|

|

市場調査レポート

商品コード

1693068

抗CD20モノクローナル抗体(mAB)の世界市場 2025~2029年Global Anti-cd20 Monoclonal Antibodies (mabs) Market 2025-2029 |

||||||

カスタマイズ可能

|

|||||||

| 抗CD20モノクローナル抗体(mAB)の世界市場 2025~2029年 |

|

出版日: 2025年03月20日

発行: TechNavio

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

抗CD20モノクローナル抗体(mAB)市場は2024-2029年に156億4,310万米ドル、予測期間中のCAGRは12.3%で成長すると予測されます。

当レポートでは、抗CD20モノクローナル抗体(mAB)市場の全体的な分析、市場規模・予測、動向、成長促進要因、課題、約25のベンダーを網羅したベンダー分析などを掲載しています。

現在の市場シナリオ、最新動向と促進要因、市場環境全体に関する最新分析を提供しています。市場は、併用療法の増加、抗CD20 MABの高い標的親和性と特異性、強力なパイプラインと最近の承認によって牽引されています。

| 市場範囲 | |

|---|---|

| 基準年 | 2025 |

| 終了年 | 2029 |

| 予測期間 | 2025-2029 |

| 成長モメンタム | 加速 |

| 前年比2025年 | 10.5% |

| CAGR | 12.3% |

| 増分額 | 156億4,310万米ドル |

本調査は、業界の主要参加者からのインプットを含め、一次情報と二次情報を客観的に組み合わせて実施しました。レポートには、主要企業の分析に加え、包括的な市場規模データ、地域分析によるセグメント、ベンダー情勢が含まれています。レポートには過去データと予測データを掲載しています。

本調査では、今後数年間における抗CD20モノクローナル抗体(mAB)市場の成長を促進する主な要因の一つとして、治療領域に対する意識の高まりを挙げています。また、保険償還や患者支援プログラムの存在、CD20二重特異性抗体の市場開拓は、市場の大きな需要につながります。

目次

第1章 エグゼクティブサマリー

- 市場概要

第2章 Technavio分析

- 価格・ライフサイクル・顧客購入バスケット・採用率・購入基準の分析

- インプットの重要性と差別化の要因

- 混乱の要因

- 促進要因と課題の影響

第3章 市場情勢

- 市場エコシステム

- 市場の特徴

- バリューチェーン分析

第4章 市場規模

- 市場の定義

- 市場セグメント分析

- 市場規模 2024

- 市場の見通し 2024-2029

第5章 市場規模実績

- 抗CD20モノクローナル抗体(mAB)の世界市場 2019-2023

- 製品別セグメント分析 2019-2023

- タイプ別セグメント分析 2019-2023

- エンドユーザー別セグメント分析 2019-2023

- 薬剤クラス別セグメント分析 2019-2023

- 投与経路別セグメント分析 2019-2023

- 地域別セグメント分析 2019-2023

- 国別セグメント分析 2019-2023

第6章 定性分析

- AIの影響:抗CD20モノクローナル抗体(mAB)の世界市場

第7章 ファイブフォース分析

- ファイブフォースの要約

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争の脅威

- 市況

第8章 市場セグメンテーション:製品別

- 市場セグメント

- 比較:製品別

- 腫瘍学:市場規模と予測 2024-2029

- 神経学:市場規模と予測 2024-2029

- 免疫学:市場規模と予測 2024-2029

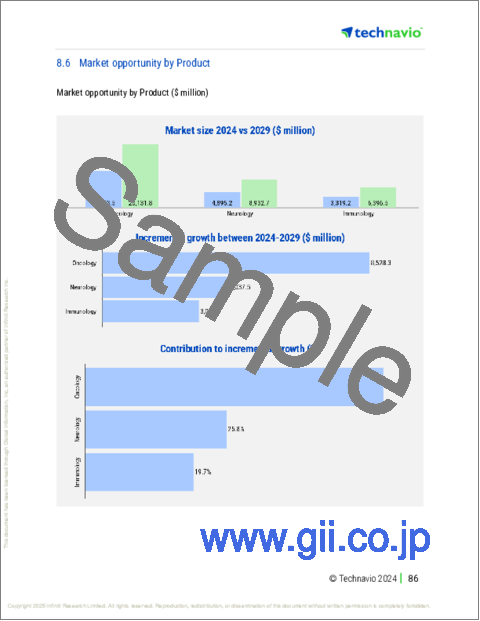

- 市場機会:製品別

第9章 市場セグメンテーション:タイプ別

- 市場セグメント

- 比較:タイプ別

- 第一世代:市場規模と予測 2024-2029

- 第二世代:市場規模と予測 2024-2029

- 第三世代:市場規模と予測 2024-2029

- 市場機会:タイプ別

第10章 市場セグメンテーション:エンドユーザー別

- 市場セグメント

- 比較:エンドユーザー別

- 病院と診療所:市場規模と予測 2024-2029

- 学術調査機関:市場規模と予測 2024-2029

- 委託調査機関:市場規模と予測 2024-2029

- 市場機会:エンドユーザー別

第11章 市場セグメンテーション:薬剤クラス別

- 市場セグメント

- 比較:薬剤クラス別

- リツキシマブ:市場規模と予測 2024-2029

- オファツムマブ:市場規模と予測 2024-2029

- オビヌツズマブ:市場規模と予測 2024-2029

- ウブリツキシマブ:市場規模と予測 2024-2029

- その他:市場規模と予測 2024-2029

- 市場機会:薬剤クラス別

第12章 市場セグメンテーション:投与経路別

- 市場セグメント

- 比較:投与経路別

- 静脈内:市場規模と予測 2024-2029

- 皮下:市場規模と予測 2024-2029

- 市場機会:投与経路別

第13章 顧客情勢

- 顧客情勢の概要

第14章 地域別情勢

- 地域別セグメンテーション

- 地域別比較

- 北米:市場規模と予測 2024-2029

- 欧州:市場規模と予測 2024-2029

- アジア:市場規模と予測 2024-2029

- 世界のその他の地域:市場規模と予測 2024-2029

- 米国:市場規模と予測 2024-2029

- カナダ:市場規模と予測 2024-2029

- 中国:市場規模と予測 2024-2029

- 英国:市場規模と予測 2024-2029

- ドイツ:市場規模と予測 2024-2029

- 日本:市場規模と予測 2024-2029

- インド:市場規模と予測 2024-2029

- イタリア:市場規模と予測 2024-2029

- フランス:市場規模と予測 2024-2029

- 韓国:市場規模と予測 2024-2029

- 市場機会:地域情勢別

第15章 促進要因・課題・機会・抑制要因

- 市場促進要因

- 市場の課題

- 促進要因と課題の影響

- 市場の機会・抑制要因

第16章 競合情勢

- 概要

- 競合情勢

- 混乱の状況

- 業界のリスク

第17章 競合分析

- 企業プロファイル

- 企業ランキング指数

- 企業の市場ポジショニング

- Acrotech Biopharma Inc.

