|

|

市場調査レポート

商品コード

1080269

バイオマス発電所向けマテリアルハンドリング設備の世界市場:2022年~2026年Global Material Handling Equipment Market in Biomass Power Plant 2022-2026 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| バイオマス発電所向けマテリアルハンドリング設備の世界市場:2022年~2026年 |

|

出版日: 2022年05月20日

発行: TechNavio

ページ情報: 英文 120 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界のバイオマス発電所向けマテリアルハンドリング設備の市場規模は、2022年~2026年の間に8億6,916万米ドルの増加が見込まれ、予測期間中にCAGRで6.36%の成長が予測されています。

市場は、バイオマス発電所における燃焼プロセスの効率化、バイオマス発電を含む再生可能エネルギーに対する政府支援の増加、石炭発電所のバイオマス発電所への転換などによって牽引されています。

当レポートでは、世界のバイオマス発電所向けマテリアルハンドリング設備市場について調査分析し、市場規模や予測、動向、成長促進要因、課題、約25のベンダーを網羅したベンダー分析など、総合的な分析を提供しています。

目次

第1章 エグゼクティブサマリー

- 市場概要

第2章 市場情勢

- 市場のエコシステム

第3章 市場規模

- 市場の定義

- 市場セグメント分析

- 市場規模:2021年

- 市場の見通し:2021年~2026年の予測

第4章 ファイブフォース分析

- ファイブフォースの要約

- 買い手の交渉力

- サプライヤーの交渉力

- 新興企業の脅威

- 代替品の脅威

- 競合企業の脅威

- 市況

第5章 市場セグメンテーション:製品別

- 市場セグメント

- 比較:製品別

- ダイジェスター - 市場規模と予測:2021年~2026年

- フィーダーシステム - 市場規模と予測:2021年~2026年

- サイロ・貯蔵タンク - 市場規模と予測:2021年~2026年

- チッパー - 市場規模と予測:2021年~2026年

- グラインダー - 市場規模と予測:2021年~2026年

- 市場機会:製品別

第6章 顧客情勢

- 顧客情勢の概要

第7章 地域別情勢

- 地域別セグメンテーション

- 地域別比較

- 欧州 - 市場規模と予測:2021年~2026年

- アジア太平洋 - 市場規模と予測:2021年~2026年

- 北米 - 市場規模と予測:2021年~2026年

- 南米 - 市場規模と予測:2021年~2026年

- 中東とアフリカ - 市場規模と予測:2021年~2026年

- 米国 - 市場規模と予測:2021年~2026年

- ドイツ - 市場規模と予測:2021年~2026年

- 中国 - 市場規模と予測:2021年~2026年

- フランス - 市場規模と予測:2021年~2026年

- インド - 市場規模と予測:2021年~2026年

- 市場機会:地域情勢別

第8章 促進要因、課題、および動向

- 市場促進要因

- 市場の課題

- 促進要因と課題の影響

- 市場動向

第9章 ベンダー情勢

- 概要

- ベンダー情勢

- 混乱の状況

- 業界のリスク

第10章 ベンダー分析

- 対象ベンダー

- ベンダーの市場ポジショニング

- Andritz AG

- Amandus Kahl GmbH and Co. KG

- Astec Industries Inc.

- Babcock and Wilcox Enterprises Inc.

- Evoqua Water Technologies LLC

- General Kinematics Corp.

- MAX Automation SE

- Dust Solutions Inc.

- Schenck Process Holding GmbH

- ZE ENERGY Inc.

