|

|

市場調査レポート

商品コード

1676838

半導体計測・検査市場:タイプ別、技術タイプ別、部品タイプ別、エンドユーザー別、用途別、産業分野別-2025-2030年の世界予測Semiconductor Metrology & Inspection Market by Type, Technology Type, Component Type, End User, Application, Industry Vertical - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 半導体計測・検査市場:タイプ別、技術タイプ別、部品タイプ別、エンドユーザー別、用途別、産業分野別-2025-2030年の世界予測 |

|

出版日: 2025年03月09日

発行: 360iResearch

ページ情報: 英文 182 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

半導体計測・検査市場の2024年の市場規模は120億9,000万米ドルで、2025年にはCAGR 7.41%で129億5,000万米ドルに成長し、2030年には185億8,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年 2024 | 120億9,000万米ドル |

| 推定年 2025 | 129億5,000万米ドル |

| 予測年 2030 | 185億8,000万米ドル |

| CAGR(%) | 7.41% |

急速に進化する技術環境の中で、半導体計測・検査市場はイノベーションとオペレーショナル・エクセレンスの最前線にあります。このエグゼクティブサマリーでは、市場力学に影響を与える重要な要因、技術による変革の影響、今日の業界リーダーの指針となる戦略的洞察について詳しく解説します。品質管理、プロセス最適化、技術統合に再び焦点が当てられる中、半導体分野の専門家は業務上のベンチマークを絶えず再定義しています。測定精度、非破壊検査、リアルタイム分析の進歩は検査基準を高め、半導体製造の信頼性を強化しています。本分析では、新たな動向、市場セグメント、地域ダイナミクスを掘り下げ、十分な情報に基づいた意思決定の舞台を整えています。精度が成功と陳腐化の分かれ目となるこの業界では、これらの要素を理解することが長期的な成功に不可欠です。デジタルトランスフォーメーションと複雑化の時代を乗り切るにあたり、この包括的な概要は市場の現状について詳細な説明を提供し、利害関係者が機会を活用し、課題に効果的に対処するための十分な準備を整えていることを保証します。

情勢における変革的な変化革新と効率化の推進

半導体計測・検査業界は、業界全体の業務フレームワークを再定義する変革的なシフトを目の当たりにしてきました。高度なセンサー技術、自動化、人工知能の急速な統合は、かつてないレベルの精度と効率への道を開いた。従来の検査プロセスは、生産サイクルを加速させるだけでなく、品質管理も強化するリアルタイムのデータ駆動型手法に取って代わられました。市場関係者は、欠陥検出と特性評価を改善し、ダウンタイムを最小限に抑えてコストを削減するデジタル・ソリューションへの依存を強めています。この進化は技術的なアップグレードにとどまらず、生産手法や品質フレームワークの戦略的な再編成をも含んでいます。計測機器の近代化により、メーカーは微細な偏差を顕微鏡レベルで特定できるようになり、すべての部品が厳格な業界基準を満たしていることを保証できるようになりました。さらに、持続可能性と資源の最適化に重点を置くことで、高スループットとエネルギー効率の両方を実現する装置への投資に拍車がかかっています。市場力学が急速に変化する中、業界の専門家たちは適応を続け、競争力を維持するために革新的な技術を取り入れています。統合されたデジタルエコシステムとクラウドベースのアナリティクスへのシフトは大きな飛躍を意味し、さらなる改善を約束し、半導体品質保証の新時代の舞台を整えます。

