|

|

市場調査レポート

商品コード

1353319

ホットソースの世界市場規模、シェア、産業動向分析レポート:タイプ別、最終用途別、流通チャネル別、地域別展望と予測、2023年~2030年Global Hot Sauce Market Size, Share & Industry Trends Analysis Report By Type , By End-use, By Distribution Channel, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| ホットソースの世界市場規模、シェア、産業動向分析レポート:タイプ別、最終用途別、流通チャネル別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年08月31日

発行: KBV Research

ページ情報: 英文 378 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

ホットソース市場規模は、予測期間中にCAGR 6.6%で成長し、2030年には45億米ドルに達すると予測されます。2022年の市場規模は227.1キロトンに達し、6%の成長を遂げる(2019-2022年)。

しかし市場は、特にトマト、トウガラシ、唐辛子、ハラペーニョなどの原材料の価格変動によって大きな制約を受けています。COVID-19パンデミックの突然の世界的拡大は輸送システムの混乱を引き起こし、原材料価格に影響を与えました。予測不可能な作物の収穫高は、原料価格に影響を与え、それによって生産コストに影響を与え、消費者に価格上昇をもたらす可能性があります。こうした障害を軽減するために、メーカーは強靭なサプライチェーンを確立し、信頼できるサプライヤーとの関係を培い、代替調達戦略を検討しなければならないです。したがって、これらの原材料価格の変動は、今後数年間の市場の成長を阻害する可能性があります。

最終用途の展望

最終用途別に見ると、市場は商業用と住宅用に二分されます。2022年には、商業用セグメントが最大の収益シェアで市場を独占しました。市場開拓のチャンスは、研究開発イニシアティブ、継続的な製品イノベーション、製品の多様化から生まれると予想されます。主要メーカーは、消費者の嗜好を進化させるために、新しいフレーバー、加熱レベル、成分を導入しています。また、高品質の原料を使用して少量生産される職人的・工芸的なホットソースに対する消費者の需要の高まりにより、ニッチ市場セグメントも発展しています。市販業者は、より幅広い消費者にアピールするため、新しい最先端のホットソースの味、原料、パッケージデザインを導入することができます。

タイプ別展望

市場はタイプ別に、タバスコ・ペッパー・ソース、ハバネロ・ペッパー・ソース、ハラペーニョ・ソース、スイート&スパイシー・ソース、その他に分類されます。スイート&スパイシーソース分野は2022年の市場でかなりの収益シェアを占めました。そのおいしさとヘルシーさから、甘辛ソースの普及率は世界中で急上昇しています。さらに、甘辛ソースの選択肢の高級化、エスニック食品の受け入れ拡大、エキゾチックでスパイシーな風味を加えた斬新な調味料に対する消費者の関心の高まりはすべて、この市場セグメントに巨大な潜在機会をもたらすと予測されています。

流通チャネルの展望

市場は流通チャネル別に、量販店、専門店、コンビニエンスストア、オンラインショップ、その他に分類されます。2022年には、量販店セグメントが市場で最大の収益シェアを占める。大型小売店やスーパーストアなどの量販店には、ホットソースやその他の製品を流通チャネルを通じて販売するメリットがいくつかあります。量販店は、実店舗とオンライン・プラットフォームの広範なネットワークにより、大規模で多様な顧客層を惹きつけています。そのため、ホットソースブランドは幅広い潜在顧客に製品をアピールする機会を得ることができます。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、北米地域が最も高い収益シェアを獲得して市場をリードしました。北米における同地域の市場支配力は、同地域の消費者の高い消費力に起因しています。さらに、食品の風味の多様化が進んでいるため、チリソースがこの地域で縁辺のエスニック食品ではなく、キッチンの主食になる可能性があります。米国やカナダのような国々でのチリソースの幅広い人気は、製品の地域取引にプラスの影響を与えており、これは市場拡大のプラスの側面です。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

第4章 ホットソース市場における展開戦略

第5章 世界のホットソース市場:タイプ別

- 世界のタバスコペッパーソース市場:地域別

- 世界のハバネロペッパーソース市場:地域別

- 世界のハラペーニョソース市場:地域別

- 世界の甘辛ソース市場:地域別

- 世界のその他の市場:地域別

第6章 世界のホットソース市場:最終用途別

- 世界の商業市場:地域別

- 世界の住宅市場:地域別

第7章 世界のホットソース市場:流通チャネル別

- 世界の量販店市場:地域別

- 世界の専門小売業者市場:地域別

- 世界のコンビニエンスストア市場:地域別

- 世界のオンライン小売市場:地域別

- 世界のその他の市場:地域別

第8章 世界のホットソース市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第9章 企業プロファイル

- McIlhenny Company

- Summit hill Foods

- Hormel Foods Corporation

- Baumer Foods, Inc

- The Kraft Heinz Company

- McCormick & Company, Inc

- Campbell Soup Company

- Unilever PLC

- Conagra Brands, Inc

- TW GARNER FOOD COMPANY

第10章 ホットソース市場の勝利は必須

LIST OF TABLES

- TABLE 1 Global Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 2 Global Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 3 Global Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 4 Global Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 5 Global Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 6 Global Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 7 Global Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 8 Global Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 9 Global Tabasco Pepper Sauce Market by Region, 2019 - 2022, USD Million

