|

|

市場調査レポート

商品コード

1309712

ネットワークアクセス制御の世界市場規模、シェア、産業動向分析レポート:展開別、提供別、企業規模別(大企業、中小企業)、業界別、地域別展望と予測、2023年~2030年Global Network Access Control Market Size, Share & Industry Trends Analysis Report By Deployment, By Offering, By Enterprise Size (Large Enterprises, and Small & Medium Enterprises), By Vertical, By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| ネットワークアクセス制御の世界市場規模、シェア、産業動向分析レポート:展開別、提供別、企業規模別(大企業、中小企業)、業界別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年06月30日

発行: KBV Research

ページ情報: 英文 304 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

ネットワークアクセス制御市場規模は2030年までに140億米ドルに達すると予測され、予測期間中のCAGRは25.3%で上昇する見込みです。

KBVカーディナルマトリックスに示された分析によると、Microsoft Corporationが同市場における主要な先駆者です。2021年7月、Microsoft Corporationは米国を拠点とする特権アクセスソリューションプロバイダーCloudKnoxの買収を発表しました。この買収は、自動修復ときめ細かな可視性を提供することで、Microsoft Azureを強化します。Cisco Systems, Inc Broadcom, Inc., Huawei Technologies Co., Ltd.などは、この市場における主要なイノベーターです。

市場成長要因

高度な仮想セキュリティ・ソリューションに対する需要の高まり

企業、銀行、データセンター、金融機関は、重要なデータを保存・更新するためのネットワークアクセス制御ソリューションに対する需要をリードし続けています。驚くほど高いサイバー犯罪率や地政学的不安の高まりが、ネットワーク・セキュリティの不備や不正侵入の増加に拍車をかけており、ネットワークアクセス制御を重要なコンポーネントとする効果的なセキュリティ・ソリューションの導入が必要となっています。多数の企業ネットワークが保護された境界の外まで到達しようと競い合っているため、ネットワークアクセス制御システムへの投資は予測期間中に着実に増加すると思われます。このため、同市場は今後数年間で成長すると予測されます。

サイバーセキュリティ脅威のリスク増大

各国政府は、サイバーセキュリティのリスクやデータ漏洩に対応するため、機密データや個人データを保護するためのより強力な法律を制定しています。カリフォルニア州消費者プライバシー法(CCPA)や一般データ保護規則(GDPR)のようなデータ保護とアクセス制御の規制は、厳格な基準を課しています。アクセス・ルールの実施、監査証跡の保存、ネットワーク活動への洞察の提供を通じて、NACソリューションは企業がこれらのコンプライアンス要件を満たすのを支援します。これを考慮すると、市場は大きく成長すると推定されます。

市場抑制要因

導入の課題と関連する複雑性

複数のシステム、アプリケーション、プラットフォームで構成される多様なITエコシステムは、組織において一般的です。NACシステムをこれらのさまざまなコンポーネントと統合するのは困難で時間がかかる可能性があります。NACソリューションの展開と統合は、互換性の問題、統合の難しさ、さまざまなテクノロジーやプロバイダー間の相互運用性の欠如によって妨げられる可能性があります。NAC業界には統一された標準がないため、数多くの独自のソリューションや手法が存在します。様々なベンダーや様々な環境におけるNACシステムの採用は、この標準化の欠如と相互運用性の問題を引き起こす可能性によって妨げられる可能性があります。この制約を克服するには、標準化努力と業界連携が必要です。

オファリングの展望

オファリング別に見ると、市場はハードウェア、ソフトウェア、サービスに区分されます。2022年の市場では、サービス分野が大きな収益シェアを獲得しました。展開、メンテナンス、顧客サポート、トレーニング、アドバイザリーサービスはすべてネットワークアクセス制御サービスの範囲に含まれます。同分野の成長を促進すると予想される主な要因は、これらのソリューション、デバイス、インフラストラクチャに対する需要の増加であり、ライセンス更新、サポート&メンテナンス、顧客サポート要件の継続的な必要性により、サービス分野が長期的に維持されると予想されます。

展開の展望

デプロイメントに基づき、市場はオンプレミスとクラウドに細分化されます。2022年には、クラウドセグメントが市場で最大の売上シェアを占める。サブスクリプションモデルは、クラウドベースのネットワークアクセス制御を定義する主な方法です。これにより、企業はクラウドインフラストラクチャが提供する最先端のネットワークセキュリティサービスを利用し、アクセスすることができます。利用状況、需要、購買力に基づき、ネットワーク・セキュリティを監視・保証するための手頃で適応性の高い方法を企業に提供します。

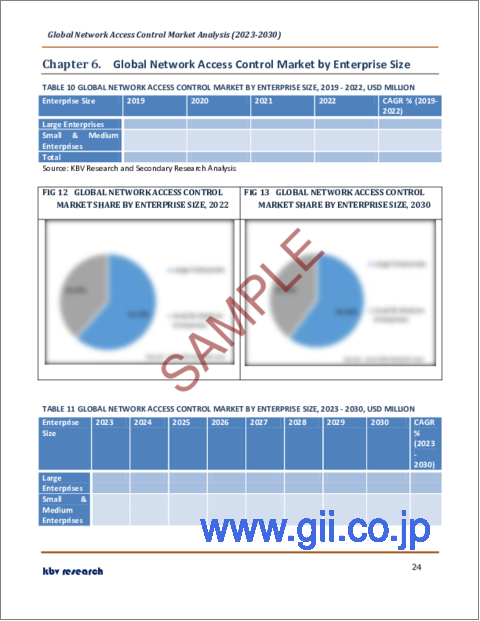

企業規模の見通し

企業規模別に見ると、市場は大企業と中小企業に二分されます。2022年には、大企業セグメントが最大の収益シェアで市場を独占しました。サイバー犯罪者が銀行や金融機関、IT企業、ヘルスケア機関、政府機関などの大企業に引き寄せられる主な要因は、テクノロジーの急速な導入、リモートワーク文化、接続デバイス、データ共有のための安全でないネットワークの導入によって引き起こされるサイバー攻撃、データ盗難、セキュリティ侵害の発生件数の増加です。したがって、企業ネットワークと接続機器のセキュリティを保護することは、大企業にとってますます重要になっています。

業界別展望

業界別では、BFSI、IT&テレコム、小売&eコマース、ヘルスケア&歯科、製造、政府、教育、製造、その他に分類されます。2022年の市場では、IT・通信分野が大きな収益シェアを獲得しました。より多くの消費者データが利用可能になり、より多くの重要データが大規模ネットワーク上で共有され、より多くのデジタル技術が使用され、より多くの接続デバイスが使用されるようになったため、IT・通信分野ではサイバー攻撃やその他のセキュリティ侵害が急増しています。IT・通信分野では、企業の知識向上とセキュリティへの関心の高まりから、こうしたソリューションのニーズも高まると予想されます。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、北米地域が最も高い収益シェアを獲得して市場をリードしました。北米の市場は、政府、ヘルスケア、IT・通信、教育、BFSIなど、いくつかの主要なエンドユースセクターでネットワークセキュリティソリューションのニーズが高まっていることから、拡大が見込まれています。同地域では、サイバー犯罪者やデータ窃盗犯が、大量の個人データや組織データを含む重要な組織ネットワークやデバイスにアクセスするために、以下のような業界を頻繁に標的にしています。これらの要素は、この地域の市場拡大に拍車をかけると予想されます。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