- Amgen Inc.

- AstraZeneca Plc

- Celltrion Healthcare Co. Ltd.

- F. Hoffmann La Roche Ltd.

- Fosun International Ltd.

- Genmab AS

- IGM Biosciences Inc.

- JSC BIOCAD

- LFB SA

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Spectrum Pharmaceuticals Inc.

- TG Therapeutics Inc.

第18章 付録

Exhibits:

- Exhibits1: Executive Summary - Chart on Market Overview

- Exhibits2: Executive Summary - Data Table on Market Overview

- Exhibits3: Executive Summary - Chart on Global Market Characteristics

- Exhibits4: Executive Summary - Chart on Market By Geographical Landscape

- Exhibits5: Executive Summary - Chart on Market Segmentation by Product

- Exhibits6: Executive Summary - Chart on Market Segmentation by Type

- Exhibits7: Executive Summary - Chart on Market Segmentation by End-user

- Exhibits8: Executive Summary - Chart on Market Segmentation by Drug Class

- Exhibits9: Executive Summary - Chart on Market Segmentation by Route of Administration

- Exhibits10: Executive Summary - Chart on Incremental Growth

- Exhibits11: Executive Summary - Data Table on Incremental Growth

- Exhibits12: Executive Summary - Chart on Company Market Positioning

- Exhibits13: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

- Exhibits14: Overview on criticality of inputs and factors of differentiation

- Exhibits15: Overview on factors of disruption

- Exhibits16: Impact of drivers and challenges in 2024 and 2029

- Exhibits17: Parent Market

- Exhibits18: Data Table on - Parent Market

- Exhibits19: Market characteristics analysis

- Exhibits20: Value chain analysis

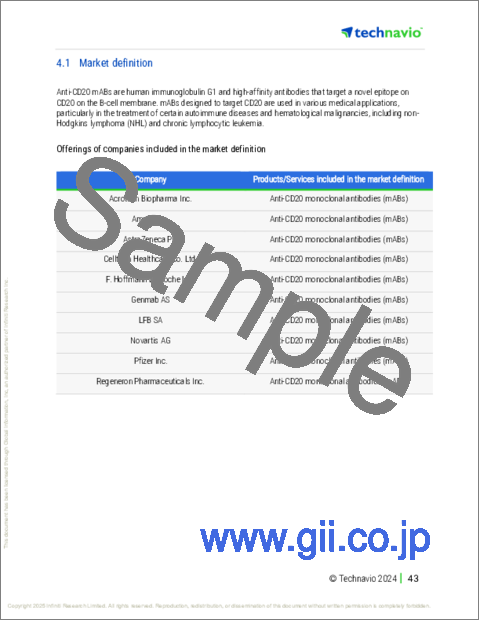

- Exhibits21: Offerings of companies included in the market definition

- Exhibits22: Market segments

- Exhibits23: Chart on Global - Market size and forecast 2024-2029 ($ million)

- Exhibits24: Data Table on Global - Market size and forecast 2024-2029 ($ million)

- Exhibits25: Chart on Global Market: Year-over-year growth 2024-2029 (%)

- Exhibits26: Data Table on Global Market: Year-over-year growth 2024-2029 (%)

- Exhibits27: Historic Market Size - Data Table on Global Anti-CD20 Monoclonal Antibodies (MABs) Market 2019 - 2023 ($ million)

- Exhibits28: Historic Market Size - Product Segment 2019 - 2023 ($ million)

- Exhibits29: Historic Market Size - Type Segment 2019 - 2023 ($ million)

- Exhibits30: Historic Market Size - End-user Segment 2019 - 2023 ($ million)

- Exhibits31: Historic Market Size - Drug Class Segment 2019 - 2023 ($ million)

- Exhibits32: Historic Market Size - Route of Administration Segment 2019 - 2023 ($ million)

- Exhibits33: Historic Market Size - Geography Segment 2019 - 2023 ($ million)

- Exhibits34: Historic Market Size - Country Segment 2019 - 2023 ($ million)

- Exhibits35: Five forces analysis - Comparison between 2024 and 2029

- Exhibits36: Bargaining power of buyers - Impact of key factors 2024 and 2029

- Exhibits37: Bargaining power of suppliers - Impact of key factors in 2024 and 2029

- Exhibits38: Threat of new entrants - Impact of key factors in 2024 and 2029

- Exhibits39: Threat of substitutes - Impact of key factors in 2024 and 2029

- Exhibits40: Threat of rivalry - Impact of key factors in 2024 and 2029

- Exhibits41: Chart on Market condition - Five forces 2024 and 2029

- Exhibits42: Chart on Product - Market share 2024-2029 (%)

- Exhibits43: Data Table on Product - Market share 2024-2029 (%)

- Exhibits44: Chart on Comparison by Product

- Exhibits45: Data Table on Comparison by Product

- Exhibits46: Chart on Oncology - Market size and forecast 2024-2029 ($ million)

- Exhibits47: Data Table on Oncology - Market size and forecast 2024-2029 ($ million)

- Exhibits48: Chart on Oncology - Year-over-year growth 2024-2029 (%)

- Exhibits49: Data Table on Oncology - Year-over-year growth 2024-2029 (%)

- Exhibits50: Chart on Neurology - Market size and forecast 2024-2029 ($ million)

- Exhibits51: Data Table on Neurology - Market size and forecast 2024-2029 ($ million)

- Exhibits52: Chart on Neurology - Year-over-year growth 2024-2029 (%)

- Exhibits53: Data Table on Neurology - Year-over-year growth 2024-2029 (%)

- Exhibits54: Chart on Immunology - Market size and forecast 2024-2029 ($ million)

- Exhibits55: Data Table on Immunology - Market size and forecast 2024-2029 ($ million)

- Exhibits56: Chart on Immunology - Year-over-year growth 2024-2029 (%)

- Exhibits57: Data Table on Immunology - Year-over-year growth 2024-2029 (%)

- Exhibits58: Market opportunity by Product ($ million)

- Exhibits59: Data Table on Market opportunity by Product ($ million)

- Exhibits60: Chart on Type - Market share 2024-2029 (%)

- Exhibits61: Data Table on Type - Market share 2024-2029 (%)

- Exhibits62: Chart on Comparison by Type

- Exhibits63: Data Table on Comparison by Type

- Exhibits64: Chart on First generation - Market size and forecast 2024-2029 ($ million)

- Exhibits65: Data Table on First generation - Market size and forecast 2024-2029 ($ million)

- Exhibits66: Chart on First generation - Year-over-year growth 2024-2029 (%)

- Exhibits67: Data Table on First generation - Year-over-year growth 2024-2029 (%)

- Exhibits68: Chart on Second generation - Market size and forecast 2024-2029 ($ million)

- Exhibits69: Data Table on Second generation - Market size and forecast 2024-2029 ($ million)

- Exhibits70: Chart on Second generation - Year-over-year growth 2024-2029 (%)

