|

|

市場調査レポート

商品コード

1806204

再生医療市場:製品タイプ、供給源、応用分野、エンドユーザー別-2025-2030年の世界予測Regenerative Medicine Market by Product Type, Source, Application Areas, End User - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 再生医療市場:製品タイプ、供給源、応用分野、エンドユーザー別-2025-2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

再生医療市場は、2024年には283億5,000万米ドルとなり、2025年には349億9,000万米ドル、CAGR23.86%で成長し、2030年には1,024億米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 283億5,000万米ドル |

| 推定年2025 | 349億9,000万米ドル |

| 予測年2030 | 1,024億米ドル |

| CAGR(%) | 23.86% |

現代ヘルスケアの革新と治療開発における変革的フロンティアとしての再生医療の進化の情勢を探る

再生医療は、慢性疾患や退行性疾患の治療において何が可能かを再定義する、パラダイムシフトの頂点に立っています。細胞生物学、生体材料科学、遺伝子編集技術の進歩に後押しされ、この分野は理論的な可能性を超えて、具体的な臨床的現実へと移行しつつあります。幹細胞治療における先駆的な試みから、細胞を用いたアプローチの改良に至るまで、研究者も臨床医も同様に、前例のない治療の可能性を目の当たりにしています。世界のヘルスケア・エコシステムが心血管障害、神経疾患、複雑な創傷の増加傾向に取り組む中、再生戦略は従来の薬理学的介入に代わる説得力のある選択肢を提供しています。その結果、研究開発への投資が急増し、学界、産業界、規制機関にまたがる共同ネットワークに支えられています。

再生療法のパラダイムシフトを推進する重要な変曲点を特定し、治療イノベーションのダイナミックな将来のエコシステムを形成します

再生医療分野は、その戦略的方向性を再構築する一連の変曲点を経験しています。精密遺伝子編集における最近のブレークスルーは、治療ペイロードのより効率的な送達を促進し、概念的研究とスケーラブルな臨床応用との間のギャップを埋めています。同時に、人工知能と機械学習ツールの統合は、標的探索を加速し、製造ワークフローを最適化することで、開発期間を短縮しています。このような技術的アクセラレーターを補完するのが、主要市場における先進的な規制の枠組みであり、アンメット・メディカル・ニーズにより迅速に対応するため、承認経路の迅速化や適応型ライセンシング・モデルの導入が進んでいます。

2025年の米国の関税変更が国際再生医療供給ネットワークと共同研究アライアンスに与える影響の評価

2025年、米国は一連の関税調整を実施し、世界の再生医療供給ネットワーク全体に大きな波及効果をもたらしました。その意図は国内の製造能力を保護することであったが、未加工の生体材料、ウイルスベクター、特殊な足場部品に対する輸入関税の引き上げは、多くの国際的なパートナーの製造コストを上昇させました。その結果、メーカーや研究機関は調達戦略を見直す必要に迫られ、ニアショアリングの機会や代替地域のハブを模索し、高騰する費用圧力を緩和しています。

再生医療の製品、供給元、用途、エンドユーザーの各側面における戦略的な道筋を明らかにするために、市場セグメンテーションの深い観点を明らかにします

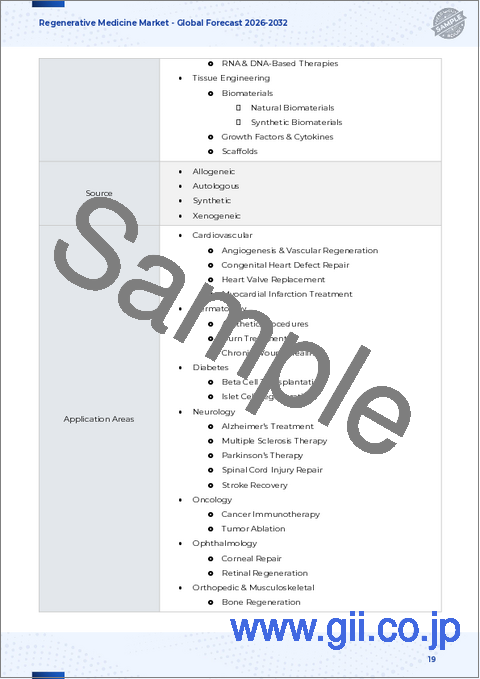

市場セグメンテーションの微妙な理解は、戦略的投資の枠組みと調査経路の優先順位付けに不可欠です。製品タイプに基づくと、この分野は細胞治療から細胞外・細胞培養アプローチ、遺伝子治療ソリューション、組織工学プラットフォームまで、多様な様式を包含しています。細胞治療では、樹状細胞、ナチュラルキラー細胞、T細胞などの免疫細胞製品など、幹細胞を用いない治療法と、多能性幹細胞や成体前駆細胞集団を活用する幹細胞ベースの治療法が区別されます。遺伝子編集技術、遺伝子導入ベクター、そしてRNAやDNAをベースとしたシステムは、ベクターの分類が非ウィルス性やウィルス性のプラットフォームにまで及んでおり、さらに複雑なレイヤーを提示しています。組織工学はさらに、バイオマテリアル、成長因子とサイトカインの製剤、足場構築物に細分化され、天然バイオマテリアルと合成バイオマテリアルの選択が、性能とコストプロファイルの違いを生み出しています。

再生医療エコシステムにおけるアメリカ、中東アフリカ、アジア太平洋の機会を形成する地域ダイナミクスの分析

再生医療分野における投資決定、規制の動向、商業化戦略の形成において、地域のニュアンスが極めて重要な役割を果たしています。アメリカ大陸では、民間および公的機関からの旺盛な資金調達により臨床応用が加速しており、先進的な製造拠点が顕著に拡大し、新規治療法の承認プロセスが合理化されています。この地域の主要研究機関と業界関係者の国境を越えた協力により、卓越したセンターが設立され、最先端治療の迅速な反復が促進されています。

再生医療における商業化の道筋を再定義する戦略的提携を通じて競争を牽引する業界をリードするパイオニアを紹介します

業界をリードする企業は、社内の研究開発と社外との提携をバランスよく組み合わせた多様な戦略によってポートフォリオを進化させています。先駆的なバイオ医薬品企業のいくつかは、専門知識を集約し、パイプラインの開発を加速するために、細胞治療と遺伝子治療の専門部門を設立しています。これらのチームは、柔軟性と規模を拡大するために、アカデミックセンターや専門的な受託開発企業との戦略的パートナーシップとともに、社内の能力を活用しています。共同事業もまた、製造インフラに共同投資するための好ましい手段として台頭してきており、開発スケジュール全体にわたって利害を一致させ、リスクを共有することを保証しています。

