|

|

市場調査レポート

商品コード

1661113

フェライト磁石粉末の市場レポート:最終用途別、地域別、2025年~2033年Ferrite Magnet Powder Market Report by End Use (Electro-Acoustic Production Products, Electronics Industry, Power Play Tools, Car Line Industry, Calculating Machines, and Others), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| フェライト磁石粉末の市場レポート:最終用途別、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

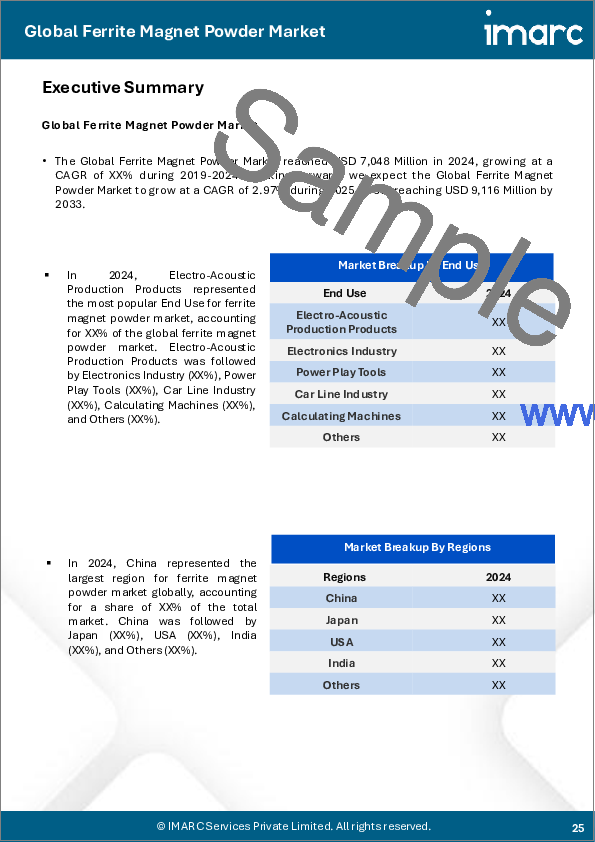

フェライト磁石粉末の市場の世界市場規模は2024年に70億米ドルに達しました。今後、IMARC Groupは、2033年までに市場は91億米ドルに達し、2025年から2033年にかけて2.97%の成長率(CAGR)を示すと予測しています。自動車産業におけるグリーン技術の採用拡大、新興国市場を中心とした家電製品の販売拡大、再生可能エネルギーシステムにおける継続的な技術進歩などが、市場を推進している要因の一例です。

フェライト磁石粉末は、一般的に酸化鉄とストロンチウム、バリウム、その他の金属を組み合わせた複合材料です。この粉末の特徴は、減磁しにくく、高温などの過酷な条件下でも安定し、腐食に強いことです。主にプレスと焼結を組み合わせたセラミック製法で製造されます。フェライト磁石粉末は磁気的に等方性であり、用途に応じて様々な方向に磁化することができます。この材料の磁気特性は、希土類磁石のような他のタイプほど強力ではありませんが、低コストで安定性が高いため、幅広い用途に適しています。主にモーター、家電製品、再生可能エネルギーシステムに不可欠な永久磁石の製造に使用されています。

世界市場の主な原動力となっているのは、自動車産業におけるグリーンテクノロジーの採用拡大であり、これがエネルギー効率の高い永久磁石の需要を刺激しています。これに伴い、特に発展途上国での家庭用電子機器の販売増加により、フェライト磁石の使用増加が必要とされています。さらに、永久磁石を使用する風力タービンのような再生可能エネルギーの重要性が、市場の成長に勢いを与えています。さらに、小型で効率的なモーターが不可欠なスマート家電の開発も市場に影響を与えています。さらに、5G技術の展開を含む通信セクターの拡大が、信頼性の高い磁気部品の必要性を高めています。エネルギー効率の高い電化製品や自動車に対する規制の焦点は、メーカーがその有効性と低コストのためにフェライト磁石粉末を選ぶことを後押ししています。その他の寄与要因としては、産業オートメーションにおける採用の増加、ヘルスケア分野における磁気共鳴画像法(MRI)のニーズの高まり、材料の磁気特性を改善するための広範な研究開発活動などが挙げられます。