- Exhibits71: Data Table on Second generation - Year-over-year growth 2024-2029 (%)

- Exhibits72: Chart on Third generation - Market size and forecast 2024-2029 ($ million)

- Exhibits73: Data Table on Third generation - Market size and forecast 2024-2029 ($ million)

- Exhibits74: Chart on Third generation - Year-over-year growth 2024-2029 (%)

- Exhibits75: Data Table on Third generation - Year-over-year growth 2024-2029 (%)

- Exhibits76: Market opportunity by Type ($ million)

- Exhibits77: Data Table on Market opportunity by Type ($ million)

- Exhibits78: Chart on End-user - Market share 2024-2029 (%)

- Exhibits79: Data Table on End-user - Market share 2024-2029 (%)

- Exhibits80: Chart on Comparison by End-user

- Exhibits81: Data Table on Comparison by End-user

- Exhibits82: Chart on Hospitals and clinics - Market size and forecast 2024-2029 ($ million)

- Exhibits83: Data Table on Hospitals and clinics - Market size and forecast 2024-2029 ($ million)

- Exhibits84: Chart on Hospitals and clinics - Year-over-year growth 2024-2029 (%)

- Exhibits85: Data Table on Hospitals and clinics - Year-over-year growth 2024-2029 (%)

- Exhibits86: Chart on Academic and research institutions - Market size and forecast 2024-2029 ($ million)

- Exhibits87: Data Table on Academic and research institutions - Market size and forecast 2024-2029 ($ million)

- Exhibits88: Chart on Academic and research institutions - Year-over-year growth 2024-2029 (%)

- Exhibits89: Data Table on Academic and research institutions - Year-over-year growth 2024-2029 (%)

- Exhibits90: Chart on Contract research organizations - Market size and forecast 2024-2029 ($ million)

- Exhibits91: Data Table on Contract research organizations - Market size and forecast 2024-2029 ($ million)

- Exhibits92: Chart on Contract research organizations - Year-over-year growth 2024-2029 (%)

- Exhibits93: Data Table on Contract research organizations - Year-over-year growth 2024-2029 (%)

- Exhibits94: Market opportunity by End-user ($ million)

- Exhibits95: Data Table on Market opportunity by End-user ($ million)

- Exhibits96: Chart on Drug Class - Market share 2024-2029 (%)

- Exhibits97: Data Table on Drug Class - Market share 2024-2029 (%)

- Exhibits98: Chart on Comparison by Drug Class

- Exhibits99: Data Table on Comparison by Drug Class

- Exhibits100: Chart on Rituximab - Market size and forecast 2024-2029 ($ million)

- Exhibits101: Data Table on Rituximab - Market size and forecast 2024-2029 ($ million)

- Exhibits102: Chart on Rituximab - Year-over-year growth 2024-2029 (%)

- Exhibits103: Data Table on Rituximab - Year-over-year growth 2024-2029 (%)

- Exhibits104: Chart on Ofatumumab - Market size and forecast 2024-2029 ($ million)

- Exhibits105: Data Table on Ofatumumab - Market size and forecast 2024-2029 ($ million)

- Exhibits106: Chart on Ofatumumab - Year-over-year growth 2024-2029 (%)

- Exhibits107: Data Table on Ofatumumab - Year-over-year growth 2024-2029 (%)

- Exhibits108: Chart on Obinutuzumab - Market size and forecast 2024-2029 ($ million)

- Exhibits109: Data Table on Obinutuzumab - Market size and forecast 2024-2029 ($ million)

- Exhibits110: Chart on Obinutuzumab - Year-over-year growth 2024-2029 (%)

- Exhibits111: Data Table on Obinutuzumab - Year-over-year growth 2024-2029 (%)

- Exhibits112: Chart on Ublituximab - Market size and forecast 2024-2029 ($ million)

- Exhibits113: Data Table on Ublituximab - Market size and forecast 2024-2029 ($ million)

- Exhibits114: Chart on Ublituximab - Year-over-year growth 2024-2029 (%)

- Exhibits115: Data Table on Ublituximab - Year-over-year growth 2024-2029 (%)

- Exhibits116: Chart on Others - Market size and forecast 2024-2029 ($ million)

- Exhibits117: Data Table on Others - Market size and forecast 2024-2029 ($ million)

- Exhibits118: Chart on Others - Year-over-year growth 2024-2029 (%)

- Exhibits119: Data Table on Others - Year-over-year growth 2024-2029 (%)

- Exhibits120: Market opportunity by Drug Class ($ million)

- Exhibits121: Data Table on Market opportunity by Drug Class ($ million)

- Exhibits122: Chart on Route of Administration - Market share 2024-2029 (%)

- Exhibits123: Data Table on Route of Administration - Market share 2024-2029 (%)

- Exhibits124: Chart on Comparison by Route of Administration

- Exhibits125: Data Table on Comparison by Route of Administration

- Exhibits126: Chart on Intravenous - Market size and forecast 2024-2029 ($ million)

- Exhibits127: Data Table on Intravenous - Market size and forecast 2024-2029 ($ million)

- Exhibits128: Chart on Intravenous - Year-over-year growth 2024-2029 (%)

- Exhibits129: Data Table on Intravenous - Year-over-year growth 2024-2029 (%)

- Exhibits130: Chart on Subcutaneous - Market size and forecast 2024-2029 ($ million)

- Exhibits131: Data Table on Subcutaneous - Market size and forecast 2024-2029 ($ million)

- Exhibits132: Chart on Subcutaneous - Year-over-year growth 2024-2029 (%)

- Exhibits133: Data Table on Subcutaneous - Year-over-year growth 2024-2029 (%)

- Exhibits134: Market opportunity by Route of Administration ($ million)

- Exhibits135: Data Table on Market opportunity by Route of Administration ($ million)

- Exhibits136: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

- Exhibits137: Chart on Market share By Geographical Landscape 2024-2029 (%)

- Exhibits138: Data Table on Market share By Geographical Landscape 2024-2029 (%)

- Exhibits139: Chart on Geographic comparison

- Exhibits140: Data Table on Geographic comparison

- Exhibits141: Chart on North America - Market size and forecast 2024-2029 ($ million)

- Exhibits142: Data Table on North America - Market size and forecast 2024-2029 ($ million)

- Exhibits143: Chart on North America - Year-over-year growth 2024-2029 (%)

- Exhibits144: Data Table on North America - Year-over-year growth 2024-2029 (%)

- Exhibits145: Chart on Europe - Market size and forecast 2024-2029 ($ million)

- Exhibits146: Data Table on Europe - Market size and forecast 2024-2029 ($ million)

- Exhibits147: Chart on Europe - Year-over-year growth 2024-2029 (%)

- Exhibits148: Data Table on Europe - Year-over-year growth 2024-2029 (%)

- Exhibits149: Chart on Asia - Market size and forecast 2024-2029 ($ million)

- Exhibits150: Data Table on Asia - Market size and forecast 2024-2029 ($ million)

