|

|

市場調査レポート

商品コード

1090200

DevSecOpsの世界市場(2022年)DevSecOps Market |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| DevSecOpsの世界市場(2022年) |

|

出版日: 2022年05月19日

発行: IndustryARC

ページ情報: 英文 122 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

DevSecOpsの市場規模は、2020年から2025年にかけて28.85%のCAGRで推移し、2025年には65億米ドルの規模に成長すると予測されています。セキュリティ侵害の増加に伴い、より安全性の高い継続的なアプリケーションデリバリーが大きく伸びています。そのため、サイバー保護、クラウドセキュリティ、アプリケーションセキュリティなどを提供するため、セキュリティとコンプライアンスへの注目が高まっており、DevSecOps市場の成長に影響を与えると分析されています。

産業別で見ると、BFSI部門が2019年に最大のシェアを示しています。金融部門におけるデータ侵害の大幅な増加が、高い市場シェアに寄与しています。また、地域別では、アジア太平洋地域が市場をリードし、北米と欧州がそれに続いています。アジア太平洋地域の経済は、主に中国やインドなどの経済動態や、大規模企業の高いプレゼンスに影響されています。

当レポートでは、世界のDevSecOpsの市場を調査し、市場の定義と概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分・地域/主要国別の内訳、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 DevSecOps:市場概要

