|

|

市場調査レポート

商品コード

1561442

湿度センサー市場レポート:タイプ、製品、材料、最終用途、地域別、2024年~2032年Humidity Sensor Market Report by Type, Product, Material, End Use, and Region 2024-2032 |

||||||

カスタマイズ可能

|

|||||||

| 湿度センサー市場レポート:タイプ、製品、材料、最終用途、地域別、2024年~2032年 |

|

出版日: 2024年09月10日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

湿度センサー市場の世界市場規模は、2023年に11億5,850万米ドルに達しました。今後、IMARC Groupは、市場は2032年までに20億3,850万米ドルに達し、2024年から2032年の間に6.3%の成長率(CAGR)を示すと予測しています。同市場は、IoT導入の増加、環境モニタリングに焦点を当てた厳しい規制要件、センサー技術の継続的な進歩によって、着実な成長を遂げています。

湿度センサー市場分析:

- 主な市場促進要因:モノのインターネット(IoT)および関連スマートデバイスの採用が増加しており、スマートホーム、産業オートメーション、ヘルスケアなどの用途で湿度センサーの需要が拡大しています。また、飲食品、製薬、環境保護分野での環境モニタリングに関する厳しい規制環境も湿度センサーの需要に拍車をかけています。

- 主な市場動向:小型化や高度な統合機能などセンサー技術の進歩により、湿度センサーの汎用性が大幅に向上しています。その結果、さまざまな分野で湿度センサーの採用が拡大していることが大きな動向となっています。主な市場動向は、デジタル化され接続されたセンシング技術がIoTシステムとシームレスに統合される方向に急速にシフトしていることであり、最近の動向にはリアルタイムのデータモニタリングや遠隔制御の促進などが含まれます。

- 地理的動向:世界の湿度センサー市場は、環境規制の厳しさと先端技術の採用率の高さから、アジア太平洋地域が支配的です。北米と欧州も、エレクトロニクス製造業を中心とした産業拡大とスマートインフラへの投資により急成長を遂げています。

- 競合情勢:市場の競争は激しく、大手企業はそれぞれの市場での地位を維持するため、先端センサーの革新と市場開拓に投資しています。また、戦略的提携や買収によって製品ポートフォリオを拡充し、新興市場での存在感を高めています。主なプレーヤーとしては、Amphenol Corporation、Analog Devices Inc.、株式会社デンソー、株式会社日立製作所、Honeywell International Inc.、Infineon Technologies AG、Robert Bosch GmbH、Sensata Technologies Inc.、Sensirion Holding AG、STMicroelectronics、TE Connectivity、Texas Instruments Incorporatedなどが挙げられます。

- 課題と機会:高度なセンサーの高コストと、変化する業界標準に対応するために必要な継続的な技術革新は、市場における課題の一部です。その一方で、特に新興市場におけるスマートデバイスやコネクテッドデバイスの需要の成長や、業界全体における環境モニタリングへの関心の高まりから生まれる機会もあります。

湿度センサー市場動向:

IoTとスマートデバイスの採用拡大

IoTおよびスマートデバイスの業界全体における製品採用の増加は、市場の成長を促進する主な要因の1つです。IoT技術の向上により、湿度などの環境条件をリアルタイムで測定するセンサーの需要が増加しています。これらのセンサーは、スマートホーム、産業オートメーションシステム、ヘルスケア機器に組み込まれ、より良い意思決定と自動化を支援する適切なデータを提供します。スマートホームでは、湿度センサーは、省エネを図りながら快適な生活環境を実現するためにHVACシステムを最適化するために応用されています。さらに、ヘルスケア分野でも、湿度レベルが健康や医療器具の効率にさまざまな影響を与える可能性のある医療機器や環境への適用を通じて、湿度センサーの恩恵を受けています。したがって、これが湿度センサー市場の成長を大きく後押ししています。さらに、IoTやスマート技術の普及により、高精度、高信頼性、接続性を提供する高度な湿度センサーの需要が高まっています。