- Exhibits151: Chart on Asia - Year-over-year growth 2024-2029 (%)

- Exhibits152: Data Table on Asia - Year-over-year growth 2024-2029 (%)

- Exhibits153: Chart on Rest of World (ROW) - Market size and forecast 2024-2029 ($ million)

- Exhibits154: Data Table on Rest of World (ROW) - Market size and forecast 2024-2029 ($ million)

- Exhibits155: Chart on Rest of World (ROW) - Year-over-year growth 2024-2029 (%)

- Exhibits156: Data Table on Rest of World (ROW) - Year-over-year growth 2024-2029 (%)

- Exhibits157: Chart on US - Market size and forecast 2024-2029 ($ million)

- Exhibits158: Data Table on US - Market size and forecast 2024-2029 ($ million)

- Exhibits159: Chart on US - Year-over-year growth 2024-2029 (%)

- Exhibits160: Data Table on US - Year-over-year growth 2024-2029 (%)

- Exhibits161: Chart on Canada - Market size and forecast 2024-2029 ($ million)

- Exhibits162: Data Table on Canada - Market size and forecast 2024-2029 ($ million)

- Exhibits163: Chart on Canada - Year-over-year growth 2024-2029 (%)

- Exhibits164: Data Table on Canada - Year-over-year growth 2024-2029 (%)

- Exhibits165: Chart on China - Market size and forecast 2024-2029 ($ million)

- Exhibits166: Data Table on China - Market size and forecast 2024-2029 ($ million)

- Exhibits167: Chart on China - Year-over-year growth 2024-2029 (%)

- Exhibits168: Data Table on China - Year-over-year growth 2024-2029 (%)

- Exhibits169: Chart on UK - Market size and forecast 2024-2029 ($ million)

- Exhibits170: Data Table on UK - Market size and forecast 2024-2029 ($ million)

- Exhibits171: Chart on UK - Year-over-year growth 2024-2029 (%)

- Exhibits172: Data Table on UK - Year-over-year growth 2024-2029 (%)

- Exhibits173: Chart on Germany - Market size and forecast 2024-2029 ($ million)

- Exhibits174: Data Table on Germany - Market size and forecast 2024-2029 ($ million)

- Exhibits175: Chart on Germany - Year-over-year growth 2024-2029 (%)

- Exhibits176: Data Table on Germany - Year-over-year growth 2024-2029 (%)

- Exhibits177: Chart on Japan - Market size and forecast 2024-2029 ($ million)

- Exhibits178: Data Table on Japan - Market size and forecast 2024-2029 ($ million)

- Exhibits179: Chart on Japan - Year-over-year growth 2024-2029 (%)

- Exhibits180: Data Table on Japan - Year-over-year growth 2024-2029 (%)

- Exhibits181: Chart on India - Market size and forecast 2024-2029 ($ million)

- Exhibits182: Data Table on India - Market size and forecast 2024-2029 ($ million)

- Exhibits183: Chart on India - Year-over-year growth 2024-2029 (%)

- Exhibits184: Data Table on India - Year-over-year growth 2024-2029 (%)

- Exhibits185: Chart on Italy - Market size and forecast 2024-2029 ($ million)

- Exhibits186: Data Table on Italy - Market size and forecast 2024-2029 ($ million)

- Exhibits187: Chart on Italy - Year-over-year growth 2024-2029 (%)

- Exhibits188: Data Table on Italy - Year-over-year growth 2024-2029 (%)

- Exhibits189: Chart on France - Market size and forecast 2024-2029 ($ million)

- Exhibits190: Data Table on France - Market size and forecast 2024-2029 ($ million)

- Exhibits191: Chart on France - Year-over-year growth 2024-2029 (%)

- Exhibits192: Data Table on France - Year-over-year growth 2024-2029 (%)

- Exhibits193: Chart on South Korea - Market size and forecast 2024-2029 ($ million)

- Exhibits194: Data Table on South Korea - Market size and forecast 2024-2029 ($ million)

- Exhibits195: Chart on South Korea - Year-over-year growth 2024-2029 (%)

- Exhibits196: Data Table on South Korea - Year-over-year growth 2024-2029 (%)

- Exhibits197: Market opportunity By Geographical Landscape ($ million)

- Exhibits198: Data Tables on Market opportunity By Geographical Landscape ($ million)

