|

|

市場調査レポート

商品コード

1335933

ワイヤレスネットワークセキュリティの世界市場規模、シェア、産業動向分析レポート:コンポーネント別、企業規模別(大企業、中小企業)、展開タイプ別、最終用途別、地域別展望と予測、2023年~2030年Global Wireless Network Security Market Size, Share & Industry Trends Analysis Report By Component, By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By Deployment Type, By End-use, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| ワイヤレスネットワークセキュリティの世界市場規模、シェア、産業動向分析レポート:コンポーネント別、企業規模別(大企業、中小企業)、展開タイプ別、最終用途別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年07月31日

発行: KBV Research

ページ情報: 英文 373 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

ワイヤレスネットワークセキュリティ市場規模は2030年までに577億米ドルに達すると予測され、予測期間中のCAGRは12.8%の市場成長率で上昇します。

KBVカーディナルマトリックスに掲載された分析によると、シスコシステムズ社とブロードコム社が同市場におけるトップランナーです。2023年2月、シスコは、安全で軽快なデジタルサービスの最新波の展開を加速するため、STCと提携しました。アルバネットワークス、モトローラ・ソリューションズ、フォーティネットなどの企業は、この市場における主要なイノベーターです。

市場成長要因

スマートホームでのIoT利用が拡大

ワイヤレスセキュリティカメラシステムを購入した顧客は、スマートフォンやタブレットを使って安全、セキュリティ、ビデオ、オーディオ、アラームシステムにリモートアクセスできます。また、デバイスには広角レンズ、暗視機能、双方向オーディオが搭載されています。ペットの給餌や照明の制御など、家庭内の日常生活のいくつかの側面は、モノのインターネットを介して自動化されることを意図しています。カメラのハードウェアとソフトウェアにはオプションが用意されています。防犯カメラは、家庭内の侵入や違反を即座に特定します。防犯カメラには数多くの種類があります。カメラに内蔵された光センサーは、事故防止と侵入者防止の両方に役立ちます。このようにスマート家電が広く採用されることで、セキュリティのリスクが生じ、市場の成長見通しが開ける。

小売業が市場成長に大きく貢献する見込み

ここ数年、eコマース分野の急速な世界化により、小売セクターは大幅に拡大しています。そのため、小売業者は競争力を獲得するために、IoTソリューションを導入して業務効率を高め、消費者体験を向上させています。小売業におけるIoT利用の拡大により、無線セキュリティの需要は予想される期間中に増加すると予想されます。欧州の多くの店舗では、プログラム可能な小型のIoT接続ダッシュボードやボタンを設置して顧客の入力を収集し、その結果を顧客体験の改善に役立てています。市場は、IoT技術を採用する小売業者が増えるにつれて発展すると予測されます。

市場抑制要因

企業のセキュリティ予算の低さが市場に影響を与える可能性

ほとんどすべての企業が脅威への対応に苦慮しており、真のデータ・セキュリティが欠如しています。にもかかわらず、企業はネットワーク・セキュリティ・ソリューションを軽視し続けています。さらに、これらのソリューションは初期設定コストが高く、継続的なメンテナンスが必要であるため、しばらくの間、普及が遅れることが予想されます。中堅・中小企業は、ソリューションのコストが高く、攻撃事例が増加しているにもかかわらず、自社の要件や業務に応じて、コスト効率の高いセキュリティ・ソリューションを導入することができます。中小企業は、資金力が乏しいために適切なITセキュリティ・インフラが整備されておらず、新技術や企業向けセキュリティ・ソリューションの導入が遅れています。中小企業は、さまざまな運用上の問題や事業継続計画のために確保した予算資金を適切に管理しなければならず、無線ネットワーク・セキュリティ・ソリューションの採用から注意がそれています。

コンポーネントの展望

コンポーネント別に見ると、市場はソリューションとサービスに区分されます。2022年の市場では、サービス分野が大きな収益シェアを獲得しました。このセグメントの大幅な増加は、無線ネットワークセキュリティシステムを可能な限り低コストで導入、アップグレード、保守するためのマネージド&プロフェッショナルサービスを求めるエンドユーザー企業の増加に起因すると考えられます。高度な調査、アドバイス、定期メンテナンス、クラウド移行、ネットワーク管理、ユニファイド・コミュニケーションは、このサービスの主な強みです。

ソリューションの展望

ソリューションの種類によって、市場はさらに暗号化、ファイアウォール、ID&アクセス管理、侵入防御システム(IPS)/侵入検知システム(IDS)、統合脅威ソリューション、その他に分けられます。統一脅威ソリューションセグメントは、2022年の市場でかなりの収益シェアを占めています。統合脅威ソリューションは、脅威に対するソリューションを提供し、コンテンツフィルタリング、ロードバランシング、ネットワークファイアウォール、データ漏洩防止、ネットワークハッキング防止など、さまざまなセキュリティタスクを実行できるセキュリティ製品で、従来のファイアウォールを改良したものと考えられています。

企業規模の展望

企業規模によって、市場は大企業と中小企業に分類されます。2022年には、大企業セグメントが市場で最も高い収益シェアを記録しました。無線ネットワークは、大企業に対するサイバー攻撃、データ漏洩、その他の有害行為の標的となっています。これらの企業は、データ盗難により多額の金銭的損失を被る可能性があります。これを防ぐため、大企業の大半は無線ネットワーク・セキュリティ・ソリューションを利用して機密データを保護し、さまざまなデバイス経由のデータ転送を制御しています。

展開タイプの展望

導入タイプによって、市場はクラウド型とオンプレミス型に分類されます。クラウドセグメントは、2022年の市場で大きな収益シェアを獲得しました。メンテナンスコストの削減、柔軟性の向上、データ保護の一元化、迅速なアプリケーション開発など、数多くの利点があるため、クラウドベースの無線ネットワークセキュリティソリューションは大きく拡大しています。クラウドベースのソリューションにより、無線ネットワーク・セキュリティ・ソリューションを管理するための余分なソフトウェアやハードウェアの要件がなくなるため、このセグメントの成長には明るい展望が開けています。

