|

|

市場調査レポート

商品コード

1508848

新興市場におけるモバイルマネー:2024-2029年Mobile Money in Emerging Markets: 2024-2029 |

||||||

|

|||||||

| 新興市場におけるモバイルマネー:2024-2029年 |

|

出版日: 2024年07月15日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

| 主要統計 | |

|---|---|

| 2024年のモバイルマネーサービスによる支出: | 15億9,000万米ドル |

| 2029年のモバイルマネーサービスによる支出: | 24億米ドル |

| 2024年から2029年の市場成長率 | 51% |

| 予測期間 | 2024-2029年 |

当調査レポートは、モバイルファイナンシャルサービスの進化・発展動向に関して詳細な評価と分析を提供しています。また、高度なサービスへの移行や加盟店決済の拡大など、モバイルマネー市場における今後の動向や課題についても考察しています。

さらに、本レポートにはJuniper Researchの競合リーダーボードが2つ掲載されており、この分野の競争力を総合的に理解することができます。競合情勢では、20のモバイルマネーサービスと16のモバイルマネー技術プラットフォームプロバイダーの位置付けを行っており、消費者向けおよびB2Bベースの両方でモバイルマネー市場の競合情勢を理解しようとするステークホルダーにとって貴重な資料となります。

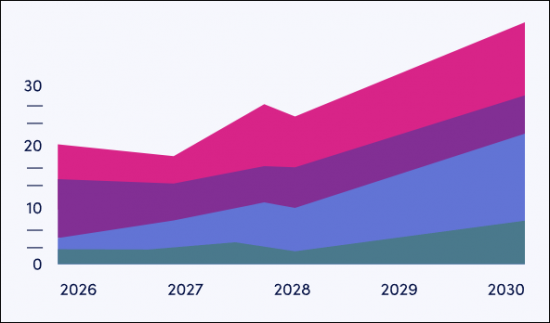

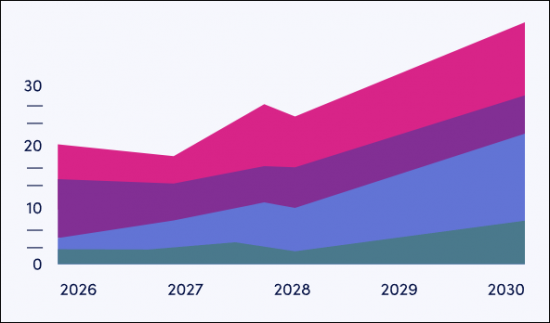

当調査スイートには詳細なデータセットが含まれており、モバイルマネーサービスを介して行われた総ユーザー数およびトランザクション数、マイクロクレジットのユーザーへの貸出額、モバイルマネーサービスでの総支出額および入金額など、さまざまな指標におけるモバイルファイナンシャルサービスの利用予測を提供しています。

主な特徴

- 市場力学:基本サービスの提供からより高度なサービスやデジタル決済への移行、Payments as a Platformビジネスモデルの台頭、モバイルウォレット内の新機能を可能にするAIの活用など、モバイルマネー業界の導入と発展を形作る主な促進要因、課題、イノベーションを戦略的に分析

- 主な要点と戦略的提言:モバイルマネー市場における主な発展機会と知見を詳細に分析し、デジタルウォレットプロバイダー、モバイルネットワーク事業者、銀行などのステークホルダーに対する戦略的提言を掲載

- ベンチマーク業界予測:モバイルマネープラットフォームの総ユーザー数、モバイルマネープラットフォームを介した消費額の予測を、異なるセグメントおよびトランザクションタイプに分けて掲載しています。このデータは4つの主要予測地域と15カ国に分かれています

- Juniper Researchの競合リーダーボード:モバイルマネーサービス20社とモバイルマネー技術プラットフォームプロバイダー16社の主要企業の能力を、2つのJuniper Researchの競合リーダーボードで評価