第11章 付録

Exhibits:

- Exhibits1: Executive Summary - Chart on Market Overview

- Exhibits2: Executive Summary - Data Table on Market Overview

- Exhibits3: Executive Summary - Chart on Global Market Characteristics

- Exhibits4: Executive Summary - Chart on Market By Geographical Landscape

- Exhibits5: Executive Summary - Chart on Market Segmentation by Product

- Exhibits6: Executive Summary - Chart on Incremental Growth

- Exhibits7: Executive Summary - Data Table on Incremental Growth

- Exhibits8: Executive Summary - Chart on Vendor Market Positioning

- Exhibits9: Parent market

- Exhibits10: Market Characteristics

- Exhibits11: Offerings of vendors included in the market definition

- Exhibits12: Market segments

- Exhibits13: Chart on Global - Market size and forecast 2021-2026 ($ million)

- Exhibits14: Data Table on Global - Market size and forecast 2021-2026 ($ million)

- Exhibits15: Chart on Global Market: Year-over-year growth 2021-2026 (%)

- Exhibits16: Data Table on Global Market: Year-over-year growth 2021-2026 (%)

- Exhibits17: Five forces analysis - Comparison between 2021 and 2026

- Exhibits18: Chart on Bargaining power of buyers - Impact of key factors 2021 and 2026

- Exhibits19: Bargaining power of suppliers - Impact of key factors in 2021 and 2026

- Exhibits20: Threat of new entrants - Impact of key factors in 2021 and 2026

- Exhibits21: Threat of substitutes - Impact of key factors in 2021 and 2026

- Exhibits22: Threat of rivalry - Impact of key factors in 2021 and 2026

- Exhibits23: Chart on Market condition - Five forces 2021 and 2026

- Exhibits24: Chart on Product - Market share 2021-2026 (%)

- Exhibits25: Data Table on Product - Market share 2021-2026 (%)

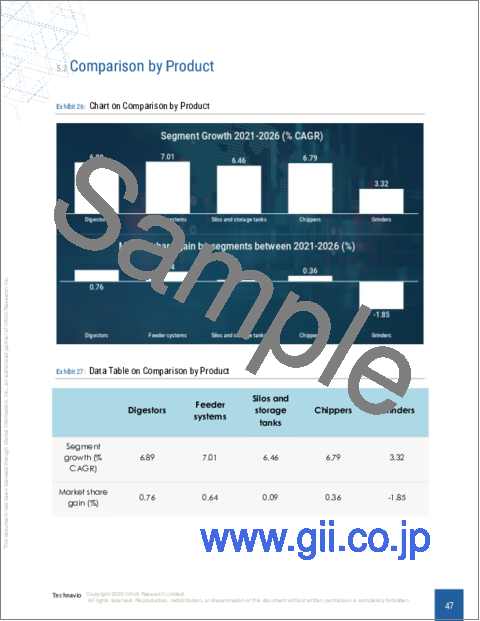

- Exhibits26: Chart on Comparison by Product

- Exhibits27: Data Table on Comparison by Product

- Exhibits28: Chart on Digestors - Market size and forecast 2021-2026 ($ million)

- Exhibits29: Data Table on Digestors - Market size and forecast 2021-2026 ($ million)

- Exhibits30: Chart on Digestors - Year-over-year growth 2021-2026 (%)

- Exhibits31: Data Table on Digestors - Year-over-year growth 2021-2026 (%)

- Exhibits32: Chart on Feeder systems - Market size and forecast 2021-2026 ($ million)

- Exhibits33: Data Table on Feeder systems - Market size and forecast 2021-2026 ($ million)

- Exhibits34: Chart on Feeder systems - Year-over-year growth 2021-2026 (%)

- Exhibits35: Data Table on Feeder systems - Year-over-year growth 2021-2026 (%)

- Exhibits36: Chart on Silos and storage tanks - Market size and forecast 2021-2026 ($ million)

- Exhibits37: Data Table on Silos and storage tanks - Market size and forecast 2021-2026 ($ million)

- Exhibits38: Chart on Silos and storage tanks - Year-over-year growth 2021-2026 (%)

- Exhibits39: Data Table on Silos and storage tanks - Year-over-year growth 2021-2026 (%)

- Exhibits40: Chart on Chippers - Market size and forecast 2021-2026 ($ million)

- Exhibits41: Data Table on Chippers - Market size and forecast 2021-2026 ($ million)

- Exhibits42: Chart on Chippers - Year-over-year growth 2021-2026 (%)

- Exhibits43: Data Table on Chippers - Year-over-year growth 2021-2026 (%)

- Exhibits44: Chart on Grinders - Market size and forecast 2021-2026 ($ million)