最終用途の展望

エンドユース別では、BFSI、小売、IT・通信、ヘルスケア、製造、政府・防衛、その他に区分されます。2022年の市場では、小売セグメントが突出した収益シェアを予測しています。世界のeコマースビジネスの巨大な発展が小売セクターに影響を与えています。その結果、小売業はIoTソリューションを利用して業務効率と顧客満足度を高め、競争優位を獲得しています。予測期間中、小売業界ではモノのインターネットの利用頻度が高まり、無線セキュリティの需要が高まる可能性が高いです。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、北米地域が最も高い収益シェアを獲得して市場をリードしました。BYODコンセプトの受け入れ拡大、セキュリティ侵害の増加、経験豊富な市場プレイヤーの存在が北米市場の促進要因となっています。さらに、BFSI、小売、ヘルスケアなど、数多くの業種のエンドユーザー企業が、この地域で拡大するデジタル脅威から企業データを保護するためにサイバーセキュリティに投資しており、市場に好影響を与えています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第4章 競合分析- 世界

- KBVカーディナルマトリックス

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 市場シェア分析2021

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

- ポーターのファイブフォース分析

第5章 世界のワイヤレスネットワークセキュリティ市場:コンポーネント別

- 世界のソリューション市場:地域別

- 世界のワイヤレスネットワークセキュリティ市場:ソリューションタイプ別

- 世界のファイアウォール市場:地域別

- 世界のアイデンティティおよびアクセス管理市場:地域別

- 世界の暗号化市場:地域別

- 世界の侵入防御システム(IPS)/侵入検知システム(IDS)市場:地域別

- 世界の統合脅威ソリューション市場:地域別

- その他のソリューションタイプの世界市場:地域別

- 世界サービス市場:地域別

第6章 世界のワイヤレスネットワークセキュリティ市場:企業規模別

- 世界の大企業市場:地域別

- 世界の中小企業市場:地域別

第7章 世界のワイヤレスネットワークセキュリティ市場:展開タイプ別

- 世界のオンプレミス市場:地域別

- 世界のクラウド市場:地域別

第8章 世界のワイヤレスネットワークセキュリティ市場:最終用途別

- 世界のBFSI市場:地域別

- 世界の政府および防衛市場:地域別

- 世界のITおよびテレコム市場:地域別

- 世界のヘルスケアおよびライフサイエンス市場:地域別

- 世界の小売市場:地域別

- 世界の製造業市場:地域別

- 世界のその他の市場:地域別

第9章 世界のワイヤレスネットワークセキュリティ市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第10章 企業プロファイル

- Check Point Software Technologies Ltd

- Aruba Networks(Hewlett Packard Enterprise Company)

- Kaspersky Lab

- Cisco Systems, Inc

- Fortinet, Inc

- Juniper Networks, Inc

- Motorola Solutions, Inc

- Sophos Group PLC(Thoma Bravo)

- Broadcom, Inc(Symantec Corporation)

- Trend Micro, Inc

第11章 ワイヤレスネットワークセキュリティ市場での勝利は必須

LIST OF TABLES

- TABLE 1 Global Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 2 Global Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Wireless Network Security Market

- TABLE 4 Product Launches And Product Expansions- Wireless Network Security Market

- TABLE 5 Acquisition and Mergers- Wireless Network Security Market

- TABLE 6 Global Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 7 Global Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 8 Global Solution Market by Region, 2019 - 2022, USD Million

- TABLE 9 Global Solution Market by Region, 2023 - 2030, USD Million

- TABLE 10 Global Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 11 Global Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 12 Global Firewall Market by Region, 2019 - 2022, USD Million

- TABLE 13 Global Firewall Market by Region, 2023 - 2030, USD Million

- TABLE 14 Global Identity & Access Management Market by Region, 2019 - 2022, USD Million

- TABLE 15 Global Identity & Access Management Market by Region, 2023 - 2030, USD Million

- TABLE 16 Global Encryption Market by Region, 2019 - 2022, USD Million

- TABLE 17 Global Encryption Market by Region, 2023 - 2030, USD Million

- TABLE 18 Global Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Region, 2019 - 2022, USD Million

- TABLE 19 Global Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Region, 2023 - 2030, USD Million

- TABLE 20 Global Unified Threat Solutions Market by Region, 2019 - 2022, USD Million

- TABLE 21 Global Unified Threat Solutions Market by Region, 2023 - 2030, USD Million

- TABLE 22 Global Other Solution Type Market by Region, 2019 - 2022, USD Million

- TABLE 23 Global Other Solution Type Market by Region, 2023 - 2030, USD Million

- TABLE 24 Global Services Market by Region, 2019 - 2022, USD Million

- TABLE 25 Global Services Market by Region, 2023 - 2030, USD Million

- TABLE 26 Global Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 27 Global Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 28 Global Large Enterprises Market by Region, 2019 - 2022, USD Million

- TABLE 29 Global Large Enterprises Market by Region, 2023 - 2030, USD Million

- TABLE 30 Global Small & Medium Enterprises Market by Region, 2019 - 2022, USD Million

- TABLE 31 Global Small & Medium Enterprises Market by Region, 2023 - 2030, USD Million

- TABLE 32 Global Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 33 Global Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 34 Global On premise Market by Region, 2019 - 2022, USD Million

- TABLE 35 Global On premise Market by Region, 2023 - 2030, USD Million

- TABLE 36 Global Cloud Market by Region, 2019 - 2022, USD Million

- TABLE 37 Global Cloud Market by Region, 2023 - 2030, USD Million

- TABLE 38 Global Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 39 Global Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 40 Global BFSI Market by Region, 2019 - 2022, USD Million

- TABLE 41 Global BFSI Market by Region, 2023 - 2030, USD Million

- TABLE 42 Global Government & Defense Market by Region, 2019 - 2022, USD Million

- TABLE 43 Global Government & Defense Market by Region, 2023 - 2030, USD Million