イノベーションを加速し、持続可能な成長を促進し、再生医療における主要課題を克服するために、リーダーを強化するための的を絞った提言を提供します

複雑な再生医療環境を乗り切るために、業界のリーダーは戦略的、運営的、規制的な側面にまたがる多面的なアプローチを採用すべきです。まず、学術機関や専門的な契約組織と強固なパートナーシップを築くことで、資本支出リスクを軽減しながらパイプラインの進行を加速することができます。インセンティブを調整し、モジュール式製造プラットフォームに共同投資することで、利害関係者は生産需要が拡大しても俊敏性を維持することができます。

1次調査と2次データ分析を統合した厳密な調査手法により、包括的な再生医療に関する洞察をお届けします

本レポートで紹介する洞察は、深さと妥当性の両方を確保するために設計された厳格な混合手法の枠組みに基づいています。1次調査では、科学的な創始者やプロセスエンジニアから規制の専門家や商業戦略家に至るまで、さまざまな利害関係者との詳細なインタビューを行いました。これらの会話は、技術導入、規制動向、臨床開発の課題に関する微妙な視点を明らかにするために構成されました。これと並行して、二次データ分析では、新たな動向とベンチマークを検証するため、査読付き文献、政府の政策文書、一般に公開されている臨床試験リポジトリを活用しました。

世界の再生医療の力学と市場影響要因の包括的な調査から得られた主要な要点と戦略的重要事項の要約

再生医療分野は、技術的ブレークスルー、進化する規制状況、グローバル供給ネットワーク内の戦略的再編成によって定義される変曲点にあります。先進的な細胞治療と遺伝子治療は、支持的な政策枠組みと製造能力の拡大により、実験段階から近い将来の商業化へと移行しつつあります。主要市場における関税の調整は、コスト圧力とサプライチェーンの複雑さをもたらす一方で、現地生産と弾力的なパートナーシップのための革新的な戦略を触媒してきました。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- 慢性創傷治癒をターゲットとした再生療法の拡大

- 遺伝子編集技術の発展がイノベーションを加速

- 再生製品開発を促進する産学連携

- 人工知能の統合による再生医療調査の最適化

- 加齢に伴う疾患に対処する再生ソリューションの需要の高まり

- 再生における足場の有効性を高める新しい生体材料の出現

- 組織工学における3Dバイオプリンティング技術の採用増加

- 幹細胞療法の進歩が個別化再生治療を推進

- 再生医療の承認経路を改善する規制の進化

- 再生医療のスタートアップ企業や臨床試験を支援する投資の急増

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 再生医療市場:製品タイプ別

- 細胞療法

- 非幹細胞療法

- 免疫細胞

- 樹状細胞

- ナチュラルキラー(NK)細胞

- T細胞

- 非免疫細胞

- 幹細胞療法

- 非幹細胞療法

- 細胞外および無細胞療法

- 遺伝子治療

- 遺伝子編集技術

- 遺伝子導入ベクター

- 非ウイルスベクター

- ウイルスベクター

- RNAおよびDNAベースの治療法

- 組織工学

- 生体材料

- 天然バイオマテリアル

- 合成バイオマテリアル

- 成長因子とサイトカイン

- 足場

- 生体材料

第9章 再生医療市場:ソース別

- 同種異系

- 自家移植

- 合成

- 異種

第10章 再生医療市場アプリケーション分野別

- 心血管系

- 血管新生と血管再生

- 先天性心疾患の修復

- 心臓弁置換術

- 心筋梗塞の治療

- 皮膚科

- 美容処置

- 火傷治療

- 慢性創傷治癒

- 糖尿病

- ベータ細胞移植

- 膵島細胞の再生

- 神経学

- アルツハイマー病の治療

- 多発性硬化症の治療

- パーキンソン病の治療

- 脊髄損傷の修復

- 脳卒中からの回復

- 腫瘍学

- がん免疫療法

- 腫瘍アブレーション

- 眼科

- 角膜修復

- 網膜再生

- 整形外科および筋骨格

- 骨再生

- 軟骨修復

- 腱の修復

第11章 再生医療市場:エンドユーザー別

- 学術調査機関

- 契約調査機関

- 病院と診療所

- 製薬・バイオテクノロジー企業

第12章 南北アメリカの再生医療市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第13章 欧州・中東・アフリカの再生医療市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第14章 アジア太平洋地域の再生医療市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- 4D Molecular Therapeutics, Inc.

- AbbVie Inc.

- Abeona Therapeutics Inc.

- Adaptimmune Therapeutics PLC

- Adverum Biotechnologies, Inc.

- AGC Biologics

- Astellas Pharma Inc.

- Bayer AG

- CMIC Co., Ltd.

- CRISPR Therapeutics AG

- F. Hoffmann-La Roche Ltd.

- Fate Therapeutics, Inc.

- FUJIFILM Holdings Corporation

- Gilead Sciences, Inc.

- HEALIOS K.K.

- Integra LifeSciences Holdings Corporation

- JCR Pharmaceuticals Co., Ltd.

- Johnson & Johnson

- Merck KGaA

- Mesoblast Limited

- Novartis AG

- Orchard Therapeutics PLC

- Organogenesis Holdings Inc.

- Pfizer Inc.

- Pluri Biotech Ltd.

- Poseida Therapeutics, Inc.

- REPROCELL Inc.

- SanBio Company Limited

- Stryker Corporation

- Sumitomo Pharma Co., Ltd.

- Sysmex Corporation

- Takeda Pharmaceutical Company Limited

- Tenaya Therapeutics, Inc.

- Vericel Corporation

- Voyager Therapeutics Inc.

- Zimmer Biomet Holdings, Inc.

