|

|

市場調査レポート

商品コード

1464279

世界のデジタル送金市場:2024-2028年Global Digital Money Transfer & Remittances: 2024-2028 |

||||||

|

|||||||

| 世界のデジタル送金市場:2024-2028年 |

|

出版日: 2024年04月18日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

| 主要統計 | |

|---|---|

| 2024年の総取引額: | 3兆9,000億米ドル |

| 2028年の総取引額: | 6兆5,000億米ドル |

| 2024年から2028年の市場成長率: | 41% |

| 予測期間: | 2024-2028年 |

当レポートでは、世界のデジタル送金の市場を調査し、デジタル送金の導入・発展を形成する主な推進要因と課題、オープンバンキング、ステーブルコイン、CBDC、モバイルマネーなどの各種金融技術の動向、ユーザー数・取引件数・取引額の推移・予測、モバイル・オンライン・国内/国際・インスタントペイメントなどの各種区分および地域/主要国別の詳細分析、主要ベンダーの競合リーダーボードなどをまとめています。

サンプルビュー

市場データと予測レポート

市場動向と戦略レポート

市場データ&予測レポート

本調査スイートには、85の表と40,000を超えるデータポイントの予測データ一式へのアクセスが含まれています。調査スイートには以下の指標が含まれます:

- 送金ユーザー数

- 送金取引総件数

- 送金取引総額

これらの指標は以下の主要市場について提供されています:

- モバイル国内送金

- オンライン国内送金

- モバイル国際送金

- オンライン国際送金

- 消費者向けインスタントペイメント

Juniper Researchインタラクティブ予測 (Excel) には以下の機能があります:

- 統計分析:データ期間中のすべての地域と国について表示される特定の指標を検索できるのがメリットです。グラフは簡単に変更でき、クリップボードへのエクスポートも可能です。

- 国別データツール:このツールでは、予測期間中のすべての地域と国の指標を見ることができます。検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:特定の国を選択して比較することができます。このツールには、グラフをエクスポートする機能が含まれています。

