|

|

市場調査レポート

商品コード

1827377

外科手術市場:処置タイプ、デバイスタイプ、エンドユーザー、用途別 - 2025年~2032年の世界予測Surgical Procedures Market by Procedure Type, Device Type, End User, Application - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 外科手術市場:処置タイプ、デバイスタイプ、エンドユーザー、用途別 - 2025年~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 192 Pages

納期: 即日から翌営業日

|

概要

外科手術市場は、2032年までにCAGR 7.39%で667億7,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 377億2,000万米ドル |

| 推定年2025 | 404億6,000万米ドル |

| 予測年2032 | 667億7,000万米ドル |

| CAGR(%) | 7.39% |

現代的な外科手術を形成する臨床革新運用圧力と商業的要請の収束を強調する簡潔な戦略的概要

現代の外科手術を取り巻く環境は、臨床革新、技術導入、進化する医療提供経路の急速な収束を経験しており、バリューチェーン全体の利害関係者に戦略的明確性を求めています。本レポートは、メーカー、医療提供者、投資家、政策立案者の意思決定に役立つよう、分野横断的なエビデンスを統合し、まとまりのあるエグゼクティブサマリーとしてまとめたものです。本レポートは、戦略的選択に影響を与える業務上および規制上の圧力に焦点を当てながら、手技的アプローチ、機器ポートフォリオ、制度的準備態勢を再構築しつつある動向を抽出しています。

読者は、ロボットによる支援や視覚化の強化といった技術的進歩に加え、より低侵襲な選択肢への手技嗜好の変化や、それに対応する器具消耗品、インプラント、器具への影響をまとめた統合的な物語を見つけることができます。本書は、より深い分析を可能にする簡潔かつ包括的なオリエンテーションを提供し、指導者が研究開発の優先順位、サプライチェーン戦略、商品化計画を、現代の外科医療における臨床的・経済的な現実と一致させることを意図しています。

このイントロダクションを通して、臨床的な推進力と商業的な推進力との結びつきを強調し、差別化された製品設計、的を絞ったサービスの提供、および患者の安全性と医療の質を維持しながら導入を加速させるパートナーシップを通じて、競合優位性を構築できる場所を明確にしています。

技術導入に関する統合的な検証手技のパスウェイと商業的ダイナミクスを根本的に再定義している、臨床労働力の進化とケアデリバリーシフト

外科手術のエコシステムは、技術的成熟度、労働力のダイナミクス、そして手技がどこでどのように行われるかを再構築するケア環境の変化により、変革の時を迎えています。ロボットによる支援と高精度の視覚化の進歩により、かつては三次医療センターに限られていた手技が外来や専門クリニックに移行することが可能になり、機器ベンダーやサービスプロバイダーに新たなビジネスモデルを促しています。同時に、外科医や医療システムは、入院期間を短縮し、患者のスループットを向上させる低侵襲アプローチを優先しており、消耗品、器具、インプラントの需要プロファイルも変化しています。

同時に、デジタル化とデータ統合は周術期のワークフローを再定義しつつあります。術中画像、手技別分析、コネクテッド器具は、アウトカムに連動したサービスモデルと市販後サーベイランスの改善の機会を生み出しています。このような変化は、実世界のエビデンスとライフサイクル・モニタリングをより重視する規制の進化を伴っており、メーカーはデータ機能とコンプライアンス・インフラへの投資を余儀なくされています。労働力の制約とトレーニングの格差は、複雑なプラットフォームの学習曲線を短縮するために、人間工学に基づいた機器設計とシミュレーションベースの教育の必要性を加速させています。

2025年の関税調整が、外科用サプライチェーン全体において、どのようにソーシング・エコノミクスのオペレーションモデルや戦略的調達の意思決定を再形成しているかを重点的に分析します

2025年に施行された米国の関税動向は、外科手術のエコシステムにおけるグローバルサプライチェーンと調達の意思決定に新たな複雑性をもたらしました。関税措置により、輸入部品や完成機器に対するコスト圧力が高まり、メーカーは調達戦略や投入コスト構造を見直す必要に迫られています。これに対応するため、多くの企業がニアショアリング、サプライヤーの統合、マルチソーシングを評価し、品質と規制遵守を維持しながら、リスクを軽減し、マージンの整合性を保とうとしています。