第16章 リサーチAI

第17章 リサーチ統計

第18章 リサーチコンタクト

第19章 リサーチ記事

第20章 付録

LIST OF FIGURES

- FIGURE 1. REGENERATIVE MEDICINE MARKET RESEARCH PROCESS

- FIGURE 2. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 3. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 4. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 5. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2030 (%)

- FIGURE 6. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2024 VS 2030 (%)

- FIGURE 8. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 9. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2024 VS 2030 (%)

- FIGURE 10. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 11. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2024 VS 2030 (%)

- FIGURE 12. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 13. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 14. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 15. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 16. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 17. EUROPE, MIDDLE EAST & AFRICA REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 18. EUROPE, MIDDLE EAST & AFRICA REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 19. ASIA-PACIFIC REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 20. ASIA-PACIFIC REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 21. REGENERATIVE MEDICINE MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 22. REGENERATIVE MEDICINE MARKET, FPNV POSITIONING MATRIX, 2024

- FIGURE 23. REGENERATIVE MEDICINE MARKET: RESEARCHAI

- FIGURE 24. REGENERATIVE MEDICINE MARKET: RESEARCHSTATISTICS

- FIGURE 25. REGENERATIVE MEDICINE MARKET: RESEARCHCONTACTS

- FIGURE 26. REGENERATIVE MEDICINE MARKET: RESEARCHARTICLES

LIST OF TABLES

- TABLE 1. REGENERATIVE MEDICINE MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, 2018-2024 (USD MILLION)

- TABLE 4. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, 2025-2030 (USD MILLION)

- TABLE 5. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

- TABLE 6. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 7. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 8. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 9. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 10. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 11. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 12. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 13. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 14. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 15. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 16. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DENDRITIC CELLS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 18. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DENDRITIC CELLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NATURAL KILLER (NK) CELLS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 20. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NATURAL KILLER (NK) CELLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY T CELLS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 22. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY T CELLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2018-2024 (USD MILLION)

- TABLE 24. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2025-2030 (USD MILLION)

- TABLE 25. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-IMMUNE CELLS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 26. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-IMMUNE CELLS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2018-2024 (USD MILLION)

- TABLE 28. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2025-2030 (USD MILLION)

- TABLE 29. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY STEM CELL-BASED THERAPY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 30. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY STEM CELL-BASED THERAPY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2018-2024 (USD MILLION)

- TABLE 32. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2025-2030 (USD MILLION)

- TABLE 33. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY EXTRACELLULAR & ACELLULAR THERAPIES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 34. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY EXTRACELLULAR & ACELLULAR THERAPIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 36. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE EDITING TECHNOLOGIES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 38. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE EDITING TECHNOLOGIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 40. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-VIRAL VECTORS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 42. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NON-VIRAL VECTORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY VIRAL VECTORS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 44. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY VIRAL VECTORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2018-2024 (USD MILLION)

- TABLE 46. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2025-2030 (USD MILLION)

- TABLE 47. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY RNA & DNA-BASED THERAPIES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 48. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY RNA & DNA-BASED THERAPIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2018-2024 (USD MILLION)

- TABLE 50. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2025-2030 (USD MILLION)

- TABLE 51. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 52. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 54. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NATURAL BIOMATERIALS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 56. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NATURAL BIOMATERIALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SYNTHETIC BIOMATERIALS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 58. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SYNTHETIC BIOMATERIALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2018-2024 (USD MILLION)

- TABLE 60. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2025-2030 (USD MILLION)

- TABLE 61. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GROWTH FACTORS & CYTOKINES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 62. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY GROWTH FACTORS & CYTOKINES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SCAFFOLDS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 64. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SCAFFOLDS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2018-2024 (USD MILLION)

- TABLE 66. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2025-2030 (USD MILLION)

- TABLE 67. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 68. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 69. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ALLOGENEIC, BY REGION, 2018-2024 (USD MILLION)

- TABLE 70. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ALLOGENEIC, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY AUTOLOGOUS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 72. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY AUTOLOGOUS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SYNTHETIC, BY REGION, 2018-2024 (USD MILLION)

- TABLE 74. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SYNTHETIC, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY XENOGENEIC, BY REGION, 2018-2024 (USD MILLION)

- TABLE 76. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY XENOGENEIC, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2018-2024 (USD MILLION)

- TABLE 78. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2025-2030 (USD MILLION)

- TABLE 79. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, BY REGION, 2018-2024 (USD MILLION)

- TABLE 80. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ANGIOGENESIS & VASCULAR REGENERATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 82. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ANGIOGENESIS & VASCULAR REGENERATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CONGENITAL HEART DEFECT REPAIR, BY REGION, 2018-2024 (USD MILLION)

- TABLE 84. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CONGENITAL HEART DEFECT REPAIR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY HEART VALVE REPLACEMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 86. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY HEART VALVE REPLACEMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY MYOCARDIAL INFARCTION TREATMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 88. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY MYOCARDIAL INFARCTION TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2018-2024 (USD MILLION)

- TABLE 90. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2025-2030 (USD MILLION)

- TABLE 91. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 92. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY AESTHETIC PROCEDURES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 94. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY AESTHETIC PROCEDURES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BURN TREATMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 96. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BURN TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CHRONIC WOUND HEALING, BY REGION, 2018-2024 (USD MILLION)

- TABLE 98. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CHRONIC WOUND HEALING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2018-2024 (USD MILLION)

- TABLE 100. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2025-2030 (USD MILLION)

- TABLE 101. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 102. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BETA CELL TRANSPLANTATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 104. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BETA CELL TRANSPLANTATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ISLET CELL REGENERATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 106. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ISLET CELL REGENERATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2018-2024 (USD MILLION)

- TABLE 108. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2025-2030 (USD MILLION)

- TABLE 109. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 110. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ALZHEIMER'S TREATMENT, BY REGION, 2018-2024 (USD MILLION)

- TABLE 112. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ALZHEIMER'S TREATMENT, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY MULTIPLE SCLEROSIS THERAPY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 114. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY MULTIPLE SCLEROSIS THERAPY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PARKINSON'S THERAPY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 116. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PARKINSON'S THERAPY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SPINAL CORD INJURY REPAIR, BY REGION, 2018-2024 (USD MILLION)

- TABLE 118. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY SPINAL CORD INJURY REPAIR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY STROKE RECOVERY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 120. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY STROKE RECOVERY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2018-2024 (USD MILLION)

- TABLE 122. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2025-2030 (USD MILLION)

- TABLE 123. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 124. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CANCER IMMUNOTHERAPY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 126. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CANCER IMMUNOTHERAPY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TUMOR ABLATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 128. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TUMOR ABLATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2018-2024 (USD MILLION)

