|

|

市場調査レポート

商品コード

1647384

湿度センサー市場:タイプ別、測定技術別、最終用途別、地域別 - 2030年までの予測Humidity Sensor Market by Type (Capacitive, Resistive, Thermal Conductivity, Optical, Carbon, Ceramic, Lithium Chloride), Measurement Technique (Relative, Absolute), Technology (MEMS, Thin-film, Printed, Wireless Nodes) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 湿度センサー市場:タイプ別、測定技術別、最終用途別、地域別 - 2030年までの予測 |

|

出版日: 2025年01月29日

発行: MarketsandMarkets

ページ情報: 英文 248 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

湿度センサーの市場規模は、2025年の34億4,000万米ドルから成長し、2030年には46億4,000万米ドルに達すると予測され、2025年から2030年までのCAGRは6.2%になると見込まれています。

これは主に、効率の最適化、機器の統合プロセスの簡素化、今日の技術的変化のサポートに焦点を当てた小型デジタル湿度センサーへの関心の高まりによるものです。湿度センサーは、ヘルスケア、家電、自動車、産業オートメーションなどの分野で応用されており、いずれも環境関連のデータをリアルタイムで正確に収集する機能を備えています。IoT、スマートデバイス、環境モニタリングに関する厳格な規制に対する需要の高まりが、湿度制御製品の需要を押し上げています。生産性とエネルギー効率を高めるための高度なセンサー技術へのニーズの高まり。MEMSベースのセンサーやワイヤレスモニタリングによる技術革新が市場の成長を支えています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | タイプ別、測定技術別、最終用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

熱伝導湿度センサーは、生産環境における湿度の観察と調整に不可欠であり、不良品や腐敗の発生を防ぎます。さらに、産業環境における自動化とIoT技術の進歩により、プロセスを最適化するための継続的で正確なデータを提供するセンサーの必要性が高まっています。熱伝導率湿度センサーは、その堅牢性と極端な温度や過酷な条件下でも機能する能力で特に珍重されており、産業用では不可欠となっています。環境への配慮や持続可能性に関する厳しい規制が強化される中、センサーの需要は、産業の気候制御を改善するため、エネルギーの浪費を減少させ続けています。さまざまな産業で高度なプロセス制御システムが採用されていることも、センサーの需要を後押ししています。センサーの効率は、業務効率の向上と熱伝導率湿度センサー市場のさらなる拡大にとって極めて重要であることが証明されるからです。

相対測定技術セグメントは、その幅広い適用性、費用対効果、多様なシステムへの容易な統合により、市場支配的なセグメントの1つとなっています。個別には、この技術に基づく相対湿度センサーは、HVAC、農業、製薬、家電産業で広く使用されています。これらのセンサーの利点は、動的な環境に関するリアルタイムで正確な湿度情報の需要が高いことであり、その結果、温度に敏感なプロセスにおいて、適切な条件が取得され、維持されます。小規模および大規模産業で相対湿度センサーが多く使用されている理由は、絶対測定技術よりも比較的安価であることです。これらのセンサーは小型化とセンサー技術の向上により、性能と信頼性を高めています。携帯機器やIoTアプリケーションに適しています。ワイヤレスやクラウドベースのシステムに統合することで、最新の産業オートメーションやホームオートメーション市場にも適しています。これらすべての要因が相まって、予測期間中にこのセグメントの市場シェアを大きく押し上げます。

湿度センサーは、精度、効率、高品質の製品を提供する上で重要な役割を果たすため、産業用プロセス制御で関心が高まっています。これらのセンサーは、クリーンルームや管理された空間内の極端な環境条件を維持することが非常に重要な要件である製薬、化学、食品加工産業で重要な役割を果たしています。製造やプロセスの自動化では、湿度レベルを維持し、機器の劣化を防ぎ、製品の安定した出力を保証します。インダストリー4.0とスマート・マニュファクチャリングに採用された湿度センサーは、自動制御システムに統合され、環境パラメーターの変化をリアルタイムで監視して調整します。そのため、ダウンタイムや無駄を最小限に抑え、生産効率を高めることができます。自動車、電子機器、製薬業界では、材料の品質を維持し、材料の劣化が起こらないようにするために、このセンサーを必要としています。メーカーが高度なセンシング・ソリューションに注力する中、湿度センサーの役割はプロセスの最適化とコンプライアンスを推進することで進化を続け、自動化された効率的なオペレーションをさらにサポートします。

