|

|

市場調査レポート

商品コード

1870265

歯科用スプリント市場:製品別、種類別、材質別、調整機能別、用途別、流通経路別、エンドユーザー別-2025年~2032年の世界予測Dental Splints Market by Product, Type, Material, Adjustability Features, Application, Distribution Channel, End User - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 歯科用スプリント市場:製品別、種類別、材質別、調整機能別、用途別、流通経路別、エンドユーザー別-2025年~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 189 Pages

納期: 即日から翌営業日

|

概要

歯科用スプリント市場は、2032年までにCAGR4.50%で6億3,980万米ドル規模に成長すると予測されております。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 4億4,985万米ドル |

| 推定年2025 | 4億6,924万米ドル |

| 予測年2032 | 6億3,980万米ドル |

| CAGR(%) | 4.50% |

デジタル製造、材料革新、流通経路の細分化が歯科用スプリントと利害関係者の優先事項を再定義している状況を簡潔に概説する導入部

歯科用スプリントの分野は、ニッチな臨床補助具から、歯科技術、材料科学、消費者健康が交差する学際的な製品カテゴリーへと進化しました。本導入部では、臨床現場と家庭環境におけるスプリントの設計、製造、流通、採用方法を再構築する促進要因を統合的に解説します。先進的な製造手法の融合、患者様の期待の変化、規制監視の強化が相まって、メーカー、ラボラトリー、クリニック、小売チャネルの競争的ポジショニングを再定義している点を強調します。

デジタルデンティストリー革新、先進熱可塑性材料、変化する患者購買行動、規制更新が歯科用スプリント市場に与える総合的変革

歯科用スプリント業界情勢における変革的な変化は、技術進歩、患者行動の変化、規制動向の相乗効果によって推進されています。デジタルデンティストリーはこの進化の中核をなします。口腔内スキャン、クラウドベースのワークフロー、3Dプリント技術は生産リードタイムを短縮し、費用対効果の高いカスタマイズを可能にすると同時に、臨床的トレーサビリティとデータセキュリティへの期待を高めています。同時に、材料科学の進歩(特にポリカーボネートや高性能アクリル樹脂などの熱可塑性樹脂分野)は、臨床医やメーカーが利用できる選択肢の幅を広げ、剛性、弾性、患者様の快適性のバランスを保つ装置の開発を支えています。

2025年米国関税措置が歯科用スプリント利害関係者に及ぼしたサプライチェーン多様化・材料調達先転換・事業リスクヘッジ対策の評価

2025年の新関税導入は、歯科用スプリント及びその部品を供給するサプライチェーン全体に多層的な影響をもたらし、調達先の選択、契約交渉、在庫戦略に影響を与えました。関税調整により、特殊熱可塑性プラスチックや特定の金属部品などの輸入原材料・部品の着陸コストが上昇したため、メーカーはサプライヤーポートフォリオの再評価や、技術的・経済的に実現可能な代替材料の配合、国内調達オプションの模索を迫られました。

製品形態、デバイス構造、材料、調整機能、臨床応用、流通経路、エンドユーザー要件を結びつける包括的なセグメンテーション分析に基づく知見

セグメンテーション分析により、製品形態、デバイス構造、材料組成、調整機能、臨床応用、流通経路、エンドユーザーごとに異なる性能と商業的ダイナミクスが明らかになりました。製品別では、臨床医主導のデジタル/アナログワークフロー向けに設計されたカスタムフィットスプリントと、費用対効果の高い迅速な展開を最適化したプレファブリケイテッドスプリントに市場が分かれており、これら二つのアプローチは個別対応と規模拡大の間で異なるトレードオフを示しています。タイプ別では、情勢はハード歯科用スプリント、ハイブリッド歯科用スプリント、ソフト歯科用スプリントに分類されます。ハード歯科用スプリントには調整可能スプリントやメチルメタクリレートスプリントなどのサブタイプが含まれ、ソフト歯科用スプリントはさらに弾性アクリルスプリントと熱可塑性材料スプリントに細分化されます。それぞれが異なる機械的特性と患者様の快適性を提供します。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場洞察