サンプルビュー

市場データ・予測 (PDFレポート)

Juniper ResearchのPDFレポート「市場データ&予測」をご覧ください。

市場動向・戦略レポート

現在の市場情勢を包括的に分析し、戦略的な提言を行います。

市場データと予測

当調査スイートには、76の表と10,000を超えるデータポイントの予測データ一式へのアクセスが含まれています。調査スイートの指標には以下が含まれます:

- ユーザー数

- 利用額

データは以下のセクターとトランザクションタイプに分かれています:

- 4つの主要セクター:マイクロ保健、マイクロローン、マイクロセービング、モバイル送金

- 8つのトランザクションタイプ:通信時間トップアップ、請求書支払い、キャッシュイン、キャッシュアウト、国内P2P、G2P、国際P2P、マーチャントペイメント

Juniper Research Interactive Forecast Excelには以下の機能があります:

- 統計分析:データ期間中のすべての地域と国について、特定の指標を検索することができます。グラフは簡単に変更でき、クリップボードへのエクスポートも可能です。

- 国別データツール:このツールでは、予測期間中のすべての地域と国の指標を見ることができます。検索バーで表示される指標を絞り込むことができます。

- 国別比較ツール:特定の国を選択して比較することができます。このツールには、グラフをエクスポートする機能が含まれています。

- What-if分析:5つのインタラクティブなシナリオを通じて、予測指標を独自の前提条件と比較することができます。

目次

市場動向と戦略

第1章 重要ポイント・戦略的推奨事項

- モバイルマネーサービスの主なポイント

- モバイルマネーサービスに関する戦略的推奨事項

- 高度MFSの重要ポイント

- 高度MFSのための戦略的推奨事項

第2章 モバイルマネー市場の現状と今後の展望

- モバイルマネー:概要

- モバイルマネーの定義

- 背景

- 促進要因

- モバイルマネーの重要な柱

- 課題

第3章 セグメント分析

- モバイル送金

- i.国内

- ii.越境

- モバイルマイクロローン

- モバイルマイクロ保険

- モバイルマイクロセービング

- 加盟店決済 (店舗内とオンラインの両方)

- モバイルマネー市場の現状

- モバイル送金

- モバイルマイクロローン

- モバイルマイクロ保険

- モバイルマイクロセービング

- 加盟店決済

第4章 主な動向と将来の見通し

- 主な実現要因

- 主要技術

- 重要な関係

- 高度なサービスへの移行

- 新しいサービス提供のためのプラットフォーム機能

- 決済プラットフォームとモバイルマネーの未来

- 最適化されたUX (ユーザーエクスペリエンス) とUI (ユーザーインターフェース)

- パーソナライズされた製品デザイン

- 重要なパートナーシップの構築と管理

- 規制上の課題の克服

競合リーダーボード

第1章 モバイルマネーサービスの競合リーダーボードとベンダープロファイル

- ベンダープロファイル

- Airtel Money

- bKash

- Easypaisa

- EcoCash

- eZ Cash

- Gcash (Philippines)

- Grameenphone (GPAY)

- LinkAja

- Mon Cash

- Moov Money (Benin)