- What-if分析:5つのインタラクティブなシナリオを通じて、予測指標を独自の前提条件と比較することができます。

目次

市場動向と戦略

第1章 重要ポイント・戦略的推奨事項

- 重要ポイント

- 戦略的推奨事項

第2章 国際デジタル送金

- 国際デジタル送金

- ブロックチェーンとステーブルコイン

- ブロックチェーン

- ステーブルコイン

- CBDC

- 国際決済におけるインスタントペイメント

- CBDC

- デジタル送金におけるAI

- 国際送金市場にディスラプションを起こす要因

- モバイルマネー

- ネオバンク

- 決済ゲートウェイ

- マイクロファイナンス

- 時事問題

- P2Pプラットフォーム別デジタル送金の改善

第3章 国内デジタル送金とモバイルマネー

- 国内デジタル送金とモバイルマネー

- 現在の市場状況と注目すべき動向

第4章 デジタル送金:主要な送金経路と地域分析

- デジタル送金:主要な送金経路と地域分析

- デジタル送金:地域分析と将来の展望

- 北米

- ラテンアメリカ

- 西欧

- 中欧・東欧

- インド亜大陸

- 極東・中国

- その他のアジア太平洋地域

- アフリカ・中東

- デジタル送金に関する国別準備状況:ヒートマップ分析

競合のリーダーボード

第1章 デジタル送金プラットフォームプロバイダー:Juniper Research競合リーダーボード

第2章 デジタル送金プラットフォームプロバイダーの企業プロファイル

- デジタル送金プラットフォームプロバイダーベンダープロファイル

- Amdocs

- Comviva

- Huawei

- Infosys EdgeVerve

- Interac

- Mastercard

- Nium

- OBOPAY

- PayPal

- RemitONE

- Ripple

- Seamless Distributions Systems

- Telepin Software

- Thunes

- Visa

- Juniper Researchリーダーボード評価調査手法

第3章 デジタル送金サービスプロバイダー:Juniper Research競合リーダーボード

- 送金業者ベンダープロファイル

- Currencies Direct

- CurrencyFair

- FairFX

- Instarem

- Moneycorp

- MoneyGram

- OFX

- Remitly

- Ria

- Skrill

- Western Union

- Wise

- WorldRemit

- Xoom

- Juniper Researchリーダーボード評価調査手法

データと予測

第1章 市場概要

- デジタル送金:イントロダクション

- 国内デジタル送金とモバイルマネー

第2章 調査手法の前提と要約

- 調査手法と前提

- 即時支払い

第3章 デジタル送金:予測の概要

- デジタル送金の利用予測

- モバイルおよびオンラインデジタル送金アクティブユーザー

- モバイルおよびオンライン送金の総取引件数

- モバイルおよびオンライン送金の総取引額

第4章 国内送金:市場予測と重要ポイント

- 国内送金の予測

- 国内送金アクティブユーザー

- 国内送金の総取引件数

- 国内送金の総取引額

第5章 国際送金:市場予測と重要ポイント

- 国際送金の予測

- 国際送金アクティブユーザー

- 国際送金の総取引件数

- 国際送金の総取引額

第6章 消費者向け即時決済:市場予測と重要ポイント

- 消費者向け即時決済の予測

- 取引額:国内消費者

- 取引額:国外消費者

- 取引額:消費者

| KEY STATISTICS | |

|---|---|

| Total transaction value in 2024: | $3.9tn |

| Total transaction value in 2028: | $6.5tn |

| 2024 to 2028 market growth: | 41% |

| Forecast period: | 2024-2028 |

Overview

Our "Digital Money Transfer & Remittances" research report provides a detailed evaluation and analysis of both the domestic and international markets, including the impact of instant payments, blockchain and CBDC and other initiatives disrupting the market such as mobile money, neobanks, mobile wallets and payment gateways. The research also considers the future challenges within digital money transfer and remittances, and emerging trends in the space.

In addition, this report covers market opportunities; providing strategic insights into the development of digital money transfer capabilities in line with new technologies, such as AI and machine learning.

It highlights future opportunities and technologies that are important for vendors, merchants and financial institutions to consider when adapting money transfer and digital remittances for the future, incorporating aspects such as Open Banking, instant transfers and CBDCs.

The report also positions 29 vendors across two Juniper Research Competitor Leaderboards, for digital money transfer and digital remittance; providing an invaluable resource for stakeholders seeking to understand the competitive landscape in the market.

The research suite contains a detailed dataset; providing forecasts for 61 countries across a wide range of different metrics, including total revenue from mobile domestic money transfer and online domestic money transfer to international mobile and online money transfer and instant transfers.

Key Features

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the digital money transfer and remittances space, including:

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Future strategic directions and market outlook for digital money transfer and remittances vendors.

- Key drivers and benefits of digital money transfer and remittances for vendors, including an increase in global digital acceptance, the implementation of AI and ML, the analysis of real-time data and the impact on the digital money transfer and remittance space, as well as how money transfer platforms can improve the digital money transfer space.

