|

|

市場調査レポート

商品コード

1431788

EaaS (Equipment as a Service) 市場:2024-2028年Equipment as a Service Market Report 2024-2028 |

||||||

|

|||||||

| EaaS (Equipment as a Service) 市場:2024-2028年 |

|

出版日: 2024年02月22日

発行: IoT Analytics GmbH

ページ情報: 英文 147 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

当レポートでは、EaaS (Equipment as a Service) ベンダーやエンドユーザーへのインタビュー結果に基づき世界のEaaS市場の動向を調査し、EaaSの定義、市場規模の推移・予測、市場促進要因・促進要因の分析、ベンダー分析、ケーススタディ分析、主要動向・課題などをまとめています。

サンプルビュー

掲載企業:

|

|

目次

第1章 エグゼクティブサマリー

第2章 トピック概要

- 出発点:「従量課金制」と「EaaS」:OEMデジタル化ロードマップにおける重要トレンド

- EaaS導入企業の代表的な事例4選

- EaaSとは何か?

- 消費者がEaaSから恩恵を受けるのはなぜか?

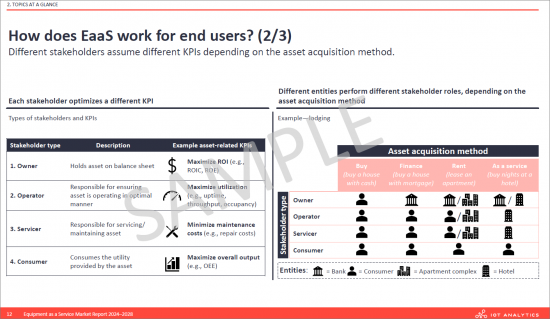

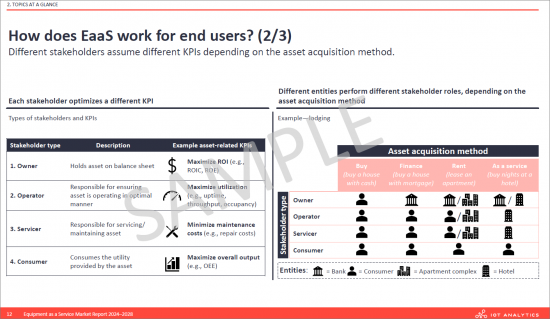

- EaaSはエンドユーザーにとってどのように機能するか?

- OEMのEaaSへの一般的な道筋

- 一般的なEaaSソリューションの作成方法

- OEMがEaaSを提供するのはなぜか?

