|

|

市場調査レポート

商品コード

1807568

海底ケーブルシステム市場:ケーブルの種類別、設置の種類別、容量別、定格深度別、電圧別、用途別 - 2025~2030年の世界予測Submarine Cable System Market by Cable Type, Installation Type, Capacity, Depth Rating, Voltage, Application - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 海底ケーブルシステム市場:ケーブルの種類別、設置の種類別、容量別、定格深度別、電圧別、用途別 - 2025~2030年の世界予測 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 182 Pages

納期: 即日から翌営業日

|

概要

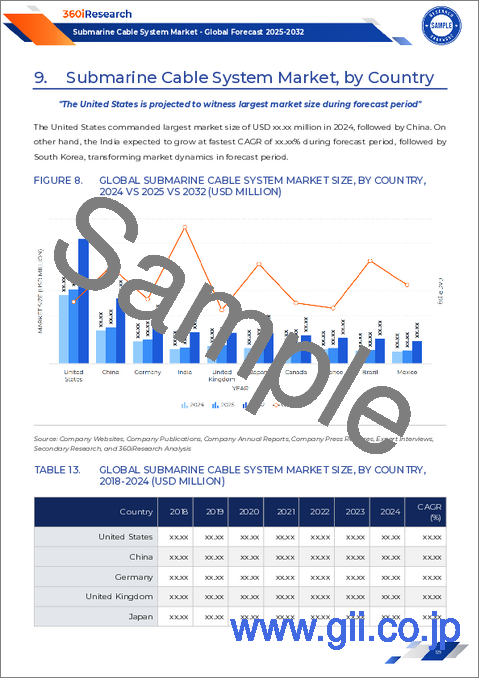

海底ケーブルシステム市場は、2024年には176億4,000万米ドルとなり、2025年には190億5,000万米ドル、CAGR 8.20%で成長し、2030年には283億2,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 176億4,000万米ドル |

| 推定年2025 | 190億5,000万米ドル |

| 予測年2030 | 283億2,000万米ドル |

| CAGR(%) | 8.20% |

急速なデジタル変革の中で、海底ケーブルシステムの戦略的意義を解き明かし、弾力性のあるグローバルな接続性を確保する

海底ケーブルシステムは、世界のインターネットとデータトラフィックの99%以上を促進し、現代のデジタル経済を支える重要な大容量経路を提供しています。これらの海底ケーブルは、大海や海洋、海峡を横断し、光ファイバーや同軸回線を通じて大陸間を結び、ビデオ通話、金融取引、クラウド・サービスがリアルタイムでシームレスに動作することを保証しています。地上ネットワークが容量制限やセキュリティの脆弱性に直面する中、海底ケーブルは比類のない帯域幅、回復力、遅延性能を提供し、国際商取引、防衛通信、科学的共同研究に不可欠な存在となっています。

技術の進歩と地政学的発展が、海底ケーブルの状況をかつてないほど機敏に変化させていることを分析する

海底ケーブル市場は、光ファイバー技術、空間多重化技術、統合モニタリング・ソリューションの飛躍的進歩によって急速な進化を遂げています。マルチコアファイバーやプログラマブルリピーターにおける最近の進歩は、機械学習対応ネットワーク管理と相まって、容量制約や運用効率を再定義しています。これらの技術革新により、海底ケーブル事業者は、障害検出と予知保全機能を強化しながら、数千キロメートルにわたってテラビットレベルのチャネルを提供できるようになっています。

2025年に予定されている米国の関税調整が海底ケーブル・インフラと貿易に及ぼす遠大な影響の評価

米国が2025年に予定している関税調整は、海底ケーブルのバリュー・チェーン全体のコスト構造を変える構えです。光ファイバー部品、電子中継器、特殊なケーブル補強システムに高い関税を課すことで、機器メーカーやシステムインテグレーターは単価の上昇に直面します。その結果、ネットワーク事業者は、原材料、半導体、精密エンジニアリング・サービスに関連する費用の上昇を考慮して、新規の大洋横断工事や定期保守工事の予算配分を見直さなければならないです。

市場セグメンテーションのダイナミクスを深く掘り下げることで、ケーブルの種類、設置モデル、容量、定格深度、電圧、用途に関する洞察を明らかにする

詳細なセグメンテーション分析により、海底ケーブル配備の多次元にわたる微妙なダイナミクスが明らかになりました。ケーブルの種類に基づくと、業界はレガシー同軸ソリューションとより高度な光ファイバー製品で構成され、光ファイバーはさらに、さまざまな距離と帯域幅の要件に最適化されたマルチモードとシングルモードの構成に分岐します。設置の種類を検討する場合、ネットワークは新設と修理・保守に分類され、新設の場合は工学的課題と環境への配慮を考慮し、陸上部と海底部に細分化されます。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋地域の海底ネットワークの成長軌道とインフラ投資のマッピング

地域別分析では、南北アメリカ、欧州、中東・アフリカ、アジア太平洋の海底回廊における明確な開発経路と投資の必要性を明らかにします。南北アメリカでは、ハイパースケールクラウドプロバイダーやデジタルメディアプラットフォームからの旺盛な需要が、大西洋横断および太平洋横断ルートの拡大を促進しています。両海岸沿いの新たな相互接続ハブは、官民パートナーシップを活用して、ケーブル陸揚げに資金を供給し、地上バックホールを最適化し、陸揚げ局をより高い電力と監視能力のためにアップグレードしています。

