|

|

市場調査レポート

商品コード

1722945

合成生物学の市場規模、シェア、動向、予測:製品、技術、用途、地域別、2025年~2033年Synthetic Biology Market Size, Share, Trends and Forecast by Product, Technology, Application, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 合成生物学の市場規模、シェア、動向、予測:製品、技術、用途、地域別、2025年~2033年 |

|

出版日: 2025年05月01日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

合成生物学の世界市場規模は2024年に185億米ドルとなりました。今後、IMARC Groupは、2033年には667億米ドルに達し、2025年から2033年にかけて15.3%のCAGRを示すと予測しています。現在市場を独占しているのは北米で、2024年の市場シェアは41.8%を超えます。北米の優位性は、強固なバイオテクノロジー・インフラ、研究事業への投資の増加、政府の支援策に起因しています。

合成生物学の市場分析:

主な市場促進要因:世界の合成生物学の市場は、遺伝子編集技術の向上により力強い成長を遂げています。

主な市場動向:学術界、産業界、政府間の協力体制がイノベーションと開発能力を強化しています。

地理的動向:バイオテクノロジーへの投資拡大により北米が市場を独占しています。しかし、アジア太平洋地域では研究活動や政府の取り組みが活発化しており、急成長市場として浮上しています。

競合情勢:主要企業は、技術革新を推進し、複雑な生物学的課題に対処するため、研究事業に投資しています。合成生物学の業界の主要市場プレイヤーには、GenScript Biotech Corporation、Amyris Inc.、Ginkgo Bioworks、Mammoth Biosciences、Novozymes、Merck KGaAなどがいます。

課題と機会:課題としては、遺伝子組み換え製品に関する倫理的・安全的懸念が挙げられます。しかしながら、規制を遵守し、倫理的に配慮されたイノベーションを開発する市場開拓の機会は、こうした課題を克服するものと予測されます。

合成生物学の市場動向と促進要因:

遺伝子編集技術の進歩

現在、CRISPR-Cas9のような様々な技術は、遺伝物質の正確かつ効率的な操作を可能にすることで生物学研究分野を向上させることができ、合成生物学の市場の需要を強化しています。研究者たちはDNA配列を極めて正確に設計、編集、操作しており、特定の機能に応じてカスタマイズされた複雑な合成生物の創出を容易にしています。この技術革新は、遺伝子治療による疾病治療や、酵素やバイオ燃料のような貴重な化合物を生産できる生物工学的生物の創出のような、新しい側面の開発に新たな道を開き、市場拡大に貢献しています。さらに、世界保健機関(WHO)はヒトゲノム編集の世界ガバナンスに関する画期的な勧告を発表し、安全性、有効性、倫理性を強調しました。

持続可能なソリューションへの需要

さまざまな業界において、持続可能で環境に優しいソリューションへの需要が高まっていることが、合成生物学の市場を後押ししています。合成生物学のは、事業による環境への影響を減らすという要求を満たすための様々な新しい道を各分野に提示しています。これに伴い、再生可能な資源から抽出されたバイオプラスチックの生産や、持続可能性に向けた世界の動きに沿った二酸化炭素排出量を削減したバイオ燃料の開発が、市場の成長に寄与しています。これとは別に、合成生物学のはバイオレメディエーション用の微生物を作り出すことができ、これは汚染物質を無害化する方法であり、環境を浄化し、様々な緊急の生態学的合併症に対処するのに役立ちます。さらに、合成生物学のは美容分野の持続可能な取り組みに革命を起こしています。Vogue Businessの推計によると、美容製品の20~40%が毎年廃棄物となり、業界ではリサイクル困難なパッケージが年間1,200億個も発生しています。さらに、化粧品原料の10種類のうち8種類は、持続不可能な方法で調達されています。これらの課題に対処するため、合成生物学のは微生物のDNAを改変し、持続可能な素材を作り出しています。合成生物学の市場価格は、技術革新と多様な用途による急成長を反映しています。