- TABLE 44 Global IT & Telecom Market by Region, 2019 - 2022, USD Million

- TABLE 45 Global IT & Telecom Market by Region, 2023 - 2030, USD Million

- TABLE 46 Global Healthcare & Lifesciences Market by Region, 2019 - 2022, USD Million

- TABLE 47 Global Healthcare & Lifesciences Market by Region, 2023 - 2030, USD Million

- TABLE 48 Global Retail Market by Region, 2019 - 2022, USD Million

- TABLE 49 Global Retail Market by Region, 2023 - 2030, USD Million

- TABLE 50 Global Manufacturing Market by Region, 2019 - 2022, USD Million

- TABLE 51 Global Manufacturing Market by Region, 2023 - 2030, USD Million

- TABLE 52 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 53 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 54 Global Wireless Network Security Market by Region, 2019 - 2022, USD Million

- TABLE 55 Global Wireless Network Security Market by Region, 2023 - 2030, USD Million

- TABLE 56 North America Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 57 North America Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 58 North America Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 59 North America Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 60 North America Solution Market by Country, 2019 - 2022, USD Million

- TABLE 61 North America Solution Market by Country, 2023 - 2030, USD Million

- TABLE 62 North America Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 63 North America Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 64 North America Firewall Market by Country, 2019 - 2022, USD Million

- TABLE 65 North America Firewall Market by Country, 2023 - 2030, USD Million

- TABLE 66 North America Identity & Access Management Market by Country, 2019 - 2022, USD Million

- TABLE 67 North America Identity & Access Management Market by Country, 2023 - 2030, USD Million

- TABLE 68 North America Encryption Market by Country, 2019 - 2022, USD Million

- TABLE 69 North America Encryption Market by Country, 2023 - 2030, USD Million

- TABLE 70 North America Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2019 - 2022, USD Million

- TABLE 71 North America Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2023 - 2030, USD Million

- TABLE 72 North America Unified Threat Solutions Market by Country, 2019 - 2022, USD Million

- TABLE 73 North America Unified Threat Solutions Market by Country, 2023 - 2030, USD Million

- TABLE 74 North America Other Solution Type Market by Country, 2019 - 2022, USD Million

- TABLE 75 North America Other Solution Type Market by Country, 2023 - 2030, USD Million

- TABLE 76 North America Services Market by Country, 2019 - 2022, USD Million

- TABLE 77 North America Services Market by Country, 2023 - 2030, USD Million

- TABLE 78 North America Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 79 North America Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 80 North America Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 81 North America Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 82 North America Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 83 North America Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 84 North America Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 85 North America Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 86 North America On premise Market by Country, 2019 - 2022, USD Million

- TABLE 87 North America On premise Market by Country, 2023 - 2030, USD Million

- TABLE 88 North America Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 89 North America Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 90 North America Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 91 North America Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 92 North America BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 93 North America BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 94 North America Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 95 North America Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 96 North America IT & Telecom Market by Country, 2019 - 2022, USD Million

- TABLE 97 North America IT & Telecom Market by Country, 2023 - 2030, USD Million

- TABLE 98 North America Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 99 North America Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 100 North America Retail Market by Country, 2019 - 2022, USD Million

- TABLE 101 North America Retail Market by Country, 2023 - 2030, USD Million

- TABLE 102 North America Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 103 North America Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 104 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 105 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 106 North America Wireless Network Security Market by Country, 2019 - 2022, USD Million

- TABLE 107 North America Wireless Network Security Market by Country, 2023 - 2030, USD Million

- TABLE 108 US Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 109 US Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 110 US Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 111 US Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 112 US Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 113 US Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 114 US Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 115 US Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 116 US Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 117 US Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 118 US Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 119 US Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 120 Canada Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 121 Canada Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 122 Canada Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 123 Canada Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 124 Canada Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 125 Canada Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 126 Canada Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 127 Canada Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 128 Canada Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 129 Canada Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 130 Canada Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 131 Canada Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 132 Mexico Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 133 Mexico Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 134 Mexico Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 135 Mexico Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 136 Mexico Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 137 Mexico Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 138 Mexico Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 139 Mexico Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 140 Mexico Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 141 Mexico Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 142 Mexico Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 143 Mexico Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 144 Rest of North America Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 145 Rest of North America Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 146 Rest of North America Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 147 Rest of North America Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 148 Rest of North America Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 149 Rest of North America Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 150 Rest of North America Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 151 Rest of North America Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 152 Rest of North America Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 153 Rest of North America Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 154 Rest of North America Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 155 Rest of North America Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 156 Europe Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 157 Europe Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 158 Europe Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 159 Europe Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 160 Europe Solution Market by Country, 2019 - 2022, USD Million

- TABLE 161 Europe Solution Market by Country, 2023 - 2030, USD Million

- TABLE 162 Europe Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 163 Europe Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 164 Europe Firewall Market by Country, 2019 - 2022, USD Million

- TABLE 165 Europe Firewall Market by Country, 2023 - 2030, USD Million

- TABLE 166 Europe Identity & Access Management Market by Country, 2019 - 2022, USD Million

- TABLE 167 Europe Identity & Access Management Market by Country, 2023 - 2030, USD Million

- TABLE 168 Europe Encryption Market by Country, 2019 - 2022, USD Million

- TABLE 169 Europe Encryption Market by Country, 2023 - 2030, USD Million

- TABLE 170 Europe Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2019 - 2022, USD Million

- TABLE 171 Europe Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2023 - 2030, USD Million

- TABLE 172 Europe Unified Threat Solutions Market by Country, 2019 - 2022, USD Million

- TABLE 173 Europe Unified Threat Solutions Market by Country, 2023 - 2030, USD Million

- TABLE 174 Europe Other Solution Type Market by Country, 2019 - 2022, USD Million

- TABLE 175 Europe Other Solution Type Market by Country, 2023 - 2030, USD Million

- TABLE 176 Europe Services Market by Country, 2019 - 2022, USD Million

- TABLE 177 Europe Services Market by Country, 2023 - 2030, USD Million

- TABLE 178 Europe Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 179 Europe Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 180 Europe Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 181 Europe Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 182 Europe Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 183 Europe Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 184 Europe Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 185 Europe Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 186 Europe On premise Market by Country, 2019 - 2022, USD Million