環境モニタリングに対する厳しい規制要件

市場を支えるもう1つの主な原動力は、環境モニタリングに関連する厳しい規制要件であり、特に飲食品や製薬産業、環境保護に関するものです。これに伴い、各国の規制機関は、製品の品質と安全性を確保し、環境基準を満たすために、湿度レベルの厳格な管理と監視を定めています。例えば、飲食品加工では、湿度センサーにより、生鮮品の保管中や輸送中に腐敗が起こらないようにします。製薬分野では、湿度管理は製造と保管の全段階で医薬品の有効性を確保するための鍵となります。また、環境保護や公衆衛生のために、環境保護機関の側でも特定のエリアにおける湿度の継続的なモニタリングが必要です。このような規制により、法的措置からユーザーを保護するための正しいデータを提供する信頼性の高い湿度センサが常に求められています。このように、先進的な湿度モニタリングソリューションへの大規模投資につながる世界中の規制圧力の強化が、前向きな湿度センサー市場見通しを生み出しています。

センサー技術の進歩

湿度センサー市場の世界の成長を促進する主な要因の1つは、小型化、精度、統合能力に関するセンサー技術の進歩です。次世代湿度センサは、性能を落とすことなく小型化が進んでおり、複数の機器やシステムに組み込むことが可能になっています。これらのセンサーは、環境モニタリングが重視される用途において、より優れた精度と高速応答時間を提供します。さらに、改良された材料と微小電気機械システムのイントロダクションは、過酷な条件が支配する困難なアプリケーションで使用するための高度な堅牢性と信頼性に大きく貢献しています。これとは別に、より良いプロセスや品質管理のために産業界がリアルタイムデータを重視するようになり、高性能湿度センサーの開発ニーズが高まっていることも、最近の湿度センサー市場に多くの機会をもたらしています。そのため、センサ技術の革新は分野横断的なアプリケーションの拡大に大きな役割を果たしており、市場の成長をさらに後押ししています。

本レポートで扱う主な質問

- 世界の湿度センサー市場はこれまでどのように推移してきたのか?

- 世界の湿度センサー市場における促進要因、抑制要因、機会は何か?

- 促進要因、抑制要因、機会が世界の湿度センサー市場に与える影響は?

- 主要地域市場とは?

- 最も魅力的な湿度センサー市場はどの国か?

- タイプ別の市場内訳は?

- 湿度センサー市場で最も魅力的なタイプは?

- 製品別の市場内訳は?

- 湿度センサー市場で最も魅力的な製品は?

- 素材別の市場内訳は?

- 湿度センサー市場で最も魅力的な材料は?

- 最終用途別の市場内訳は?

- 湿度センサー市場で最も魅力的な最終用途は?

- 市場の競合構造は?

- 世界の湿度センサー市場における主要プレーヤー/企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の湿度センサー市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- デジタル

- 市場動向

- 市場予測

- アナログ

- 市場動向

- 市場予測

第7章 市場内訳:製品別

- 相対湿度センサー

- 市場動向

- 市場予測

- 絶対湿度センサー

- 市場動向

- 市場予測

第8章 市場内訳:材料別

- 半導体金属酸化物

- 市場動向

- 市場予測

- ポリマーベース

- 市場動向

- 市場予測

- セラミックセンシング

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:最終用途別

- 自動車

- 市場動向

- 市場予測

- 医薬品・ヘルスケア

- 市場動向

- 市場予測

- ビルオートメーションと家庭用電化製品

- 市場動向

- 市場予測

- 飲食品

- 市場動向

- 市場予測

- 環境

- 市場動向

- 市場予測

- 農業

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第10章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場動向

- 市場内訳:国別

- 市場予測

第11章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第14章 価格分析

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Amphenol Corporation

- Analog Devices Inc.

- DENSO Corporation

- Hitachi Ltd.

- Honeywell International Inc.

- Infineon Technologies AG

- Robert Bosch GmbH

- Sensata Technologies Inc.