- Exhibits45: Data Table on Grinders - Market size and forecast 2021-2026 ($ million)

- Exhibits46: Chart on Grinders - Year-over-year growth 2021-2026 (%)

- Exhibits47: Data Table on Grinders - Year-over-year growth 2021-2026 (%)

- Exhibits48: Market opportunity by Product ($ million)

- Exhibits49: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

- Exhibits50: Chart on Market share By Geographical Landscape 2021-2026 (%)

- Exhibits51: Data Table on Market share By Geographical Landscape 2021-2026 (%)

- Exhibits52: Chart on Geographic comparison

- Exhibits53: Data Table on Geographic comparison

- Exhibits54: Chart on Europe - Market size and forecast 2021-2026 ($ million)

- Exhibits55: Data Table on Europe - Market size and forecast 2021-2026 ($ million)

- Exhibits56: Chart on Europe - Year-over-year growth 2021-2026 (%)

- Exhibits57: Data Table on Europe - Year-over-year growth 2021-2026 (%)

- Exhibits58: Chart on APAC - Market size and forecast 2021-2026 ($ million)

- Exhibits59: Data Table on APAC - Market size and forecast 2021-2026 ($ million)

- Exhibits60: Chart on APAC - Year-over-year growth 2021-2026 (%)

- Exhibits61: Data Table on APAC - Year-over-year growth 2021-2026 (%)

- Exhibits62: Chart on North America - Market size and forecast 2021-2026 ($ million)

- Exhibits63: Data Table on North America - Market size and forecast 2021-2026 ($ million)

- Exhibits64: Chart on North America - Year-over-year growth 2021-2026 (%)

- Exhibits65: Data Table on North America - Year-over-year growth 2021-2026 (%)

- Exhibits66: Chart on South America - Market size and forecast 2021-2026 ($ million)

- Exhibits67: Data Table on South America - Market size and forecast 2021-2026 ($ million)

- Exhibits68: Chart on South America - Year-over-year growth 2021-2026 (%)

- Exhibits69: Data Table on South America - Year-over-year growth 2021-2026 (%)

- Exhibits70: Chart on Middle East and Africa - Market size and forecast 2021-2026 ($ million)

- Exhibits71: Data Table on Middle East and Africa - Market size and forecast 2021-2026 ($ million)

- Exhibits72: Chart on Middle East and Africa - Year-over-year growth 2021-2026 (%)

- Exhibits73: Data Table on Middle East and Africa - Year-over-year growth 2021-2026 (%)

- Exhibits74: Chart on US - Market size and forecast 2021-2026 ($ million)

- Exhibits75: Data Table on US - Market size and forecast 2021-2026 ($ million)

- Exhibits76: Chart on US - Year-over-year growth 2021-2026 (%)

- Exhibits77: Data Table on US - Year-over-year growth 2021-2026 (%)

- Exhibits78: Chart on Germany - Market size and forecast 2021-2026 ($ million)

- Exhibits79: Data Table on Germany - Market size and forecast 2021-2026 ($ million)

- Exhibits80: Chart on Germany - Year-over-year growth 2021-2026 (%)

- Exhibits81: Data Table on Germany - Year-over-year growth 2021-2026 (%)

- Exhibits82: Chart on China - Market size and forecast 2021-2026 ($ million)

- Exhibits83: Data Table on China - Market size and forecast 2021-2026 ($ million)

- Exhibits84: Chart on China - Year-over-year growth 2021-2026 (%)

- Exhibits85: Data Table on China - Year-over-year growth 2021-2026 (%)

- Exhibits86: Chart on France - Market size and forecast 2021-2026 ($ million)

- Exhibits87: Data Table on France - Market size and forecast 2021-2026 ($ million)

- Exhibits88: Chart on France - Year-over-year growth 2021-2026 (%)

- Exhibits89: Data Table on France - Year-over-year growth 2021-2026 (%)

- Exhibits90: Chart on India - Market size and forecast 2021-2026 ($ million)

- Exhibits91: Data Table on India - Market size and forecast 2021-2026 ($ million)

- Exhibits92: Chart on India - Year-over-year growth 2021-2026 (%)