- TABLE 187 Europe On premise Market by Country, 2023 - 2030, USD Million

- TABLE 188 Europe Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 189 Europe Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 190 Europe Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 191 Europe Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 192 Europe BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 193 Europe BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 194 Europe Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 195 Europe Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 196 Europe IT & Telecom Market by Country, 2019 - 2022, USD Million

- TABLE 197 Europe IT & Telecom Market by Country, 2023 - 2030, USD Million

- TABLE 198 Europe Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 199 Europe Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 200 Europe Retail Market by Country, 2019 - 2022, USD Million

- TABLE 201 Europe Retail Market by Country, 2023 - 2030, USD Million

- TABLE 202 Europe Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 203 Europe Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 204 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 205 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 206 Europe Wireless Network Security Market by Country, 2019 - 2022, USD Million

- TABLE 207 Europe Wireless Network Security Market by Country, 2023 - 2030, USD Million

- TABLE 208 Germany Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 209 Germany Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 210 Germany Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 211 Germany Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 212 Germany Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 213 Germany Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 214 Germany Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 215 Germany Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 216 Germany Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 217 Germany Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 218 Germany Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 219 Germany Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 220 UK Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 221 UK Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 222 UK Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 223 UK Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 224 UK Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 225 UK Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 226 UK Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 227 UK Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 228 UK Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 229 UK Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 230 UK Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 231 UK Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 232 France Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 233 France Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 234 France Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 235 France Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 236 France Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 237 France Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 238 France Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 239 France Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 240 France Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 241 France Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 242 France Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 243 France Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 244 Russia Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 245 Russia Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 246 Russia Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 247 Russia Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 248 Russia Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 249 Russia Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 250 Russia Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 251 Russia Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 252 Russia Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 253 Russia Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 254 Russia Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 255 Russia Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 256 Spain Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 257 Spain Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 258 Spain Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 259 Spain Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 260 Spain Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 261 Spain Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 262 Spain Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 263 Spain Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 264 Spain Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 265 Spain Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 266 Spain Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 267 Spain Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 268 Italy Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 269 Italy Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 270 Italy Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 271 Italy Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 272 Italy Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 273 Italy Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 274 Italy Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 275 Italy Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 276 Italy Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 277 Italy Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 278 Italy Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 279 Italy Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 280 Rest of Europe Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 281 Rest of Europe Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 282 Rest of Europe Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 283 Rest of Europe Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 284 Rest of Europe Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 285 Rest of Europe Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 286 Rest of Europe Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 287 Rest of Europe Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 288 Rest of Europe Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 289 Rest of Europe Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 290 Rest of Europe Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 291 Rest of Europe Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 292 Asia Pacific Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 293 Asia Pacific Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 294 Asia Pacific Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 295 Asia Pacific Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 296 Asia Pacific Solution Market by Country, 2019 - 2022, USD Million

- TABLE 297 Asia Pacific Solution Market by Country, 2023 - 2030, USD Million

- TABLE 298 Asia Pacific Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 299 Asia Pacific Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 300 Asia Pacific Firewall Market by Country, 2019 - 2022, USD Million

- TABLE 301 Asia Pacific Firewall Market by Country, 2023 - 2030, USD Million

- TABLE 302 Asia Pacific Identity & Access Management Market by Country, 2019 - 2022, USD Million

- TABLE 303 Asia Pacific Identity & Access Management Market by Country, 2023 - 2030, USD Million

- TABLE 304 Asia Pacific Encryption Market by Country, 2019 - 2022, USD Million

- TABLE 305 Asia Pacific Encryption Market by Country, 2023 - 2030, USD Million

- TABLE 306 Asia Pacific Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2019 - 2022, USD Million

- TABLE 307 Asia Pacific Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2023 - 2030, USD Million

- TABLE 308 Asia Pacific Unified Threat Solutions Market by Country, 2019 - 2022, USD Million

- TABLE 309 Asia Pacific Unified Threat Solutions Market by Country, 2023 - 2030, USD Million

- TABLE 310 Asia Pacific Other Solution Type Market by Country, 2019 - 2022, USD Million

- TABLE 311 Asia Pacific Other Solution Type Market by Country, 2023 - 2030, USD Million

- TABLE 312 Asia Pacific Services Market by Country, 2019 - 2022, USD Million

- TABLE 313 Asia Pacific Services Market by Country, 2023 - 2030, USD Million

- TABLE 314 Asia Pacific Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 315 Asia Pacific Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 316 Asia Pacific Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 317 Asia Pacific Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 318 Asia Pacific Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 319 Asia Pacific Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 320 Asia Pacific Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 321 Asia Pacific Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 322 Asia Pacific On premise Market by Country, 2019 - 2022, USD Million

- TABLE 323 Asia Pacific On premise Market by Country, 2023 - 2030, USD Million

- TABLE 324 Asia Pacific Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 325 Asia Pacific Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 326 Asia Pacific Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 327 Asia Pacific Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 328 Asia Pacific BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 329 Asia Pacific BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 330 Asia Pacific Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 331 Asia Pacific Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 332 Asia Pacific IT & Telecom Market by Country, 2019 - 2022, USD Million

- TABLE 333 Asia Pacific IT & Telecom Market by Country, 2023 - 2030, USD Million

- TABLE 334 Asia Pacific Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 335 Asia Pacific Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 336 Asia Pacific Retail Market by Country, 2019 - 2022, USD Million

- TABLE 337 Asia Pacific Retail Market by Country, 2023 - 2030, USD Million

- TABLE 338 Asia Pacific Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 339 Asia Pacific Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 340 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 341 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

- TABLE 342 Asia Pacific Wireless Network Security Market by Country, 2019 - 2022, USD Million

- TABLE 343 Asia Pacific Wireless Network Security Market by Country, 2023 - 2030, USD Million