第2章 DevSecOps:エグゼクティブサマリー

第3章 DevSecOps市場

- 比較分析

第4章 DevSecOps市場の影響因子

- 市場促進要因

- 市場抑制要因

- 課題

- ポーターのファイブフォース分析

第5章 DevSecOps市場:戦略的分析

- バリューチェーン分析

- 市場機会の分析

- 製品ライフサイクル

- サプライヤーおよび流通販売業者の市場シェア

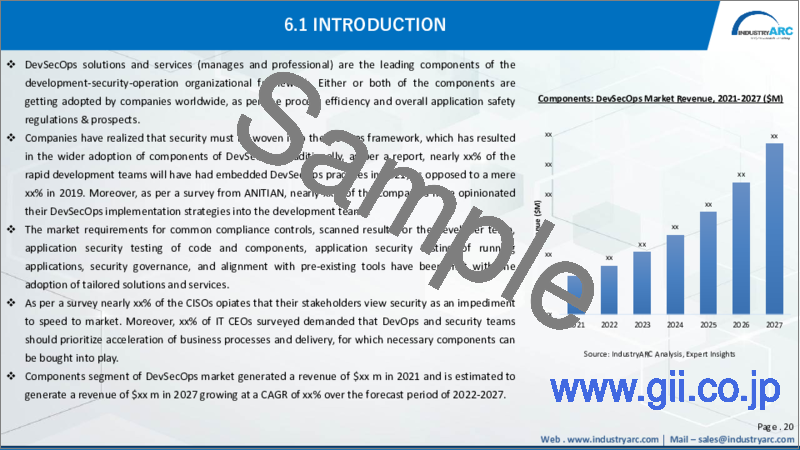

第6章 DevSecOps市場:コンポーネント別

- ソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 DevSecOps市場:展開タイプ別

- クラウド

- オンプレミス

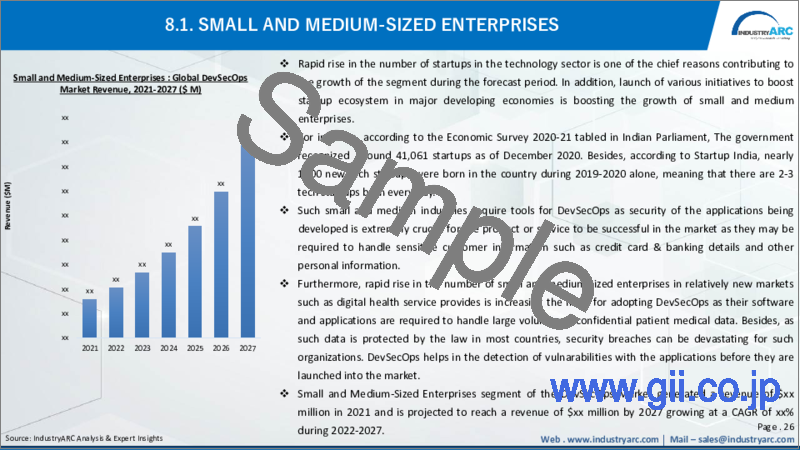

第8章 DevSecOps市場:組織規模別

- 中小企業

- 大企業

第9章 DevSecOps市場:産業別

- 銀行・金融サービス・保険

- IT・電気通信

- 政府・公共部門

- 小売・消費財

- 製造

- エネルギー・ユーティリティ

- メディア・エンターテインメント

- ヘルスケア・ライフサイエンス

- その他

第10章 DevSecOps市場:地域別

- 北米

- 南米

- 欧州

- アジア太平洋

- 中東・アフリカ

第11章 DevSecOps市場:エントロピー

- 新製品発売

- M&A・協力・JV・提携

第12章 DevSecOps市場:企業分析

- 市場シェア・企業収益・製品・M&A・展開

- 4Armed

- Algosec

- Aqua Security

- Ca Technology

- Checkmarx

- Chef Software

- Cloudpassage

- Continuum Security

- Contrast Security

- Cyberark

- Dome9

- Entersoft

- Ibm

- Micro Focus

- Microsoft

- Palo Alto Network

- Puppet

- Qualys

- Rogue Wave Software

- Splunk

- Sumo Logic

- Synopsys

- Threatmodeler

- Whitehat

- その他

第13章 DevSecOps市場:付録

第14章 DevSecOps市場:調査手法

DevSecOps Market is forecast to reach $6.5 billion by 2025, after growing at a CAGR of 28.85% during 2020-2025. With the rise in security breaches and there has been a significant growth in the higher secure continuous application delivery. Therefore the increasing focus on security and compliance are analyzed to impact on the growth of the DevSecOps market as it provides cyber protection, cloud security, application security, and so on.

Report Coverage

The report: "DevSecOps Market - Forecast (2019-2024)", by IndustryARC, covers an in-depth analysis of the following segments of the DevSecOps Market.

Key Takeaways

- Asia-Pacific is analyzed to grow at highest rate owing to the increasing growth in the small and medium scale enterprises.

- The increasing need for highly secure continuous application delivery and the improved focus on security and compliance is likely to aid in the market growth of DevSecOps.

- The high adoption rate in the large scale enterprises with the increasing awareness of the security threats is analyzed to impact on the growth of the DevSecOps market during the forecast period.

DevSecOps Market Segment Analysis - By Organization Size

Large scale enterprises hold the highest market share over the small and medium scale enterprises due to the high capital investment. As stated by Norton, the total number of data breaches have reached 4 billion records during the first six months of 2019. Therefore the increasing security breaches have significantly impacted on the increasing adoption in the large scale enterprises to ensure maximum security in the enterprise despite high capital investment and requirement of highly skilled employees.

DevSecOps Market Segment Analysis - By Vertical

BFSI sector is analyzed to hold the highest market share during 2019. The significant rise in the data breaches in the financial sectors are contributing to the highest market share. In the first six months of 2019 alone there has been 106 million number of records breached, the highest among all other sectors. As stated by Norton, in 2019, Capital One has suffered from $100 to $150million thereby creating a dire need for updating the technology to fix the vulnerabilities. Therefore there is dire need for employment of the DevSecOps solutions to ensure the cyber security in the enterprises which is in turn impacting on the growth of the DevSecOps market growth rate during the forecast period 2020-2025.

DevSecOps Market Segment Analysis - By Geography

APAC dominated the DevSecOps market, followed by North America and Europe. The economy of APAC is mainly influenced by the economic dynamics of countries such as China and India, and the high presence of the large scale enterprises. The significant growth in the small and medium scale enterprises alongside the increasing awareness about the security breaches and the loses caused to the industry. Moreover the increasing cyberattacks in this region including data breach in Toyota, Japan in March 2019, and Singapore healthcare data breach in January 2019 and many other security breaches are analysed impact on the increasing adoption rate of the DevSecOps solutions for the cyber security in APAC region.

DevSecOps Market Drivers

Increasing focus on security

There has been a significant rise in the security breaches during 2019, which has caused severe loss to the enterprises thereby leading the industries to focus more on the security of the data by employing various solution including devsecops and many other. In 2019, data breaches in entertainment vertical have been recorded as 100million, similarly, in government sector the number of data breaches has been 2.3million and many other have been recorded during the first six months of 2019. Therefore these security breaches are impacting on the adoption rate of the DevSecOps thereby boosting the DevSecOps market.

