|

|

市場調査レポート

商品コード

1158981

金融不正検知におけるAI:主要動向・競合リーダーボード・市場予測 (2022-2027年)AI in Financial Fraud Detection: Key Trends, Competitor Leaderboard & Market Forecasts 2022-2027 |

||||||

| 金融不正検知におけるAI:主要動向・競合リーダーボード・市場予測 (2022-2027年) |

|

出版日: 2022年11月21日

発行: Juniper Research Ltd

ページ情報: 英文

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

AIを活用した金融不正検知・防止プラットフォームに対する世界の支出額は、2022年の65億米ドル超から、2027年には100億米ドルを超える規模に成長すると予測されています。予測期間中の成長率は57%を示しています。また、AIによるコスト削減額は2022年の27億米ドルから、2027年には104億米ドルに達し、285%の成長を示すと予測されています。

主な市場統計

| 2022年の市場規模 | 65億米ドル |

| 2027年の市場規模 | 100億米ドル |

| 2021年から2027年の市場成長率 | 57% |

当レポートでは、世界の金融不正検知におけるAIの市場を調査し、市場の定義と概要、金融不正検知におけるAIの重要性、市場成長への各種影響因子の分析、主要AIベンダーの競合分析、AI不正検出への支出額、AIが監視するトランザクション件数、AIによるコスト削減額などの予測、戦略的提言などをまとめています。

調査パッケージの提供内容

- 戦略・予測(PDF)

- 5カ年市場規模・予測スプレッドシート(Excel)

- オンラインデータプラットフォームへの12カ月間のアクセス

データ&インタラクティブ予測

主な市場予測:区分別

- AI対応金融不正検知・防止プラットフォームへの支出額

- AI対応システムでスクリーニングされたデジタルコマース件数

- 純粋なルールベースのシステムによりスクリーニングされたデジタルコマース件数

- 金融不正取引の監視にAIを使用することによる時間の節約

- 金融不正取引の監視にAIを使用することによるコスト削減効果

目次

第1章 金融不正検知におけるAI:重要ポイント・戦略的提言

第2章 金融不正検知におけるAI:市場情勢

- イントロダクション・定義

- AIの重要性

- オンライン決済不正と不正防止市場

第3章 金融不正検知におけるAI:競合リーダーボード

- ベンダープロファイル

- ACI Worldwide

- Cybersource

- Experian

- Featurespace

- Feedzai

- FICO

- GBG

- Kount, an Equifax Company

- LexisNexis Risk Solutions

- Microsoft

- NICE Actimize

- NuData Security

- Pelican

- Riskified

- SymphonyAI Sensa

- Temenos

- Vesta

第4章 金融不正検知におけるAI:市場予測

- イントロダクション

- 調査手法・仮定

- 予測サマリー

- AI不正検出への支出額

- AIが監視するトランザクション件数

- AIによる総コスト削減額

Juniper Research's new “AI in Financial Fraud Detection” research report provides a highly detailed analysis of this rapidly growing market. The report assesses key trends driving the need for AI implementation within financial fraud detection and prevention, the key segments where AI is being used, and challenges for future use of AI. It also analyses 17 leading AI in financial fraud detection and prevention vendors via the Juniper Research Competitor Leaderboard.

The research also provides industry benchmark forecasts for the market; covering spend on AI-enabled financial fraud detection and prevention platforms, as well as the number of digital commerce transactions screened by AI versus rules-based systems, and the time and cost savings from the use of AI in financial fraud transaction monitoring. This data is split by our 8 key regions and 60 countries.

This research suite comprises:

- Strategy & Forecasts (PDF)

- 5-year Market Sizing & Forecast Spreadsheet (Excel)

- 12 months' access to harvest Online Data Platform

Key Market Statistics

| Market size in 2022: | $6.5bn |

| Market size in 2027: | $10bn |

| 2021 to 2027 Market Growth: | 57% |

KEY FEATURES

- Market Dynamics: Detailed assessment of how different trends are leading to greater adoption of AI and machine learning within the financial fraud detection and prevention space, such as the need for greater scalability, increases in digital transactions, and ongoing fraudster innovation.