第3章 競合分析- 世界

- KBVカーディナルマトリックス

- 最近の業界全体の戦略的展開

- 提携、協定、および契約

- 製品の発売と製品の拡大

- 買収と合併

- 市場シェア分析、2021年

- 主要成功戦略

- 主な戦略

- 主要な戦略的動き

第4章 世界のネットワークアクセス制御市場:展開別

- 世界のクラウド市場:地域別

- 世界のオンプレミス市場:地域別

第5章 世界のネットワークアクセス制御市場:提供別

- 世界のハードウェア市場:地域別

- 世界のソフトウェア市場:地域別

- 世界サービス市場:地域別

第6章 世界のネットワークアクセス制御市場:企業規模別

- 世界の大企業市場:地域別

- 世界の中小企業市場:地域別

第7章 世界のネットワークアクセス制御市場:業界別

- 世界のBFSI市場:地域別

- 世界のIT・通信市場:地域別

- 世界の小売市場:地域別

- 世界の教育市場:地域別

- 世界のヘルスケアおよび歯科市場:地域別

- 世界のエネルギーおよび公益事業市場:地域別

- 世界の製造業市場:地域別

- 世界の政府市場:地域別

- 世界のその他の市場:地域別

第8章 世界のネットワークアクセス制御市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- シンガポール

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第9章 企業プロファイル

- Cisco Systems, Inc

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- Huawei Technologies Co, Ltd.(Huawei Investment & Holding Co., Ltd.)

- IBM Corporation

- Broadcom, Inc

- VMware, Inc

- Juniper Networks, Inc

- Sophos Group PLC(Thoma Bravo)

- Fortinet, Inc

LIST OF TABLES

- TABLE 1 Global Network Access Control Market, 2019 - 2022, USD Million

- TABLE 2 Global Network Access Control Market, 2023 - 2030, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Network Access Control Market

- TABLE 4 Product Launches And Product Expansions- Network Access Control Market

- TABLE 5 Acquisition and Mergers- Network Access Control Market

- TABLE 6 Global Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 7 Global Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 8 Global Cloud Market by Region, 2019 - 2022, USD Million

- TABLE 9 Global Cloud Market by Region, 2023 - 2030, USD Million

- TABLE 10 Global On-premise Market by Region, 2019 - 2022, USD Million

- TABLE 11 Global On-premise Market by Region, 2023 - 2030, USD Million

- TABLE 12 Global Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 13 Global Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 14 Global Hardware Market by Region, 2019 - 2022, USD Million

- TABLE 15 Global Hardware Market by Region, 2023 - 2030, USD Million

- TABLE 16 Global Software Market by Region, 2019 - 2022, USD Million

- TABLE 17 Global Software Market by Region, 2023 - 2030, USD Million

- TABLE 18 Global Services Market by Region, 2019 - 2022, USD Million

- TABLE 19 Global Services Market by Region, 2023 - 2030, USD Million

- TABLE 20 Global Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 21 Global Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 22 Global Large Enterprises Market by Region, 2019 - 2022, USD Million

- TABLE 23 Global Large Enterprises Market by Region, 2023 - 2030, USD Million

- TABLE 24 Global Small & Medium Enterprises Market by Region, 2019 - 2022, USD Million

- TABLE 25 Global Small & Medium Enterprises Market by Region, 2023 - 2030, USD Million

- TABLE 26 Global Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 27 Global Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 28 Global BFSI Market by Region, 2019 - 2022, USD Million

- TABLE 29 Global BFSI Market by Region, 2023 - 2030, USD Million

- TABLE 30 Global IT & Telecommunication Market by Region, 2019 - 2022, USD Million

- TABLE 31 Global IT & Telecommunication Market by Region, 2023 - 2030, USD Million

- TABLE 32 Global Retail Market by Region, 2019 - 2022, USD Million

- TABLE 33 Global Retail Market by Region, 2023 - 2030, USD Million

- TABLE 34 Global Education Market by Region, 2019 - 2022, USD Million

- TABLE 35 Global Education Market by Region, 2023 - 2030, USD Million

- TABLE 36 Global Healthcare & Dental Market by Region, 2019 - 2022, USD Million

- TABLE 37 Global Healthcare & Dental Market by Region, 2023 - 2030, USD Million

- TABLE 38 Global Energy & Utilities Market by Region, 2019 - 2022, USD Million

- TABLE 39 Global Energy & Utilities Market by Region, 2023 - 2030, USD Million

- TABLE 40 Global Manufacturing Market by Region, 2019 - 2022, USD Million

- TABLE 41 Global Manufacturing Market by Region, 2023 - 2030, USD Million

- TABLE 42 Global Government Market by Region, 2019 - 2022, USD Million

- TABLE 43 Global Government Market by Region, 2023 - 2030, USD Million

- TABLE 44 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 45 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 46 Global Network Access Control Market by Region, 2019 - 2022, USD Million

- TABLE 47 Global Network Access Control Market by Region, 2023 - 2030, USD Million

- TABLE 48 North America Network Access Control Market, 2019 - 2022, USD Million

- TABLE 49 North America Network Access Control Market, 2023 - 2030, USD Million

- TABLE 50 North America Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 51 North America Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 52 North America Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 53 North America Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 54 North America On-premise Market by Country, 2019 - 2022, USD Million

- TABLE 55 North America On-premise Market by Country, 2023 - 2030, USD Million

- TABLE 56 North America Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 57 North America Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 58 North America Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 59 North America Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 60 North America Software Market by Country, 2019 - 2022, USD Million

- TABLE 61 North America Software Market by Country, 2023 - 2030, USD Million

- TABLE 62 North America Services Market by Country, 2019 - 2022, USD Million

- TABLE 63 North America Services Market by Country, 2023 - 2030, USD Million

- TABLE 64 North America Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 65 North America Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 66 North America Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 67 North America Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 68 North America Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 69 North America Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 70 North America Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 71 North America Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 72 North America BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 73 North America BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 74 North America IT & Telecommunication Market by Country, 2019 - 2022, USD Million

- TABLE 75 North America IT & Telecommunication Market by Country, 2023 - 2030, USD Million

- TABLE 76 North America Retail Market by Country, 2019 - 2022, USD Million

- TABLE 77 North America Retail Market by Country, 2023 - 2030, USD Million

- TABLE 78 North America Education Market by Country, 2019 - 2022, USD Million

- TABLE 79 North America Education Market by Country, 2023 - 2030, USD Million

- TABLE 80 North America Healthcare & Dental Market by Country, 2019 - 2022, USD Million

- TABLE 81 North America Healthcare & Dental Market by Country, 2023 - 2030, USD Million

- TABLE 82 North America Energy & Utilities Market by Country, 2019 - 2022, USD Million

- TABLE 83 North America Energy & Utilities Market by Country, 2023 - 2030, USD Million

- TABLE 84 North America Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 85 North America Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 86 North America Government Market by Country, 2019 - 2022, USD Million

- TABLE 87 North America Government Market by Country, 2023 - 2030, USD Million

- TABLE 88 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 89 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 90 North America Network Access Control Market by Country, 2019 - 2022, USD Million

- TABLE 91 North America Network Access Control Market by Country, 2023 - 2030, USD Million

- TABLE 92 US Network Access Control Market, 2019 - 2022, USD Million

- TABLE 93 US Network Access Control Market, 2023 - 2030, USD Million

- TABLE 94 US Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 95 US Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 96 US Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 97 US Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 98 US Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 99 US Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 100 US Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 101 US Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 102 Canada Network Access Control Market, 2019 - 2022, USD Million