当レポートでは、世界の湿度センサー市場について調査し、タイプ別、測定技術別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- AI/生成AIが湿度センサー市場に与える影響

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 関税と規制状況

- 特許分析

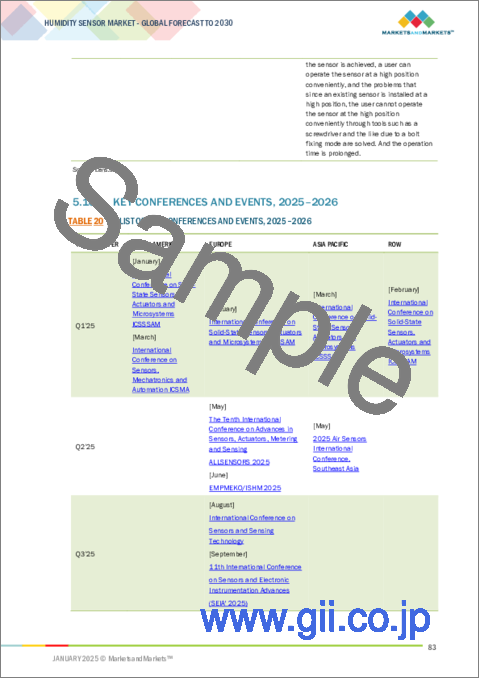

- 2025年~2026年の主な会議とイベント

第6章 湿度センシング技術

- イントロダクション

- MEMSベースのセンサー

- 薄膜センサー

- プリント湿度センサー

- ワイヤレスセンサーノード

第7章 湿度センサー市場(タイプ別)

- イントロダクション

- 静電容量式

- 抵抗式

- 熱式

- その他

第8章 湿度センサー市場(計測技術別)

- イントロダクション

- 絶対的

- 相対的

第9章 湿度センサー市場(最終用途別)

- イントロダクション

- 環境モニタリング

- HVACと気候制御

- 産業プロセス制御

- 家電

- ヘルスケア・医薬品

- 農業

- 自動車

- 食品・飲料

- 建築・建設

- 物流・サプライチェーン

第10章 湿度センサー市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- その他

- 行

- その他の地域のマクロ経済見通し

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- 製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- AMPHENOL ADVANCED SENSORS

- HONEYWELL INTERNATIONAL INC.

- TEXAS INSTRUMENTS INCORPORATED

- SETRA SYSTEMS

- SENSIRION AG

- TE CONNECTIVITY

- SIEMENS

- TERACOM

- BOSCH SENSORTEC GMBH

- SCHNEIDER ELECTRIC

- RENESAS ELECTRONICS CORPORATION

- その他の企業

- B+B THERMO-TECHNIK GMBH

- E+E ELEKTRONIK GES.M.B.H.

- IST AG

- HUNAN RIKA ELECTRONIC TECH CO.,LTD

- DICKSON

- GALLTEC MESS-UND REGELTECHNIK GMBH

- PCE HOLDING GMBH

- SETRA SYSTEMS

- SUNSUI PROCESS SYSTEM

- PRESSAC COMMUNICATIONS LIMITED

- SMART FOG

- WINSEN

- KELE PRECISION MANUFACTURING

- RAYSTEK PROCESS INSTRUMENTS

- AHLBORN

- SHANDONG RENKE CONTROL TECHNOLOGY CO.,LTD.

- AVTECH SOFTWARE, INC.

- NOVOSENSE

第13章 付録

List of Tables

- TABLE 1 HUMIDITY SENSOR MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 HUMIDITY SENSOR MARKET: RISK ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN HUMIDITY SENSOR ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF HUMIDITY SENSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD)

- TABLE 5 INDICATIVE PRICING OF HUMIDITY SENSORS, BY TYPE, 2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF HUMIDITY SENSORS, BY REGION, 2021-2024 (USD)

- TABLE 7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

- TABLE 10 IMPORT DATA FOR HS CODE 902690-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 902690-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 MFN TARIFF FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 13 MFN TARIFF FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023

- TABLE 14 MFN TARIFF FOR HS CODE 902690-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2023

