|

|

市場調査レポート

商品コード

1661275

燃料電池の市場規模、シェア、動向、予測:タイプ別、用途別、地域別、2025-2033年Fuel Cell Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 燃料電池の市場規模、シェア、動向、予測:タイプ別、用途別、地域別、2025-2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 138 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

燃料電池の市場の世界市場規模は2024年に66億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに437億米ドルに達し、2025年から2033年にかけて20.81%の成長率(CAGR)を示すと予測しています。現在、アジア太平洋地域が市場を独占しており、2024年の市場シェアは56.6%を超えています。この優位性は、政府の強力な支援、水素インフラへの投資、産業全体での採用拡大によってもたらされます。

燃料電池とは、化学ポテンシャルエネルギーを電気エネルギーに変換する電気化学電池を指します。正極、負極、電解質から成り、一方の電極から他方の電極に向かって電荷を帯びた粒子を運ぶ。主に、商業用、産業用、住宅用の建物や、人里離れた場所やアクセスしにくい場所でのバックアップ電源として利用されています。また、フォークリフト、自動車、バス、列車、ボート、オートバイ、潜水艦などの乗り物の動力源としても使用されています。より高い効率性、柔軟性、より長い運転時間、より高い信頼性、そして費用対効果を提供します。従来の発電方法と比較すると、燃焼を伴わずに電気を生産するため、温室効果ガスの排出量が少なく、公害が減少します。

クイックスタートと高電力密度により、バス、実用車、電動スクーターの電動モーターに電力を供給するために自動車産業で製品が広く利用されていることは、市場成長を促進する主な要因の1つです。これに伴い、家庭やホテル、病院、教育センター、公共施設などの商業スペースで熱電併給(CHP)を行うための製品需要が増加していることも、成長を促進する要因となっています。これとは別に、二酸化炭素排出量の削減と持続可能なエネルギーソリューションへの移行への関心の高まりにより、クリーンで持続可能なエネルギー源への需要が高まっていることも、市場成長に弾みをつけています。さらに、継続的な研究開発(R&D)努力によって技術が大幅に進歩し、性能、耐久性、費用対効果が向上していることも、市場成長を後押ししています。その他にも、最新技術の導入と開発を奨励する有利な政府イニシアチブの実施、エネルギーキャリアとしての水素への関心の高まり、急速な工業化、関連する利点に関する意識の高まりなどが、市場に有益な成長機会をもたらしています。

燃料電池の市場傾向/促進要因:

自動車産業における著しい成長

燃料電池は、内燃エンジン(ICE)に代わる可能性のあるものとして自動車産業で広く使用されており、ゼロ・エミッション、高効率、静かな運転音など、いくつかの利点を提供しています。燃料電池はまた、商用トラックやバスのエアコンや暖房などの車両アクセサリーに電力を供給する補助動力装置(APU)にも使用されています。さらに、燃料電池電気自動車(FCEV)の採用が市場成長を後押ししています。これらの車両は、燃料源として水素ガスを利用します。水素ガスは、電気分解、天然ガス改質、その他のプロセスを通じて、再生可能エネルギーを含む様々なソースから製造することができます。

クリーンで持続可能なエネルギー源に対する需要の高まり

気候変動、大気汚染、温室効果ガス排出量削減の必要性に対する懸念の高まりが、よりクリーンな代替エネルギーへの需要に拍車をかけています。燃料電池は、燃焼を伴わない電気化学反応によって電気を生産するため、低排出またはゼロ排出のエネルギー変換技術を提供し、これが市場の成長に寄与しています。加えて、貯蔵された水素や他の再生可能燃料を効率的に電気に変換することで、断続的な再生可能エネルギー源をグリッドに統合する手助けをするため、製品の利用が広がっていることも、市場の成長を後押ししています。これに加えて、クリーンエネルギー技術の採用を促進するための様々な支援政策、政府のイニシアティブ、財政的インセンティブの実施が、市場成長に弾みをつけています。

