|

|

市場調査レポート

商品コード

1839052

セラミックボール市場:材料、用途、最終用途産業、ボール直径範囲、ボールタイプ別-2025~2032年の世界予測Ceramic Balls Market by Material, Application, End Use Industry, Ball Diameter Range, Ball Type - Global Forecast 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| セラミックボール市場:材料、用途、最終用途産業、ボール直径範囲、ボールタイプ別-2025~2032年の世界予測 |

|

出版日: 2025年09月30日

発行: 360iResearch

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

概要

セラミックボール市場は、2032年までにCAGR 6.41%で10億2,886万米ドルの成長が予測されます。

| 主要市場の統計 | |

|---|---|

| 基準年 2024年 | 6億2,585万米ドル |

| 推定年 2025年 | 6億6,529万米ドル |

| 予測年 2032年 | 10億2,886万米ドル |

| CAGR(%) | 6.41% |

セラミックボールの簡潔な概要では、その工学的な性能特性、製造の進化、重要な産業用途における戦略的役割が強調されています

セラミックボールは、高精度アセンブリー、研磨システム、高温用途など、金属の代替品では性能的に対応できない用途の基礎部品です。硬度、熱安定性、耐薬品性のために設計されたこれらの部品は、ベアリング、研削媒体、バルブシール、摩耗が重要なインターフェースに使用されています。セラミックの化学的性質と製造技術の進歩は、ライフサイクルコストを削減し、システムの信頼性を向上させる一方で、より厳しい条件下での適用範囲を広げてきました。

過去10年間で、焼結技術、付加製造補助剤、表面仕上げの改善により、公差がより厳しくなり、機械的特性がより安定するようになりました。その結果、設計者や調達チームは、卓越した耐久性だけでなく、軽量化や汚染制御のためにセラミックを優先するようになっています。これと並行して、サプライチェーンの継続性と材料のトレーサビリティへの注目が高まっており、原料の調達とプロセスの適格性に関する上流プロセスでの考慮が高まっています。その結果、意思決定者は、新規またはアップグレードシステムにセラミックボールを指定する際に、材料科学、生産能力、最終使用環境の評価を統合する必要があります。

新たな材料科学、生産自動化、用途レベルの電化により、サプライヤーの戦略と採用チャネルが産業全体でどのように変化しているか

セラミックボールの情勢は、材料技術革新、用途需要、地政学的施策の収束力によって、変容しつつあります。新しい材料システム、特に窒化ケイ素と高度ジルコニア配合は、回転アセンブリの動作速度の高速化、破壊靭性の向上、サービス間隔の延長を可能にしています。同時に、生産ワークフローは、リードタイムを短縮し、バッチ間の一貫性を向上させる、より自動化されたインライン計測を採用しています。

用途層では、輸送の電動化の動向と自動化された製造環境の激化により、低振動、長寿命のベアリングと耐汚染性研削メディアへの要求が高まっています。このような使用事例の進化により、サプライヤーはOEMとの適格性評価プロトコルや共同検査プログラムに投資し、採用を加速させています。さらに、排出ガスやライフサイクルのモニタリング強化など、規制や環境への配慮から、潤滑金属システムをドライランニングのセラミック代替品に置き換えることが可能な場合は奨励されています。これらの変化を総合すると、サプライヤーとの関係、研究開発投資の優先順位、購入者がバリューチェーン全体で総所有コストを評価する方法が見直されつつあります。

米国の関税措置の進展がセラミック部品のサプライチェーン全体の調達戦略、国内生産能力計画、サプライヤーリスク軽減に及ぼす影響

米国における最近の関税措置と貿易施策の再調整は、セラミック部品の調達とサプライチェーン計画に新たな複雑性をもたらしています。関税調整、国境措置、国際貿易摩擦は、サプライヤーの多様化、ニアショアリングの検討、リードタイムとコストの変動を緩和するための契約上の柔軟性の重要性を高めています。地政学的リスクやロジスティクスの混乱が許容できないオペレーショナル・エクスポージャーをもたらす場合には、代替サプライヤーを探したり、国内生産を適格としたりする必要があります。

このような施策変更は、バリューチェーンの一部を内部化し、予測可能な供給窓口を提供できる垂直統合型サプライヤーの価値をも高めています。規制主導のシフトは、特に窒化ケイ素やジルコニアなど、特殊な製造能力を必要とする重要なセラミック化学品について、国内の生産能力拡大や技術移転プログラムへの投資を加速させる可能性があります。一方、相手先商標製品メーカーとシステムインテグレーターは、製品の性能と仕様の完全性を維持しつつ、貿易コンプライアンス、デュアルソーシング戦略、関税によるマージン低下をヘッジする契約条件に焦点を当てたサプライヤー監査を優先すべきです。