- TABLE 103 Canada Network Access Control Market, 2023 - 2030, USD Million

- TABLE 104 Canada Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 105 Canada Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 106 Canada Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 107 Canada Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 108 Canada Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 109 Canada Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 110 Canada Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 111 Canada Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 112 Mexico Network Access Control Market, 2019 - 2022, USD Million

- TABLE 113 Mexico Network Access Control Market, 2023 - 2030, USD Million

- TABLE 114 Mexico Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 115 Mexico Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 116 Mexico Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 117 Mexico Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 118 Mexico Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 119 Mexico Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 120 Mexico Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 121 Mexico Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 122 Rest of North America Network Access Control Market, 2019 - 2022, USD Million

- TABLE 123 Rest of North America Network Access Control Market, 2023 - 2030, USD Million

- TABLE 124 Rest of North America Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 125 Rest of North America Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 126 Rest of North America Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 127 Rest of North America Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 128 Rest of North America Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 129 Rest of North America Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 130 Rest of North America Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 131 Rest of North America Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 132 Europe Network Access Control Market, 2019 - 2022, USD Million

- TABLE 133 Europe Network Access Control Market, 2023 - 2030, USD Million

- TABLE 134 Europe Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 135 Europe Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 136 Europe Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 137 Europe Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 138 Europe On-premise Market by Country, 2019 - 2022, USD Million

- TABLE 139 Europe On-premise Market by Country, 2023 - 2030, USD Million

- TABLE 140 Europe Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 141 Europe Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 142 Europe Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 143 Europe Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 144 Europe Software Market by Country, 2019 - 2022, USD Million

- TABLE 145 Europe Software Market by Country, 2023 - 2030, USD Million

- TABLE 146 Europe Services Market by Country, 2019 - 2022, USD Million

- TABLE 147 Europe Services Market by Country, 2023 - 2030, USD Million

- TABLE 148 Europe Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 149 Europe Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 150 Europe Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 151 Europe Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 152 Europe Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 153 Europe Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 154 Europe Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 155 Europe Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 156 Europe BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 157 Europe BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 158 Europe IT & Telecommunication Market by Country, 2019 - 2022, USD Million

- TABLE 159 Europe IT & Telecommunication Market by Country, 2023 - 2030, USD Million

- TABLE 160 Europe Retail Market by Country, 2019 - 2022, USD Million

- TABLE 161 Europe Retail Market by Country, 2023 - 2030, USD Million

- TABLE 162 Europe Education Market by Country, 2019 - 2022, USD Million

- TABLE 163 Europe Education Market by Country, 2023 - 2030, USD Million

- TABLE 164 Europe Healthcare & Dental Market by Country, 2019 - 2022, USD Million

- TABLE 165 Europe Healthcare & Dental Market by Country, 2023 - 2030, USD Million

- TABLE 166 Europe Energy & Utilities Market by Country, 2019 - 2022, USD Million

- TABLE 167 Europe Energy & Utilities Market by Country, 2023 - 2030, USD Million

- TABLE 168 Europe Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 169 Europe Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 170 Europe Government Market by Country, 2019 - 2022, USD Million

- TABLE 171 Europe Government Market by Country, 2023 - 2030, USD Million

- TABLE 172 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 173 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 174 Europe Network Access Control Market by Country, 2019 - 2022, USD Million

- TABLE 175 Europe Network Access Control Market by Country, 2023 - 2030, USD Million

- TABLE 176 Germany Network Access Control Market, 2019 - 2022, USD Million

- TABLE 177 Germany Network Access Control Market, 2023 - 2030, USD Million

- TABLE 178 Germany Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 179 Germany Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 180 Germany Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 181 Germany Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 182 Germany Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 183 Germany Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 184 Germany Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 185 Germany Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 186 UK Network Access Control Market, 2019 - 2022, USD Million

- TABLE 187 UK Network Access Control Market, 2023 - 2030, USD Million

- TABLE 188 UK Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 189 UK Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 190 UK Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 191 UK Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 192 UK Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 193 UK Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 194 UK Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 195 UK Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 196 France Network Access Control Market, 2019 - 2022, USD Million

- TABLE 197 France Network Access Control Market, 2023 - 2030, USD Million

- TABLE 198 France Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 199 France Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 200 France Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 201 France Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 202 France Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 203 France Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 204 France Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 205 France Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 206 Russia Network Access Control Market, 2019 - 2022, USD Million

- TABLE 207 Russia Network Access Control Market, 2023 - 2030, USD Million

- TABLE 208 Russia Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 209 Russia Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 210 Russia Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 211 Russia Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 212 Russia Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 213 Russia Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 214 Russia Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 215 Russia Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 216 Spain Network Access Control Market, 2019 - 2022, USD Million

- TABLE 217 Spain Network Access Control Market, 2023 - 2030, USD Million

- TABLE 218 Spain Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 219 Spain Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 220 Spain Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 221 Spain Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 222 Spain Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 223 Spain Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 224 Spain Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 225 Spain Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 226 Italy Network Access Control Market, 2019 - 2022, USD Million

- TABLE 227 Italy Network Access Control Market, 2023 - 2030, USD Million

- TABLE 228 Italy Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 229 Italy Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 230 Italy Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 231 Italy Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 232 Italy Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 233 Italy Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 234 Italy Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 235 Italy Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 236 Rest of Europe Network Access Control Market, 2019 - 2022, USD Million

- TABLE 237 Rest of Europe Network Access Control Market, 2023 - 2030, USD Million

- TABLE 238 Rest of Europe Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 239 Rest of Europe Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 240 Rest of Europe Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 241 Rest of Europe Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 242 Rest of Europe Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 243 Rest of Europe Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 244 Rest of Europe Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 245 Rest of Europe Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 246 Asia Pacific Network Access Control Market, 2019 - 2022, USD Million

- TABLE 247 Asia Pacific Network Access Control Market, 2023 - 2030, USD Million

- TABLE 248 Asia Pacific Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 249 Asia Pacific Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 250 Asia Pacific Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 251 Asia Pacific Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 252 Asia Pacific On-premise Market by Country, 2019 - 2022, USD Million

- TABLE 253 Asia Pacific On-premise Market by Country, 2023 - 2030, USD Million

- TABLE 254 Asia Pacific Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 255 Asia Pacific Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 256 Asia Pacific Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 257 Asia Pacific Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 258 Asia Pacific Software Market by Country, 2019 - 2022, USD Million

- TABLE 259 Asia Pacific Software Market by Country, 2023 - 2030, USD Million

- TABLE 260 Asia Pacific Services Market by Country, 2019 - 2022, USD Million

- TABLE 261 Asia Pacific Services Market by Country, 2023 - 2030, USD Million

- TABLE 262 Asia Pacific Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 263 Asia Pacific Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 264 Asia Pacific Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 265 Asia Pacific Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 266 Asia Pacific Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 267 Asia Pacific Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 268 Asia Pacific Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 269 Asia Pacific Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 270 Asia Pacific BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 271 Asia Pacific BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 272 Asia Pacific IT & Telecommunication Market by Country, 2019 - 2022, USD Million

- TABLE 273 Asia Pacific IT & Telecommunication Market by Country, 2023 - 2030, USD Million

- TABLE 274 Asia Pacific Retail Market by Country, 2019 - 2022, USD Million

- TABLE 275 Asia Pacific Retail Market by Country, 2023 - 2030, USD Million

- TABLE 276 Asia Pacific Education Market by Country, 2019 - 2022, USD Million

- TABLE 277 Asia Pacific Education Market by Country, 2023 - 2030, USD Million

- TABLE 278 Asia Pacific Healthcare & Dental Market by Country, 2019 - 2022, USD Million