- TABLE 10 Global Tabasco Pepper Sauce Market by Region, 2023 - 2030, USD Million

- TABLE 11 Global Tabasco Pepper Sauce Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 12 Global Tabasco Pepper Sauce Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 13 Global Habanero Pepper Sauce Market by Region, 2019 - 2022, USD Million

- TABLE 14 Global Habanero Pepper Sauce Market by Region, 2023 - 2030, USD Million

- TABLE 15 Global Habanero Pepper Sauce Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 16 Global Habanero Pepper Sauce Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 17 Global Jalapeno Sauce Market by Region, 2019 - 2022, USD Million

- TABLE 18 Global Jalapeno Sauce Market by Region, 2023 - 2030, USD Million

- TABLE 19 Global Jalapeno Sauce Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 20 Global Jalapeno Sauce Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 21 Global Sweet & Spicy Sauce Market by Region, 2019 - 2022, USD Million

- TABLE 22 Global Sweet & Spicy Sauce Market by Region, 2023 - 2030, USD Million

- TABLE 23 Global Sweet & Spicy Sauce Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 24 Global Sweet & Spicy Sauce Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 25 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 27 Global Others Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 28 Global Others Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 29 Global Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 30 Global Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 31 Global Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 32 Global Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 33 Global Commercial Market by Region, 2019 - 2022, USD Million

- TABLE 34 Global Commercial Market by Region, 2023 - 2030, USD Million

- TABLE 35 Global Commercial Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 36 Global Commercial Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 37 Global Residential Market by Region, 2019 - 2022, USD Million

- TABLE 38 Global Residential Market by Region, 2023 - 2030, USD Million

- TABLE 39 Global Residential Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 40 Global Residential Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 41 Global Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 42 Global Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 43 Global Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 44 Global Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 45 Global Mass Merchandisers Market by Region, 2019 - 2022, USD Million

- TABLE 46 Global Mass Merchandisers Market by Region, 2023 - 2030, USD Million

- TABLE 47 Global Mass Merchandisers Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 48 Global Mass Merchandisers Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 49 Global Specialist Retailers Market by Region, 2019 - 2022, USD Million

- TABLE 50 Global Specialist Retailers Market by Region, 2023 - 2030, USD Million

- TABLE 51 Global Specialist Retailers Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 52 Global Specialist Retailers Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 53 Global Convenience Stores Market by Region, 2019 - 2022, USD Million

- TABLE 54 Global Convenience Stores Market by Region, 2023 - 2030, USD Million

- TABLE 55 Global Convenience Stores Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 56 Global Convenience Stores Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 57 Global Online Retail Market by Region, 2019 - 2022, USD Million

- TABLE 58 Global Online Retail Market by Region, 2023 - 2030, USD Million

- TABLE 59 Global Online Retail Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 60 Global Online Retail Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 61 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 62 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 63 Global Others Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 64 Global Others Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 65 Global Hot Sauce Market by Region, 2019 - 2022, USD Million

- TABLE 66 Global Hot Sauce Market by Region, 2023 - 2030, USD Million

- TABLE 67 Global Hot Sauce Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 68 Global Hot Sauce Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 69 North America Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 70 North America Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 71 North America Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 72 North America Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 73 North America Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 74 North America Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 75 North America Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 76 North America Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 77 North America Tabasco Pepper Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 78 North America Tabasco Pepper Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 79 North America Tabasco Pepper Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 80 North America Tabasco Pepper Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 81 North America Habanero Pepper Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 82 North America Habanero Pepper Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 83 North America Habanero Pepper Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 84 North America Habanero Pepper Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 85 North America Jalapeno Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 86 North America Jalapeno Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 87 North America Jalapeno Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 88 North America Jalapeno Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 89 North America Sweet & Spicy Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 90 North America Sweet & Spicy Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 91 North America Sweet & Spicy Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 92 North America Sweet & Spicy Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 93 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 94 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 95 North America Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 96 North America Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 97 North America Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 98 North America Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 99 North America Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 100 North America Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 101 North America Commercial Market by Country, 2019 - 2022, USD Million

- TABLE 102 North America Commercial Market by Country, 2023 - 2030, USD Million

- TABLE 103 North America Commercial Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 104 North America Commercial Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 105 North America Residential Market by Country, 2019 - 2022, USD Million

- TABLE 106 North America Residential Market by Country, 2023 - 2030, USD Million

- TABLE 107 North America Residential Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 108 North America Residential Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 109 North America Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 110 North America Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 111 North America Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 112 North America Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 113 North America Mass Merchandisers Market by Country, 2019 - 2022, USD Million

- TABLE 114 North America Mass Merchandisers Market by Country, 2023 - 2030, USD Million

- TABLE 115 North America Mass Merchandisers Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 116 North America Mass Merchandisers Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 117 North America Specialist Retailers Market by Country, 2019 - 2022, USD Million

- TABLE 118 North America Specialist Retailers Market by Country, 2023 - 2030, USD Million

- TABLE 119 North America Specialist Retailers Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 120 North America Specialist Retailers Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 121 North America Convenience Stores Market by Country, 2019 - 2022, USD Million

- TABLE 122 North America Convenience Stores Market by Country, 2023 - 2030, USD Million

- TABLE 123 North America Convenience Stores Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 124 North America Convenience Stores Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 125 North America Online Retail Market by Country, 2019 - 2022, USD Million

- TABLE 126 North America Online Retail Market by Country, 2023 - 2030, USD Million

