|

|

市場調査レポート

商品コード

1840678

神経血管デバイス市場:製品タイプ、適応症、エンドユーザー、流通チャネル別-2025-2032年の世界予測Neurovascular Devices Market by Product Type, Indication, End User, Distribution Channel - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 神経血管デバイス市場:製品タイプ、適応症、エンドユーザー、流通チャネル別-2025-2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

概要

神経血管デバイス市場は、2032年までにCAGR 7.56%で61億8,000万米ドルの成長が予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 34億4,000万米ドル |

| 推定年2025 | 37億1,000万米ドル |

| 予測年2032 | 61億8,000万米ドル |

| CAGR(%) | 7.56% |

臨床革新と商業的・規制的判断基準を整合させる神経血管機器エコシステムの明確なエグゼクティブ・オーバービュー

神経血管デバイスの領域は、急速な臨床革新と医療システムの監視強化の交差点に位置し、戦略的選択を行う経営幹部にとって明確性が要求されます。機器設計、画像統合、および手技周囲のケアにおける進歩は、臨床医の期待を再形成し、手技の適応を拡大する一方で、支払者と調達担当者は、実証可能な結果と費用対効果をますます要求しています。利害関係者は今、技術的能力を臨床的エンドポイントや商業的実行可能性に結びつける、簡潔でエビデンスに基づいた総合的な情報を求めています。

低侵襲的アプローチや画像誘導によるインターベンションをめぐる臨床的な機運は、機器の性能やオペレーターのトレーニングに対するハードルを上げています。同時にヘルスケアプロバイダーは、患者のスループットを最適化し、罹患率や在院日数の測定可能な改善を通じて資本支出や消耗品支出を正当化するというプレッシャーに直面しています。そのため、投資家や企業の戦略担当者は、手技の革新を持続可能な導入経路に変換する分析を求めています。このイントロダクションでは、神経血管エコシステムにおいてどの技術やプロバイダーが永続的な支持を得るかを決定する臨床、規制、および商業のベクトルを調整することで、より広範なレポートの枠組みを作っています。

続くセクションでは、変化の主な促進要因、調達と償還の決定に影響を与えるセグメンテーションパターン、市場参入と拡大を形成する地域と競合力学に焦点を当てています。本レポートの目的は、複雑で進化の速いこの分野において、優先順位付けと投資決定の指針となる首尾一貫した物語を指導者チームに提供することです。

技術の成熟、規制当局の期待、手技の標準化が、どのように採用経路と競合優位性を再構築しているか

神経血管デバイスを取り巻く環境は、技術の成熟、手技の標準化、支払者の期待の変化という3つの力が収束することによって、大きく変化しています。デバイスの反復は、実世界の性能データと計算モデリングによってますます情報化され、その結果、単回使用のプロトタイプから臨床的に堅牢なプラットフォームへの移行が加速しています。手順の改良と標準化されたトレーニング・パスウェイは、患者の転帰のばらつきを減少させ、ニッチな紹介センターから、より広範な施設での採用を後押ししています。

規制当局もまた、臨床エビデンスと市販後サーベイランスに対する期待を進化させており、メーカーにデータ作成機能を機器のライフサイクルに組み込むよう促しています。利害関係者は、測定可能な治療結果の改善と合理化されたワークフローを提供する統合ソリューションを求めています。さらに、サプライチェーンの弾力性と製造の拡張性が戦略的優先事項となっており、リーダーは外部からの衝撃を緩和するために試薬調達戦略やデュアルソーシングに投資しています。

その結果、マーケットプレースでは、臨床的エビデンス、手技の効率性、支払者や病院の調達委員会に価値を示せるかどうかが、差別化の決め手になりつつあります。このようなシフトは、製品開発ロードマップ、商業化モデル、提携戦略に現実的な影響を及ぼし、企業は研究開発の優先順位と市場参入のタイミングを、臨床診療パターンと償還の現実の両方に合わせて再調整する必要があります。