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 LIST OF KEY PATENTS, 2024

- TABLE 20 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 22 HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 23 HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 24 HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 25 CAPACITIVE: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 CAPACITIVE: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 CAPACITIVE: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 28 CAPACITIVE: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 CAPACITIVE: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 30 CAPACITIVE: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 31 CAPACITIVE: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 CAPACITIVE: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 CAPACITIVE: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 CAPACITIVE: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 RESISTIVE: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 RESISTIVE: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 RESISTIVE: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 RESISTIVE: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 RESISTIVE: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 RESISTIVE: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 RESISTIVE: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 RESISTIVE: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 RESISTIVE: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 RESISTIVE: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 THERMAL: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 THERMAL: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 THERMAL: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 THERMAL: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 THERMAL: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 THERMAL: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 THERMAL: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 THERMAL: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 THERMAL: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 THERMAL: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 OTHER HUMIDITY SENSORS: HUMIDITY SENSOR MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 66 HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 67 ABSOLUTE: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 ABSOLUTE: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 RELATIVE: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 RELATIVE: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 74 HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 75 ENVIRONMENTAL MONITORING: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 ENVIRONMENTAL MONITORING: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 HVAC & CLIMATE CONTROL: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 HVAC & CLIMATE CONTROL: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 INDUSTRIAL PROCESS CONTROL: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 INDUSTRIAL PROCESS CONTROL: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 CONSUMER ELECTRONICS: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 CONSUMER ELECTRONICS: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 HEALTHCARE & PHARMACEUTICAL: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 HEALTHCARE & PHARMACEUTICAL: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 AGRICULTURE: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 AGRICULTURE: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 AUTOMOTIVE: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 AUTOMOTIVE: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 FOOD & BEVERAGE: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 FOOD & BEVERAGE: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 BUILDING & CONSTRUCTION: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 BUILDING & CONSTRUCTION: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 LOGISTICS & SUPPLY CHAIN: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 LOGISTICS & SUPPLY CHAIN: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 105 US: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 US: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 US: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 108 US: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 109 CANADA: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 110 CANADA: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 112 CANADA: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 114 MEXICO: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 115 MEXICO: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 116 MEXICO: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: HUMIDITY SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: HUMIDITY SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 EUROPE: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 122 EUROPE: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 125 UK: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 126 UK: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 127 UK: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 128 UK: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 GERMANY: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 132 GERMANY: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 133 FRANCE: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 134 FRANCE: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 135 FRANCE: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 136 FRANCE: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 137 NORDICS: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 138 NORDICS: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 139 NORDICS: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 140 NORDICS: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 141 REST OF EUROPE: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 142 REST OF EUROPE: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 REST OF EUROPE: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 144 REST OF EUROPE: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 154 CHINA: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 JAPAN: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 156 JAPAN: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 INDIA: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 INDIA: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 ROW: HUMIDITY SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 ROW: HUMIDITY SENSOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 ROW: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 164 ROW: HUMIDITY SENSOR MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 165 ROW: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 ROW: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 ROW: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 168 ROW: HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 169 ROW: HUMIDITY SENSOR MARKET FOR CAPACITIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 ROW: HUMIDITY SENSOR MARKET FOR CAPACITIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 171 ROW: HUMIDITY SENSOR MARKET FOR RESISTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 172 ROW: HUMIDITY SENSOR MARKET FOR RESISTIVE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 173 ROW: HUMIDITY SENSOR MARKET FOR THERMAL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 174 ROW: HUMIDITY SENSOR MARKET FOR THERMAL, BY REGION, 2025-2030 (USD MILLION)

- TABLE 175 ROW: HUMIDITY SENSOR MARKET FOR OTHER HUMIDITY SENSORS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 176 ROW: HUMIDITY SENSOR MARKET FOR OTHER HUMIDITY SENSORS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 177 SOUTH AMERICA: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 SOUTH AMERICA: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST: HUMIDITY SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST: HUMIDITY SENSOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 AFRICA: HUMIDITY SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 184 AFRICA: HUMIDITY SENSOR MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 HUMIDITY SENSOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-DECEMBER 2024

- TABLE 186 HUMIDITY SENSOR MARKET: DEGREE OF COMPETITION, 2023

- TABLE 187 HUMIDITY SENSOR MARKET: REGION FOOTPRINT

- TABLE 188 HUMIDITY SENSOR MARKET: TYPE FOOTPRINT

- TABLE 189 HUMIDITY SENSOR MARKET: MEASUREMENT TECHNIQUE FOOTPRINT

- TABLE 190 HUMIDITY SENSOR MARKET: END-USE APPLICATION FOOTPRINT

- TABLE 191 HUMIDITY SENSOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 192 HUMIDITY SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 193 HUMIDITY SENSOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 194 HUMIDITY SENSOR MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 195 AMPHENOL ADVANCED SENSORS: COMPANY OVERVIEW