- TABLE 130. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2025-2030 (USD MILLION)

- TABLE 131. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, BY REGION, 2018-2024 (USD MILLION)

- TABLE 132. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 133. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CORNEAL REPAIR, BY REGION, 2018-2024 (USD MILLION)

- TABLE 134. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CORNEAL REPAIR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY RETINAL REGENERATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 136. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY RETINAL REGENERATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 137. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2018-2024 (USD MILLION)

- TABLE 138. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2025-2030 (USD MILLION)

- TABLE 139. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, BY REGION, 2018-2024 (USD MILLION)

- TABLE 140. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 141. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BONE REGENERATION, BY REGION, 2018-2024 (USD MILLION)

- TABLE 142. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY BONE REGENERATION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CARTILAGE REPAIR, BY REGION, 2018-2024 (USD MILLION)

- TABLE 144. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CARTILAGE REPAIR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 145. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TENDON REPAIR, BY REGION, 2018-2024 (USD MILLION)

- TABLE 146. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY TENDON REPAIR, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2018-2024 (USD MILLION)

- TABLE 148. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2025-2030 (USD MILLION)

- TABLE 149. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 150. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 152. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 153. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 154. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 155. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY HOSPITALS & CLINICS, BY REGION, 2018-2024 (USD MILLION)

- TABLE 156. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY HOSPITALS & CLINICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 157. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2018-2024 (USD MILLION)

- TABLE 158. GLOBAL REGENERATIVE MEDICINE MARKET SIZE, BY PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 159. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 160. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 161. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2018-2024 (USD MILLION)

- TABLE 162. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2025-2030 (USD MILLION)

- TABLE 163. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2018-2024 (USD MILLION)

- TABLE 164. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2025-2030 (USD MILLION)

- TABLE 165. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2018-2024 (USD MILLION)

- TABLE 166. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2025-2030 (USD MILLION)

- TABLE 167. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2018-2024 (USD MILLION)

- TABLE 168. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2025-2030 (USD MILLION)

- TABLE 169. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2018-2024 (USD MILLION)

- TABLE 170. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2025-2030 (USD MILLION)

- TABLE 171. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2018-2024 (USD MILLION)

- TABLE 172. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2025-2030 (USD MILLION)

- TABLE 173. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2018-2024 (USD MILLION)

- TABLE 174. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2025-2030 (USD MILLION)

- TABLE 175. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 176. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 177. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2018-2024 (USD MILLION)

- TABLE 178. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2025-2030 (USD MILLION)

- TABLE 179. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2018-2024 (USD MILLION)

- TABLE 180. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2025-2030 (USD MILLION)

- TABLE 181. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2018-2024 (USD MILLION)

- TABLE 182. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2025-2030 (USD MILLION)

- TABLE 183. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2018-2024 (USD MILLION)

- TABLE 184. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2025-2030 (USD MILLION)

- TABLE 185. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2018-2024 (USD MILLION)

- TABLE 186. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2025-2030 (USD MILLION)

- TABLE 187. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2018-2024 (USD MILLION)

- TABLE 188. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2025-2030 (USD MILLION)

- TABLE 189. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2018-2024 (USD MILLION)

- TABLE 190. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2025-2030 (USD MILLION)

- TABLE 191. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2018-2024 (USD MILLION)

- TABLE 192. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2025-2030 (USD MILLION)

- TABLE 193. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 194. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 195. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

- TABLE 196. AMERICAS REGENERATIVE MEDICINE MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 198. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 199. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2018-2024 (USD MILLION)

- TABLE 200. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2025-2030 (USD MILLION)

- TABLE 201. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2018-2024 (USD MILLION)

- TABLE 202. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2025-2030 (USD MILLION)

- TABLE 203. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2018-2024 (USD MILLION)

- TABLE 204. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2025-2030 (USD MILLION)

- TABLE 205. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2018-2024 (USD MILLION)

- TABLE 206. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2025-2030 (USD MILLION)

- TABLE 207. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2018-2024 (USD MILLION)

- TABLE 208. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2025-2030 (USD MILLION)

- TABLE 209. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2018-2024 (USD MILLION)

- TABLE 210. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2025-2030 (USD MILLION)

- TABLE 211. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2018-2024 (USD MILLION)

- TABLE 212. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2025-2030 (USD MILLION)

- TABLE 213. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 214. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 215. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2018-2024 (USD MILLION)

- TABLE 216. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2025-2030 (USD MILLION)

- TABLE 217. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2018-2024 (USD MILLION)

- TABLE 218. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2025-2030 (USD MILLION)

- TABLE 219. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2018-2024 (USD MILLION)

- TABLE 220. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2025-2030 (USD MILLION)

- TABLE 221. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2018-2024 (USD MILLION)

- TABLE 222. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2025-2030 (USD MILLION)

- TABLE 223. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2018-2024 (USD MILLION)

- TABLE 224. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2025-2030 (USD MILLION)

- TABLE 225. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2018-2024 (USD MILLION)

- TABLE 226. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2025-2030 (USD MILLION)

- TABLE 227. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2018-2024 (USD MILLION)

- TABLE 228. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2025-2030 (USD MILLION)

- TABLE 229. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2018-2024 (USD MILLION)

- TABLE 230. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2025-2030 (USD MILLION)

- TABLE 231. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 232. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 233. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

- TABLE 234. UNITED STATES REGENERATIVE MEDICINE MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

- TABLE 235. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 236. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 237. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2018-2024 (USD MILLION)

- TABLE 238. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2025-2030 (USD MILLION)

- TABLE 239. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2018-2024 (USD MILLION)

- TABLE 240. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2025-2030 (USD MILLION)

- TABLE 241. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2018-2024 (USD MILLION)

- TABLE 242. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2025-2030 (USD MILLION)

- TABLE 243. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2018-2024 (USD MILLION)

- TABLE 244. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2025-2030 (USD MILLION)

- TABLE 245. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2018-2024 (USD MILLION)

- TABLE 246. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2025-2030 (USD MILLION)

- TABLE 247. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2018-2024 (USD MILLION)

- TABLE 248. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2025-2030 (USD MILLION)

- TABLE 249. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2018-2024 (USD MILLION)

- TABLE 250. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2025-2030 (USD MILLION)

