|

|

市場調査レポート

商品コード

1792695

グラフェンの市場規模、シェア、動向、予測:タイプ別、用途別、最終用途産業別、地域別、2025年~2033年Graphene Market Size, Share, Trends and Forecast by Type, Application, End-Use Industry, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| グラフェンの市場規模、シェア、動向、予測:タイプ別、用途別、最終用途産業別、地域別、2025年~2033年 |

|

出版日: 2025年08月01日

発行: IMARC

ページ情報: 英文 147 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

グラフェンの世界市場規模は2024年に2億9,000万米ドルとなりました。今後、IMARC Groupは、市場は2033年までに78億2,000万米ドルに達し、2025年から2033年の間に39.01%のCAGRを示すと予測しています。現在、アジア太平洋地域が市場を独占しています。さまざまな生物医学的用途の改善、性能向上のための半導体製造の進歩、軽量で耐久性のある建設材料への需要の増加が、グラフェン市場の成長を促している主な要因の一部です。

グラフェンの世界市場は、エレクトロニクス、エネルギー、自動車、ヘルスケアなど多様な産業で採用が増加していることが牽引しています。グラフェンは、高い導電性、軽量構造、機械的強度、熱安定性などの卓越した特性により、バッテリー、センサー、フレキシブルエレクトロニクスなどの高度な用途に好んで使用されています。持続可能でエネルギー効率の高いソリューションに対する需要の高まりは、再生可能エネルギー技術や次世代半導体におけるグラフェンの利用をさらに加速させます。2024年12月19日、Westlake Corporationの子会社であるWestlake Innovationsは、持続可能なグラフェンの生産に注力するバーリントンのUniversal Matter, Inc.に投資しました。Universal Matter社が特許を取得したFJH技術は、コスト効率の高いフラッシュジュール加熱技術により、炭素廃棄物を産業用の高品質なグラフェンにアップサイクルすることを保証するものです。この投資は、先端材料における持続可能性と革新へのWestlakeのコミットメントに沿ったものです。さらに、ナノテクノロジーを支援する政府の取り組みと相まって、研究開発への投資が増加しており、市場の成長を促進しています。さらに、複合材料やコーティングにおけるグラフェンベースの材料の適用範囲の拡大も、世界の市場の躍進を後押ししています。

米国は主要な地域市場として際立っており、主に政府と民間部門の強力な投資に支えられたナノテクノロジーと材料科学の力強い進歩によって牽引されています。2024年7月18日、米国エネルギー省の先進材料・製造技術局(AMMTO)は、スマート製造技術に3,300万米ドルを投じると発表しました。これは、循環型サプライチェーン、クリーン輸送、高性能材料などの分野における効率性、持続可能性、革新性を強化し、製造業におけるアメリカの競争力を高めることを目的としています。イノベーションを重視するアメリカは、航空宇宙、防衛、再生可能エネルギーなどの高性能用途におけるグラフェンの需要を促進しています。電気自動車(EV)の急速な開発と効率的なエネルギー貯蔵ソリューションの必要性により、グラフェンのバッテリーやスーパーキャパシタへの使用は強化されています。同時に、米国のヘルスケア分野では、ドラッグデリバリーやバイオセンサーなど、グラフェンをベースとしたバイオメディカルアプリケーションの探求が市場成長に寄与しています。さらに、学術機関と産業界とのパートナーシップの高まりが、この地域におけるグラフェンイノベーションをさらに促進しています。

グラフェン市場の動向:

半導体生産における進歩の拡大

半導体生産における進歩は、グラフェン市場に明るい展望をもたらしています。グラフェンは、半導体の性能を向上させるのに役立つ電気伝導性と放熱性を高めています。これとは別に、グラフェン市場のメーカーは、電子デバイスの高速化とエネルギー効率の向上に注力しています。また、トランジスタやその他の半導体部品にグラフェンを組み込むための様々な方法を模索しています。半導体産業協会(SIA)の報告によると、半導体産業の売上高は、2024年2月中に世界で462億米ドルに達します。