- Exhibits199: Impact of drivers and challenges in 2024 and 2029

- Exhibits200: Overview on criticality of inputs and factors of differentiation

- Exhibits201: Overview on factors of disruption

- Exhibits202: Impact of key risks on business

- Exhibits203: Companies covered

- Exhibits204: Company ranking index

- Exhibits205: Matrix on companies position and classification

- Exhibits206: Acrotech Biopharma Inc. - Overview

- Exhibits207: Acrotech Biopharma Inc. - Product / Service

- Exhibits208: Acrotech Biopharma Inc. - Key offerings

- Exhibits209: SWOT

- Exhibits210: Amgen Inc. - Overview

- Exhibits211: Amgen Inc. - Product / Service

- Exhibits212: Amgen Inc. - Key news

- Exhibits213: Amgen Inc. - Key offerings

- Exhibits214: SWOT

- Exhibits215: AstraZeneca Plc - Overview

- Exhibits216: AstraZeneca Plc - Product / Service

- Exhibits217: AstraZeneca Plc - Key news

- Exhibits218: AstraZeneca Plc - Key offerings

- Exhibits219: SWOT

- Exhibits220: Celltrion Healthcare Co. Ltd. - Overview

- Exhibits221: Celltrion Healthcare Co. Ltd. - Business segments

- Exhibits222: Celltrion Healthcare Co. Ltd. - Key offerings

- Exhibits223: Celltrion Healthcare Co. Ltd. - Segment focus

- Exhibits224: SWOT

- Exhibits225: F. Hoffmann La Roche Ltd. - Overview

- Exhibits226: F. Hoffmann La Roche Ltd. - Business segments

- Exhibits227: F. Hoffmann La Roche Ltd. - Key news

- Exhibits228: F. Hoffmann La Roche Ltd. - Key offerings

- Exhibits229: F. Hoffmann La Roche Ltd. - Segment focus

- Exhibits230: SWOT

- Exhibits231: Fosun International Ltd. - Overview

- Exhibits232: Fosun International Ltd. - Business segments

- Exhibits233: Fosun International Ltd. - Key offerings

- Exhibits234: Fosun International Ltd. - Segment focus

- Exhibits235: SWOT

- Exhibits236: Genmab AS - Overview

- Exhibits237: Genmab AS - Product / Service

- Exhibits238: Genmab AS - Key offerings

- Exhibits239: SWOT

- Exhibits240: IGM Biosciences Inc. - Overview

- Exhibits241: IGM Biosciences Inc. - Product / Service

- Exhibits242: IGM Biosciences Inc. - Key offerings

- Exhibits243: SWOT

- Exhibits244: JSC BIOCAD - Overview

- Exhibits245: JSC BIOCAD - Product / Service

- Exhibits246: JSC BIOCAD - Key offerings

- Exhibits247: SWOT

- Exhibits248: LFB SA - Overview

- Exhibits249: LFB SA - Product / Service

- Exhibits250: LFB SA - Key offerings

- Exhibits251: SWOT

- Exhibits252: Novartis AG - Overview

- Exhibits253: Novartis AG - Business segments

- Exhibits254: Novartis AG - Key news

- Exhibits255: Novartis AG - Key offerings

- Exhibits256: Novartis AG - Segment focus

- Exhibits257: SWOT

- Exhibits258: Pfizer Inc. - Overview

- Exhibits259: Pfizer Inc. - Product / Service

- Exhibits260: Pfizer Inc. - Key news

- Exhibits261: Pfizer Inc. - Key offerings

- Exhibits262: SWOT

- Exhibits263: Regeneron Pharmaceuticals Inc. - Overview

- Exhibits264: Regeneron Pharmaceuticals Inc. - Product / Service

- Exhibits265: Regeneron Pharmaceuticals Inc. - Key offerings

- Exhibits266: SWOT

- Exhibits267: Spectrum Pharmaceuticals Inc. - Overview

- Exhibits268: Spectrum Pharmaceuticals Inc. - Product / Service

- Exhibits269: Spectrum Pharmaceuticals Inc. - Key offerings

- Exhibits270: SWOT

- Exhibits271: TG Therapeutics Inc. - Overview

- Exhibits272: TG Therapeutics Inc. - Product / Service

- Exhibits273: TG Therapeutics Inc. - Key offerings

- Exhibits274: SWOT

- Exhibits275: Inclusions checklist

- Exhibits276: Exclusions checklist

- Exhibits277: Currency conversion rates for US$

- Exhibits278: Research methodology

- Exhibits279: Information sources

- Exhibits280: Data validation

- Exhibits281: Validation techniques employed for market sizing

- Exhibits282: Data synthesis

- Exhibits283: 360 degree market analysis

- Exhibits284: List of abbreviations

The anti-CD20 monoclonal antibodies (MABs) market is forecasted to grow by USD 15643.1 million during 2024-2029, accelerating at a CAGR of 12.3% during the forecast period. The report on the anti-CD20 monoclonal antibodies (MABs) market provides a holistic analysis, market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 25 vendors.

The report offers an up-to-date analysis regarding the current market scenario, the latest trends and drivers, and the overall market environment. The market is driven by increased use of combination therapies, high target affinity and specificity of anti-CD20 MABs, and strong pipeline and recent approvals.

| Market Scope | |

|---|---|

| Base Year | 2025 |

| End Year | 2029 |

| Series Year | 2025-2029 |

| Growth Momentum | Accelerate |

| YOY 2025 | 10.5% |

| CAGR | 12.3% |

| Incremental Value | $15643.1 mn |

The study was conducted using an objective combination of primary and secondary information including inputs from key participants in the industry. The report contains a comprehensive market size data, segment with regional analysis and vendor landscape in addition to an analysis of the key companies. Reports have historic and forecast data.

Technavio's anti-CD20 monoclonal antibodies (MABs) market is segmented as below:

By Product

- Oncology

- Neurology

- Immunology

By Type

- First generation

- Second generation

- Third generation

By End-user

- Hospitals and clinics

- Academic and research institutions

- Contract research organizations

By Drug Class

- Rituximab

- Ofatumumab

- Obinutuzumab

- Ublituximab

- Others

By Route Of Administration

- Intravenous

- Subcutaneous

By Geographical Landscape

- North America

- Europe

- Asia

- Rest of World (ROW)

This study identifies the increasing awareness about therapeutic areas as one of the prime reasons driving the anti-CD20 monoclonal antibodies (MABs) market growth during the next few years. Also, presence of reimbursement and patient assistance programs and the development of CD20 bispecific antibodies will lead to sizable demand in the market.

The report on the anti-CD20 monoclonal antibodies (MABs) market covers the following areas:

- Anti-CD20 Monoclonal Antibodies (MABs) Market sizing

- Anti-CD20 Monoclonal Antibodies (MABs) Market forecast

- Anti-CD20 Monoclonal Antibodies (MABs) Market industry analysis

The robust vendor analysis is designed to help clients improve their market position, and in line with this, this report provides a detailed analysis of several leading anti-cd20 monoclonal antibodies (MABs) market vendors that include Acrotech Biopharma Inc., Amgen Inc., AstraZeneca PLC, Celltrion Healthcare Co. Ltd., F. Hoffmann La Roche Ltd., Fosun International Ltd., Genmab AS, IGM Biosciences Inc., JSC BIOCAD, LFB SA, Novartis AG, Pfizer Inc., Regeneron Pharmaceuticals Inc., Spectrum Pharmaceuticals Inc., TG Therapeutics Inc., United BioPharma Inc., and ZHEJIANG HISUN PHARMACEUTICAL Co. Ltd.. Also, the anti-CD20 monoclonal antibodies (MABs) market analysis report includes information on upcoming trends and challenges that will influence market growth. This is to help companies strategize and leverage all forthcoming growth opportunities.

The publisher presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources by an analysis of key parameters such as profit, pricing, competition, and promotions. It presents various market facets by identifying the key industry influencers. The data presented is comprehensive, reliable, and a result of extensive primary and secondary research. The market research reports provide a complete competitive landscape and an in-depth vendor selection methodology and analysis using qualitative and quantitative research to forecast accurate market growth.

Table of Contents

1 Executive Summary

- 1.1 Market overview

- Executive Summary - Chart on Market Overview

- Executive Summary - Data Table on Market Overview

- Executive Summary - Chart on Global Market Characteristics

- Executive Summary - Chart on Market By Geographical Landscape

- Executive Summary - Chart on Market Segmentation by Product

- Executive Summary - Chart on Market Segmentation by Type

- Executive Summary - Chart on Market Segmentation by End-user

- Executive Summary - Chart on Market Segmentation by Drug Class

- Executive Summary - Chart on Market Segmentation by Route of Administration

- Executive Summary - Chart on Incremental Growth

- Executive Summary - Data Table on Incremental Growth

- Executive Summary - Chart on Company Market Positioning

2 Technavio Analysis

- 2.1 Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

- Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

- 2.2 Criticality of inputs and Factors of differentiation

- Overview on criticality of inputs and factors of differentiation

- 2.3 Factors of disruption

- Overview on factors of disruption

- 2.4 Impact of drivers and challenges

- Impact of drivers and challenges in 2024 and 2029

3 Market Landscape

- 3.1 Market ecosystem

- Parent Market

- Data Table on - Parent Market

- 3.2 Market characteristics

- Market characteristics analysis

- 3.3 Value chain analysis

- Value chain analysis

4 Market Sizing

- 4.1 Market definition

- Offerings of companies included in the market definition

- 4.2 Market segment analysis

- Market segments

- 4.3 Market size 2024

- 4.4 Market outlook: Forecast for 2024-2029

- Chart on Global - Market size and forecast 2024-2029 ($ million)

