|

|

市場調査レポート

商品コード

1675829

ニッケルの市場規模、シェア、動向、予測:製品タイプ、用途、最終用途産業、地域別、2025~2033年Nickel Market Size, Share, Trends and Forecast by Product Type, Application, End Use Industry, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| ニッケルの市場規模、シェア、動向、予測:製品タイプ、用途、最終用途産業、地域別、2025~2033年 |

|

出版日: 2025年03月01日

発行: IMARC

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

ニッケルの市場の世界市場規模は、2024年に370億米ドルとなりました。今後、IMARC Groupは、同市場が2033年までに555億米ドルに達し、2025年から2033年にかけて4.6%のCAGRを示すと予測しています。現在、アジア太平洋地域がニッケルの市場のシェアを独占しており、2024年には72.0%を超える大きな市場シェアを占めています。急速な技術革新と進歩、有利な政府の政策と規制、インフラおよび開発プロジェクトへの投資の増加、そしてステンレス鋼製品の需要の増加は、市場を推進する主な要因のいくつかです。

ニッケルは、その強度と耐久性で知られる万能金属です。耐食性に優れるニッケルは、電気メッキ、電池、ステンレス鋼の製造など幅広い用途に使われています。そのユニークな特性から、化学プラントや船舶用機器など、厳しい環境に適した選択肢となっています。インコネルやモネルなどのニッケル合金は、卓越した耐熱性を持ち、航空宇宙や発電の高温用途に最適です。さらに、電気自動車(EV)用バッテリー、充電式バッテリー、電気モーター、発電機の製造においても重要な役割を果たしています。

世界のニッケルの市場を牽引しているのは、ステンレス鋼産業におけるニッケル需要の増加やEVの普及拡大など、さまざまな要因です。さらに、急速なインフラ開発と都市化が建設資材、特にステンレス鉄筋の生産におけるニッケル需要を促進しており、これが市場開拓を後押ししています。さらに、技術の進歩や、航空宇宙、電子機器、化学処理など、さまざまな産業分野でのニッケルの幅広い応用が、市場成長に寄与しています。また、新たな発見や既存事業の拡大など、ニッケル採掘プロジェクトが世界的に継続的に開発されており、ニッケルの安定供給が確保されていることも追い風となっています。さらに、新しい技術や材料の出現、採掘、貿易、環境保護、持続可能性の実践に関連する政府の政策と政策が、市場の成長を後押ししています。

ニッケルの市場動向/促進要因:

ステンレス鋼産業におけるニッケル需要の増大

ステンレス鋼産業はニッケルの主要な消費者であり、ステンレス鋼製品の強度、耐食性、耐久性を高める主要合金元素としてニッケルを利用しています。建設、自動車、消費財など、様々な分野でステンレス鋼の需要が高まっていることが、市場の成長を牽引しています。建設分野では、ステンレス鋼はその優れた構造特性と耐食性により、橋梁、鉄道、ビルなどのインフラ・プロジェクトに広く使用されています。自動車分野では、ニッケル含有ステンレス鋼が排気装置や触媒コンバーターなどの部品に利用されています。さらに、一般家庭でのステンレス鋼製電化製品や調理器具の人気が高まっていることも、ニッケルの需要を押し上げています。

EVの採用増加

ニッケルは、EVに使用されるリチウムイオン二次電池の正極の主要成分です。世界中の政府と消費者が温室効果ガスの排出量と化石燃料への依存度を削減することを優先しているため、EVの需要が大きく伸びています。そのため、電池分野でのニッケル需要が高まっています。ニッケルベースのリチウムイオン電池は、エネルギー密度が高く、寿命が延び、走行距離が延びるため、EVの普及に不可欠です。大手自動車メーカーがEV生産への投資を続け、各国政府が支援政策や優遇措置を実施する中、電池セクターのニッケル需要は飛躍的に増加すると予想され、世界のニッケルの市場の強力な原動力となっています。

新興経済諸国におけるインフラ開発と都市化

ニッケルは、ビル、橋梁、高速道路などの建設プロジェクトに欠かせないステンレス鋼鉄筋の製造に広く使用されています。新興諸国では人口増加、都市化、生活水準の向上が進み、インフラ需要が拡大しています。ステンレス鋼鉄筋は、強度、耐久性、耐食性に優れ、建設用として好まれています。その結果、インフラ開発と都市化に牽引され、建設セクターにおけるニッケル需要は成長を続けている。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のニッケル市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品タイプ別