最近の関税措置がサプライチェーン、調達、パートナーシップに与える累積的影響により、調達と価格戦略が再構築されつつあります

最近の関税措置と貿易政策の調整により、神経血管デバイスのサプライチェーン全体にわたって、メーカーとプロバイダーがナビゲートしなければならない明確なプレッシャーポイントが生じています。原材料の輸入、部品、および完成機器に影響を及ぼす関税は、一部のメーカーの調達コストを引き上げ、陸上製造や戦略的調達の手配を促しています。これを受けて、いくつかのメーカーはサプライヤーとの契約を再検討し、マージンの整合性と供給の継続性を維持するためにニアショアリングや地域製造ハブを模索しています。

病院や外来センターでは、調達コストの上昇に伴い、資本配分の決定が圧迫され、機器の使用率や1症例あたりのコスト指標に対する監視の目が厳しくなっています。その結果、購買部門は競争入札を強化し、ベンダーの認定サイクルを長期化する一方、臨床チームは臨床転帰の改善や下流コストの削減を実証するエビデンスによって機器選択を正当化するよう求められています。同時に、関税は柔軟な流通チャネルの重要性を高めており、企業は交渉力を維持するために、直販、第三者販売代理店、デジタル調達プラットフォームの間で多様化を進めています。

重要なことは、政策環境が戦略的パートナーシップやライセンシングの取り決めにも影響を及ぼしていることです。関税の影響を受ける管轄区域外に製造拠点を持つ企業は、相対的に物流面で優位に立つ一方、市場アクセスを維持するために移転契約や地域ライセンシングを加速させている企業もあります。今後、積極的に調達を最適化し、価格戦略を適応させ、地域ロジスティクスを強化する利害関係者は、政策によるコスト変動を吸収し、供給の信頼性を維持する上で、より有利な立場に立つことになるであろう。

詳細なセグメンテーション分析により、製品アーキテクチャ、臨床適応症、ケア設定、流通経路が、どのように個別の採用・調達行動を促進するかを明らかにします

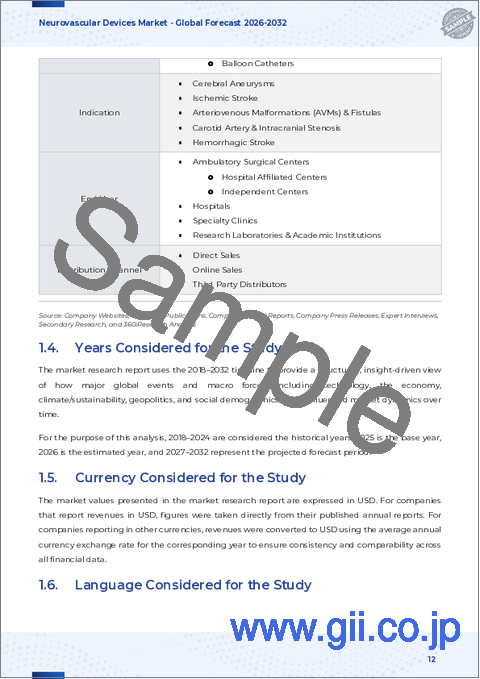

神経血管デバイス分野のセグメンテーションにより、製品タイプ、臨床適応症、エンドユーザー、流通チャネルに関連する、採用への明確な経路と明確な商業的要請が明らかになりました。製品タイプには、流路転換装置、マイクロカテーテル、神経血管コイル、神経血管ステントがあり、それぞれに固有の工学的制約と臨床的有用性があります。分流装置では、パイプライン塞栓プラットフォーム、シルク型構造物、サーパスアーキテクチャーシステムなどの装置が送達能と壁面適合性で競合し、マイクロカテーテルは、曲がりくねった脳血管系を最適に通過するために親水性やPTFEなどのコーティングに依存しています。コイル技術は、ベアメタルから、動脈瘤の閉塞耐久性を向上させることを目的とした生体活性型やハイドロゲル強化型まで多岐にわたる。ステントファミリーは編組型とレーザーカット型に分かれ、半径方向の強度と柔軟性および血管適合性のバランスをとっています。