第3章 市場規模・展望

- EaaSの市場区分:定義

- OEM市場、EaaS市場、EaaS導入率の定義

- 世界市場の規模と展望:概要

- 世界のEaaS市場の規模・展望:市場成長に関するアナリストの意見

- 世界市場の規模・展望:地域別

- ディープダイブ1:サービスとしての機械

- ディープダイブ2:コンピューター、周辺機器、サービスとしてのオンプレミスデータセンター

- ディープダイブ3:商用車、航空機および関連部品のサービス- 市場予測

- ディープダイブ4:サービスとしての電気照明機器

- ディープダイブ5:サービスとしての発電、送電、配電

- 世界のEaaS市場の成長に影響を与える追風と逆風:概要

- 1.インフレ/金利の上昇がアセットライト型のサブスクリプション経済を推進

- 2.人手不足により時間単位での機器使用の必要性が高まる

- 3.政府別設備投資型投資への補助

- 4.柔軟性の向上に対する需要の高まり

- 5.IIoT技術の改善

- 市場成長の分析

- 世界市場の規模・展望:詳細情報

第4章 EaaSの導入

- EaaS導入の促進要因

- EaaS導入率を詳細区分別に分割

- EaaSの機会の概要 (1/2) :現在の導入と将来の導入

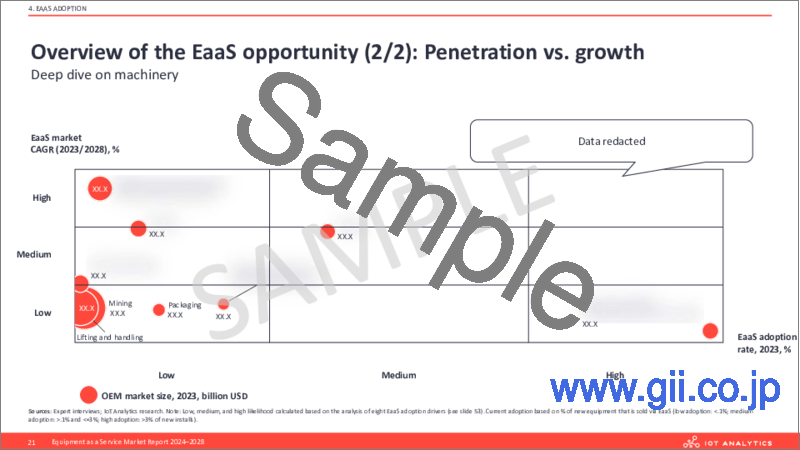

- EaaSの機会の概要 (2/2) :現在の導入と将来の導入- 機械の詳細

第5章 既知の採用企業とベンダー

- EaaSを実現するインフラ情勢

- 既知の採用企業の情勢

- ディープダイブ1:Robotics as a Service

- ディープダイブ2:Compressor as a Service

- ディープダイブ3:EaaSのパイオニア

- ディープダイブ4:成功事例:Heidelberger Druckmaschinen

- ディープダイブ5:挫折の物語:Festo

第6章 EaaSの資金調達

- 金融機関:EaaSの仕様に対応するため従量課金制の金融商品を導入

- 背景:ペイパーユースファイナンスはオフバランスシートファイナンスの一種

- OEMは一般的に機器の資金調達についてどのように考えているか

- EaaSに資金提供する3つの理論的オプション:ユーザーの観点から

- 専用のEaaSサービスを提供する金融機関の情勢

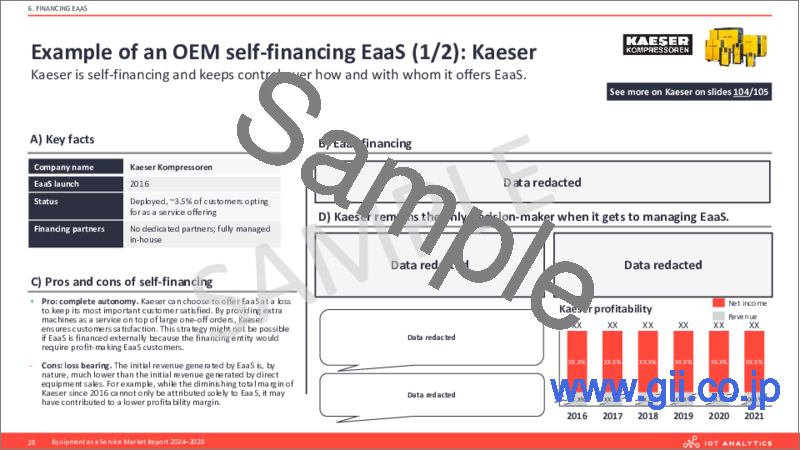

- OEMによる自己資金調達EaaSの例 (1/2) :Kaeser

- OEMによる自己資金調達EaaSの例 (2/2) :Caterpillar

- サードパーティと協力してEaaSに資金提供するOEMの例:Trumpf

- SPV Symboticを使用してOEMがEaaSに融資する例

第7章 ケーススタディ

- EaaSケーススタディ (95件)

