|

|

市場調査レポート

商品コード

1729349

日本のリスク管理市場レポート:コンポーネント別、展開モード別、企業規模別、業界別、地域別、2025年~2033年Japan Risk Management Market Report by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region 2025-2033. |

||||||

カスタマイズ可能

|

|||||||

| 日本のリスク管理市場レポート:コンポーネント別、展開モード別、企業規模別、業界別、地域別、2025年~2033年 |

|

出版日: 2025年05月01日

発行: IMARC

ページ情報: 英文 121 Pages

納期: 5~7営業日

|

全表示

- 概要

- 目次

日本のリスク管理の市場規模は2024年に7億9,700万米ドルに達しました。今後、IMARC Groupは、同市場が2033年までに25億7,000万米ドルに達し、2025~2033年の成長率(CAGR)は13.5%に達すると予測しています。事業運営の複雑化、機密データ、知的財産、顧客情報を保護するための強固なサイバーセキュリティリスク管理サービスに対する需要の高まり、厳しい規制環境などが市場を牽引する主な要因となっています。

本レポートで扱う主な質問

- 日本のリスク管理市場はこれまでどのように推移し、今後どのように推移するのか?

- COVID-19が日本のリスク管理市場に与えた影響は?

- 日本のリスク管理市場のコンポーネント別区分は?

- 日本のリスク管理市場の展開モード別区分は?

- 日本のリスク管理市場の企業規模別区分は?

- 日本のリスク管理市場の業界別区分は?

- 日本のリスク管理市場のバリューチェーンにおける様々なステージとは?

- 日本のリスク管理市場の主な促進要因と課題は?

- 日本のリスク管理市場の構造と主要プレーヤーは?

- 日本のリスク管理市場における競合の程度は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 市場推定

- 調査手法

第3章 エグゼクティブサマリー

第4章 日本のリスク管理市場:イントロダクション

- 概要

- 市場力学

- 業界動向

- 競合情報

第5章 日本のリスク管理市場情勢

- 過去および現在の市場動向(2019~2024年)

- 市場予測(2025~2033年)

第6章 日本のリスク管理市場:コンポーネント別の内訳

- ソフトウェア

- サービス

第7章 日本のリスク管理市場:展開モード別の内訳

- オンプレミス

- クラウドベース

第8章 日本のリスク管理市場:企業規模別内訳

- 大企業

- 中小企業

第9章 日本のリスク管理市場:業界別内訳

- BFSI

- ITおよび通信

- 小売り

- ヘルスケア

- エネルギーと公益事業

- 製造

- 政府と防衛

- その他

第10章 日本のリスク管理市場:競合情勢

- 概要

- 市場構造

- 市場企業のポジショニング

- 主要成功戦略

- 競合ダッシュボード

- 企業評価象限

第11章 主要企業のプロファイル

第12章 日本のリスク管理市場:業界分析

- 促進要因、抑制要因、機会

- ポーターのファイブフォース分析

- バリューチェーン分析

第13章 付録

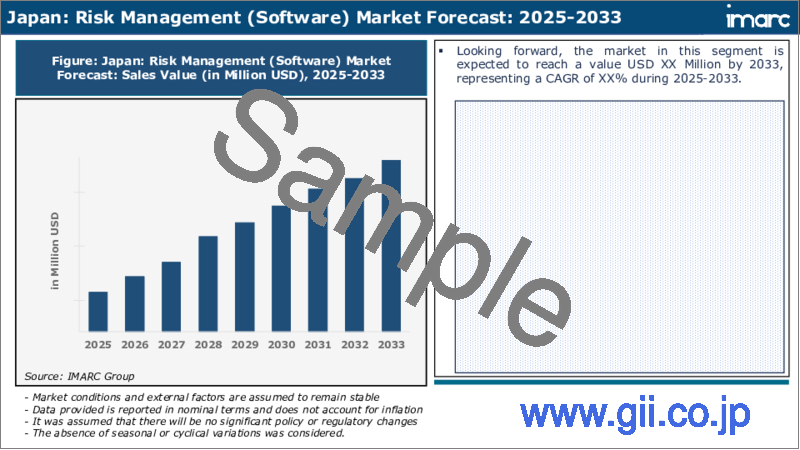

The Japan risk management market size reached USD 797.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,570.0 Million by 2033, exhibiting a growth rate (CAGR) of 13.5% during 2025-2033. The growing complexity of business operations, rising demand for robust cybersecurity risk management services to safeguard sensitive data, intellectual property, and customer information, and stringent regulatory environment represent some of the key factors driving the market.