効果的な戦略を有する企業は、動静脈奇形の治療、頭蓋内動脈瘤の治療、頭蓋内狭窄の管理、虚血性脳卒中の治療など、さまざまな分野でステントを採用しています。一方、頭蓋内動脈瘤の治療では、血管内コイリング、流路転換戦略、ステント支援コイリングの中から、動脈瘤の形態や臨床的リスクプロファイルに影響されながらデバイスを選択することになります。頭蓋内狭窄の治療ではバルーン血管形成術とステント留置術が中心であり、虚血性脳卒中の治療では動脈内血栓溶解療法と機械的血栓除去術があり、それぞれ特定のデバイスの適合性と画像ワークフローが要求されます。

エンドユーザーセグメンテーションでは、外来手術センター、病院、専門クリニックで購買行動が異なることが明らかになりました。外来センターは提携状況によって異なり、病院は一次的な地域施設から複雑な神経インターベンション・プログラムを持つ三次医療センターまで、専門クリニックはインターベンショナル・ラジオロジーや神経学クリニックを含み、紹介ハブとして機能することもあります。流通チャネルもまた、市場アクセスやサービスモデルに大きな影響を及ぼし、現場代理人や施設契約による直接販売、eコマース・プラットフォームやメーカーのウェブポータルによるオンライン販売、小売・卸売ネットワークにまたがるサードパーティ販売業者などがあります。このように重層的なセグメンテーションをナビゲートするには、各利害関係者に合わせた価値提案が必要であり、機器の機能と手続き要件、償還の現実、調達モデルを整合させる必要があります。

世界の主要ヘルスケア地域間で差別化された商業戦略を決定する地域横断的な規制、償還、製造のダイナミクス

地域間の力学は、規制状況、償還の枠組み、および神経血管デバイスの製造戦略に強力な影響を及ぼし、南北アメリカ、欧州、中東・アフリカ、およびアジア太平洋の管轄区域間で大きな違いが見られます。南北アメリカでは、病院システムの統合と実世界のエビデンスの重視が償還の議論を形成し、調達の会話における医療経済学の重要性を高めています。この地域の医療提供者は、手技の効率や在院日数短縮の可能性を示す技術を優先することが多く、その結果、コマーシャル・メッセージングや臨床試験デザインに影響を与えることになります。

欧州、中東・アフリカでは、規制の調和への取り組みと、様々な償還環境が、チャンスと複雑さの両方を生み出しています。メーカー各社は、各国の医療制度や支払者の要件をモザイク状に操りながら、国境を越えた入札のための集中調達の機会を活用しなければならないです。一方、アジア太平洋地域は、急速に拡大する手技量と異なる規制の成熟度が混在しており、コスト競争力とスケーラブルな臨床教育プログラムとのバランスをとる戦略が必要です。同地域では、価格感応度に対処しつつ導入を加速するため、製造の現地化と対象を絞った臨床提携が一般的な戦術となっています。

すべての地域において、国境を越えたロジスティクス、知的財産の考慮、地域のトレーニング能力が、参入戦略とパートナーシップモデルの両方に影響を与えています。地域特有の薬事計画、地域に特化した臨床エビデンスの創出、サプライチェーンの冗長性に早期に投資する利害関係者は、より確実な市場アクセスを確保し、より深い臨床医の関与を促進する傾向があり、その結果、地理的に多様な医療エコシステム全体で持続的に採用される確率が向上します。

製品の差別化、戦略的提携、オペレーショナル・エクセレンスがどのように競合優位性と長期的な臨床医選好を形成しているか

神経血管機器分野で活躍する企業間の競合力学の中心は、製品の差別化、エビデンスの創出、コア技術の臨床的有用性を拡大する戦略的提携です。老舗の機器メーカーは、幅広いポートフォリオを活用して、機器、画像処理ソフトウェア、トレーニングサービスを含むバンドルソリューションを提供することが多く、統合された製品を求める病院システムの導入障壁を低くしています。これとは対照的に、専門企業や新興企業は通常、臨床的な実証点を確立し、提携や買収の関心を集めるために、新規の流路転換足場や高度なコイルケミストリーなど、狭いイノベーションのベクトルに集中します。