- TABLE 344 China Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 345 China Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 346 China Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 347 China Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 348 China Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 349 China Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 350 China Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 351 China Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 352 China Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 353 China Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 354 China Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 355 China Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 356 Japan Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 357 Japan Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 358 Japan Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 359 Japan Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 360 Japan Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 361 Japan Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 362 Japan Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 363 Japan Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 364 Japan Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 365 Japan Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 366 Japan Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 367 Japan Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 368 India Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 369 India Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 370 India Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 371 India Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 372 India Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 373 India Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 374 India Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 375 India Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 376 India Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 377 India Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 378 India Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 379 India Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 380 South Korea Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 381 South Korea Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 382 South Korea Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 383 South Korea Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 384 South Korea Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 385 South Korea Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 386 South Korea Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 387 South Korea Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 388 South Korea Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 389 South Korea Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 390 South Korea Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 391 South Korea Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 392 Singapore Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 393 Singapore Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 394 Singapore Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 395 Singapore Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 396 Singapore Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 397 Singapore Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 398 Singapore Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 399 Singapore Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 400 Singapore Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 401 Singapore Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 402 Singapore Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 403 Singapore Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 404 Malaysia Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 405 Malaysia Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 406 Malaysia Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 407 Malaysia Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 408 Malaysia Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 409 Malaysia Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 410 Malaysia Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 411 Malaysia Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 412 Malaysia Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 413 Malaysia Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 414 Malaysia Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 415 Malaysia Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 416 Rest of Asia Pacific Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 417 Rest of Asia Pacific Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 418 Rest of Asia Pacific Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 419 Rest of Asia Pacific Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 420 Rest of Asia Pacific Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 421 Rest of Asia Pacific Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 422 Rest of Asia Pacific Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 423 Rest of Asia Pacific Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 424 Rest of Asia Pacific Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 425 Rest of Asia Pacific Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 426 Rest of Asia Pacific Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 427 Rest of Asia Pacific Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 428 LAMEA Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 429 LAMEA Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 430 LAMEA Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 431 LAMEA Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 432 LAMEA Solution Market by Country, 2019 - 2022, USD Million

- TABLE 433 LAMEA Solution Market by Country, 2023 - 2030, USD Million

- TABLE 434 LAMEA Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 435 LAMEA Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 436 LAMEA Firewall Market by Country, 2019 - 2022, USD Million

- TABLE 437 LAMEA Firewall Market by Country, 2023 - 2030, USD Million

- TABLE 438 LAMEA Identity & Access Management Market by Country, 2019 - 2022, USD Million

- TABLE 439 LAMEA Identity & Access Management Market by Country, 2023 - 2030, USD Million

- TABLE 440 LAMEA Encryption Market by Country, 2019 - 2022, USD Million

- TABLE 441 LAMEA Encryption Market by Country, 2023 - 2030, USD Million

- TABLE 442 LAMEA Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2019 - 2022, USD Million

- TABLE 443 LAMEA Intrusion Prevention System (IPS)/Intrusion Detection System (IDS) Market by Country, 2023 - 2030, USD Million

- TABLE 444 LAMEA Unified Threat Solutions Market by Country, 2019 - 2022, USD Million

- TABLE 445 LAMEA Unified Threat Solutions Market by Country, 2023 - 2030, USD Million

- TABLE 446 LAMEA Other Solution Type Market by Country, 2019 - 2022, USD Million

- TABLE 447 LAMEA Other Solution Type Market by Country, 2023 - 2030, USD Million

- TABLE 448 LAMEA Services Market by Country, 2019 - 2022, USD Million

- TABLE 449 LAMEA Services Market by Country, 2023 - 2030, USD Million

- TABLE 450 LAMEA Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 451 LAMEA Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 452 LAMEA Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 453 LAMEA Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 454 LAMEA Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 455 LAMEA Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 456 LAMEA Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 457 LAMEA Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 458 LAMEA On premise Market by Country, 2019 - 2022, USD Million

- TABLE 459 LAMEA On premise Market by Country, 2023 - 2030, USD Million

- TABLE 460 LAMEA Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 461 LAMEA Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 462 LAMEA Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 463 LAMEA Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 464 LAMEA BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 465 LAMEA BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 466 LAMEA Government & Defense Market by Country, 2019 - 2022, USD Million

- TABLE 467 LAMEA Government & Defense Market by Country, 2023 - 2030, USD Million

- TABLE 468 LAMEA IT & Telecom Market by Country, 2019 - 2022, USD Million

- TABLE 469 LAMEA IT & Telecom Market by Country, 2023 - 2030, USD Million

- TABLE 470 LAMEA Healthcare & Lifesciences Market by Country, 2019 - 2022, USD Million

- TABLE 471 LAMEA Healthcare & Lifesciences Market by Country, 2023 - 2030, USD Million

- TABLE 472 LAMEA Retail Market by Country, 2019 - 2022, USD Million

- TABLE 473 LAMEA Retail Market by Country, 2023 - 2030, USD Million

- TABLE 474 LAMEA Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 475 LAMEA Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 476 LAMEA Others Market by Country, 2019 - 2022, USD Million

- TABLE 477 LAMEA Others Market by Country, 2023 - 2030, USD Million

- TABLE 478 LAMEA Wireless Network Security Market by Country, 2019 - 2022, USD Million

- TABLE 479 LAMEA Wireless Network Security Market by Country, 2023 - 2030, USD Million

- TABLE 480 Brazil Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 481 Brazil Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 482 Brazil Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 483 Brazil Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 484 Brazil Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 485 Brazil Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 486 Brazil Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 487 Brazil Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 488 Brazil Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 489 Brazil Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 490 Brazil Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 491 Brazil Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 492 Argentina Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 493 Argentina Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 494 Argentina Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 495 Argentina Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 496 Argentina Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 497 Argentina Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 498 Argentina Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 499 Argentina Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 500 Argentina Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 501 Argentina Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 502 Argentina Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 503 Argentina Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 504 UAE Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 505 UAE Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 506 UAE Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 507 UAE Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 508 UAE Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 509 UAE Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 510 UAE Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 511 UAE Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 512 UAE Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 513 UAE Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 514 UAE Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 515 UAE Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 516 Saudi Arabia Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 517 Saudi Arabia Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 518 Saudi Arabia Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 519 Saudi Arabia Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 520 Saudi Arabia Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 521 Saudi Arabia Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 522 Saudi Arabia Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 523 Saudi Arabia Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 524 Saudi Arabia Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 525 Saudi Arabia Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 526 Saudi Arabia Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 527 Saudi Arabia Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 528 South Africa Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 529 South Africa Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 530 South Africa Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 531 South Africa Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 532 South Africa Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 533 South Africa Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 534 South Africa Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 535 South Africa Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 536 South Africa Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 537 South Africa Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 538 South Africa Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 539 South Africa Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 540 Nigeria Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 541 Nigeria Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 542 Nigeria Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 543 Nigeria Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 544 Nigeria Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 545 Nigeria Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 546 Nigeria Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 547 Nigeria Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 548 Nigeria Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 549 Nigeria Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 550 Nigeria Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 551 Nigeria Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 552 Rest of LAMEA Wireless Network Security Market, 2019 - 2022, USD Million