主要なセグメンテーションの洞察市場インテリジェンスを導く多様な分類

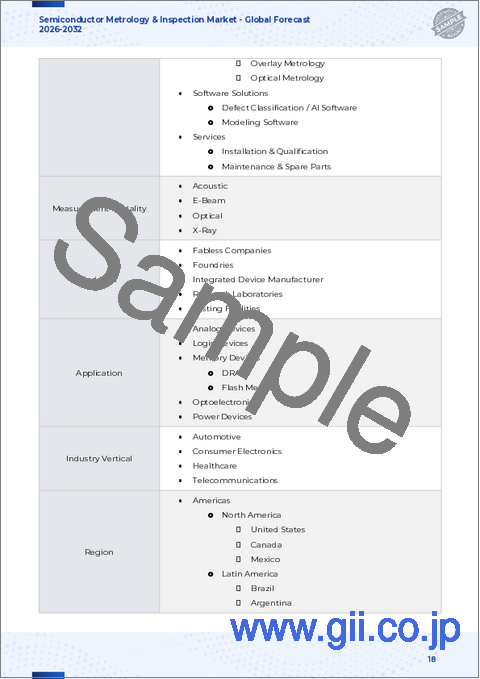

半導体計測・検査市場を評価すると、競争戦略と顧客ニーズをより深く理解するための複雑なモザイク状のセグメントが見えてくる。市場をタイプ別に分析すると、バンプ検査、リードフレーム検査、マスク検査システム、パッケージ検査、プローブカード検査、薄膜計測、ウエハー検査システムなど、幅広い検査手法を重視しています。各セグメントは独自の利点を提供し、特定の製造課題に対応しています。技術タイプ別では、音響法、電子ビーム法、光学法、X線法が調査対象となっており、それぞれ分解能、速度、さまざまな材料特性への適応性などの点で独自のメリットを提供しています。技術的な用途だけでなく、コンポーネント別のセグメンテーションでは、物理的な装置とデジタル分析の相互依存の性質を反映し、ソフトウェアソリューションだけでなくハードウェアデバイスにも焦点が当てられていることが強調されています。この分析ではエンドユーザーカテゴリもターゲットとしており、ファブレス企業、鋳造、集積デバイスメーカー、研究所、試験施設のニーズを調査しています。さらに、アナログデバイス、ロジックデバイス、メモリデバイス(DRAMやフラッシュメモリなどの特殊なサブカテゴリを含む)、オプトエレクトロニクス、パワーデバイスなどのアプリケーションを調査することで、市場の粒度を高めています。さらに、業界別セグメンテーションでは、自動車、家電、ヘルスケア、通信などの主要セクターをカバーしており、それぞれが市場動向に影響を与える明確な課題と機会を提示しています。これらの多面的な洞察により、利害関係者は成長分野を特定し、変化する需要に対応した製品を提供できるようになります。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 市場力学

- 促進要因

- 電子機器における半導体チップの需要増加

- 世界中の消費者の間で家電製品やウェアラブルデバイスの採用が増加

- 先進パッケージングプロセスにおける計測と検査の利用増加

- 抑制要因

- 計測・検査機器のセットアップコストが高い

- 機会

- 革新的な欠陥検査システムの継続的な開発

- 計測・検査システムにおけるAIの導入増加

- 課題

- 半導体計測検査装置に対する厳格な規制基準

- 促進要因

- 市場セグメンテーション分析

- タイプ:先進パッケージングの生産ラインに統合するためのバンプ検査の好みが高まっています

- エンドユーザー:異なるビジネスモデルを運営する鋳造における半導体計測の採用拡大

- ポーターのファイブフォース分析

- PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 法律上

- 環境

第6章 半導体計測・検査市場:タイプ別

- バンプ検査

- リードフレーム検査

- マスク検査システム

- パッケージ検査

- プローブカード検査

- 薄膜計測

- ウエハー検査システム

第7章 半導体計測・検査市場テクノロジーの種類別

- 音響

- 電子ビーム

- 光学

- X線

第8章 半導体計測・検査市場:コンポーネントタイプ別

- ハードウェアデバイス

- ソフトウェアソリューション

第9章 半導体計測・検査市場:エンドユーザー別

- ファブレス企業

- 鋳造

- 統合デバイスメーカー

- 調査室

- 試験施設

第10章 半導体計測・検査市場:用途別

- アナログデバイス

- ロジックデバイス

- メモリデバイス

- DRAM

- フラッシュメモリ

- オプトエレクトロニクス

- パワーデバイス

第11章 半導体計測・検査市場:業界別

- 自動車

- 家電

- ヘルスケア

- 通信

第12章 南北アメリカの半導体計測・検査市場

- アルゼンチン

- ブラジル

- カナダ

- メキシコ

- 米国

第13章 アジア太平洋地域の半導体計測・検査市場

- オーストラリア

- 中国

- インド

- インドネシア

- 日本

- マレーシア

- フィリピン

- シンガポール

- 韓国

- 台湾

- タイ

- ベトナム

第14章 欧州・中東・アフリカの半導体計測・検査市場

- デンマーク

- エジプト

- フィンランド

- フランス

- ドイツ

- イスラエル

- イタリア

- オランダ

- ナイジェリア

- ノルウェー

- ポーランド

- カタール

- ロシア

- サウジアラビア

- 南アフリカ

- スペイン

- スウェーデン

- スイス

- トルコ

- アラブ首長国連邦

- 英国

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合シナリオ分析

- 戦略分析と提言

企業一覧

- ADVANTEST Corporation

- Applied Materials, Inc.