医療提供者や支払者の価格感応度は、総所有コスト(TCO)分析の重要性を高めており、購入者は単価だけでなく、耐久性、再加工の必要性、サービス契約、臨床転帰なども精査しています。このような動きにより、ベンダーは合併症発生率の減少や手術室効率の改善など、プレミアム価格を正当化する差別化要因を強調するようになります。中小のサプライヤーやニッチなイノベーターにとって、関税主導のコスト上昇は営業利益率を圧迫し、統合圧力を強め、提携、ライセンシング契約、選択的撤退を加速させています。

同時に、関税措置は、高価値部品の製造の現地化、サプライヤーとの関係管理の強化、関税分類と貿易コンプライアンス能力への投資をめぐる戦略的対話のきっかけともなりました。流通モデルを積極的に適応させ、医療システムの顧客と協調的な需要計画に取り組み、成果ベースの利益を強調するように価値提案を再設計する組織は、関税の累積的な影響をうまく乗り切ることができると思われます。

包括的なセグメンテーション主導の分析により、手技モダリティ・デバイス・クラスのエンドユーザーの購買行動と臨床用途を、商業的経路と業務上の優先事項に結びつける

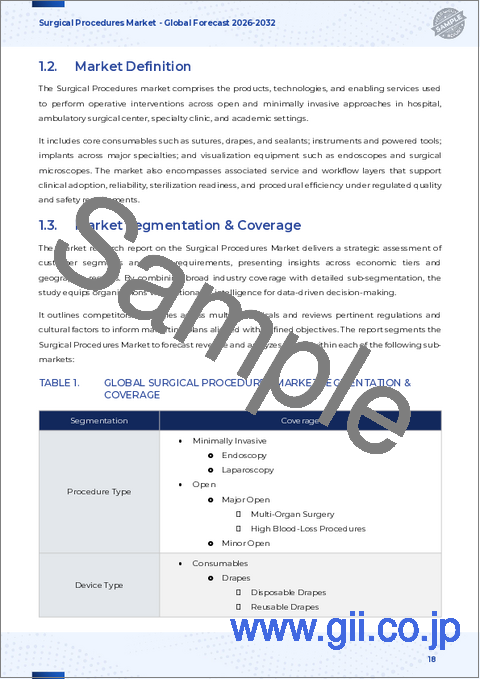

主要なセグメンテーションの洞察は、手技の種類、デバイスのカテゴリー、エンドユーザー、臨床応用の異質性が、どのように差別化された商機と業務上の優先順位につながるかを明らかにします。内視鏡検査と腹腔鏡検査は、より小さなフットプリントの可視化機器と特殊な消耗品への需要を促進する一方、開腹手術は、大開腹か小開腹かにかかわらず、堅牢な機器ポートフォリオと、臨床的適応を維持するインプラントの可用性が引き続き必要です。ロボット支援手術は、消耗品の使用と器具の設計の両方に影響を及ぼしており、パートナーは習熟までの時間を短縮するモジュラーシステムとサービスモデルを検討する必要があります。

器具の種類を考慮すると、ドレープ、手術用シーラント、縫合糸などの消耗品は、規模や供給の信頼性に見合った高頻度の購入パターンを示すが、心臓血管、神経、整形外科の各専門分野にまたがるインプラントは、採用をサポートするために厳密な臨床エビデンスと長期的な市販後サーベイランスを必要とします。また、内視鏡や手術用顕微鏡を含む可視化機器は、イメージングや分析のためのデジタルシステムとの相互運用性が高まっています。このような機器固有のダイナミクスは、大量生産ロジスティックスと、移植機器に必要な規制および臨床サポートのバランスをとる、個別の商品化戦略の必要性を強調しています。

