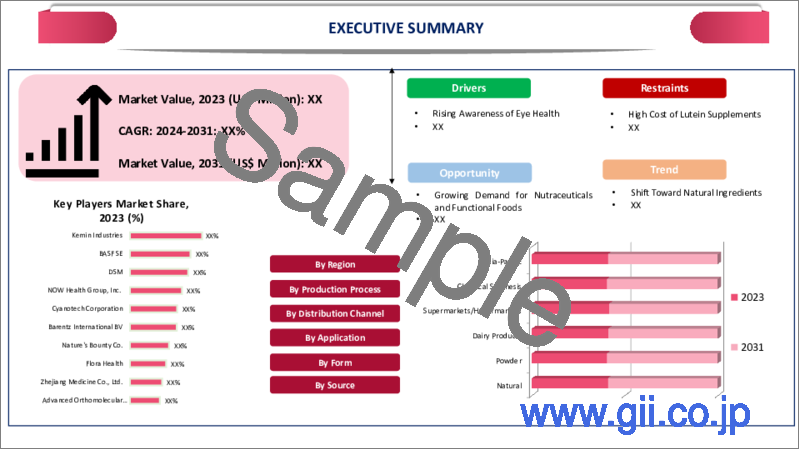

世界のルテイン食品の市場規模は、2023年に3億9,210万米ドルに達し、2024~2031年の予測期間中にCAGR 5.9%で成長し、2031年には6億2,020万米ドルに達すると予測されています。

ルテイン食品市場は、自然界に存在する抗酸化物質のカロテノイドであるルテインを強化した商品に特化した、より大きな機能性食品・栄養補助食品産業の一部門です。ルテインは、ケール、ブロッコリー、ホウレンソウ、その他の果物や野菜に豊富に含まれており、目の健康、特に白内障や加齢黄斑変性症(AMD)の発症率を低下させる効果があることが広く知られています。

ルテイン食品市場を推進している主な要因の一つは、消費者の予防ヘルスケアと目の健康に対する意識の高まりです。人口の高齢化と目に関連する病気の有病率の上昇に伴い、目の健康を維持し、加齢に伴う視力の低下を防ぐための食事対策に関心を持つ人が増えています。ルテインを多く含む食品やサプリメントを摂取することで、この重要なミネラルを日常の食生活に簡単かつ上手に取り入れることができます。

天然ルテイン食品は市場シェアの3分の1以上を占めています。同様に、アジア太平洋がルテイン食品市場を独占し、1/3以上の最大市場シェアを獲得しています。健康的な老化を支援し、栄養不足を治療する政策が、ルテイン高含有食品市場を改善しています。主要企業は、バングラデシュ、インド、インドネシア、パキスタン、フィリピンの命を救い、改善するために、アジアの栄養不良と戦うために政府と協力しており、この地域の市場を牽引しています。

ダイナミクス

機能性食品・栄養補助食品に対する需要の高まり

ルテイン食品産業は、機能性食品・栄養補助食品に対する需要の高まりにより拡大しています。消費者が健康志向を高め、天然成分を重視するようになるにつれて、さまざまな果物や野菜に含まれる天然由来のカロテノイドであるルテインを補った食品やサプリメントを求める傾向が顕著になっています。

例えば、2023年2月、英国のレーザー眼科治療専門会社Optimaxa.が発表したレポートによると、加齢黄斑変性症(AMD)は世界で1億9,600万人が罹患し、2040年には世界人口の8.7%を占める2億8,800万人に達すると予想されています。

目の健康と予防ヘルスケアの重要性が認識されるようになったことが、ルテインを豊富に含む食品やサプリメントの需要を高める主な要因のひとつとなっています。世界の人口が高齢化し、白内障や加齢黄斑変性症(AMD)のような加齢に伴う眼疾患が一般的になるにつれ、消費者は眼の健康を維持するための栄養学的アプローチにますます注目するようになっています。

眼疾患の発生率の増加

若年層における眼疾患の増加は、座りがちな生活、食生活の乱れ、長時間のスクリーン使用など、生活習慣に関連した危険因子の増加によるものです。Institute for Health Metricsの報告書によると、スクリーンの前で長時間過ごす人や、目を酷使する活動をする人が増えるにつれ、ブルーライト障害やデジタル眼精疲労を予防する食事法がますます普及しています。