- TABLE 196 AMPHENOL ADVANCED SENSORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 198 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 200 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 201 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 202 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 203 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 204 SETRA SYSTEMS: COMPANY OVERVIEW

- TABLE 205 SETRA SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 SETRA SYSTEMS: DEALS

- TABLE 207 SENSIRION AG: COMPANY OVERVIEW

- TABLE 208 SENSIRION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SENSIRION AG: PRODUCT LAUNCHES

- TABLE 210 SENSIRION AG: DEALS

- TABLE 211 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 212 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 TE CONNECTIVITY: DEALS

- TABLE 214 SIEMENS: COMPANY OVERVIEW

- TABLE 215 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 SIEMENS: DEALS

- TABLE 217 TERACOM: COMPANY OVERVIEW

- TABLE 218 TERACOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 BOSCH SENSORTEC GMBH: COMPANY OVERVIEW

- TABLE 220 BOSCH SENSORTEC GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 222 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 224 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

List of Figures

- FIGURE 1 HUMIDITY SENSOR MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HUMIDITY SENSOR MARKET: RESEARCH DESIGN

- FIGURE 3 HUMIDITY SENSOR MARKET: RESEARCH APPROACH

- FIGURE 4 HUMIDITY SENSOR MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 5 HUMIDITY SENSOR MARKET: BOTTOM-UP APPROACH

- FIGURE 6 HUMIDITY SENSOR MARKET: TOP-DOWN APPROACH

- FIGURE 7 HUMIDITY SENSOR MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 HUMIDITY SENSOR MARKET: DATA TRIANGULATION

- FIGURE 9 HUMIDITY SENSOR MARKET: RESEARCH LIMITATIONS

- FIGURE 10 THERMAL SEGMENT TO EXHIBIT HIGHEST CAGR IN HUMIDITY SENSOR MARKET FROM 2025 TO 2030

- FIGURE 11 ABSOLUTE SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 INDUSTRIAL PROCESS CONTROL SEGMENT TO DOMINATE HUMIDITY SENSOR MARKET BETWEEN 2025 AND 2030

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN HUMIDITY SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 14 RISING EMPHASIS ON AIR QUALITY MONITORING TO OFFER LUCRATIVE OPPORTUNITIES FOR PLAYERS IN HUMIDITY SENSOR MARKET

- FIGURE 15 CAPACITIVE SEGMENT TO DOMINATE HUMIDITY SENSOR MARKET BETWEEN 2025 AND 2030

- FIGURE 16 RELATIVE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 17 INDUSTRIAL PROCESS CONTROL SEGMENT AND US HELD LARGEST SHARES OF HUMIDITY SENSOR MARKET IN NORTH AMERICA IN 2024

- FIGURE 18 INDUSTRIAL PROCESS CONTROL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL HUMIDITY SENSOR MARKET FROM 2025 TO 2030

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT ANALYSIS: DRIVERS

- FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 24 IMPACT ANALYSIS: CHALLENGES

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 HUMIDITY SENSOR ECOSYSTEM

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2020-2023

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 AVERAGE SELLING PRICE OF HUMIDITY SENSORS OFFERED BY KEY PLAYERS, BY TYPE, 2024

- FIGURE 30 AVERAGE SELLING PRICE TREND OF HUMIDITY SENSORS, BY REGION, 2021-2024

- FIGURE 31 IMPACT OF AI/GEN AI ON HUMIDITY SENSOR MARKET

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE APPLICATIONS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END-USE APPLICATIONS

- FIGURE 35 IMPORT DATA FOR HS CODE 902690-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 36 EXPORT DATA FOR HS CODE 902690-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2019-2023

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2012-2023

- FIGURE 38 THERMAL SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ABSOLUTE SEGMENT TO EXHIBIT HIGHER CAGR BETWEEN 2025 AND 2030

- FIGURE 40 ENVIRONMENTAL MONITORING SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO DOMINATE HUMIDITY SENSOR MARKET FROM 2025 TO 2030

- FIGURE 42 NORTH AMERICA: HUMIDITY SENSOR MARKET SNAPSHOT

- FIGURE 43 US TO REGISTER HIGHEST CAGR IN NORTH AMERICAN HUMIDITY SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 44 EUROPE: HUMIDITY SENSOR MARKET SNAPSHOT