バイオメディカル用途の拡大

グラフェンのバイオセンシング技術への統合は、グラフェンの市場範囲を拡大しています。IMARC Groupによると、世界のバイオセンサー市場は2024年に309億米ドルに達しました。グラフェンベースの材料は、抗菌特性を示し、無菌環境を維持することで創傷治癒プロセスを早めることができるため、創傷被覆材や治癒アプリケーションに使用されています。これに伴い、バイオメディカル用途の進歩が、医療分野におけるグラフェン市場の需要を強化しています。さらに、研究者やヘルスケア専門家は、病原体や健康に関連する指標を特定するためにグラフェンベースのバイオセンサーを採用することに注力しています。例えば、IITグワハティ校の研究者たちは、バイオメディカル用途への修飾グラフェン酸化物の使用に関して重要な発見をしました。彼らは2023年11月8日、グラフェン酸化物を改質するための費用対効果の高い実験を紹介しました。

軽量で耐久性のある建設材料への需要の増加

建設分野の成長により、グラフェンの用途が増加しています。グラフェン酸化物は、コンクリート、複合材料、コーティングなどの建築部材に応用され、インフラプロジェクトを強化し、その寿命を延ばします。これにより、建築資材の耐久性と効率が向上します。また、建設プロジェクトはますます高度化しており、創造的なソリューションが求められています。Invest Indiaによると、インドの建設セクターは2025年までに1兆4,000億米ドルを達成すると予想されています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のグラフェン市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- 単層と二重層グラフェン

- 少数のレイヤーグラフェン(FLG)

- グラフェン酸化物(GO)

- グラフェンナノプレートレット(GNP)

- その他

第7章 市場内訳:用途別

- 電池

- スーパーキャパシタ

- 透明電極

- 集積回路

- その他

第8章 市場内訳:最終用途産業別

- 電子工学と通信

- バイオメディカルとヘルスケア

- エネルギー

- 航空宇宙および防衛

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格指標

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- ACS Material, LLC

- Global Graphene Group, Inc.

- CVD Equipment Corporation

- Grafoid Inc.

- G6 Materials Corp.(Graphene 3D Lab Inc.)

- Graphene NanoChem PLC

- Graphenea Inc.

- Haydale Graphene Industries Plc

- Vorbeck Materials Corp.

- XG Sciences Inc.

List of Figures

- Figure 1: Global: Graphene Market: Major Drivers and Challenges

- Figure 2: Global: Graphene Market: Sales Value (in Million USD), 2019-2024

- Figure 3: Global: Graphene Market: Breakup by Type (in %), 2024

- Figure 4: Global: Graphene Market: Breakup by Application (in %), 2024

- Figure 5: Global: Graphene Market: Breakup by End-Use Industry (in %), 2024

- Figure 6: Global: Graphene Market: Breakup by Region (in %), 2024

- Figure 7: Global: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 8: Global: Graphene (Mono-layer & Bi-layer Graphene) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Graphene (Mono-layer & Bi-layer Graphene) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Graphene (Few Layer Graphene) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Graphene (Few Layer Graphene) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Graphene (Graphene Oxide) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Graphene (Graphene Oxide) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Graphene (Graphene Nano Platelets) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Graphene (Graphene Nano Platelets) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Graphene (Others) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Graphene (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Graphene (Batteries) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Graphene (Batteries) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Graphene (Supercapacitors) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Graphene (Supercapacitors) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Graphene (Transparent Electrodes) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Graphene (Transparent Electrodes) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Graphene (Integrated Circuits) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Graphene (Integrated Circuits) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Graphene (Others) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Graphene (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Graphene (Electronics and Telecommunication) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Graphene (Electronics and Telecommunication) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Graphene (Bio-medical and Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Graphene (Bio-medical and Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Graphene (Energy) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Graphene (Energy) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Graphene (Aerospace and Defense) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Graphene (Aerospace and Defense) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Global: Graphene (Others) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Global: Graphene (Others) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: North America: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: North America: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: United States: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: United States: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Canada: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Canada: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Asia Pacific: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Asia Pacific: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: China: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: China: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Japan: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Japan: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: India: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: India: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: South Korea: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: South Korea: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Australia: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Australia: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Indonesia: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Indonesia: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Others: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Others: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Europe: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Europe: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Germany: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Germany: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: France: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: France: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: United Kingdom: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: United Kingdom: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Italy: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Italy: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Spain: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Spain: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Russia: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Russia: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Others: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Others: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Latin America: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Latin America: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: Brazil: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: Brazil: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: Mexico: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 81: Mexico: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 82: Others: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 83: Others: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 84: Middle East and Africa: Graphene Market: Sales Value (in Million USD), 2019 & 2024