- TABLE 553 Rest of LAMEA Wireless Network Security Market, 2023 - 2030, USD Million

- TABLE 554 Rest of LAMEA Wireless Network Security Market by Component, 2019 - 2022, USD Million

- TABLE 555 Rest of LAMEA Wireless Network Security Market by Component, 2023 - 2030, USD Million

- TABLE 556 Rest of LAMEA Wireless Network Security Market by Solution Type, 2019 - 2022, USD Million

- TABLE 557 Rest of LAMEA Wireless Network Security Market by Solution Type, 2023 - 2030, USD Million

- TABLE 558 Rest of LAMEA Wireless Network Security Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 559 Rest of LAMEA Wireless Network Security Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 560 Rest of LAMEA Wireless Network Security Market by Deployment Type, 2019 - 2022, USD Million

- TABLE 561 Rest of LAMEA Wireless Network Security Market by Deployment Type, 2023 - 2030, USD Million

- TABLE 562 Rest of LAMEA Wireless Network Security Market by End-use, 2019 - 2022, USD Million

- TABLE 563 Rest of LAMEA Wireless Network Security Market by End-use, 2023 - 2030, USD Million

- TABLE 564 Key Information - Check Point Software Technologies Ltd.

- TABLE 565 Key Information - Aruba Networks

- TABLE 566 Key Information - Kaspersky Lab

- TABLE 567 Key Information - Cisco Systems, Inc.

- TABLE 568 Key Information - Fortinet, Inc.

- TABLE 569 Key Information - Juniper Networks, Inc.

- TABLE 570 Key Information - Motorola Solutions, Inc.

- TABLE 571 Key Information - Sophos Group PLC

- TABLE 572 Key Information - Broadcom, Inc.

- TABLE 573 Key Information - Trend Micro, Inc.

List of Figures

- FIG 1 Methodology for the research

- FIG 2 Global Wireless Network Security Market, 2019 - 2030, USD Million

- FIG 3 Key Factors Impacting Wireless Network Security Market

- FIG 4 KBV Cardinal Matrix

- FIG 5 Market Share Analysis, 2021

- FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

- FIG 7 Key Strategic Move: (Partnerships, Collaborations and Agreements: 2021, Jul - 2023, Jun) Leading Players

- FIG 8 Porter's Five Forces Analysis - Wireless Network Security Market

- FIG 9 Global Wireless Network Security Market share by Component, 2022

- FIG 10 Global Wireless Network Security Market share by Component, 2030

- FIG 11 Global Wireless Network Security Market by Component, 2019 - 2030, USD Million

- FIG 12 Global Wireless Network Security Market share by Enterprise Size, 2022

- FIG 13 Global Wireless Network Security Market share by Enterprise Size, 2030

- FIG 14 Global Wireless Network Security Market by Enterprise Size, 2019 - 2030, USD Million

- FIG 15 Global Wireless Network Security Market share by Deployment Type, 2022

- FIG 16 Global Wireless Network Security Market share by Deployment Type, 2030

- FIG 17 Global Wireless Network Security Market by Deployment Type, 2019 - 2030, USD Million

- FIG 18 Global Wireless Network Security Market share by End-use, 2022

- FIG 19 Global Wireless Network Security Market share by End-use, 2030

- FIG 20 Global Wireless Network Security Market by End-use, 2019 - 2030, USD Million

- FIG 21 Global Wireless Network Security Market share by Region, 2022

- FIG 22 Global Wireless Network Security Market share by Region, 2030

- FIG 23 Global Wireless Network Security Market by Region, 2019 - 2030, USD Million

- FIG 24 SWOT Analysis: Check Point Software Technologies Ltd.

- FIG 25 Recent strategies and developments: Aruba Networks

- FIG 26 SWOT Analysis: Aruba Networks

- FIG 27 SWOT Analysis: Kaspersky Lab

- FIG 28 Recent strategies and developments: Cisco Systems, Inc.

- FIG 29 SWOT Analysis: Cisco Systems, Inc.

- FIG 30 Recent strategies and developments: Fortinet, Inc.

- FIG 31 SWOT Analysis: Fortinet, Inc.

- FIG 32 Recent strategies and developments: Juniper Networks, Inc.

- FIG 33 SWOT Analysis: Juniper Networks, Inc.

- FIG 34 SWOT Analysis: Motorola Solutions, Inc.

- FIG 35 SWOT Analysis: Sophos Group PLC

- FIG 36 SWOT Analysis: Broadcom, Inc.

- FIG 37 SWOT Analysis: Trend Micro Inc.

The Global Wireless Network Security Market size is expected to reach $57.7 billion by 2030, rising at a market growth of 12.8% CAGR during the forecast period.

The usage of digital solutions, connected devices, and IT systems is rising due to global technological improvement. Many businesses use software to handle and keep sensitive data in the cloud. The encryption segment acquired $3,029.4 million revenue in 2022 as the organizations employ encryption software to safeguard data transfers from one remote location and overcome the risk of cyber-attacks. The fundamental objective of encryption software is to improve data security from unauthorized users.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2022, Aruba, a Hewlett Packard Enterprise company formed a partnership with Siemens to support clients by providing customers with data networks that are highly dependable, secure, and insightful, ensuring high plant and network availability. Additionally, In February, 2023, Juniper Networks expanded its partnership with IBM to empower communications service providers (CSPs) in the delivery improved experience to mobile users through advanced automation.

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. and Broadcom, Inc. are the forerunners in the Market. In February, 2023, Cisco entered into collaboration with STC for accelerating the rollout of the newest wave of safe, nimble digital services. Companies such as Aruba Networks, Motorola Solutions, Inc., Fortinet, Inc. are some of the key innovators in the Market.