- FIGURE 45 FRANCE TO HOLD LARGEST SHARE OF EUROPEAN HUMIDITY SENSOR MARKET BETWEEN 2025 AND 2030

- FIGURE 46 ASIA PACIFIC: HUMIDITY SENSOR MARKET SNAPSHOT

- FIGURE 47 INDIA TO EXHIBIT HIGHEST CAGR IN ASIA PACIFIC HUMIDITY SENSOR MARKET DURING FORECAST PERIOD

- FIGURE 48 ROW: HUMIDITY SENSOR MARKET SNAPSHOT

- FIGURE 49 MIDDLE EAST TO DOMINATE ROW HUMIDITY SENSOR MARKET FROM 2025 TO 2030

- FIGURE 50 HUMIDITY SENSOR MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2019-2023

- FIGURE 51 MARKET SHARE ANALYSIS OF COMPANIES OFFERING HUMIDITY SENSORS, 2023

- FIGURE 52 COMPANY VALUATION, 2024

- FIGURE 53 FINANCIAL METRICS, 2024 (EV/EBITDA)

- FIGURE 54 PRODUCT COMPARISON

- FIGURE 55 HUMIDITY SENSOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 56 HUMIDITY SENSOR MARKET: COMPANY FOOTPRINT

- FIGURE 57 HUMIDITY SENSOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 AMPHENOL ADVANCED SENSORS: COMPANY SNAPSHOT

- FIGURE 59 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 60 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 61 SENSIRION AG: COMPANY SNAPSHOT

- FIGURE 62 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 63 SIEMENS: COMPANY SNAPSHOT

- FIGURE 64 BOSCH SENSORTEC GMBH: COMPANY SNAPSHOT

- FIGURE 65 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 66 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

The humidity sensor market is projected to grow from USD 3.44 billion in 2025 and is projected to reach USD 4.64 billion by 2030; it is expected to grow at a CAGR of 6.2% from 2025 to 2030. This is largely due to increased interest in compact digital humidity sensors, mainly focused on optimizing efficiency, easing the integration process for devices, and supporting today's technological changes. These are finding applications across health care, consumer electronics, automotive, and industrial automation fields, all for their precise real-time environment-related data gathering capability. Growing demand for IoT applications, smart devices, and strict regulations for environmental monitoring is boosting the demand for humidity control products. The growing need for sophisticated sensor technologies for enhancing productivity and energy efficiency. Innovation through MEMS-based sensors and wireless monitoring is supporting the market's growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Measurement Technique, End-User Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Growing need of thermal conductivity humidity sensors in the industrial process control to boost the market growth of thermal conductivity humidity sensors"

Thermal conductivity humidity sensors are critical for observing and regulating humidity in a production setting; avoiding any defectiveness or spoilage. In addition, the advancements in automation and IoT technologies in the industrial environment have increased the need for sensors to deliver continuous and precise data to optimize the process. Thermal conductivity humidity sensors are especially prized for their ruggedness and ability to function in extreme temperatures and harsh conditions, which makes them essential in industrial applications. With strict regulations on environmental considerations and greater sustainability, the demand for sensors continues to decrease the wastage of energy because they provide improved climate control for industries. The adoption of advanced process control systems across various industries has contributed to fuelled demand for sensors, since their efficiency can prove to be pivotal for improved operational efficiencies and further expansion of thermal conductivity humidity sensor market.

"Market for relative measurement technique segment is projected to hold for largest share during the forecast timeline."

Relative measurement technique segment is one of the dominant market segments due to its wide applicability, cost-effectiveness, and easy integration into diverse systems. Individually, relative humidity sensors based on this technique are widely used in HVAC, agricultural, pharmaceutical, and consumer electronics industries. The benefits of these sensors are that they are highly in demand for real-time and accurate humidity information about dynamic environments; thus, in temperature-sensitive processes, the appropriate conditions are acquired and maintained. The reason for the greater use of relative humidity sensors among small-scale and large-scale industries is their relatively lesser costs than the absolute measurement technique. These sensors improve miniaturization and sensor technology to increase performance and reliability. They are good for portable devices and IoT applications. Integration in wireless and cloud-based systems makes them relevant in the modern industrial automation and home automation markets. All of these factors work together to propel this segment significantly in the market share during the forecast period.

"Market for industrial process control holds for largest market share during the forecast period."