フェライト磁石粉末の市場傾向/促進要因:

再生可能エネルギーシステムにおける継続的な技術進歩

フェライト磁石粉末の市場を推進する重要な要因のひとつは、再生可能エネルギーシステムの世界レベルでの継続的な進歩です。各国が二酸化炭素排出量を削減し、化石燃料からの脱却を目指す中、代替エネルギーソリューションへの需要が高まっています。フェライト磁石粉末は、風力タービンに使用される永久磁石の製造において極めて重要な役割を果たしています。これらの磁石は、風力エネルギーシステムの効率と寿命に貢献しています。これとは別に、太陽エネルギー技術が進化するにつれて、エネルギー貯蔵ソリューションに役立つ安定した長寿命の磁石の必要性が高まっており、フェライト磁石粉末は有望視されています。これに加えて、より環境に優しく持続可能なエネルギー・ソリューションの推進により、フェライト磁石粉末の安定した需要が今後何年にもわたって確保されます。

家庭用電子機器とIoTアプリケーションの著しい成長

家庭用電子機器とモノのインターネット(IoT)アプリケーションの急激な成長も、市場に有利な機会を生み出している重要な要因です。スマートフォン、ノートパソコン、スマート家電などのデバイスはすべて、フェライト磁石粉末から作られたものを含む、さまざまな種類の永久磁石を必要とします。IoTアプリケーションの数が増えるにつれて、より効率的で、より小さく、より堅牢な部品へのニーズが付随しています。低コストで幅広い条件下で安定した性能を発揮するフェライト磁石は、品質を犠牲にすることなくこうした要求に応えようとするメーカーにとって理想的な選択肢です。これとは別に、家庭用電子機器とIoT技術における数々のイノベーションがこの材料の需要を維持し、これらの産業において不可欠な部品になると予想されます。

急速な工業化とインフラ開発

フェライト磁石粉末の市場にプラスの影響を与えているもう一つの重要な要因は、産業化とインフラ開発の世界的動向です。世界の多くの地域で、交通システム、公共施設、産業設備など、既存のインフラをアップグレードするための協調的な取り組みが行われています。これらのプロジェクトでは、永久磁石を必要とする電気モーターを使用することが多いです。フェライト磁石粉末は、その費用対効果とさまざまな条件下での性能から、しばしば選択される材料です。さらに、エネルギー効率に優れた産業用ソリューションの開発にますます注目が集まっているため、効果的でありながら手頃な価格の磁性材料を使用する必要があります。したがって、産業化がさまざまな地域を席巻し続ける中、フェライト磁石粉末の市場は世界経済におけるその重要性を強調し、需要が大幅に増加する可能性が高いです。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の永久磁石市場

- 市場概要

- 市場動向

- ボリュームトレンド

- 価値トレンド

- 価格動向

- 市場内訳:地域別

- 市場内訳:タイプ別

- 市場予測

第6章 世界のフェライト磁石粉末産業

- 市場概要

- 市場動向

- 数量動向

- 金額動向

- COVID-19の影響

- 価格分析

- 主要価格指標

- 価格構造

- 価格動向

- 市場内訳:国別

- 市場内訳:最終用途別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 市場促進要因と成功要因

第7章 主要地域の実績

- 中国

- 市場動向

- 市場予測

- 日本

- 市場動向

- 市場予測

- 米国

- 市場動向

- 市場予測

- インド

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:最終用途別

- 電子音響制作製品

- 市場動向

- 市場予測

- エレクトロニクス産業

- 市場動向

- 市場予測

- パワープレイツール

- 市場動向

- 市場予測

- 自動車ライン業界

- 市場動向

- 市場予測

- 計算機

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 競合情勢

- 市場構造

- 主要企業

第10章 フェライト磁石粉末の製造工程

- 製品概要

- 詳細なプロセスフロー

- 様々な種類の単位操作

- マスバランスと原材料要件

第11章 プロジェクトの詳細・必要条件・費用

- 土地要件と費用

- 建設要件と費用

- 工場レイアウト

- 工場の機械

- 機械写真

- 原材料の要件と支出

- 原材料と最終製品の写真

- 包装の要件と支出

- 輸送の要件と支出

- ユーティリティの要件と支出

- 人員要件と支出

- その他の設備投資

第12章 融資と資金援助

第13章 プロジェクトの経済性

- プロジェクトの資本コスト

- 技術経済的パラメーター

- サプライチェーンの各段階における製品価格とマージン

- 課税と減価償却

- 収入予測

- 支出予測

- 財務分析

- 利益分析

第14章 主要企業のプロファイル

- Ningbo Yunsheng Co. Ltd.