エンドユーザーのセグメンテーションは、明確な購買行動と運用上の制約を示しています。外来手術センターは、独立型であれ病院付属であれ、手技の効率とコストの予測可能性を優先し、病院は民間・公的セクターを問わず、複雑な購買エコシステムと長期にわたる手技ミックスを管理し、専門クリニックは、複数の専門医であれ単一の専門医であれ、手技量と臨床医の嗜好にぴったり合う差別化されたデバイスの提供を求めています。アプリケーション主導のセグメンテーションは、バイパス手術、ステント留置、弁修復などの心臓血管インターベンション、腹腔鏡、開腹、ロボット支援アプローチにまたがる一般外科診療、開頭術から脊椎除圧術までの神経学的処置、白内障、緑内障、網膜治療を含む眼科インターベンション、人工関節置換術、脊椎手術、外傷固定術などの整形外科的処置にまたがる多様な臨床経路を浮き彫りにします。各用途分野では、機器の性能、エビデンスの作成、トレーニングに明確な要件が課せられており、企業はこれらの要件を製品開拓と市場参入戦略に組み込む必要があります。

南北アメリカ、欧州、中東・アフリカ、アジア太平洋の地域別市場輪郭を評価し、優先順位をつけた市場参入投資と流通の選択に役立てる

地域ダイナミックスは、臨床採用、償還政策、サプライチェーン構築に強力な影響を及ぼし、アメリカ大陸、欧州中東アフリカ、アジア太平洋地域で差別化された戦略的要請を生み出しています。アメリカ大陸では、三次医療機関における高度な手技技術の導入が加速し、選択的手技の外来へのシフトが加速していることが多く、コンパクトな機器とコスト効率の高い消耗品への需要が高まっています。この地域の支払いモデルと病院統合動向も、調達サイクルとベンダー交渉力学を形成しており、機器をアウトカムと効率向上に結びつける統合サービス提案が支持されています。

中東・アフリカ地域は、国ごとの規制状況、インフラの多様性、公共と民間の医療提供能力の違いなど、市場参入と商業化戦略が微妙に異なる異質な地域です。現地の製造能力、地域ごとの調達入札、臨床ガイドラインの違いなどが、医療機器の採用・拡大方法に影響するため、国レベルでの確固としたエビデンス計画と適応性のある価格戦略が必要となります。アジア太平洋地域では、生産能力の急速な拡大、第3次医療センターへの投資、低侵襲手術やロボット手術への注目が高まっており、市場の可能性が拡大する一方で、地域のサプライヤーとの競争も激化しています。同地域におけるサプライチェーンの強靭性とコスト競争力のある製造により、同地域は重要な生産拠点であると同時にダイナミックな商業市場でもあり、多国籍ベンダーは現地の臨床診療パターンや償還の枠組みに合わせて製品を調整する必要に迫られています。

どの企業が外科手術において永続的な優位性を確保できるかを決定する、競合他社との戦略的提携や価値ベースのサービスモデルの評価

大手企業と新興の課題的企業間の競争力学は、技術的差別化、消耗品や器具における規模の優位性、臨床的・経済的価値を実証する能力の組み合わせによって形成されます。幅広いポートフォリオを持つ既存企業は、インプラント、器具、サービスプログラムをバンドルした統合製品から利益を得ており、病院や大規模な外来ネットワークとの粘り強い関係を構築しています。このような既存企業は、製品ライフサイクルを延長するために漸進的なイノベーションを追求する一方で、新たな手技分野を獲得するために、モジュラー型ロボットや高度な視覚化など、破壊的なプラットフォームに選択的に投資することが多いです。

課題やニッチなイノベーターは、明確な臨床的有用性と合理化された規制経路を示すことに重点を置き、エビデンスを構築して採用を加速するために臨床センターと提携することが多いです。ハードウェア、アナリティクス、教育を組み合わせた総合的なソリューションの提供を目指す企業として、機器メーカー、ソフトウェアプロバイダー、臨床研修機関の戦略的提携が一般的になりつつあります。また、戦略的ライセンシング契約や共同開発契約は、開発リスクの分散と市場投入期間の短縮に役立ちます。