- ASML Holding N.V.

- Camtek Ltd

- Canon, Inc.

- CyberOptics Corporation

- HAMAMATSU Group

- Hitachi High-Tech Corporation

- HORIBA, Ltd.

- JEOL Ltd.

- KLA Corporation

- Lam Research Corporation

- Lasertec Corporation

- Mirtec Co., Ltd.

- Nova Measuring Instruments Ltd.

- Onto Innovation, Inc.

- Oxford Instruments Plc

- Rohde & Schwarz GmbH & Co KG

- SCREEN Holdings Co., Ltd.

- SUSS MicroTec SE

- Thermo Fisher Scientific Inc.

- Toray Engineering Co., Ltd

- Zeiss Group

LIST OF FIGURES

- FIGURE 1. SEMICONDUCTOR METROLOGY & INSPECTION MARKET MULTI-CURRENCY

- FIGURE 2. SEMICONDUCTOR METROLOGY & INSPECTION MARKET MULTI-LANGUAGE

- FIGURE 3. SEMICONDUCTOR METROLOGY & INSPECTION MARKET RESEARCH PROCESS

- FIGURE 4. SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, 2024 VS 2030

- FIGURE 5. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 6. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 7. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 8. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2024 VS 2030 (%)

- FIGURE 9. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 10. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2024 VS 2030 (%)

- FIGURE 11. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 12. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2024 VS 2030 (%)

- FIGURE 13. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 14. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2024 VS 2030 (%)

- FIGURE 15. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 16. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

- FIGURE 17. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 18. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2024 VS 2030 (%)

- FIGURE 19. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 20. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 21. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 22. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY STATE, 2024 VS 2030 (%)

- FIGURE 23. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 24. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 25. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 26. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