共同エコシステムと投資

学術界、産業界、政府間の協力的な相乗効果は、合成生物学の分野での研究活動を促進する環境を育みます。共同研究は、知識、資産、視点の交換を促進し、発明の速度を速める。政府当局は研究活動を支援するために助成金や資金を頻繁に提供し、既存企業と新興企業は市場の成長を促進する画期的なベンチャーのためにリソースを出し合う。これに加えて、バイオテクノロジー新興企業へのベンチャーキャピタル投資の急増は、この分野に重要な資本を注入し、萌芽的なアイデアを具体的な製品や合成生物学の市場への応用へと成長させます。この協力的なエコシステムが、研究、革新、商業化のサイクルを維持し、世界の合成生物学の市場を前進させています。

さらに、合成生物学の市場の将来は、比類のないイノベーション、持続可能なソリューション、広大な成長の可能性を約束します。Algal Bioのような企業は、多様な菌株を利用して斬新なソリューションを革新しており、Basecamp Researchのような新興企業は、機械学習(ML)を利用して合成タンパク質工学のための自然界の設計原理を解読しています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

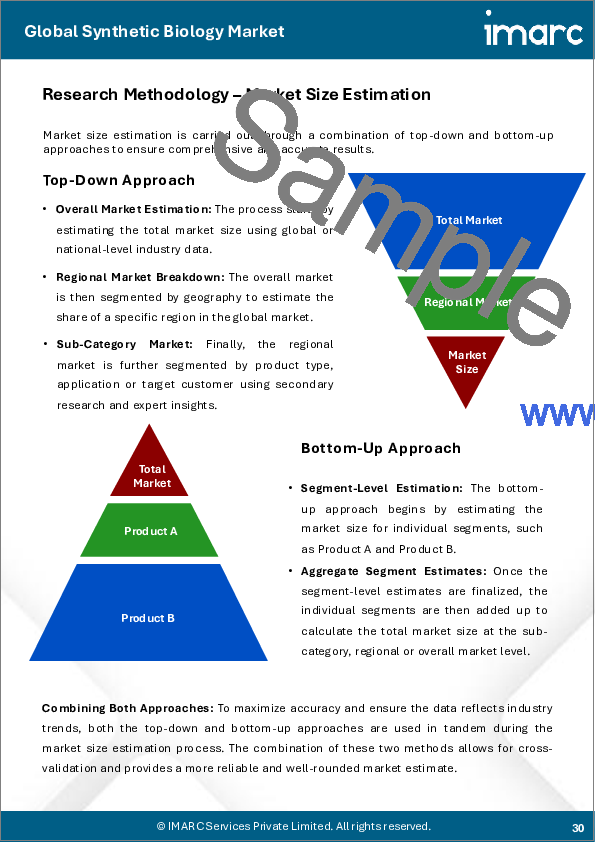

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の合成生物学市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品別

- オリゴヌクレオチド/オリゴプールと合成DNA

- 酵素

- クローニング技術キット

- 異種核酸

- シャーシ有機体

第7章 市場内訳:技術別

- NGSテクノロジー

- PCR技術

- ゲノム編集技術

- バイオプロセス技術

- その他

第8章 市場内訳:用途別

- ヘルスケア

- 主要セグメント

- 臨床

- 非臨床/研究

- 主要セグメント

- 非医療

- 主要セグメント

- バイオテクノロジー作物

- 特殊化学品

- バイオ燃料

- その他

- 主要セグメント

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Agilent Technologies Inc.

- Amyris Inc.

- Codexis Inc.

- Danaher Corporation

- Eurofins Scientific

- GenScript Biotech Corporation

- Illumina Inc.

- Merck KGaA

- New England Biolabs

- Synthego Corporation

- Thermo Fisher Scientific Inc.

- Twist Bioscience

- Viridos Inc.

