|

|

市場調査レポート

商品コード

1729426

日本のアンモニア市場レポート:物理的形状、用途、最終用途産業、地域別、2025年~2033年Japan Ammonia Market Report by Physical Form, Application, End Use Industry, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 日本のアンモニア市場レポート:物理的形状、用途、最終用途産業、地域別、2025年~2033年 |

|

出版日: 2025年05月01日

発行: IMARC

ページ情報: 英文 120 Pages

納期: 5~7営業日

|

全表示

- 概要

- 目次

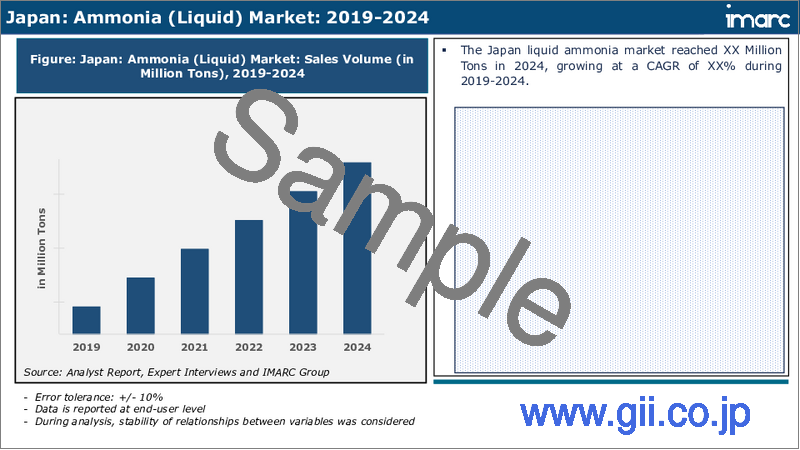

日本のアンモニアの市場規模は2024年に130万トンに達しました。今後、IMARC Groupは、市場は2033年までに190万トンに達し、2025~2033年の成長率(CAGR)は4.1%になると予測しています。市場は、水処理および廃水管理プロセスにおける同製品の広範な採用や、インフラ整備の増加など、重要な要因によって牽引されています。

本レポートで扱う主な質問

- 日本のアンモニア市場はこれまでどのように推移し、今後どのように推移するのか?

- COVID-19が日本のアンモニア市場に与えた影響は?

- 日本のアンモニア市場の物理的形態による区分は?

- 日本のアンモニア市場の用途別区分は?

- 日本のアンモニア市場の最終用途産業別の区分は?

- 日本のアンモニア市場のバリューチェーンにおける様々なステージとは?

- 日本のアンモニアの主な促進要因と課題は?

- 日本のアンモニア市場の構造と主要プレーヤーは?

- 日本のアンモニア市場における競合の程度は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 市場推定

- 調査手法

第3章 エグゼクティブサマリー

第4章 日本のアンモニア市場:イントロダクション

- 概要

- 市場力学

- 業界動向

- 競合情報

第5章 日本のアンモニア市場情勢

- 過去および現在の市場動向(2019~2024年)

- 市場予測(2025~2033年)

第6章 日本のアンモニア市場:物理的形態別の内訳

- 液体

- 粉

- ガス

第7章 日本のアンモニア市場:用途別の内訳

- MAPとDAP

- 尿素

- 硝酸

- 硫酸アンモニウム

- 硝酸アンモニウム

- その他

第8章 日本のアンモニア市場:最終用途産業別の内訳

- 農薬

- 工業化学

- 鉱業

- 医薬品

- テキスタイル

- その他

第9章 日本のアンモニア市場:競合情勢

- 概要

- 市場構造

- 市場企業のポジショニング

- 主要成功戦略

- 競合ダッシュボード

- 企業評価象限

第10章 主要企業のプロファイル

第11章 日本のアンモニア市場:業界分析

- 促進要因、抑制要因、機会

- ポーターのファイブフォース分析

- バリューチェーン分析

第12章 付録

Japan ammonia market size reached 1.3 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 1.9 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. The market is being driven by significant factors, including the extensive adoption of the product in water treatment and wastewater management processes, as well as the increasing development of infrastructure.