Humidity sensors have gained increasing interest in industrial process control because they play a key role in delivering precision, efficiency, and high-quality products. These sensors play a crucial role in the pharmaceutical, chemical, and food processing industries, where the requirement to maintain extreme environmental conditions inside clean rooms and controlled spaces is highly critical. In manufacturing and process automation, they maintain the moisture level, prevent equipment degradation, and ensure the product output is consistent. Adopted with Industry 4.0 and smart manufacturing, humidity sensors are integrated in automated control systems to monitor real-time changes of environmental parameters in order to regulate them. Thus, it can minimize downtime and waste and enhance production efficiency. Automotive, electronic, and pharmaceutical industries require this sensor to maintain the quality of materials and also ensure that material degradation does not occur. As manufacturers focus on advanced sensing solutions, the role of humidity sensors continues to evolve in driving process optimization and compliance, thereby bringing more support to automated and efficient operations.

"Asia Pacific is expected to have the highest market share during the forecast period."

The Asia Pacific region is poised to dominate the humidity sensor market because of rapid industrialization, urbanization, and technological advancement in this region. Industries like automotive, electronics, pharmaceutical, and food processing, which need a humid sensor for quality checking, process optimization, are highly successful in countries like China, India, and Japan. Industry 4.0 and smart manufacturing are being introduced all over the region, further increasing the chance for high-performance humidity sensing solutions. Commercial and residential construction continue to grow, boosted by the increasing disposable income of people and rapid urban development, which requires an effective HVAC system. Governments in the region are also investing in infrastructure projects and environmental monitoring initiatives, increasing humidity sensor adoption opportunities. With a strong manufacturing base, cost-effective labor availability, and the right government policies, Asia Pacific becomes a significant production and consumption hub for humidity sensors during the forecast period.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the humidity sensor marketplace. The break-up of the profile of primary participants in the humidity sensor market:

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By Designation: C Level - 40%, Director Level - 30%, Others-30%

- By Region: North America - 35%, Europe - 35%, Asia Pacific - 20%, ROW- 10%

Amphenol Advanced Sensors (Subsidiary of Amphenol Corporation) (US), Honeywell International Inc. (US), Texas Instruments Incorporated (US), Setra Systems (US), Sensirion AG (Switzerland), TE Connectivity (Ireland), Siemens (Germany), Teracom (Sweden), Bosch Sensortec GmbH (Subsidiary of Robert Bosch GmbH) (US), Schneider Electric (France), and Renesas Electronics Corporation. (Japan) are some of the key players in the humidity sensor Market.

The study includes an in-depth competitive analysis of these key players in the humidity sensor market, with their company profiles, recent developments, and key market strategies. Research Coverage: This research report categorizes the humidity sensor market by type (Capacitive, Resistive, Thermal Condustivity & Others); by measurement technique (Relative, Absolute); by end-user industry (Environmental Monitoring, HVAC and Climate Control, Industrial Process Control, Consumer Electronics , Healthcare & Pharmaceuticals, Agriculture, Automotive, Food & Beverage, Building & Construction, and Logistics & Supply Chain) and by region (North America, Europe, Asia Pacific, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the humidity sensor market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the humidity sensor market have been covered in the report. This report covers a competitive analysis of upcoming startups in the humidity sensor market ecosystem.

Reasons to buy this report The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall humidity sensor market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key benefits of buying the report:

- Analysis of key drivers (Increasing focus on compact digital humidity sensors to enhance efficiency and simplify device design; Rising demand for humidity sensors in industrial processing, semiconductor manufacturing, and smart home applications; Need for precise humidity control in printing to enhance efficiency, quality, and reduce costs), restraints (Limited integration with legacy systems and devices; Sensor drift and performance degradation over time), opportunities (Advancements in printed humidity sensors enable innovative applications in flexible and wearable electronics; Growing demand for calibrated, precise humidity sensors with I2C interface for cost-effective, reliable applications) and challenges (Complex standardization across different industrial sectors; Material limitations in harsh operating environments) influencing the growth of the humidity sensor market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the humidity sensor market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the humidity sensor market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the humidity sensor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading Amphenol Advanced (US), Honeywell International Inc. (US), Texas Instruments Incorporated (US), Setra Systems (US), Sensirion AG (Switzerland), TE Connectivity (Ireland), Siemens (Germany), Teracom (Sweden), Bosch Sensortec GmbH (US), Schneider Electric (France), and Renesas Electronics Corporation. (Japan) among others in the humidity sensor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HUMIDITY SENSOR MARKET