- TABLE 279 Asia Pacific Healthcare & Dental Market by Country, 2023 - 2030, USD Million

- TABLE 280 Asia Pacific Energy & Utilities Market by Country, 2019 - 2022, USD Million

- TABLE 281 Asia Pacific Energy & Utilities Market by Country, 2023 - 2030, USD Million

- TABLE 282 Asia Pacific Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 283 Asia Pacific Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 284 Asia Pacific Government Market by Country, 2019 - 2022, USD Million

- TABLE 285 Asia Pacific Government Market by Country, 2023 - 2030, USD Million

- TABLE 286 Asia Pacific Others Market by Country, 2019 - 2022, USD Million

- TABLE 287 Asia Pacific Others Market by Country, 2023 - 2030, USD Million

- TABLE 288 Asia Pacific Network Access Control Market by Country, 2019 - 2022, USD Million

- TABLE 289 Asia Pacific Network Access Control Market by Country, 2023 - 2030, USD Million

- TABLE 290 China Network Access Control Market, 2019 - 2022, USD Million

- TABLE 291 China Network Access Control Market, 2023 - 2030, USD Million

- TABLE 292 China Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 293 China Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 294 China Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 295 China Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 296 China Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 297 China Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 298 China Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 299 China Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 300 Japan Network Access Control Market, 2019 - 2022, USD Million

- TABLE 301 Japan Network Access Control Market, 2023 - 2030, USD Million

- TABLE 302 Japan Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 303 Japan Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 304 Japan Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 305 Japan Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 306 Japan Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 307 Japan Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 308 Japan Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 309 Japan Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 310 India Network Access Control Market, 2019 - 2022, USD Million

- TABLE 311 India Network Access Control Market, 2023 - 2030, USD Million

- TABLE 312 India Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 313 India Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 314 India Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 315 India Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 316 India Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 317 India Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 318 India Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 319 India Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 320 South Korea Network Access Control Market, 2019 - 2022, USD Million

- TABLE 321 South Korea Network Access Control Market, 2023 - 2030, USD Million

- TABLE 322 South Korea Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 323 South Korea Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 324 South Korea Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 325 South Korea Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 326 South Korea Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 327 South Korea Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 328 South Korea Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 329 South Korea Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 330 Singapore Network Access Control Market, 2019 - 2022, USD Million

- TABLE 331 Singapore Network Access Control Market, 2023 - 2030, USD Million

- TABLE 332 Singapore Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 333 Singapore Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 334 Singapore Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 335 Singapore Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 336 Singapore Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 337 Singapore Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 338 Singapore Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 339 Singapore Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 340 Malaysia Network Access Control Market, 2019 - 2022, USD Million

- TABLE 341 Malaysia Network Access Control Market, 2023 - 2030, USD Million

- TABLE 342 Malaysia Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 343 Malaysia Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 344 Malaysia Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 345 Malaysia Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 346 Malaysia Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 347 Malaysia Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 348 Malaysia Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 349 Malaysia Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 350 Rest of Asia Pacific Network Access Control Market, 2019 - 2022, USD Million

- TABLE 351 Rest of Asia Pacific Network Access Control Market, 2023 - 2030, USD Million

- TABLE 352 Rest of Asia Pacific Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 353 Rest of Asia Pacific Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 354 Rest of Asia Pacific Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 355 Rest of Asia Pacific Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 356 Rest of Asia Pacific Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 357 Rest of Asia Pacific Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 358 Rest of Asia Pacific Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 359 Rest of Asia Pacific Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 360 LAMEA Network Access Control Market, 2019 - 2022, USD Million

- TABLE 361 LAMEA Network Access Control Market, 2023 - 2030, USD Million

- TABLE 362 LAMEA Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 363 LAMEA Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 364 LAMEA Cloud Market by Country, 2019 - 2022, USD Million

- TABLE 365 LAMEA Cloud Market by Country, 2023 - 2030, USD Million

- TABLE 366 LAMEA On-premise Market by Country, 2019 - 2022, USD Million

- TABLE 367 LAMEA On-premise Market by Country, 2023 - 2030, USD Million

- TABLE 368 LAMEA Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 369 LAMEA Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 370 LAMEA Hardware Market by Country, 2019 - 2022, USD Million

- TABLE 371 LAMEA Hardware Market by Country, 2023 - 2030, USD Million

- TABLE 372 LAMEA Software Market by Country, 2019 - 2022, USD Million

- TABLE 373 LAMEA Software Market by Country, 2023 - 2030, USD Million

- TABLE 374 LAMEA Services Market by Country, 2019 - 2022, USD Million

- TABLE 375 LAMEA Services Market by Country, 2023 - 2030, USD Million

- TABLE 376 LAMEA Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 377 LAMEA Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 378 LAMEA Large Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 379 LAMEA Large Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 380 LAMEA Small & Medium Enterprises Market by Country, 2019 - 2022, USD Million

- TABLE 381 LAMEA Small & Medium Enterprises Market by Country, 2023 - 2030, USD Million

- TABLE 382 LAMEA Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 383 LAMEA Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 384 LAMEA BFSI Market by Country, 2019 - 2022, USD Million

- TABLE 385 LAMEA BFSI Market by Country, 2023 - 2030, USD Million

- TABLE 386 LAMEA IT & Telecommunication Market by Country, 2019 - 2022, USD Million

- TABLE 387 LAMEA IT & Telecommunication Market by Country, 2023 - 2030, USD Million

- TABLE 388 LAMEA Retail Market by Country, 2019 - 2022, USD Million

- TABLE 389 LAMEA Retail Market by Country, 2023 - 2030, USD Million

- TABLE 390 LAMEA Education Market by Country, 2019 - 2022, USD Million

- TABLE 391 LAMEA Education Market by Country, 2023 - 2030, USD Million

- TABLE 392 LAMEA Healthcare & Dental Market by Country, 2019 - 2022, USD Million

- TABLE 393 LAMEA Healthcare & Dental Market by Country, 2023 - 2030, USD Million

- TABLE 394 LAMEA Energy & Utilities Market by Country, 2019 - 2022, USD Million

- TABLE 395 LAMEA Energy & Utilities Market by Country, 2023 - 2030, USD Million

- TABLE 396 LAMEA Manufacturing Market by Country, 2019 - 2022, USD Million

- TABLE 397 LAMEA Manufacturing Market by Country, 2023 - 2030, USD Million

- TABLE 398 LAMEA Government Market by Country, 2019 - 2022, USD Million

- TABLE 399 LAMEA Government Market by Country, 2023 - 2030, USD Million

- TABLE 400 LAMEA Others Market by Country, 2019 - 2022, USD Million

- TABLE 401 LAMEA Others Market by Country, 2023 - 2030, USD Million

- TABLE 402 LAMEA Network Access Control Market by Country, 2019 - 2022, USD Million

- TABLE 403 LAMEA Network Access Control Market by Country, 2023 - 2030, USD Million

- TABLE 404 Brazil Network Access Control Market, 2019 - 2022, USD Million

- TABLE 405 Brazil Network Access Control Market, 2023 - 2030, USD Million

- TABLE 406 Brazil Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 407 Brazil Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 408 Brazil Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 409 Brazil Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 410 Brazil Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 411 Brazil Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 412 Brazil Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 413 Brazil Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 414 Argentina Network Access Control Market, 2019 - 2022, USD Million

- TABLE 415 Argentina Network Access Control Market, 2023 - 2030, USD Million

- TABLE 416 Argentina Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 417 Argentina Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 418 Argentina Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 419 Argentina Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 420 Argentina Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 421 Argentina Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 422 Argentina Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 423 Argentina Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 424 UAE Network Access Control Market, 2019 - 2022, USD Million