- Figure 85: Middle East and Africa: Graphene Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 86: Global: Graphene Industry: SWOT Analysis

- Figure 87: Global: Graphene Industry: Value Chain Analysis

- Figure 88: Global: Graphene Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Graphene Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Graphene Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Graphene Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 4: Global: Graphene Market Forecast: Breakup by End-Use Industry (in Million USD), 2025-2033

- Table 5: Global: Graphene Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Graphene Market: Competitive Structure

- Table 7: Global: Graphene Market: Key Players

The global graphene market size was valued at USD 290 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 7,820 Million by 2033, exhibiting a CAGR of 39.01% during 2025-2033. Asia-Pacific currently dominates the market. Improvements in various biomedical applications, advancements in the production of semiconductors for enhanced performance, and increasing demand for lighter and more durable construction materials are some of the key factors that are impelling the graphene market growth.

The global graphene market is driven by its increasing adoption across diverse industries, including electronics, energy, automotive, and healthcare. Graphene's exceptional properties, such as high electrical conductivity, lightweight structure, mechanical strength, and thermal stability, make it a preferred choice for advanced applications such as batteries, sensors, and flexible electronics. The growing demand for sustainable and energy-efficient solutions further accelerates graphene's usage in renewable energy technologies and next-generation semiconductors. On 19th December 2024, Westlake Innovations, a subsidiary of Westlake Corporation, invested in Burlington-based Universal Matter, Inc., a firm that focuses on sustainable graphene production. FJH technology patented by Universal Matter guarantees the upcycling of carbon waste into high-quality graphene for industrial purposes through the cost-effective Flash Joule Heating technology. This investment aligns with Westlake's commitment to sustainability and innovation in advanced materials. Additionally, rising investments in research and development, coupled with government initiatives supporting nanotechnology, are fostering market growth. Moreover, the expanding scope of graphene-based materials in composites and coatings also propels the market's advancement worldwide.

The United States stands out as a key regional market, primarily driven by robust advancements in nanotechnology and material science, supported by strong government and private sector investments. On 18th July 2024, the U.S. Department of Energy's Advanced Materials and Manufacturing Technologies Office (AMMTO) has announced USD 33 Million for smart manufacturing technologies, representing an important step toward the clean energy transition. It is geared to enhance efficiency, sustainability, and innovation in areas such as circular supply chains, clean transportation, and high-performance materials, and enhance American competitiveness in manufacturing. The country's focus on innovation fuels the demand for graphene in high-performance applications such as aerospace, defense, and renewable energy. The rapid development of electric vehicles (EVs) and the need for efficient energy storage solutions have bolstered graphene's use in batteries and supercapacitors. Concurrently, the U.S. healthcare sector's exploration of graphene-based biomedical applications, including drug delivery and biosensors, contributes to market growth. Furthermore, growing partnerships between academic institutions and industries further catalyze graphene innovation in the region.

Graphene Market Trends:

Growing advancements in the production of semiconductors

Advancements in the production of semiconductors are offering a positive graphene market outlook. Graphene exhibits enhanced electrical conductivity and heat dissipation properties that help in increasing the performance of semiconductors. Apart from this, manufacturers in the graphene market are focusing on producing electronic devices faster and more energy efficient. They are also exploring various methods to incorporate graphene into transistors and other semiconductor components. The semiconductor industry sales totaled USD 46.2 Billion worldwide during February 2024, as reported by the Semiconductor Industry Association (SIA).

Rising improvements in biomedical applications

The integration of graphene into biosensing technologies is expanding the graphene market scope. According to the IMARC Group, the global biosensors market reached USD 30.9 Billion in 2024. Graphene-based materials are used for wound dressings and healing applications as they exhibit antimicrobial properties and can help fasten the wound healing process by maintaining a sterile environment. In line with this, advancements in biomedical applications are strengthening the graphene market demand in the medical sector. Furthermore, researchers and healthcare professionals are focusing on employing graphene-based biosensors to identify pathogens and health-related indicators. For instance, researchers at IIT Guwahati made crucial discoveries regarding the use of modified graphene oxide for biomedical applications. They introduced cost-effective experiments for modifying graphene oxide on 8 November 2023.