- Exhibits93: Data Table on India - Year-over-year growth 2021-2026 (%)

- Exhibits94: Market opportunity By Geographical Landscape ($ million)

- Exhibits95: Impact of drivers and challenges in 2021 and 2026

- Exhibits96: Overview on Criticality of inputs and Factors of differentiation

- Exhibits97: Overview on factors of disruption

- Exhibits98: Impact of key risks on business

- Exhibits99: Vendors covered

- Exhibits100: Matrix on vendor position and classification

- Exhibits101: Andritz AG - Overview

- Exhibits102: Andritz AG - Business segments

- Exhibits103: Andritz AG - Key offerings

- Exhibits104: Andritz AG - Segment focus

- Exhibits105: Amandus Kahl GmbH and Co. KG - Overview

- Exhibits106: Amandus Kahl GmbH and Co. KG - Product / Service

- Exhibits107: Amandus Kahl GmbH and Co. KG - Key offerings

- Exhibits108: Astec Industries Inc. - Overview

- Exhibits109: Astec Industries Inc. - Business segments

- Exhibits110: Astec Industries Inc. - Key offerings

- Exhibits111: Astec Industries Inc. - Segment focus

- Exhibits112: Babcock and Wilcox Enterprises Inc. - Overview

- Exhibits113: Babcock and Wilcox Enterprises Inc. - Business segments

- Exhibits114: Babcock and Wilcox Enterprises Inc. - Key news

- Exhibits115: Babcock and Wilcox Enterprises Inc. - Key offerings

- Exhibits116: Babcock and Wilcox Enterprises Inc. - Segment focus

- Exhibits117: Evoqua Water Technologies LLC - Overview

- Exhibits118: Evoqua Water Technologies LLC - Business segments

- Exhibits119: Evoqua Water Technologies LLC - Key news

- Exhibits120: Evoqua Water Technologies LLC - Key offerings

- Exhibits121: Evoqua Water Technologies LLC - Segment focus

- Exhibits122: General Kinematics Corp. - Overview

- Exhibits123: General Kinematics Corp. - Product / Service

- Exhibits124: General Kinematics Corp. - Key offerings

- Exhibits125: MAX Automation SE - Overview

- Exhibits126: MAX Automation SE - Business segments

- Exhibits127: MAX Automation SE - Key offerings

- Exhibits128: MAX Automation SE - Segment focus

- Exhibits129: Dust Solutions Inc. - Overview

- Exhibits130: Dust Solutions Inc. - Product / Service

- Exhibits131: Dust Solutions Inc. - Key offerings

- Exhibits132: Schenck Process Holding GmbH - Overview

- Exhibits133: Schenck Process Holding GmbH - Product / Service

- Exhibits134: Schenck Process Holding GmbH - Key offerings

- Exhibits135: ZE ENERGY Inc. - Overview

- Exhibits136: ZE ENERGY Inc. - Product / Service

- Exhibits137: ZE ENERGY Inc. - Key offerings

- Exhibits138: Inclusions checklist

- Exhibits139: Exclusions checklist

- Exhibits140: Currency conversion rates for US$

- Exhibits141: Research methodology

- Exhibits142: Validation techniques employed for market sizing

- Exhibits143: Information sources

- Exhibits144: List of abbreviations

Technavio has been monitoring the material handling equipment market in biomass power plants and it is poised to grow by $ 869.16 mn during 2022-2026, accelerating at a CAGR of 6.36% during the forecast period. Our report on the material handling equipment market in biomass power plants provides a holistic analysis, of market size and forecast, trends, growth drivers, and challenges, as well as vendor analysis covering around 25 vendors.

The report offers an up-to-date analysis of the current global market scenario, the latest trends and drivers, and the overall market environment. The market is driven by material handling equipment increases in the efficiency of the combustion process in a biomass power plant, a rise in government support for renewable energy, including biomass power, and the conversion of coal power plants into biomass power plants.

The material handling equipment market in biomass power plant analysis includes product segment and geographic landscape.