- Key Takeaways and Strategic Recommendations: This provides actionable recommendations and vital key takeaways, allowing vendors in this market to refine their strategies.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 17 AI in financial fraud detection and prevention vendors:

- ACI Worldwide

- Cybersource

- Experian

- Featurespace

- Feedzai

- FICO

- GBG

- Kount, an Equifax Company

- LexisNexis Risk Solutions

- Microsoft

- NICE Actimize

- NuData Security

- Pelican

- Riskified

- SymphonyAI Sensa

- Temenos

- Vesta

- Benchmark Industry Forecasts: 5-year forecasts for the spend on AI-enabled financial fraud detection and prevention platforms, as well as the number of digital commerce transactions screened by AI versus rules-based systems, and the time and cost savings from the use of AI in financial fraud transaction monitoring. Data is also split by our 8 key regions and the 60 countries listed below:

- North America:

- Canada, US

- Latin America:

- Argentina, Brazil, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay

- West Europe:

- Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, UK

- Central & East Europe:

- Croatia, Czech Republic, Hungary, Poland, Romania, Russia, Turkey, Ukraine

- Far East & China:

- China, Hong Kong, Japan, South Korea

- Indian Subcontinent:

- Bangladesh, India, Nepal, Pakistan

- Rest of Asia Pacific:

- Australia, Indonesia, Malaysia, New Zealand, Philippines, Singapore, Thailand, Vietnam

- Africa & Middle East:

- Algeria, Egypt, Israel, Kenya, Kuwait, Nigeria, Qatar, Saudi Arabia, South Africa, United Arab Emirates

- North America:

KEY QUESTIONS ANSWERED

- 1. What will the total value of the AI financial fraud detection and prevention market be in 2027?

- 2. How important is explainability where AI is used to prevent financial fraud, and how can this be facilitated?

- 3. How will greater AI use impact financial fraud?

- 4. Where are the biggest opportunities for vendors in the AI financial fraud detection market?

- 5. Who are the leading vendors of AI financial fraud detection platforms?

COMPANIES REFERENCED

- Included in the Juniper Research Competitor Leaderboard: ACI Worldwide, Cybersource, Experian, Featurespace, Feedzai, FICO, GBG, Kount, an Equifax Company, LexisNexis Risk Solutions, Microsoft, NICE Actimize, NuData Security, Pelican, Riskified, SymphonyAI Sensa, Temenos, Vesta.

- Mentioned: Accertify, Accuity, Acuris, Adidas, Air Europa, Aldo, Alipay, Amadeus, AT&T, Auchan, Azul Systems, Banca Sella, Barclaycard, Betfair , BioCatch, BlueSnap, BNP Paribas, BNY Mellon, Braintree, Bukalapak, Bvaccel, Canada Goose, Capgemini, CARDNET, Cayan, CellPoint Digital, Chargebacks911, Checkout.com, Citrus Pay, Cloudera, Coneta, Coop, Credorax, CSI, Data Robot, Datastax, Deloitte, Diebold Nixdorf, Discover, eBay, EgyptAir, Elevon, Emailage, Entersekt, Equifax, Ethoca, Etisalat, Eversheds, Evo Payments, Eway, Experian, FedNow, Finxact, First Data, Fiserv, FreedomPay, Gemalto/Thales, General Insurance , GPG (Global Payroll Gateway), Hay, HP, HSBC, IBM, ID R&D, IDology, ING, Innovalor, Invation, iovation, Jack Henry & Associates, JPMorgan Chase, Karlsgate, Last Minute, Lego, Linktera, Magneto, Mastercard, Mattel, Moku, NASDAQ, NetSuite, NorthRow, OpenWrks, Oracle, Oracle Commerce, PassFort, PayPal, Pilot Flying J, Plaid, PLDT, Prada, Protiviti, Red Hat, RELX, Revelock, Ring, RSA, Sage, Salesforce, Santander Bank, SAP, Sayari Labs, Sekura, SEON, Shopify, Singapore Airlines, Sionic, Socure, Solarisbank, Sparkling Logic, SPhonic, State Bank of India, Stripe, Stuzo, Swedbank, TCH, TCS (Tata Consultancy Services), Telcel, ThreatMetrix, T Mobile, TransUnion, UBS, UnionPay, United Colours of Benneton, Venmo, VeriFone, Visa, Visualsoft, Wells Fargo, Wendy's, Westpac, Whitepages Pro, Wish , Zelle, Zilch, Zooz.

DATA & INTERACTIVE FORECAST

Key Market Forecast Splits

The “AI in Financial Fraud Detection” forecast suite provides data splits for the following metrics:

- Spend on AI-enabled financial fraud detection and prevention platforms

- The number of digital commerce transactions screened by AI-enabled systems

- The number of digital commerce transactions screened by purely rules-based systems

- Time savings from the use of AI in financial fraud transaction monitoring

- Cost savings from the use of AI in financial fraud transaction monitoring

- Geographical splits: 60 countries

- Number of tables: 23 tables

- Number of datapoints: Over 10,400 datapoints

harvest: Our online data platform, harvest, contains the very latest market data and is updated throughout the year. This is a fully featured platform; enabling clients to better understand key data trends and manipulate charts and tables, overlaying different forecasts within the one chart - using the comparison tool. Empower your business with our market intelligence centre, and get alerted whenever your data is updated.