List of Figures

- Figure 1: Global: Synthetic Biology Market: Major Drivers and Challenges

- Figure 2: Global: Synthetic Biology Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Synthetic Biology Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Synthetic Biology Market: Breakup by Product (in %), 2024

- Figure 5: Global: Synthetic Biology Market: Breakup by Technology (in %), 2024

- Figure 6: Global: Synthetic Biology Market: Breakup by Application (in %), 2024

- Figure 7: Global: Synthetic Biology Market: Breakup by Region (in %), 2024

- Figure 8: Global: Synthetic Biology (Oligonucleotide/Oligo Pools and Synthetic DNA) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Synthetic Biology (Oligonucleotide/Oligo Pools and Synthetic DNA) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Synthetic Biology (Enzymes) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Synthetic Biology (Enzymes) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Synthetic Biology (Cloning Technologies Kits) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Synthetic Biology (Cloning Technologies Kits) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Synthetic Biology (Xeno-nucleic Acids) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Synthetic Biology (Xeno-nucleic Acids) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Synthetic Biology (Chassis Organism) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Synthetic Biology (Chassis Organism) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Synthetic Biology (NGS Technology) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Synthetic Biology (NGS Technology) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Synthetic Biology (PCR Technology) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Synthetic Biology (PCR Technology) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Synthetic Biology (Genome Editing Technology) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Synthetic Biology (Genome Editing Technology) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Synthetic Biology (Bioprocessing Technology) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Synthetic Biology (Bioprocessing Technology) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Synthetic Biology (Other Technologies) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Synthetic Biology (Other Technologies) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Synthetic Biology (Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Synthetic Biology (Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Synthetic Biology (Non-Healthcare) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Synthetic Biology (Non-Healthcare) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: North America: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: North America: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: United States: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: United States: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Canada: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Canada: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Asia-Pacific: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Asia-Pacific: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: China: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: China: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Japan: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Japan: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: India: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: India: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: South Korea: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: South Korea: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Australia: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Australia: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Indonesia: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Indonesia: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Others: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Others: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Europe: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Europe: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Germany: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Germany: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: France: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: France: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: United Kingdom: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: United Kingdom: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Italy: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Italy: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Spain: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Spain: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Russia: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Russia: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Others: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Others: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Latin America: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Latin America: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Brazil: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Brazil: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Mexico: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Mexico: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Others: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Others: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: Middle East and Africa: Synthetic Biology Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: Middle East and Africa: Synthetic Biology Market: Breakup by Country (in %), 2024

- Figure 80: Middle East and Africa: Synthetic Biology Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 81: Global: Synthetic Biology Industry: SWOT Analysis

- Figure 82: Global: Synthetic Biology Industry: Value Chain Analysis

- Figure 83: Global: Synthetic Biology Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Synthetic Biology Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Synthetic Biology Market Forecast: Breakup by Product (in Million USD), 2025-2033

- Table 3: Global: Synthetic Biology Market Forecast: Breakup by Technology (in Million USD), 2025-2033

- Table 4: Global: Synthetic Biology Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Synthetic Biology Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Synthetic Biology Market: Competitive Structure

- Table 7: Global: Synthetic Biology Market: Key Players

The global synthetic biology market size was valued at USD 18.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 66.7 Billion by 2033, exhibiting a CAGR of 15.3% from 2025-2033. North America currently dominates the market, holding a market share of over 41.8% in 2024. The dominance of North America can be attributed to robust biotechnology infrastructure, increasing investments in research operations, and supportive government initiatives.

Synthetic Biology Market Analysis:

Major Market Drivers: The global synthetic biology market is experiencing robust growth, driven by increasing improvements in gene editing technologies.

Key Market Trends: Collaborative efforts between academia, industry, and government are enhancing innovation and development capabilities.

Geographical Trends: North America dominates the market owing to the growing investments in biotechnology. However, Asia Pacific is emerging as a fast-growing market due to the increasing research activities and government initiatives in the region.