- Sensirion Holding AG

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

List of Figures

- Figure 1: Global: Humidity Sensor Market: Major Drivers and Challenges

- Figure 2: Global: Humidity Sensor Market: Sales Value (in Million US$), 2018-2023

- Figure 3: Global: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 4: Global: Humidity Sensor Market: Breakup by Type (in %), 2023

- Figure 5: Global: Humidity Sensor Market: Breakup by Product (in %), 2023

- Figure 6: Global: Humidity Sensor Market: Breakup by Material (in %), 2023

- Figure 7: Global: Humidity Sensor Market: Breakup by End Use (in %), 2023

- Figure 8: Global: Humidity Sensor Market: Breakup by Region (in %), 2023

- Figure 9: Global: Humidity Sensor (Digital) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 10: Global: Humidity Sensor (Digital) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 11: Global: Humidity Sensor (Analog) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 12: Global: Humidity Sensor (Analog) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 13: Global: Humidity Sensor (Relative Humidity Sensors) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 14: Global: Humidity Sensor (Relative Humidity Sensors) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 15: Global: Humidity Sensor (Absolute Humidity Sensors) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 16: Global: Humidity Sensor (Absolute Humidity Sensors) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 17: Global: Humidity Sensor (Semiconducting Metal Oxides) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 18: Global: Humidity Sensor (Semiconducting Metal Oxides) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 19: Global: Humidity Sensor (Polymer-based) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 20: Global: Humidity Sensor (Polymer-based) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 21: Global: Humidity Sensor (Ceramic Sensing) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 22: Global: Humidity Sensor (Ceramic Sensing) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 23: Global: Humidity Sensor (Other Materials) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 24: Global: Humidity Sensor (Other Materials) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 25: Global: Humidity Sensor (Automotive) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 26: Global: Humidity Sensor (Automotive) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 27: Global: Humidity Sensor (Pharmaceutical and Healthcare) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 28: Global: Humidity Sensor (Pharmaceutical and Healthcare) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 29: Global: Humidity Sensor (Building Automation and Domestic Appliances) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 30: Global: Humidity Sensor (Building Automation and Domestic Appliances) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 31: Global: Humidity Sensor (Food and Beverages) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 32: Global: Humidity Sensor (Food and Beverages) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 33: Global: Humidity Sensor (Environmental) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 34: Global: Humidity Sensor (Environmental) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 35: Global: Humidity Sensor (Agriculture) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 36: Global: Humidity Sensor (Agriculture) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 37: Global: Humidity Sensor (Other End Uses) Market: Sales Value (in Million US$), 2018 & 2023

- Figure 38: Global: Humidity Sensor (Other End Uses) Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 39: North America: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 40: North America: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 41: United States: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 42: United States: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 43: Canada: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 44: Canada: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 45: Asia-Pacific: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 46: Asia-Pacific: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 47: China: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 48: China: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 49: Japan: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 50: Japan: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 51: India: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 52: India: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 53: South Korea: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 54: South Korea: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 55: Australia: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 56: Australia: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 57: Indonesia: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 58: Indonesia: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 59: Others: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 60: Others: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 61: Europe: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 62: Europe: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 63: Germany: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 64: Germany: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 65: France: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 66: France: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 67: United Kingdom: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 68: United Kingdom: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 69: Italy: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 70: Italy: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 71: Spain: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 72: Spain: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 73: Russia: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 74: Russia: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 75: Others: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 76: Others: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 77: Latin America: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 78: Latin America: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 79: Brazil: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 80: Brazil: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 81: Mexico: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 82: Mexico: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 83: Others: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 84: Others: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 85: Middle East and Africa: Humidity Sensor Market: Sales Value (in Million US$), 2018 & 2023

- Figure 86: Middle East and Africa: Humidity Sensor Market: Breakup by Country (in %), 2023

- Figure 87: Middle East and Africa: Humidity Sensor Market Forecast: Sales Value (in Million US$), 2024-2032