- TABLE 127 North America Online Retail Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 128 North America Online Retail Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 129 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 130 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 131 North America Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 132 North America Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 133 North America Hot Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 134 North America Hot Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 135 North America Hot Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 136 North America Hot Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 137 US Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 138 US Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 139 US Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 140 US Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 141 US Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 142 US Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 143 US Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 144 US Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 145 US Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 146 US Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 147 US Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 148 US Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 149 US Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 150 US Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 151 US Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 152 US Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 153 Canada Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 154 Canada Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 155 Canada Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 156 Canada Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 157 Canada Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 158 Canada Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 159 Canada Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 160 Canada Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 161 Canada Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 162 Canada Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 163 Canada Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 164 Canada Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 165 Canada Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 166 Canada Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 167 Canada Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 168 Canada Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 169 Mexico Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 170 Mexico Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 171 Mexico Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 172 Mexico Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 173 Mexico Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 174 Mexico Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 175 Mexico Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 176 Mexico Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 177 Mexico Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 178 Mexico Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 179 Mexico Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 180 Mexico Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 181 Mexico Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 182 Mexico Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 183 Mexico Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 184 Mexico Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 185 Rest of North America Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 186 Rest of North America Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 187 Rest of North America Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 188 Rest of North America Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 189 Rest of North America Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 190 Rest of North America Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 191 Rest of North America Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 192 Rest of North America Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 193 Rest of North America Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 194 Rest of North America Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 195 Rest of North America Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 196 Rest of North America Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 197 Rest of North America Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 198 Rest of North America Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 199 Rest of North America Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 200 Rest of North America Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 201 Europe Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 202 Europe Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 203 Europe Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 204 Europe Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 205 Europe Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 206 Europe Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 207 Europe Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 208 Europe Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 209 Europe Tabasco Pepper Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 210 Europe Tabasco Pepper Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 211 Europe Tabasco Pepper Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 212 Europe Tabasco Pepper Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 213 Europe Habanero Pepper Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 214 Europe Habanero Pepper Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 215 Europe Habanero Pepper Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 216 Europe Habanero Pepper Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 217 Europe Jalapeno Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 218 Europe Jalapeno Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 219 Europe Jalapeno Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 220 Europe Jalapeno Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 221 Europe Sweet & Spicy Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 222 Europe Sweet & Spicy Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 223 Europe Sweet & Spicy Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 224 Europe Sweet & Spicy Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 225 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 226 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 227 Europe Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 228 Europe Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 229 Europe Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 230 Europe Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 231 Europe Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 232 Europe Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 233 Europe Commercial Market by Country, 2019 - 2022, USD Million

- TABLE 234 Europe Commercial Market by Country, 2023 - 2030, USD Million

- TABLE 235 Europe Commercial Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 236 Europe Commercial Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 237 Europe Residential Market by Country, 2019 - 2022, USD Million

- TABLE 238 Europe Residential Market by Country, 2023 - 2030, USD Million

- TABLE 239 Europe Residential Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 240 Europe Residential Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 241 Europe Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 242 Europe Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 243 Europe Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 244 Europe Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 245 Europe Mass Merchandisers Market by Country, 2019 - 2022, USD Million

- TABLE 246 Europe Mass Merchandisers Market by Country, 2023 - 2030, USD Million

- TABLE 247 Europe Mass Merchandisers Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 248 Europe Mass Merchandisers Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 249 Europe Specialist Retailers Market by Country, 2019 - 2022, USD Million

- TABLE 250 Europe Specialist Retailers Market by Country, 2023 - 2030, USD Million

- TABLE 251 Europe Specialist Retailers Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 252 Europe Specialist Retailers Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 253 Europe Convenience Stores Market by Country, 2019 - 2022, USD Million

- TABLE 254 Europe Convenience Stores Market by Country, 2023 - 2030, USD Million

- TABLE 255 Europe Convenience Stores Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 256 Europe Convenience Stores Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 257 Europe Online Retail Market by Country, 2019 - 2022, USD Million

- TABLE 258 Europe Online Retail Market by Country, 2023 - 2030, USD Million

- TABLE 259 Europe Online Retail Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 260 Europe Online Retail Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 261 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 262 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 263 Europe Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 264 Europe Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 265 Europe Hot Sauce Market by Country, 2019 - 2022, USD Million

- TABLE 266 Europe Hot Sauce Market by Country, 2023 - 2030, USD Million

- TABLE 267 Europe Hot Sauce Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 268 Europe Hot Sauce Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 269 Germany Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 270 Germany Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 271 Germany Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 272 Germany Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 273 Germany Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 274 Germany Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 275 Germany Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 276 Germany Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 277 Germany Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 278 Germany Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 279 Germany Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 280 Germany Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 281 Germany Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 282 Germany Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 283 Germany Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 284 Germany Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

- TABLE 285 UK Hot Sauce Market, 2019 - 2022, USD Million

- TABLE 286 UK Hot Sauce Market, 2023 - 2030, USD Million

- TABLE 287 UK Hot Sauce Market, 2019 - 2022, Kilo Tonnes

- TABLE 288 UK Hot Sauce Market, 2023 - 2030, Kilo Tonnes

- TABLE 289 UK Hot Sauce Market by Type, 2019 - 2022, USD Million

- TABLE 290 UK Hot Sauce Market by Type, 2023 - 2030, USD Million

- TABLE 291 UK Hot Sauce Market by Type, 2019 - 2022, Kilo Tonnes

- TABLE 292 UK Hot Sauce Market by Type, 2023 - 2030, Kilo Tonnes

- TABLE 293 UK Hot Sauce Market by End-use, 2019 - 2022, USD Million

- TABLE 294 UK Hot Sauce Market by End-use, 2023 - 2030, USD Million

- TABLE 295 UK Hot Sauce Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 296 UK Hot Sauce Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 297 UK Hot Sauce Market by Distribution Channel, 2019 - 2022, USD Million

- TABLE 298 UK Hot Sauce Market by Distribution Channel, 2023 - 2030, USD Million

- TABLE 299 UK Hot Sauce Market by Distribution Channel, 2019 - 2022, Kilo Tonnes

- TABLE 300 UK Hot Sauce Market by Distribution Channel, 2023 - 2030, Kilo Tonnes

The Global Hot Sauce Market size is expected to reach $4.5 billion by 2030, rising at a market growth of 6.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 227.1 Kilo Tonnes, experiencing a growth of 6% (2019-2022).