- FIGURE 27. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

- FIGURE 28. SEMICONDUCTOR METROLOGY & INSPECTION MARKET SHARE, BY KEY PLAYER, 2024

- FIGURE 29. SEMICONDUCTOR METROLOGY & INSPECTION MARKET, FPNV POSITIONING MATRIX, 2024

LIST OF TABLES

- TABLE 1. SEMICONDUCTOR METROLOGY & INSPECTION MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

- TABLE 3. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 6. SEMICONDUCTOR METROLOGY & INSPECTION MARKET DYNAMICS

- TABLE 7. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 8. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY BUMP INSPECTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY LEAD FRAME INSPECTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MASK INSPECTION SYSTEM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 11. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY PACKAGE INSPECTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY PROBE CARD INSPECTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY THIN FILM METROLOGY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY WAFER INSPECTION SYSTEM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 16. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY ACOUSTIC, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY E-BEAM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY OPTICAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 19. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY X-RAY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 21. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY HARDWARE DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY SOFTWARE SOLUTIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 24. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY FABLESS COMPANIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY FOUNDRIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 26. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INTEGRATED DEVICE MANUFACTURER, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY RESEARCH LABORATORIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TESTING FACILITIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 29. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 30. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY ANALOG DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 31. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY LOGIC DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 32. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY DRAM, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY FLASH MEMORY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 35. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 36. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY OPTOELECTRONICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 37. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY POWER DEVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 38. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 39. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 40. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY CONSUMER ELECTRONICS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 41. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY HEALTHCARE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 42. GLOBAL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TELECOMMUNICATIONS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 43. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 44. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 45. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 46. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 47. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 48. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 49. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 50. AMERICAS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 51. ARGENTINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 52. ARGENTINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 53. ARGENTINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 54. ARGENTINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 55. ARGENTINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 56. ARGENTINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 57. ARGENTINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 58. BRAZIL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 59. BRAZIL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 60. BRAZIL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 61. BRAZIL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 62. BRAZIL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 63. BRAZIL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 64. BRAZIL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 65. CANADA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 66. CANADA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 67. CANADA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 68. CANADA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 69. CANADA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 70. CANADA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 71. CANADA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 72. MEXICO SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 73. MEXICO SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 74. MEXICO SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 75. MEXICO SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 76. MEXICO SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 77. MEXICO SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 78. MEXICO SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 79. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 80. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 81. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 82. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 83. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 84. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 85. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 86. UNITED STATES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 87. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 88. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 89. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 90. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 91. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 92. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 93. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 94. ASIA-PACIFIC SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 95. AUSTRALIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 96. AUSTRALIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 97. AUSTRALIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 98. AUSTRALIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 99. AUSTRALIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 100. AUSTRALIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 101. AUSTRALIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 102. CHINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 103. CHINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 104. CHINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 105. CHINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 106. CHINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 107. CHINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 108. CHINA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 109. INDIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 110. INDIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 111. INDIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 112. INDIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 113. INDIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 114. INDIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 115. INDIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 116. INDONESIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 117. INDONESIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 118. INDONESIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 119. INDONESIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 120. INDONESIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 121. INDONESIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 122. INDONESIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 123. JAPAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 124. JAPAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 125. JAPAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 126. JAPAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 127. JAPAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 128. JAPAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 129. JAPAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 130. MALAYSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 131. MALAYSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 132. MALAYSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 133. MALAYSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 134. MALAYSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 135. MALAYSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 136. MALAYSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 137. PHILIPPINES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 138. PHILIPPINES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 139. PHILIPPINES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 140. PHILIPPINES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 141. PHILIPPINES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 142. PHILIPPINES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 143. PHILIPPINES SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 144. SINGAPORE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 145. SINGAPORE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 146. SINGAPORE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 147. SINGAPORE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 148. SINGAPORE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 149. SINGAPORE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 150. SINGAPORE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 151. SOUTH KOREA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 152. SOUTH KOREA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 153. SOUTH KOREA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 154. SOUTH KOREA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 155. SOUTH KOREA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 156. SOUTH KOREA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 157. SOUTH KOREA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 158. TAIWAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 159. TAIWAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 160. TAIWAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 161. TAIWAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 162. TAIWAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 163. TAIWAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 164. TAIWAN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 165. THAILAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 166. THAILAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 167. THAILAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 168. THAILAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 169. THAILAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 170. THAILAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 171. THAILAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 172. VIETNAM SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 173. VIETNAM SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 174. VIETNAM SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 175. VIETNAM SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 176. VIETNAM SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 177. VIETNAM SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 178. VIETNAM SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 179. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 180. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 181. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 182. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 183. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 184. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 185. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 186. EUROPE, MIDDLE EAST & AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 187. DENMARK SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 188. DENMARK SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 189. DENMARK SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 190. DENMARK SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 191. DENMARK SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 192. DENMARK SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 193. DENMARK SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 194. EGYPT SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 195. EGYPT SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 196. EGYPT SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 197. EGYPT SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 198. EGYPT SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 199. EGYPT SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 200. EGYPT SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 201. FINLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 202. FINLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 203. FINLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 204. FINLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 205. FINLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 206. FINLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 207. FINLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 208. FRANCE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 209. FRANCE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 210. FRANCE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 211. FRANCE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 212. FRANCE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 213. FRANCE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 214. FRANCE SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 215. GERMANY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 216. GERMANY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 217. GERMANY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 218. GERMANY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 219. GERMANY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 220. GERMANY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 221. GERMANY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 222. ISRAEL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 223. ISRAEL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 224. ISRAEL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 225. ISRAEL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 226. ISRAEL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 227. ISRAEL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 228. ISRAEL SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 229. ITALY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 230. ITALY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 231. ITALY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 232. ITALY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 233. ITALY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 234. ITALY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 235. ITALY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 236. NETHERLANDS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 237. NETHERLANDS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 238. NETHERLANDS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 239. NETHERLANDS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 240. NETHERLANDS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 241. NETHERLANDS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 242. NETHERLANDS SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 243. NIGERIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 244. NIGERIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 245. NIGERIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 246. NIGERIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 247. NIGERIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 248. NIGERIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 249. NIGERIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 250. NORWAY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 251. NORWAY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 252. NORWAY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 253. NORWAY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 254. NORWAY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 255. NORWAY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 256. NORWAY SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 257. POLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 258. POLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 259. POLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 260. POLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 261. POLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 262. POLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 263. POLAND SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 264. QATAR SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 265. QATAR SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 266. QATAR SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 267. QATAR SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 268. QATAR SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 269. QATAR SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 270. QATAR SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 271. RUSSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 272. RUSSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 273. RUSSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 274. RUSSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 275. RUSSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 276. RUSSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 277. RUSSIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 278. SAUDI ARABIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 279. SAUDI ARABIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 280. SAUDI ARABIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 281. SAUDI ARABIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 282. SAUDI ARABIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 283. SAUDI ARABIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 284. SAUDI ARABIA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 285. SOUTH AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 286. SOUTH AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 287. SOUTH AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 288. SOUTH AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY END USER, 2018-2030 (USD MILLION)