- M-PESA

- MTN Mobile Money

- Ooredoo Money

- Orange Money

- Roshan M-Paisa

- Tigo

- Transfer/Telcel

- TrueMoney

- UPaisa

- Wave Money

- 調査手法

- 制限と解釈

第2章 モバイルマネープラットフォームプロバイダーの競合リーダーボード

- ベンダープロファイル

- Amdocs

- Comviva

- DigiPay.Guru

- Ericsson

- Estel

- Huawei

- inswitch

- Obopay

- Omobio

- OpenWay

- Panamax

- Seamless Distribution Systems

- Telepin

- Tmob - Thinks Mobility

- Veengu

- Youtap

- 調査手法

- 制限と解釈

データと予測

第1章 イントロダクション・予測調査手法

- モバイルマネー:イントロダクション

- モバイルマネー:定義

- 予測のイントロダクション

- 市場予測:サマリー

- モバイルファイナンシャルサービスの総ユーザー数

- モバイルファイナンシャルサービスにおける消費者の支出総額と預金額

- 高度なマイクロファイナンスの予測

- 高度なマイクロファイナンス取引を行うモバイルユーザーの数

- 高度なマイクロファイナンス取引の総量

- モバイルマネー予測

- 年間モバイルマネー取引総数

- 新興市場におけるモバイルマネー取引総額

- マイクロローンとマイクロクレジットの予測

- 新興市場におけるモバイルマイクロローンの総数

- 新興市場におけるモバイルマイクロローンの総額

- モバイルマイクロセービング予測

- モバイルマイクロセービング口座の総数

- モバイルマイクロセービングの年間総預金額

- モバイルマイクロ保険予測

- モバイルマイクロ保険のユーザー総費用

| KEY STATISTICS | |

|---|---|

| Spend via mobile money services in 2024: | $1.59bn |

| Spend via mobile money services in 2029: | $2.4tn |

| 2024 to 2029 market growth: | 51% |

| Forecast period: | 2024-2029 |

Overview

Our "Mobile Money in Emerging Markets" research report provides a detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing. The research also considers future trends and challenges within the mobile money market, such as the shift to advanced services and the expansion of merchant payments.

In addition, the report contains two Juniper Research Competitor Leaderboards; giving readers a comprehensive understanding of the competitive dynamics in this space. The Competitor Leaderboards position 20 mobile money services and 16 mobile money technology platform providers; delivering an invaluable resource for stakeholders seeking to understand the competitive landscape in the mobile money market on both a consumer-facing and B2B basis.

The research suite contains a detailed dataset; providing forecasts for mobile financial services use across a wide range of different metrics, including the total users and transactions made via mobile money services, the amount lent to users of microcredit, and the total monetary spend and deposits for mobile money services in mobile money.

Key Features

- Market Dynamics: A strategic analysis of the major drivers, challenges, and innovations shaping the adoption and development of the mobile money industry, including the shift from offering basic services to more advanced services and digital payments, the rise of the Payments as a Platform business model, and the use of AI to enable new capabilities within mobile wallets.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the mobile money market, accompanied by strategic recommendations for stakeholders, such as digital wallet providers, mobile network operators and banks.

- Benchmark Industry Forecasts: Includes forecasts for the total users of, and spend via, mobile money platforms, split by different segments and transaction types. This data is split by 4 key forecast regions and 15 countries.

- Juniper Research Competitor Leaderboards: Key player capability and capacity assessment for 20 mobile money services and 16 mobile money technology platform providers, via two Juniper Research Competitor Leaderboards.

SAMPLE VIEW

Market Data & Forecasts PDF Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasts

The market-leading research suite for the "Mobile Money in Emerging Markets" includes access to the full set of forecast data of 76 tables and over 10,000 datapoints. Metrics in the research suite include:

- Number of Users

- Value of Spend

The data is split by the following sectors and transaction types:

- 4 Key Sectors (Microinsurance, Microloans, Microsavings, Mobile Money Transfer)

- 8 Transaction Types (Airtime Top-up, Bill Payment, Cash In, Cash Out, Domestic P2P, G2P, International P2P, Merchant Payment)

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via 5 interactive scenarios.

Market Trends & Strategies Report

Juniper Research's new report examines the "Mobile Money in Emerging Markets" landscape in detail; assessing current trends and factors shaping the market, such as the growing shift to advanced services, the use of AI & machine learning to unlock new capabilities, and the impact of new payment types, such as CBDCs (Central Bank Digital Currencies). The report delivers comprehensive analysis of the strategic opportunities for mobile money services and platform providers; addressing key verticals, developing challenges, and how stakeholders should navigate these.