Technavio's material handling equipment market in the biomass power plants is segmented as below:

By Product

- Digestors

- Feeder systems

- Silos and storage tanks

- Chippers

- Grinders

By Geographical Landscape

- Europe

- APAC

- North America

- South America

- The Middle East and Africa

This study identifies the increasing requirement of managing municipal solid waste as one of the prime reasons driving the material handling equipment market in biomass power plant growth during the next few years. Also, the emergence of competing end-user industries for biomass and growing activism against biomass power generation will lead to sizable demand in the market.

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources by an analysis of key parameters. Our report on the material handling equipment market in biomass power plants covers the following areas:

- The material handling equipment market in biomass power plant sizing

- The material handling equipment market in biomass power plant forecast

- The material handling equipment market in biomass power plant industry analysis

Technavio's robust vendor analysis is designed to help clients improve their market position, and in line with this, this report provides a detailed analysis of several leading material handling equipment markets in biomass power plant vendors that include Andritz AG, Amandus Kahl GmbH, and Co. KG, Astec Industries Inc., Babcock and Wilcox Enterprises Inc., Evoqua Water Technologies LLC, General Kinematics Corp., MAX Automation SE, Dust Solutions Inc., RUD Ketten Rieger, and Dietz GmbH u Co. KG, Schenck Process Holding GmbH, Terex Corp., and ZE ENERGY Inc. Also, the material handling equipment market in the biomass power plant analysis report includes information on upcoming trends and challenges that will influence market growth. This is to help companies strategize and leverage all forthcoming growth opportunities.

The study was conducted using an objective combination of primary and secondary information including inputs from key participants in the industry. The report contains a comprehensive market and vendor landscape in addition to an analysis of the key vendors.

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources by an analysis of key parameters such as profit, pricing, competition, and promotions. It presents various market facets by identifying the key industry influencers. The data presented is comprehensive, reliable, and a result of extensive research - both primary and secondary. Technavio's market research reports provide a complete competitive landscape and an in-depth vendor selection methodology and analysis using qualitative and quantitative research to forecast accurate market growth.

Table of Contents

1 Executive Summary

- 1.1 Market overview

- Exhibit 01: Executive Summary - Chart on Market Overview

- Exhibit 02: Executive Summary - Data Table on Market Overview

- Exhibit 03: Executive Summary - Chart on Global Market Characteristics

- Exhibit 04: Executive Summary - Chart on Market By Geographical Landscape

- Exhibit 05: Executive Summary - Chart on Market Segmentation by Product

- Exhibit 06: Executive Summary - Chart on Incremental Growth

- Exhibit 07: Executive Summary - Data Table on Incremental Growth

- Exhibit 08: Executive Summary - Chart on Vendor Market Positioning

2 Market Landscape

- 2.1 Market ecosystem

- Exhibit 09: Parent market

- Exhibit 10: Market Characteristics

3 Market Sizing

- 3.1 Market definition

- Exhibit 11: Offerings of vendors included in the market definition

- 3.2 Market segment analysis

- Exhibit 12: Market segments

- 3.3 Market size 2021

- 3.4 Market outlook: Forecast for 2021-2026

- Exhibit 13: Chart on Global - Market size and forecast 2021-2026 ($ million)

- Exhibit 14: Data Table on Global - Market size and forecast 2021-2026 ($ million)

- Exhibit 15: Chart on Global Market: Year-over-year growth 2021-2026 (%)

- Exhibit 16: Data Table on Global Market: Year-over-year growth 2021-2026 (%)

4 Five Forces Analysis

- 4.1 Five forces summary

- Exhibit 17: Five forces analysis - Comparison between 2021 and 2026

- 4.2 Bargaining power of buyers

- Exhibit 18: Chart on Bargaining power of buyers - Impact of key factors 2021 and 2026

- 4.3 Bargaining power of suppliers

- Exhibit 19: Bargaining power of suppliers - Impact of key factors in 2021 and 2026