広範な研究開発(R&D)活動

性能、耐久性、費用対効果を高めるためのさまざまな技術革新につながる広範な研究開発活動により、市場は継続的に進化しています。さらに、基本的なプロセスを改善し、設計を最適化するための高度なモデリングおよびシミュレーションツールの発売が、市場の成長を後押ししています。これとは別に、製品の耐久性と寿命を向上させるための改良された材料と設計技術の利用が、もう一つの成長促進要因として作用しています。さらに、メーカーは効率的で信頼性の高い運転のために数値流体力学(CFD)モデリング、マルチフィジックス・シミュレーション、制御戦略を採用しており、これが市場成長に寄与しています。

目次

第1章 序文

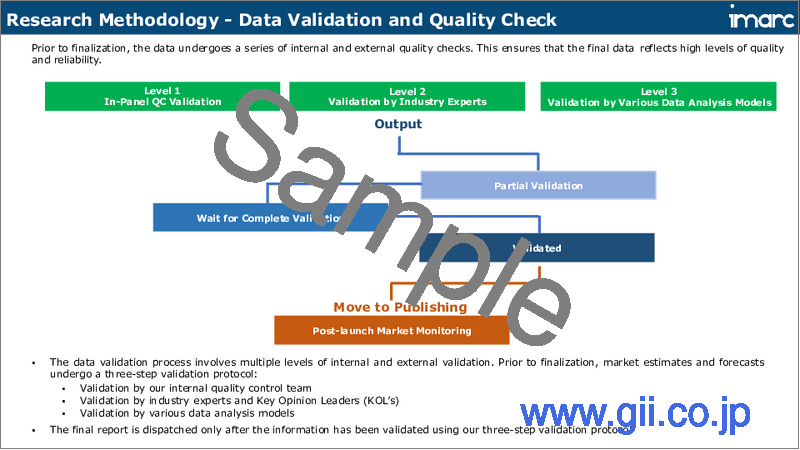

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の燃料電池市場

- 市場概要

- 市場実績

- COVID-19の影響

- 価格分析

- 主要価格指標

- 価格構造

- マージン分析

- 市場内訳:タイプ別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 概要

- 研究開発

- 原材料調達

- 製造

- マーケティング

- 流通

- 最終用途

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第6章 市場内訳:タイプ別

- プロトン交換膜燃料電池(PEMFC)

- 市場動向

- 市場予測

- 固体酸化物燃料電池(SOFC)

- 市場動向

- 市場予測

- 溶融炭酸塩燃料電池(MCFC)

- 市場動向

- 市場予測

- 直接メタノール燃料電池(DMFC)

- 市場動向

- 市場予測

- リン酸燃料電池(PAFC)

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:用途別

- 据置型

- 市場動向

- 市場予測

- 輸送

- 市場動向

- 市場予測

- ポータブル

- 市場動向

- 市場予測

第8章 市場内訳:地域別

- アジア太平洋地域

- 北米

- 欧州

- 中東・アフリカ

- ラテンアメリカ

第9章 燃料電池の製造プロセス

- 製品概要

- 原材料要件

- 製造工程

- 主要成功要因とリスク要因

第10章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Ballard Power Systems Inc.

- Bloom Energy Corporation

- Toshiba Fuel Cell Power Systems Corporation

- FuelCell Energy Inc

- Plug Power Inc

- Nuvera Fuel Cells Inc

- AFC Energy plc

- SFC Energy AG

- Mitsubishi Hitachi Power Systems, Ltd.

- Panasonic Corporation

- Intelligent Energy Limited

- Doosan Fuel Cell America Inc.