- Figure 88: Global: Humidity Sensor Industry: SWOT Analysis

- Figure 89: Global: Humidity Sensor Industry: Value Chain Analysis

- Figure 90: Global: Humidity Sensor Industry: Porter's Five Forces Analysis

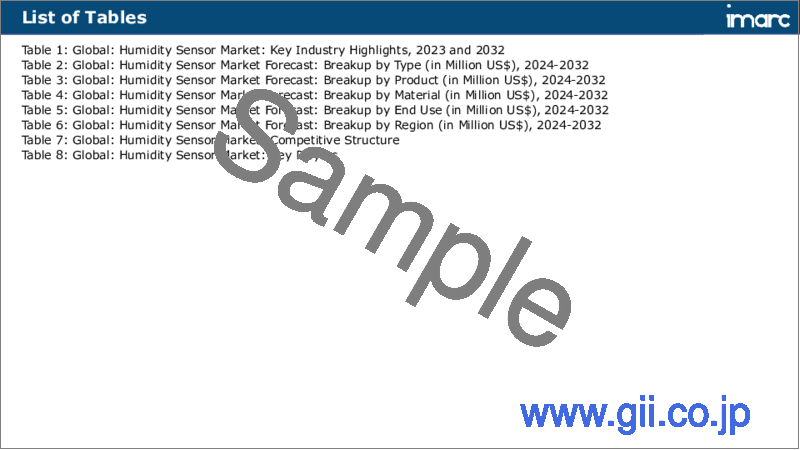

List of Tables

- Table 1: Global: Humidity Sensor Market: Key Industry Highlights, 2023 and 2032

- Table 2: Global: Humidity Sensor Market Forecast: Breakup by Type (in Million US$), 2024-2032

- Table 3: Global: Humidity Sensor Market Forecast: Breakup by Product (in Million US$), 2024-2032

- Table 4: Global: Humidity Sensor Market Forecast: Breakup by Material (in Million US$), 2024-2032

- Table 5: Global: Humidity Sensor Market Forecast: Breakup by End Use (in Million US$), 2024-2032

- Table 6: Global: Humidity Sensor Market Forecast: Breakup by Region (in Million US$), 2024-2032

- Table 7: Global: Humidity Sensor Market: Competitive Structure

- Table 8: Global: Humidity Sensor Market: Key Players

The global humidity sensor market size reached US$ 1,158.5 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 2,038.5 Million by 2032, exhibiting a growth rate (CAGR) of 6.3% during 2024-2032. The market is experiencing steady growth driven by the increasing IoT adoption, stringent regulatory requirements focused on environmental monitoring, and continual advancements in sensor technology.

Humidity Sensor Market Analysis:

- Major Market Drivers: The increasing adoption of the Internet of Things (IoT) and related smart devices is augmenting the demand for humidity sensors across smart homes, industrial automation, and healthcare applications. Another factor providing impetus to the demand for humidity sensors is the strict regulatory environment in terms of environment monitoring within the food and beverage, pharmaceutical, and environmental protection sectors.

- Key Market Trends: Advancements in sensor technology, including miniaturization and advanced integration capabilities have significantly enhanced the versatility of humidity sensors. Consequently, a major trend is the growing adoption of these sensors across various sectors. A key market trend is the rapid shift of digital and connected sensing technologies toward seamless integration with IoT systems, where humidity sensor market recent developments include facilitating real-time data monitoring and remote control.

- Geographical Trends: The global humidity sensor market is dominated by Asia-Pacific, due to the strictness of environmental regulations and high adoption rate of advanced technologies. North America and Europe are also witnessing fast growth due to industrial expansion, mainly in the form of electronics manufacturing, and investment in smart infrastructure.

- Competitive Landscape: The market is highly competitive, wherein major players are investing in innovation and development of advanced sensors to hold on to respective market positions. Strategic partnerships and acquisitions are also augmenting product portfolios and enhancing presence in emerging markets. Some of the key players Amphenol Corporation, Analog Devices Inc., DENSO Corporation, Hitachi Ltd., Honeywell International Inc., Infineon Technologies AG, Robert Bosch GmbH, Sensata Technologies Inc., Sensirion Holding AG, STMicroelectronics, TE Connectivity and Texas Instruments Incorporated.