- クラスI製品

- クラスII製品

第7章 市場内訳:用途別

- ステンレス鋼および合金鋼

- 非鉄合金および超合金

- 電気メッキ

- 鋳造

- バッテリー

- その他

第8章 市場内訳:最終用途産業別

- 運輸・防衛

- 金属加工製品

- 電気・電子

- 化学薬品

- 石油化学

- 工事

- 耐久消費財

- 産業機械

- その他

第9章 市場内訳:地域別

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- 北米

- 米国

- カナダ

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- コロンビア

- チリ

- ペルー

- その他

- 中東・アフリカ

- トルコ

- サウジアラビア

- イラン

- アラブ首長国連邦

- その他

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

- 概要

- 採掘・製錬企業

- 金属メーカー

- 合金メーカー

- 流通と輸出

- 最終用途産業

- リサイクル会社

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Anglo American Plc

- BHP Group Limited

- Cunico Corporation

- Eramet Group

- Glencore Plc

- IGO Limited

- Jinchuan Group International Resources Co. Ltd.

- Norilsk Nickel

- Pacific Metal Company

- Queensland Nickel Group

- Sherritt International Corporation

- Sumitomo Corporation

- Terraframe Ltd.

- Vale S.A.

- Votorantim SA

List of Figures

- Figure 1: Global: Nickel Market: Major Drivers and Challenges

- Figure 2: Global: Nickel Market: Value Trends (in Billion USD), 2019-2024

- Figure 3: Global: Nickel Market: Breakup by Product Type (in %), 2024

- Figure 4: Global: Nickel Market: Breakup by Application (in %), 2024

- Figure 5: Global: Nickel Market: Breakup by End-Use Industry (in %), 2024

- Figure 6: Global: Nickel Market: Breakup by Region (in %), 2024

- Figure 7: Global: Nickel Market Forecast: Value Trends (in Billion USD), 2025-2033

- Figure 8: Global: Nickel (Class I Products) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 9: Global: Nickel (Class I Products) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 10: Global: Nickel (Class II Products) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 11: Global: Nickel (Class II Products) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 12: Global: Nickel (Stainless Steel and Alloy Steel) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 13: Global: Nickel (Stainless Steel and Alloy Steel) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 14: Global: Nickel (Non-ferrous Alloys and Superalloys) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 15: Global: Nickel (Non-ferrous Alloys and Superalloys) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 16: Global: Nickel (Electroplating) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 17: Global: Nickel (Electroplating) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 18: Global: Nickel (Casting) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 19: Global: Nickel (Casting) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 20: Global: Nickel (Batteries) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 21: Global: Nickel (Batteries) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 22: Global: Nickel (Other Applications) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 23: Global: Nickel (Other Applications) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 24: Global: Nickel (Transportation & Defense) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 25: Global: Nickel (Transportation & Defense) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 26: Global: Nickel (Fabricated Metal Products) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 27: Global: Nickel (Fabricated Metal Products) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 28: Global: Nickel (Electrical & Electronics) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 29: Global: Nickel (Electrical & Electronics) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 30: Global: Nickel (Chemical) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 31: Global: Nickel (Chemical) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 32: Global: Nickel (Petrochemical) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 33: Global: Nickel (Petrochemical) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 34: Global: Nickel (Construction) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 35: Global: Nickel (Construction) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 36: Global: Nickel (Consumer Durables) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 37: Global: Nickel (Consumer Durables) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 38: Global: Nickel (Industrial Machinery) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 39: Global: Nickel (Industrial Machinery) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 40: Global: Nickel (Other Industries) Market: Value Trends (in Million USD), 2019 & 2024