DevSecOps Market Challenges

Lack of Skilled professional

Although the growth rate of the DevsecOps market is significantly high, the primary challenge is finding the skilled professional for the deployment of DevSecOps solutions in the enterprises. The lack of skilled professionals is mainly due to the gap between the supply and demand for security professionals that is created due to the improper understanding of new technology in the information security.

DevSecOps Market Landscape

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the DevSecOps market. In 2018, the market of DevSecOps has been consolidated by the top players including CA Technologies, IBM, MicroFocus, Synopsys, Microsoft, Google, Dome9, PaloAltoNetworks, Qualys, Chef Software, Threat Modeler, Contrast Security, CyberArk, Entersoft among others.

Acquisitions/Technology Launches

- In July, 2019, IBM has completed the acquisition of Red Hat for $34Bn thereby contributing in the in the increase in the IBM DevOps market share.

- In 2018, Micro Focus has launched ITOM Platform which integrates DevOps with AIOps to speed up service delivery across large-scale hybrid IT environments.

Table of Contents

1. DevSecOps Market - Overview

- 1.1 Definitions and Scope

2. DevSecOps Market - Executive summary

- 2.1 Market Revenue, Market Size and Key Trends by Company

- 2.2 Key Trends by type of Application

- 2.3 Key Trends segmented by Geography

3. DevSecOps Market

- 3.1 Comparative analysis

- 3.1.1 Product Benchmarking - Top 10 companies

- 3.1.2 Top 5 Financials Analysis

- 3.1.3 Market Value split by Top 10 companies

- 3.1.4 Patent Analysis - Top 10 companies

- 3.1.5 Pricing Analysis

4. DevSecOps Market Forces

- 4.1 Drivers

- 4.2 Constraints

- 4.3 Challenges

- 4.4 Porters five force model

- 4.4.1 Bargaining power of suppliers

- 4.4.2 Bargaining powers of customers

- 4.4.3 Threat of new entrants

- 4.4.4 Rivalry among existing players

- 4.4.5 Threat of substitutes

5. DevSecOps Market -Strategic analysis

- 5.1 Value chain analysis

- 5.2 Opportunities analysis

- 5.3 Product life cycle

- 5.4 Suppliers and distributors Market Share

6. DevSecOps Market - By Component (Market Size -$Million / $Billion)

- 6.1 Introduction

- 6.2 Solution

- 6.3 Services

- 6.3.1 Professional Services

- 6.3.2 Managed Services

7. DevSecOps Market - By Deployment Type (Market Size -$Million / $Billion)

- 7.1 Cloud

- 7.2 On-Premises

8. DevSecOps Market - By Organization Size (Market Size -$Million / $Billion)

- 8.1 Introduction

- 8.2 Small and Medium-Sized Enterprises

- 8.3 Large Enterprises

9. DevSecOps Market - By Vertical (Market Size -$Million / $Billion)

- 9.1 Introduction

- 9.2 Banking, Financial Services, and Insurance

- 9.3 IT and Telecommunications

- 9.4 Government and Public Sector

- 9.5 Retail and Consumer Goods

- 9.6 Manufacturing

- 9.7 Energy and Utilities

- 9.8 Media and Entertainment

- 9.9 Healthcare and Life Sciences

- 9.10 Others

10. DevSecOps- By Geography (Market Size -$Million / $Billion)

- 10.1 DevSecOps Market - North America Segment Research

- 10.2 North America Market Research (Million / $Billion)

- 10.2.1 Segment type Size and Market Size Analysis

- 10.2.2 Revenue and Trends

- 10.2.3 Application Revenue and Trends by type of Application

- 10.2.4 Company Revenue and Product Analysis

- 10.2.5 North America Product type and Application Market Size

- 10.2.5.1 U.S

- 10.2.5.2 Canada

- 10.2.5.3 Mexico

- 10.2.5.4 Rest of North America

- 10.3 DevSecOps- South America Segment Research

- 10.4 South America Market Research (Market Size -$Million / $Billion)