Competitive Landscape: Key players are investing in research operations to drive innovation and address complex biological challenges. Some of the major market players in the synthetic biology industry include GenScript Biotech Corporation, Amyris Inc., Ginkgo Bioworks, Mammoth Biosciences, Novozymes, Merck KGaA, among many others.

Challenges and Opportunities: Challenges include ethical and safety concerns related to genetically modified products. Nonetheless, opportunities for the market to develop regulatory-compliant, ethically considered innovations are projected to overcome these challenges.

Synthetic Biology Market Trends/Drivers:

Advancements in gene editing technologies

At present, various techniques like CRISPR-Cas9 are capable of improving the field of biology research by enabling precise and efficient manipulation of genetic material, strengthening the synthetic biology market demand. Researchers are designing, editing, and engineering DNA sequences with exceptional accuracy, facilitating the creation of intricate synthetic organisms customized according to specific functions. This innovation is opening new avenues for the development of novel aspects, like disease treatment through gene therapies and creation of bioengineered organisms capable of producing valuable compounds such as enzymes and biofuels, thus aiding in market expansion. Moreover, The World Health Organization (WHO) released groundbreaking recommendations for the global governance of human genome editing, emphasizing safety, efficacy, and ethics.

Demand for sustainable solutions

The rising demand for sustainable and environment-friendly solutions across various industries is propelling the synthetic biology market. Synthetic biology presents various new avenues for sectors to fulfill their demands to reduce the environmental impact of their operations. In line with this, the production of bioplastics extracted from renewable resources and the development of biofuels with reduced carbon emissions aligning with the global push towards sustainability are contributing to the market growth. Apart from this, synthetic biology is capable of creating microbes for bioremediation which is a method to detoxify contaminants or help clean up the environment and address various urgent ecological complications. Furthermore, synthetic biology is revolutionizing the sustainability efforts of the beauty sector. Vogue Business estimates that 20-40% of beauty products become waste annually, and the industry generates 120 billion units of difficult-to-recycle packaging yearly. Moreover, eight out of ten cosmetic ingredients are unsustainably sourced. To address these challenges, synthetic biology modifies microorganism DNA to create sustainable materials. The synthetic biology market price reflects rapid growth due to innovation and diverse applications.

Collaborative ecosystem and investment

The collaborative synergy between academia, industry, and government entities fosters a conducive environment for research operations within the synthetic biology field. Collaborations facilitate the exchange of knowledge, assets, and perspectives, thus quickening the rate of invention. Governing authorities frequently provide grants and funds to assist research endeavors, while established businesses and startups work together to pool resources for ground-breaking ventures that promote market growth. In addition to this, the surge in venture capital investments in biotechnology startups injects vital capital into the field, nurturing the growth of nascent ideas into tangible products and synthetic biology market application. This collaborative ecosystem sustains a cycle of research, innovation, and commercialization, propelling the global synthetic biology market forward.

Additionally, the future of the synthetic biology market promises unparalleled innovation, sustainability solutions, and expansive growth potential. Companies, such as Algal Bio utilize a diverse array of strains to innovate novel solutions, while startups like Basecamp Research employ machine learning (ML) to decipher the design principles of nature for synthetic protein engineering.

Synthetic Biology Industry Segmentation:

Breakup by Product:

- Oligonucleotide/Oligo Pools and Synthetic DNA

- Enzymes

- Cloning Technologies Kits

- Xeno-nucleic Acids

- Chassis Organism

Oligonucleotide/oligo pools and synthetic DNA dominates the market

The growing demand for synthetic biology products, specifically oligonucleotide/oligo pools and synthetic DNA, is mainly fueled by the exponential growth in fields such as personalized medicine, gene therapy, and molecular diagnostics that have amplified the need for precise and customizable genetic materials. Additionally, the rise of synthetic biology startups and the democratization of gene editing technologies have made these products more accessible, empowering researchers across diverse disciplines to engage in innovative projects, thereby creating a favorable synthetic biology market outlook. For example, Synbio Technologies offers oligo pool synthesis for companies or clients who need to mass-produce short DNA strands, also known as oligonucleotides.