サプライヤーにとっては、成果ベースの契約、マネージド機器サービス、消耗品バンドル・プログラムなどのサービス・モデルを通じて差別化を図ることで、顧客との関係を深め、継続的な収益源を生み出すことができます。研究開発投資を測定可能な臨床成果に合わせ、強固な市販後データ機能を確保し、外科医のトレーニングと周術期のワークフローを強化するパートナーシップを組織化する企業は、市場での優れたポジショニングを達成することができます。

製品イノベーションのサプライチェーンの強靭性と商業的実行力を臨床採用の動向と一致させるための、リーダーのための実践的な戦略的優先事項と業務上のレバーのセット

業界のリーダーは、コスト圧力と規制の複雑さを克服しつつ、成長機会と回復力を獲得するために、一連の戦略的行動を協調して追求すべきです。第一に、低侵襲およびロボット支援トレンドに沿った製品開発を優先し、モジュール化、使いやすさ、視覚化およびデータプラットフォームとの相互運用性に重点を置いて、採用障壁を低減し、臨床医の学習曲線を短縮します。同時に、差別化された価格設定と償還に関する会話をサポートするため、臨床結果と医療経済分析を組み合わせたエビデンス創出プログラムに投資します。

第二に、可能であればニアショアリング、重要部品の多様な供給者ネットワーク、関税エクスポージャーを管理する高度な貿易コンプライアンス能力を通じて、サプライチェーンの強靭性を強化します。これらのステップは、購入者にとっての総所有コスト(Total Cost of Ownership)と運用価値を重視する商業的イニシアティブによって補完されるべきであり、ベンダーは、実証可能な効率や品質の改善を通じて、プレミアムの位置付けを正当化できるようにする必要があります。第三に、エンドユーザーのタイプや地域のダイナミクスに合わせた柔軟な市場開拓戦略を立てることです。外来診療ではコンパクトでコスト効率の高いソリューションが求められるが、病院ではトレーニングやメンテナンスプログラムに裏打ちされた包括的な製品サービスバンドルが求められることが多いです。

最後に、臨床センター、テクノロジープラットフォーム、専門クリニックといったエコシステム全体のパートナーシップを構築し、ワークフロー、シミュレーションベースのトレーニングモジュール、アウトカムモニタリングシステムを共同開発することで、導入を加速し、ネットワーク効果を生み出します。このような行動を共に実行することで、組織は短期的な混乱に対処しながら、持続可能な競合差別化を構築することができます。

専門家別インタビューとエビデンスの統合と三角測量を組み合わせた透明性の高い混合手法の調査フレームワークにより、強固な戦略的結論とシナリオ立案をサポートします

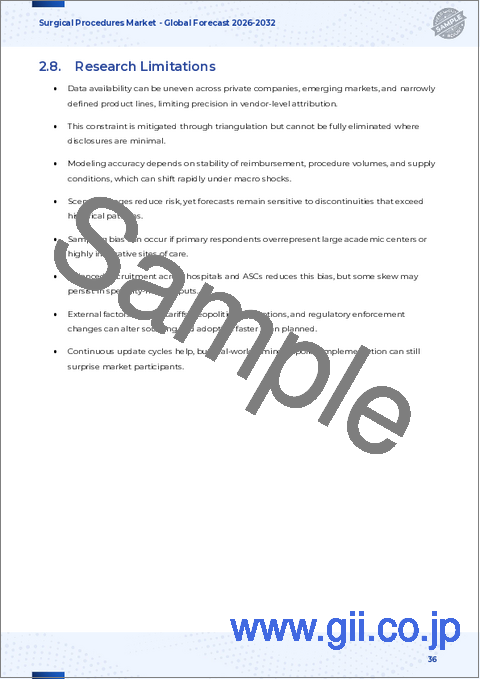

本エグゼクティブサマリーに示された調査結果は、1次定性的調査と2次的証拠の統合および三角測量とを統合した、構造化された混合方法調査アプローチから得られたものです。1次調査には、様々な地域の臨床医、調達リーダー、および業界幹部とのインタビューが含まれ、手技の嗜好、機器の性能、および購買促進要因に関する現場の視点を把握しました。二次分析では、査読済みの臨床文献、規制当局のガイダンス文書、一般に公開されている政策や償還に関する資料を網羅し、検証可能な臨床的・規制的背景を踏まえた考察を行いました。