Interactive Excels (IFxl): Our IFxl tool enables clients to manipulate both forecast data and charts, within an Excel environment, to test their own assumptions using the interactive scenario tool and compare selected markets side by side in customised charts and tables. IFxls greatly increase a clients' ability to both understand a particular market and to integrate their own views into the model.

FORECAST SUMMARY

The global business spend on AI-enabled financial fraud detection and prevention platforms will exceed $10 billion globally in 2027; rising from just over $6.5 billion in 2022.

- Growing at 57% over the period, we predict that as fraudsters become more sophisticated in their attacks, merchants and issuers will become more adept at utilising highly advanced AI-enabled fraud detection methods to combat crime. The ability of AI to recognise fraudulent payment trends at scale is critical to provide improved fraud prevention.

- Cost savings from AI deployment will be critical to taking system use beyond regulatory compliance and providing a genuine return on investment on fraud prevention services, with improving models and greater data access creating a virtuous circle of improvement.

- We forecast growth of 285%, with cost savings reaching $10.4 billion globally in 2027, from $2.7 billion in 2022.

- By leveraging AI, businesses can shift their fraud management resource to where it matters, investigating the key issues, rather than dealing with endless false positives, boosting efficiency.

- Additionally, AI is increasingly standard within financial fraud prevention services; making differentiation a challenge. Therefore, vendors should focus on access to transaction and trends data, as gaining the best level of network intelligence will allow businesses to benefit from fraud information from beyond just their own transactions, significantly improving fraud prevention. Vendors should make partnerships with third parties, such as credit bureaus and payment networks, to improve their data coverage.

Table of Contents

1. AI in Financial Fraud Detection - Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. AI in Financial Fraud Detection - Market Landscape

- 2.1. Introduction & Definition

- Figure 2.1: AI Skills in Fintech

- Figure 2.2: Types of AI

- 2.2. Why AI?

- 2.2.1. Scale

- Figure 2.3: Total Transaction Value of eCommerce Fraud ($m), Split by 8 Key Regions, 2022-2027