- Data Table on Global - Market size and forecast 2024-2029 ($ million)

- Chart on Global Market: Year-over-year growth 2024-2029 (%)

- Data Table on Global Market: Year-over-year growth 2024-2029 (%)

5 Historic Market Size

- 5.1 Global Anti-CD20 Monoclonal Antibodies (MABs) Market 2019 - 2023

- Historic Market Size - Data Table on Global Anti-CD20 Monoclonal Antibodies (MABs) Market 2019 - 2023 ($ million)

- 5.2 Product segment analysis 2019 - 2023

- Historic Market Size - Product Segment 2019 - 2023 ($ million)

- 5.3 Type segment analysis 2019 - 2023

- Historic Market Size - Type Segment 2019 - 2023 ($ million)

- 5.4 End-user segment analysis 2019 - 2023

- Historic Market Size - End-user Segment 2019 - 2023 ($ million)

- 5.5 Drug Class segment analysis 2019 - 2023

- Historic Market Size - Drug Class Segment 2019 - 2023 ($ million)

- 5.6 Route of Administration segment analysis 2019 - 2023

- Historic Market Size - Route of Administration Segment 2019 - 2023 ($ million)

- 5.7 Geography segment analysis 2019 - 2023

- Historic Market Size - Geography Segment 2019 - 2023 ($ million)

- 5.8 Country segment analysis 2019 - 2023

- Historic Market Size - Country Segment 2019 - 2023 ($ million)

6 Qualitative Analysis

- 6.1 Impact of AI on global anti-CD20 monoclonal antibodies (mABs) market

7 Five Forces Analysis

- 7.1 Five forces summary

- Five forces analysis - Comparison between 2024 and 2029

- 7.2 Bargaining power of buyers

- Bargaining power of buyers - Impact of key factors 2024 and 2029

- 7.3 Bargaining power of suppliers

- Bargaining power of suppliers - Impact of key factors in 2024 and 2029

- 7.4 Threat of new entrants

- Threat of new entrants - Impact of key factors in 2024 and 2029

- 7.5 Threat of substitutes

- Threat of substitutes - Impact of key factors in 2024 and 2029

- 7.6 Threat of rivalry

- Threat of rivalry - Impact of key factors in 2024 and 2029

- 7.7 Market condition

- Chart on Market condition - Five forces 2024 and 2029

8 Market Segmentation by Product

- 8.1 Market segments

- Chart on Product - Market share 2024-2029 (%)

- Data Table on Product - Market share 2024-2029 (%)

- 8.2 Comparison by Product

- Chart on Comparison by Product

- Data Table on Comparison by Product

- 8.3 Oncology - Market size and forecast 2024-2029

- Chart on Oncology - Market size and forecast 2024-2029 ($ million)

- Data Table on Oncology - Market size and forecast 2024-2029 ($ million)

- Chart on Oncology - Year-over-year growth 2024-2029 (%)

- Data Table on Oncology - Year-over-year growth 2024-2029 (%)

- 8.4 Neurology - Market size and forecast 2024-2029

- Chart on Neurology - Market size and forecast 2024-2029 ($ million)

- Data Table on Neurology - Market size and forecast 2024-2029 ($ million)

- Chart on Neurology - Year-over-year growth 2024-2029 (%)

- Data Table on Neurology - Year-over-year growth 2024-2029 (%)

- 8.5 Immunology - Market size and forecast 2024-2029

- Chart on Immunology - Market size and forecast 2024-2029 ($ million)

- Data Table on Immunology - Market size and forecast 2024-2029 ($ million)

- Chart on Immunology - Year-over-year growth 2024-2029 (%)

- Data Table on Immunology - Year-over-year growth 2024-2029 (%)

- 8.6 Market opportunity by Product

- Market opportunity by Product ($ million)

- Data Table on Market opportunity by Product ($ million)

9 Market Segmentation by Type

- 9.1 Market segments

- Chart on Type - Market share 2024-2029 (%)

- Data Table on Type - Market share 2024-2029 (%)

- 9.2 Comparison by Type

- Chart on Comparison by Type

- Data Table on Comparison by Type

- 9.3 First generation - Market size and forecast 2024-2029

- Chart on First generation - Market size and forecast 2024-2029 ($ million)

- Data Table on First generation - Market size and forecast 2024-2029 ($ million)

- Chart on First generation - Year-over-year growth 2024-2029 (%)

- Data Table on First generation - Year-over-year growth 2024-2029 (%)

- 9.4 Second generation - Market size and forecast 2024-2029

- Chart on Second generation - Market size and forecast 2024-2029 ($ million)

- Data Table on Second generation - Market size and forecast 2024-2029 ($ million)

- Chart on Second generation - Year-over-year growth 2024-2029 (%)

- Data Table on Second generation - Year-over-year growth 2024-2029 (%)

- 9.5 Third generation - Market size and forecast 2024-2029

- Chart on Third generation - Market size and forecast 2024-2029 ($ million)

- Data Table on Third generation - Market size and forecast 2024-2029 ($ million)

- Chart on Third generation - Year-over-year growth 2024-2029 (%)

- Data Table on Third generation - Year-over-year growth 2024-2029 (%)

- 9.6 Market opportunity by Type

- Market opportunity by Type ($ million)

- Data Table on Market opportunity by Type ($ million)

10 Market Segmentation by End-user

- 10.1 Market segments

- Chart on End-user - Market share 2024-2029 (%)

- Data Table on End-user - Market share 2024-2029 (%)

- 10.2 Comparison by End-user

- Chart on Comparison by End-user

- Data Table on Comparison by End-user

- 10.3 Hospitals and clinics - Market size and forecast 2024-2029

- Chart on Hospitals and clinics - Market size and forecast 2024-2029 ($ million)

- Data Table on Hospitals and clinics - Market size and forecast 2024-2029 ($ million)

- Chart on Hospitals and clinics - Year-over-year growth 2024-2029 (%)

- Data Table on Hospitals and clinics - Year-over-year growth 2024-2029 (%)

- 10.4 Academic and research institutions - Market size and forecast 2024-2029

- Chart on Academic and research institutions - Market size and forecast 2024-2029 ($ million)

- Data Table on Academic and research institutions - Market size and forecast 2024-2029 ($ million)

- Chart on Academic and research institutions - Year-over-year growth 2024-2029 (%)

- Data Table on Academic and research institutions - Year-over-year growth 2024-2029 (%)

- 10.5 Contract research organizations - Market size and forecast 2024-2029

- Chart on Contract research organizations - Market size and forecast 2024-2029 ($ million)

- Data Table on Contract research organizations - Market size and forecast 2024-2029 ($ million)

- Chart on Contract research organizations - Year-over-year growth 2024-2029 (%)

- Data Table on Contract research organizations - Year-over-year growth 2024-2029 (%)

- 10.6 Market opportunity by End-user

- Market opportunity by End-user ($ million)