戦略的取引、ライセンシング契約、共同開発パートナーシップは、特に薬事規制や臨床検証のタイムラインが長い場合に、技術を拡大し市場参入を加速するための有力なルートです。主要な神経インターベンションセンターと提携し、手技のワークフローを共同設計する企業は、早期に採用され、支払者との話し合いをサポートする実世界のデータストリームを得ることができます。同様に、画像診断やソフトウエアのベンダーと提携することで、医療機器メーカー各社は自社の価値提案にアナリティクスや治療成績の追跡を取り入れることができます。

製造品質システム、強固な市販後サーベイランス、迅速な現場サポートに投資する企業は、臨床医の信頼と施設契約を維持する傾向があります。価格設定の柔軟性、バンドル契約、アウトカムベース契約は、調達の複雑さに対処し、患者の転帰目標を共有することへのコミットメントを示すために、企業によってますます採用されるようになっています。最終的には、技術的な差別化と、エビデンス創出への明確な道筋と信頼できるサービス提供を両立させる企業が、長期的な臨床的選好を獲得する上で最も有利な立場になると思われます。

医療機器メーカーと医療提供者が、臨床的エビデンス、製造の強靭性、ニーズに合わせた商品化を整合させ、普及を加速させるための実用的な戦略的プレイブック

業界のリーダーは、研究開発の優先順位を実証可能な臨床的価値と整合させると同時に、サプライチェーンの強靭性と商業的機敏性を強化する多方面にわたる戦略を採用すべきです。第一に、アウトカムとオフセットコストに関する支払者や病院の意思決定者の疑問に答えるように設計された臨床エビデンスプログラムを優先し、研究エンドポイントが現実世界の意思決定基準に適合するようにします。第二に、データ収集と分析機能を機器と市販後登録に組み込み、償還に関する議論と反復的な製品改良を支援する継続的な性能に関する洞察を得る。

第三に、政策や物流の混乱を緩和するために製造や調達のフットプリントを多様化し、市場の継続性を維持するために地域パートナーシップやライセンシングを検討します。第四に、外来センター、三次病院、専門クリニック向けに、それぞれの臨床ワークフローや購買制約を反映した差別化された価値提案を行うことで、エンドユーザーのセグメンテーションに合わせて市場アプローチを調整します。第五に、商業モデルを拡大し、柔軟な契約、バンドル製品、トレーニングパートナーシップを含めることで、導入の摩擦を減らし、プロバイダーとメーカー間のインセンティブを調整します。

最後に、包括的なプロシージャー・ソリューションを構築するために、画像やソフトウェアのプロバイダー、臨床指導者、販売パートナーとの協力関係に投資します。ターゲットを絞った臨床プログラムを、弾力的な運用と適応力のある商業化と結びつけることで、組織は採用を加速させ、神経血管エコシステム全体の利害関係者に長期的な価値を示すことができます。

戦略的意思決定を支援するために、専門家へのインタビュー、規制分析、臨床エビデンスの統合を組み合わせた厳密な混合手法別調査アプローチ

本レポートの基礎となる調査は、臨床専門家、調達リーダー、および機器幹部との1次定性的な関わりと、規制ガイダンスおよび査読付き臨床文献の体系的な分析を統合したものです。一次インタビューは、インターベンショナル神経科医、神経インターベンション放射線科医、病院購買管理者、製品開発リーダーに実施され、公表された情報源には一貫して記載されていない業務実態と意思決定要因を浮き彫りにしました。調査チームは、観察された動向を検証し、新たな採用障壁を特定するために、インタビュー結果を規制当局への申請、機器のラベル情報、および臨床登録の結果と照合しました。

2次調査では、臨床試験、システマティックレビュー、医療技術評価報告書の構造的レビューを行い、適応症における機器使用の臨床的背景を明らかにしました。サプライチェーン分析では、一般に入手可能な貿易データ、製造フットプリント、企業情報公開を活用し、関税や調達の影響を受けそうなポイントをマッピングしました。さらに、この調査手法では、具体的な市場規模や予測を行うことなく、サプライチェーン、償還、規制の組み合わせがどのように調達力学に影響を与えうるかを検討するために、シナリオプランニングを取り入れました。

調査手法全体を通じて、再現性と透明性を重視しました。インタビューのプロトコールと対象基準は標準化され、データソースはバイアスを減らすために相互参照されました。質的な洞察と文書に基づく検証を組み合わせることで、神経血管機器領域に携わる利害関係者に戦略および事業計画を知らせるために設計された強固なエビデンスベースが得られます。