- Hangzhou Permanent Magnet Group

- JPMF Guangdong Co. Ltd.

- Ninggang Permanent Magnet Materials Co. Ltd.

- Hitachi Metals Ltd.

List of Figures

- Figure 1: Global: Ferrite Magnet Market: Major Drivers and Challenges

- Figure 2: Global: Permanent Magnets Market: Sales Volume Trends (in Metric Tons), 2019-2024

- Figure 3: Global: Permanent Magnets Market: Sales Value Trends (in Billion USD), 2019-2024

- Figure 4: Global: Permanent Magnets Market: Average Prices (in USD/Ton), 2019-2024

- Figure 5: Global: Permanent Magnets Market: Breakup by Region (in %), 2024

- Figure 6: Global: Permanent Magnets Market: Breakup by Type (in %), 2024

- Figure 7: Global: Permanent Magnets Market Forecast: Sales Volume Trends (in Metric Tons), 2025-2033

- Figure 8: Global: Permanent Magnets Market Forecast: Sales Value Trends (in Billion USD), 2025-2033

- Figure 9: Global: Ferrite Magnet Market: Sales Volume (in Metric Tons), 2019-2024

- Figure 10: Global: Ferrite Magnet Market: Sales Value (in Billion USD), 2019-2024

- Figure 11: Global: Ferrite Magnet Market: Average Prices (in USD/Ton), 2019-2024

- Figure 12: Global: Ferrite Magnet Market: Breakup by Region (in %), 2024

- Figure 13: Global: Ferrite Magnet Market: Breakup by End Use (in %), 2024

- Figure 14: Global: Ferrite Magnet Market Forecast: Sales Volume (in Metric Tons), 2025-2033

- Figure 15: Global: Ferrite Magnet Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 16: Global: Ferrite Magnet Industry: SWOT Analysis

- Figure 17: Global: Ferrite Magnet Industry: Value Chain Analysis

- Figure 18: Global: Ferrite Magnet Industry: Porter's Five Forces Analysis

- Figure 19: China: Ferrite Magnet Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: China: Ferrite Magnet Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Japan: Ferrite Magnet Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Japan: Ferrite Magnet Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: USA: Ferrite Magnet Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: USA: Ferrite Magnet Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: India: Ferrite Magnet Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: India: Ferrite Magnet Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Others: Ferrite Magnet Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Others: Ferrite Magnet Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Ferrite Magnet (Electro-Acoustic Production Products) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Ferrite Magnet (Electro-Acoustic Production Products) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Ferrite Magnet (Electronics Industry) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Ferrite Magnet (Electronics Industry) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Ferrite Magnet (Power Play Tools) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Ferrite Magnet (Power Play Tools) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Global: Ferrite Magnet (Car Line Industry) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Global: Ferrite Magnet (Car Line Industry) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Global: Ferrite Magnet (Calculating Machines) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Global: Ferrite Magnet (Calculating Machines) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Global: Ferrite Magnet (Other End Uses) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: Global: Ferrite Magnet (Other End Uses) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Ferrite Magnet Powder Manufacturing: Detailed Process Flow

- Figure 42: Ferrite Magnet Powder Manufacturing Process: Conversion Rate of Products

- Figure 43: Ferrite Magnet Powder Manufacturing: Proposed Plant Layout

- Figure 44: Ferrite Magnet Powder Manufacturing Plant: Breakup of Capital Costs (in %)

- Figure 45: Ferrite Magnet Powder Industry: Profit Margins at Various Levels of the Supply Chain

- Figure 46: Ferrite Magnet Powder Production: Manufacturing Cost Breakup (in %)

List of Tables

- Table 1: Global: Permanent Magnet Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Ferrite Magnet Market: Key Industry Highlights, 2024 and 2033

- Table 3: Global: Ferrite Magnet Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 4: Global: Ferrite Magnet Market Forecast: Breakup by End Use (in Million USD), 2025-2033