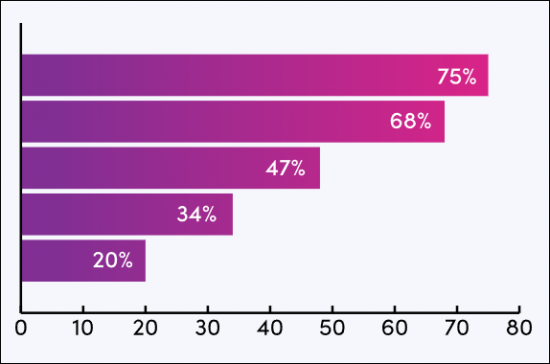

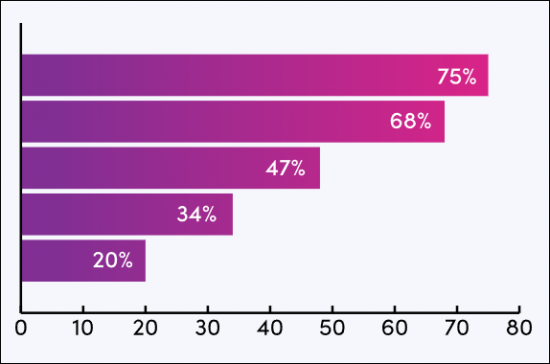

- Country Readiness Index: Comprehensive coverage featuring country-level market analysis on the future of the market in a select 61 countries split by 8 key regions; thoroughly analysing each country's potential success in the digital money transfer and remittance market, with insight into current and future trends, paired with supplementary 5-year forecast data.

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Benchmark Industry Forecasts: Includes forecasts for the total money transfer for both domestic and international money movement, as well as the total money sent through consumer instant payment. This data is split by our 8 key forecast regions and 61 countries.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment for 29 vendors in the digital money transfer and remittance space, via two Juniper Research Competitor Leaderboards.

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the digital money transfer and remittances space, including:

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Future strategic directions and market outlook for digital money transfer and remittances vendors.

- Key drivers and benefits of digital money transfer and remittances for vendors, including an increase in global digital acceptance, the implementation of AI and ML, the analysis of real-time data and the impact on the digital money transfer and remittance space, as well as how money transfer platforms can improve the digital money transfer space.

- The importance of using digital money transfer and remittances systems in the face of growing digital solutions.

- Country Readiness Index: Comprehensive coverage featuring country-level market analysis on the future of the market in a select 61 countries split by 8 key regions; thoroughly analysing each country's potential success in the digital money transfer and remittance market, with insight into current and future trends, paired with supplementary 5-year forecast data.

- Benchmark Industry Forecasts: Includes forecasts for the total money transfer for both domestic and international money movement, as well as the total money sent through consumer instant payment. This data is split by our 8 key forecast regions and 61 countries.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment for 29 vendors in the digital money transfer and remittance space, via two Juniper Research Competitor Leaderboards.

SAMPLE VIEW

Market Data & Forecasting Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

The market-leading research suite for the "Digital Money Transfer & Remittances" market includes access to the full set of forecast data of 85 tables and over 40,000 datapoints. Metrics in the research suite include:

- Total number of Money Transfer Users

- Total Number of Money Transfer Transactions

- Total Money Transfer Transaction Value

These metrics are provided for the following key market verticals:

- Mobile Domestic Money Transfer

- Online Domestic Money Transfer

- Mobile International Money Transfer

- Online International Money Transfer

- Consumer Instant Payments

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios

Market Trends & Strategies Report

Juniper Research's new report examines the "Digital Money Transfer & Remittances" market landscape in detail; assessing current trends and factors shaping the market such as the growing use and anticipation surrounding different financial technologies such as Open Banking, stablecoins, CBDCs and mobile money, and the use of AI and machine learning to improve the money transfer space. The report delivers comprehensive analysis of the strategic opportunities for digital money transfer and remittance providers within various markets; addressing key verticals and developing challenges, and how stakeholders should navigate these.

Competitor Leaderboard Report

Juniper Research's Competitor Leaderboards provide detailed evaluation and market positioning for 29 leading vendors in the "Digital Money Transfer & Remittances" space. The vendors are positioned either as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments. The vendors in the Digital Money Transfer Leaderboard include:

- Amdocs

- Comviva

- Huawei

- Infosys EdgeVerve

- Interac

- Mastercard

- Nium

- OBOPAY

- PayPal

- RemitONE

- Ripple

- Seamless Distribution Systems

- Telepin Software

- Thunes

- Visa

The vendors in the Digital Remittances Competitor Leaderboard include:

- Currencies Direct

- CurrencyFair

- FairFX

- InstaREM

- Moneycorp

- MoneyGram

- OFX

- Remitly

- Ria

- Skrill

- Western Union

- Wise

- WorldRemit

- Xoom

Backed by a robust and comprehensive scoring methodology, Juniper Research's Competitor Leaderboard allows readers to gain greater insight into leading market players; enabling them to view which companies have the highest market prospects and the strategies being implemented.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. International Digital Money Transfer & Remittances

- 2.1. International Digital Money Transfer & Remittances

- 2.1.1. Definition and Scope

- 2.2. Blockchain and Stablecoins

- 2.2.1. Blockchain

- i. Examples of Blockchain Use in International Digital Money Transfer

- ii. Advantages of Blockchain in International Digital Money Transfer

- Figure 2.1: Advantages of Blockchain in Digital Money Transfer

- 2.2.2. Stablecoins

- i. Benefits of Stablecoins in Cross-border Digital Money Transfer

- ii. Perceived Risks of Stablecoins in Cross-border Digital Money Transfer

- 2.2.3. CBDCs

- 2.2.1. Blockchain

- 2.3. Instant Payments within Cross-border Payments

- 2.4. CBDCs

- 2.4.1. Project mBridge

- 2.5. Artificial Intelligence in Digital Money Transfer

- 2.6. Players Disrupting the International Remittance Market

- 2.6.1. Mobile Money

- 2.6.2. Neobanks

- 2.6.3. Payment Gateways

- 2.6.4. Microfinance

- 2.6.5. Current Events

- 2.6.6. Improving Digital Money Transfer through P2P Platforms

- i. Additional Services

- ii. Partnerships and Open APIs

3. Domestic Digital Money Transfer & Mobile Money

- 3.1. Domestic Digital Money Transfer and Mobile Money

- 3.1.1. Definitions and Scope

- 3.2. Current Market Status and Trends to Watch

4. Digital Money Transfer: Key Remittance Corridors & Regional Analysis

- 4.1. Digital Money Transfer: Key Remittance Corridors & Regional Analysis

- Figure 4.1: Juniper Research's 8 Key Regions Definition

- Table 4.2: Juniper Research Digital Money Transfer Country Readiness Index: Scoring Criteria

- Figure 4.3: Juniper Research Country Readiness Index - Digital Money Transfer Remittances

- Figure 4.4: Juniper Research's Competitive Web: Digital Money Transfer Regional Opportunities

- 4.2. Digital Money Transfer: Regional Analysis & Future Outlook

- 4.2.1. North America

- i. US

- ii. Canada

- 4.2.2. Latin America

- i. Argentina

- ii. Brazil

- iii. Colombia

- iv. Mexico

- 4.2.3. West Europe

- i. Denmark

- ii. France

- iii. Germany

- iv. Italy

- v.Netherlands

- vi. Norway

- vii. Portugal

- viii. Spain

- ix. Sweden

- x. UK

- 4.2.4. Central & East Europe

- i. Poland

- ii. Russia

- iii. Turkey

- 4.2.5. Indian Subcontinent

- i. India

- 4.2.6. Far East & China

- i. China

- ii. Japan

- iii. South Korea

- 4.2.7. Rest of Asia Pacific

- i. Australia

- ii. Singapore

- 4.2.8. Africa & Middle East

- i. Saudi Arabia

- ii. South Africa

- 4.2.9. Digital Money Transfer & Remittances Country Readiness: Heatmap Analysis

- Table 4.5: Juniper Research's Country Readiness Index: North America

- Table 4.6: Juniper Research's Country Readiness Index: Latin America

- Table 4.7: Juniper Research's Country Readiness Index: West Europe

- Table 4.8: Juniper Research's Country Readiness Index: Far East & China

- Table 4.9: Juniper Research's Country Readiness Index: Indian Subcontinent

- Table 4.10: Juniper Research's Country Readiness Index: Rest of Asia Pacific

- Table 4.11: Juniper Research's Country Readiness Index: Africa & Middle East

- 4.2.1. North America

Competitor Leaderboard

1. Juniper Research Digital Money Transfer Platform Providers Competitor Leaderboard

- 1.1. Why Read This Report?