Competitor Leaderboard Report

Juniper Research's Competitor Leaderboard provides detailed evaluation and market positioning for 20 leading mobile money services and 16 mobile money technology platforms. The vendors in each Competitor Leaderboard are positioned either as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments. The vendors in the mobile money services Competitor Leaderboard include:

|

|

The vendors in the mobile money technology platforms Competitor Leaderboard include:

|

|

Backed by a robust and comprehensive scoring methodology, Juniper Research's Competitor Leaderboard allows readers to gain greater insight into leading market players; enabling them to view which companies have the highest market prospects and the strategies being implemented.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways for Mobile Money Services

- 1.2. Strategic Recommendations for Mobile Money Services

- 1.3. Key Takeaways for Sophisticated MFS

- 1.4. Strategic Recommendations for Sophisticated MFS

2. Current Status of the Mobile Money Market & Future Outlook

- 2.1. Introduction to Mobile Money

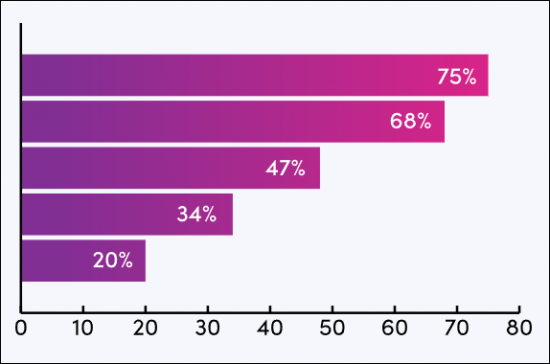

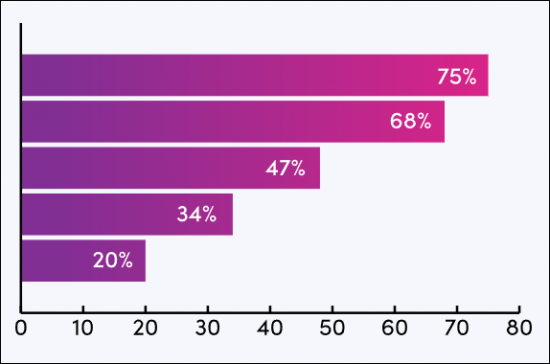

- Figure 2.1: Unbanked Adult Population (m), Split by 8 Key Regions, 2024

- 2.2. Definitions within Mobile Money

- 2.2.1. The Context

- 2.2.2. The Drivers

- 2.2.3. The Key Pillars of Mobile Money

- 2.2.4. The Challenges

- Figure 2.2: Smartphone Penetration Rate (%), Split by 8 Key Regions, 2024

3. Segment Analysis

- 3.1.1. Mobile Money Transfer

- i. Domestic

- ii. Cross-border

- 3.1.2. Mobile Microloans

- 3.1.3. Mobile Microinsurance

- 3.1.4. Mobile Microsavings

- 3.1.5. Merchant Payments (both In-store and Online)

- i. In-store Merchant Payments

- ii. Online Merchant Payments

- 3.2. Status of the Mobile Money Market

- 3.2.1. Mobile Money Transfer

- i. Introduction

- ii. SWOT Analysis

- iii. Outlook

- 3.2.2. Mobile Microloans

- i. Introduction

- ii. SWOT Analysis

- iii. Outlook

- 3.2.3. Mobile Microinsurance

- i. Introduction

- Figure 3.1: Mobile Microinsurance Categories

- ii. SWOT Analysis

- iii. Outlook

- i. Introduction

- 3.2.4. Mobile Microsavings

- i. Introduction

- ii. SWOT Analysis

- iii. Outlook

- 3.2.5. Merchant Payments

- i. Introduction

- ii. SWOT Analysis

- iii. Key Vendors to Watch

- iv. Outlook

- 3.2.1. Mobile Money Transfer

4. Key Trends & Future Outlook

- 4.1. Key Enabling Factors

- 4.1.1. Key Technologies

- i. AI (Artificial Intelligence) and ML (Machine Learning)