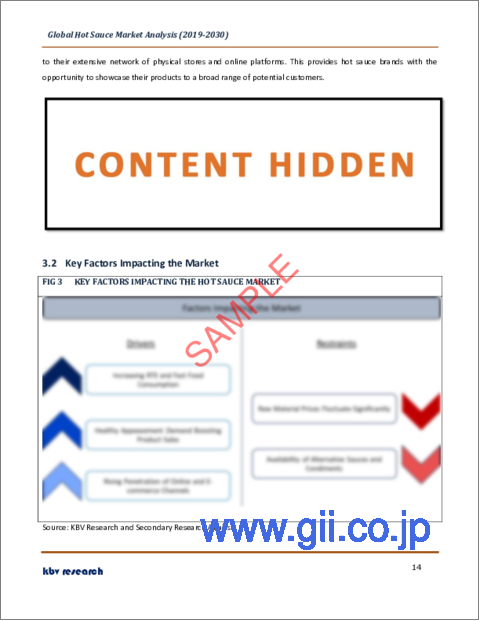

The demand for convenience foods has risen significantly in recent years due to a variety of social, cultural, and economic factors. Hence, the Convenience Stores segment will register more than 14% share in the market by 2030. Convenience foods offer a way to save time while still enjoying a meal. Additionally, the rise in single-person households has led to increased demand for portion-controlled and single-serving convenience options that minimize waste. The convenience food sale has grown as more people move to urban areas. The convenience food sector is growing due to several causes, including an increasing demand for ready-to-eat food, strong demand from emerging markets, a sedentary lifestyle, rising disposable income, and a surge in the working population. Some of the factors impacting the market are healthy appeasement demand boosting product sales, rising penetration of online and e-commerce channels, and raw material prices fluctuating significantly.

The rising demand for these sauce as a healthy condiment is driven by several factors, including changing consumer preferences, cultural influences, and growing awareness of the potential health benefits associated with consuming spicy foods. Many hot sauces are naturally low in calories and fat, making them an appealing choice for individuals who are conscious of their calorie intake and overall diet. Some chili peppers used to make hot sauce contain antioxidants, which can help combat oxidative stress and inflammation in the body. Therefore, such trend will significantly increase sauce sales in both developed and developing markets. Additionally, the expansion of online retail and e-commerce has had a significant impact on the sales of the market, influencing consumer behavior, market dynamics, and the strategies of hot sauce manufacturers and retailers. E-commerce allows hot sauce manufacturers to reach a global audience without the need for physical presence in every region. Online platforms provide detailed product information, including ingredients, heat levels, and flavor profiles. Customer reviews and ratings also help consumers make informed choices, enhancing their buying experience. Thus, the expansion of this distribution channel will aid in the expansion of the market in the coming years.

However, the market is severely constrained by price volatility, particularly for raw materials like tomatoes, peppers, chilies, jalapenos, and other items. The sudden global spread of the COVID-19 pandemic caused disruptions in the transportation system, which affected the prices of raw materials. Unpredictable crop yields can impact the price of raw materials, thereby impacting production costs and possibly resulting in price rises for consumers. To mitigate these obstacles, manufacturers must establish resilient supply chains, cultivate relationships with dependable suppliers, and consider alternative sourcing strategies. Therefore, the variations in the prices of these raw materials may obstruct the growth of the market in the coming years.

End-Use Outlook

On the basis of end-use, the market is bifurcated into commercial and residential. In 2022, the commercial segment dominated the market with maximum revenue share. Opportunities for the market are anticipated to arise from research and development initiatives, ongoing product innovation, and product diversification. Major manufacturers are introducing new flavors, heat levels, and ingredients to evolve consumer preferences. A niche market segment has also been developed due to the growing consumer demand for artisanal and craft hot sauces produced in small batches using high-quality ingredients. Commercial players can introduce new, cutting-edge hot sauce tastes, ingredients, and packaging designs to appeal to a wider range of consumers.

Type Outlook

By type, the market is categorized into tabasco pepper sauce, habanero pepper sauce, jalapeno sauce, sweet & spicy sauce, and others. The sweet and spicy sauce segment covered a considerable revenue share in the market in 2022. Due to its deliciousness and healthiness, the prevalence of sweet and spicy sauces is soaring across the globe. Additionally, the premiumization of sweet and spicy sauce options, expanding acceptance of ethnic food products, and growing consumer interest in novel condiments infused with exotic and spicy flavors are all predicted to present the market segment with enormous potential opportunities.