- TABLE 251. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 252. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 253. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2018-2024 (USD MILLION)

- TABLE 254. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2025-2030 (USD MILLION)

- TABLE 255. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2018-2024 (USD MILLION)

- TABLE 256. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2025-2030 (USD MILLION)

- TABLE 257. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2018-2024 (USD MILLION)

- TABLE 258. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2025-2030 (USD MILLION)

- TABLE 259. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2018-2024 (USD MILLION)

- TABLE 260. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2025-2030 (USD MILLION)

- TABLE 261. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2018-2024 (USD MILLION)

- TABLE 262. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2025-2030 (USD MILLION)

- TABLE 263. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2018-2024 (USD MILLION)

- TABLE 264. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2025-2030 (USD MILLION)

- TABLE 265. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2018-2024 (USD MILLION)

- TABLE 266. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2025-2030 (USD MILLION)

- TABLE 267. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2018-2024 (USD MILLION)

- TABLE 268. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2025-2030 (USD MILLION)

- TABLE 269. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 270. CANADA REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 271. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 272. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 273. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2018-2024 (USD MILLION)

- TABLE 274. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2025-2030 (USD MILLION)

- TABLE 275. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2018-2024 (USD MILLION)

- TABLE 276. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2025-2030 (USD MILLION)

- TABLE 277. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2018-2024 (USD MILLION)

- TABLE 278. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2025-2030 (USD MILLION)

- TABLE 279. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2018-2024 (USD MILLION)

- TABLE 280. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2025-2030 (USD MILLION)

- TABLE 281. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2018-2024 (USD MILLION)

- TABLE 282. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2025-2030 (USD MILLION)

- TABLE 283. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2018-2024 (USD MILLION)

- TABLE 284. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2025-2030 (USD MILLION)

- TABLE 285. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2018-2024 (USD MILLION)

- TABLE 286. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2025-2030 (USD MILLION)

- TABLE 287. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2018-2024 (USD MILLION)

- TABLE 288. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY SOURCE, 2025-2030 (USD MILLION)

- TABLE 289. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2018-2024 (USD MILLION)

- TABLE 290. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY APPLICATION AREAS, 2025-2030 (USD MILLION)

- TABLE 291. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2018-2024 (USD MILLION)

- TABLE 292. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY CARDIOVASCULAR, 2025-2030 (USD MILLION)

- TABLE 293. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2018-2024 (USD MILLION)

- TABLE 294. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY DERMATOLOGY, 2025-2030 (USD MILLION)

- TABLE 295. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2018-2024 (USD MILLION)

- TABLE 296. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY DIABETES, 2025-2030 (USD MILLION)

- TABLE 297. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2018-2024 (USD MILLION)

- TABLE 298. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY NEUROLOGY, 2025-2030 (USD MILLION)

- TABLE 299. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2018-2024 (USD MILLION)

- TABLE 300. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY ONCOLOGY, 2025-2030 (USD MILLION)

- TABLE 301. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2018-2024 (USD MILLION)

- TABLE 302. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY OPHTHALMOLOGY, 2025-2030 (USD MILLION)

- TABLE 303. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2018-2024 (USD MILLION)

- TABLE 304. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY ORTHOPEDIC & MUSCULOSKELETAL, 2025-2030 (USD MILLION)

- TABLE 305. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

- TABLE 306. MEXICO REGENERATIVE MEDICINE MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

- TABLE 307. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2018-2024 (USD MILLION)

- TABLE 308. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 309. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2018-2024 (USD MILLION)

- TABLE 310. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY CELL THERAPY, 2025-2030 (USD MILLION)

- TABLE 311. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2018-2024 (USD MILLION)

- TABLE 312. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY NON-STEM CELL-BASED THERAPY, 2025-2030 (USD MILLION)

- TABLE 313. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2018-2024 (USD MILLION)

- TABLE 314. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY IMMUNE CELLS, 2025-2030 (USD MILLION)

- TABLE 315. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2018-2024 (USD MILLION)

- TABLE 316. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY GENE THERAPY, 2025-2030 (USD MILLION)

- TABLE 317. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2018-2024 (USD MILLION)

- TABLE 318. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY GENE TRANSFER VECTORS, 2025-2030 (USD MILLION)

- TABLE 319. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2018-2024 (USD MILLION)

- TABLE 320. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY TISSUE ENGINEERING, 2025-2030 (USD MILLION)

- TABLE 321. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIALS, 2018-2024 (USD MILLION)

- TABLE 322. BRAZIL REGENERATIVE MEDICINE MARKET SIZE, BY BIOMATERIA

The Regenerative Medicine Market was valued at USD 28.35 billion in 2024 and is projected to grow to USD 34.99 billion in 2025, with a CAGR of 23.86%, reaching USD 102.40 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 28.35 billion |

| Estimated Year [2025] | USD 34.99 billion |

| Forecast Year [2030] | USD 102.40 billion |

| CAGR (%) | 23.86% |

Exploring the Evolutionary Landscape of Regenerative Medicine as a Transformative Frontier in Modern Healthcare Innovation and Therapeutic Development

Regenerative medicine stands at the cusp of a paradigm shift, redefining what is possible in the treatment of chronic and degenerative diseases. Fueled by advances in cell biology, biomaterials science, and gene editing technologies, this discipline is moving beyond theoretical promise into tangible clinical realities. From pioneering trials in stem cell therapies to the refinement of acellular approaches, researchers and clinicians alike are witnessing unprecedented therapeutic potential. As the global healthcare ecosystem grapples with rising incidences of cardiovascular disorders, neurological conditions, and complex wounds, regenerative strategies offer a compelling alternative to traditional pharmacological interventions. Consequently, investment in research and development has surged, supported by collaborative networks spanning academia, industry, and regulatory bodies.

In response to these trends, this executive summary distills the critical developments shaping the regenerative medicine landscape. It highlights key technological breakthroughs, examines the evolving regulatory environment, and explores how shifting reimbursement paradigms are influencing stakeholder decision-making. Moreover, this report delves into supply chain dynamics and policy influences that will dictate future trajectories. By synthesizing qualitative insights from expert interviews with rigorous secondary analysis, the summary offers a comprehensive foundation for strategic planning. Ultimately, this introduction sets the stage for an in-depth examination of transformative shifts, tariff implications, segmentation patterns, regional dynamics, and actionable recommendations essential for leaders seeking to capitalize on the regenerative medicine revolution.