- 3Dプリントとデジタル口腔内スキャンの統合による個別対応型スプリント製作の推進

- 矯正治療併用を目的とした、透明アライナー対応咬合スプリントの採用拡大

- 抗菌性および生体活性ポリマー複合材の開発によるスプリント衛生性の向上

- 夜間用マウスガードの遠隔モニタリングと調整を提供するテレデンティストリープラットフォームの成長

- 軽量で柔軟な熱可塑性樹脂製夜間歯ぎしり用スプリントに対する患者様の選好度が高まっております

- 小児の歯ぎしり用スプリントにおける人間工学に基づいた設計の拡大によるコンプライアンス率の向上

- AIを活用した予測分析の急増:歯ぎしりの強度を定量化し、スプリントの硬度をカスタマイズするため

- 歯科技工所とソフトウェアプロバイダーの連携によるCAD/CAMスプリント生産ワークフローの効率化

- 歯科用スプリントの材料生体適合性試験の標準化を推進する規制当局の監視強化

- カスタムスプリント装置の配送・交換におけるサブスクリプションモデルの台頭

第6章 米国の関税の累積的な影響, 2025

第7章 AIの累積的影響, 2025

第8章 歯科用スプリント市場:製品別

- オーダーメイドスプリント

- 既製スプリント

第9章 歯科用スプリント市場:種類別

- 硬質歯科用スプリント

- 調整可能なスプリント

- メタクリル酸メチル製スプリント

- ハイブリッド歯科用スプリント

- ソフト歯科用スプリント

- 弾性アクリル製スプリント

- 熱可塑性樹脂製スプリント

第10章 歯科用スプリント市場:材質別

- 金属

- 軟質/柔軟性材料

- 熱可塑性プラスチック

- アクリル樹脂

- ポリカーボネート

- ポリエチレン

第11章 歯科用スプリント市場:調整機能別

- 非調整式スプリント

- 自動調整式スプリント

第12章 歯科用スプリント市場:用途別

- 歯ぎしり

- 睡眠時無呼吸症候群

- 顎関節症

- 外傷・損傷防止

第13章 歯科用スプリント市場:流通チャネル別

- オフライン小売

- オンライン小売

第14章 歯科用スプリント市場:エンドユーザー別

- 歯科技工所

- 家庭用

- 病院および診療所

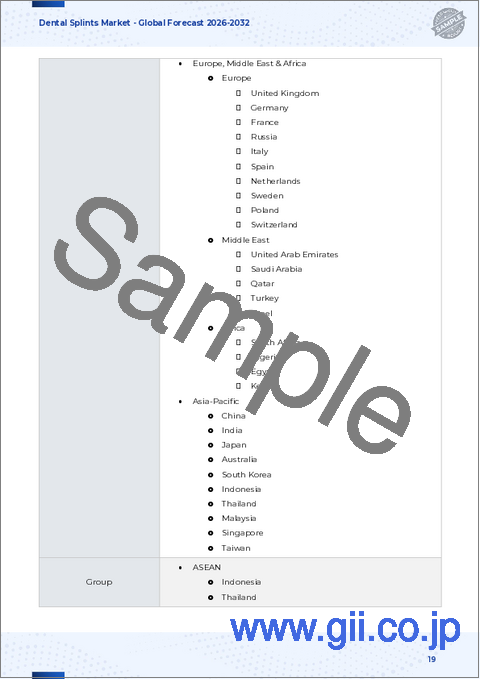

第15章 歯科用スプリント市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州、中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋地域

第16章 歯科用スプリント市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第17章 歯科用スプリント市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第18章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- 3M Company

- 3Shape A/S

- Align Technology, Inc.

- BEGO Medical GmbH

- BioHorizons IPH, Inc.

- BISCO, Inc.

- Blue Sky Bio, LLC

- Bupa Dental Corporation

- Carestream Dental LLC

- Danaher Corporation

- Dentsply Sirona Company

- Dentsply Sirona Inc.

- GC Corporation

- Henry Schein, Inc.

- Heraeus Kulzer GmbH

- Ivoclar Vivadent AG

- Kavo Dental GmbH

- Keystone Dental, Inc.

- Medit Corp.

- Mitsui Chemicals, Inc.

- Osstem Implant Co., Ltd.

- Patterson Companies, Inc.

- Planmeca Oy

- PreXion Corporation

- Schutz Dental GmbH

- Septodont Holding

- Straumann Holding AG

- Vatech Co., Ltd.

- Zimmer Biomet Holdings, Inc.