- 10.4.1 Segment type Size and Market Size Analysis

- 10.4.2 Revenue and Trends

- 10.4.3 Application Revenue and Trends by type of Application

- 10.4.4 Company Revenue and Product Analysis

- 10.4.5 South America Product type and Application Market Size

- 10.4.5.1 Brazil

- 10.4.5.2 Venezuela

- 10.4.5.3 Argentina

- 10.4.5.4 Ecuador

- 10.4.5.5 Peru

- 10.4.5.6 Colombia

- 10.4.5.7 Costa Rica

- 10.4.5.8 Rest of South America

- 10.5 DevSecOps- Europe Segment Research

- 10.6 Europe Market Research (Market Size -$Million / $Billion)

- 10.6.1 Segment type Size and Market Size Analysis

- 10.6.2 Revenue and Trends

- 10.6.3 Application Revenue and Trends by type of Application

- 10.6.4 Company Revenue and Product Analysis

- 10.6.5 Europe Segment Product type and Application Market Size

- 10.6.5.1 U.K

- 10.6.5.2 Germany

- 10.6.5.3 Italy

- 10.6.5.4 France

- 10.6.5.5 Netherlands

- 10.6.5.6 Belgium

- 10.6.5.7 Denmark

- 10.6.5.8 Spain

- 10.6.5.9 Rest of Europe

- 10.7 DevSecOps - APAC Segment Research

- 10.8 APAC Market Research (Market Size -$Million / $Billion)

- 10.8.1 Segment type Size and Market Size Analysis

- 10.8.2 Revenue and Trends

- 10.8.3 Application Revenue and Trends by type of Application

- 10.8.4 Company Revenue and Product Analysis

- 10.8.5 APAC Segment - Product type and Application Market Size

- 10.8.5.1 China

- 10.8.5.2 Australia

- 10.8.5.3 Japan

- 10.8.5.4 South Korea

- 10.8.5.5 India

- 10.8.5.6 Taiwan

- 10.8.5.7 Malaysia

- 10.8.5.8 Hong kong

- 10.8.5.9 Rest of APAC

- 10.9 DevSecOps - Middle East Segment and Africa Segment Research

- 10.10 Middle East & Africa Market Research (Market Size -$Million / $Billion)

- 10.10.1 Segment type Size and Market Size Analysis

- 10.10.2 Revenue and Trend Analysis

- 10.10.3 Application Revenue and Trends by type of Application

- 10.10.4 Company Revenue and Product Analysis

- 10.10.5 Middle East Segment Product type and Application Market Size

- 10.10.5.1 Israel

- 10.10.5.2 Saudi Arabia

- 10.10.5.3 UAE

- 10.10.6 Africa Segment Analysis

- 10.10.6.1 South Africa

- 10.10.6.2 Rest of Middle East & Africa

11. DevSecOps Market - Entropy

- 11.1 New product launches

- 11.2 M&A s, collaborations, JVs and partnerships

12. DevSecOps Market Company Analysis

- 12.1 Market Share, Company Revenue, Products, M&A, Developments

- 12.2 4Armed

- 12.3 Algosec

- 12.4 Aqua Security

- 12.5 Ca Technology

- 12.6 Checkmarx

- 12.7 Chef Software

- 12.8 Cloudpassage

- 12.9 Continuum Security

- 12.10 Contrast Security

- 12.11 Cyberark

- 12.12 Dome9

- 12.13 Entersoft

- 12.14 Google

- 12.15 Ibm

- 12.16 Micro Focus

- 12.17 Microsoft

- 12.18 Palo Alto Network

- 12.19 Puppet

- 12.20 Qualys

- 12.21 Rogue Wave Software

- 12.22 Splunk

- 12.23 Sumo Logic

- 12.24 Synopsys

- 12.25 Threatmodeler

- 12.26 Whitehat

- 12.27 Company 26

- 12.28 Company 27 & More

Financials would be provided on a best efforts basis for private companies

13. DevSecOps Market - Appendix

- 13.1 Abbreviations

- 13.2 Sources

14. DevSecOps Market - Methodology

- 14.1 Research Methodology

- 14.1.1 Company Expert Interviews

- 14.1.2 Industry Databases

- 14.1.3 Associations

- 14.1.4 Company News

- 14.1.5 Company Annual Reports

- 14.1.6 Application Trends

- 14.1.7 New Products and Product database

- 14.1.8 Company Transcripts

- 14.1.9 R&D Trends

- 14.1.10 Key Opinion Leaders Interviews

- 14.1.11 Supply and Demand Trends