- 4.4 Threat of new entrants

- Exhibit 20: Threat of new entrants - Impact of key factors in 2021 and 2026

- 4.5 Threat of substitutes

- Exhibit 21: Threat of substitutes - Impact of key factors in 2021 and 2026

- 4.6 Threat of rivalry

- Exhibit 22: Threat of rivalry - Impact of key factors in 2021 and 2026

- 4.7 Market condition

- Exhibit 23: Chart on Market condition - Five forces 2021 and 2026

5 Market Segmentation by Product

- 5.1 Market segments

- Exhibit 24: Chart on Product - Market share 2021-2026 (%)

- Exhibit 25: Data Table on Product - Market share 2021-2026 (%)

- 5.2 Comparison by Product

- Exhibit 26: Chart on Comparison by Product

- Exhibit 27: Data Table on Comparison by Product

- 5.3 Digestors - Market size and forecast 2021-2026

- Exhibit 28: Chart on Digestors - Market size and forecast 2021-2026 ($ million)

- Exhibit 29: Data Table on Digestors - Market size and forecast 2021-2026 ($ million)

- Exhibit 30: Chart on Digestors - Year-over-year growth 2021-2026 (%)

- Exhibit 31: Data Table on Digestors - Year-over-year growth 2021-2026 (%)

- 5.4 Feeder systems - Market size and forecast 2021-2026

- Exhibit 32: Chart on Feeder systems - Market size and forecast 2021-2026 ($ million)

- Exhibit 33: Data Table on Feeder systems - Market size and forecast 2021-2026 ($ million)

- Exhibit 34: Chart on Feeder systems - Year-over-year growth 2021-2026 (%)

- Exhibit 35: Data Table on Feeder systems - Year-over-year growth 2021-2026 (%)

- 5.5 Silos and storage tanks - Market size and forecast 2021-2026

- Exhibit 36: Chart on Silos and storage tanks - Market size and forecast 2021-2026 ($ million)

- Exhibit 37: Data Table on Silos and storage tanks - Market size and forecast 2021-2026 ($ million)

- Exhibit 38: Chart on Silos and storage tanks - Year-over-year growth 2021-2026 (%)

- Exhibit 39: Data Table on Silos and storage tanks - Year-over-year growth 2021-2026 (%)

- 5.6 Chippers - Market size and forecast 2021-2026

- Exhibit 40: Chart on Chippers - Market size and forecast 2021-2026 ($ million)

- Exhibit 41: Data Table on Chippers - Market size and forecast 2021-2026 ($ million)

- Exhibit 42: Chart on Chippers - Year-over-year growth 2021-2026 (%)

- Exhibit 43: Data Table on Chippers - Year-over-year growth 2021-2026 (%)

- 5.7 Grinders - Market size and forecast 2021-2026

- Exhibit 44: Chart on Grinders - Market size and forecast 2021-2026 ($ million)

- Exhibit 45: Data Table on Grinders - Market size and forecast 2021-2026 ($ million)

- Exhibit 46: Chart on Grinders - Year-over-year growth 2021-2026 (%)

- Exhibit 47: Data Table on Grinders - Year-over-year growth 2021-2026 (%)

- 5.8 Market opportunity by Product

- Exhibit 48: Market opportunity by Product ($ million)

6 Customer Landscape

- 6.1 Customer landscape overview

- Exhibit 49: Analysis of price sensitivity, lifecycle, customer purchase basket, adoption rates, and purchase criteria

7 Geographic Landscape

- 7.1 Geographic segmentation

- Exhibit 50: Chart on Market share By Geographical Landscape 2021-2026 (%)

- Exhibit 51: Data Table on Market share By Geographical Landscape 2021-2026 (%)

- 7.2 Geographic comparison

- Exhibit 52: Chart on Geographic comparison

- Exhibit 53: Data Table on Geographic comparison

- 7.3 Europe - Market size and forecast 2021-2026

- Exhibit 54: Chart on Europe - Market size and forecast 2021-2026 ($ million)

- Exhibit 55: Data Table on Europe - Market size and forecast 2021-2026 ($ million)

- Exhibit 56: Chart on Europe - Year-over-year growth 2021-2026 (%)

- Exhibit 57: Data Table on Europe - Year-over-year growth 2021-2026 (%)

- 7.4 APAC - Market size and forecast 2021-2026

- Exhibit 58: Chart on APAC - Market size and forecast 2021-2026 ($ million)