- Table 5: Global: Ferrite Magnet Powder Market: Competitive Structure

- Table 6: Global: Ferrite Magnet Powder Market: Key Suppliers

- Table 7: Ferrite Magnet Powder Manufacturing Plant: Costs Related to Land and Site Development (in USD)

- Table 8: Ferrite Magnet Powder Manufacturing Plant: Costs Related to Civil Works (in USD)

- Table 9: Ferrite Magnet Powder Manufacturing Plant: Costs Related to Plant Machinery (in USD)

- Table 10: Ferrite Magnet Powder Manufacturing Plant: Raw Materials Requirements (in Tons/Day)

- Table 11: Ferrite Magnet Powder Manufacturing Plant: Costs Related to Salaries and Wedges (in USD)

- Table 12: Ferrite Magnet Powder Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

- Table 13: Details of Financial Assistance Offered by Financial Institutions

- Table 14: Ferrite Magnet Powder Manufacturing Plant: Capital Costs (in USD)

- Table 15: Ferrite Magnet Powder Manufacturing Plant: Techno-Economic Parameters

- Table 16: Ferrite Magnet Powder Manufacturing Plant: Taxation and Depreciation (in USD)

- Table 17: Ferrite Magnet Powder Manufacturing Plant: Income Projections (in USD)

- Table 18: Ferrite Magnet Powder Manufacturing Plant: Expenditure Projections (in USD)

- Table 19: Ferrite Magnet Powder Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in USD)

- Table 20: Ferrite Magnet Powder Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in USD)

- Table 21: Ferrite Magnet Powder Manufacturing Plant: Profit and Loss Account (in USD)

The global ferrite magnet powder market size reached USD 7.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.1 Billion by 2033, exhibiting a growth rate (CAGR) of 2.97% during 2025-2033. The growing adoption of green technology in automotive industries, the escalating sales of consumer electronics, especially in developing countries, and continual technological advancements in renewable energy systems represent some of the factors that are propelling the market.

Ferrite magnet powder is a composite material commonly composed of iron oxide combined with strontium, barium, or other metals. This powder is characterized by its resistance to demagnetization, stability under harsh conditions such as high temperatures, and resistance to corrosion. It is chiefly manufactured using a ceramic process that involves a combination of pressing and sintering. Ferrite magnet powder is magnetically isotropic, meaning it can be magnetized in various directions, depending on the requirements of the application. The magnetic properties of this material are not as strong as other types, such as rare earth magnets, but its lower cost and higher stability make it suitable for a wide array of applications. It is primarily used in the manufacturing of permanent magnets which are integral in motors, consumer electronics, and renewable energy systems.

The global market is primarily driven by the growing adoption of green technology in automotive industries, which is stimulating demand for energy-efficient permanent magnets. In line with this, the escalating sales of consumer electronics, especially in developing countries, are necessitating the increased use of ferrite magnets. Moreover, the significance of renewable energy sources, such as wind turbines that use permanent magnets, is adding momentum to market growth. Additional influences on the market include the development of smart home appliances, where compact and efficient motors are essential. Furthermore, the telecommunications sector's expansion, including the rollout of 5G technology, is driving the need for reliable magnetic components. Regulatory focus on energy-efficient appliances and automobiles is pushing manufacturers to opt for ferrite magnet powder for its effectiveness and lower cost. Some of the other contributing factors include increased adoption in industrial automation, the healthcare sector's growing needs for magnetic resonance imaging (MRI), and extensive research and development (R&D) activities to improve the material's magnetic properties.

Ferrite Magnet Powder Market Trends/Drivers:

Continual technological advancements in renewable energy systems

One significant factor driving the ferrite magnet powder market is continual advancements in renewable energy systems on a global level. As countries strive to reduce their carbon footprint and transition away from fossil fuels, the demand for alternative energy solutions is escalating. Ferrite magnet powder plays a pivotal role in the manufacturing of permanent magnets used in wind turbines. These magnets contribute to the efficiency and longevity of the wind energy systems. Apart from this, as solar energy technologies evolve, there is an increasing need for stable, long-lasting magnets to aid in energy storage solutions, where ferrite magnet powder has shown promise. In addition to this, the push toward greener, more sustainable energy solutions ensures a steady demand for ferrite magnet powder for years to come.