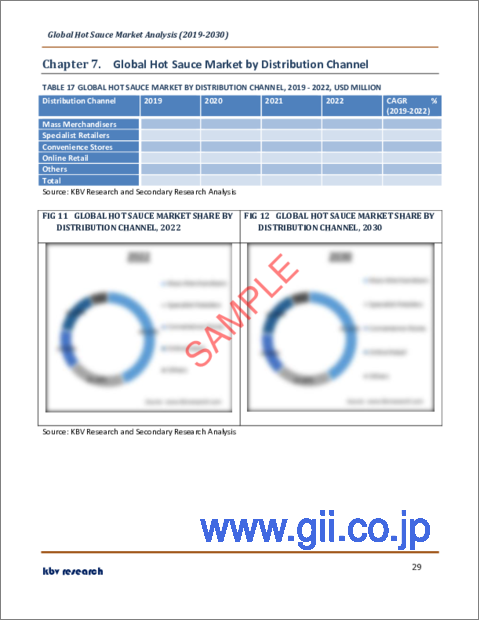

Distribution Channel Outlook

Based on distribution channel, the market is classified into mass merchandisers, specialist retailers, convenience stores, online retail, and others. In 2022, the mass merchandisers segment witnessed the largest revenue share in the market. Mass merchandisers, such as big-box retailers and superstores, offer several benefits for selling hot sauce and other products through their distribution channels. Mass merchandisers attract a large and diverse customer base due to their extensive network of physical stores and online platforms. This provides hot sauce brands with the opportunity to showcase their products to a broad range of potential customers.

Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. This region's market dominance in North America can be attributed to its consumers' high spending power. In addition, the intensifying diversity of food flavors makes it feasible for chili sauce to become a potential kitchen staple in the region instead of a fringe ethnic food. The widespread popularity of chili sauce in nations like the United States and Canada has positively impacted the regional trade of the product, which is a positive aspect of the market's expansion.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include McIlhenny Company, Summit hill foods, Hormel Foods Corporation, Baumer Foods, Inc., The Kraft Heinz Company, McCormick & Company, Inc., Campbell Soup Company, Unilever PLC, Conagra Brands, Inc., TW Garner Food Company

Strategies Deployed in Hot Sauce Market

Aug-2023: Campbell Soup acquired Sovos, a food company. This acquisition strengthens Campbell's Meals & Beverages segment and would be paired with its emerging and differentiated Snacks division, (the Sovos portfolio) making Campbell one of the most dependable, growth-oriented names in food.

Apr-2023: Heinz launched Heinz Hot varieties which include a new line-up of three Spicy Ketchup flavours and the first-ever Heinz Hot 57 Sauce, the four fiery additions to its offering. The launched offerings are available in three different, thick and rich varieties - Chipotle (medium), Jalapeno (hot), and Habanero (hotter). Heinz Hot 57 Sauce shows a red jalapeno twist on the brand's 57 sauce and marks the first product in the range in over 10 years.

Apr-2023: Campbell Soup Company-owned brand SpaghettiOs announced the launch of new spicy ring-shaped pasta pieces made with Frank's Red Hot sauce. The launched product features a mild-medium heat level, meeting consumers' demand for spicy food.

Feb-2023: TABASCO Brand introduced TABASCO® Brand x TINX Avocado Jalapeno Hot Sauce Dressing. The TABASCO® Green Jalapeno Sauce is a dressing and sharing this hack with her millions of social media followers caught the brand's eye, sparking the partnership and product innovation.

Sep-2021: The Kraft Heinz Company signed an agreement to acquire Companhia Hemmer Industria e Comercio (Hemmer), a Brazilian company focused on condiments and sauces. Following this acquisition, Hemmer would broaden consumers' taste options in Brazil, while leveraging Kraft Heinz's strategy of emerging its International Taste Elevation product platform and its reach in growing markets.

Jun-2021: Hormell Foods, Inc. launched HERDEZ® Avocado Hot Sauce, the hot sauce offers a unique, tangy flavor that enhances any dish, no matter the cuisine. The HERDEZ® Avocado Hot Sauce brings a creamy touch of heat to change any meal from boring to exciting, from eggs and sandwiches to pizza and salad, and is perfect for topping, drizzling, dipping, or pouring on almost any food.

Jun-2021: The Kraft Heinz Company signed an agreement to acquire Assan Foods, a rapidly growing sauces-focused business with local manufacturing facilities. This acquisition offers Kraft Heinz the opportunity to create its retail and food service business in Europe, the Middle East, and Africa.

Scope of the Study

Market Segments covered in the Report:

By Type (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Tabasco Pepper Sauce

- Habanero Pepper Sauce

- Jalapeno Sauce

- Sweet & Spicy Sauce

- Others

By End-use (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Commercial

- Residential

By Distribution Channel (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Mass Merchandisers

- Specialist Retailers

- Convenience Stores

- Online Retail

- Others

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- McIlhenny Company

- Summit hill foods

- Hormel Foods Corporation

- Baumer Foods, Inc.

- The Kraft Heinz Company

- McCormick & Company, Inc.

- Campbell Soup Company

- Unilever PLC

- Conagra Brands, Inc.