Increasing demand for lighter and durable construction materials

Due to the growing construction sector, graphene application is increasing. It is applied in the components of building such as concrete, composites, and coatings, to fortify infrastructure projects and extend their lifetime. This will help enhance the durability and efficiency of building materials. Additionally, construction projects are becoming increasingly sophisticated, making them require creative solutions. According to the Invest India, the construction sector in India is anticipated to achieve USD 1.4 Trillion by 2025.

Graphene Industry Segmentation:

Analysis by Type:

- Mono-layer & Bi-layer Graphene

- Few Layer Graphene (FLG)

- Graphene Oxide (GO)

- Graphene Nano Platelets (GNP)

- Others

Graphene nano platelets (GNP) stand as the largest component in 2024. Graphene nano platelets (GNPs) are one of the nanomaterials. They comprise stranded graphene sheets. These materials show a very high level of electrical conductivity, high thermal conductivity, and flexibility along with good mechanical strength. GNPS are used in industry as filler materials to produce products to enhance electrical conductivity and some mechanical qualities. They are added to composite materials, such as polymer composites and coatings, to enhance mechanical strength, thermal conductivity, and electromagnetic shielding properties. Besides this, many industry players are launching products based on GNPs to cater to a broader consumer base. On 5 May 2023, Gerdau Graphene announced two new cutting-edge additives as being commercially available for the paint and coatings industry, including NanoDUR and NanoLAV. These additives are being developed based on GNPs in order to provide more premium performance improvements for water-based paints and coatings.

Analysis by Application:

- Batteries

- Supercapacitors

- Transparent Electrodes

- Integrated Circuits

- Others

Batteries lead the market in 2024. Lithium-ion batteries employ graphene as an anode material. Its high electrical conductivity and large surface area enhance the capacity and charge-discharge efficiency of batteries. Graphene oxide and reduced graphene oxide are adopted as components of battery separators. These materials assist in enhancing the thermal and mechanical stability of the separator while maintaining good ionic conductivity. This also improves the safety and overall performance of the battery. Besides this, the rising utilization of batteries in vehicles is catalyzing the demand for graphene.

Analysis by End-Use Industry:

- Electronics and Telecommunication

- Bio-medical and Healthcare

- Energy

- Aerospace and Defense

- Others

Electronics and telecommunication lead the market in 2024. The electronics and telecommunication sector uses graphene for making flexible and bendable electronic components, including wearable electronics, displays, and flexible sensors. Graphene-based sensors are sensitive to a variety of signals, such as temperature, pressure, and gas molecules. In addition, graphene antennas enhance the performance of wireless communication devices. They can also function over a wide array of frequencies and offer improved radiation efficiency. Furthermore, there is a rise in the adoption of wearable electronics owing to changing lifestyles of individuals. The global wearable electronics market is projected to grow to US$ 624.7 Billion by 2032, as claimed by the IMARC Group.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share due to the growing emphasis on developing efficient semiconductor materials. Along with this, rising demand for energy storage solutions that are more efficient and longer lasting is fueling growth in the market. In addition to this, growing healthcare expenses coupled with the development of drug delivery, tissue engineering, and diagnostic devices support the market growth. The region also benefits from significant government investments in nanotechnology research and development. Moreover, the increasing adoption of graphene-based materials in automotive and aerospace industries further drives the market's expansion in Asia-Pacific.

Key Regional Takeaways:

United States Graphene Market Analysis

The advancements in technology, rising demand for lightweight and durable materials, and increasing investment in research and development (R&D) activities is propelling the market growth. One key driver is the increasing use of graphene in energy storage systems, including lithium-ion batteries and supercapacitors. With the growing demand for electric vehicles (EVs) and renewable energy, graphene's ability to improve battery efficiency and lifespan is attracting significant attention. In 2023, sales of new electric light-duty vehicles in the United States reached about 1.4 Million, as reported by the International Council on Clean Transportation. In addition, the U.S. Department of Energy's focus on enhancing energy storage technologies is contributing to increased research funding in this domain. The electronics sector is another major growth area. Graphene's high electrical conductivity and transparency make it ideal for applications in flexible displays, sensors, and high-speed transistors. Additionally, rising environmental concerns are encouraging the use of graphene in water filtration systems, where it aids in removing contaminants efficiently. Federal policies promoting sustainable technologies are further impelling the adoption of graphene in environmental applications.