2023年6月現在、世界中で5億人以上が糖尿病を患っており、2050年には2倍以上の13億人になると予測されています。これは6.1%の世界有病率で、あらゆる国のあらゆる年齢、性別の人々が罹患しています。最も高いのは北アフリカと中東の9.3%で、2050年には16.8%まで増加すると予測されています。

糖尿病のような慢性疾患の有病率が高まっているため、目の健康を管理・監視する必要性に対する意識が高まっています。糖尿病網膜症は、網膜の血管に影響を及ぼす糖尿病の一般的な結果であり、治療せずに放置しておくと失明や視力障害を引き起こす可能性があります。ルテインには抗炎症作用や抗酸化作用があるため、糖尿病網膜症の進行を予防したり遅らせたり、糖尿病患者の視機能を維持したりする意義があるのではないかと研究されています。

不十分な食事摂取と消費者の意識

単に食事から十分なルテインを摂取することが難しいことが、ルテイン食品分野の大きな障壁となっています。ほうれん草、ケール、ブロッコリーなどは、ルテインを自然に含む野菜や果物の一種であるが、これらの食品からのルテインの一日平均摂取量は、最適な目の健康のための推奨レベルを満たすには十分ではないかもしれないです。この制限は、白内障や加齢黄斑変性症(AMD)など、眼に関連する疾患の発症率が上昇していることを考慮すると、特に重要です。

さらに、消費者のルテイン摂取不足の原因は、食事習慣や生活習慣にあるかもしれないです。食事に果物や野菜が少なすぎるため、多くの人が理想的なルテインの摂取量より少なくなっています。さらに、ルテインは茹でたり炒めたりといった調理法で分解され、栄養素の生物学的利用能がさらに低下します。したがって、目の健康を最適に保ちたい人は、ルテインを食事から摂取するだけでは十分でない可能性があります。

目次

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 機能性食品・栄養補助食品に対する需要の高まり

- 眼疾患の発生率の増加

- 抑制要因

- 不十分な食事摂取と消費者の意識

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 由来別

- 天然

- 合成

第8章 形状別

- 粉末

- 液体

- スプレードライ

- その他

第9章 用途別

- 乳製品

- ベーカリー・スナック

- ベビーフード

- 栄養補助食品

- その他

第10章 流通チャネル別

- スーパーマーケット/ハイパーマーケット

- オンライン小売

- 専門店

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Kemin Industries

- BASF SE

- DSM

- Allied Biotech Corporation

- Cyanotech Corporation

- Chr. Hansen Holding A/S

- Nature's Bounty Co.

- Naturex S.A.

- Zhejiang Medicine Co., Ltd.

- Piveg Inc.

第14章 付録

Overview

Global Lutein Food Market reached US$ 392.1 million in 2023 and is expected to reach US$ 620.2 million by 2031, growing with a CAGR of 5.9% during the forecast period 2024-2031.

The lutein food market is a division of the larger functional food and nutritional supplement industry that specializes in goods fortified with the antioxidant carotenoid lutein, which occurs naturally. Lutein, which is abundant in kale, broccoli, spinach, and other fruits and vegetables, is widely known for its positive benefits on eye health, especially in lowering the incidence of cataracts and age-related macular degeneration (AMD).

One of the main factors propelling the lutein food market is consumers' growing awareness of preventative healthcare and eye health. A growing number of people are interested in dietary measures to maintain ocular health and prevent age-related vision deterioration as the population ages and the prevalence of illnesses related to the eyes rises. People can easily and successfully include this vital mineral in their everyday diet by consuming foods and supplements high in lutein.

The natural lutein food accounts for over one-third of the market share. Similarly, Asia-Pacific dominates the lutein food market, capturing the largest market share of over 1/3rd. Policies that support healthy aging and treat nutritional deficiencies have improved the market for foods high in lutein. Major players are working with governments to combat malnutrition in Asia to save and improve lives in Bangladesh, India, Indonesia, Pakistan, and the Philippines is driving the market in the region.

Dynamics

Rising Demand for Functional Foods and Nutraceuticals

The lutein food industry is expanding due in large part to the growing demand for functional foods and nutraceuticals. There has been a noticeable trend in consumers' diets to seek out foods and supplements supplemented with lutein, a naturally occurring carotenoid present in a variety of fruits and vegetables, as they become more health-conscious and value natural ingredients.