Considerable growth in consumer electronics and IoT applications

The exponential growth in consumer electronics and Internet of Things (IoT) applications is another significant factor that is creating lucrative opportunities in the market. Devices such as smartphones, laptops, and smart home appliances all require various types of permanent magnets, including those made from ferrite magnet powder. As the number of IoT applications multiply, there is an attendant need for more efficient, smaller, and more robust components. The low cost and stability of the product under a wide range of conditions make it an ideal choice for manufacturers looking to meet these requirements without sacrificing quality. Apart from this, the numerous innovations in consumer electronics and IoT technology are expected to sustain the demand for this material, making it an indispensable component in these industries.

Rapid industrialization and infrastructure development

Another critical force that is impacting the ferrite magnet powder market positively is the global trend of industrialization and infrastructure development. In many parts of the world, there is a concerted effort to upgrade existing infrastructure, such as transportation systems, utilities, and industrial equipment. Each of these projects often involves the use of electric motors, which require permanent magnets. Given its cost-effectiveness and performance under a variety of conditions, ferrite magnet powder is often the material of choice. Moreover, the increasing focus on creating energy-efficient industrial solutions necessitates the use of effective yet affordable magnetic materials. Therefore, as industrialization continues to sweep across various regions, the ferrite magnet powder market is likely to see a considerable rise in demand, underlining its importance in the global economy.

Ferrite Magnet Powder Industry Segmentation:

Breakup by End Use:

- Electro-Acoustic Production Products

- Electronics Industry

- Power Play Tools

- Car Line Industry

- Calculating Machines

- Others

Electro-acoustic production products represents the largest market segment

The electro-acoustic production products segment is seeing a considerable rise in demand for ferrite magnet powder largely due to the burgeoning market for consumer audio devices such as speakers, headphones, and home theater systems. The rising consumption of digital content and multimedia has significantly driven the need for high-quality audio equipment. Furthermore, professional settings like concerts, theaters, and broadcasting also contribute to the increased requirement for superior electro-acoustic products. The trend towards smart homes is necessitating the use of smart speakers, which inherently require quality magnets made from ferrite magnet powder. Advances in acoustic technology aiming for compactness and high performance are another factor making ferrite magnet powder essential in this segment.

On the other hand, in the electronics industry, ferrite magnet powder is indispensable for components like transformers and inductors, critical in almost every electronic device. Power play tools benefit from the durability and temperature resistance that ferrite magnet powder offers. The car line industry leverages it for electric motors in vehicles, especially as electric vehicles gain prominence. Calculating machines and other devices rely on the cost-effectiveness and efficiency of ferrite-based magnets for their operation.

Breakup by Region:

- China

- Japan

- USA

- India

- Others

China exhibits a clear dominance, accounting for the largest ferrite magnet powder market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, the USA, India, and others. According to the report, China accounted for the largest market share.

China stands as a dominant player in the ferrite magnet powder market for multiple reasons. The country is a hub for manufacturing, not only for domestic consumption but also for exports, leading to high demand for various types of magnets including those made from ferrite magnet powder. Moreover, China's aggressive push towards green technologies, particularly in the automotive and renewable energy sectors, necessitates the use of efficient and cost-effective materials like ferrite magnet powder.

Additionally, China is home to significant raw material reserves, facilitating cost-effective and efficient production. Fourth, the government's focus on advancing its technological capabilities aligns well with the increasing utilization of ferrite magnet powder in sectors like electronics, healthcare, and telecommunication.

Furthermore, China's large population results in substantial domestic demand for consumer electronics, automotive, and various other products that utilize ferrite magnets. Besides this, the country has a robust research and development ecosystem supported by both public and private investments, focused on enhancing material properties, which indirectly boosts the demand for ferrite magnet powder.

Competitive Landscape:

Key stakeholders are focusing on enhancing the quality and performance of their products by committing to R&D initiatives that aim at developing high-grade magnet powders for a variety of applications. Collaborations with end-user industries are common, helping these companies to tailor their products to meet specific needs. Market leaders are also adopting advanced manufacturing techniques to improve yield and reduce production costs. Furthermore, these companies are exploring new markets to capitalize on the growing demand for ferrite magnet powders. They are making their supply chain more robust to mitigate risks related to raw material procurement. To establish credibility, these businesses often seek industry certifications and adhere to international standards. Companies are also investing in strategic marketing campaigns that focus on the benefits of using high-quality ferrite magnet powder.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ningbo Yunsheng Co. Ltd.