List of Figures

- Figure 1: Global: Fuel Cell Market: Major Drivers and Challenges

- Figure 2: Global: Fuel Cell Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Fuel Cell Market: Breakup by Type (in %), 2024

- Figure 4: Global: Fuel Cell Market: Breakup by Application (in %), 2024

- Figure 5: Global: Fuel Cell Market: Breakup by Region (in %), 2024

- Figure 6: Global: Fuel Cell Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 7: Fuel Cell Market: Price Structure

- Figure 8: Global: Fuel Cell Industry: SWOT Analysis

- Figure 9: Global: Fuel Cell Industry: Value Chain Analysis

- Figure 10: Global: Fuel Cell Industry: Porter's Five Forces Analysis

- Figure 11: Global: Fuel Cell (Proton Exchange Membrane) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Fuel Cell (Proton Exchange Membrane) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Fuel Cell (Solid Oxide) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Fuel Cell (Solid Oxide) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Fuel Cell (Molten Carbonate) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Fuel Cell (Molten Carbonate) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Fuel Cell (Direct Methanol) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Fuel Cell (Direct Methanol) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Fuel Cell (Phosphoric Acid) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Fuel Cell (Phosphoric Acid) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Fuel Cell (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Fuel Cell (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Fuel Cell (Stationary) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Fuel Cell (Stationary) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Fuel Cell (Transportation) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Fuel Cell (Transportation) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Fuel Cell (Portable) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Fuel Cell (Portable) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Asia Pacific: Fuel Cell Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Asia Pacific: Fuel Cell Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: North America: Fuel Cell Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: North America: Fuel Cell Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Europe: Fuel Cell Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Europe: Fuel Cell Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Middle East and Africa: Fuel Cell Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Middle East and Africa: Fuel Cell Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Latin America: Fuel Cell Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Latin America: Fuel Cell Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Fuel Cell Manufacturing: Detailed Process Flow

List of Tables

- Table 1: Global: Fuel Cell Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Fuel Cell Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Fuel Cell Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 4: Global: Fuel Cell Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 5: Fuel Cell: Raw Material Requirements

- Table 6: Global: Fuel Cell Market: Competitive Structure

- Table 7: Global: Fuel Cell Market: Key Players

The global fuel cell market size reached USD 6.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.7 Billion by 2033, exhibiting a growth rate (CAGR) of 20.81% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 56.6% in 2024. This dominance is driven by strong government support, investments in hydrogen infrastructure, and growing adoption across industries.

A fuel cell refers to an electrochemical cell that converts chemical potential energy into electrical energy. It consists of a cathode, anode, and electrolyte, which carries electrically charged particles from one electrode toward the other. It is primarily utilized as a backup power in commercial, industrial, and residential buildings and in remote or inaccessible areas. It is also used to power vehicles, including forklifts, automobiles, buses, trains, boats, motorcycles, and submarines. It offers higher efficiency, flexibility, longer operating time, enhanced reliability, and cost-effectiveness. As compared to traditional power generation methods, it produces electricity without combustion, resulting in lower greenhouse gas emissions and reduced pollution.

The widespread product utilization in the automotive industry to power the electric motor of buses, utility vehicles, and electric scooters due to their quick start and high-power densities is one of the key factors driving the market growth. In line with this, the increasing product demand to produce combined heat and power (CHP) in households and commercial spaces like hotels, hospitals, educational centers, and public buildings is acting as another growth-inducing factor. Apart from this, the rising demand for clean and sustainable energy sources, owing to the increasing focus on reducing carbon emissions and transitioning to sustainable energy solutions, is providing an impetus to the market growth. Furthermore, continuous research and development (R&D) efforts have led to significant advancements in technology, improving the performance, durability, and cost-effectiveness, which, in turn, is fostering the market growth. Other factors, including the implementation of favorable government initiatives to encourage the adoption and development of the latest technology, growing interest in hydrogen as an energy carrier, rapid industrialization, and rising awareness about the associated benefits, are presenting remunerative growth opportunities for the market.