For instance, in February 2023, according to the reports shared by Optimaxa., a UK-based laser eye treatment specialist, age-related macular degeneration (AMD) affected 196 million individuals globally and is expected to reach 288 million in 2040, accounting for 8.7 percent of the world's population.

The increasing recognition of the significance of eye health and preventative healthcare is one of the main drivers of the demand for lutein-rich foods and supplements. As the world's population ages and age-related eye disorders like cataracts and age-related macular degeneration (AMD) become more common, consumers are looking more and more to nutritional approaches to maintain their ocular health.

Increasing Incidence of Eye Diseases

The growth in eye disorders among younger populations has been attributed to the rising incidence of lifestyle-related risk factors, such as sedentary lifestyles, poor diets, and prolonged screen time. Dietary methods to prevent blue light damage and digital eye strain are becoming increasingly popular as more individuals spend longer hours in front of screens and partake in According to the Institute for Health Metrics report, eye-straining activities.

As of June 2023, more than half a billion people worldwide have diabetes, which is projected to more than double to 1.3 billion by 2050. This is a 6.1% global prevalence rate that affects people of all ages and genders in every country. The highest rate is 9.3% in North Africa and the Middle East and is projected to increase to 16.8% by 2050.

There is more awareness of the need to manage and monitor eye health due to the increasing prevalence of chronic diseases like diabetes. If left untreated, diabetic retinopathy, a common consequence of diabetes that affects the blood vessels in the retina, can result in blindness and impaired vision. Lutein's possible significance in preventing or delaying the progression of diabetic retinopathy and maintaining visual function in diabetics has been investigated due to its anti-inflammatory and antioxidant qualities.

Insufficient Dietary Intake and Consumer Awareness

The difficulty of getting enough lutein from diet sources merely is a significant barrier to the lutein food sector. Although spinach, kale, and broccoli are among the fruits and vegetables that naturally contain lutein, the average daily intake of lutein from these foods may not be sufficient to satisfy the recommended levels for optimal eye health. This restriction is especially important in light of the rising incidence of eye-related diseases including cataracts and age-related macular degeneration (AMD).

Moreover, dietary practices and lifestyle elements may be responsible for consumers' inadequate lutein consumption. Too little fruit and vegetables in their diets cause many people to consume less lutein than is ideal. Furthermore, lutein degradation can result from cooking techniques like boiling or frying, which lowers the nutrient's bioavailability even more. Therefore, for people who want to maintain optimal eye health, depending just on dietary sources of lutein may not be sufficient.

Segment Analysis

The global lutein food market is segmented based on origin, form, application, distribution channel and region.

Surge in the Demand for Lutein Food in Nutritional Supplements

Many people suffer from symptoms of digital eye strain, such as irritation, dryness, and weariness, as a result of the extensive use of digital devices like computers, tablets, and smartphones. Concerns have also been expressed concerning the possible long-term impact of blue light. People who want to lessen the negative effects of extended screen time and shield their eyes from blue light are becoming more and more interested in lutein supplements. There is a growing need for lutein-containing supplements as knowledge of digital eye strain increases.

Lutein's prominence as a component in dietary supplements can be attributed to the large body of scientific evidence that supports its effectiveness in promoting eye health. The advantages of lutein supplementation in lowering the risk of AMD progression, enhancing visual acuity, and guarding against oxidative damage to the eyes have been shown in numerous clinical investigations. The reliability of lutein supplements is further reinforced by endorsements from eye care specialists and healthcare professionals.

In April 2022, Melts Eye Care, the world's first all-natural eye vitamin, was introduced by Wellbeing Nutrition. developed under their well-known worldwide trademark Melts, which delivers vitamins straight into the bloodstream using cutting-edge nanotechnology, increasing their bioavailability and bioactivity compared to conventional capsules and tablets.

Geographical Penetration

The Growing Aging Population and Heart Health Disorders in Asia-Pacific

The Asia-Pacific area has witnessed an increase in consumer awareness and consciousness regarding health. Concerns over aging populations and lifestyle-related health problems are leading to an increase in interest in preventive healthcare and dietary supplements as ways to promote general well-being. Due to its well-known advantages for eye health, lutein has become more popular among people who want to preserve their best eyesight and lower their chance of developing age-related eye conditions.