- Exhibit 59: Data Table on APAC - Market size and forecast 2021-2026 ($ million)

- Exhibit 60: Chart on APAC - Year-over-year growth 2021-2026 (%)

- Exhibit 61: Data Table on APAC - Year-over-year growth 2021-2026 (%)

- 7.5 North America - Market size and forecast 2021-2026

- Exhibit 62: Chart on North America - Market size and forecast 2021-2026 ($ million)

- Exhibit 63: Data Table on North America - Market size and forecast 2021-2026 ($ million)

- Exhibit 64: Chart on North America - Year-over-year growth 2021-2026 (%)

- Exhibit 65: Data Table on North America - Year-over-year growth 2021-2026 (%)

- 7.6 South America - Market size and forecast 2021-2026

- Exhibit 66: Chart on South America - Market size and forecast 2021-2026 ($ million)

- Exhibit 67: Data Table on South America - Market size and forecast 2021-2026 ($ million)

- Exhibit 68: Chart on South America - Year-over-year growth 2021-2026 (%)

- Exhibit 69: Data Table on South America - Year-over-year growth 2021-2026 (%)

- 7.7 Middle East and Africa - Market size and forecast 2021-2026

- Exhibit 70: Chart on Middle East and Africa - Market size and forecast 2021-2026 ($ million)

- Exhibit 71: Data Table on Middle East and Africa - Market size and forecast 2021-2026 ($ million)

- Exhibit 72: Chart on Middle East and Africa - Year-over-year growth 2021-2026 (%)

- Exhibit 73: Data Table on Middle East and Africa - Year-over-year growth 2021-2026 (%)

- 7.8 US - Market size and forecast 2021-2026

- Exhibit 74: Chart on US - Market size and forecast 2021-2026 ($ million)

- Exhibit 75: Data Table on US - Market size and forecast 2021-2026 ($ million)

- Exhibit 76: Chart on US - Year-over-year growth 2021-2026 (%)

- Exhibit 77: Data Table on US - Year-over-year growth 2021-2026 (%)

- 7.9 Germany - Market size and forecast 2021-2026

- Exhibit 78: Chart on Germany - Market size and forecast 2021-2026 ($ million)

- Exhibit 79: Data Table on Germany - Market size and forecast 2021-2026 ($ million)

- Exhibit 80: Chart on Germany - Year-over-year growth 2021-2026 (%)

- Exhibit 81: Data Table on Germany - Year-over-year growth 2021-2026 (%)

- 7.10 China - Market size and forecast 2021-2026

- Exhibit 82: Chart on China - Market size and forecast 2021-2026 ($ million)

- Exhibit 83: Data Table on China - Market size and forecast 2021-2026 ($ million)

- Exhibit 84: Chart on China - Year-over-year growth 2021-2026 (%)

- Exhibit 85: Data Table on China - Year-over-year growth 2021-2026 (%)

- 7.11 France - Market size and forecast 2021-2026

- Exhibit 86: Chart on France - Market size and forecast 2021-2026 ($ million)

- Exhibit 87: Data Table on France - Market size and forecast 2021-2026 ($ million)

- Exhibit 88: Chart on France - Year-over-year growth 2021-2026 (%)

- Exhibit 89: Data Table on France - Year-over-year growth 2021-2026 (%)

- 7.12 India - Market size and forecast 2021-2026

- Exhibit 90: Chart on India - Market size and forecast 2021-2026 ($ million)

- Exhibit 91: Data Table on India - Market size and forecast 2021-2026 ($ million)

- Exhibit 92: Chart on India - Year-over-year growth 2021-2026 (%)

- Exhibit 93: Data Table on India - Year-over-year growth 2021-2026 (%)

- 7.13 Market opportunity By Geographical Landscape

- Exhibit 94: Market opportunity By Geographical Landscape ($ million)