- ケーススタディ1:Heller

- ケーススタディ2:Carrier Commercial Refrigeration

- ケーススタディ3:Kaeser Compressors

- ケーススタディ4:Heidelberg Druckmaschinen

- ケーススタディ5:Kaer

- ケーススタディ6:Hewlett Packard Enterprise

- ケーススタディ7:Signify

- ケーススタディ8:Mitsubishi Elevator Europe

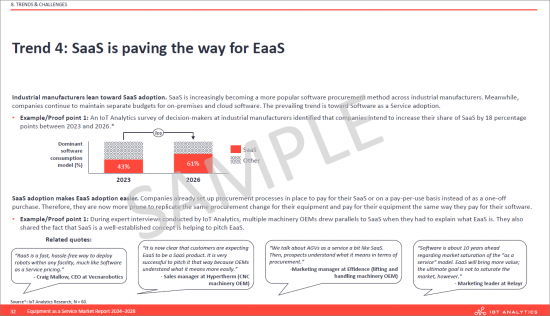

第8章 動向と課題

- トレンド1:OEMはEaaSを使用してサードパーティに失われた収益を回収

- トレンド2:パフォーマンス保証契約はEaaSの代替手段を提供

- トレンド3:OEMは持続可能性の課題を推進するためにEaaSを使用

- トレンド4:EaaSは商用電気/水素自動車の顕著なビジネスモデルとなっている

- トレンド5:EaaSの導入は業界クラスターで起こる

- トレンド6:EaaSセットアップの一部としてスペアパーツを再利用

- トレンド7:EaaSが商用電気/水素自動車の有力なビジネスモデルになりつつある

- 課題1:EaaSの価格設定/契約の確立

- 課題2:既存のビジネスモデルからの移行

- 課題3:柔軟な資金源の調達

- 課題4:より大きなバランスシートの管理

- 課題5:エンドユーザーはEaaS機器を適切に扱っていない

- 課題6:資金調達のベストプラクティスの欠如

第9章 調査インサイト

- EaaS:OEMによる採用状況 (区分別)

- 顧客によるEaaSの導入

- 顧客がEaaSを採用する理由

- EaaSへのピボットを確実に成功させるために必要なアクション

- EaaSへの移行時によくある間違い

- 回答者のプロファイルと調査概要

第7章 調査手法

第8章 IoT Analyticsについて

Comprehensive 147-page analysis on OEMs' transition to pay-per-use models. Includes market forecasts, vendor analyses, adoption drivers, case studies, key trends, and challenges.

The "Equipment as a Service Market Report 2024-2028" is part of IoT Analytics' ongoing coverage of Industrial IoT. The information presented in this report is based on the results of multiple surveys, secondary research, and qualitative research, i.e., interviews with Equipment as a Service (EaaS) vendors and end users from between August 2023 and February 2024. The document includes a definition of EaaS, market projections, analysis of vendors, adoption drivers, case study analysis, key trends and challenges, and insights from relevant surveys.

SAMPLE VIEW

The main purpose of this document is to help our readers understand the current EaaS landscape by defining, sizing, and analyzing the market.

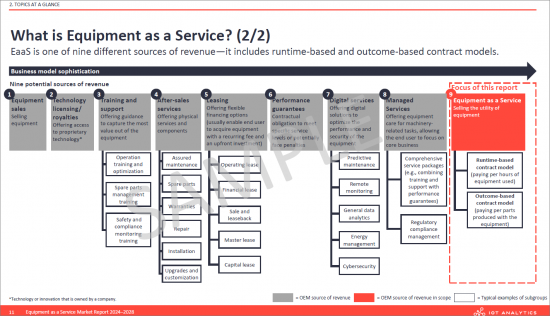

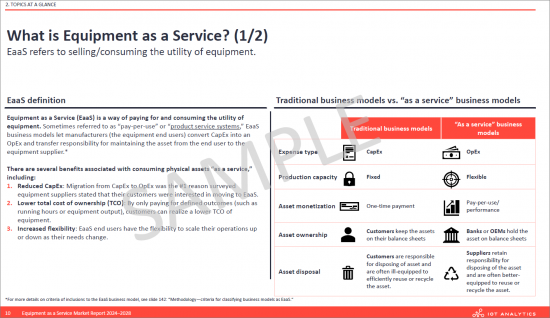

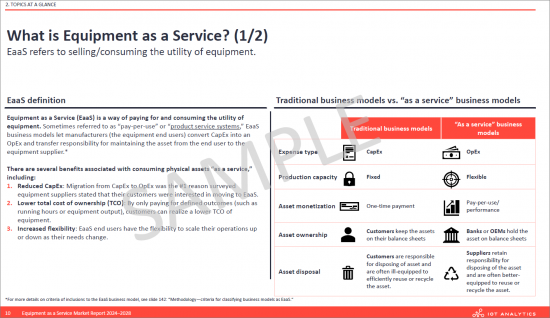

What is Equipment as a Service?