Identifying Critical Inflection Points Driving the Paradigm Shift in Regenerative Therapies and Shaping a Dynamic Future Ecosystem of Treatment Innovation

The regenerative medicine sector is experiencing a series of inflection points that are collectively reshaping its strategic direction. Recent breakthroughs in precision gene editing have facilitated more efficient delivery of therapeutic payloads, bridging the gap between conceptual research and scalable clinical application. At the same time, integration of artificial intelligence and machine learning tools is accelerating target discovery and optimizing manufacturing workflows, thereby reducing development timelines. These technological accelerators are complemented by progressive regulatory frameworks in key markets, which are progressively offering accelerated approval pathways and adaptive licensing models to address unmet medical needs more rapidly.

Simultaneously, growing alignment between biopharmaceutical sponsors and specialized contract development and manufacturing organizations is fostering greater agility and cost-effectiveness within supply chains. This shift reflects a broader ecosystem trend toward modular, flexible manufacturing that can accommodate personalized therapies and small-batch production. In parallel, rising engagement from venture capital and nontraditional investors signals heightened confidence in the commercial viability of regenerative products. As public-private partnerships evolve and philanthropic funding supports early-stage innovation, the sector is transitioning from siloed research efforts into a cohesive network of collaborative ventures. Consequently, stakeholders must navigate an increasingly dynamic environment characterized by cross-disciplinary alliances, regulatory flexibility, and next-generation manufacturing strategies.

Assessing the Impact of United States Tariff Changes in 2025 on International Regenerative Medicine Supply Networks and Collaborative Research Alliances

In 2025, the United States implemented a series of tariff adjustments that have generated substantial ripple effects throughout the global regenerative medicine supply network. While the intention was to protect domestic manufacturing capabilities, increased import duties on raw biomaterials, viral vectors, and specialized scaffolding components have elevated production costs for many international partners. Consequently, manufacturers and research institutions have had to recalibrate sourcing strategies, exploring nearshoring opportunities and alternative regional hubs to mitigate escalating expense pressures.

Moreover, these tariff changes have spurred a strategic realignment of collaborative research alliances. Firms are seeking to establish integrated supply chain partnerships within tariff-friendly jurisdictions, thereby preserving cost efficiencies while maintaining access to critical inputs. Academic and contract organizations have intensified negotiations to secure long-term procurement contracts, often involving co-investment in localized production facilities. Although these measures have introduced temporary delays in certain clinical trial timelines, they have also catalyzed innovative manufacturing approaches, such as single-use bioreactors and modular cleanroom systems, which reduce dependence on cross-border shipments.

Looking ahead, stakeholders must remain vigilant to policy shifts that could further influence trade dynamics. Engaging proactively with regulatory and legislative bodies will be crucial to shaping more balanced tariff frameworks and developing resilient supply networks. In doing so, industry participants can safeguard research continuity, accelerate product development, and foster sustainable growth despite evolving trade policies.

Unveiling Deep Market Segmentation Perspectives to Illuminate Strategic Pathways in Product, Source, Application, and End User Dimensions of Regenerative Medicine

A nuanced understanding of market segmentation is essential for framing strategic investments and prioritizing research pathways. Based on product type, the sector encompasses a diverse array of modalities ranging from cell therapy to extracelluar and acellular approaches, gene therapy solutions, and tissue engineering platforms. Within cell therapy, distinctions emerge between non-stem cell-based modalities-such as immune cell products including dendritic cells, natural killer cells, and T cells-and stem cell-based interventions that leverage pluripotent and adult progenitor populations. Gene editing technologies, gene transfer vectors, and RNA- or DNA-based systems present additional layers of complexity, with vector classifications extending to non-viral and viral-based platforms. Tissue engineering further subdivides into biomaterials, growth factor and cytokine formulations, and scaffold constructs, wherein the choice between natural and synthetic biomaterials drives differential performance and cost profiles.

When considering source origin, therapeutic products are categorized as allogeneic, autologous, synthetic, or xenogeneic, each possessing distinct immunological and manufacturing considerations. Application areas span a broad clinical spectrum, including cardiovascular interventions for angiogenesis and valve repair, dermatological treatments for burn wounds and chronic lesions, and diabetes therapeutics focused on beta cell transplantation. Neurology targets encompass Alzheimer's disease, multiple sclerosis, Parkinson's therapeutics, spinal cord repair, and post-stroke recovery, while oncology strategies leverage immunotherapy and ablative modalities. Ophthalmological innovations address corneal and retinal regeneration, and orthopedic and musculoskeletal repairs concentrate on bone, cartilage, and tendon restoration. End users range from academic research centers and contract research organizations to hospitals, clinics, and pharmaceutical and biotechnology enterprises, each bringing unique procurement criteria and adoption timelines to the landscape.

Analyzing Regional Dynamics Shaping Opportunities in the Americas, Europe Middle East Africa, and Asia Pacific Across the Regenerative Medicine Ecosystem

Regional nuances play a pivotal role in shaping investment decisions, regulatory trajectories, and commercialization strategies across the regenerative medicine field. In the Americas, robust funding from private and public sources has accelerated clinical translation, with notable expansion of advanced manufacturing hubs and streamlined approval processes for novel therapies. Cross-border collaborations between leading research institutions and industry participants in this region have established centers of excellence, fostering rapid iteration of cutting-edge treatments.

Transitioning to Europe, the Middle East, and Africa, a mosaic of regulatory frameworks and reimbursement models influences market entry strategies. While some jurisdictions offer adaptive regulatory pathways and research incentives, others maintain more conservative approaches that require comprehensive safety and efficacy data. Consequently, strategic alliances and consortium-based research initiatives are common tools for managing heterogeneous policy landscapes. Emerging markets within this region are increasingly attractive for early-stage trials, owing to evolving infrastructure and competitive cost environments.

Across the Asia Pacific, ambitious government programs and supportive policy initiatives have catalyzed exponential growth in both academic research and commercial manufacturing capacity. Local manufacturers are investing heavily in scalable bioproduction facilities, while multinational companies are engaging in technology transfer agreements to localize supply chains. The convergence of favorable regulatory reforms, growing patient populations, and competitive operational costs has positioned this region as a critical hub for future regenerative medicine innovation.