- TABLE 289. SOUTH AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY APPLICATION, 2018-2030 (USD MILLION)

- TABLE 290. SOUTH AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY MEMORY DEVICES, 2018-2030 (USD MILLION)

- TABLE 291. SOUTH AFRICA SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY INDUSTRY VERTICAL, 2018-2030 (USD MILLION)

- TABLE 292. SPAIN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TYPE, 2018-2030 (USD MILLION)

- TABLE 293. SPAIN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY TECHNOLOGY TYPE, 2018-2030 (USD MILLION)

- TABLE 294. SPAIN SEMICONDUCTOR METROLOGY & INSPECTION MARKET SIZE, BY COMPONENT TYPE, 2018-2030 (USD MILLION)

- TABLE 295. SPAIN SEMICONDUCTOR METROLOGY & INSPE

The Semiconductor Metrology & Inspection Market was valued at USD 12.09 billion in 2024 and is projected to grow to USD 12.95 billion in 2025, with a CAGR of 7.41%, reaching USD 18.58 billion by 2030.

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2024] | USD 12.09 billion |

| Estimated Year [2025] | USD 12.95 billion |

| Forecast Year [2030] | USD 18.58 billion |

| CAGR (%) | 7.41% |

In a rapidly evolving technological landscape, the semiconductor metrology and inspection market is at the forefront of innovation and operational excellence. This executive summary provides an in-depth look at the critical factors influencing market dynamics, the transformative impact of technology, and the strategic insights that guide today's industry leaders. With a renewed focus on quality control, process optimization, and technology integration, professionals across the semiconductor space are continually redefining operational benchmarks. Advances in measurement accuracy, non-destructive testing, and real-time analytics have elevated inspection standards and bolstered the reliability of semiconductor manufacturing. The present analysis delves into emerging trends, market segments, and regional dynamics, setting the stage for informed decision-making. In an industry where precision can make the difference between success and obsolescence, understanding these elements is essential for long-term success. As we navigate an era of digital transformation and increasing complexity, this comprehensive overview offers a detailed narrative on the current state of the market, ensuring that stakeholders are well-equipped to harness opportunities and address challenges effectively.

Transformative Shifts in the Landscape: Driving Innovation and Efficiency

The semiconductor metrology and inspection industry has witnessed transformative shifts that are redefining the operational framework across the sector. The rapid integration of advanced sensor technologies, automation, and artificial intelligence has paved the way for unprecedented levels of precision and efficiency. Traditional inspection processes have given way to real-time, data-driven methodologies that not only accelerate production cycles but also enhance quality control. Market players are increasingly relying on digital solutions that offer improved defect detection and characterization, thus minimizing downtime and reducing costs. This evolution is not limited to technological upgrades; it also encompasses strategic realignments in production methodologies and quality frameworks. The modernization of metrology instruments has enabled manufacturers to identify subtle deviations at the microscopic level, ensuring that every component meets rigorous industry standards. Furthermore, the focus on sustainability and resource optimization has spurred investments in equipment that delivers both high throughput and energy efficiency. As market dynamics shift rapidly, industry experts continue to adapt, embracing innovative techniques to maintain competitiveness. The shift toward integrated digital ecosystems and cloud-based analytics represents a major leap forward, promising further improvements and setting the stage for a new era in semiconductor quality assurance.