- Challenges and Opportunities: The high cost of advanced sensors and continuous innovations needed to meet the changing standards of the industry include some of the challenges in the market. On the other hand, opportunities arise from growth in demand for smart and connected devices, particularly in emerging markets, and increasing interest in environmental monitoring across industries.

Humidity Sensor Market Trends:

Increasing adoption of IoT and smart devices

The growing product adoption across industries for IoT and smart devices is one of the major factors that fuel the growth of the market. Improvements in IoT technology are increasing the demand for sensors that measure environmental conditions such as humidity in real time. These sensors are embedded in smart homes, industrial automation systems, and healthcare devices to provide proper data that aids better decision-making and automation. In smart homes, humidity sensors are applied to optimize HVAC systems for comfortable living conditions while trying to save energy. Additionally, the healthcare sector also benefits from humidity sensors through their application in medical devices and environments where the level of humidity might affect the health or the efficiency of medical tools differently. Therefore, this is significantly driving the humidity sensor market growth. Moreover, the demand for advanced humidity sensors that provide high accuracy, reliability, and connectivity is rising due to the increasing popularity of IoT and smart technologies.

Stringent regulatory requirements for environmental monitoring

Another key driving force behind the market is strict regulatory requirements related to environmental monitoring, particularly regarding the food and beverage and pharmaceutical industries, as well as environmental protection. Along with this, the regulating bodies of various countries set stringent control and monitoring of the level of humidity to ensure the quality and safety of products and to meet environmental standards. For instance, in food and beverage processing, humidity sensors ensure that no spoilage of perishable goods occurs during storage and in-transit phases. In the pharmaceutical sector, humidity control is key to ensuring the effectiveness of drugs at all stages of production and storage. Continuous monitoring of humidity in certain areas is also necessary on the part of environmental protection agencies for environmental protection and public health. These regulations create a constant demand for reliable humidity sensors that provide correct data to protect users from legal measures. Thus, the enhanced regulatory pressures across the globe leading to large investments in advanced humidity monitoring solutions are creating a positive humidity sensor market outlook.

Advancements in sensor technology

One of the key factors driving growth in the global humidity sensor market is the advancements in sensor technology with respect to miniaturization, accuracy, and integration capability. Next-generation humidity sensors are becoming compact in size without performance degradation, thus making them feasible for embedding in several devices and systems. They offer better accuracy and faster response time for applications where environment monitoring is a prime concern. In addition, the introduction of improved materials and microelectromechanical systems is significantly contributing to a high degree of robustness and reliability for use in challenging applications where harsh conditions prevail. Apart from this, the growing need for developing high-performance humidity sensors due to the industries turning to real-time data for better processes and quality control is providing numerous humidity sensor market recent opportunities. Sensor technology innovation is, therefore, playing a major role in extending applications across sectors, further fueling the market growth.

Humidity Sensor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2024-2032. Our report has categorized the market based on type, product, material and end use.

Breakup by Type:

- Digital

- Analog

Digital accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes digital and analog. According to the report, digital represented the largest segment.

The digital humidity sensors segment is the largest in the market, driven by superior accuracy, ease of integration, and compatibility with modern IoT systems. Their working principle, converting the humidity readings into digital signals, is making these devices quite expedient in applications that require perfect environmental monitoring, such as in smart homes, industrial automation, and healthcare. Along with this, the escalating adoption of smart technologies is supporting the demand for digital sensors, offering real-time monitoring and remote access in order to enable optimization of environmental conditions with very minimal manual intervention. Besides, digital sensors are more rugged and reliable compared to their analog counterpart. This reduces the possibility of signal degradation and offers equal performance in different environments. Furthermore, the growing wave of data-driven decision-making and automation is also increasing humidity sensor demand.

