|

|

市場調査レポート

商品コード

1722962

モリブデンの市場規模、シェア、動向、予測:製品タイプ、販売チャネル、最終用途、地域別、2025-2033年Molybdenum Market Size, Share, Trends and Forecast by Product Type, Sales Channel, End Use, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| モリブデンの市場規模、シェア、動向、予測:製品タイプ、販売チャネル、最終用途、地域別、2025-2033年 |

|

出版日: 2025年05月01日

発行: IMARC

ページ情報: 英文 136 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のモリブデンの市場規模は2024年に5,868.7トンとなりました。今後、IMARC Groupは、2033年には7,170.2トンに達し、2025年から2033年のCAGRは2.25%になると予測しています。アジア太平洋地域は現在、2024年のモリブデンの市場シェアの61.4%以上を占めています。同地域の市場を牽引しているのは、鉄鋼・合金業界の需要拡大、エレクトロニクス・エネルギー分野での採用拡大、生産プロセスにおける継続的な技術進歩、新興経済諸国におけるインフラ整備などです。

モリブデンは、高温での強度、耐食性、機械的安定性を高め、融点が高い耐火性金属です。豆類、穀類、葉物野菜などの食品に含まれ、様々な酵素プロセスにおいて重要な役割を果たす、人間の食生活に不可欠な微量元素です。生物の健康維持を助けます。高強度合金や超合金の生産に広く使用されているため、モリブデンの需要は世界中で増加しています。

現在、モリブデンは耐食性に優れているため、エレクトロニクス分野での採用が増加しており、市場の成長に寄与しています。これに伴い、航空宇宙分野では振動を低減し、パイロットや乗客の快適性を向上させる必要性が高まっており、市場の成長を強化しています。さらにモリブデンは、自動車の排ガスを低減し、厳しい排ガス基準に適合する触媒コンバーターの主要部品であるため、採用が増加しており、市場の成長を後押ししています。また、モリブデンの耐久性と性能の高さから、いくつかの産業でモリブデンの利用が増加しており、業界の投資家に有利な成長機会を提供しています。さらに、プレミア弾頭、ノズル、成形装薬ライナーの製造が増加していることも、市場の成長を支えています。

モリブデンの市場動向と促進要因:

高強度鋼と超合金の需要増加

高強度鋼と超合金の需要の高まりが市場の成長に寄与しています。さらに、これらの材料は、耐久性と極限条件への耐性が求められる航空宇宙、自動車、建設産業で広く利用されています。航空宇宙分野では、モリブデンのに基づく超合金は、極度の熱と圧力の下で信頼性の高い性能を確保するため、航空機エンジン部品に不可欠です。さらに、自動車産業では、燃費と安全性を高めた軽量で高強度な自動車部品の製造に使用されており、市場の見通しは明るいです。これとは別に、工業用材料の品質と耐久性を高めることへの注目も高まっています。

インフラ・プロジェクトの増加

世界中でインフラ開発や建設プロジェクトが増加していることが、市場の成長を支えています。これに伴い、重要なインフラ・プロジェクトの寿命と性能を確保する上で重要な役割を果たしています。これに加えて、発電所や化学処理施設で使用される圧力容器のようなインフラ部品に不可欠な高温に対する耐性があります。さらに、橋梁、高層ビル、高速道路の建設に広く利用され、厳しい気象条件に耐えながら必要な強度と耐食性を提供します。これとは別に、世界中の大衆の間で住宅リフォームの需要が高まっていることも、市場の成長を後押ししています。

排出量削減のための再生可能エネルギーへの注目の高まり

二酸化炭素排出量を削減し、環境の持続可能性を維持するために再生可能エネルギーへの注目が高まっていることが、市場の成長を支えています。また、風力タービンやソーラーパネルは、クリーンエネルギー発電に不可欠な部品であり、モリブデンを含む材料に依存することが多いです。これに伴い、風力タービンのシャフトは、その強度と耐疲労性により、この耐火性金属を必要とします。これとは別に、エネルギー・インフラの拡大と、よりクリーンなエネルギー源への注目が市場の成長に寄与しています。さらに、極端な温度や高圧環境などの過酷な条件で使用される掘削工具や機器にも使用されています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