回答者のインセンティブや地域による診療のばらつきによってもたらされる潜在的なバイアスに注意しながら、異なる視点を調整し、複数の情報源にまたがる動向を検証するために、データの三角測量技術を適用しました。適切な場合には、シナリオ分析を用いて、技術導入とサプライチェーンの進化に関する代替的な軌道を探り、異なる条件下での戦略的選択肢を評価する枠組みを提供しました。地域データの粒度のばらつきや、意思決定の妥当性を維持するために定期的な更新が必要となる規制枠組みの進化など、調査の限界についても言及しています。

最後に、現在進行中の変革の中で長期的な優位性を確保するために、サプライチェーンの強靭性、エビデンスの創出、製品の相互運用性に関して断固とした行動をとることを強調します

結論として、外科手術の情勢は、技術の進歩、医療提供の変革、進化する取引と規制の圧力が交錯し、競合力学と業務要件を再形成する変曲点にあります。製品ロードマップを低侵襲医療やロボット支援医療の臨床ニーズと整合させ、エビデンスとトレーニングに投資して導入障壁を減らし、関税関連のコスト圧力に耐えられるようにサプライチェーンを再設計する組織は、混乱をチャンスに変える最良の立場にあると思われます。利害関係者(メーカー、医療提供者、支払者、規制当局)間の協力は、イノベーションを患者の転帰改善につなげることを加速します。

戦略的明確性、規律ある実行、そしてアウトカムにリンクした提案に商業モデルを適応させる意欲が、長期的成功のための差別化の核となります。サプライチェーンの強靭性を強化し、相互運用性とユーザー中心の機器設計を優先し、測定可能な価値創造にコミットするために、今日、断固とした措置を講じるリーダーは、手続きのパラダイムが進化し続ける中で、永続的な市場優位性を確保することができます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 複雑な低侵襲手術のためのロボット支援手術プラットフォームの普及

- 術前計画と術中ガイダンスへの人工知能アルゴリズムの統合

- 外来手術センターの拡張により、主要な選択的処置の当日退院が可能

- 患者固有のインプラントや手術モデルのための3Dプリント技術の利用の増加

- 外科手術のトレーニングとナビゲーションにおける拡張現実可視化ツールの導入が増加

- 入院期間の短縮を目指し、手術後の回復促進プロトコルに重点を置く

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 外科手術市場:処置タイプ別

- 低侵襲

- 内視鏡検査

- 腹腔鏡検査

- オープン

- メジャーオープン

- マイナーオープン

- ロボット支援

第9章 外科手術市場:デバイスタイプ別

- 消耗品

- ドレープ

- 外科用シーラント

- 縫合糸

- インプラント

- 心臓血管インプラント

- 神経インプラント

- 整形外科インプラント

- 機器

- ハンドヘルド機器

- 電動機器

- 可視化装置

- 内視鏡

- 手術用顕微鏡

第10章 外科手術市場:エンドユーザー別

- 外来手術センター

- フリースタンディング

- 病院関連

- 病院

- 私立病院

- 公立病院

- 専門クリニック

- マルチスペシャリティ

- 単一専門分野

第11章 外科手術市場:用途別

- 心血管系

- バイパス手術

- ステント留置

- バルブ修理

- 一般外科

- 腹腔鏡

- オープン

- ロボット支援

- 神経学

- 頭蓋切開術

- 脊椎減圧術

- 眼科

- 白内障

- 緑内障

- 網膜

- 整形外科

- 関節置換術

- 脊椎手術

- トラウマの固定

第12章 外科手術市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第13章 外科手術市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第14章 外科手術市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Johnson & Johnson

- Medtronic plc

- Stryker Corporation

- B. Braun Melsungen AG

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Baxter International Inc.

- Intuitive Surgical, Inc.

- Olympus Corporation

- Boston Scientific Corporation