- ii. Digital Identity

- iii. Credit Scoring Alternative

- iv. Blockchain and CBDCs

- 4.1.2. Key Relationships

- i. Banks

- ii. Regulators

- iii. Agent Networks

- iv. Merchant Networks

- v. Remittance Partners

- vi. Platform Providers

- 4.1.1. Key Technologies

- 4.2. The Shift to Advanced Services

- 4.2.1. Platform Capabilities for New Service Offerings

- 4.2.2. Payments-as-a-Platform and the Future of Mobile Money

- 4.2.3. Optimised UX (User Experience) and UI (User Interface)

- 4.2.4. Personalised Product Design

- 4.2.5. Building and Managing Key Partnerships

- 4.2.6. Navigating Regulatory Challenges

Competitor Leaderboard

1. Mobile Money Services Competitor Leaderboard & Vendor Profiles

- Table 1.1: Juniper Research Competitor Leaderboard: Mobile Money Vendors Included & Product Portfolio

- Figure 1.2: Juniper Research Leaderboard: Mobile Money Services

- Table 1.3: Juniper Research Leaderboard: Mobile Money Services

- Table 1.4: Juniper Research Leaderboard Heatmap: Mobile Money Services - Part 1 of 2

- Table 1.5: Juniper Research Leaderboard Heatmap: Mobile Money Services - Part 2 of 2

- 1.1. Vendor Profiles

- 1.1.1. Airtel Money

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.2. bKash

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.3. Easypaisa

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.4. EcoCash

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.5. eZ Cash

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.6. Gcash (Philippines)

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 1.6: GCash Cash-in Kiosk

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.7. Grameenphone (GPAY)

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.8. LinkAja

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.9. Mon Cash

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.10. Moov Money (Benin)

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.11. M-PESA

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.12. MTN Mobile Money

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.13. Ooredoo Money

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.14. Orange Money

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.15. Roshan M-Paisa

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.16. Tigo

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.17. Transfer/Telcel

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.18. TrueMoney

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.19. UPaisa

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.20. Wave Money

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.1.1. Airtel Money

- 1.2. Juniper Research Leaderboard Assessment Methodology

- 1.3. Limitations & Interpretations

- Table 1.7: Juniper Research Competitor Leaderboard Scoring Criteria: Mobile Money Services

2. Mobile Money Platform Providers Competitor Leaderboard

- Table 2.1: Juniper Research Competitor Leaderboard: Mobile Money Platform Vendors Included & Product Portfolio

- Figure 2.2: Juniper Research Competitor Leaderboard: Mobile Money Platforms

- Table 2.3: Juniper Research Leaderboard: Mobile Money Platforms

- Table 2.4: Juniper Research Leaderboard Heatmap: Mobile Money Platforms

- 2.1. Vendor Profiles

- 2.1.1. Amdocs

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. Comviva

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. DigiPay.Guru

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Ericsson

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. Estel

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Huawei

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. inswitch

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Obopay

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.9. Omobio

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. OpenWay

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.5: Way4 Payment Business Capabilities

- Figure 2.6: Way4 Technologies Capabilities

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Panamax

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. Seamless Distribution Systems

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.13. Telepin

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.14. Tmob - Thinks Mobility

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.15. Veengu

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.16. Youtap

- i. Corporate

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Amdocs

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.3. Limitations & Interpretations

- Table 2.7: Juniper Research Competitor Leaderboard Scoring Criteria: Mobile Money Platforms