- Figure 41: Global: Nickel (Other Industries) Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 42: Asia Pacific: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 43: Asia Pacific: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 44: China: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 45: China: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 46: Japan: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 47: Japan: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 48: India: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 49: India: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 50: South Korea: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 51: South Korea: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 52: Australia: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 53: Australia: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 54: Indonesia: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 55: Indonesia: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 56: Others: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 57: Others: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 58: Europe: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 59: Europe: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 60: Germany: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 61: Germany: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 62: France: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 63: France: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 64: United Kingdom: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 65: United Kingdom: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 66: Italy: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 67: Italy: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 68: Spain: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 69: Spain: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 70: Russia: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 71: Russia: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 72: Others: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 73: Others: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 74: North America: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 75: North America: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 76: United States: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 77: United States: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 78: Canada: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 79: Canada: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 80: Latin America: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 81: Latin America: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 82: Brazil: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 83: Brazil: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 84: Mexico: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 85: Mexico: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 86: Argentina: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 87: Argentina: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 88: Colombia: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 89: Colombia: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 90: Chile: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 91: Chile: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 92: Peru: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 93: Peru: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 94: Others: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 95: Others: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 96: Middle East and Africa: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 97: Middle East and Africa: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 98: Turkey: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 99: Turkey: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 100: Saudi Arabia: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 101: Saudi Arabia: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 102: Iran: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 103: Iran: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 104: United Arab Emirates: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 105: United Arab Emirates: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 106: Others: Nickel Market: Value Trends (in Million USD), 2019 & 2024

- Figure 107: Others: Nickel Market Forecast: Value Trends (in Million USD), 2025-2033

- Figure 108: Global: Nickel Industry: SWOT Analysis

- Figure 109: Global: Nickel Industry: Value Chain Analysis

- Figure 110: Global: Nickel Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Nickel Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Nickel Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

- Table 3: Global: Nickel Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 4: Global: Nickel Market Forecast: Breakup by End-Use Industry (in Million USD), 2025-2033

- Table 5: Global: Nickel Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Nickel Market: Competitive Structure

- Table 7: Global: Nickel Market: Key Players

The global nickel market size was valued at USD 37.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 55.5 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. Asia Pacific currently dominates the nickel market share, holding a significant market share of over 72.0% in 2024. Rapid technological advancements and innovation, favorable government policies and regulations, burgeoning investments in infrastructure and development projects, and the rising demand for stainless steel products are some of the major factors propelling the market.

Nickel is a versatile metal known for its strength and durability. With excellent resistance to corrosion, nickel finds extensive applications in electroplating, batteries, and stainless steel production. Its unique properties make it a preferred choice for demanding environments, such as chemical plants and marine equipment. Nickel alloys, such as Inconel and Monel, offer exceptional heat resistance, making them ideal for high-temperature applications in aerospace and power generation. Moreover, it plays a crucial role in producing electric vehicle (EV) batteries, rechargeable batteries, electric motors, and generators.

The global nickel market is being driven by various factors, such as the increasing demand for nickel in the stainless steel industry and the increasing adoption of EVs. Moreover, rapid infrastructure development and urbanization are fueling the demand for nickel in construction materials, particularly to produce stainless steel reinforcement bars, which is supporting the market growth. Furthermore, advancements in technology and the widespread application of nickel in various industrial sectors, such as aerospace, electronics, and chemical processing, are contributing to the market growth. Another driver is the continuous development of nickel mining projects globally, including new discoveries and the expansion of existing operations, ensuring a steady supply of the metal. Additionally, the emergence of new technologies and materials and government policies and regulations related to mining, trade, environmental protection, and sustainability practices are propelling the market growth.

Nickel Market Trends/Drivers:

Growing demand for nickel in the stainless steel industry

The stainless steel industry is a major consumer of nickel, utilizing it as a key alloying element to enhance the strength, corrosion resistance, and durability of stainless steel products. The rising demand for stainless steel in various sectors, including construction, automotive, and consumer goods, is driving the market growth. In construction, stainless steel is widely used in infrastructure projects, such as bridges, railways, and buildings, due to its excellent structural properties and resistance to corrosion. In the automotive sector, nickel-containing stainless steel is utilized in components like exhaust systems and catalytic converters. Additionally, the increasing popularity of stainless steel appliances and utensils in households further boosts the demand for nickel.

Increasing adoption of EVs

Nickel is a key component in the cathode of rechargeable lithium-ion batteries used in EVs. As governments and consumers worldwide prioritize reducing greenhouse gas emissions and dependence on fossil fuels, the demand for EVs is experiencing significant growth. This, in turn, drives the demand for nickel in the battery sector. Nickel-based lithium-ion batteries offer higher energy density, improved longevity, and increased driving range, making them essential for the widespread adoption of EVs. As major automotive manufacturers continue to invest in EV production and governments implement supportive policies and incentives, the demand for nickel in the battery sector is expected to rise exponentially, creating a strong driver for the global nickel market.