- Data Table on Market opportunity by End-user ($ million)

11 Market Segmentation by Drug Class

- 11.1 Market segments

- Chart on Drug Class - Market share 2024-2029 (%)

- Data Table on Drug Class - Market share 2024-2029 (%)

- 11.2 Comparison by Drug Class

- Chart on Comparison by Drug Class

- Data Table on Comparison by Drug Class

- 11.3 Rituximab - Market size and forecast 2024-2029

- Chart on Rituximab - Market size and forecast 2024-2029 ($ million)

- Data Table on Rituximab - Market size and forecast 2024-2029 ($ million)

- Chart on Rituximab - Year-over-year growth 2024-2029 (%)

- Data Table on Rituximab - Year-over-year growth 2024-2029 (%)

- 11.4 Ofatumumab - Market size and forecast 2024-2029

- Chart on Ofatumumab - Market size and forecast 2024-2029 ($ million)

- Data Table on Ofatumumab - Market size and forecast 2024-2029 ($ million)

- Chart on Ofatumumab - Year-over-year growth 2024-2029 (%)

- Data Table on Ofatumumab - Year-over-year growth 2024-2029 (%)

- 11.5 Obinutuzumab - Market size and forecast 2024-2029

- Chart on Obinutuzumab - Market size and forecast 2024-2029 ($ million)

- Data Table on Obinutuzumab - Market size and forecast 2024-2029 ($ million)

- Chart on Obinutuzumab - Year-over-year growth 2024-2029 (%)

- Data Table on Obinutuzumab - Year-over-year growth 2024-2029 (%)

- 11.6 Ublituximab - Market size and forecast 2024-2029

- Chart on Ublituximab - Market size and forecast 2024-2029 ($ million)

- Data Table on Ublituximab - Market size and forecast 2024-2029 ($ million)

- Chart on Ublituximab - Year-over-year growth 2024-2029 (%)

- Data Table on Ublituximab - Year-over-year growth 2024-2029 (%)

- 11.7 Others - Market size and forecast 2024-2029

- Chart on Others - Market size and forecast 2024-2029 ($ million)

- Data Table on Others - Market size and forecast 2024-2029 ($ million)

- Chart on Others - Year-over-year growth 2024-2029 (%)

- Data Table on Others - Year-over-year growth 2024-2029 (%)

- 11.8 Market opportunity by Drug Class

- Market opportunity by Drug Class ($ million)

- Data Table on Market opportunity by Drug Class ($ million)

12 Market Segmentation by Route of Administration

- 12.1 Market segments

- Chart on Route of Administration - Market share 2024-2029 (%)

- Data Table on Route of Administration - Market share 2024-2029 (%)

- 12.2 Comparison by Route of Administration

- Chart on Comparison by Route of Administration

- Data Table on Comparison by Route of Administration

- 12.3 Intravenous - Market size and forecast 2024-2029

- Chart on Intravenous - Market size and forecast 2024-2029 ($ million)

- Data Table on Intravenous - Market size and forecast 2024-2029 ($ million)

- Chart on Intravenous - Year-over-year growth 2024-2029 (%)

- Data Table on Intravenous - Year-over-year growth 2024-2029 (%)

- 12.4 Subcutaneous - Market size and forecast 2024-2029

- Chart on Subcutaneous - Market size and forecast 2024-2029 ($ million)

- Data Table on Subcutaneous - Market size and forecast 2024-2029 ($ million)

- Chart on Subcutaneous - Year-over-year growth 2024-2029 (%)

- Data Table on Subcutaneous - Year-over-year growth 2024-2029 (%)

- 12.5 Market opportunity by Route of Administration

- Market opportunity by Route of Administration ($ million)

- Data Table on Market opportunity by Route of Administration ($ million)

13 Customer Landscape

- 13.1 Customer landscape overview

- Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

14 Geographic Landscape

- 14.1 Geographic segmentation

- Chart on Market share By Geographical Landscape 2024-2029 (%)

- Data Table on Market share By Geographical Landscape 2024-2029 (%)

- 14.2 Geographic comparison

- Chart on Geographic comparison

- Data Table on Geographic comparison

- 14.3 North America - Market size and forecast 2024-2029

- Chart on North America - Market size and forecast 2024-2029 ($ million)

- Data Table on North America - Market size and forecast 2024-2029 ($ million)

- Chart on North America - Year-over-year growth 2024-2029 (%)

- Data Table on North America - Year-over-year growth 2024-2029 (%)

- 14.4 Europe - Market size and forecast 2024-2029

- Chart on Europe - Market size and forecast 2024-2029 ($ million)

- Data Table on Europe - Market size and forecast 2024-2029 ($ million)

- Chart on Europe - Year-over-year growth 2024-2029 (%)

- Data Table on Europe - Year-over-year growth 2024-2029 (%)

- 14.5 Asia - Market size and forecast 2024-2029

- Chart on Asia - Market size and forecast 2024-2029 ($ million)

- Data Table on Asia - Market size and forecast 2024-2029 ($ million)

- Chart on Asia - Year-over-year growth 2024-2029 (%)

- Data Table on Asia - Year-over-year growth 2024-2029 (%)

- 14.6 Rest of World (ROW) - Market size and forecast 2024-2029

- Chart on Rest of World (ROW) - Market size and forecast 2024-2029 ($ million)

- Data Table on Rest of World (ROW) - Market size and forecast 2024-2029 ($ million)

- Chart on Rest of World (ROW) - Year-over-year growth 2024-2029 (%)

- Data Table on Rest of World (ROW) - Year-over-year growth 2024-2029 (%)

- 14.7 US - Market size and forecast 2024-2029

- Chart on US - Market size and forecast 2024-2029 ($ million)

- Data Table on US - Market size and forecast 2024-2029 ($ million)

- Chart on US - Year-over-year growth 2024-2029 (%)

- Data Table on US - Year-over-year growth 2024-2029 (%)

- 14.8 Canada - Market size and forecast 2024-2029

- Chart on Canada - Market size and forecast 2024-2029 ($ million)

- Data Table on Canada - Market size and forecast 2024-2029 ($ million)

- Chart on Canada - Year-over-year growth 2024-2029 (%)

- Data Table on Canada - Year-over-year growth 2024-2029 (%)

- 14.9 China - Market size and forecast 2024-2029

- Chart on China - Market size and forecast 2024-2029 ($ million)

- Data Table on China - Market size and forecast 2024-2029 ($ million)

- Chart on China - Year-over-year growth 2024-2029 (%)

- Data Table on China - Year-over-year growth 2024-2029 (%)

- 14.10 UK - Market size and forecast 2024-2029

- Chart on UK - Market size and forecast 2024-2029 ($ million)

- Data Table on UK - Market size and forecast 2024-2029 ($ million)

- Chart on UK - Year-over-year growth 2024-2029 (%)

- Data Table on UK - Year-over-year growth 2024-2029 (%)