- TABLE 425 UAE Network Access Control Market, 2023 - 2030, USD Million

- TABLE 426 UAE Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 427 UAE Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 428 UAE Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 429 UAE Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 430 UAE Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 431 UAE Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 432 UAE Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 433 UAE Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 434 Saudi Arabia Network Access Control Market, 2019 - 2022, USD Million

- TABLE 435 Saudi Arabia Network Access Control Market, 2023 - 2030, USD Million

- TABLE 436 Saudi Arabia Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 437 Saudi Arabia Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 438 Saudi Arabia Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 439 Saudi Arabia Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 440 Saudi Arabia Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 441 Saudi Arabia Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 442 Saudi Arabia Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 443 Saudi Arabia Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 444 South Africa Network Access Control Market, 2019 - 2022, USD Million

- TABLE 445 South Africa Network Access Control Market, 2023 - 2030, USD Million

- TABLE 446 South Africa Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 447 South Africa Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 448 South Africa Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 449 South Africa Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 450 South Africa Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 451 South Africa Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 452 South Africa Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 453 South Africa Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 454 Nigeria Network Access Control Market, 2019 - 2022, USD Million

- TABLE 455 Nigeria Network Access Control Market, 2023 - 2030, USD Million

- TABLE 456 Nigeria Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 457 Nigeria Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 458 Nigeria Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 459 Nigeria Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 460 Nigeria Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 461 Nigeria Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 462 Nigeria Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 463 Nigeria Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 464 Rest of LAMEA Network Access Control Market, 2019 - 2022, USD Million

- TABLE 465 Rest of LAMEA Network Access Control Market, 2023 - 2030, USD Million

- TABLE 466 Rest of LAMEA Network Access Control Market by Deployment, 2019 - 2022, USD Million

- TABLE 467 Rest of LAMEA Network Access Control Market by Deployment, 2023 - 2030, USD Million

- TABLE 468 Rest of LAMEA Network Access Control Market by Offering, 2019 - 2022, USD Million

- TABLE 469 Rest of LAMEA Network Access Control Market by Offering, 2023 - 2030, USD Million

- TABLE 470 Rest of LAMEA Network Access Control Market by Enterprise Size, 2019 - 2022, USD Million

- TABLE 471 Rest of LAMEA Network Access Control Market by Enterprise Size, 2023 - 2030, USD Million

- TABLE 472 Rest of LAMEA Network Access Control Market by Vertical, 2019 - 2022, USD Million

- TABLE 473 Rest of LAMEA Network Access Control Market by Vertical, 2023 - 2030, USD Million

- TABLE 474 Key Information - Cisco Systems, Inc.

- TABLE 475 Key Information - Hewlett Packard Enterprise Company

- TABLE 476 Key Information - Microsoft Corporation

- TABLE 477 Key Information - Huawei Technologies Co., Ltd.

- TABLE 478 Key Information - IBM Corporation

- TABLE 479 Key Information - Broadcom, Inc.

- TABLE 480 Key Information - VMware, Inc.

- TABLE 481 Key Information - Juniper Networks, Inc.

- TABLE 482 Key Information - Sophos Group PLC

- TABLE 483 Key Information - Fortinet, Inc.

List of Figures

- FIG 1 Methodology for the research

- FIG 2 KBV Cardinal Matrix

- FIG 3 Market Share Analysis, 2021

- FIG 4 Key Leading Strategies: Percentage Distribution (2019-2023)

- FIG 5 Key Strategic Move: (Mergers & Acquisition: 2019, Jan - 2023, May) Leading Players

- FIG 6 Global Network Access Control Market share by Deployment, 2022

- FIG 7 Global Network Access Control Market share by Deployment, 2030

- FIG 8 Global Network Access Control Market by Deployment, 2019 - 2030, USD Million

- FIG 9 Global Network Access Control Market share by Offering, 2022

- FIG 10 Global Network Access Control Market share by Offering, 2030

- FIG 11 Global Network Access Control Market by Offering, 2019 - 2030, USD Million

- FIG 12 Global Network Access Control Market share by Enterprise Size, 2022

- FIG 13 Global Network Access Control Market share by Enterprise Size, 2030

- FIG 14 Global Network Access Control Market by Enterprise Size, 2019 - 2030, USD Million

- FIG 15 Global Network Access Control Market share by Vertical, 2022

- FIG 16 Global Network Access Control Market share by Vertical, 2030

- FIG 17 Global Network Access Control Market by Vertical, 2019 - 2030, USD Million

- FIG 18 Global Network Access Control Market share by Region, 2022

- FIG 19 Global Network Access Control Market share by Region, 2030

- FIG 20 Global Network Access Control Market by Region, 2019 - 2030, USD Million

- FIG 21 Recent strategies and developments: Cisco Systems, Inc.

- FIG 22 SWOT Analysis: Cisco Systems, Inc.

- FIG 23 SWOT Analysis: Hewlett Packard Enterprise Company

- FIG 24 Recent strategies and developments: Microsoft Corporation

- FIG 25 SWOT Analysis: Microsoft Corporation

- FIG 26 Recent strategies and developments: IBM Corporation

- FIG 27 SWOT Analysis: IBM Corporation

- FIG 28 SWOT Analysis: Broadcom, Inc.

- FIG 29 Recent strategies and developments: VMware, Inc.

- FIG 30 SWOT Analysis: VMware, Inc.

- FIG 31 Recent strategies and developments: Juniper Networks, Inc.

- FIG 32 SWOT Analysis: Juniper Networks, Inc.

- FIG 33 Recent strategies and developments: Sophos Group PLC

- FIG 34 Recent strategies and developments: Fortinet, Inc.

- FIG 35 SWOT Analysis: Fortinet, Inc.

The Global Network Access Control Market size is expected to reach $14 billion by 2030, rising at a market growth of 25.3% CAGR during the forecast period.

Governmental organizations deal with a lot of private and confidential data. Only authorized people can access vital systems and data due to the assistance of NAC solutions in enforcing rigorous access controls. Therefore, Government sector registered $223.7 million revenue in the market in 2022. Networks and resources used by the government, such as databases, infrastructure, and crucial systems, require strong defense against internal and external attacks. To protect government assets, NAC systems establish access controls according to device health, user identity, and contextual data. As a result, only authorized individuals and reliable devices can connect to and access private government data.

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2023, IBM Corporation acquired Polar Security. The acquisition makes IBM a premier provider of DSPM solutions. In March, 2023, Hewlett Packard Enterprise Company announced the acquisition of OpsRamp, an IT operations management solutions provider. The acquisition would allow Hewlett-Packard to integrate its portfolio with OpsRamp's offerings which would create an effective and manageable edge-to-cloud platform. Furthermore, the acquisition strengthens the reach of the HPE GreenLake platform in IT Operations Management.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the major forerunner in the Market. In July, 2021, Microsoft Corporation announced the acquisition of CloudKnox, a privileged access solutions provider based in the US. The acquisition enhances Microsoft Azure by providing it with automated remediation and granular visibility. Companies such as Cisco Systems, Inc Broadcom, Inc., Huawei Technologies Co., Ltd. are some of the key innovators in the Market.