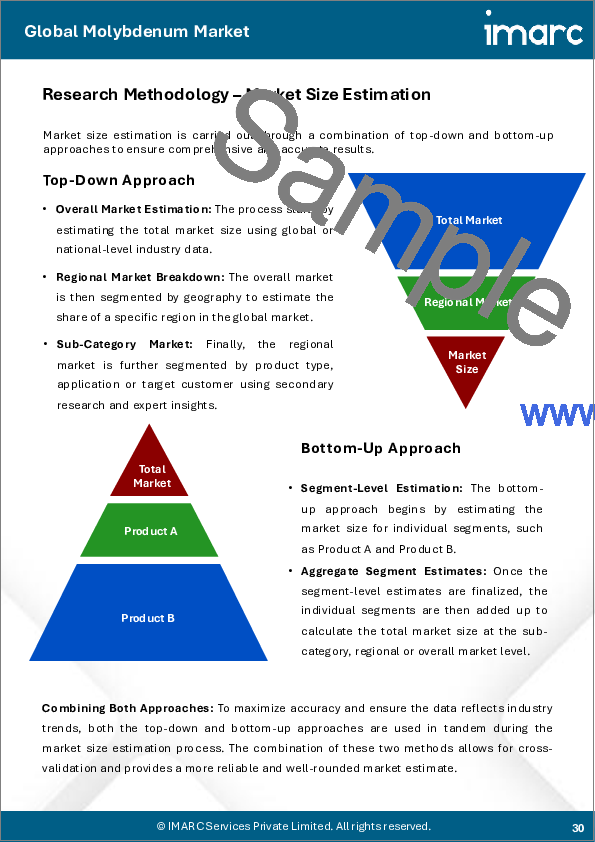

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のモリブデンの市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品タイプ別

- 鋼鉄

- 化学薬品

- 鋳造所

- 金属

- ニッケル合金

第7章 市場内訳:販売チャネル別

- 製造元/販売元

- アフターマーケット

第8章 市場内訳:最終用途別

- 石油・ガス

- 自動車

- 重機

- エネルギー

- 航空宇宙および防衛

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- ABSCO Limited

- American CuMo Mining Corporation

- Centerra Gold Inc.

- China Molybdenum Co. Ltd.

- China Rare Metal Material Co. Ltd.

- Codelco

- Freeport-McMoRan Inc.

- Grupo Mexico

- Jinduicheng Molybdenum Co. Ltd

- KGHM Polska Miedz S.A.

- Molten Corporation

- Moly Metal L.L.P

List of Figures

- Figure 1: Global: Molybdenum Market: Major Drivers and Challenges

- Figure 2: Global: Molybdenum Market: Volume Trends (in Tons), 2019-2024

- Figure 3: Global: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 4: Global: Molybdenum Market: Breakup by Product Type (in %), 2024

- Figure 5: Global: Molybdenum Market: Breakup by Sales Channel (in %), 2024

- Figure 6: Global: Molybdenum Market: Breakup by End Use (in %), 2024

- Figure 7: Global: Molybdenum Market: Breakup by Region (in %), 2024

- Figure 8: Global: Molybdenum (Steel) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 9: Global: Molybdenum (Steel) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 10: Global: Molybdenum (Chemical) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 11: Global: Molybdenum (Chemical) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 12: Global: Molybdenum (Foundry) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 13: Global: Molybdenum (Foundry) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 14: Global: Molybdenum (Molybdenum Metal) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 15: Global: Molybdenum (Molybdenum Metal) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 16: Global: Molybdenum (Nickel Alloy) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 17: Global: Molybdenum (Nickel Alloy) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 18: Global: Molybdenum (Manufacturer/Distributor) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 19: Global: Molybdenum (Manufacturer/Distributor) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 20: Global: Molybdenum (Aftermarket) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 21: Global: Molybdenum (Aftermarket) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 22: Global: Molybdenum (Oil and Gas) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 23: Global: Molybdenum (Oil and Gas) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 24: Global: Molybdenum (Automotive) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 25: Global: Molybdenum (Automotive) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 26: Global: Molybdenum (Heavy Machinery) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 27: Global: Molybdenum (Heavy Machinery) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 28: Global: Molybdenum (Energy) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 29: Global: Molybdenum (Energy) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 30: Global: Molybdenum (Aerospace and Defense) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 31: Global: Molybdenum (Aerospace and Defense) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 32: Global: Molybdenum (Other End Uses) Market: Volume Trends (in Tons), 2019 & 2024

- Figure 33: Global: Molybdenum (Other End Uses) Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 34: North America: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 35: North America: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 36: United States: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 37: United States: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 38: Canada: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 39: Canada: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 40: Asia-Pacific: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 41: Asia-Pacific: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 42: China: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 43: China: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 44: Japan: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 45: Japan: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 46: India: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 47: India: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 48: South Korea: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 49: South Korea: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 50: Australia: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 51: Australia: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 52: Indonesia: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 53: Indonesia: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 54: Others: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 55: Others: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 56: Europe: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 57: Europe: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 58: Germany: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 59: Germany: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 60: France: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 61: France: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 62: United Kingdom: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 63: United Kingdom: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 64: Italy: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 65: Italy: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 66: Spain: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 67: Spain: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 68: Russia: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 69: Russia: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 70: Others: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 71: Others: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 72: Latin America: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 73: Latin America: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 74: Brazil: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 75: Brazil: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 76: Mexico: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 77: Mexico: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 78: Others: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 79: Others: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 80: Middle East and Africa: Molybdenum Market: Volume Trends (in Tons), 2019 & 2024