Asia Pacific Graphene Market Analysis

The Asia Pacific region's graphene market is driven by robust industrial growth, increasing investments in advanced materials, and government initiatives supporting innovation. India's industrial production increased to 3.8% in December 2023, as per the Ministry of Statistics and Programme Implementation (MoSPI). This region, home to leading economies including China, Japan, South Korea, and India, is becoming a global hub for graphene research, development, and commercialization. Moreover, rapid advancements in the electronics industry are a major driver in the Asia Pacific market. Countries, such as South Korea and Japan, known for their cutting-edge semiconductor and display technologies, are increasingly incorporating graphene into flexible displays, transistors, and high-speed circuits. Furthermore, the rising focus on energy storage is supporting the market growth. Additionally, with rising adoption of electric vehicles (EVs) and renewable energy solutions, graphene is being used to improve the performance and longevity of lithium-ion batteries and supercapacitors. China, a global leader in EV production, is driving demand for graphene-based energy storage solutions, supported by significant government incentives for clean energy technologies. China and India are using graphene to improve the performance of materials, reduce the weight of vehicles and aircraft, and enhance energy efficiency. Apart from this, the significant government support through funding, partnerships, and other positive policies on advanced material research is driving graphene development in the region.

Europe Graphene Market Analysis

Increased investment in research and development, the demand for advanced materials, and the region's focus on sustainability and innovation is driving the growth of the market. Europe has emerged as a leader in graphene technology through partnerships between industry, academia, and government. The commitment to green energy solutions and decarbonization is one key driver. This would complement Europe's general thrust of devising renewables as an energy base while encouraging electric vehicles. Graphene can improve the energy storage efficiency of batteries and supercapacitors. The European Environment Agency estimates that 24.1% of the EU's total energy consumption in 2023 came from renewable sources. Moreover, the European Green Deal and initiatives such as Horizon Europe are providing substantial funding for graphene research, particularly in energy applications. The electronics and semiconductors industries are other contributors to growth in the market. Graphene's properties also include high electrical conductivity and mechanical flexibility, giving it an application in developing cutting-edge components: sensors, transistors, and flexible displays. European firms are already using graphene-based technology to improve their device performance based on a relatively well-established electronic ecosystem. Automotive and aerospace segments constitute considerable market share for graphene in Europe, integrating it into lightweight composites for fuel efficiency and emission management according to EU regulations. The exceptional strength and durability of graphene make it particularly useful for electric vehicles and high-performance aerospace components.

Latin America Graphene Market Analysis

The region's expanding automotive and aerospace sectors are adopting graphene to enhance material strength, reduce weight, and improve energy efficiency. According to the CEIC, Brazil motor vehicle production was reported at 2,324,838.000 units in December 2023. In line with this, Brazil, with its robust industrial base, is a leading contributor, supported by government-backed research programs. Energy storage solutions are another key driver, as Latin America's renewable energy initiatives and the rising adoption of electric vehicles spur demand for graphene-enhanced batteries and supercapacitors. Countries such as Chile, a major lithium producer, are exploring synergies between local resources and graphene technologies. Besides this, graphene's use in water purification aligns with regional efforts to improve water quality. Its ability to efficiently remove contaminants makes it a valuable material in addressing water scarcity and pollution challenges. Furthermore, collaborations between academia and industry are further accelerating graphene innovation across Latin America.

Middle East and Africa Graphene Market Analysis

The Middle East and Africa graphene market is driven by growing investments in advanced materials, increasing demand for sustainable technologies, and regional economic diversification initiatives. The rising number of renewable energy projects in the Middle East, particularly solar power, is enhancing interest in graphene-based energy storage and photovoltaic applications. By the end of 2023, the production capacity of renewable energy projects under construction in Saudi Arabia will exceed 8 GW, as per the Saudi and Middle East.

Graphene's high conductivity and efficiency enhance the performance of solar panels and batteries, aligning with the region's clean energy goals. In Africa, the need for effective water purification technologies is a key driver. Graphene's capability to filter impurities and improve water quality addresses critical challenges in water-scarce areas, supporting governmental and non-governmental sustainability initiatives. Additionally, increased collaborations between local industries and global research institutions are accelerating graphene innovation and commercialization in the region.