Breakup by Product:

- Relative Humidity Sensors

- Absolute Humidity Sensors

Relative humidity sensors hold the largest share of the industry

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes relative humidity sensors and absolute humidity sensors. According to the report, relative humidity sensors accounted for the largest market share.

Relative humidity sensors represent the largest market share, finding wide application across numerous industries, impelled by their accuracy and cost-effectiveness, besides their versatility. These are sensors that detect the level of moisture in the air relative to the maximum amount of moisture that can be held by air at any particular temperature. Real-time data from RH sensors is imperative for maintaining the best conditions possible in an environment where exacting control over moisture prevents spoilage, contamination, or equipment malfunction. Along with this, the increasing integration of RH sensors into smart devices and IoT platforms is adding consumer electronics and wearable devices to the list of applications, thus increasing the humidity sensor market revenue. In addition, the development of sensor technology in terms of miniaturization and improved durability is making RH sensors more versatile in applications. Since industries remain focused on environmental monitoring and control, RH sensors are dominating the market.

Breakup by Material:

- Semiconducting Metal Oxides

- Polymer-based

- Ceramic Sensing

- Others

Semiconducting metal oxides represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the material. This includes semiconducting metal oxides, polymer-based, ceramic sensing, and others. According to the report, semiconducting metal oxides represented the largest segment.

Semiconducting metal oxides dominate the market due to high sensitivity, reliability, and adaptability across a wide range of applications. Among them, tin oxide (SnO2), titanium dioxide (TiO2), and zinc oxide (ZnO) have massive applications in humidity sensors due to their fine electrical conductivity and high chemical stability, which helps in detecting changes in relative humidity with a high degree of accuracy. One of the unique properties of semiconducting metal oxides is their fast response to changes in moisture content, providing real-time data for applications in industrial automation, environment monitoring, and smart devices with accuracy. According to the humidity sensor market forecast, semiconducting metal oxides can easily be incorporated into several sensor configurations and technologies, such as thin-film and nanostructures, which enhance their performance even more and aid in the integration into portable devices. In addition, advances in material science have led to the creation of better semiconducting metal oxides that are more sensitive and robust, hence finding application in extreme conditions such as high-temperature and corrosive environments. This can be supported by continuous research and development in optimizing their performance and broadening their use in state-of-the-art sensor technologies.

Breakup by End Use:

- Automotive

- Pharmaceutical and Healthcare

- Building Automation and Domestic Appliances

- Food and Beverages

- Environmental

- Agriculture

- Others

Automotive exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes automotive, pharmaceutical and healthcare, building automation and domestic appliances, food and beverages, environmental, agriculture, and others. According to the report, automotive accounted for the largest market share.

The automotive sector represents the biggest end-use segment of the market due to the trend of increased integration of better sensors into new vehicles for safety, comfort, and efficiency. This further plays a very crucial role in automotive climate control systems, providing optimum air quality and comfort by adjusting the inside environment with respect to real-time humidity. These sensors are also vital in preventing fogging on windshields and windows, thereby improving visibility and safety for drivers. According to the humidity sensor market overview, the increasing demands from EVs and autonomous driving technologies are due to the growing need for highly accurate environmental sensors as these vehicles rely on accurate data to maintain the best operating conditions and ensure the safety of their occupants. Moreover, automotive manufacturers are increasingly integrating humidity sensors into the engine control system to aid in fuel optimization and reduction of emissions through adjustment of the relevant parameters of an engine in relation to surrounding humidity. As the automobile industry innovates, demand for advanced humidity sensors is rising, thereby solidifying this sector's position as the largest end-use market for humidity sensors, thus driving growth in this segment.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest humidity sensor market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for humidity sensors.