8 Drivers, Challenges, and Trends

- 8.1 Market drivers

- 8.2 Market challenges

- 8.3 Impact of drivers and challenges

- Exhibit 95: Impact of drivers and challenges in 2021 and 2026

- 8.4 Market trends

9 Vendor Landscape

- 9.1 Overview

- 9.2 Vendor landscape

- Exhibit 96: Overview on Criticality of inputs and Factors of differentiation

- 9.3 Landscape disruption

- Exhibit 97: Overview on factors of disruption

- 9.4 Industry risks

- Exhibit 98: Impact of key risks on business

10 Vendor Analysis

- 10.1 Vendors covered

- Exhibit 99: Vendors covered

- 10.2 Market positioning of vendors

- Exhibit 100: Matrix on vendor position and classification

- 10.3 Andritz AG

- Exhibit 101: Andritz AG - Overview

- Exhibit 102: Andritz AG - Business segments

- Exhibit 103: Andritz AG - Key offerings

- Exhibit 104: Andritz AG - Segment focus

- 10.4 Amandus Kahl GmbH and Co. KG

- Exhibit 105: Amandus Kahl GmbH and Co. KG - Overview

- Exhibit 106: Amandus Kahl GmbH and Co. KG - Product / Service

- Exhibit 107: Amandus Kahl GmbH and Co. KG - Key offerings

- 10.5 Astec Industries Inc.

- Exhibit 108: Astec Industries Inc. - Overview

- Exhibit 109: Astec Industries Inc. - Business segments

- Exhibit 110: Astec Industries Inc. - Key offerings

- Exhibit 111: Astec Industries Inc. - Segment focus

- 10.6 Babcock and Wilcox Enterprises Inc.

- Exhibit 112: Babcock and Wilcox Enterprises Inc. - Overview

- Exhibit 113: Babcock and Wilcox Enterprises Inc. - Business segments

- Exhibit 114: Babcock and Wilcox Enterprises Inc. - Key news

- Exhibit 115: Babcock and Wilcox Enterprises Inc. - Key offerings

- Exhibit 116: Babcock and Wilcox Enterprises Inc. - Segment focus

- 10.7 Evoqua Water Technologies LLC

- Exhibit 117: Evoqua Water Technologies LLC - Overview

- Exhibit 118: Evoqua Water Technologies LLC - Business segments

- Exhibit 119: Evoqua Water Technologies LLC - Key news

- Exhibit 120: Evoqua Water Technologies LLC - Key offerings

- Exhibit 121: Evoqua Water Technologies LLC - Segment focus

- 10.8 General Kinematics Corp.

- Exhibit 122: General Kinematics Corp. - Overview

- Exhibit 123: General Kinematics Corp. - Product / Service

- Exhibit 124: General Kinematics Corp. - Key offerings

- 10.9 MAX Automation SE

- Exhibit 125: MAX Automation SE - Overview

- Exhibit 126: MAX Automation SE - Business segments

- Exhibit 127: MAX Automation SE - Key offerings

- Exhibit 128: MAX Automation SE - Segment focus

- 10.10 Dust Solutions Inc.

- Exhibit 129: Dust Solutions Inc. - Overview

- Exhibit 130: Dust Solutions Inc. - Product / Service

- Exhibit 131: Dust Solutions Inc. - Key offerings

- 10.11 Schenck Process Holding GmbH

- Exhibit 132: Schenck Process Holding GmbH - Overview

- Exhibit 133: Schenck Process Holding GmbH - Product / Service

- Exhibit 134: Schenck Process Holding GmbH - Key offerings

- 10.12 ZE ENERGY Inc.

- Exhibit 135: ZE ENERGY Inc. - Overview

- Exhibit 136: ZE ENERGY Inc. - Product / Service

- Exhibit 137: ZE ENERGY Inc. - Key offerings

11 Appendix

- 11.1 Scope of the report

- 11.2 Inclusions and exclusions checklist

- Exhibit 138: Inclusions checklist

- Exhibit 139: Exclusions checklist

- 11.3 Currency conversion rates for US$

- Exhibit 140: Currency conversion rates for US$

- 11.4 Research methodology

- Exhibit 141: Research methodology

- Exhibit 142: Validation techniques employed for market sizing

- Exhibit 143: Information sources

- 11.5 List of abbreviations

- Exhibit 144: List of abbreviations