Market Growth Factors

Rising demand for advanced virtual security solutions

Enterprises, banks, data centers, and financial institutions continue to lead the market demand for network access control solutions to store & update crucial data. Alarmingly high rates of cybercrime and rising geopolitical unrest have fueled an increase in network security lapses and unauthorized intrusions, necessitating the implementation of effective security solutions, network access control being a key component. Investments in network access control systems will increase steadily during the projection period as numerous enterprise networks compete to reach outside of protected boundaries. Thus, the market is predicted to witness growth in the upcoming years.

Growing risk of cybersecurity threats

Governments have passed stronger laws to protect sensitive & personal data in response to cybersecurity risks & data breaches. Data protection and access control regulations, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR), impose strict standards. Through the enforcement of access rules, the preservation of audit trails, and the provision of insight into network activities, NAC solutions assist enterprises in meeting these compliance requirements. In consideration of this, the market is estimated to grow significantly.

Market Restraining Factors

Deployment challenges and associated complexity

A diversified IT ecosystem comprising several systems, applications, and platforms is common in organizations. It might be difficult and time-consuming to integrate NAC systems with these various components. NAC solution deployment and integration might be hampered by compatibility problems, integration difficulties, and a lack of interoperability across various technologies and providers. Due to the lack of a uniform set of standards in the NAC industry, numerous proprietary solutions and methods exist. The adoption of NAC systems from various vendors or in various environments may be hampered by this lack of standardization and its potential to cause interoperability issues. To overcome this restriction, standardized efforts and industry partnerships are required.

Offering Outlook

By Offering, the market is segmented into hardware, software, and services. The services segment acquired a substantial revenue share in the market in 2022. Deployment, maintenance, customer support, training, and advisory services are all included in the scope of network access control services. The primary factors anticipated to propel the growth of the segment are the increasing demand for these solutions, devices, and infrastructure and which is expected to sustain the service segments for a longer period due to the ongoing need for license renewal, support & maintenance, and customer support requirements.

Deployment Outlook

Based on deployment, the market is fragmented into on-premise and cloud. In 2022, the cloud segment witnessed the largest revenue share in the market. Subscription models are the main way that cloud-based network access control is defined. It allows companies to use and access cutting-edge network security services cloud infrastructure provides. Based on usage, demand, and purchasing power, it provides enterprises with an affordable and adaptable method of monitoring and guaranteeing network security.

Enterprise Size Outlook

On the basis of enterprise size, the market is bifurcated into large enterprises and SMEs. In 2022, the large enterprises segment dominated the market with the maximum revenue share. The main factors drawing cybercriminals to large organizations like banks and financial institutions, IT firms, healthcare institutions, and government agencies are the rising incidences of cyberattacks, data theft, and security breaches caused by the rapid adoption of technologies, remote work cultures, connected devices, and the implementation of unsecured networks to share data. Therefore, protecting the security of corporate networks & connected devices is increasingly crucial for large enterprises.

Vertical Outlook

Based on vertical, the market is classified into BFSI, IT & telecom, retail & e-commerce, healthcare & dental, manufacturing, government, education, manufacturing, and others. The IT & telecom segment garnered a significant revenue share in the market in 2022. Because more consumer data is available, more important data is shared over big networks, more digital technologies are being used, and more connected devices are being used, the IT and telecommunications sectors are seeing a sharp increase in cyberattacks and other security breaches. The need for these solutions in the IT and telecommunications sector is also anticipated to increase due to enterprises' growing knowledge and growing security concerns.

Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The market in North America is anticipated to expand due to the growing need for network security solutions across several key end-use sectors, including government, healthcare, IT and telecom, education, and BFSI. The following industries are frequently targeted by cybercriminals and data thieves in the region to access vital organizational networks & devices carrying massive amounts of personal & organizational data. These elements are anticipated to fuel the expansion of the regional market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), IBM Corporation, Broadcom, Inc., VMware, Inc., Hewlett Packard Enterprise Company, Microsoft Corporation, Juniper Networks, Inc., Sophos Group PLC (Thoma Bravo) and Fortinet, Inc.

Recent Strategies Deployed in Network Access Control Market

Partnerships, Collaborations, and Agreements:

Apr-2023: VMware, Inc. entered a partnership with Lookout, Inc., a cloud-based endpoint security solutions provider, to develop solutions for data protection and network connectivity solutions. The partnership features the integration of VMware SD-WAN with the Lookout Cloud Security Platform that would provide the joint customers of the two companies with a secure access service edge (SASE) solution.

Jan-2023: Microsoft Corporation signed a partnership with Cloudflare, Inc., a cloud security services provider, to develop solutions for Zero Trust security. Together, the two companies would develop solutions that would facilitate network security and enhanced automation across customers' businesses.

Nov-2022: Microsoft Corporation came into partnership with Lockheed Martin, a multinational company based in the United States, to develop solutions for the Department of Defense. The partnership would provide a 5G-powered secure platform to the defense Industry in America.

Sep-2022: IBM Corporation partnered with Bharti Airtel, an Indian communications solutions provider, to integrate IBM's hybrid cloud offerings with Airtel's edge computing platform. The partnership would provide Indian enterprises to drive 5G-powered innovation securely.

Aug-2022: Fortinet, Inc. came into partnership with Comcast Business, a networking solutions provider, to develop security service edge (SSE) and secure access service edge (SASE) solutions for customers. Through this partnership, the two companies would be better positioned to serve their customers by providing them with secure services for digital transformation.

Aug-2022: Fortinet, Inc. announced a partnership with NEC Corporation, a Japanese IT company, to develop solutions for secure 5G networks. The partnership would allow Fortinet to serve its customers in a better way by providing them with solutions for secure 5G adoption.

Mar-2022: Cisco Systems, Inc teamed up with NetApp, a data management solutions provider. The partnership would provide the joint customers of the two companies with automation, hybrid cloud operations, and visibility solutions.

Feb-2022: Microsoft Corporation partnered with Qualcomm Technologies, Inc., an American technology company, to develop 5G private network solutions. The partnership would allow Microsoft to provide its customers with private 5G connectivity solutions.

Product Launches and Product Expansions:

May-2023: IBM Corporation released IBM Hybrid Cloud Mesh, a SaaS-based service used for managing multi-cloud infrastructure. The Hybrid Cloud Mesh uses DNS traffic steering facilities by NS1 for performance management and observability.

May-2023: Juniper Networks, Inc. announced the launch of Juniper Mist Access Assurance service, a suite of policy management and network access control solutions. The features of the service are Granular security, AI-driven automation, Cloud-native simplicity, and Client-to-cloud assurance.

Mar-2023: Huawei Technologies Co., Ltd. introduced four new network solutions. The smart campus would be used as a campus network manager. The solution features AirEngine 8771-X1T, CloudEngine S16700, and enterprise-level Wi-Fi 7 AP, Easy branch which would be used to simplify hyper-converged branches and Single OptiX, an end-to-end optical service unit offering.

Feb-2023: Sophos Group PLC expanded its firewall portfolio through the launch of XGS 7500 and 8500 models. The two models are used for facilitating trusted traffic flow and Transport Layer Security. The two models feature a firewall throughput of around 190 Gbps, two port connectivity with speeds up to 100 Gbps, enhanced non-volatile memory express (NVMe), and high-speed random-access memory (RAM) solid-state drives for better storage.

Feb-2023: Cisco Systems, Inc announced the launch of Cisco Cyber Vision and Secure Equipment Access Plus for its IoT operations dashboard. Cisco Cyber Vision provides complete visibility into OT and IT devices for threat management across organizations. Secure Equipment Access Plus is used for managing and troubleshooting connected equipment.