Fuel Cell Market Trends/Drivers:

Significant growth in the automotive industry

Fuel cells are widely used in the automotive industry as a potential alternative to internal combustion engines (ICEs), offering several advantages such as zero emissions, higher efficiency, and quieter operation. They are also used in auxiliary power units (APUs) to provide electric power for vehicle accessories, such as air conditioning and heating in commercial trucks and buses. Moreover, the adoption of fuel cell electric vehicles (FCEVs) is favoring the market growth. These vehicles utilize hydrogen gas as the fuel source that can be produced from a variety of sources, including renewable energy through electrolysis, natural gas reforming, or other processes.

The rising demand for clean and sustainable energy sources

Growing concerns about climate change, air pollution, and the need to reduce greenhouse gas emissions have fueled the demand for cleaner energy alternatives. Fuel cells offer a low or zero-emission energy conversion technology, as they produce electricity through electrochemical reactions without combustion, which, in turn, is contributing to the market growth. Additionally, the widespread product utilization, as it assists in integrating intermittent renewable energy sources into the grid by efficiently converting stored hydrogen or other renewable fuels into electricity, is favoring the market growth. Besides this, the implementation of various supportive policies, government initiatives, and financial incentives to promote the adoption of clean energy technologies are providing an impetus to the market growth.

Extensive research and development (R&D) activities

The market is continuously evolving due to the extensive R&D activities leading to various innovations to enhance their performance, durability, and cost-effectiveness. Moreover, the launch of advanced modeling and simulation tools to improve the fundamental processes and optimize the designs is providing a thrust to the market growth. Apart from this, the utilization of improved materials and design techniques to increase the product durability and lifespan is acting as another growth-inducing factor. Furthermore, manufacturers are adopting computational fluid dynamics (CFD) modeling, multi-physics simulations, and control strategies for efficient and reliable operation, which is contributing to the market growth.

Fuel Cell Industry Segmentation:

Breakup by Type:

- Proton Exchange Membrane Fuel Cells (PEMFC)

- Solid Oxide Fuel Cells (SOFC)

- Molten Carbonate Fuel Cells (MCFC)

- Direct Methanol Fuel Cells (DMFC)

- Phosphoric Acid Fuel Cells (PAFC)

- Others

Proton exchange membrane fuel cells (PEMFC) dominate the market

Proton exchange membrane fuel cells (PEMFCs) are widely used in applications, such as automotive vehicles, to provide quick refueling times and operate in a wide range of environmental conditions, making them suitable for passenger cars, buses, and other forms of transportation. Moreover, PEMFCs are used in portable electronic devices, such as laptops, smartphones, tablets, and cameras, to offer longer runtime than batteries and can be rapidly refueled with hydrogen or methanol cartridges. Furthermore, PEMFC provides a reliable and sustainable power source for outdoor activities, emergency backup power, and remote locations, which, in turn, is positively influencing the market growth.

Breakup by Application:

- Stationary

- Transportation

- Portable

Stationary represents the leading segment

Stationary systems are designed for stationary or non-mobile applications. They provide reliable and continuous power generation for residential, commercial, and industrial purposes. Additionally, stationary variants are used in industrial settings, such as manufacturing facilities, warehouses, and industrial parks, which is acting as another growth-inducing factor. Besides this, stationary variants offer several advantages, including high efficiency, low emissions, fuel flexibility, and modularity, making them suitable for a wide range of stationary applications, thus supporting the market growth.

Breakup by Region:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific exhibits a clear dominance in the market, accounting for the largest fuel cell market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Middle East and Africa, and Latin America.

The increasing energy demand, the need for clean and sustainable energy solutions, and government support for the adoption of the technology are some of the key factors driving the market growth in the Asia Pacific region. Apart from this, fuel cells are being used in backup power systems for critical infrastructure, including data centers and telecommunications facilities, which is providing a considerable boost to the market. Besides this, the widespread product utilization in distributed power generation systems and backup power applications, coupled with the development of hydrogen refueling stations, is favoring the market growth. Apart from this, continued investments and collaborations in research, development, and infrastructure development are expected to further propel the product use across various sectors in the region.