技術革新、エビデンスの創出、運用の強靭性を整合させ、永続的な臨床採用を確保するための戦略的必須事項の簡潔な統合

この分析で提示された洞察の積み重ねは、利害関係者が迅速かつ慎重に行動するための明確な必要条件を示しています。機器設計と手技の実践における技術的進歩は、臨床の選択肢を拡大しつつあるが、その採用は、実証可能なアウトカム、明確な価格設定、供給の信頼性にかかっています。規制当局の期待と支払者の監視は、統合エビデンス戦略と市販後データ取得の重要性を高めており、貿易政策の転換は、多様な調達と地域製造戦略の価値を強化しています。

意思決定者にとっては、製品開発を臨床医、支払者、病院購入者の情報ニーズと一致させることが前進への道筋となります。これは、実用的なアウトカムデータを生み出す臨床プログラムを優先し、調達の摩擦を減らす商業モデルを設計し、トレーニングや機器のライフサイクル管理をサポートするサービス機能に投資することを意味します。技術的な差別化と運用面での強靭さ、そしてエビデンスに基づく商品化を両立させる組織は、持続的な優位性を生み出し、臨床で選ばれるための明確な道筋を作ることができます。

まとめると、神経血管デバイスの市場情勢には大きな機会があるが、その機会を実現するには、研究開発、規制状況、製造、および市場投入の実行にわたって協調した戦略が必要です。エビデンスの創出、サプライチェーンの柔軟性、および商業的関与の調整を強化するために今行動する利害関係者は、技術革新を持続的な臨床的・商業的成功につなげるために最も有利な立場にあると思われます。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 長期的な血管炎症を軽減する次世代生体吸収性ステントの採用

- 神経血管介入計画における人工知能と機械学習の統合

- 遠位脳血管へのアクセスを可能にするマイクロカテーテル技術の開発

- 大血管性急性虚血性脳卒中に対する血栓除去デバイスの適応拡大

- 複雑な解剖学的構造における動脈瘤閉塞の耐久性を向上させるポリマーコーティングコイルの登場

- 複雑な神経介入処置のための遠隔医療対応遠隔監視の拡大

- 手術結果を最適化するための患者固有の3Dプリント血管モデルの進歩

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 神経血管デバイス市場:製品タイプ別

- 流量転換装置

- パイプライン塞栓デバイス

- シルクデバイス

- サーパスデバイス

- マイクロカテーテル

- 親水性コーティング

- PTFEコーティング

- 神経血管コイル

- ベアメタルコイル

- バイオアクティブコイル

- ハイドロゲルコイル

- 神経血管ステント

- 編組ステント

- レーザーカットステント

第9章 神経血管デバイス市場:適応症別

- 動静脈奇形

- 接着剤塞栓剤

- オニキス

- 頭蓋内動脈瘤

- 血管内コイル塞栓術

- 流量転換

- ステント補助コイル塞栓術

- 頭蓋内狭窄

- バルーン血管形成術

- ステント留置術

- 虚血性脳卒中

- 動脈内血栓溶解療法

- 機械的血栓除去術

第10章 神経血管デバイス市場:エンドユーザー別

- 外来手術センター

- 病院関連センター

- 独立センター

- 病院

- プライマリ病院

- 三次医療機関

- 専門クリニック

- インターベンショナルラジオロジークリニック

- 神経科クリニック

第11章 神経血管デバイス市場:流通チャネル別

- 直接販売

- フィールド担当者

- 病院契約

- オンライン販売

- Eコマースプラットフォーム

- メーカーのウェブサイト

- サードパーティディストリビューター

- 小売販売業者

- 卸売業者

第12章 神経血管デバイス市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第13章 神経血管デバイス市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第14章 神経血管デバイス市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第15章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Medtronic plc

- Stryker Corporation

- Johnson & Johnson Services, Inc.

- Penumbra, Inc.

- Terumo Corporation

- Boston Scientific Corporation

- MicroPort Scientific Corporation

- Cordis LLC

- Siemens Healthineers AG

- Asahi Intecc Co., Ltd.