- Figure 81: Middle East and Africa: Molybdenum Market: Breakup by Country (in %), 2024

- Figure 82: Middle East and Africa: Molybdenum Market Forecast: Volume Trends (in Tons), 2025-2033

- Figure 83: Global: Molybdenum Industry: SWOT Analysis

- Figure 84: Global: Molybdenum Industry: Value Chain Analysis

- Figure 85: Global: Molybdenum Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Molybdenum Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Molybdenum Market Forecast: Breakup by Product Type (in Tons), 2025-2033

- Table 3: Global: Molybdenum Market Forecast: Breakup by Sales Channel (in Tons), 2025-2033

- Table 4: Global: Molybdenum Market Forecast: Breakup by End Use (in Tons), 2025-2033

- Table 5: Global: Molybdenum Market Forecast: Breakup by Region (in Tons), 2025-2033

- Table 6: Global: Molybdenum Market: Competitive Structure

- Table 7: Global: Molybdenum Market: Key Players

The global molybdenum market size was valued at 5,868.7 Tons in 2024. Looking forward, IMARC Group estimates the market to reach 7,170.2 Tons by 2033, exhibiting a CAGR of 2.25% from 2025-2033. Asia Pacific currently dominates the molybdenum market share by holding over 61.4% in 2024. The market in the region is driven by the growing demand from the steel and alloy industries, increased adoption in electronics and energy sectors, ongoing technological advancements in production processes, and infrastructure development in emerging economies.

Molybdenum is a refractory metal that offers enhanced strength, corrosion resistance, and mechanical stability at high temperatures and has a high melting point. It is found in foods like legumes, grains, and leafy vegetables and is an essential trace element in the human diet that plays a vital role in various enzymatic processes. It assists in maintaining the health of living organisms. As it is widely employed in the production of high-strength alloys and superalloys, the demand for molybdenum is increasing across the globe.

At present, the rising employment of molybdenum in the electronics sector due to its corrosion-resistant properties is contributing to the growth of the market. In line with this, the increasing need to reduce vibration and improve pilot and passenger comfort in the aerospace sector is strengthening the growth of the market. Moreover, the rising adoption of molybdenum, as it is a key component in catalytic converters, which reduces emissions in vehicles and aligns with stringent emissions standards, is bolstering the growth of the market. In addition, the increasing utilization of molybdenum in several industries due to its durability and high performance is offering lucrative growth opportunities to industry investors. Furthermore, the rising manufacturing of premier warheads, nozzles, and shaped charge liners is supporting the growth of the market.

Molybdenum Market Trends/Drivers:

Rising demand for high-strength steel and superalloys

The rising demand for high-strength steel and superalloys is contributing to the growth of the market. In addition, these materials are widely utilized in the aerospace, automotive, and construction industries, where durability and resistance to extreme conditions are concerned. In the aerospace sector, molybdenum-based superalloys are vital for aircraft engine components to ensure reliable performance under extreme heat and pressure. Moreover, in the automotive industry, it is used to create lightweight and high-strength vehicle components with enhanced fuel efficiency and safety, which is offering a positive market outlook. Apart from this, there is a rise in the focus on enhancing the quality and durability of industrial materials.

Increasing number of infrastructure projects

The increasing number of infrastructure development and construction projects across the globe is supporting the growth of the market. In line with this, it plays a crucial role in ensuring the longevity and performance of critical infrastructure projects. Besides this, it is resistance to high temperatures that is vital in infrastructure components like pressure vessels used in power plants and chemical processing facilities. Moreover, it is widely utilized to build bridges, skyscrapers, and highways and provides the required strength and corrosion resistance while withstanding harsh weather conditions. Apart from this, the rising demand for residential renovation among the masses around the world is propelling the growth of the market.

Growing focus on renewable energy to reduce emissions

The growing focus on renewable energy to reduce carbon emissions and maintain environmental sustainability is supporting the growth of the market. Additionally, wind turbines and solar panels are essential components of clean energy generation that often rely on molybdenum-containing materials. In line with this, wind turbine shafts require this refractory metal due to their strength and resistance to fatigue. Apart from this, the expansion of energy infrastructure, along with the focus on a cleaner energy source, are contributing to the growth of the market. In addition, it is used in drilling tools and equipment that operate in harsh conditions, including extreme temperatures and high-pressure environments.