Asia Pacific is the largest region in the market, propelled by rapid industrialization, urbanization, and increasing adoption of advanced technologies across the key sectors. This is led by countries such as China, Japan, South Korea, and India with their robust manufacturing bases, mainly in sectors such as electronics, automotive, and consumer goods. The region's unrivaled position in this respect is strongly attributed to its wide adoption within industries where precise environmental monitoring is required. Another key driver of the market in the region is the role of Asia Pacific as a global vehicle manufacturing and innovation hub, leading to the rising adoption of humidity sensors in climate control and engine management systems. Moreover, with the rapid growth in smart infrastructure projects, such as smart cities and connected homes, the demand for humidity sensors has risen significantly in the region. Furthermore, the initiatives being taken by governments towards industrial automation and environmental sustainability are playing an important role in driving the adoption of humidity sensors.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the humidity sensor industry include Amphenol Corporation, Analog Devices Inc., DENSO Corporation, Hitachi Ltd., Honeywell International Inc., Infineon Technologies AG, Robert Bosch GmbH, Sensata Technologies Inc., Sensirion Holding AG, STMicroelectronics, TE Connectivity and Texas Instruments Incorporated.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are trying to provide technological innovations and strategic collaborations that hold them in good stead, under the competitive scenario. Companies are investing substantial resources in R&D to facilitate higher accuracy, better miniaturization, and integration of sensors with IoT systems for their wider application across industries, ranging from automotive to healthcare. In addition, major humidity sensor companies are launching product lines with the addition of new digital and connected sensors, which also serve the demand for smart devices and real-time environmental monitoring. Along with this, strategic partnerships and acquisitions are enabling companies to reinforce their presence in the target markets and leverage leading positions in new markets, especially in the Asia Pacific region.

Key Questions Answered in This Report:

- How has the global humidity sensor market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global humidity sensor market?

- What is the impact of each driver, restraint, and opportunity on the global humidity sensor market?

- What are the key regional markets?

- Which countries represent the most attractive humidity sensor market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the humidity sensor market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the humidity sensor market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the humidity sensor market?

- What is the breakup of the market based on the end use?

- Which is the most attractive end use in the humidity sensor market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global humidity sensor market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Humidity Sensor Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type

- 6.1 Digital

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Analog

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Product

- 7.1 Relative Humidity Sensors

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Absolute Humidity Sensors

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by Material

- 8.1 Semiconducting Metal Oxides

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Polymer-based

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Ceramic Sensing

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Others

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

9 Market Breakup by End Use

- 9.1 Automotive

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Pharmaceutical & Healthcare

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Building Automation and Domestic Appliances