Infrastructure development and urbanization in emerging economies

Nickel is extensively used in producing stainless steel reinforcement bars, which are crucial components in construction projects, including buildings, bridges, and highways. As developing countries experience population growth, increased urbanization, and rising standards of living, the demand for infrastructure expands. Stainless steel reinforcement bars offer superior strength, durability, and resistance to corrosion, making them a preferred choice for construction purposes. As a result, the demand for nickel in the construction sector, driven by infrastructure development and urbanization, continues to grow.

Nickel Industry Segmentation:

Breakup by Product Type:

- Class I Products

- Class II Products

Class I products dominate the market

Class I nickel products are high-purity nickel suitable for use in advanced technological applications, including the production of batteries for electric vehicles and energy storage. The purity level of Class I nickel is typically higher than 99.8%. These products include electrolytic nickel, nickel briquettes, nickel carbonyl, nickel powder, and nickel sulfate. Consequently, surge in the electric vehicle industry, a shift towards renewable energy, the implementation of stringent regulations to reduce carbon emissions, and increasing urbanization and industrial activities are driving the market growth.

On the other hand, class 2 nickel products include lower-purity nickel sources. These products include ferronickel, nickel pig iron (NPI), and nickel oxide, and they typically have a nickel content of less than 99.8%. Class 2 nickel is commonly used in stainless steel manufacturing and other industries where high purity isn't as critical. The primary driver of Class 2 nickel demand is its extensive use in stainless steel production. Nickel improves the corrosion resistance and mechanical properties of stainless steel, making it suitable for a variety of applications. Moreover, with the increasing pace of global urbanization and infrastructure development, the demand for materials like stainless steel - and by extension, Class 2 nickel has surged, thus favoring the market growth.

Breakup by Application:

- Stainless Steel and Alloy Steel

- Non-ferrous Alloys and Superalloys

- Electroplating

- Casting

- Batteries

- Others

Stainless steel and alloy steel holds the largest share in the market

Stainless steel, a highly durable and corrosion-resistant material, finds extensive use in the construction, automotive, and aerospace industries due to its superior strength-to-weight ratio. Alloy steel, made from a blend of iron with elements like nickel, chromium, and molybdenum, is renowned for its mechanical strength, toughness, and wear resistance, making it ideal for structural components and machinery. Non-ferrous alloys such as copper, aluminum, and titanium are prevalent in electronics, aerospace, and automotive industries, offering lightweight, electrically conductive, and corrosion-resistant solutions. Superalloys, with their exceptional resistance to high temperatures and oxidation, are critical in aircraft engines, gas turbines, and nuclear reactors. Electroplating enhances object aesthetics and durability, while casting enables accurate, complex shapes for automotive, aerospace, and construction applications. Nickel is essential in rechargeable batteries, offering high energy density and longevity. It also finds applications in chemical processing, oil and gas refining, heat exchangers, and medical equipment due to its corrosion resistance and high-temperature tolerance.

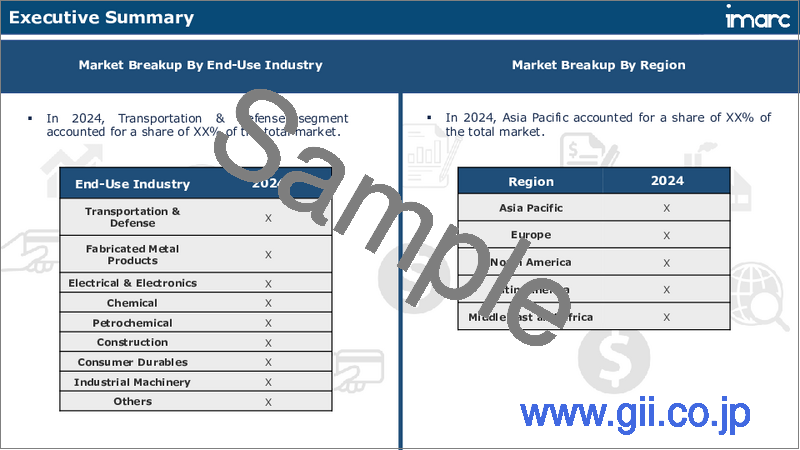

Breakup by End-Use Industry:

- Transportation & Defense

- Fabricated Metal Products

- Electrical & Electronics

- Chemical

- Petrochemical

- Construction

- Consumer Durables

- Industrial Machinery

- Others

Transportation and defense holds the largest share in the market

Nickel has diverse applications across numerous sectors. In transportation and defense, it is used in stainless and alloy steels to enhance durability and corrosion resistance, crucial for vehicles and military equipment. Fabricated metal products also leverage nickel for its robustness and resistance properties. In the electrical and electronics sector, nickel's high electrical conductivity makes it integral in components and battery technologies. The chemical and petrochemical industries use nickel-based alloys in processing equipment due to their exceptional resistance to harsh chemicals and high temperatures. In construction, nickel strengthens and provides corrosion resistance to structural steel. Consumer durables often incorporate nickel for its aesthetic appeal and durability, while industrial machinery utilizes nickel-alloyed steel for enhanced longevity and performance. The 'others' category includes sectors like medical, where nickel's non-corrosive properties make it suitable for surgical equipment, and energy, where it's used in batteries and renewable energy systems.

Breakup by Region:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific exhibits a clear dominance, accounting for the largest nickel market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others).

Asia Pacific has emerged as a market leader for nickel due to its vast population, rapid industrialization, and dynamic economic growth. Countries like China, Japan, South Korea, and India have become manufacturing powerhouses, offering cost-effective production capabilities and a massive consumer base. The region's strong focus on exports, technological advancements, and investments in research and development have propelled industries such as electronics, automotive, telecommunications, and e-commerce, driving its market leadership. In line with this, the escalating adoption of electric vehicles (EVs) in the region is driving the need for high-purity nickel in battery production, given nickel's crucial role in enhancing energy density and longevity of lithium-ion batteries. Governments in this region are also implementing favorable policies and providing subsidies for EVs and renewable energy, indirectly influencing the nickel market. Besides this, the region's growing economy increases demand for consumer goods and infrastructure, leading to more nickel use in these products and structures.

Competitive Landscape:

The competitive landscape of the nickel market is characterized by the presence of several key players vying for market share. These companies operate across various segments of the nickel value chain, including mining, refining, production, and distribution. Some of the prominent players in the market have established themselves as major nickel producers, leveraging their extensive mining operations and technological expertise. Furthermore, the market is also witnessing the emergence of new players, particularly in countries with substantial nickel reserves, such as Indonesia and the Philippines. As the demand for nickel continues to grow, competition intensifies, leading to strategic collaborations, investments in research and development, and expansion of production capacities to maintain a competitive edge in the dynamic nickel market.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Anglo American Plc

- BHP Group Limited

- Cunico Corporation

- Eramet Group

- Glencore Plc

- IGO Limited

- Jinchuan Group International Resources Co. Ltd.

- Norilsk Nickel

- Pacific Metal Company

- Queensland Nickel Group

- Sherritt International Corporation

- Sumitomo Corporation

- Terraframe Ltd.

- Vale S.A.

- Votorantim SA.

Key Questions Answered in This Report

- 1.What is the nickel market?

- 2.How big is the nickel market?

- 3.What is the market forecast for nickel?

- 4.What are the key factors driving the nickel market?

- 5.Which region accounts for the largest nickel market share?

- 6.Which are the leading companies in the global nickel market?

- 7.What is the nickel market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Nickel Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product Type

- 6.1 Class I Products

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Class II Products

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Application

- 7.1 Stainless Steel and Alloy Steel

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Non-ferrous Alloys and Superalloys

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Electroplating

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Casting

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Batteries

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Others

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market Breakup by End-Use Industry

- 8.1 Transportation & Defense

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Fabricated Metal Products

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Electrical & Electronics

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Chemical

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Petrochemical

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Construction

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

- 8.7 Consumer Durables

- 8.7.1 Market Trends

- 8.7.2 Market Forecast

- 8.8 Industrial Machinery

- 8.8.1 Market Trends

- 8.8.2 Market Forecast

- 8.9 Others

- 8.9.1 Market Trends

- 8.9.2 Market Forecast

9 Market Breakup by Region

- 9.1 Asia Pacific

- 9.1.1 China

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Japan

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.3 India

- 9.1.3.1 Market Trends

- 9.1.3.2 Market Forecast

- 9.1.4 South Korea

- 9.1.4.1 Market Trends

- 9.1.4.2 Market Forecast

- 9.1.5 Australia

- 9.1.5.1 Market Trends

- 9.1.5.2 Market Forecast

- 9.1.6 Indonesia

- 9.1.6.1 Market Trends

- 9.1.6.2 Market Forecast

- 9.1.7 Others

- 9.1.7.1 Market Trends

- 9.1.7.2 Market Forecast

- 9.1.1 China

- 9.2 Europe

- 9.2.1 Germany

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 France

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 United Kingdom

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 Italy

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Spain

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Russia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 Germany