- TW Garner Food Company

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Hot Sauce Market, by Type

- 1.4.2 Global Hot Sauce Market, by End-use

- 1.4.3 Global Hot Sauce Market, by Distribution Channel

- 1.4.4 Global Hot Sauce Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market At a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.3 Porter's Five Forces Analysis

Chapter 4. Strategies Deployed in Hot Sauce Market

Chapter 5. Global Hot Sauce Market by Type

- 5.1 Global Tabasco Pepper Sauce Market by Region

- 5.2 Global Habanero Pepper Sauce Market by Region

- 5.3 Global Jalapeno Sauce Market by Region

- 5.4 Global Sweet & Spicy Sauce Market by Region

- 5.5 Global Others Market by Region

Chapter 6. Global Hot Sauce Market by End-use

- 6.1 Global Commercial Market by Region

- 6.2 Global Residential Market by Region

Chapter 7. Global Hot Sauce Market by Distribution Channel

- 7.1 Global Mass Merchandisers Market by Region

- 7.2 Global Specialist Retailers Market by Region

- 7.3 Global Convenience Stores Market by Region

- 7.4 Global Online Retail Market by Region

- 7.5 Global Others Market by Region

Chapter 8. Global Hot Sauce Market by Region

- 8.1 North America Hot Sauce Market

- 8.1.1 North America Hot Sauce Market by Type

- 8.1.1.1 North America Tabasco Pepper Sauce Market by Country

- 8.1.1.2 North America Habanero Pepper Sauce Market by Country

- 8.1.1.3 North America Jalapeno Sauce Market by Country

- 8.1.1.4 North America Sweet & Spicy Sauce Market by Country

- 8.1.1.5 North America Others Market by Country

- 8.1.2 North America Hot Sauce Market by End-use

- 8.1.2.1 North America Commercial Market by Country

- 8.1.2.2 North America Residential Market by Country

- 8.1.3 North America Hot Sauce Market by Distribution Channel

- 8.1.3.1 North America Mass Merchandisers Market by Country

- 8.1.3.2 North America Specialist Retailers Market by Country

- 8.1.3.3 North America Convenience Stores Market by Country

- 8.1.3.4 North America Online Retail Market by Country

- 8.1.3.5 North America Others Market by Country

- 8.1.4 North America Hot Sauce Market by Country

- 8.1.4.1 US Hot Sauce Market

- 8.1.4.1.1 US Hot Sauce Market by Type

- 8.1.4.1.2 US Hot Sauce Market by End-use

- 8.1.4.1.3 US Hot Sauce Market by Distribution Channel

- 8.1.4.2 Canada Hot Sauce Market

- 8.1.4.2.1 Canada Hot Sauce Market by Type

- 8.1.4.2.2 Canada Hot Sauce Market by End-use

- 8.1.4.2.3 Canada Hot Sauce Market by Distribution Channel

- 8.1.4.3 Mexico Hot Sauce Market

- 8.1.4.3.1 Mexico Hot Sauce Market by Type

- 8.1.4.3.2 Mexico Hot Sauce Market by End-use

- 8.1.4.3.3 Mexico Hot Sauce Market by Distribution Channel

- 8.1.4.4 Rest of North America Hot Sauce Market

- 8.1.4.4.1 Rest of North America Hot Sauce Market by Type

- 8.1.4.4.2 Rest of North America Hot Sauce Market by End-use

- 8.1.4.4.3 Rest of North America Hot Sauce Market by Distribution Channel

- 8.1.4.1 US Hot Sauce Market

- 8.1.1 North America Hot Sauce Market by Type

- 8.2 Europe Hot Sauce Market

- 8.2.1 Europe Hot Sauce Market by Type

- 8.2.1.1 Europe Tabasco Pepper Sauce Market by Country

- 8.2.1.2 Europe Habanero Pepper Sauce Market by Country

- 8.2.1.3 Europe Jalapeno Sauce Market by Country

- 8.2.1.4 Europe Sweet & Spicy Sauce Market by Country

- 8.2.1.5 Europe Others Market by Country

- 8.2.2 Europe Hot Sauce Market by End-use

- 8.2.2.1 Europe Commercial Market by Country

- 8.2.2.2 Europe Residential Market by Country

- 8.2.3 Europe Hot Sauce Market by Distribution Channel

- 8.2.3.1 Europe Mass Merchandisers Market by Country

- 8.2.3.2 Europe Specialist Retailers Market by Country

- 8.2.3.3 Europe Convenience Stores Market by Country

- 8.2.3.4 Europe Online Retail Market by Country

- 8.2.3.5 Europe Others Market by Country

- 8.2.4 Europe Hot Sauce Market by Country

- 8.2.4.1 Germany Hot Sauce Market

- 8.2.4.1.1 Germany Hot Sauce Market by Type