Risk management is a systematic approach employed by organizations to identify, assess, and mitigate potential threats and uncertainties that could impact the achievement of their objectives. It involves the identification and analysis of various risks, followed by the implementation of appropriate measures to minimize their potential negative impacts. It helps companies enhance their decision-making processes, protect their assets, and improve overall performance. It also enables organizations to proactively identify potential risks before they encounter significant issues, thereby reducing the likelihood of unexpected setbacks. It assists in gaining a better understanding of their vulnerabilities and developing contingency plans to handle adverse situations more effectively. Risk management enhances the credibility and reliability of organizations in the eyes of stakeholders, including clients, investors, and partners. By demonstrating a commitment to identifying and addressing potential risks, companies can foster trust and confidence, leading to stronger relationships with stakeholders. Furthermore, effective risk management contributes to cost reduction and efficiency improvements. As it fosters a culture of proactive decision-making and innovation, the demand for risk management is rising in Japan.

Japan Risk Management Market Trends:

At present, the increasing complexity of business operations and the globalization of markets represent one of the key factors supporting the growth of the market in Japan. Companies operating in diverse sectors are facing multifaceted risks, including financial, operational, and reputational. As a result, businesses are seeking comprehensive risk management services to mitigate potential threats and enhance their overall resilience in the country. Besides this, the rising prevalence of cyber threats posing significant challenges for businesses in Japan is propelling the growth of the market. With the proliferation of digitalization and reliance on technology, cyberattacks are becoming more sophisticated and frequent in the country. Consequently, the demand for robust cybersecurity risk management services is increasing to safeguard sensitive data, intellectual property, and customer information. In addition, the regulatory environment in Japan is becoming more stringent, especially in sectors, such as finance and healthcare. Compliance with various regulatory frameworks and reporting requirements necessitates the implementation of rigorous risk management practices. Moreover, key market players are actively seeking support from risk management consultants to ensure adherence to these evolving regulations. Additionally, as Japan is prone to natural disasters like earthquakes, tsunamis, and typhoons on account of its climate and topography, there is rise in the focus on disaster risk management. Furthermore, organizations are proactively seeking risk assessment and contingency planning services to prepare for potential catastrophes and minimize their impact on business operations.

Japan Risk Management Market Segmentation:

Component Insights:

- Software

- Services

Deployment Mode Insights:

- On-premises

- Cloud-based

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Industry Vertical Insights:

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Government and Defense

- Others

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the Japan risk management market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key Questions Answered in This Report:

- How has the Japan risk management market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan risk management market?

- What is the breakup of the Japan risk management market on the basis of component?

- What is the breakup of the Japan risk management market on the basis of deployment mode?

- What is the breakup of the Japan risk management market on the basis of enterprise size?

- What is the breakup of the Japan risk management market on the basis of industry vertical?

- What are the various stages in the value chain of the Japan risk management market?

- What are the key driving factors and challenges in the Japan risk management market?

- What is the structure of the Japan risk management market and who are the key players?

- What is the degree of competition in the Japan risk management market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Japan Risk Management Market - Introduction

- 4.1 Overview

- 4.2 Market Dynamics

- 4.3 Industry Trends

- 4.4 Competitive Intelligence

5 Japan Risk Management Market Landscape

- 5.1 Historical and Current Market Trends (2019-2024)

- 5.2 Market Forecast (2025-2033)

6 Japan Risk Management Market - Breakup by Component

- 6.1 Software

- 6.1.1 Overview

- 6.1.2 Historical and Current Market Trends (2019-2024)

- 6.1.3 Market Forecast (2025-2033)

- 6.2 Services

- 6.2.1 Overview

- 6.2.2 Historical and Current Market Trends (2019-2024)

- 6.2.3 Market Forecast (2025-2033)

7 Japan Risk Management Market - Breakup by Deployment Mode

- 7.1 On-premises

- 7.1.1 Overview

- 7.1.2 Historical and Current Market Trends (2019-2024)