- Table 1.1: Juniper Research Competitor Leaderboard Vendors: Digital Money Transfer Platform Providers

- Figure 1.2: Juniper Research Competitor Leaderboard: Digital Money Transfer Platform Providers

- Table 1.3: Juniper Research Competitor Leaderboard: Digital Money Transfer Platform Providers

- Table 1.4: Juniper Research Competitor Leaderboard Digital Money Transfer Platform Providers - Heatmap

2. Digital Money Transfer Platform Providers Company Profiles

- 2.1. Digital Money Transfer Platform Providers Vendor Profiles

- 2.1.1. Amdocs

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.2. Comviva

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level Views of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.3. Huawei

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.4. Infosys EdgeVerve

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.5. Interac

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.6. Mastercard

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.1: Mastercard Send Platform

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.7. Nium

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.8. OBOPAY

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.9. PayPal

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Strategic Opportunities

- 2.1.10. RemitONE

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.11. Ripple

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Deevelopment Opportunities

- 2.1.12. Seamless Distributions Systems

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.13. Telepin Software

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.14. Thunes

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 2.1.15. Visa

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- Table 2.2: Juniper Research Digital Money Transfer Leaderboard Assessment Criteria

- 2.1.1. Amdocs

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

3. Juniper Research Competitor Leaderboard for Digital Money Transfer Remittance Providers

- Table 3.1: Juniper Research Competitor Leaderboard: Digital Remittance Providers

- Figure 3.2: Juniper Research Competitor Leaderboard - Digital Remittance Vendors

- Table 3.3: Juniper Research Competitor Leaderboard: Digital Remittance Vendor Ranking

- Table 3.4: Juniper Research Competitor Leaderboard: Digital Remittance Vendors - Heatmap

- 3.1. Money Transfer Remittance Providers Vendor Profiles

- 3.1.1. Currencies Direct

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.2. CurrencyFair

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.3. FairFX

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.4. Instarem

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.5. Moneycorp

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.6. MoneyGram

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.7. OFX

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research View: Strategic Recommendations & Key Development Opportunities

- 3.1.8. Remitly

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.9. Ria

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.10. Skrill

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.11. Western Union

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.12. Wise

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.13. WorldRemit

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- 3.1.14. Xoom

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Strategic Recommendations & Key Development Opportunities