Market Growth Factors

IoT usage in smart homes is expanding

Customers who buy wireless security camera systems can use their smartphones and tablets to remotely access safety, security, video, audio, and alarm systems. The device also contains a wide-angle lens, night vision, and two-way audio. Several aspects of everyday life in the home, such as pet feeding and lighting control, are intended to be automated via the Internet of Things. Options are available for the camera's hardware and software. The security camera will immediately identify any breach or intrusion within the home. There are numerous varieties of security cameras. The cameras' in-built light sensors aid in both accident and intruder prevention. With this wide adoption of smart home appliances, risk of security arises which open growth prospects for the market.

Retail is anticipated to contribute significantly to market growth

In the past few years, the retail sector has expanded substantially due to the rapid globalization of the e-commerce sector. Therefore, to acquire a competitive edge, retailers are implementing IoT solutions to boost operational effectiveness and improve the consumer experience. The demand for wireless security is anticipated to rise during the expected time frame due to the growing use of IoT in the retail sector. Many European stores are installing small, programmable IoT-connected dashboards or buttons to collect client input and use the results to improve customer experiences. The market is projected to develop as more retailers adopt IoT technologies.

Market Restraining Factors

Low security budgets by businesses may impact the market

Almost all businesses struggle to deal with threats and lack real data security. Despite this, businesses continue to neglect network security solutions. Additionally, these solutions have a high initial setup cost and requires ongoing maintenance, which is predicted to delay its acceptance for a short while. Small & medium businesses can implement cost-effective security solutions depending on their requirements and company operations, despite the high cost of solutions and rising instances of assaults. Due to a lack of adequate IT security infrastructures caused by their lower financial capacity, these businesses slowly implement new technologies and enterprise security solutions. Small enterprises must properly manage budget funds set aside for various operational issues and business continuity planning, diverting attention away from adopting wireless network security solutions.

Component Outlook

On the basis of component, the market is segmented into solution, and services. The services segment acquired a substantial revenue share in the market in 2022. The significant rise of the segment may be attributable to the increase in end-user companies' desire for managed & professional services to deploy, upgrade, and maintain wireless network security systems at the lowest possible cost. Advanced investigating, advising, routine maintenance, cloud migration, network administration, and unified communications are some of the service's primary strengths.

Solution Outlook

Under solution type, the market is further divided into encryption, firewall, identity & access management, Intrusion Prevention System (IPS)/Intrusion Detection System (IDS), united threat solutions, and others. The united threat solution segment covered a considerable revenue share in the market in 2022. United threat solution provides solutions to threats and is considered an improvement over the conventional firewall in a security product capable of carrying out many different security tasks, including content filtering, load balancing, network firewalling, data leak prevention, and network hacking prevention.

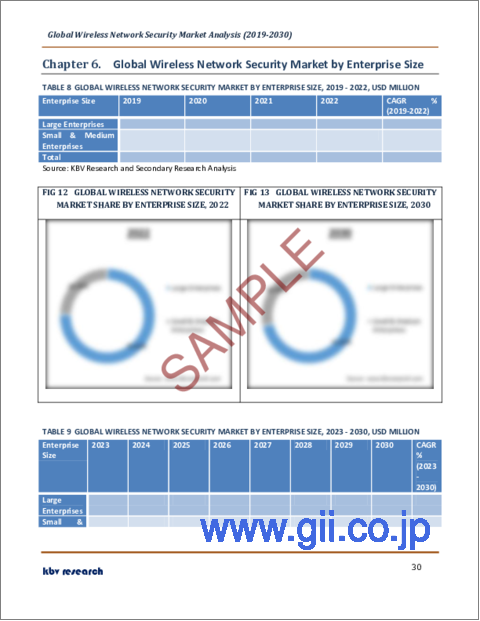

Enterprise Size Outlook

On the basis of enterprise size, the market is categorised into large enterprises, and small and medium-sized enterprises. In 2022, the large enterprise segment registered the highest revenue share in the market. The wireless network is a target for several cyberattacks, data breaches, and other harmful acts against large businesses. These businesses may suffer large financial losses because of data theft. In order to prevent this, the majority of large enterprises utilize wireless network security solutions to safeguard their sensitive data & control data transfer via a variety of devices, hence encouraging the segment's expansion.

Deployment Type Outlook

Based on deployment type, the market is classified into cloud, and on-premises. The cloud segment garnered a significant revenue share in the market in 2022. Due to numerous benefits, including low maintenance costs, increased flexibility, centralized data protection, and rapid application development, cloud-based wireless network security solutions are expanding significantly. Eliminating extra software or hardware requirements for managing wireless network security solutions with cloud-based solutions creates a bright outlook for the segment's growth.

End-use Outlook

By end-use, the market is segmented into BFSI, retail, IT & telecom, healthcare, manufacturing, government & defense, and others. The retail segment projected a prominent revenue share in the market in 2022. The enormous development of the global e-commerce business is impacting the retail sector. As a result, retailers use IoT solutions to boost operational effectiveness and customer satisfaction to gain a competitive advantage. During the forecast period, the retail sector will likely use the Internet of Things more frequently, which will likely lead to a boost in demand for wireless security.

Regional Outlook

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating highest revenue share. The growing acceptance of the BYOD concept, increased security breaches, and the presence of experienced market players are driving factors in the North American market. Additionally, numerous end-user businesses from numerous industries, including BFSI, retail, and healthcare, are investing in cybersecurity to safeguard their corporate data from growing digital threats in this region, favourably impacting the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Check Point Software Technologies Ltd., Aruba Networks (Hewlett Packard Enterprise Company), Kaspersky Lab, Cisco Systems, Inc., Fortinet, Inc., Juniper Networks, Inc., Motorola Solutions, Inc., Sophos Group PLC (Thoma Bravo), Broadcom, Inc. (Symantec Corporation) and Trend Micro Inc.

Recent Strategies Deployed in Wireless Network Security Market

Partnerships, Collaboration and Agreements:

Jun-2023: Check Point Software Technologies Ltd. formed a partnership with TELUS, a Canadian multinational publicly traded holding company. With this partnership, the company aimed to combine its advanced technological capabilities with TELUS' expertise in managed security services, to release TELUS Cloud Security Posture Management (CSPM) service in Canada.