Equipment as a Service (EaaS) is a way of paying for and consuming the utility of equipment. Sometimes referred to as "pay-per-use" or "product service systems," EaaS business models let manufacturers (the equipment end users) convert CapEx into an OpEx and transfer responsibility for maintaining the asset from the end user to the equipment supplier.*

There are several benefits associated with consuming physical assets "as a service," including:

- 1. Reduced CapEx: Migration from CapEx to OpEx was the #1 reason surveyed equipment suppliers stated that their customers were interested in moving to EaaS.

- 2. Lower total cost of ownership (TCO): By only paying for defined outcomes (such as running hours or equipment output), customers can realize a lower TCO of equipment.

- 3. Increased flexibility: EaaS end users have the flexibility to scale their operations up or down as their needs change.

The Equipment as a Service (EaaS) market has been experiencing growth and is poised to continue growing in the coming years. This market encompasses a wide range of segments, with commercial vehicles, aircraft, and related parts leading the way. Closely followed by computers, peripheral equipment, and on-premises data centers, machinery, electric power generation, transmission, and distribution, and electrical lighting equipment.

Geographically, the Americas hold the largest share of the EaaS market, with EMEA and APAC regions also contributing substantial portions. The EaaS market's robust growth can be attributed to the increasing adoption of this business model across various industries, offering them the flexibility to use high-quality equipment without the upfront costs of ownership.

As we move forward, the EaaS market is expected to maintain its upward trajectory, driven by technological advancements, evolving business needs, and the increasing recognition of the benefits of this service model.

Questions answered:

- What is EaaS? (Definition, how it works for consumers and original equipment makers (OEMs), why and how consumers benefit from EaaS; and why OEMs offer EaaS)

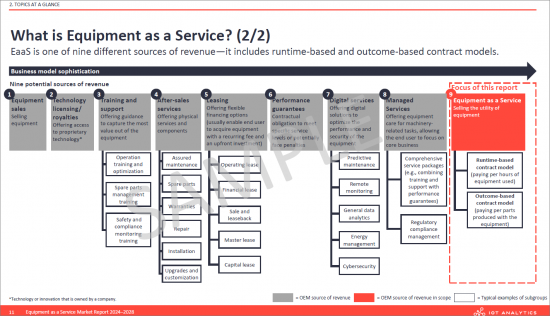

- Where does EaaS fit compared to other services provided by OEMs?

- How big is the EaaS market, and how is it expected to evolve?

- Who are the OEMs leading EaaS adoption, and what is their market share?

- What macro trends impact the market growth, and what are the headwinds/tailwinds?

- What are the drivers for EaaS adoption?

- How are EaaS solutions created?

- How are OEMs financing EaaS? How are they making EaaS successful?

- What are some best-in-class case studies of EaaS?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

Table of Contents

1. Executive summary

2. Topic at a glance

- 2.1. Starting point: "Pay-per-use" and "Equipment as a Service" are important trends on the OEM digitization roadmap

- 2.2. 4 prominent examples of companies that have introduced EaaS

- 2.3. What is Equipment as a Service (EaaS)?

- 2.4. Why do consumers theoretically benefit from EaaS?

- 2.5. How does Equipment as a Service work for end users?

- 2.6. OEM's typical path towards Equipment as a Service

- 2.7. How typical EaaS solutions are created

- 2.8. Why do OEMs offer Equipment as a Service?

3. Market size & outlook

- 3.1. EaaS market segments definitions

- 3.2. Definitions of OEM market, EaaS market and EaaS adoption rate

- 3.3. Global market size and outlook - Overview

- 3.4. Global EaaS market size and outlook - Analyst's opinion on market growth

- 3.5. Global market size and outlook - by region

- 3.6. Deep-dive 1: Machinery as a Service

- 3.7. Deep-dive 2: Computers, peripheral equipment and on-premises data centers as a Service

- 3.8. Deep-dive 3: Commercial vehicle, aircrafts and related parts as a Service - Market forecast

- 3.9. Deep-dive 4: Electrical lighting equipment as a Service

- 3.10. Deep-dive 5: Electric power generation, transmission and distribution as a Service

- 3.11. Overview of headwinds and tailwinds impacting the global EaaS market growth

- 3.12. 1. Rising inflation/interest rates driving the asset-light subscription economy