Feb-2023: Fortinet, Inc. unveiled FortiSP5, a distributed edge security solution. The FortiSP5 features Secure boot, Volumetric DDoS protection, and VXLAN/GRE hardware-accelerated encapsulation. Furthermore, FortiSP5 can be used for five applications namely, Campus, Edge Compute, 5G, and Operational Technology.

Jan-2023: Sophos Group PLC released Sophos ZTNA v2, a Zero Trust Network Access (ZTNA) solution. The ZTNA v2 features Cloud Gateways and On-Premise Gateways.

Aug-2022: VMware, Inc. unveiled new services for network security. These include Project Northstar, a service used for end-to-end visibility in multi-cloud networking, VMware NSX Gateway Firewall, a firewall service threat detection, the solution features, TLS proxy, stateful Network Address Translation (NAT) and malware analysis, and VMware NSX Advanced Load Balancer, a service used for multi-layer application security, the solutions bring with it new bot management capabilities and security analytics capabilities.

Apr-2022: Fortinet, Inc. announced the launch of FortiOS 7.2, a solution used for security-services applications. The FortiOS 7.2 includes SOC-as-a-Service, Inline Sandbox, Inline CASB, Dedicated IPS, and Advanced Device Protection.

Feb-2022: Juniper Networks, Inc. introduced Juniper Secure Edge, a Firewall service used for securing workforces. The benefits of the service include Validated security effectiveness, Dynamic Zero Trust segmentation, Unified policy management, and Secure user access from anywhere.

Oct-2021: VMware, Inc. introduced VMware AN Intelligent Controller, a solution used for facilitating the deployment of cloud-native control. The VMware RIC features VMware Centralized RIC and VMware Distributed RIC.

Aug-2021: IBM Corporation launched IBM Security Services for SASE, a SaaS-based service used for cloud security applications. The IBM Security Services for SASE consists of Hybrid Workforce Access, Third-Party Access, Mergers and Acquisitions, Network Transformation, and 5G, Edge, and IoT Protection and Support.

Acquisition and Mergers:

May-2023: IBM Corporation acquired Polar Security, an Israeli enterprise security software provider. The acquisition makes IBM a premier provider of DSPM solutions.

Mar-2023: Cisco Systems, Inc completed the acquisition of Lightspin Technologies Ltd., a security software provider based in Israel. The acquisition would enhance Cisco's ability to deliver secure solutions for cloud environments to their customers.

Mar-2023: Hewlett Packard Enterprise Company announced the acquisition of OpsRamp, an IT operations management solutions provider. The acquisition would allow Hewlett-Packard to integrate its portfolio with OpsRamp's offerings which would create an effective and manageable edge-to-cloud platform. Furthermore, the acquisition strengthens the reach of the HPE GreenLake platform in IT Operations Management.

Apr-2022: Sophos Group PLC acquired SOC.OS, a cloud-based anomaly detection solution provider. The acquisition expands Sophos' MDR and XDR capabilities.

Feb-2022: Juniper Networks, Inc. completed the acquisition of WiteSand, a Zero Trust Network Access solutions provider. The acquisition complements Juniper's enterprise portfolio. Furthermore, the acquisition brings with it Network Access Control solutions that would benefit Juniper.

Jul-2021: Microsoft Corporation announced the acquisition of CloudKnox, a privileged access solutions provider based in the US. The acquisition enhances Microsoft Azure by providing it with automated remediation and granular visibility.

Jul-2021: Sophos Group PLC acquired Capsule8, an American software company. The acquisition strengthens Sophos' portfolio of Detection and Response Solutions across cloud and unprotected service environments.

Scope of the Study

Market Segments covered in the Report:

By Deployment

- Cloud

- On-premise

By Offering

- Hardware

- Software

- Services

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Vertical

- BFSI

- IT & Telecommunication

- Retail

- Education

- Healthcare & Dental

- Energy & Utilities

- Manufacturing

- Government

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Cisco Systems, Inc

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- IBM Corporation

- Broadcom, Inc.

- VMware, Inc.

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- Juniper Networks, Inc.

- Sophos Group PLC (Thoma Bravo)

- Fortinet, Inc.

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Network Access Control Market, by Deployment

- 1.4.2 Global Network Access Control Market, by Offering

- 1.4.3 Global Network Access Control Market, by Enterprise Size

- 1.4.4 Global Network Access Control Market, by Vertical

- 1.4.5 Global Network Access Control Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market Overview

- 2.1 Introduction

- 2.1.1 Overview

- 2.1.1.1 Market Composition and Scenario

- 2.1.1 Overview

- 2.2 Key Factors Impacting the Market

- 2.2.1 Market Drivers

- 2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

- 3.1 KBV Cardinal Matrix

- 3.2 Recent Industry Wide Strategic Developments

- 3.2.1 Partnerships, Collaborations and Agreements

- 3.2.2 Product Launches and Product Expansions

- 3.2.3 Acquisition and Mergers

- 3.3 Market Share Analysis, 2021

- 3.4 Top Winning Strategies

- 3.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

- 3.4.2 Key Strategic Move: (Mergers & Acquisition: 2019, Jan - 2023, May) Leading Players