Competitive Landscape:

Key market players are investing hugely to expand the application range of graphene, which include new manufacturing techniques, improving graphene product quality, and discovering new applications for graphene in different fields. They also diversify their product portfolios in order to reach a wider spectrum of graphene-based materials and products. Along with this, large companies have taken to upscaling their manufacturing process through designing large-scale manufacturing plants and further refining manufacturing methodologies. The organizations also forge strategic collaborations with others such as the university, research institute, or even other organizations operating in this sector for new products that might incorporate graphene-based innovation. Haydale Graphene Industries announced its collaboration with Cadent Ltd to manufacture graphene ink-based low-power radiator heaters on 24 July 2023.

The report provides a comprehensive analysis of the competitive landscape in the graphene market with detailed profiles of all major companies, including:

- ACS Material, LLC,

- Global Graphene Group, Inc.

- CVD Equipment Corporation

- Grafoid Inc.

- G6 Materials Corp. (Graphene 3D Lab Inc.)

- Graphene NanoChem PLC

- Graphenea Inc.

- Haydale Graphene Industries Plc

- Vorbeck Materials Corp.

- XG Sciences Inc.

Key Questions Answered in This Report

- 1.How big is the global graphene market?

- 2.What is the expected growth rate of the global graphene market during 2025-2033?

- 3.What are the key factors driving the global graphene market?

- 4.What are the key regions in the global graphene market?

- 5.Who are the key players/companies in the global graphene market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

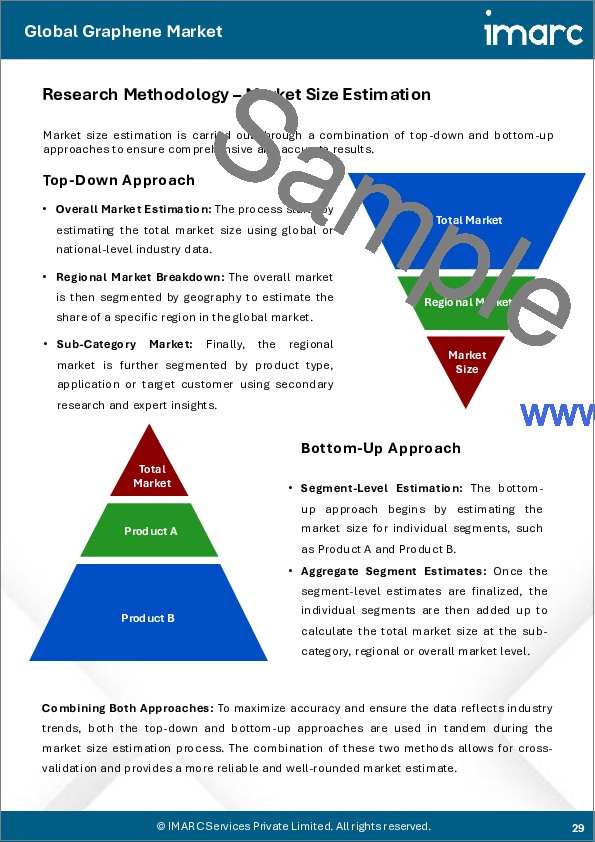

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Graphene Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type

- 6.1 Mono-layer & Bi-layer Graphene

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Few Layer Graphene (FLG)

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Graphene Oxide (GO)

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Graphene Nano Platelets (GNP)

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Application

- 7.1 Batteries

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Supercapacitors

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Transparent Electrodes

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Integrated Circuits

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Others

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

8 Market Breakup by End-Use Industry

- 8.1 Electronics and Telecommunication

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Bio-medical and Healthcare

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Energy

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Aerospace and Defense

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Others

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Indicators

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 ACS Material, LLC

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.2 Global Graphene Group, Inc.

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.3 CVD Equipment Corporation

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.4 Grafoid Inc.

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.5 G6 Materials Corp. (Graphene 3D Lab Inc.)

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.6 Graphene NanoChem PLC

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.7 Graphenea Inc.

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.8 Haydale Graphene Industries Plc

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.9 Vorbeck Materials Corp.

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 XG Sciences Inc.

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.1 ACS Material, LLC