- Hangzhou Permanent Magnet Group

- JPMF Guangdong Co. Ltd.

- Ninggang Permanent Magnet Materials Co. Ltd.

- Hitachi Metals Ltd.

Key Questions Answered in This Report

- 1.How big is the ferrite magnet powder market?

- 2.What is the expected growth rate of the global ferrite magnet powder market during 2025-2033?

- 3.What are the key factors driving the global ferrite magnet powder market?

- 4.What has been the impact of COVID-19 on the global ferrite magnet powder market?

- 5.What is the breakup of the global ferrite magnet powder market based on the end use?

- 6.What are the key regions in the global ferrite magnet powder market?

- 7.Who are the key players/companies in the global ferrite magnet powder market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Permanent Magnet Market

- 5.1 Market Overview

- 5.2 Market Trends

- 5.2.1 Volume Trend

- 5.2.2 Value Trend

- 5.3 Price Trend

- 5.4 Market Breakup by Region

- 5.5 Market Breakup by Type

- 5.6 Market Forecast

6 Global Ferrite Magnet Industry

- 6.1 Market Overview

- 6.2 Market Trends

- 6.2.1 Volume Trends

- 6.2.2 Value Trends

- 6.3 Impact of COVID-19

- 6.4 Price Analysis

- 6.4.1 Key Price Indicators

- 6.4.2 Price Structure

- 6.4.3 Price Trends

- 6.5 Market Breakup by Country

- 6.6 Market Breakup by End Use

- 6.7 Market Forecast

- 6.8 SWOT Analysis

- 6.8.1 Overview

- 6.8.2 Strengths

- 6.8.3 Weaknesses

- 6.8.4 Opportunities

- 6.8.5 Threats

- 6.9 Value Chain Analysis

- 6.10 Porter's Five Forces Analysis

- 6.10.1 Overview

- 6.10.2 Bargaining Power of Buyers

- 6.10.3 Bargaining Power of Suppliers

- 6.10.4 Degree of Competition

- 6.10.5 Threat of New Entrants

- 6.10.6 Threat of Substitutes

- 6.11 Key Market Drivers and Success Factors

7 Performance of Key Regions

- 7.1 China

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Japan

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 USA

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 India

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Others

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

8 Market Breakup by End Use

- 8.1 Electro-Acoustic Production Products

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Electronics Industry

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Power Play Tools

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Car Line Industry

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Calculating Machines

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Others

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

9 Competitive Landscape

- 9.1 Market Structure

- 9.2 Key Players

10 Ferrite Magnet Powder Manufacturing Process

- 10.1 Product Overview

- 10.2 Detailed Process Flow

- 10.3 Various Types of Unit Operations Involved

- 10.4 Mass Balance and Raw Material Requirements

11 Project Details, Requirements and Costs Involved

- 11.1 Land Requirements and Expenditures

- 11.2 Construction Requirements and Expenditures

- 11.3 Plant Layout

- 11.4 Plant Machinery

- 11.5 Machinery Pictures

- 11.6 Raw Material Requirements and Expenditures

- 11.7 Raw Material and Final Product Pictures

- 11.8 Packaging Requirements and Expenditures

- 11.9 Transportation Requirements and Expenditures

- 11.10 Utility Requirements and Expenditures

- 11.11 Manpower Requirements and Expenditures

- 11.12 Other Capital Investments

12 Loans and Financial Assistance

13 Project Economics

- 13.1 Capital Cost of the Project

- 13.2 Techno-Economic Parameters

- 13.3 Product Pricing and Margins Across Various Levels of the Supply Chain

- 13.4 Taxation and Depreciation

- 13.5 Income Projections

- 13.6 Expenditure Projections

- 13.7 Financial Analysis

- 13.8 Profit Analysis

14 Key Player Profiles

- 14.1 Ningbo Yunsheng Co. Ltd.

- 14.2 Hangzhou Permanent Magnet Group

- 14.3 JPMF Guangdong Co. Ltd.

- 14.4 Ninggang Permanent Magnet Materials Co. Ltd.

- 14.5 Hitachi Metals Ltd.