Key Segmentation Insights: Diverse Classifications Guiding Market Intelligence

Evaluating the semiconductor metrology and inspection market reveals a complex mosaic of segments that drive a deeper understanding of competitive strategies and customer needs. When analyzing the market based on type, the study emphasizes a wide range of inspection methodologies that include bump inspection, lead frame inspection, mask inspection system, package inspection, probe card inspection, thin film metrology, and wafer inspection system. Each segment provides unique advantages and caters to specific manufacturing challenges. In terms of technology type, the research spans across acoustic, e-beam, optical, and x-ray methods, each offering distinct benefits in terms of resolution, speed, and adaptability to various material properties. Beyond technical applications, segmentation by component underscores a dual focus on hardware devices as well as software solutions, reflecting the interdependent nature of physical instrumentation and digital analytics. The analysis also targets the end-user categories, examining the needs of fabless companies, foundries, integrated device manufacturers, research laboratories, and testing facilities. Further granularity is achieved when inspecting applications, where the market is studied across analog devices, logic devices, memory devices - with specialized sub-categories such as DRAM and flash memory - optoelectronics, and power devices. Additionally, industry vertical segmentation covers key sectors such as automotive, consumer electronics, healthcare, and telecommunications, each of which presents distinct challenges and opportunities that influence market behavior. These multi-faceted insights empower stakeholders to pinpoint growth areas and tailor offerings to meet evolving demands.

Based on Type, market is studied across Bump Inspection, Lead Frame Inspection, Mask Inspection System, Package Inspection, Probe Card Inspection, Thin Film Metrology, and Wafer Inspection System.

Based on Technology Type, market is studied across Acoustic, E-Beam, Optical, and X-Ray.

Based on Component Type, market is studied across Hardware Devices and Software Solutions.

Based on End User, market is studied across Fabless Companies, Foundries, Integrated Device Manufacturer, Research Laboratories, and Testing Facilities.

Based on Application, market is studied across Analog Devices, Logic Devices, Memory Devices, Optoelectronics, and Power Devices. The Memory Devices is further studied across DRAM and Flash Memory.

Based on Industry Vertical, market is studied across Automotive, Consumer Electronics, Healthcare, and Telecommunications.

Key Regional Insights: Navigating Global Dynamics

The global semiconductor metrology and inspection market is marked by significant regional diversification and dynamic variations in demand. Analysis of the Americas shows a robust mix of industrial innovation and high adoption rates of quality assurance technologies, driven by extensive manufacturing ecosystems and a strong emphasis on research and development. In regions covering Europe, the Middle East, and Africa, a blend of technological advancement and emerging market potentials creates an environment ripe for investment and technological transformation. Companies operating in these areas are continuously upgrading their metrology infrastructures to align with global best practices, while local regulatory frameworks further enhance the shift towards higher standardization. The Asia-Pacific region remains a powerhouse due to its considerable concentration of semiconductor manufacturing hubs. Innovations rooted in advanced process technologies and stringent quality controls drive competitive advantage here, supported by significant government backing and aggressive technology rollouts. Overall, each region contributes uniquely to the global narrative of semiconductor metrology and inspection. The interplay between mature markets and emerging economies establishes a rich, interconnected ecosystem where regional insights serve as critical indicators for strategic expansion and localized innovation.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Companies Insights: Market Leaders Shaping the Future

A closer look at the competitive landscape reveals a constellation of key companies that are significantly shaping market trends and technological advancements in semiconductor metrology and inspection. Industry pioneers such as ADVANTEST Corporation, Applied Materials, Inc., and ASML Holding N.V. have set high benchmarks by consistently pushing the limits of measurement precision and operational efficiency. Companies like Camtek Ltd, Canon, Inc., and CyberOptics Corporation have carved out significant niches by emphasizing innovation and agile market responsiveness. These leaders work in concert with well-established entities such as HAMAMATSU Group, Hitachi High-Tech Corporation, and HORIBA, Ltd., all of which contribute extensive research and development prowess to the sector. JEOL Ltd., KLA Corporation, and Lam Research Corporation further underscore the value of integrating cutting-edge technology with robust service networks. Additional influential players including Lasertec Corporation, Mirtec Co., Ltd., Nova Measuring Instruments Ltd., and Onto Innovation, Inc. continue to drive technological evolution by focusing on data integration and enhanced diagnostic capabilities. Meanwhile, Oxford Instruments Plc, Rohde & Schwarz GmbH & Co KG, SCREEN Holdings Co., Ltd., SUSS MicroTec SE, Thermo Fisher Scientific Inc., Toray Engineering Co., Ltd, and Zeiss Group collectively illustrate the market's commitment to innovation and quality. Their efforts, ranging from advanced imaging to precision analysis, shape the emerging contours of a market that is agile, forward-thinking, and attuned to the demands of modern semiconductor manufacturing.