統合されたセグメンテーション分析により、材料化学、用途要求、直径分類、最終用途要件、ボールの類型が、どのように仕様と調達の選択を促進するかを明らかにします

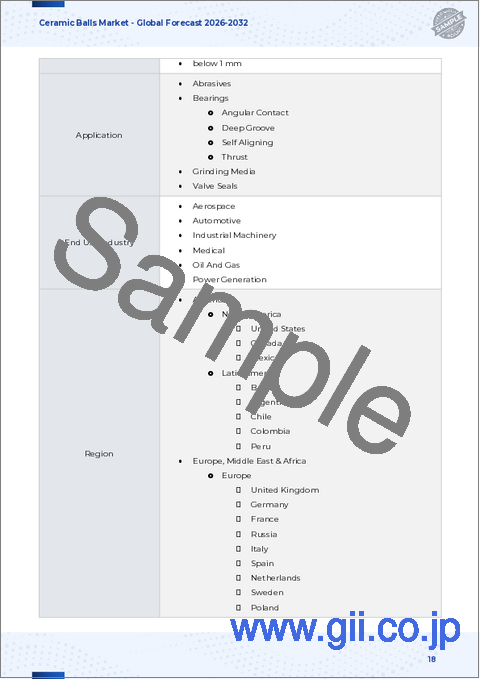

セラミックボールのセグメンテーション洞察は、材料、用途、最終用途産業、直径範囲、ボールタイプに渡って調査することで、微妙な性能と商業力学を明らかにします。材料に基づき、酸化アルミニウム、炭化ケイ素、窒化ケイ素、ジルコニアについて市場を調査しています。各化学は、硬度、靭性、熱伝導性、コスト間の独自のトレードオフを提示し、用途の適合性と認定スケジュールに影響を与えます。酸化アルミニウムは、手頃な価格と耐摩耗性のバランスが取れており、多くの研磨用途やシーリング用途に適しています。一方、炭化ケイ素は、腐食環境での耐熱性と耐薬品性を重視しています。窒化ケイ素は、高速ベアリングを支える優れた疲労寿命と破壊靭性を提供し、高度ジルコニアは、要求の厳しいシーリングと精密な役割のために、耐摩耗性と組み合わせた卓越した靭性をもたらします。

よくあるご質問

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場概要

第5章 市場洞察

- 半導体ウエハーハンドリングにおける高純度アルミナの採用

- エネルギー効率の高い電気自動車モーターへのシリコン窒化物セラミックボールの統合

- 耐摩耗性向上のため、ダウンホール掘削ツールにおけるセラミックボールの使用増加

- 整形外科インプラント用途におけるバイオセラミックボールの需要増加

- リサイクル材料を使用したセラミック研磨媒体のサステイナブル製造への市場シフト

- 高温動作の航空宇宙用途におけるセラミックボールベアリングの成長

- 耐腐食性を向上させるナノ構造セラミックボールコーティングの革新

- 光学レンズの精密研磨における高度セラミックボールの拡大

- 低摩擦を実現するカーボンとジルコニアを組み合わせたハイブリッドセラミックボールベアリングの開発

- リードタイム短縮用カスタム形態セラミックボールへの積層造形の採用

第6章 米国の関税の累積的な影響、2025年

第7章 AIの累積的影響、2025年

第8章 セラミックボール市場:材料別

- 酸化アルミニウム

- 炭化ケイ素

- 窒化シリコン

- ジルコニア

第9章 セラミックボール市場:用途別

- 研磨剤

- ベアリング

- アンギュラーコンタクト

- ディープグルーヴ

- 自動調整

- 推力

- 粉砕媒体

- バルブシール

第10章 セラミックボール市場:最終用途産業別

- 航空宇宙

- 自動車

- 産業機械

- 医療

- 石油・ガス

- 発電

第11章 セラミックボール市場:ボール直径範囲別

- 10mm以上

- 5~10mm

- 1~5mm

- 1mm以下

第12章 セラミックボール市場:ボールタイプ別

- 精度

- 特殊

- 標準

第13章 セラミックボール市場:地域別

- 南北アメリカ

- 北米

- ラテンアメリカ

- 欧州・中東・アフリカ

- 欧州

- 中東

- アフリカ

- アジア太平洋

第14章 セラミックボール市場:グループ別

- ASEAN

- GCC

- EU

- BRICS

- G7

- NATO

第15章 セラミックボール市場:国別

- 米国

- カナダ

- メキシコ

- ブラジル

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- 中国

- インド

- 日本

- オーストラリア

- 韓国

第16章 競合情勢

- 市場シェア分析、2024年

- FPNVポジショニングマトリックス、2024年

- 競合分析

- CeramTec GmbH

- CoorsTek, Inc.

- NGK SPARK PLUG CO., LTD.

- Kyocera Corporation

- Saint-Gobain S.A.

- 3M Company

- SKF AB

- Morgan Advanced Materials plc

- ITT Inc.

- Precision Ceramics, Inc.