Jun-2023: Check Point Software Technologies Ltd. joined hands with Everphone, a leading provider of Device as a Service (DaaS). The collaboration aimed to help defend enterprises from increasing cyber risks by combining Everphone's DaaS solution with Harmony Mobile's strong protection.

Feb-2023: Cisco entered into collaboration with STC, which offers a variety of ICT solutions and digital services. Through this partnership, our Telco Cloud solution will help in accelerating the rollout of the newest wave of safe, nimble digital services.

Feb-2023: Juniper Networks expanded its partnership with IBM, a technological corporation, to provide an integrated RAN management platform. With this expansion of the partnership, integrating IBM's network automation offerings with Juniper's Radio Access Network (RAN)optimization and Open Radio Access Network (O-RAN) technology power develop an integrated RAN management platform that would be helpful for IBM to empower communications service providers (CSPs) in the delivery improved experience to mobile users through advanced automation.

Nov-2022: Check Point Software Technologies Ltd. teamed up with Network Perception, innovators of operational technology (OT) solutions. The company will integrate security technologies and offers a solution to verify access to ports and services across different trust zones to protect mission-critical assets.

Oct-2022: Aruba, a Hewlett Packard Enterprise company formed a partnership with Siemens, a technology company focused on the digital transformation of industry and infrastructure. The company aimed to support clients by providing customers with data networks that are highly dependable, secure, and insightful, ensuring high plant and network availability. Based on Siemens' experience as a leading supplier of industrial Ethernet network components and Aruba's knowledge as a leader in wired and wireless LAN infrastructure, customers benefit from integrated networks with proven interoperability from factory floors to corporate offices.

Oct-2022: Cisco formed a partnership with the University of Canberra. The partnership would enable the company to boost the adoption of technology and address major risks to the Australian economy and society by addressing the cybersecurity skills shortage.

Aug-2022: Fortinet, Inc. announced a partnership with NEC Corporation, a Japanese IT company, to develop solutions for secure 5G networks. The partnership would allow Fortinet to serve its customers in a better way by providing them with solutions for secure 5G adoption.

Feb-2022: Check Point Software Technologies partnered with Redington India Limited, the largest IT software and products distributor in India. The company would offer Enterprise-grade security to SMB customers with an easy-to-manage, deploy, and affordable solution.

Nov-2021: Fortinet collaborated with Microsoft, an American multinational technology corporation. With this collaboration, the company aimed to integrate Microsoft Azure Virtual WAN to deliver a next-generation firewall (NGFW) and enhance its ability to secure any application on any cloud and to secure the cloud on-ramp into, between, and within the cloud.

Jul-2021: Trend Micro Incorporated teamed up with Microsoft, an America-based multinational technology corporation. Together, the companies focused to offer greater impact in cybersecurity for the combined customers that allows digital transformation for them by using Trend Micro's expansive security expertise and Azure's cloud computing platform. Moreover, the companies aimed to develop cloud-based cybersecurity solutions on Microsoft Azure as well as give rise to co-selling opportunities.

Product Launch and Product Expansions:

Feb-2023: Cisco launched two new services in its cloud managing network including Cisco Cyber Vision and Secure Equipment Access Plus. The launch of these two new solutions is aimed to provide organizations with the tools necessary for a unified, cloud-delivered strategy that leverages the strength of the enterprise IT network to scale and secure the industrial edge thanks to these new advances.

Feb-2023: Fortinet, Inc. unveiled FortiSP5, a distributed edge security solution. The FortiSP5 features Secure boot, Volumetric DDoS protection, and VXLAN/GRE hardware-accelerated encapsulation. Furthermore, FortiSP5 can be used for five applications namely, Campus, Edge Compute, 5G, and Operational Technology.

Feb-2022: Juniper Networks, Inc. introduced Juniper Secure Edge, a Firewall service used for securing workforces. The benefits of the service include Validated security effectiveness, Dynamic Zero Trust segmentation, Unified policy management, and Secure user access from anywhere.

May-2021: Aruba, a Hewlett Packard Enterprise company, unveiled Wi-Fi 6E, the 630 Series of campus access points (APs). The new product uses the 6 GHz band. The amount of RF spectrum available for Wi-Fi use more than doubles with the opening of the 6 GHz band, allowing for less crowded airwaves, bigger channels, and faster connections as well as enabling a variety of advances across industries.

Acquisitions and Merger:

Dec-2022: Motorola Solutions acquired Rave Mobile Safety, a leader in mass notification and incident management. The acquisition of Rave complements the portfolio of the company with a platform specifically designed to help individuals, businesses, and public safety agencies work together in more powerful ways.

Feb-2022: Juniper Networks, Inc. completed the acquisition of WiteSand, a Zero Trust Network Access solutions provider. The acquisition complements Juniper's enterprise portfolio. Furthermore, the acquisition brings with it Network Access Control solutions that would benefit Juniper.

Scope of the Study

Market Segments covered in the Report:

By Component

- Solution

- Firewall

- Identity & Access Management

- Encryption

- Intrusion Prevention System (IPS)/Intrusion Detection System (IDS)

- Unified Threat Solutions

- Others

- Services

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Deployment Type

- On premise

- Cloud

By End-use

- BFSI

- Government & Defense

- IT & Telecom

- Healthcare & Lifesciences

- Retail

- Manufacturing

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Check Point Software Technologies Ltd.

- Aruba Networks (Hewlett Packard Enterprise Company)

- Kaspersky Lab

- Cisco Systems, Inc.

- Fortinet, Inc.

- Juniper Networks, Inc.

- Motorola Solutions, Inc.

- Sophos Group PLC (Thoma Bravo)

- Broadcom, Inc. (Symantec Corporation)

- Trend Micro Inc.

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Wireless Network Security Market, by Component

- 1.4.2 Global Wireless Network Security Market, by Enterprise Size

- 1.4.3 Global Wireless Network Security Market, by Deployment Type

- 1.4.4 Global Wireless Network Security Market, by End-use