- 7.1.3 Market Forecast (2025-2033)

- 7.2 Cloud-based

- 7.2.1 Overview

- 7.2.2 Historical and Current Market Trends (2019-2024)

- 7.2.3 Market Forecast (2025-2033)

8 Japan Risk Management Market - Breakup by Enterprise Size

- 8.1 Large Enterprises

- 8.1.1 Overview

- 8.1.2 Historical and Current Market Trends (2019-2024)

- 8.1.3 Market Forecast (2025-2033)

- 8.2 Small and Medium-sized Enterprises

- 8.2.1 Overview

- 8.2.2 Historical and Current Market Trends (2019-2024)

- 8.2.3 Market Forecast (2025-2033)

9 Japan Risk Management Market - Breakup by Industry Vertical

- 9.1 BFSI

- 9.1.1 Overview

- 9.1.2 Historical and Current Market Trends (2019-2024)

- 9.1.3 Market Forecast (2025-2033)

- 9.2 IT and Telecom

- 9.2.1 Overview

- 9.2.2 Historical and Current Market Trends (2019-2024)

- 9.2.3 Market Forecast (2025-2033)

- 9.3 Retail

- 9.3.1 Overview

- 9.3.2 Historical and Current Market Trends (2019-2024)

- 9.3.3 Market Forecast (2025-2033)

- 9.4 Healthcare

- 9.4.1 Overview

- 9.4.2 Historical and Current Market Trends (2019-2024)

- 9.4.3 Market Forecast (2025-2033)

- 9.5 Energy and Utilities

- 9.5.1 Overview

- 9.5.2 Historical and Current Market Trends (2019-2024)

- 9.5.3 Market Forecast (2025-2033)

- 9.6 Manufacturing

- 9.6.1 Overview

- 9.6.2 Historical and Current Market Trends (2019-2024)

- 9.6.3 Market Forecast (2025-2033)

- 9.7 Government and Defense

- 9.7.1 Overview

- 9.7.2 Historical and Current Market Trends (2019-2024)

- 9.7.3 Market Forecast (2025-2033)

- 9.8 Others

- 9.8.1 Historical and Current Market Trends (2019-2024)

- 9.8.2 Market Forecast (2025-2033)

10 Japan Risk Management Market - Competitive Landscape

- 10.1 Overview

- 10.2 Market Structure

- 10.3 Market Player Positioning

- 10.4 Top Winning Strategies

- 10.5 Competitive Dashboard

- 10.6 Company Evaluation Quadrant

11 Profiles of Key Players

- 11.1 Company A

- 11.1.1 Business Overview

- 11.1.2 Services Offered

- 11.1.3 Business Strategies

- 11.1.4 SWOT Analysis

- 11.1.5 Major News and Events

- 11.2 Company B

- 11.2.1 Business Overview

- 11.2.2 Services Offered

- 11.2.3 Business Strategies

- 11.2.4 SWOT Analysis

- 11.2.5 Major News and Events

- 11.3 Company C

- 11.3.1 Business Overview

- 11.3.2 Services Offered

- 11.3.3 Business Strategies

- 11.3.4 SWOT Analysis

- 11.3.5 Major News and Events

- 11.4 Company D

- 11.4.1 Business Overview

- 11.4.2 Services Offered

- 11.4.3 Business Strategies

- 11.4.4 SWOT Analysis

- 11.4.5 Major News and Events

- 11.5 Company E

- 11.5.1 Business Overview

- 11.5.2 Services Offered

- 11.5.3 Business Strategies

- 11.5.4 SWOT Analysis

- 11.5.5 Major News and Events

12 Japan Risk Management Market - Industry Analysis

- 12.1 Drivers, Restraints and Opportunities

- 12.1.1 Overview

- 12.1.2 Drivers

- 12.1.3 Restraints

- 12.1.4 Opportunities

- 12.2 Porters Five Forces Analysis

- 12.2.1 Overview

- 12.2.2 Bargaining Power of Buyers

- 12.2.3 Bargaining Power of Suppliers

- 12.2.4 Degree of Competition

- 12.2.5 Threat of New Entrants

- 12.2.6 Threat of Substitutes

- 12.3 Value Chain Analysis