- 8.2.4.1.2 Germany Hot Sauce Market by End-use

- 8.2.4.1.3 Germany Hot Sauce Market by Distribution Channel

- 8.2.4.2 UK Hot Sauce Market

- 8.2.4.2.1 UK Hot Sauce Market by Type

- 8.2.4.2.2 UK Hot Sauce Market by End-use

- 8.2.4.2.3 UK Hot Sauce Market by Distribution Channel

- 8.2.4.3 France Hot Sauce Market

- 8.2.4.3.1 France Hot Sauce Market by Type

- 8.2.4.3.2 France Hot Sauce Market by End-use

- 8.2.4.3.3 France Hot Sauce Market by Distribution Channel

- 8.2.4.4 Russia Hot Sauce Market

- 8.2.4.4.1 Russia Hot Sauce Market by Type

- 8.2.4.4.2 Russia Hot Sauce Market by End-use

- 8.2.4.4.3 Russia Hot Sauce Market by Distribution Channel

- 8.2.4.5 Spain Hot Sauce Market

- 8.2.4.5.1 Spain Hot Sauce Market by Type

- 8.2.4.5.2 Spain Hot Sauce Market by End-use

- 8.2.4.5.3 Spain Hot Sauce Market by Distribution Channel

- 8.2.4.6 Italy Hot Sauce Market

- 8.2.4.6.1 Italy Hot Sauce Market by Type

- 8.2.4.6.2 Italy Hot Sauce Market by End-use

- 8.2.4.6.3 Italy Hot Sauce Market by Distribution Channel

- 8.2.4.7 Rest of Europe Hot Sauce Market

- 8.2.4.7.1 Rest of Europe Hot Sauce Market by Type

- 8.2.4.7.2 Rest of Europe Hot Sauce Market by End-use

- 8.2.4.7.3 Rest of Europe Hot Sauce Market by Distribution Channel

- 8.2.4.1 Germany Hot Sauce Market

- 8.2.1 Europe Hot Sauce Market by Type

- 8.3 Asia Pacific Hot Sauce Market

- 8.3.1 Asia Pacific Hot Sauce Market by Type

- 8.3.1.1 Asia Pacific Tabasco Pepper Sauce Market by Country

- 8.3.1.2 Asia Pacific Habanero Pepper Sauce Market by Country

- 8.3.1.3 Asia Pacific Jalapeno Sauce Market by Country

- 8.3.1.4 Asia Pacific Sweet & Spicy Sauce Market by Country

- 8.3.1.5 Asia Pacific Others Market by Country

- 8.3.2 Asia Pacific Hot Sauce Market by End-use

- 8.3.2.1 Asia Pacific Commercial Market by Country

- 8.3.2.2 Asia Pacific Residential Market by Country

- 8.3.3 Asia Pacific Hot Sauce Market by Distribution Channel

- 8.3.3.1 Asia Pacific Mass Merchandisers Market by Country

- 8.3.3.2 Asia Pacific Specialist Retailers Market by Country

- 8.3.3.3 Asia Pacific Convenience Stores Market by Country

- 8.3.3.4 Asia Pacific Online Retail Market by Country

- 8.3.3.5 Asia Pacific Others Market by Country

- 8.3.4 Asia Pacific Hot Sauce Market by Country

- 8.3.4.1 China Hot Sauce Market

- 8.3.4.1.1 China Hot Sauce Market by Type

- 8.3.4.1.2 China Hot Sauce Market by End-use

- 8.3.4.1.3 China Hot Sauce Market by Distribution Channel

- 8.3.4.2 Japan Hot Sauce Market

- 8.3.4.2.1 Japan Hot Sauce Market by Type

- 8.3.4.2.2 Japan Hot Sauce Market by End-use

- 8.3.4.2.3 Japan Hot Sauce Market by Distribution Channel

- 8.3.4.3 India Hot Sauce Market

- 8.3.4.3.1 India Hot Sauce Market by Type

- 8.3.4.3.2 India Hot Sauce Market by End-use

- 8.3.4.3.3 India Hot Sauce Market by Distribution Channel

- 8.3.4.4 South Korea Hot Sauce Market

- 8.3.4.4.1 South Korea Hot Sauce Market by Type

- 8.3.4.4.2 South Korea Hot Sauce Market by End-use

- 8.3.4.4.3 South Korea Hot Sauce Market by Distribution Channel

- 8.3.4.5 Singapore Hot Sauce Market

- 8.3.4.5.1 Singapore Hot Sauce Market by Type

- 8.3.4.5.2 Singapore Hot Sauce Market by End-use

- 8.3.4.5.3 Singapore Hot Sauce Market by Distribution Channel

- 8.3.4.6 Malaysia Hot Sauce Market

- 8.3.4.6.1 Malaysia Hot Sauce Market by Type

- 8.3.4.6.2 Malaysia Hot Sauce Market by End-use

- 8.3.4.6.3 Malaysia Hot Sauce Market by Distribution Channel

- 8.3.4.7 Rest of Asia Pacific Hot Sauce Market

- 8.3.4.7.1 Rest of Asia Pacific Hot Sauce Market by Type

- 8.3.4.7.2 Rest of Asia Pacific Hot Sauce Market by End-use

- 8.3.4.7.3 Rest of Asia Pacific Hot Sauce Market by Distribution Channel

- 8.3.4.1 China Hot Sauce Market

- 8.3.1 Asia Pacific Hot Sauce Market by Type

- 8.4 LAMEA Hot Sauce Market

- 8.4.1 LAMEA Hot Sauce Market by Type

- 8.4.1.1 LAMEA Tabasco Pepper Sauce Market by Country

- 8.4.1.2 LAMEA Habanero Pepper Sauce Market by Country

