|

|

市場調査レポート

商品コード

1862622

電子鼻市場:用途別、技術別、エンドユーザー別、構成部品別- 世界予測2025-2032年Electronic Nose Market by Application, Technology, End User, Component - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 電子鼻市場:用途別、技術別、エンドユーザー別、構成部品別- 世界予測2025-2032年 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 188 Pages

納期: 即日から翌営業日

|

概要

電子鼻市場は、2032年までにCAGR8.55%で9,413万米ドルの成長が見込まれております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 4,882万米ドル |

| 推定年2025 | 5,309万米ドル |

| 予測年2032 | 9,413万米ドル |

| CAGR(%) | 8.55% |

電子鼻システム、その動作原理、および多様なセクターの利害関係者にとっての戦略的意義について、明確かつ包括的な紹介

電子鼻技術は、センサーアレイ、パターン認識アルゴリズム、統合されたサンプル処理を組み合わせ、人間の嗅覚の特定の側面を再現し、客観的な化学物質の検出と特性評価を実現します。これらのシステムはハードウェアとソフトウェアの領域を橋渡しします:センサー化学は揮発性化合物を電気信号に変換し、分析技術は複雑な信号パターンを実用的な分類と定量的指標に変換します。センサーの選択、サンプル前処理、データモデルの相互作用が、運用環境におけるシステムの感度、特異性、堅牢性を決定します。

センサー技術革新やAIを活用した分析から、分野横断的な統合や規制変更に至るまで、電子鼻導入を推進する主要な変化を特定する

電子鼻情勢における近年の変化は、複数の分野における同時並行的な進展を反映しており、機能拡張と新たな使用事例の両方を推進しています。センサー技術革新は検出化学の幅を広げ、検出限界を引き下げ続けており、一方で微細加工技術と材料工学の進歩は再現性と小型化を向上させています。機械学習とパターン認識の並行的な発展により、マルチセンサー出力のより精緻な解釈が可能となり、ノイズの多い現場環境においても誤検知を減らし、クラス分離性を高めています。

2025年の米国関税が電子鼻のサプライチェーン、部品調達、コスト構造、国際協力に与える影響の評価

2025年に実施された米国の関税措置は、電子鼻エコシステムに関連する特定のサプライチェーン関係と調達戦略を再構築しました。関税調整は、特殊なセンサー基板、マイクロエレクトロニクスアセンブリ、特定の精密製造投入物などの部品に影響を与え、買い手と供給者が調達地域と契約条件を再評価することを促しました。これに対応し、多くの組織はサプライヤーの多様化を強化し、可能な限り現地調達比率を高めることで、貿易コスト変動への曝露を軽減しました。

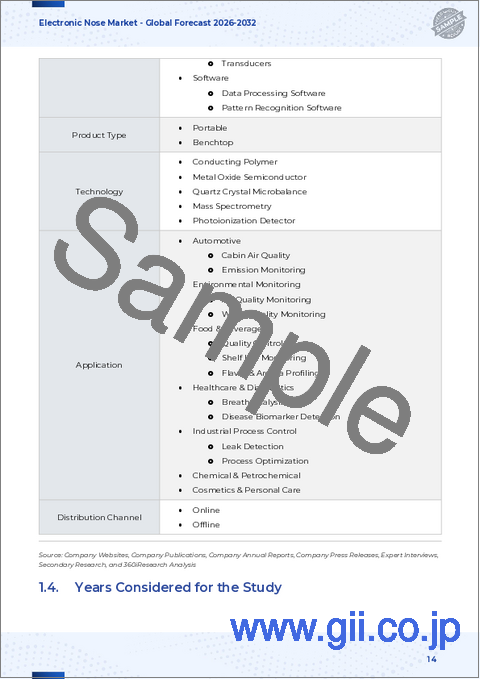

セグメンテーションの知見は、アプリケーション、技術、エンドユーザー、コンポーネントがどのように収束し、導入形態、性能、中核的価値ドライバーを決定するかを示しています

セグメンテーション分析により、アプリケーション、技術、エンドユーザー、構成要素が設計優先順位や商業化戦略に与える微妙な影響が明らかになります。例えば、自動車分野における「車室内空気質」や「排出ガス監視」向けの使用事例では、堅牢なダイナミックレンジ、高速応答性、自動車グレードの耐久性が求められます。一方、環境モニタリング分野では「大気質監視」と「水質監視」に分かれ、長期安定性、ベースラインドリフト補正、ネットワーク化されたテレメトリーが頻繁に必要となります。食品・飲料分野では、品質管理と保存期間モニタリングの用途で再現性と官能基準への適合性が重視されます。一方、医療・診断分野の呼気分析や疾患バイオマーカー検出では、厳格な臨床検証と診断ワークフローへの統合が求められます。産業プロセス制御の漏洩検知やプロセス最適化では、リアルタイム警報と制御システムとのシームレスな連携が優先されます。また、化学兵器剤検知や爆発物検知といったセキュリティ用途では、極めて高い特異性と厳密な誤警報抑制が不可欠です。

地域別(南北アメリカ、欧州、中東・アフリカ、アジア太平洋)における促進要因、サプライチェーンの動向、規制枠組み、導入動向に関する洞察

地域ごとの動向は、製品設計、認証戦略、商業化の優先順位を形作る上で極めて重要な役割を果たします。アメリカ大陸では、需要の促進要因として迅速な導入、既存の企業テレメトリーシステムとの統合、連邦および州レベルでの環境規制順守への重点がしばしば強調されます。これにより、性能と統合容易性のバランスが取れたソリューションが促進され、運用導入を加速する民間セクターとのパートナーシップやパイロットプログラムが支援されます。