Ammonia is an odorless gas with a distinct, sharp smell. Its chemical formula is NH3, consisting of a single nitrogen atom bonded to three hydrogen atoms. It exhibits high solubility in water and readily forms ammonium ions (NH4+) when dissolved in aqueous solutions. This chemical compound plays a crucial role in multiple industries and applications. One of its primary functions is in fertilizer production, where it provides essential nitrogen for plant growth. Additionally, it serves as a refrigerant due to its ability to absorb significant heat during evaporation, making it an effective coolant. Furthermore, it is employed in the manufacturing of cleaning agents, explosives, and various chemicals.

Japan Ammonia Market Trends:

With rapid urbanization, infrastructural development, and increasing construction activities across the globe, the demand for ammonia-based construction materials is escalating. For instance, it is widely used in the manufacturing of construction materials, such as adhesives, coatings, and resins. It is an essential component in the production of particleboards, plywood, laminates, and various synthetic materials used in construction applications, which is acting as another significant growth-inducing factor. Along with this, ammonia finds extensive application in water treatment processes and wastewater management, thereby positively influencing the regional market. It is commonly used in both industrial and municipal wastewater treatment plants to remove contaminants and pollutants through processes, including biological nutrient removal (BNR). In addition, its versatility as a cleaning agent extends to industrial cleaning, where it is used in equipment maintenance, degreasing, and stain removal. The expanding cleaning industry, driven by rising cleanliness standards, is contributing to the growth of the market. Moreover, the expanding cosmetics and personal care industry, driven by changing consumer preferences and a focus on self-care, is fueling the product demand in this sector. This, in turn, is expected to catalyze the regional market over the forecasted period.

Japan Ammonia Market Segmentation:

Physical Form Insights:

- Liquid

- Powder

- Gas

Application Insights:

- MAP and DAP

- Urea

- Nitric Acid

- Ammonium Sulfate

- Ammonium Nitrate

- Others

End Use Industry Insights:

- Agrochemical

- Industrial Chemical

- Mining

- Pharmaceutical

- Textiles

- Others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key Questions Answered in This Report:

- How has the Japan ammonia market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan ammonia market?

- What is the breakup of the Japan ammonia market on the basis of physical form?

- What is the breakup of the Japan ammonia market on the basis of application?

- What is the breakup of the Japan ammonia market on the basis of end use industry?

- What are the various stages in the value chain of the Japan ammonia market?

- What are the key driving factors and challenges in the Japan ammonia?

- What is the structure of the Japan ammonia market and who are the key players?

- What is the degree of competition in the Japan ammonia market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Japan Ammonia Market - Introduction

- 4.1 Overview

- 4.2 Market Dynamics

- 4.3 Industry Trends

- 4.4 Competitive Intelligence

5 Japan Ammonia Market Landscape

- 5.1 Historical and Current Market Trends (2019-2024)

- 5.2 Market Forecast (2025-2033)

6 Japan Ammonia Market - Breakup by Physical Form

- 6.1 Liquid

- 6.1.1 Overview

- 6.1.2 Historical and Current Market Trends (2019-2024)

- 6.1.3 Market Forecast (2025-2033)

- 6.2 Powder

- 6.2.1 Overview

- 6.2.2 Historical and Current Market Trends (2019-2024)

- 6.2.3 Market Forecast (2025-2033)

- 6.3 Gas

- 6.3.1 Overview

- 6.3.2 Historical and Current Market Trends (2019-2024)

- 6.3.3 Market Forecast (2025-2033)

7 Japan Ammonia Market - Breakup by Application

- 7.1 MAP and DAP

- 7.1.1 Overview

- 7.1.2 Historical and Current Market Trends (2019-2024)

- 7.1.3 Market Forecast (2025-2033)

- 7.2 Urea

- 7.2.1 Overview

- 7.2.2 Historical and Current Market Trends (2019-2024)