- Table 3.5: Juniper Research Digital Remittance Assessment Criteria

- 3.1.1. Currencies Direct

- 3.2. Juniper Research Leaderboard Assessment Methodology

- 3.2.1. Limitations & Interpretations

Data & Forecasting

1. Market Overview

- 1.1. Digital Money Transfer Introduction

- 1.1.1. Definition and Scope

- 1.2. Domestic Digital Money Transfer and Mobile Money

- 1.2.1. Definitions and Scope

2. Methodology Assumptions and Summary

- 2.1. Introduction

- 2.2. Methodology & Assumptions

- 2.2.1. Market Sizing: Introduction

- 2.2.2. Methodology

- 2.2.3. Indicators

- 2.3. Instant Payments

- 2.3.1. Introduction

- Figure 2.1: Digital Money Transfer & Remittances Market Forecast Methodology

- Figure 2.2: Consumer Instant Payments Methodology

- 2.3.1. Introduction

3. Digital Money Transfer & Remittances: Forecast Summary

- 3.1. Digital Money Transfer & Remittances Usage Forecasts

- 3.1.1. Mobile & Online Digital Money Transfer Active Users

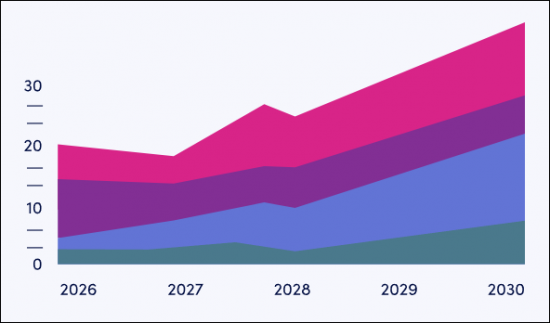

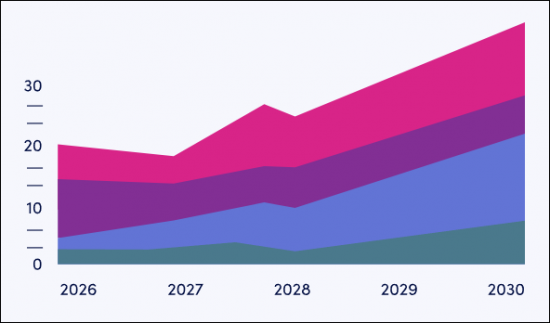

- Figure & Table 3.1: Total Number of Active Digital Money Transfer Users (m), Split by 8 Key Regions, 2023-2028

- 3.1.2. Mobile & Online Money Transfer & Remittances Total Transaction Volume

- Figure & Table 3.2: Total Digital Money Transfer & Remittance Transactions per annum (m), Split by 8 Regions, 2023-2028

- 3.1.3. Mobile & Online Money Transfer & Remittances Total Transaction Value

- Figure & Table 3.3: Total Value of Mobile & Online Money Transfer per annum ($m), Split by 8 Key Regions, 2023-2028

- 3.1.1. Mobile & Online Digital Money Transfer Active Users

4. Domestic Money Transfer: Market Forecasts & Key Takeaways

- 4.1. Domestic Money Transfer Forecasts

- 4.1.1. Domestic Money Transfer Active Users

- Figure & Table 4.1: Mobile & Online Domestic Money Transfer, Active Users (m), Split by 8 Key Regions, 2023-2028

- 4.1.2. Domestic Money Transfer Total Transactions Volumes

- Figure & Table 4.2: Total Number of Mobile & Online Domestic Money Transfer Transactions per annum (m), Split by 8 Key Regions, 2023-2028

- 4.1.3. Domestic Money Transfer Total Transaction Values

- Figure & Table 4.3: Total Value of Mobile & Online Domestic Transaction per annum ($m), Split by 8 Key Regions, 2023-2028

- 4.1.1. Domestic Money Transfer Active Users

5. International Money Transfer & Remittances: Market Forecasts & Key Takeaways

- 5.1. International Money Transfer & Remittances Forecasts

- 5.1.1. International Money Transfer Active Users

- Figure & Table 5.1: Mobile & Online International Money Transfer, Active Users (m), Split by 8 Key Regions, 2023-2028

- 5.1.2. International Money Transfer Total Transaction Volume

- Figure & Table 5.2: Total Number of Mobile & Online International Money Transfer Transactions per annum (m), Split by 8 Key Regions, 2023-2028

- 5.1.3. International Money Transfer Total Transaction Value

- Figure & Table 5.3: Total Value of Mobile & Online International Transactions per annum ($m), Split by 8 Key Regions, 2023-2028

- 5.1.1. International Money Transfer Active Users

6. Consumer Instant Payments: Market Forecasts & Key Takeaways

- 6.1. Consumer Instant Payments Forecast

- 6.1.1. Value of Domestic Consumer Instant Payments

- Figure & Table 6.1: Total Value of Instant Payments Domestic Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.2. Value of Cross-border Consumer Instant Payments

- Figure & Table 6.2: Total Value of Instant Payments Cross-border Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.3. Value of Consumer Instant Payments

- Figure & Table 6.3: Total Value of Instant Payments Consumer Transactions ($m), Split by 8 Key Regions, 2023-2028

- 6.1.1. Value of Domestic Consumer Instant Payments