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Food and Beverages

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Environmental

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

- 9.6 Agriculture

- 9.6.1 Market Trends

- 9.6.2 Market Forecast

- 9.7 Others

- 9.7.1 Market Trends

- 9.7.2 Market Forecast

10 Market Breakup by Region

- 10.1 North America

- 10.1.1 United States

- 10.1.1.1 Market Trends

- 10.1.1.2 Market Forecast

- 10.1.2 Canada

- 10.1.2.1 Market Trends

- 10.1.2.2 Market Forecast

- 10.1.1 United States

- 10.2 Asia-Pacific

- 10.2.1 China

- 10.2.1.1 Market Trends

- 10.2.1.2 Market Forecast

- 10.2.2 Japan

- 10.2.2.1 Market Trends

- 10.2.2.2 Market Forecast

- 10.2.3 India

- 10.2.3.1 Market Trends

- 10.2.3.2 Market Forecast

- 10.2.4 South Korea

- 10.2.4.1 Market Trends

- 10.2.4.2 Market Forecast

- 10.2.5 Australia

- 10.2.5.1 Market Trends

- 10.2.5.2 Market Forecast

- 10.2.6 Indonesia

- 10.2.6.1 Market Trends

- 10.2.6.2 Market Forecast

- 10.2.7 Others

- 10.2.7.1 Market Trends

- 10.2.7.2 Market Forecast

- 10.2.1 China

- 10.3 Europe

- 10.3.1 Germany

- 10.3.1.1 Market Trends

- 10.3.1.2 Market Forecast

- 10.3.2 France

- 10.3.2.1 Market Trends

- 10.3.2.2 Market Forecast

- 10.3.3 United Kingdom

- 10.3.3.1 Market Trends

- 10.3.3.2 Market Forecast

- 10.3.4 Italy

- 10.3.4.1 Market Trends

- 10.3.4.2 Market Forecast

- 10.3.5 Spain

- 10.3.5.1 Market Trends

- 10.3.5.2 Market Forecast

- 10.3.6 Russia

- 10.3.6.1 Market Trends

- 10.3.6.2 Market Forecast

- 10.3.7 Others

- 10.3.7.1 Market Trends

- 10.3.7.2 Market Forecast

- 10.3.1 Germany

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.1.1 Market Trends

- 10.4.1.2 Market Forecast

- 10.4.2 Mexico

- 10.4.2.1 Market Trends

- 10.4.2.2 Market Forecast

- 10.4.3 Others

- 10.4.3.1 Market Trends

- 10.4.3.2 Market Forecast

- 10.4.1 Brazil

- 10.5 Middle East and Africa

- 10.5.1 Market Trends

- 10.5.2 Market Breakup by Country

- 10.5.3 Market Forecast

11 SWOT Analysis

- 11.1 Overview

- 11.2 Strengths

- 11.3 Weaknesses

- 11.4 Opportunities

- 11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

- 13.1 Overview

- 13.2 Bargaining Power of Buyers

- 13.3 Bargaining Power of Suppliers

- 13.4 Degree of Competition

- 13.5 Threat of New Entrants

- 13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 Amphenol Corporation

- 15.3.1.1 Company Overview

- 15.3.1.2 Product Portfolio

- 15.3.1.3 Financials

- 15.3.1.4 SWOT Analysis

- 15.3.2 Analog Devices Inc.

- 15.3.2.1 Company Overview

- 15.3.2.2 Product Portfolio

- 15.3.2.3 Financials

- 15.3.2.4 SWOT Analysis

- 15.3.3 DENSO Corporation

- 15.3.3.1 Company Overview

- 15.3.3.2 Product Portfolio

- 15.3.3.3 Financials

- 15.3.3.4 SWOT Analysis

- 15.3.4 Hitachi Ltd.

- 15.3.4.1 Company Overview

- 15.3.4.2 Product Portfolio

- 15.3.4.3 Financials

- 15.3.4.4 SWOT Analysis

- 15.3.5 Honeywell International Inc.

- 15.3.5.1 Company Overview

- 15.3.5.2 Product Portfolio

- 15.3.5.3 Financials

- 15.3.5.4 SWOT Analysis

- 15.3.6 Infineon Technologies AG

- 15.3.6.1 Company Overview

- 15.3.6.2 Product Portfolio

- 15.3.6.3 Financials

- 15.3.6.4 SWOT Analysis

- 15.3.7 Robert Bosch GmbH

- 15.3.7.1 Company Overview

- 15.3.7.2 Product Portfolio

- 15.3.7.3 SWOT Analysis

- 15.3.8 Sensata Technologies Inc.

- 15.3.8.1 Company Overview

- 15.3.8.2 Product Portfolio

- 15.3.9 Sensirion Holding AG

- 15.3.9.1 Company Overview

- 15.3.9.2 Product Portfolio

- 15.3.9.3 Financials

- 15.3.10 STMicroelectronics

- 15.3.10.1 Company Overview

- 15.3.10.2 Product Portfolio

- 15.3.10.3 Financials

- 15.3.10.4 SWOT Analysis

- 15.3.11 TE Connectivity

- 15.3.11.1 Company Overview

- 15.3.11.2 Product Portfolio

- 15.3.11.3 Financials

- 15.3.11.4 SWOT Analysis

- 15.3.12 Texas Instruments Incorporated

- 15.3.12.1 Company Overview

- 15.3.12.2 Product Portfolio

- 15.3.12.3 Financials

- 15.3.12.4 SWOT Analysis

- 15.3.1 Amphenol Corporation