Data & Forecasting

1. Introduction & Forecast Methodology

- 1.1. Introduction to Mobile Money

- Figure 1.1: Unbanked Adult Population (m), Split by 8 Key Regions, 2024

- 1.2. Definitions Within Mobile Money

- 1.2.1. The Context

- 1.3. Forecast Introduction

- 1.3.1. Mobile Money Forecast Methodology

- Figure 1.2: Mobile Money Methodology

- Figure 1.3: Microloans Forecast Methodology

- Figure 1.4: Microsavings Forecast Methodology

- Figure 1.5: Microinsurance Forecast Methodology

- 1.3.1. Mobile Money Forecast Methodology

- 1.4. Market Forecasts Summary

- 1.4.1. Total Users of Mobile Financial Services

- Figure 1.6: Total Mobile Money Users (m), Split by 4 Emerging Regions, 2024-2029

- 1.4.2. Total Monetary Spend and Deposits Made by Consumers on Mobile Financial Services

- Figure & Table 1.7: Total Monetary Spend on Deposits Made by Consumers on Mobile Financial Services ($), Split by 4 Emerging Regions, 2024-2029

- Table 1.8: Total Monetary Spend and Deposits Made by Consumers on Mobile Financial Services ($m), Split by Services, 2024-2029

- 1.4.1. Total Users of Mobile Financial Services

- 1.5. Sophisticated Microfinance Forecasts

- 1.5.1. Number of Unique Mobile Users Who Make Sophisticated Microfinance Transactions

- Figure & Table 1.9: Total Unique Mobile Users Who Make Sophisticated Microfinance Transactions (m), Split by 4 Emerging Regions, 2024-2029

- 1.5.2. Total Volume of Sophisticated Microfinance Transactions

- Figure & Table 1.10: Total Volume of Sophisticated Microfinance Transactions per annum (m), Split by 4 Emerging Regions, 2024-2029

- 1.5.1. Number of Unique Mobile Users Who Make Sophisticated Microfinance Transactions

- 1.6. Mobile Money Forecasts

- 1.6.1. Total Number of Mobile Money Transactions per annum

- Figure & Table 1.11: Total Number of Mobile Money Transactions per annum (m), Split by 4 Emerging Markets, 2024-2029

- Table 1.12: Total Volume of Mobile Money Transactions in Emerging Markets (m), Split by Transaction Type, 2024-2029

- 1.6.2. Total Value of Mobile Money Transactions in Emerging Markets

- Figure & Table 1.13: Total Value of Mobile Money Transactions in Emerging Markets ($m), Split by 4 Emerging Markets, 2024-2029

- Table 1.14: Total Value of Mobile Money Transactions in Emerging Markets ($m) Split by Transaction Type, 2024-2029

- 1.6.1. Total Number of Mobile Money Transactions per annum

- 1.7. Microloans and Microcredit Forecasts

- 1.7.1. Total Number of Mobile Microloans in Emerging Markets

- Figure & Table 1.15: Total Number of Mobile Microloans in Emerging Markets (m), Split by 4 Emerging Markets, 2024-2029

- 1.7.2. Total Value of Mobile Microloans in Emerging Markets

- Figure & Table 1.16: Total Value of Mobile Microloans ($m), Split by 4 Emerging Markets, 2024-2029

- 1.7.1. Total Number of Mobile Microloans in Emerging Markets

- 1.8. Mobile Microsavings Forecasts

- 1.8.1. Total Number of Mobile Microsavings Accounts

- Figure & Table 1.17: Total Number of Mobile Microsavings Accounts in Emerging Markets ($m), Split by 4 Emerging Markets, 2024-2029

- 1.8.2. Total Annual Deposit Value for Mobile Microsavings

- Figure & Table 1.18: Total Annual Deposit Value for Mobile Microsavings ($m), Split by 4 Emerging Markets, 2024-2029

- 1.8.1. Total Number of Mobile Microsavings Accounts

- 1.9. Mobile Microinsurance Forecasts

- 1.9.1. Total Cost of Mobile Microinsurance to Users

- Figure & Table 1.19: Total Cost of Mobile Microinsurance to Users ($m), Split by 4 Emerging Markets, 2024-2029

- 1.9.1. Total Cost of Mobile Microinsurance to Users