世界の海底ケーブル市場における技術進歩と戦略的提携を推進する業界リーダーおよび新興イノベーターのプロファイル

海底ケーブル市場の大手企業は、規模、技術的リーダーシップ、サービス統合によって差別化を図っています。グローバルな敷設フリートを持っている老舗コントラクターは、数十年にわたる海底の専門知識を活用して、フィージビリティ・スタディ、ルート調査、陸揚げ工事、ケーブル敷設を含むマルチセグメント・プロジェクトを実施しています。その深い経験により、コスト効率と堅牢な性能保証のバランスをとる最適化されたエンジニアリング・ソリューションが可能となり、超大規模データセンター事業者や通信事業者のニーズに対応します。

海底ケーブル接続の課題を克服し、新たなチャンスを活かすための戦術的イニシアチブを業界リーダーに提供する実用的戦略ロードマップ

業界リーダーは、海底ケーブル分野で優位に立つために多面的なアプローチを採用する必要があります。モジュール式でアップグレード可能なシステム設計に投資することで、トラフィックパターンや容量需要の変化への迅速な対応が可能になる一方、複数の地理的ハブをまたぐサプライチェーンの戦略的多様化により、料金変動や部品不足に伴うリスクを軽減することができます。企業は、地域の規制当局や環境関係者と積極的に関わることで、許認可プロセスを合理化し、生態系への影響を最小限に抑え、プロジェクトのスケジュールと利害関係者の好感度を高めることができます。

進化する海底ケーブル・エコシステムにおける重要動向と利害関係者にとっての戦略的重要事項を浮き彫りにする中核的調査結果の統合

海底ケーブルシステム分野は、急速な技術革新、進化する地政学的考察、規制状況の変化により、極めて重要な岐路に立たされています。先進的なファイバー設計、プログラマブル・リピータ、AIを活用したネットワーク・モニタリングの登場により、容量の閾値と運用効率が再定義されつつあります。一方、米国で間近に迫った関税の変更により、世界のサプライチェーンは再調整され、利害関係者は調達戦略を多様化し、コスト構造を最適化するためにプロジェクトのスケジュールを早める必要に迫られます。

目次

第1章 序論

第2章 分析手法

第3章 エグゼクティブサマリー

第4章 市場概要

第5章 市場力学

- 急激なAIとクラウドデータトラフィックの増加に対応するため、海底ケーブルシステムの容量アップグレードを強化

- 機密性の高い国境を越えたデータ通信を保護するため、海底ケーブルの暗号化とサイバーセキュリティプロトコルを強化する

- 光ファイバー容量を最大化し運用コストを削減するための高度な空間分割多重技術の採用

- ケーブル投資のためのハイパースケーラー、通信事業者、政府間の戦略的な官民パートナーシップの形成

- 厳格な環境影響評価と海洋生物多様性への配慮により、新たな海底ケーブル敷設が遅れている

- 高頻度取引とフィンテックの需要を満たすため、金融センターを結ぶ低遅延の海底ルートを展開

- 自律型水中ロボットとAI駆動型監視の統合による海底ケーブル障害の予防的検出

- 従来の通信事業者インフラを迂回するクラウドサービスプロバイダーによるプライベート海底ケーブルネットワークの拡張

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響(2025年)

第8章 海底ケーブルシステム市場:ケーブルの種類別

- 同軸

- 光ファイバー

- マルチモード

- シングルモード

第9章 海底ケーブルシステム市場:設置の種類別

- 新規設置

- 陸上

- 海底

- 修理・整備

第10章 海底ケーブルシステム市場:容量別

- 10~20 Tbps

- 20 Tbps以上

- 10 Tbps未満

第11章 海底ケーブルシステム市場:定格深度別

- 深海域(200~3,000m)

- 浅水域(200m未満)

- 超深海域(3,000m以上)

第12章 海底ケーブルシステム市場:電圧別

- 高電圧(132kV以上)

- 低電圧(33kV以下)

- 中電圧(33~132kV)

第13章 海底ケーブルシステム市場:用途別

- クラウドサービス

- データセンター

- コロケーション

- ハイパースケール

- 通信サービスプロバイダー

第14章 南北アメリカの海底ケーブルシステム市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第15章 欧州・中東・アフリカの海底ケーブルシステム市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第16章 アジア太平洋の海底ケーブルシステム市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第17章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- ABB Ltd.

- Sumitomo Corporation

- Bhuwal Insulation Cable Private Limited

- Birns Aquamate LLC

- Hengtong Group Co., Ltd.

- Hexatronic Group AB

- NKT A/S

- NTT Limited

- OCC Corporation

- POWER CSL

- Scorpion Oceanics Ltd.

- T&D Power Tech Co., Ltd.

- TE Connectivity Ltd.

- Tykoflex AB

- Yuhuan Huaji Marine Electrical Appliance Co., Ltd.

- Alcatel Submarine Networks

- Ciena Corporation

- Corning Incorporated

- Fujitsu Limited

- Furukawa Electric Co., Ltd.

- Hellenic Cables S.A.

- Infinera Corporation

- Ledcor Group

- Mitsubishi Electric Corporation

- Xtera, Inc.