Highlighting Leading Industry Pioneers Driving Competition through Strategic Alliances That Are Redefining Commercialization Pathways in Regenerative Medicine

Leading organizations are advancing portfolios through diverse strategies that balance internal R&D with external collaborations. Several pioneering biopharma firms have established dedicated cell and gene therapy divisions to consolidate expertise and accelerate pipeline development. These teams leverage in-house capabilities alongside strategic partnerships with academic centers and specialized contract developers to enhance flexibility and scale. Joint ventures are also emerging as a preferred vehicle for co-investing in manufacturing infrastructure, ensuring aligned incentives and shared risk across development timelines.

Furthermore, innovative biotech start-ups are differentiating themselves by targeting niche applications such as neuroregeneration and immuno-oncology, often supported by venture capital and philanthropic grants. These nimble players benefit from agile decision-making processes, allowing them to pivot rapidly based on emerging preclinical and clinical data. Meanwhile, established pharmaceutical companies are incorporating regenerative modalities into existing therapeutic platforms, integrating novel cell or gene therapies with established small molecule or biologic regimens to deliver combination treatments.

Across the ecosystem, intellectual property strategies are evolving to cover not only core therapeutic constructs but also manufacturing processes, delivery devices, and data analytics algorithms. This holistic approach safeguards competitive advantage while enabling cross-licensing arrangements that facilitate market entry. As the competitive landscape intensifies, effective portfolio management and alignment of scientific expertise with operational excellence will remain critical determinants of success.

Delivering Targeted Recommendations to Empower Leaders to Accelerate Innovation, Foster Sustainable Growth and Overcome Key Challenges in Regenerative Medicine

To navigate the complex regenerative medicine environment, industry leaders should adopt a multifaceted approach that spans strategic, operational, and regulatory dimensions. First, forging robust partnerships with academic institutions and specialized contract organizations can accelerate pipeline progression while mitigating capital expenditure risks. By aligning incentives and co-investing in modular manufacturing platforms, stakeholders can maintain agility even as production demands scale.

Second, investing in advanced analytics and digital technologies will be paramount to optimizing clinical trial design and real-time monitoring. Leveraging machine learning for patient stratification and predictive safety assessments can reduce development timelines and enhance trial success rates. Concurrently, establishing robust quality management systems and early engagement with regulatory authorities will streamline approval pathways and support adaptive trial models.

Third, diversifying geographic footprint through the establishment of regional centers of excellence can safeguard against policy volatility and supply chain disruptions. Engaging proactively in policy dialogues and public-private partnerships will help shape balanced regulatory frameworks while unlocking incentives for local production. Lastly, cultivating a holistic intellectual property strategy that encompasses core assets, manufacturing know-how, and data management algorithms will ensure differentiated market positioning. By executing these targeted recommendations, leaders can accelerate innovation, sustain competitive advantage, and deliver transformative therapies to patients worldwide.

Detailing a Rigorous Research Methodology Integrating Primary Interviews with Secondary Data Analysis to Deliver Comprehensive Regenerative Medicine Insights

The insights presented in this report are grounded in a rigorous mixed-methodology framework designed to ensure both depth and validity. Primary research included in-depth interviews with a cross-section of stakeholders, ranging from scientific founders and process engineers to regulatory experts and commercial strategists. These conversations were structured to uncover nuanced perspectives on technology adoption, regulatory trends, and clinical development challenges. In parallel, secondary data analysis leveraged peer-reviewed literature, government policy documents, and publicly disclosed clinical trial repositories to validate emerging trends and benchmarks.

To triangulate findings, an expert validation panel comprising thought leaders from academia, industry associations, and non-profit research organizations reviewed preliminary conclusions. This validation step was integral for refining thematic priorities and verifying the accuracy of market segmentation frameworks. Methodological rigor was further enhanced through consistency checks and cross-regional comparisons, ensuring that insights account for local policy nuances and supply chain dynamics. By integrating qualitative depth with quantitative context, this report delivers a comprehensive and actionable perspective on the global regenerative medicine landscape.

Summarizing Key Takeaways and Strategic Imperatives from the Comprehensive Examination of Regenerative Medicine Dynamics and Market Influencers Worldwide

The regenerative medicine sector is at an inflection point defined by technological breakthroughs, evolving regulatory landscapes, and strategic realignments within global supply networks. Advanced cell and gene therapies are transitioning from experimental stages to near-term commercialization, driven by supportive policy frameworks and expanding manufacturing capabilities. While tariff adjustments in key markets have introduced cost pressures and supply chain complexities, they have also catalyzed innovative strategies for localized production and resilient partnerships.

Segmentation analysis reveals the multiplicity of therapeutic modalities and end-user requirements, underscoring the importance of tailored approaches across product types, sources, application areas, and organizational buyers. Regional insights highlight the Americas, Europe Middle East Africa, and Asia Pacific as critical ecosystems, each offering unique advantages in terms of funding, regulatory agility, and infrastructure. Competitive dynamics continue to be shaped by strategic alliances, intellectual property portfolios, and investments in digital platforms for clinical and manufacturing optimization.

Looking forward, stakeholders must embrace collaborative innovation models, proactive policy engagement, and adaptive commercialization strategies to capitalize on the full potential of regenerative medicine. By synthesizing these key takeaways and imperatives, industry participants can better position themselves to deliver transformative therapies, drive sustainable growth, and ultimately improve patient outcomes worldwide.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Market Sizing & Forecasting

5. Market Dynamics

- 5.1. Expansion of regenerative therapies targeting chronic wound healing

- 5.2. Growth of gene editing techniques accelerating regenerative medicine innovation

- 5.3. Collaborations between academia and industry fueling regenerative product development

- 5.4. Integration of artificial intelligence to optimize regenerative medicine research

- 5.5. Rising demand for regenerative solutions addressing age-related disorders

- 5.6. Emergence of novel biomaterials enhancing scaffold effectiveness in regeneration

- 5.7. Increasing adoption of 3D bioprinting technology in tissue engineering

- 5.8. Advancements in stem cell therapies driving personalized regenerative treatments

- 5.9. Regulatory evolution improving approval pathways for regenerative treatments

- 5.10. Surge in investments supporting regenerative medicine startups and clinical trials