The report delves into recent significant developments in the Semiconductor Metrology & Inspection Market, highlighting leading vendors and their innovative profiles. These include ADVANTEST Corporation, Applied Materials, Inc., ASML Holding N.V., Camtek Ltd, Canon, Inc., CyberOptics Corporation, HAMAMATSU Group, Hitachi High-Tech Corporation, HORIBA, Ltd., JEOL Ltd., KLA Corporation, Lam Research Corporation, Lasertec Corporation, Mirtec Co., Ltd., Nova Measuring Instruments Ltd., Onto Innovation, Inc., Oxford Instruments Plc, Rohde & Schwarz GmbH & Co KG, SCREEN Holdings Co., Ltd., SUSS MicroTec SE, Thermo Fisher Scientific Inc., Toray Engineering Co., Ltd, and Zeiss Group. Actionable Recommendations for Industry Leaders: Steer Towards Sustainable Growth

For industry leaders seeking to maintain a competitive edge in a landscape marked by constant technological innovation and evolving market demands, several actionable recommendations can serve as strategic cornerstones. First, it is crucial to invest in next-generation metrology and inspection technologies that leverage artificial intelligence, machine learning, and real-time data analytics. By integrating these advanced tools, companies can significantly enhance process efficiency, improve accuracy in defect detection, and reduce production downtimes. Additionally, considering the diverse segmentation insights, there is an opportunity to foster synergistic collaborations between hardware and software providers, ensuring that solutions are not only technologically robust but also seamlessly integrated with broader manufacturing systems. Leaders should also prioritize the development of cross-functional teams that can deploy innovative quality assurance strategies and tailor them to the specific demands of various end-user segments, including fabless companies and integrated device manufacturers. Another important recommendation is to leverage regional strengths by localizing technology rollouts and investing in region-specific research and development initiatives. This approach can better align operational capabilities with local market conditions and regulatory frameworks. Finally, establishing strategic partnerships with key suppliers and technology innovators can provide access to cutting-edge research, thereby driving long-term growth and operational excellence. These recommendations are designed to empower decision-makers to create sustainable competitive advantages while addressing challenges inherent in a complex, fast-paced industry environment.

Conclusion: Summarizing Insights and Charting the Path Forward

In summary, the semiconductor metrology and inspection market is navigating a period of significant transformation. This comprehensive review has highlighted the critical drivers behind market evolution, including technological innovation, regional diversification, and strategic segmentation. From the integration of advanced metrology instruments and digital solutions to the evolving needs of diverse end-user segments, every aspect of this market is being redefined by emerging trends and dynamic technological shifts. Global regions display unique patterns of demand, with mature markets fostering high adoption rates and emerging economies paving the way for rapid technological advancements. The presence of key industry players underscores the competitive and innovative nature of the market, where each company contributes uniquely to advancing measurement precision and operational agility. Ultimately, the convergence of these elements opens up a wealth of opportunities for companies willing to invest in innovation and establish strategic partnerships. As the market continues to evolve, stakeholders are encouraged to leverage these insights to drive future growth, enhance operational efficiencies, and sustain competitive advantages in an increasingly complex industry landscape.

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Growing demand for semiconductor chips in electronics

- 5.1.1.2. Increasing adoption of consumer electronics and wearable devices among consumers globally

- 5.1.1.3. Rising use of metrology and inspection for advanced packaging processes

- 5.1.2. Restraints

- 5.1.2.1. High setup cost of metrology and inspection equipment

- 5.1.3. Opportunities

- 5.1.3.1. Ongoing development of innovative defect inspection systems

- 5.1.3.2. Increasing adoption of AI in metrology and inspection systems

- 5.1.4. Challenges

- 5.1.4.1. Stringent regulatory standards for semiconductor metrology inspection devices

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Type: Increasing preferences for bump inspection to integrate into production lines for advanced packaging

- 5.2.2. End User: Expanding adoption of semiconductor metrology in foundries that operate different business models