Changes in consumer tastes, coupled with fast urbanization and westernization of diets, have resulted in eating patterns throughout Asia-Pacific. Convenience and processed foods have supplanted traditional diets high in fruits and vegetables, potentially leading to nutritional deficiencies, such as a deficiency in lutein-rich meals.

According to the Healthline report of Asia 2022, one study associated lutein and zeaxanthin with improvements in clinical markers in patients with heart disease. Researchers believe the anti-inflammatory properties were beneficial and suggest continued research in this area. Another study found that daily supplementation of 20 mg of lutein for 3 months was associated with a decrease in cholesterol and triglyceride levels, both of which are known risk factors for heart disease.

COVID-19 Impact Analysis

The global market for lutein-containing foods has had mixed results from the COVID-19 pandemic. On the one hand, the pandemic's heightened emphasis on health and wellbeing has raised consumer demand for lutein-fortified functional foods and nutritional supplements. Customers now understand how critical it is to maintain their general health, including the health of their eyes, as well as their immune systems. Sales of lutein-containing products have increased as a result, especially in markets that focus on immune support and preventative healthcare.

However, producers and suppliers in the lutein food market have also faced difficulties because to supply chain disruptions, logistical issues, and economic uncertainty brought on by the pandemic. Price fluctuations for raw materials, declining consumer purchasing power, and changes in consumer behavior have all had an effect on the profitability and operational efficiency of companies operating in the market.

Russia-Ukraine War Impact Analysis

Geopolitical tensions and uncertainty brought about by the conflict between Russia and Ukraine may have an effect on the global market for lutein-containing foods. The main source of lutein utilized in food applications, marigold flowers high in lutein, are produced in large quantities in Ukraine. Any hiccups in Ukraine's marigold flower production, harvesting, or export capacities could result in a scarcity of the product and unstable prices on the lutein food market.

Furthermore, Russia plays a significant role in the agriculture industry. If the war worsens, it could have an influence on trade relations and agricultural exports from the region, which would further impair the raw material supply chain for lutein-rich products. In order to lessen the effects of the conflict between Russia and Ukraine on the lutein food market, players must keep a careful eye on geopolitical developments, diversify their sourcing methods, and implement contingency plans to ensure a stable and uninterrupted supply of lutein to meet global demand.

By Origin

- Natural

- Synthetic

By Form

- Powder

- Liquid

- Spray-Dried

- Others

By Application

- Dairy Products

- Bakery and Snacks

- Baby Food

- Nutritional Supplements

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail

- Specialty Stores

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In February 2023, Herbalife Nutrition India launched a new supplement to target the eye health market. Lutein and zeaxanthin are combined in the scientifically formulated supplement Ocular Defense. The international nutrition business Herbalife Nutrition India has expanded into the eye health market with its new product, "Ocular Defense," in keeping with its dedication to nutrition and well-being.

- In October 2023, ingredient supplier OmniActive launched the "Lutein for Every Age" initiative, which is a campaign to raise awareness of macular carotenoids' roles in children's eye and brain health, and address knowledge gaps in children's nutritional needs.

- In February 2021, Kemin Industries launched a new lutein ingredient called FloraGLO Lutein 20% FS Powder. This powder form of lutein is derived from marigold flowers and is specifically designed for use in functional foods and dietary supplements. It offers superior stability, bioavailability, and formulation flexibility, making it a preferred choice for food and nutrition manufacturers.

Competitive Landscape

The major global players in the market include Kemin Industries, BASF SE, DSM, Allied Biotech Corporation, Cyanotech Corporation, Chr. Hansen Holding A/S, Nature's Bounty Co., Naturex S.A., Zhejiang Medicine Co., Ltd., and Piveg, Inc.

Why Purchase the Report?