6. Market Insights

- 6.1. Porter's Five Forces Analysis

- 6.2. PESTLE Analysis

7. Cumulative Impact of United States Tariffs 2025

8. Regenerative Medicine Market, by Product Type

- 8.1. Introduction

- 8.2. Cell Therapy

- 8.2.1. Non-Stem Cell-Based Therapy

- 8.2.1.1. Immune Cells

- 8.2.1.1.1. Dendritic Cells

- 8.2.1.1.2. Natural Killer (NK) Cells

- 8.2.1.1.3. T Cells

- 8.2.1.2. Non-immune Cells

- 8.2.2. Stem Cell-Based Therapy

- 8.2.1. Non-Stem Cell-Based Therapy

- 8.3. Extracellular & Acellular Therapies

- 8.4. Gene Therapy

- 8.4.1. Gene Editing Technologies

- 8.4.2. Gene Transfer Vectors

- 8.4.2.1. Non-Viral Vectors

- 8.4.2.2. Viral Vectors

- 8.4.3. RNA & DNA-Based Therapies

- 8.5. Tissue Engineering

- 8.5.1. Biomaterials

- 8.5.1.1. Natural Biomaterials

- 8.5.1.2. Synthetic Biomaterials

- 8.5.2. Growth Factors & Cytokines

- 8.5.3. Scaffolds

- 8.5.1. Biomaterials

9. Regenerative Medicine Market, by Source

- 9.1. Introduction

- 9.2. Allogeneic

- 9.3. Autologous

- 9.4. Synthetic

- 9.5. Xenogeneic

10. Regenerative Medicine Market, by Application Areas

- 10.1. Introduction

- 10.2. Cardiovascular

- 10.2.1. Angiogenesis & Vascular Regeneration

- 10.2.2. Congenital Heart Defect Repair

- 10.2.3. Heart Valve Replacement

- 10.2.4. Myocardial Infarction Treatment

- 10.3. Dermatology

- 10.3.1. Aesthetic Procedures

- 10.3.2. Burn Treatment

- 10.3.3. Chronic Wound Healing

- 10.4. Diabetes

- 10.4.1. Beta Cell Transplantation

- 10.4.2. Islet Cell Regeneration

- 10.5. Neurology

- 10.5.1. Alzheimer's Treatment

- 10.5.2. Multiple Sclerosis Therapy

- 10.5.3. Parkinson's Therapy

- 10.5.4. Spinal Cord Injury Repair

- 10.5.5. Stroke Recovery

- 10.6. Oncology

- 10.6.1. Cancer Immunotherapy

- 10.6.2. Tumor Ablation

- 10.7. Ophthalmology

- 10.7.1. Corneal Repair

- 10.7.2. Retinal Regeneration

- 10.8. Orthopedic & Musculoskeletal

- 10.8.1. Bone Regeneration

- 10.8.2. Cartilage Repair

- 10.8.3. Tendon Repair

11. Regenerative Medicine Market, by End User

- 11.1. Introduction

- 11.2. Academic & Research Institutes

- 11.3. Contract Research Organizations

- 11.4. Hospitals & Clinics

- 11.5. Pharmaceutical & Biotechnology Companies

12. Americas Regenerative Medicine Market

- 12.1. Introduction

- 12.2. United States

- 12.3. Canada

- 12.4. Mexico

- 12.5. Brazil

- 12.6. Argentina

13. Europe, Middle East & Africa Regenerative Medicine Market

- 13.1. Introduction

- 13.2. United Kingdom

- 13.3. Germany

- 13.4. France

- 13.5. Russia

- 13.6. Italy

- 13.7. Spain

- 13.8. United Arab Emirates

- 13.9. Saudi Arabia

- 13.10. South Africa

- 13.11. Denmark

- 13.12. Netherlands

- 13.13. Qatar

- 13.14. Finland

- 13.15. Sweden

- 13.16. Nigeria

- 13.17. Egypt

- 13.18. Turkey

- 13.19. Israel

- 13.20. Norway

- 13.21. Poland

- 13.22. Switzerland

14. Asia-Pacific Regenerative Medicine Market

- 14.1. Introduction

- 14.2. China

- 14.3. India

- 14.4. Japan

- 14.5. Australia

- 14.6. South Korea

- 14.7. Indonesia

- 14.8. Thailand

- 14.9. Philippines

- 14.10. Malaysia

- 14.11. Singapore

- 14.12. Vietnam

- 14.13. Taiwan

15. Competitive Landscape

- 15.1. Market Share Analysis, 2024

- 15.2. FPNV Positioning Matrix, 2024

- 15.3. Competitive Analysis

- 15.3.1. 4D Molecular Therapeutics, Inc.

- 15.3.2. AbbVie Inc.

- 15.3.3. Abeona Therapeutics Inc.

- 15.3.4. Adaptimmune Therapeutics PLC

- 15.3.5. Adverum Biotechnologies, Inc.

- 15.3.6. AGC Biologics

- 15.3.7. Astellas Pharma Inc.

- 15.3.8. Bayer AG

- 15.3.9. CMIC Co., Ltd.

- 15.3.10. CRISPR Therapeutics AG

- 15.3.11. F. Hoffmann-La Roche Ltd.

- 15.3.12. Fate Therapeutics, Inc.

- 15.3.13. FUJIFILM Holdings Corporation

- 15.3.14. Gilead Sciences, Inc.

- 15.3.15. HEALIOS K.K.

- 15.3.16. Integra LifeSciences Holdings Corporation

- 15.3.17. JCR Pharmaceuticals Co., Ltd.

- 15.3.18. Johnson & Johnson

- 15.3.19. Merck KGaA

- 15.3.20. Mesoblast Limited

- 15.3.21. Novartis AG

- 15.3.22. Orchard Therapeutics PLC

- 15.3.23. Organogenesis Holdings Inc.

- 15.3.24. Pfizer Inc.

- 15.3.25. Pluri Biotech Ltd.

- 15.3.26. Poseida Therapeutics, Inc.

- 15.3.27. REPROCELL Inc.

- 15.3.28. SanBio Company Limited

- 15.3.29. Stryker Corporation

- 15.3.30. Sumitomo Pharma Co., Ltd.

- 15.3.31. Sysmex Corporation

- 15.3.32. Takeda Pharmaceutical Company Limited

- 15.3.33. Tenaya Therapeutics, Inc.

- 15.3.34. Vericel Corporation

- 15.3.35. Voyager Therapeutics Inc.

- 15.3.36. Zimmer Biomet Holdings, Inc.