Breakup by Technology:

- NGS Technology

- PCR Technology

- Genome Editing Technology

- Bioprocessing Technology

- Others

Next-generation sequencing (NGS) technology has become instrumental in deciphering complex biological information, facilitating the analysis of vast genetic data sets, and accelerating the discovery of novel genetic components, which in turn, is presenting lucrative market opportunities. Moreover, polymerase chain reaction (PCR) technology remains a cornerstone for DNA amplification, crucial in generating sufficient genetic material for various applications, from research to diagnostics. Besides this, genome editing technologies, particularly CRISPR-Cas9, hold immense promise for precision genetic modifications, driving advancements in gene therapies and customized genetic engineering. Bioprocessing technologies form a critical facet, enabling efficient large-scale production of bioengineered compounds, ranging from pharmaceuticals to biofuels. Companies are also investing and focusing on these aspects to create novel technologies. For example, Bayer and Mammoth Biosciences collaborated to develop a novel gene editing technology to unlock the full potential of CRISPR systems.

Additionally, the synthetic biology market statistics highlight a robust growth trajectory, driven by advancements in biotechnology and increasing investment in research and development.

Breakup by Application:

- Healthcare

- Clinical

- Non-Clinical/Research

- Non-Healthcare

- Biotech Crops

- Specialty Chemicals

- Bio-Fuels

- Others

The bolstering growth of the healthcare sector, wherein synthetic biology is used in the development of personalized medicines, gene therapies, and diagnostics, is contributing to the synthetic biology market growth. In addition, the numerous non-clinical or research applications of synthetic biology encompassing drug discovery, functional genomics, and biomolecule production, are fueling scientific exploration and market growth. Beyond healthcare, synthetic biology's expanding usage in biotech crops engineered for improved yield and resistance to pests is positively influencing the market. Furthermore, the increasing product adoption across the specialty chemicals industry, wherein bioengineered pathways create sustainable routes to produce high-value compounds is impelling the market growth. Apart from this, the growing use of synthetic biology in the biofuel sector to optimize microorganisms for efficient biofuel production is strengthening the market growth. Key market players are focusing on collaborating with each other to develop various novel technologies in synthetic biology. For instance, scientists led by Gerard Wright at McMaster University developed a synthetic biology platform for novel glycopeptide antibiotics (GPA) discovery. They engineered Streptomyces coelicolor as a chassis for GPA biosynthesis, overcoming challenges in cloning large biosynthetic gene clusters (BGCs) using an optimized transformation-associated recombination (TAR) system. The platform enabled the synthesis of corbomycin and the discovery of novel GPAs, expanding antibiotic candidates' repertoire.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest synthetic biology market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The presence of a well-established research and innovation ecosystem in North America, characterized by leading academic institutions, cutting-edge biotechnology companies, and significant government investments, provides a fertile ground for advancements in synthetic biology. Moreover, the region's emphasis on R&D and technological innovation fosters collaborations that span academia and industry, driving the development of novel applications across sectors including healthcare, agriculture, and energy. In addition to this, the increasing focus on sustainable solutions and the demand for eco-friendly products align with synthetic biology's potential to offer greener alternatives. This, coupled with favorable regulatory frameworks that encourage biotechnology R&D, creates an environment conducive to the expansion of the North American synthetic biology market. In December 2022, the Investment Strategy by the Office of Strategic Capital (OSC) identifies synthetic biology as a priority technology area for private sector investment, aiming to attract capital and foster innovation in this field for national security purposes. The synthetic biology market overview reveals its rapid expansion, driven by innovation, research investment, and diverse applications.