- 8.4.1.3 LAMEA Jalapeno Sauce Market by Country

- 8.4.1.4 LAMEA Sweet & Spicy Sauce Market by Country

- 8.4.1.5 LAMEA Others Market by Country

- 8.4.2 LAMEA Hot Sauce Market by End-use

- 8.4.2.1 LAMEA Commercial Market by Country

- 8.4.2.2 LAMEA Residential Market by Country

- 8.4.3 LAMEA Hot Sauce Market by Distribution Channel

- 8.4.3.1 LAMEA Mass Merchandisers Market by Country

- 8.4.3.2 LAMEA Specialist Retailers Market by Country

- 8.4.3.3 LAMEA Convenience Stores Market by Country

- 8.4.3.4 LAMEA Online Retail Market by Country

- 8.4.3.5 LAMEA Others Market by Country

- 8.4.4 LAMEA Hot Sauce Market by Country

- 8.4.4.1 Brazil Hot Sauce Market

- 8.4.4.1.1 Brazil Hot Sauce Market by Type

- 8.4.4.1.2 Brazil Hot Sauce Market by End-use

- 8.4.4.1.3 Brazil Hot Sauce Market by Distribution Channel

- 8.4.4.2 Argentina Hot Sauce Market

- 8.4.4.2.1 Argentina Hot Sauce Market by Type

- 8.4.4.2.2 Argentina Hot Sauce Market by End-use

- 8.4.4.2.3 Argentina Hot Sauce Market by Distribution Channel

- 8.4.4.3 UAE Hot Sauce Market

- 8.4.4.3.1 UAE Hot Sauce Market by Type

- 8.4.4.3.2 UAE Hot Sauce Market by End-use

- 8.4.4.3.3 UAE Hot Sauce Market by Distribution Channel

- 8.4.4.4 Saudi Arabia Hot Sauce Market

- 8.4.4.4.1 Saudi Arabia Hot Sauce Market by Type

- 8.4.4.4.2 Saudi Arabia Hot Sauce Market by End-use

- 8.4.4.4.3 Saudi Arabia Hot Sauce Market by Distribution Channel

- 8.4.4.5 South Africa Hot Sauce Market

- 8.4.4.5.1 South Africa Hot Sauce Market by Type

- 8.4.4.5.2 South Africa Hot Sauce Market by End-use

- 8.4.4.5.3 South Africa Hot Sauce Market by Distribution Channel

- 8.4.4.6 Nigeria Hot Sauce Market

- 8.4.4.6.1 Nigeria Hot Sauce Market by Type

- 8.4.4.6.2 Nigeria Hot Sauce Market by End-use

- 8.4.4.6.3 Nigeria Hot Sauce Market by Distribution Channel

- 8.4.4.7 Rest of LAMEA Hot Sauce Market

- 8.4.4.7.1 Rest of LAMEA Hot Sauce Market by Type

- 8.4.4.7.2 Rest of LAMEA Hot Sauce Market by End-use

- 8.4.4.7.3 Rest of LAMEA Hot Sauce Market by Distribution Channel

- 8.4.4.1 Brazil Hot Sauce Market

- 8.4.1 LAMEA Hot Sauce Market by Type

Chapter 9. Company Profiles

- 9.1 McIlhenny Company

- 9.1.1 Company Overview

- 9.1.2 Recent strategies and developments:

- 9.1.2.1 Product Launches and Product Expansions:

- 9.1.3 SWOT Analysis

- 9.2 Summit hill Foods

- 9.2.1 Company Overview

- 9.2.2 SWOT Analysis

- 9.3 Hormel Foods Corporation

- 9.3.1 Company Overview

- 9.3.2 Financial Analysis

- 9.3.3 Segmental and Regional Analysis

- 9.3.4 Research & Development Expenses

- 9.3.5 Recent strategies and developments:

- 9.3.5.1 Product Launches and Product Expansions:

- 9.3.6 SWOT Analysis

- 9.4 Baumer Foods, Inc.

- 9.4.1 Company Overview

- 9.5 The Kraft Heinz Company

- 9.5.1 Company Overview

- 9.5.1 Financial Analysis

- 9.5.2 Regional Analysis

- 9.5.3 Research & Development Expense

- 9.5.4 Recent strategies and developments:

- 9.5.4.1 Product Launches and Product Expansions:

- 9.5.4.2 Acquisition and Mergers:

- 9.5.5 SWOT Analysis

- 9.6 McCormick & Company, Inc.

- 9.6.1 Company Overview

- 9.6.2 Financial Analysis

- 9.6.3 Segmental and Regional Analysis

- 9.6.4 Research & Development Expense

- 9.6.5 SWOT Analysis

- 9.7 Campbell Soup Company

- 9.7.1 Company Overview

- 9.7.2 Financial Analysis

- 9.7.3 Segmental Analysis

- 9.7.4 Research & Development Expenses

- 9.7.5 Recent strategies and developments:

- 9.7.5.1 Product Launches and Product Expansions:

- 9.7.5.2 Acquisition and Mergers:

- 9.7.6 SWOT Analysis

- 9.8 Unilever PLC

- 9.8.1 Company Overview

- 9.8.2 Financial Analysis

- 9.8.3 Segmental and Regional Analysis

- 9.8.4 Research & Development Expense

- 9.8.5 SWOT Analysis

- 9.9 Conagra Brands, Inc.

- 9.9.1 Company Overview

- 9.9.2 Financial Analysis

- 9.9.3 Segmental Analysis

- 9.9.4 Research & Development Expenses

- 9.9.5 SWOT Analysis

- 9.10. TW GARNER FOOD COMPANY

- 9.10.1 Company Overview

- 9.10.2 SWOT Analysis