- 4.2 HUMIDITY SENSOR MARKET, BY TYPE

- 4.3 HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE

- 4.4 HUMIDITY SENSOR MARKET IN NORTH AMERICA, BY END-USE APPLICATION AND COUNTRY

- 4.5 HUMIDITY SENSOR MARKET, BY END-USE APPLICATION

- 4.6 HUMIDITY SENSOR MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for efficient and compact sensors

- 5.2.1.2 Rising need for precise environmental monitoring solutions

- 5.2.1.3 Increasing requirement for humidity control in printing processes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Incompatibility of legacy systems with contemporary digital humidity sensors

- 5.2.2.2 Sensor drift and other performance issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid advances in printed humidity sensors

- 5.2.3.2 Growing demand for calibrated humidity sensors for cost-effective applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Sensor design complications due to lack of uniform standards

- 5.2.4.2 Requirement for substantial investments in advanced materials and sophisticated engineering approaches

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE, 2024

- 5.7.2 INDICATIVE PRICING OF HUMIDITY SENSORS, BY TYPE, 2024

- 5.7.3 AVERAGE SELLING PRICE TREND OF HUMIDITY SENSORS, BY REGION, 2021-2024

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Gravimetric humidity sensing

- 5.8.1.2 Nanomaterial-based sensors

- 5.8.1.3 Flexible electronics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Calibration technologies

- 5.8.2.2 Wireless communication modules

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Environmental simulation chambers

- 5.8.1 KEY TECHNOLOGIES

- 5.9 IMPACT OF AI/GEN AI ON HUMIDITY SENSOR MARKET

- 5.9.1 INTRODUCTION

- 5.9.2 TOP USE CASES OF AI/GEN AI IN HUMIDITY SENSOR MARKET

- 5.9.2.1 Predictive maintenance

- 5.9.2.2 Quality control in manufacturing

- 5.9.2.3 Early warning systems

- 5.9.2.4 Smart calibration

- 5.9.2.5 Energy efficiency optimization

- 5.9.3 BEST PRACTICES

- 5.9.3.1 Smart agriculture

- 5.9.3.2 Industrial process control

- 5.9.3.3 Healthcare and medical devices

- 5.9.3.4 HVAC and building management

- 5.9.3.5 Food and pharmaceutical storage

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 SIEGFRIED BAHR ADOPTS BINDER KMF 115 CLIMATE CHAMBER FOR PRECISE CLIMATE SIMULATION AND DETAILED MOISTURE ANALYSIS

- 5.12.2 CORRIGAN CORPORATION IMPLEMENTS VAPORDRY TECHNOLOGY TO MAINTAIN PRECISE HUMIDITY LEVELS IN BAKERIES

- 5.12.3 CTS CLIMA TEMPERATUR SYSTEME GMBH INTEGRATES ROTRONIC HIGH-PRECISION SENSORS TO ENHANCE PRODUCT TESTING WITH ENVIRONMENTAL SIMULATION

- 5.12.4 CORRIGAN CORPORATION'S TRIOBREEZE TECHNOLOGY HELPS PREVENT MOLD GROWTH AT CONCRETE TESTING LAB IN CHICAGO METRO AREA

- 5.12.5 EMMI AG USES ROTRONIC HYGROFLEX5 TRANSMITTERS TO MAINTAIN OPTIMAL CHEESE STORAGE CONDITIONS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE 902690)

- 5.13.2 EXPORT SCENARIO (HS CODE 902690)

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS (HS CODE 902690)