- 2.2.2. Speed

- 2.2.3. Pattern Recognition

- 2.2.4. AI versus Rules Based

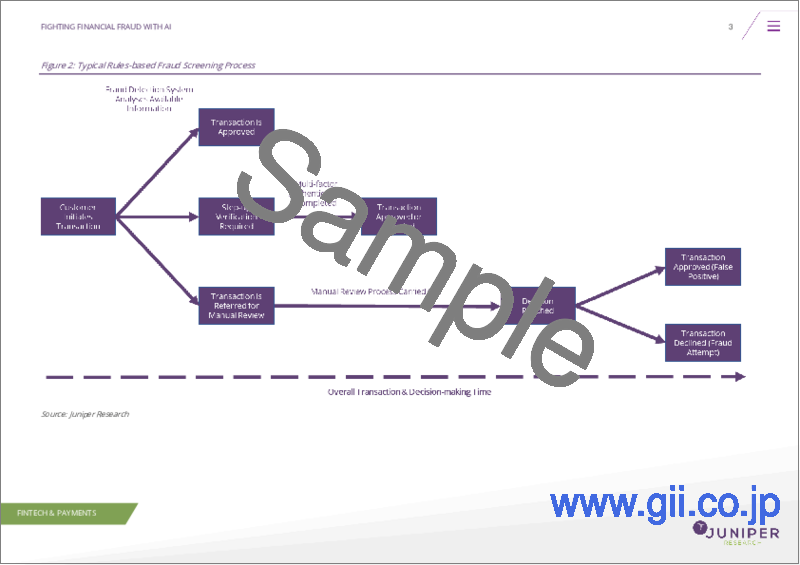

- Figure 2.4: Typical Rules-based Fraud Screening Process

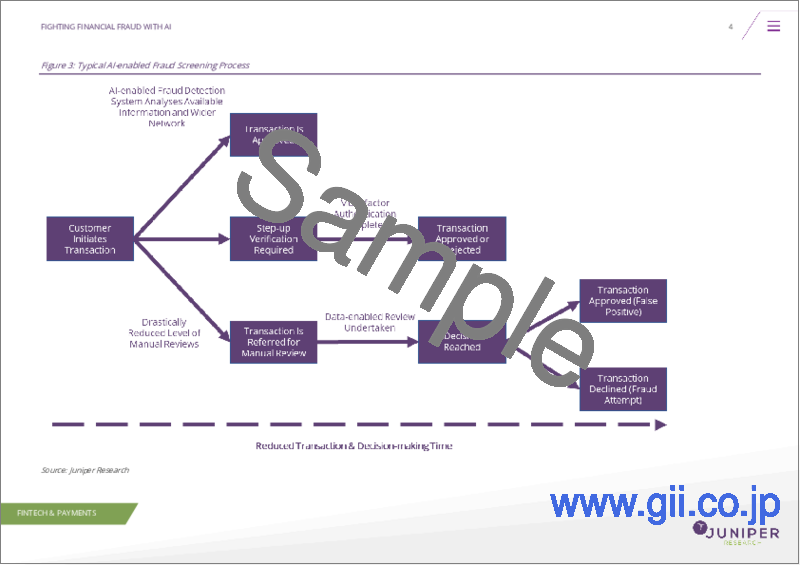

- Figure 2.5: Typical AI-enabled Fraud Screening Process

- 2.2.5. The Importance of Data

- 2.2.1. Scale

- 2.3. Online Payment Fraud & the Fraud Prevention Market

- 2.3.1. Types of Fraud

- 2.3.2. Key Fraud Trends

- 2.3.3. Different Types of Fraud Detection & Prevention Systems

- i. Merchant/eCommerce Focused

- ii. Issuer Focused

- iii. General Platforms

- iv. Identity-focused Platforms

3. AI in Financial Fraud Detection - Competitor Leaderboard

- 3.1. Why Read This Section

- Table 3.1: Juniper Research Competitor Leaderboard: AI in Fraud Detection & Prevention Vendors Included & Product Portfolio

- Figure 3.2: Juniper Research Competitor Leaderboard for AI in Fraud Detection & Prevention Vendors

- Table 3.3: Juniper Research Competitor Leaderboard: AI in Fraud Detection & Prevention Vendors & Positioning

- Table 3.4: Juniper Research Leaderboard Heatmap: AI in Fraud Detection & Prevention Vendors

- 3.2. AI in Fraud Detection & Prevention - Vendor Profiles

- 3.2.1. ACI Worldwide

- i. Corporate Information

- Table 3.5: ACI Worldwide's Financial Snapshot ($m), 2019-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 3.2.2. Cybersource

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients and Strategic Partners

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 3.2.3. Experian

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.4. Featurespace

- i. Corporate Information

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Products

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 3.2.5. Feedzai

- i. Corporate Information

- Table 3.6: Feedzai's Funding Round

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 3.2.6. FICO

- i. Corporate Information

- Table 3.7: FICO's Financial Snapshot ($m) 2018-2021

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Products

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 3.2.7. GBG

- i. Corporate Information

- Table 3.8: GBG PLC Financial Snapshot ($m) 2021-2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate Information

- 3.2.8. Kount, an Equifax Company

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.9. LexisNexis Risk Solutions

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.10. Microsoft

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.11. NICE Actimize

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 3.2.12. NuData Security

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 3.2.13. Pelican

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 3.2.14. Riskified

- i. Corporate Information

- Figure 3.9: Riskified Financial Results, Revenue & Gross Profit ($m), Q1 2020 - Q3 2021

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 3.2.15. SymphonyAI Sensa

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 3.2.16. Temenos

- i. Corporate Information

- Table 3.10: Temenos' Financial Snapshot ($m) 2020-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 3.2.17. Vesta

- i. Corporate Information

- Table 3.11: Vesta's Funding Rounds, 2003 & 2020

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 3.2.1. ACI Worldwide

- 3.3. Juniper Research Leaderboard Assessment Methodology

- 3.3.1. Limitations & Interpretation

- Table 3.12: Juniper Research Competitor Leaderboard Scoring Criteria - AI in Financial Fraud Detection

- 3.3.1. Limitations & Interpretation

4. AI in Financial Fraud Detection - Market Forecasts

- 4.1. Introduction

- 4.2. Methodology & Assumption

- Figure 4.1: AI Fraud Detection Spend Forecast Methodology

- Figure 4.2: AI Transaction Monitoring & Savings Forecast Methodology

- 4.3. Forecast Summary

- 4.3.1. AI Fraud Detection Spend

- Figure & Table 4.3: Total Spend on AI-enabled Fraud Detection & Prevention Platforms ($m), Split by 8 key Regions, 2022-2027

- 4.3.2. Number of Transactions Monitored by AI

- Figure & Table 4.4: Number of Digital Commerce Transactions Monitored by Financial Fraud Detection Systems Including AI (m) Split by 8 Key Regions, 2022-2027

- 4.3.3. Total Cost Savings from AI

- Figure & Table 4.5: Total Cost Savings from Digital Commerce Transactions Monitored by Financial Fraud Detection Systems including AI ($m), Split by 8 Key Regions, 2022-2027

- 4.3.1. AI Fraud Detection Spend