- To visualize the global lutein food market segmentation based on origin, form, application, distribution channel, and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Lutein Food market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

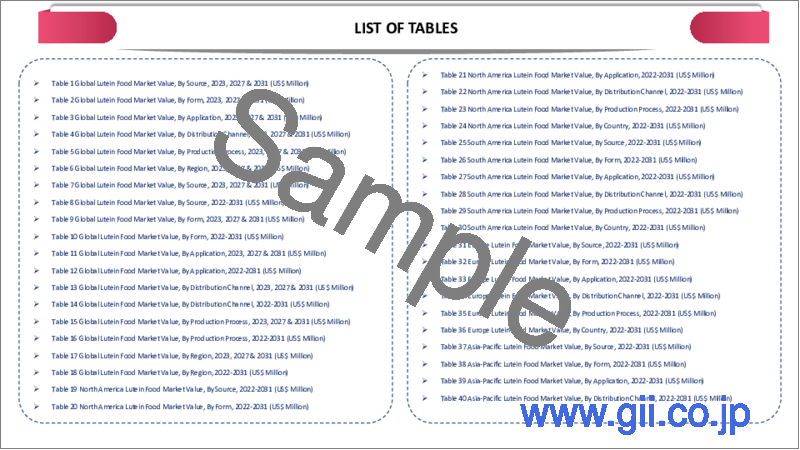

The global lutein food market report would provide approximately 70 tables, 65 figures and 219 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet By Origin

- 3.2.Snippet by Form

- 3.3.Snippet by Application

- 3.4.Snippet by Distribution Channel

- 3.5.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Rising Demand for Functional Foods and Nutraceuticals

- 4.1.1.2.Increasing Incidence of Eye Diseases

- 4.1.2.Restraints

- 4.1.2.1.Insufficient Dietary Intake and Consumer Awareness

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Origin

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Origin

- 7.1.2.Market Attractiveness Index, By Origin

- 7.2.Natural*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Synthetic

8.By Form

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2.Market Attractiveness Index, By Form

- 8.2.Powder*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Liquid

- 8.4.Spray-dried

- 8.5.Others

9.By Application

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2.Market Attractiveness Index, By Application

- 9.2.Dairy Products*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Bakery and Snacks

- 9.4.Baby Food

- 9.5.Nutritional Supplements

- 9.6.Others

10.By Distribution Channel

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.1.2.Market Attractiveness Index, By Distribution Channel

- 10.2.Supermarkets/Hypermarkets*

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Online Retail

- 10.4.Specialty Stores

- 10.5.Others

11.By Region

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2.Market Attractiveness Index, By Region

- 11.2.North America

- 11.2.1.Introduction

- 11.2.2.Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Origin

- 11.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.6.1.U.S.

- 11.2.6.2.Canada

- 11.2.6.3.Mexico

- 11.3.Europe

- 11.3.1.Introduction

- 11.3.2.Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Origin

- 11.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.6.1.Germany

- 11.3.6.2.UK

- 11.3.6.3.France

- 11.3.6.4.Italy

- 11.3.6.5.Spain

- 11.3.6.6.Rest of Europe

- 11.4.South America

- 11.4.1.Introduction

- 11.4.2.Key Region-Specific Dynamics

Market Size Analysis and Y-o-Y Growth Analysis (%), By Origin

- 11.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.6.1.Brazil

- 11.4.6.2.Argentina

- 11.4.6.3.Rest of South America

- 11.5.Asia-Pacific

- 11.5.1.Introduction

- 11.5.2.Key Region-Specific Dynamics

- 11.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Origin

- 11.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1.China

- 11.5.7.2.India

- 11.5.7.3.Japan

- 11.5.7.4.Australia

- 11.5.7.5.Rest of Asia-Pacific

- 11.6.Middle East and Africa

- 11.6.1.Introduction

- 11.6.2.Key Region-Specific Dynamics

- 11.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Origin

- 11.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

12.Competitive Landscape

- 12.1.Competitive Scenario

- 12.2.Market Positioning/Share Analysis

- 12.3.Mergers and Acquisitions Analysis

13.Company Profiles

- 13.1.Kemin Industries*

- 13.1.1.Company Overview

- 13.1.2.Product Portfolio and Description

- 13.1.3.Financial Overview

- 13.1.4.Key Developments

- 13.2.BASF SE

- 13.3.DSM

- 13.4.Allied Biotech Corporation

- 13.5.Cyanotech Corporation

- 13.6.Chr. Hansen Holding A/S

- 13.7.Nature's Bounty Co.

- 13.8.Naturex S.A.

- 13.9.Zhejiang Medicine Co., Ltd.

- 13.10.Piveg Inc.

LIST NOT EXHAUSTIVE

14.Appendix

- 14.1.About Us and Services

- 14.2.Contact Us