電子鼻産業における競争的ポジショニング、技術的差別化、パートナーシップエコシステム、市場参入アプローチに関する企業レベルの洞察

電子鼻分野における企業戦略は、垂直統合、プラットフォームの開放性、戦略的提携の選択によってますます定義されております。主要企業は、独自のセンサー化学技術、堅牢なパターン認識スタック、あるいはサンプル処理と分析を統合したエンドツーエンドソリューションによって差別化を図っております。他方、センサーアレイやキャリブレーションシステムといったモジュール部品に焦点を当て、より広範なサードパーティ機器エコシステムに統合することで、専門チャネルパートナーがニッチなエンドユーザーに到達できるようにする企業もございます。

業界リーダーが電子鼻導入に向け、調査・サプライチェーン・パートナーシップ・規制対応を整合させるための実践的提言

業界リーダーは、技術的能力と市場要件を整合させる的を絞った投資を推進すべきです。第一に、再校正頻度を最小限に抑え、現場での保守を簡素化するセンサーアレイとサンプル処理システムの設計により、堅牢性と保守性を優先してください。これにより運用上の摩擦が減少し、特に環境モニタリングや産業制御分野での導入において顧客維持率が向上します。第二に、従来の特徴量設計と最新の機械学習を組み合わせた分析パイプラインに投資し、多様な環境条件下でモデルを検証することで誤検知を抑制し、規制当局の承認獲得を支援してください。第三に、重要部品の地理的多様化や代替材料・供給元の選定を通じたサプライチェーンのレジリエンスを追求し、関税や物流リスクへの曝露を軽減すべきです。

再現性を確保するため、データ収集、定性的・定量的分析、検証手法、研究の限界を説明する透明性の高い調査手法

本分析の基盤となる調査アプローチは、主要な利害関係者との直接対話と、技術文献および公開規制ガイダンスの体系的なレビュー・統合を組み合わせたものです。主な入力情報として、製品エンジニア、研究開発責任者、調達マネージャー、エンドユーザーへのインタビューを実施し、運用上の制約、検証要件、調達要因を把握しました。これらの定性的な知見は、技術ホワイトペーパー、規格文書、事例研究に記載されたデバイス性能特性と照合され、報告された機能と実世界の要件との整合性が確保されました。

結論として、技術動向、市場力学、規制上の考慮事項、および電子鼻分野を導くための戦略的次なるステップに関する中核的知見を統合します

本統合分析は、材料科学・信号処理・システム工学が交差する技術分野に焦点を当て、センサー革新と解析技術の成熟化による具体的な進展を明らかにします。商用化の道筋は用途により異なります:規制対象の臨床・食品安全分野では厳格な検証と性能証明が求められる一方、環境・産業分野では長期安定性、統合容易性、費用対効果が重視されます。サプライチェーンと政策動向の変化により調達戦略が転換し、現地生産と調達先の多様化が促進されています。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 食品安全分野における揮発性化合物の迅速検出に向けたAI駆動型パターン認識技術の採用

- 携帯型電子鼻デバイスとスマートフォン接続の統合による現場診断

- 医療診断分野における超高感度臭気プロファイリングを実現するナノ材料センサーアレイの進歩

- リアルタイムパターンマッチングおよび臭気ライブラリ拡張のためのクラウドベースデータ分析プラットフォームの導入

- 環境モニタリング用途における選択性と安定性を向上させる小型化学抵抗式センサーの開発

- 食品メーカーと技術企業との連携による業界横断的な校正プロトコルの標準化

- 電子鼻導入における品質保証とデータプライバシーの懸念に対応するための規制枠組みの進化

- 農業分野における包括的な品質評価のため、電子鼻と視覚・聴覚を融合したマルチセンサー融合技術の登場

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 電子鼻市場:用途別

- 自動車

- 車内空気質

- 排出ガスモニタリング

- 環境モニタリング

- 大気質モニタリング

- 水質モニタリング

- 食品・飲料

- 品質管理

- 保存期間モニタリング

- 医療・診断

- 呼気分析

- 疾患バイオマーカー検出

- 産業プロセス制御

- 漏洩検知

- プロセス最適化

- セキュリティ

- 化学兵器剤検知

- 爆発物検知

第9章 電子鼻市場:技術別

- 導電性高分子センサー

- ポリアニリンセンサー

- ポリピロールセンサー

- ポリチオフェンセンサー

- 金属酸化膜半導体センサー

- 酸化スズセンサー

- 二酸化チタンセンサー

- 酸化亜鉛センサー

- 水晶振動子マイクロバランスセンサー

- 高周波QCMセンサー

- 標準QCMセンサー

- 表面弾性波センサー

- 遅延線センサー

- 共振器センサー

第10章 電子鼻市場:エンドユーザー別

- 環境機関

- 食品・飲料

- ヘルスケア

- 研究機関

第11章 電子鼻市場:コンポーネント別

- 校正システム

- 自動校正システム

- 標準校正キット

- データ処理ソフトウェア

- 解析ソフトウェア

- パターン認識ソフトウェア

- サンプル処理システム

- ガスサンプリングユニット

- 前濃縮ユニット

- センサーアレイ

- 電界効果トランジスタセンサー

- 光学式センサー

- 抵抗式センサー

第12章 電子鼻市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第13章 電子鼻市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第14章 電子鼻市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Alpha MOS S.A.

- Airsense Analytics GmbH

- Sensigent LLC

- Applied Sensor Technologies Ltd.

- EOS Systems, Inc.

- Odotech Inc.

- G.A.S. Gesellschaft fur analytische Sensorsysteme mbH

- AromaScan Limited

- Bionics Instruments, Inc.

- iSense Technology Co., Ltd.