Competitive Landscape:

The global synthetic biology market features a dynamic competitive landscape shaped by a blend of established players and innovative startups. Leading companies, with their significant financial resources and expansive research capabilities, dominate the market by offering a diverse range of synthetic biology products and services and highlighting how big is the synthetic biology market? These companies actively engage in collaborations, strategic partnerships, and mergers to enhance their offerings and expand their market reach. Furthermore, a surge in venture capital investments has catalyzed the emergence of agile startups, injecting fresh ideas and disruptive technologies into the field. The competitive arena is characterized by a focus on innovation, technology integration, and the ability to address diverse market segments, accentuating the evolutionary nature of the global synthetic biology market. On of the key players, Eurofins Genomics Blue Heron, introduced its IVT mRNA Synthesis Service, using cutting-edge technology for rapid and efficient mRNA transcript production. Tailored for various fields including molecular biology and gene therapy, it offers customizable synthesis with quick turnaround times and expert support, benefiting synthetic biology research and applications. According to synthetic biology market recent news, Aanika Biosciences is revolutionizing synthetic biology adoption across industries like food and agriculture through insurance. Their subsidiary, Aanika Insurance Services (AIS), offers cost-effective coverage, encouraging biologic use while ensuring risk mitigation and frequent sampling. Partnering with Western Growers Insurance Services, Aanika aims to expand its reach to farmers, distributors, and retailers.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Agilent Technologies Inc.

- Amyris Inc.

- Codexis Inc.

- Danaher Corporation

- Eurofins Scientific

- GenScript Biotech Corporation

- Illumina Inc.

- Merck KGaA

- New England Biolabs

- Synthego Corporation

- Thermo Fisher Scientific Inc.

- Twist Bioscience

- Viridos Inc.

Key Questions Answered in This Report

- 1.What is synthetic biology?

- 2.How big is the synthetic biology market?

- 3.What is the expected growth rate of the global synthetic biology market during 2025-2033?

- 4.What are the key factors driving the global synthetic biology market?

- 5.What is the leading segment of the global synthetic biology market based on product?

- 6.What is the leading segment of the global synthetic biology market based on technology?

- 7.What is the leading segment of the global synthetic biology market based on application?

- 8.What are the key regions in the global synthetic biology market?

- 9.Who are the key players/companies in the global synthetic biology market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Synthetic Biology Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product

- 6.1 Oligonucleotide/Oligo Pools and Synthetic DNA

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Enzymes

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Cloning Technologies Kits

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Xeno-nucleic Acids

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Chassis Organism

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Technology

- 7.1 NGS Technology

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 PCR Technology

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Genome Editing Technology

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Bioprocessing Technology

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Others

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

8 Market Breakup by Application

- 8.1 Healthcare

- 8.1.1 Market Trends

- 8.1.2 Key Segments

- 8.1.2.1 Clinical

- 8.1.2.2 Non-Clinical/Research

- 8.1.3 Market Forecast

- 8.2 Non-Healthcare

- 8.2.1 Market Trends

- 8.2.2 Key Segments

- 8.2.2.1 Biotech Crops

- 8.2.2.2 Specialty Chemicals

- 8.2.2.3 Bio-Fuels

- 8.2.2.4 Others

- 8.2.3 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Agilent Technologies Inc.

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 Amyris Inc.

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.2.3 Financials

- 14.3.3 Codexis Inc.

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 Danaher Corporation

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.4.3 Financials

- 14.3.5 Eurofins Scientific

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.5.4 SWOT Analysis

- 14.3.6 GenScript Biotech Corporation

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.7 Illumina Inc.

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.7.4 SWOT Analysis

- 14.3.8 Merck KGaA

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.9 New England Biolabs

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 Synthego Corporation

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.11 Thermo Fisher Scientific Inc.

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.12 Twist Bioscience

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.12.3 Financials

- 14.3.13 Viridos Inc.

- 14.3.13.1 Company Overview

- 14.3.13.2 Product Portfolio

- 14.3.1 Agilent Technologies Inc.