- 9.3 North America

- 9.3.1 United States

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 Canada

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.1 United States

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Argentina

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.4 Colombia

- 9.4.4.1 Market Trends

- 9.4.4.2 Market Forecast

- 9.4.5 Chile

- 9.4.5.1 Market Trends

- 9.4.5.2 Market Forecast

- 9.4.6 Peru

- 9.4.6.1 Market Trends

- 9.4.6.2 Market Forecast

- 9.4.7 Others

- 9.4.7.1 Market Trends

- 9.4.7.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Turkey

- 9.5.1.1 Market Trends

- 9.5.1.2 Market Forecast

- 9.5.2 Saudi Arabia

- 9.5.2.1 Market Trends

- 9.5.2.2 Market Forecast

- 9.5.3 Iran

- 9.5.3.1 Market Trends

- 9.5.3.2 Market Forecast

- 9.5.4 United Arab Emirates

- 9.5.4.1 Market Trends

- 9.5.4.2 Market Forecast

- 9.5.5 Others

- 9.5.5.1 Market Trends

- 9.5.5.2 Market Forecast

- 9.5.1 Turkey

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

- 11.1 Overview

- 11.2 Mining and Milling Companies

- 11.3 Metal Manufacturers

- 11.4 Alloy Manufacturers

- 11.5 Distribution and Export

- 11.6 End-Use Industries

- 11.7 Recycling Companies

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Competitive Landscape

- 13.1 Market Structure

- 13.2 Key Players

- 13.3 Profiles of Key Players

- 13.3.1 Anglo American Plc

- 13.3.1.1 Company Overview

- 13.3.1.2 Product Portfolio

- 13.3.1.3 Financials

- 13.3.1.4 SWOT Analysis

- 13.3.2 BHP Group Limited

- 13.3.2.1 Company Overview

- 13.3.2.2 Product Portfolio

- 13.3.3 Cunico Corporation

- 13.3.3.1 Company Overview

- 13.3.3.2 Product Portfolio

- 13.3.4 Eramet Group

- 13.3.4.1 Company Overview

- 13.3.4.2 Product Portfolio

- 13.3.5 Glencore Plc

- 13.3.5.1 Company Overview

- 13.3.5.2 Product Portfolio

- 13.3.6 IGO Limited

- 13.3.6.1 Company Overview

- 13.3.6.2 Product Portfolio

- 13.3.6.3 Financial

- 13.3.7 Jinchuan Group International Resources Co. Ltd.

- 13.3.7.1 Company Overview

- 13.3.7.2 Product Portfolio

- 13.3.8 Norilsk Nickel

- 13.3.8.1 Company Overview

- 13.3.8.2 Product Portfolio

- 13.3.9 Pacific Metal Company

- 13.3.9.1 Company Overview

- 13.3.9.2 Product Portfolio

- 13.3.10 Queensland Nickel Group

- 13.3.10.1 Company Overview

- 13.3.10.2 Product Portfolio

- 13.3.11 Sherritt International Corporation

- 13.3.11.1 Company Overview

- 13.3.11.2 Product Portfolio

- 13.3.11.3 Financials

- 13.3.11.4 SWOT Analysis

- 13.3.12 Sumitomo Corporation

- 13.3.12.1 Company Overview

- 13.3.12.2 Product Portfolio

- 13.3.12.3 Financials

- 13.3.12.4 SWOT Analysis

- 13.3.13 Terraframe Ltd.

- 13.3.13.1 Company Overview

- 13.3.13.2 Product Portfolio

- 13.3.14 Vale S.A.

- 13.3.14.1 Company Overview

- 13.3.14.2 Product Portfolio

- 13.3.14.3 Financials

- 13.3.14.4 SWOT Analysis

- 13.3.15 Votorantim SA

- 13.3.15.1 Company Overview

- 13.3.15.2 Product Portfolio

- 13.3.1 Anglo American Plc