- 5.3. Porter's Five Forces Analysis

- 5.3.1. Threat of New Entrants

- 5.3.2. Threat of Substitutes

- 5.3.3. Bargaining Power of Customers

- 5.3.4. Bargaining Power of Suppliers

- 5.3.5. Industry Rivalry

- 5.4. PESTLE Analysis

- 5.4.1. Political

- 5.4.2. Economic

- 5.4.3. Social

- 5.4.4. Technological

- 5.4.5. Legal

- 5.4.6. Environmental

6. Semiconductor Metrology & Inspection Market, by Type

- 6.1. Introduction

- 6.2. Bump Inspection

- 6.3. Lead Frame Inspection

- 6.4. Mask Inspection System

- 6.5. Package Inspection

- 6.6. Probe Card Inspection

- 6.7. Thin Film Metrology

- 6.8. Wafer Inspection System

7. Semiconductor Metrology & Inspection Market, by Technology Type

- 7.1. Introduction

- 7.2. Acoustic

- 7.3. E-Beam

- 7.4. Optical

- 7.5. X-Ray

8. Semiconductor Metrology & Inspection Market, by Component Type

- 8.1. Introduction

- 8.2. Hardware Devices

- 8.3. Software Solutions

9. Semiconductor Metrology & Inspection Market, by End User

- 9.1. Introduction

- 9.2. Fabless Companies

- 9.3. Foundries

- 9.4. Integrated Device Manufacturer

- 9.5. Research Laboratories

- 9.6. Testing Facilities

10. Semiconductor Metrology & Inspection Market, by Application

- 10.1. Introduction

- 10.2. Analog Devices

- 10.3. Logic Devices

- 10.4. Memory Devices

- 10.4.1. DRAM

- 10.4.2. Flash Memory

- 10.5. Optoelectronics

- 10.6. Power Devices

11. Semiconductor Metrology & Inspection Market, by Industry Vertical

- 11.1. Introduction

- 11.2. Automotive

- 11.3. Consumer Electronics

- 11.4. Healthcare

- 11.5. Telecommunications

12. Americas Semiconductor Metrology & Inspection Market

- 12.1. Introduction

- 12.2. Argentina

- 12.3. Brazil

- 12.4. Canada

- 12.5. Mexico

- 12.6. United States

13. Asia-Pacific Semiconductor Metrology & Inspection Market

- 13.1. Introduction

- 13.2. Australia

- 13.3. China

- 13.4. India

- 13.5. Indonesia

- 13.6. Japan

- 13.7. Malaysia

- 13.8. Philippines

- 13.9. Singapore

- 13.10. South Korea

- 13.11. Taiwan

- 13.12. Thailand

- 13.13. Vietnam

14. Europe, Middle East & Africa Semiconductor Metrology & Inspection Market

- 14.1. Introduction

- 14.2. Denmark

- 14.3. Egypt

- 14.4. Finland

- 14.5. France

- 14.6. Germany

- 14.7. Israel

- 14.8. Italy

- 14.9. Netherlands

- 14.10. Nigeria

- 14.11. Norway

- 14.12. Poland

- 14.13. Qatar

- 14.14. Russia

- 14.15. Saudi Arabia

- 14.16. South Africa

- 14.17. Spain

- 14.18. Sweden

- 14.19. Switzerland

- 14.20. Turkey

- 14.21. United Arab Emirates

- 14.22. United Kingdom

15. Competitive Landscape

- 15.1. Market Share Analysis, 2024

- 15.2. FPNV Positioning Matrix, 2024

- 15.3. Competitive Scenario Analysis

- 15.3.1. Merck enhances semiconductor capability by acquiring Unity-SC for advanced metrology solutions

- 15.3.2. Nearfield Instruments secures EUR 135 Million to enhance semiconductor metrology capabilities

- 15.3.3. Cohu unveils AI inspection software with advanced deep learning

- 15.4. Strategy Analysis & Recommendation

Companies Mentioned

- 1. ADVANTEST Corporation

- 2. Applied Materials, Inc.

- 3. ASML Holding N.V.

- 4. Camtek Ltd

- 5. Canon, Inc.

- 6. CyberOptics Corporation

- 7. HAMAMATSU Group

- 8. Hitachi High-Tech Corporation

- 9. HORIBA, Ltd.

- 10. JEOL Ltd.

- 11. KLA Corporation

- 12. Lam Research Corporation

- 13. Lasertec Corporation

- 14. Mirtec Co., Ltd.

- 15. Nova Measuring Instruments Ltd.

- 16. Onto Innovation, Inc.

- 17. Oxford Instruments Plc

- 18. Rohde & Schwarz GmbH & Co KG

- 19. SCREEN Holdings Co., Ltd.

- 20. SUSS MicroTec SE

- 21. Thermo Fisher Scientific Inc.

- 22. Toray Engineering Co., Ltd

- 23. Zeiss Group