Molybdenum Industry Segmentation:

Breakup by Product Type:

- Steel

- Chemical

- Foundry

- Molybdenum Metal

- Nickel Alloy

Steel represents the largest market segment

Breakup by Sales Channel:

- Manufacturer/Distributor

- Aftermarket

Manufacturer or distributor includes the sale of products directly from manufacturers or through authorized distributors. Manufacturers supply their products to various industries and end-users through this channel. Authorized distributors often play a crucial role in reaching a broader customer base and providing technical support and expertise.

Aftermarket sales involve the resale of products or services by entities other than the original manufacturers or distributors. This channel includes businesses specializing in the recycling of materials and offering maintenance, repair, and replacement services. Aftermarket providers ensure the continued functionality and longevity of products.

Breakup by End Use:

- Oil and Gas

- Automotive

- Heavy Machinery

- Energy

- Aerospace and Defense

- Others

The oil and gas industry utilizes this metal, particularly in the form of specialized steel alloys. It enhances the strength and corrosion resistance of materials used in drilling equipment, such as drill pipes and casing, and in offshore structures and pipelines. In harsh and corrosive environments deep underground or underwater, it ensures the durability and safety of oil and gas operations.

In the automotive industry, it plays a crucial role in enhancing the performance and safety of vehicles. It is used to manufacture lightweight and high-strength components like engine parts, chassis components, and safety features. This not only improves fuel efficiency but also contributes to the structural integrity of vehicles, making them safer and more reliable.

The heavy machinery sector relies on this metal for construction and industrial equipment. It is used in the manufacturing of components for heavy machinery, such as bulldozer blades, excavator buckets, and crane parts. In addition, these components require exceptional strength and wear resistance.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest molybdenum market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to the rapid industrialization and urbanization. Apart from this, the rising development of high-quality steel and alloys is contributing to the growth of the market in the region. In line with this, the increasing utilization of molybdenum-infused steel for lightweight and strong vehicles is propelling the growth of the market. Besides this, the rising adoption of cleaner technologies is bolstering the growth of the market in the Asia Pacific region.

Competitive Landscape:

Several companies are rapidly investing in the mining and extraction of molybdenum ores by focusing on exploration, drilling, and ore processing activities. They are ensuring a consistent supply of raw materials for downstream applications. In line with this, key manufacturers are refining raw concentrates to create various products, such as molybdenum oxide, ferromolybdenum, and molybdenum alloys. Apart from this, many companies are investing in research and development (R&D) activities to develop innovative alloys and materials. In addition, they are focusing on adopting sustainable practices to reduce the environmental impact of mining operations. Furthermore, major players are ensuring product quality and compliance with industry standards and regulations.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABSCO Limited

- American CuMo Mining Corporation

- Centerra Gold Inc.

- China Molybdenum Co. Ltd.

- China Rare Metal Material Co. Ltd.

- Codelco

- Freeport-McMoRan Inc.

- Grupo Mexico

- Jinduicheng Molybdenum Co. Ltd

- KGHM Polska Miedz S.A.

- Molten Corporation

- Moly Metal L.L.P

Key Questions Answered in This Report

- 1.How big is the molybdenum market?

- 2.What is the future outlook of the molybdenum market?

- 3.What are the key factors driving the molybdenum market?

- 4.Which region accounts for the largest molybdenum market share?

- 5.Which are the leading companies in the global molybdenum market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Molybdenum Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product Type

- 6.1 Steel

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Chemical

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Foundry

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Molybdenum Metal

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Nickel Alloy

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Sales Channel

- 7.1 Manufacturer/Distributor

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Aftermarket

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by End Use

- 8.1 Oil and Gas

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Automotive

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Heavy Machinery

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Energy

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Aerospace and Defense

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Others

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 ABSCO Limited

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.2 American CuMo Mining Corporation

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.3 Centerra Gold Inc.

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 China Molybdenum Co. Ltd.

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.4.3 Financials

- 14.3.5 China Rare Metal Material Co. Ltd.

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.6 Codelco

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.7 Freeport-McMoRan Inc.

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.7.4 SWOT Analysis

- 14.3.8 Grupo Mexico

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.8.4 SWOT Analysis

- 14.3.9 Jinduicheng Molybdenum Co. Ltd

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 KGHM Polska Miedz S.A.

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.10.3 Financials

- 14.3.11 Molten Corporation

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.12 Moly Metal L.L.P

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.1 ABSCO Limited