Chapter 4. Global Network Access Control Market by Deployment

- 4.1 Global Cloud Market by Region

- 4.2 Global On-premise Market by Region

Chapter 5. Global Network Access Control Market by Offering

- 5.1 Global Hardware Market by Region

- 5.2 Global Software Market by Region

- 5.3 Global Services Market by Region

Chapter 6. Global Network Access Control Market by Enterprise Size

- 6.1 Global Large Enterprises Market by Region

- 6.2 Global Small & Medium Enterprises Market by Region

Chapter 7. Global Network Access Control Market by Vertical

- 7.1 Global BFSI Market by Region

- 7.2 Global IT & Telecommunication Market by Region

- 7.3 Global Retail Market by Region

- 7.4 Global Education Market by Region

- 7.5 Global Healthcare & Dental Market by Region

- 7.6 Global Energy & Utilities Market by Region

- 7.7 Global Manufacturing Market by Region

- 7.8 Global Government Market by Region

- 7.9 Global Others Market by Region

Chapter 8. Global Network Access Control Market by Region

- 8.1 North America Network Access Control Market

- 8.1.1 North America Network Access Control Market by Deployment

- 8.1.1.1 North America Cloud Market by Country

- 8.1.1.2 North America On-premise Market by Country

- 8.1.2 North America Network Access Control Market by Offering

- 8.1.2.1 North America Hardware Market by Country

- 8.1.2.2 North America Software Market by Country

- 8.1.2.3 North America Services Market by Country

- 8.1.3 North America Network Access Control Market by Enterprise Size

- 8.1.3.1 North America Large Enterprises Market by Country

- 8.1.3.2 North America Small & Medium Enterprises Market by Country

- 8.1.4 North America Network Access Control Market by Vertical

- 8.1.4.1 North America BFSI Market by Country

- 8.1.4.2 North America IT & Telecommunication Market by Country

- 8.1.4.3 North America Retail Market by Country

- 8.1.4.4 North America Education Market by Country

- 8.1.4.5 North America Healthcare & Dental Market by Country

- 8.1.4.6 North America Energy & Utilities Market by Country

- 8.1.4.7 North America Manufacturing Market by Country

- 8.1.4.8 North America Government Market by Country

- 8.1.4.9 North America Others Market by Country

- 8.1.5 North America Network Access Control Market by Country

- 8.1.5.1 US Network Access Control Market

- 8.1.5.1.1 US Network Access Control Market by Deployment

- 8.1.5.1.2 US Network Access Control Market by Offering

- 8.1.5.1.3 US Network Access Control Market by Enterprise Size

- 8.1.5.1.4 US Network Access Control Market by Vertical

- 8.1.5.2 Canada Network Access Control Market

- 8.1.5.2.1 Canada Network Access Control Market by Deployment

- 8.1.5.2.2 Canada Network Access Control Market by Offering

- 8.1.5.2.3 Canada Network Access Control Market by Enterprise Size

- 8.1.5.2.4 Canada Network Access Control Market by Vertical

- 8.1.5.3 Mexico Network Access Control Market

- 8.1.5.3.1 Mexico Network Access Control Market by Deployment

- 8.1.5.3.2 Mexico Network Access Control Market by Offering

- 8.1.5.3.3 Mexico Network Access Control Market by Enterprise Size

- 8.1.5.3.4 Mexico Network Access Control Market by Vertical

- 8.1.5.4 Rest of North America Network Access Control Market

- 8.1.5.4.1 Rest of North America Network Access Control Market by Deployment

- 8.1.5.4.2 Rest of North America Network Access Control Market by Offering

- 8.1.5.4.3 Rest of North America Network Access Control Market by Enterprise Size

- 8.1.5.4.4 Rest of North America Network Access Control Market by Vertical

- 8.1.5.1 US Network Access Control Market

- 8.1.1 North America Network Access Control Market by Deployment

- 8.2 Europe Network Access Control Market

- 8.2.1 Europe Network Access Control Market by Deployment

- 8.2.1.1 Europe Cloud Market by Country

- 8.2.1.2 Europe On-premise Market by Country

- 8.2.2 Europe Network Access Control Market by Offering

- 8.2.2.1 Europe Hardware Market by Country

- 8.2.2.2 Europe Software Market by Country

- 8.2.2.3 Europe Services Market by Country

- 8.2.3 Europe Network Access Control Market by Enterprise Size

- 8.2.3.1 Europe Large Enterprises Market by Country

- 8.2.3.2 Europe Small & Medium Enterprises Market by Country

- 8.2.4 Europe Network Access Control Market by Vertical

- 8.2.4.1 Europe BFSI Market by Country

- 8.2.4.2 Europe IT & Telecommunication Market by Country

- 8.2.4.3 Europe Retail Market by Country

- 8.2.4.4 Europe Education Market by Country

- 8.2.4.5 Europe Healthcare & Dental Market by Country

- 8.2.4.6 Europe Energy & Utilities Market by Country

- 8.2.4.7 Europe Manufacturing Market by Country

- 8.2.4.8 Europe Government Market by Country

- 8.2.4.9 Europe Others Market by Country

- 8.2.5 Europe Network Access Control Market by Country

- 8.2.5.1 Germany Network Access Control Market

- 8.2.5.1.1 Germany Network Access Control Market by Deployment

- 8.2.5.1.2 Germany Network Access Control Market by Offering

- 8.2.5.1.3 Germany Network Access Control Market by Enterprise Size

- 8.2.5.1.4 Germany Network Access Control Market by Vertical

- 8.2.5.2 UK Network Access Control Market

- 8.2.5.2.1 UK Network Access Control Market by Deployment

- 8.2.5.2.2 UK Network Access Control Market by Offering

- 8.2.5.2.3 UK Network Access Control Market by Enterprise Size

- 8.2.5.2.4 UK Network Access Control Market by Vertical

- 8.2.5.3 France Network Access Control Market

- 8.2.5.3.1 France Network Access Control Market by Deployment

- 8.2.5.3.2 France Network Access Control Market by Offering

- 8.2.5.3.3 France Network Access Control Market by Enterprise Size

- 8.2.5.3.4 France Network Access Control Market by Vertical

- 8.2.5.4 Russia Network Access Control Market

- 8.2.5.4.1 Russia Network Access Control Market by Deployment

- 8.2.5.4.2 Russia Network Access Control Market by Offering

- 8.2.5.4.3 Russia Network Access Control Market by Enterprise Size

- 8.2.5.4.4 Russia Network Access Control Market by Vertical

- 8.2.5.5 Spain Network Access Control Market

- 8.2.5.5.1 Spain Network Access Control Market by Deployment

- 8.2.5.5.2 Spain Network Access Control Market by Offering

- 8.2.5.5.3 Spain Network Access Control Market by Enterprise Size

- 8.2.5.5.4 Spain Network Access Control Market by Vertical

- 8.2.5.6 Italy Network Access Control Market

- 8.2.5.6.1 Italy Network Access Control Market by Deployment

- 8.2.5.6.2 Italy Network Access Control Market by Offering

- 8.2.5.6.3 Italy Network Access Control Market by Enterprise Size

- 8.2.5.6.4 Italy Network Access Control Market by Vertical

- 8.2.5.7 Rest of Europe Network Access Control Market

- 8.2.5.7.1 Rest of Europe Network Access Control Market by Deployment

- 8.2.5.7.2 Rest of Europe Network Access Control Market by Offering

- 8.2.5.7.3 Rest of Europe Network Access Control Market by Enterprise Size

- 8.2.5.7.4 Rest of Europe Network Access Control Market by Vertical

- 8.2.5.1 Germany Network Access Control Market

- 8.2.1 Europe Network Access Control Market by Deployment

- 8.3 Asia Pacific Network Access Control Market

- 8.3.1 Asia Pacific Network Access Control Market by Deployment

- 8.3.1.1 Asia Pacific Cloud Market by Country

- 8.3.1.2 Asia Pacific On-premise Market by Country

- 8.3.2 Asia Pacific Network Access Control Market by Offering

- 8.3.2.1 Asia Pacific Hardware Market by Country

- 8.3.2.2 Asia Pacific Software Market by Country

- 8.3.2.3 Asia Pacific Services Market by Country

- 8.3.3 Asia Pacific Network Access Control Market by Enterprise Size

- 8.3.3.1 Asia Pacific Large Enterprises Market by Country

- 8.3.3.2 Asia Pacific Small & Medium Enterprises Market by Country

- 8.3.4 Asia Pacific Network Access Control Market by Vertical

- 8.3.4.1 Asia Pacific BFSI Market by Country

- 8.3.4.2 Asia Pacific IT & Telecommunication Market by Country

- 8.3.4.3 Asia Pacific Retail Market by Country

- 8.3.4.4 Asia Pacific Education Market by Country

- 8.3.4.5 Asia Pacific Healthcare & Dental Market by Country

- 8.3.4.6 Asia Pacific Energy & Utilities Market by Country

- 8.3.4.7 Asia Pacific Manufacturing Market by Country

- 8.3.4.8 Asia Pacific Government Market by Country

- 8.3.4.9 Asia Pacific Others Market by Country

- 8.3.5 Asia Pacific Network Access Control Market by Country

- 8.3.5.1 China Network Access Control Market

- 8.3.5.1.1 China Network Access Control Market by Deployment

- 8.3.5.1.2 China Network Access Control Market by Offering

- 8.3.5.1.3 China Network Access Control Market by Enterprise Size

- 8.3.5.1.4 China Network Access Control Market by Vertical

- 8.3.5.2 Japan Network Access Control Market

- 8.3.5.2.1 Japan Network Access Control Market by Deployment

- 8.3.5.2.2 Japan Network Access Control Market by Offering