- 14.11 Germany - Market size and forecast 2024-2029

- Chart on Germany - Market size and forecast 2024-2029 ($ million)

- Data Table on Germany - Market size and forecast 2024-2029 ($ million)

- Chart on Germany - Year-over-year growth 2024-2029 (%)

- Data Table on Germany - Year-over-year growth 2024-2029 (%)

- 14.12 Japan - Market size and forecast 2024-2029

- Chart on Japan - Market size and forecast 2024-2029 ($ million)

- Data Table on Japan - Market size and forecast 2024-2029 ($ million)

- Chart on Japan - Year-over-year growth 2024-2029 (%)

- Data Table on Japan - Year-over-year growth 2024-2029 (%)

- 14.13 India - Market size and forecast 2024-2029

- Chart on India - Market size and forecast 2024-2029 ($ million)

- Data Table on India - Market size and forecast 2024-2029 ($ million)

- Chart on India - Year-over-year growth 2024-2029 (%)

- Data Table on India - Year-over-year growth 2024-2029 (%)

- 14.14 Italy - Market size and forecast 2024-2029

- Chart on Italy - Market size and forecast 2024-2029 ($ million)

- Data Table on Italy - Market size and forecast 2024-2029 ($ million)

- Chart on Italy - Year-over-year growth 2024-2029 (%)

- Data Table on Italy - Year-over-year growth 2024-2029 (%)

- 14.15 France - Market size and forecast 2024-2029

- Chart on France - Market size and forecast 2024-2029 ($ million)

- Data Table on France - Market size and forecast 2024-2029 ($ million)

- Chart on France - Year-over-year growth 2024-2029 (%)

- Data Table on France - Year-over-year growth 2024-2029 (%)

- 14.16 South Korea - Market size and forecast 2024-2029

- Chart on South Korea - Market size and forecast 2024-2029 ($ million)

- Data Table on South Korea - Market size and forecast 2024-2029 ($ million)

- Chart on South Korea - Year-over-year growth 2024-2029 (%)

- Data Table on South Korea - Year-over-year growth 2024-2029 (%)

- 14.17 Market opportunity By Geographical Landscape

- Market opportunity By Geographical Landscape ($ million)

- Data Tables on Market opportunity By Geographical Landscape ($ million)

15 Drivers, Challenges, and Opportunity/Restraints

- 15.1 Market drivers

- 15.2 Market challenges

- 15.3 Impact of drivers and challenges

- Impact of drivers and challenges in 2024 and 2029

- 15.4 Market opportunities/restraints

16 Competitive Landscape

- 16.1 Overview

- 16.2 Competitive Landscape

- Overview on criticality of inputs and factors of differentiation

- 16.3 Landscape disruption

- Overview on factors of disruption

- 16.4 Industry risks

- Impact of key risks on business

17 Competitive Analysis

- 17.1 Companies profiled

- Companies covered

- 17.2 Company ranking index

- Company ranking index

- 17.3 Market positioning of companies

- Matrix on companies position and classification

- 17.4 Acrotech Biopharma Inc.

- Acrotech Biopharma Inc. - Overview

- Acrotech Biopharma Inc. - Product / Service

- Acrotech Biopharma Inc. - Key offerings

- SWOT

- 17.5 Amgen Inc.

- Amgen Inc. - Overview

- Amgen Inc. - Product / Service

- Amgen Inc. - Key news

- Amgen Inc. - Key offerings

- SWOT

- 17.6 AstraZeneca Plc

- AstraZeneca Plc - Overview

- AstraZeneca Plc - Product / Service

- AstraZeneca Plc - Key news

- AstraZeneca Plc - Key offerings

- SWOT

- 17.7 Celltrion Healthcare Co. Ltd.

- Celltrion Healthcare Co. Ltd. - Overview

- Celltrion Healthcare Co. Ltd. - Business segments

- Celltrion Healthcare Co. Ltd. - Key offerings

- Celltrion Healthcare Co. Ltd. - Segment focus

- SWOT

- 17.8 F. Hoffmann La Roche Ltd.

- F. Hoffmann La Roche Ltd. - Overview

- F. Hoffmann La Roche Ltd. - Business segments

- F. Hoffmann La Roche Ltd. - Key news

- F. Hoffmann La Roche Ltd. - Key offerings

- F. Hoffmann La Roche Ltd. - Segment focus

- SWOT

- 17.9 Fosun International Ltd.

- Fosun International Ltd. - Overview

- Fosun International Ltd. - Business segments

- Fosun International Ltd. - Key offerings

- Fosun International Ltd. - Segment focus

- SWOT

- 17.10 Genmab AS

- Genmab AS - Overview

- Genmab AS - Product / Service

- Genmab AS - Key offerings

- SWOT

- 17.11 IGM Biosciences Inc.

- IGM Biosciences Inc. - Overview

- IGM Biosciences Inc. - Product / Service

- IGM Biosciences Inc. - Key offerings

- SWOT

- 17.12 JSC BIOCAD

- JSC BIOCAD - Overview

- JSC BIOCAD - Product / Service

- JSC BIOCAD - Key offerings

- SWOT

- 17.13 LFB SA

- LFB SA - Overview

- LFB SA - Product / Service

- LFB SA - Key offerings

- SWOT

- 17.14 Novartis AG

- Novartis AG - Overview

- Novartis AG - Business segments

- Novartis AG - Key news

- Novartis AG - Key offerings

- Novartis AG - Segment focus

- SWOT

- 17.15 Pfizer Inc.

- Pfizer Inc. - Overview

- Pfizer Inc. - Product / Service

- Pfizer Inc. - Key news

- Pfizer Inc. - Key offerings

- SWOT

- 17.16 Regeneron Pharmaceuticals Inc.

- Regeneron Pharmaceuticals Inc. - Overview

- Regeneron Pharmaceuticals Inc. - Product / Service

- Regeneron Pharmaceuticals Inc. - Key offerings

- SWOT

- 17.17 Spectrum Pharmaceuticals Inc.

- Spectrum Pharmaceuticals Inc. - Overview

- Spectrum Pharmaceuticals Inc. - Product / Service

- Spectrum Pharmaceuticals Inc. - Key offerings

- SWOT

- 17.18 TG Therapeutics Inc.

- TG Therapeutics Inc. - Overview

- TG Therapeutics Inc. - Product / Service

- TG Therapeutics Inc. - Key offerings

- SWOT

18 Appendix

- 18.1 Scope of the report

- 18.2 Inclusions and exclusions checklist

- Inclusions checklist

- Exclusions checklist

- 18.3 Currency conversion rates for US$

- Currency conversion rates for US$

- 18.4 Research methodology

- Research methodology

- 18.5 Data procurement

- Information sources

- 18.6 Data validation

- Data validation

- 18.7 Validation techniques employed for market sizing

- Validation techniques employed for market sizing

- 18.8 Data synthesis

- Data synthesis

- 18.9 360 degree market analysis

- 360 degree market analysis

- 18.10 List of abbreviations

- List of abbreviations