- 7.2.3 Market Forecast (2025-2033)

- 7.3 Nitric Acid

- 7.3.1 Overview

- 7.3.2 Historical and Current Market Trends (2019-2024)

- 7.3.3 Market Forecast (2025-2033)

- 7.4 Ammonium Sulfate

- 7.4.1 Overview

- 7.4.2 Historical and Current Market Trends (2019-2024)

- 7.4.3 Market Forecast (2025-2033)

- 7.5 Ammonium Nitrate

- 7.5.1 Overview

- 7.5.2 Historical and Current Market Trends (2019-2024)

- 7.5.3 Market Forecast (2025-2033)

- 7.6 Others

- 7.6.1 Historical and Current Market Trends (2019-2024)

- 7.6.2 Market Forecast (2025-2033)

8 Japan Ammonia Market - Breakup by End Use Industry

- 8.1 Agrochemical

- 8.1.1 Overview

- 8.1.2 Historical and Current Market Trends (2019-2024)

- 8.1.3 Market Forecast (2025-2033)

- 8.2 Industrial Chemical

- 8.2.1 Overview

- 8.2.2 Historical and Current Market Trends (2019-2024)

- 8.2.3 Market Forecast (2025-2033)

- 8.3 Mining

- 8.3.1 Overview

- 8.3.2 Historical and Current Market Trends (2019-2024)

- 8.3.3 Market Forecast (2025-2033)

- 8.4 Pharmaceutical

- 8.4.1 Overview

- 8.4.2 Historical and Current Market Trends (2019-2024)

- 8.4.3 Market Forecast (2025-2033)

- 8.5 Textiles

- 8.5.1 Overview

- 8.5.2 Historical and Current Market Trends (2019-2024)

- 8.5.3 Market Forecast (2025-2033)

- 8.6 Others

- 8.6.1 Historical and Current Market Trends (2019-2024)

- 8.6.2 Market Forecast (2025-2033)

9 Japan Ammonia Market - Competitive Landscape

- 9.1 Overview

- 9.2 Market Structure

- 9.3 Market Player Positioning

- 9.4 Top Winning Strategies

- 9.5 Competitive Dashboard

- 9.6 Company Evaluation Quadrant

10 Profiles of Key Players

- 10.1 Company A

- 10.1.1 Business Overview

- 10.1.2 Product Portfolio

- 10.1.3 Business Strategies

- 10.1.4 SWOT Analysis

- 10.1.5 Major News and Events

- 10.2 Company B

- 10.2.1 Business Overview

- 10.2.2 Product Portfolio

- 10.2.3 Business Strategies

- 10.2.4 SWOT Analysis

- 10.2.5 Major News and Events

- 10.3 Company C

- 10.3.1 Business Overview

- 10.3.2 Product Portfolio

- 10.3.3 Business Strategies

- 10.3.4 SWOT Analysis

- 10.3.5 Major News and Events

- 10.4 Company D

- 10.4.1 Business Overview

- 10.4.2 Product Portfolio

- 10.4.3 Business Strategies

- 10.4.4 SWOT Analysis

- 10.4.5 Major News and Events

- 10.5 Company E

- 10.5.1 Business Overview

- 10.5.2 Product Portfolio

- 10.5.3 Business Strategies

- 10.5.4 SWOT Analysis

- 10.5.5 Major News and Events

11 Japan Ammonia Market - Industry Analysis

- 11.1 Drivers, Restraints and Opportunities

- 11.1.1 Overview

- 11.1.2 Drivers

- 11.1.3 Restraints

- 11.1.4 Opportunities

- 11.2 Porters Five Forces Analysis

- 11.2.1 Overview

- 11.2.2 Bargaining Power of Buyers

- 11.2.3 Bargaining Power of Suppliers

- 11.2.4 Degree of Competition

- 11.2.5 Threat of New Entrants

- 11.2.6 Threat of Substitutes

- 11.3 Value Chain Analysis