Competitive Landscape:

Several key market players are significantly investing in research and development (R&D) projects to enhance their performance, durability, and cost-effectiveness. In line with this, manufacturers are focusing on introducing new catalyst compositions to improve the overall performance. Moreover, the advent of novel applications, including transportation, stationary power, and portable power, is providing an impetus to the market growth. Apart from this, prominent players are developing advanced manufacturing processes and techniques that help lower the production costs of components and systems, which in turn, is supporting the market growth.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ballard Power Systems Inc.

- Bloom Energy Corporation

- Toshiba Fuel Cell Power Systems Corporation

- FuelCell Energy Inc

- Plug Power Inc

- Nuvera Fuel Cells Inc

- AFC Energy plc

- SFC Energy AG

- Mitsubishi Hitachi Power Systems, Ltd

- Panasonic Corporation

- Intelligent Energy Limited

- Doosan Fuel Cell America Inc.

Key Questions Answered in This Report

- 1.How big is the fuel cell market?

- 2.What is the future outlook of fuel cell market?

- 3.What are the key factors driving the fuel cell market?

- 4.Which region accounts for the largest fuel cell market share?

- 5.Which are the leading companies in the global fuel cell market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Fuel Cell Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Price Analysis

- 5.4.1 Key Price Indicators

- 5.4.2 Price Structure

- 5.4.3 Margin Analysis

- 5.5 Market Breakup by Type

- 5.6 Market Breakup by Application

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

- 5.9 SWOT Analysis

- 5.9.1 Overview

- 5.9.2 Strengths

- 5.9.3 Weaknesses

- 5.9.4 Opportunities

- 5.9.5 Threats

- 5.10 Value Chain Analysis

- 5.10.1 Overview

- 5.10.2 Research and Development

- 5.10.3 Raw Material Procurement

- 5.10.4 Manufacturing

- 5.10.5 Marketing

- 5.10.6 Distribution

- 5.10.7 End-Use

- 5.11 Porters Five Forces Analysis

- 5.11.1 Overview

- 5.11.2 Bargaining Power of Buyers

- 5.11.3 Bargaining Power of Suppliers

- 5.11.4 Degree of Competition

- 5.11.5 Threat of New Entrants

- 5.11.6 Threat of Substitutes

6 Market Breakup by Type

- 6.1 Proton Exchange Membrane Fuel Cells (PEMFC)

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Solid Oxide Fuel Cells (SOFC)

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Molten Carbonate Fuel Cells (MCFC)

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Direct Methanol Fuel Cells (DMFC)

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Phosphoric Acid Fuel Cells (PAFC)

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Others

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

7 Market Breakup by Application

- 7.1 Stationary

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Transportation

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Portable

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

8 Market Breakup by Region

- 8.1 Asia Pacific

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 North America

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Europe

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Middle East and Africa

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Latin America

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Fuel Cell Manufacturing Process

- 9.1 Product Overview

- 9.2 Raw Material Requirements

- 9.3 Manufacturing Process

- 9.4 Key Success and Risk Factors

10 Competitive Landscape

- 10.1 Market Structure

- 10.2 Key Players

- 10.3 Profiles of Key Players

- 10.3.1 Ballard Power Systems Inc.

- 10.3.2 Bloom Energy Corporation

- 10.3.3 Toshiba Fuel Cell Power Systems Corporation

- 10.3.4 FuelCell Energy Inc

- 10.3.5 Plug Power Inc

- 10.3.6 Nuvera Fuel Cells Inc

- 10.3.7 AFC Energy plc

- 10.3.8 SFC Energy AG

- 10.3.9 Mitsubishi Hitachi Power Systems, Ltd.

- 10.3.10 Panasonic Corporation

- 10.3.11 Intelligent Energy Limited

- 10.3.12 Doosan Fuel Cell America Inc.