- 3.13. 2. Labor shortages pushing the need for hourly equipment usage

- 3.14. 3. Governments subsidizing CAPEX-type investments

- 3.15. 4. Rising demand for increased flexibility

- 3.16. 5. IIoT technology improvements

- 3.17. Analysis of the market growth

- 3.18. Global market size and outlook - Further information

4. EaaS adoption

- 4.1. EaaS adoption drivers

- 4.2. EaaS adoption rate split by sub-segments

- 4.3. Overview of the EaaS opportunity (1/2): Current adoption vs future adoption

- 4.4. Overview of the EaaS opportunity (2/2): Current adoption vs future adoption - Deep dive on machinery

5. Known adopters & vendors

- 5.1. Landscape of the EaaS enabling infrastructure

- 5.2. Landscape of known adopters

- 5.3. Deep-dive 1: Robotics as a Service

- 5.4. Deep dive 2: Compressor as a Service

- 5.5. Deep dive 3: EaaS pioneer

- 5.6. Deep dive 4: Success story - Heidelberger Druckmaschinen

- 5.7. Deep dive 5: Setback story - Festo

6. Financing EaaS

- 6.1. Financial institutions are introducing pay-per-use financial products to cater to EaaS specifics

- 6.2. Background: Pay-per-use financing is a form of off-balance sheet financing

- 6.3. How OEMs generally think about equipment financing

- 6.4. 3 theoretical options to finance equipment as a service from the user's point of view

- 6.5. Landscape of financial institutions with dedicated EaaS offerings

- 6.6. Example of an OEM self-financing EaaS (1/2): Kaeser

- 6.7. Example of an OEM self-financing EaaS (2/2): Caterpillar

- 6.8. Example of an OEM financing EaaS with a 3rd party : Trumpf

- 6.9. Example of an OEM financing EaaS with an SPV Symbotic

7. Case studies

- 7.1. 95 EaaS case studies have been identified across variety of industries

- 7.2. Case study 1: Heller

- Successful OEMs focus on software add-ons with a freemium model

- 7.3. Case study 2: Carrier Commercial Refrigeration

- 7.4. Case study 3: Kaeser Compressors

- 7.5. Case study 4: Heidelberg Druckmaschinen

- 7.6. Case study 5: Kaer

- 7.7. Case study 6: Hewlett Packard Enterprise

- 7.8. Case study 7: Signify

- 7.9. Case study 8: Mitsubishi Elevator Europe

8. Trends & Challenges

- 8.1. Trend 1: OEMs are using EaaS to capture revenue lost to 3rd parties

- 8.2. Trend 2: Guaranteed performance contracts offer alternative to EaaS

- 8.3. Trend 3: OEMS are using EaaS to push their sustainability agenda

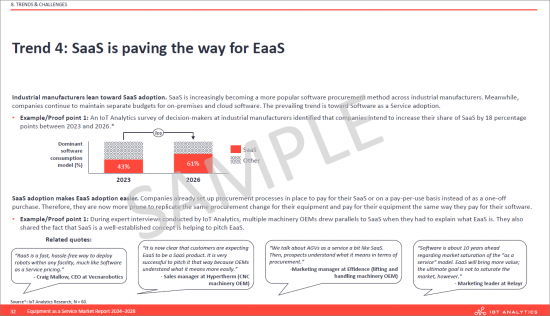

- 8.4. Trend 4: EaaS has become the prominent business model for commercial electric/hydrogen vehicles

- 8.5. Trend 5: EaaS adoption happens in industry cluster

- 8.6. Trend 6: Re-using spare parts as part of the EaaS setup

- 8.7. Trend 7: EaaS becoming the prominent business model for commercial electric/hydrogen vehicles

- 8.8. Challenge 1: Establishing EaaS pricing / contracts

- 8.9. Challenge 2: Transitioning from existing business models

- 8.10. Challenge 3: Procuring flexible financing sources

- 8.11. Challenge 4: Managing larger balance sheets

- 8.12. Challenge 5: End-users don't treat EaaS equipment well

- 8.13. Challenge 6: There are no financing best-practices

9. Survey insights

- 9.1. EaaS OEM adoption status-by segment

- 9.2. Customer adoption of EaaS

- 9.3. Reasons why customers adopt EaaS

- 9.4. Necessary actions to guarantee a successful pivot to EaaS

- 9.5. Common mistakes when transitioning to EaaS

- 9.6. Respondents' profile and survey overview