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 REGULATIONS

- 5.15 PATENT ANALYSIS

- 5.16 KEY CONFERENCES AND EVENTS, 2025-2026

6 HUMIDITY SENSING TECHNOLOGIES

- 6.1 INTRODUCTION

- 6.2 MEMS-BASED SENSORS

- 6.3 THIN-FILM SENSORS

- 6.4 PRINTED HUMIDITY SENSORS

- 6.5 WIRELESS SENSOR NODES

7 HUMIDITY SENSOR MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 CAPACITIVE

- 7.2.1 HIGH ACCURACY AND LONG-TERM STABILITY TO CONTRIBUTE TO SEGMENTAL GROWTH

- 7.3 RESISTIVE

- 7.3.1 INCREASING ADOPTION OF SMART HVAC SYSTEMS TO FOSTER SEGMENTAL GROWTH

- 7.4 THERMAL

- 7.4.1 OUTSTANDING PERFORMANCE IN EXTREME INDUSTRIAL CONDITIONS TO SPUR DEMAND

- 7.5 OTHER HUMIDITY SENSORS

8 HUMIDITY SENSOR MARKET, BY MEASUREMENT TECHNIQUE

- 8.1 INTRODUCTION

- 8.2 ABSOLUTE

- 8.2.1 REQUIREMENT FOR PRECISION MONITORING IN INDUSTRIAL PROCESSES TO BOOST SEGMENTAL GROWTH

- 8.3 RELATIVE

- 8.3.1 COST-EFFECTIVENESS AND EASE OF INTEGRATION TO ACCELERATE SEGMENTAL GROWTH

9 HUMIDITY SENSOR MARKET, BY END-USE APPLICATION

- 9.1 INTRODUCTION

- 9.2 ENVIRONMENTAL MONITORING

- 9.2.1 GROWING CONCERN ABOUT CLIMATE CHANGE AND AIR QUALITY MANAGEMENT TO AUGMENT SEGMENTAL GROWTH

- 9.2.1.1 Air quality monitoring

- 9.2.1.2 Weather forecasting

- 9.2.1 GROWING CONCERN ABOUT CLIMATE CHANGE AND AIR QUALITY MANAGEMENT TO AUGMENT SEGMENTAL GROWTH

- 9.3 HVAC & CLIMATE CONTROL

- 9.3.1 INCREASING FOCUS ON ENERGY CONSERVATION AND CLIMATE CONTROL IN MANUFACTURING FACILITIES TO DRIVE MARKET

- 9.3.1.1 Residential & commercial

- 9.3.1.2 Industrial

- 9.3.1 INCREASING FOCUS ON ENERGY CONSERVATION AND CLIMATE CONTROL IN MANUFACTURING FACILITIES TO DRIVE MARKET

- 9.4 INDUSTRIAL PROCESS CONTROL

- 9.4.1 RISING EMPHASIS ON PRECISION AND EFFICIENCY IN INDUSTRIES TO FACILITATE SEGMENTAL GROWTH

- 9.4.1.1 Manufacturing & process automation

- 9.4.1.2 Cleanroom & controlled environment monitoring

- 9.4.1 RISING EMPHASIS ON PRECISION AND EFFICIENCY IN INDUSTRIES TO FACILITATE SEGMENTAL GROWTH

- 9.5 CONSUMER ELECTRONICS

- 9.5.1 BURGEONING DEMAND FOR SMART HOME DEVICES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.5.1.1 Wearables

- 9.5.1.2 Smart home devices

- 9.5.1 BURGEONING DEMAND FOR SMART HOME DEVICES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.6 HEALTHCARE & PHARMACEUTICAL

- 9.6.1 RISING NEED TO MAINTAIN STERILE ENVIRONMENTS TO SUPPORT PATIENT RECOVERY TO BOLSTER SEGMENTAL GROWTH

- 9.6.1.1 Cold chain monitoring

- 9.6.1.2 Incubator & hospital environment monitoring

- 9.6.1.3 Sterile environment & cleanroom monitoring

- 9.6.1 RISING NEED TO MAINTAIN STERILE ENVIRONMENTS TO SUPPORT PATIENT RECOVERY TO BOLSTER SEGMENTAL GROWTH

- 9.7 AGRICULTURE

- 9.7.1 INCREASING FOCUS ON REDUCING POST-HARVEST LOSSES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.7.1.1 Greenhouse monitoring

- 9.7.1.2 Crop storage & preservation

- 9.7.1 INCREASING FOCUS ON REDUCING POST-HARVEST LOSSES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.8 AUTOMOTIVE

- 9.8.1 MOUNTING DEMAND FOR SMART VEHICLES AND ADVANCED TECHNOLOGIES TO FUEL SEGMENTAL GROWTH

- 9.8.1.1 Cabin climate control

- 9.8.1.2 Defogging

- 9.8.1.3 Engine management

- 9.8.1 MOUNTING DEMAND FOR SMART VEHICLES AND ADVANCED TECHNOLOGIES TO FUEL SEGMENTAL GROWTH

- 9.9 FOOD & BEVERAGE

- 9.9.1 RISING NEED TO PREVENT MOISTURE-RELATED SPOILAGE TO ACCELERATE SEGMENTAL GROWTH

- 9.9.1.1 Cold storage & freezers

- 9.9.1.2 Processing & packaging quality control

- 9.9.1 RISING NEED TO PREVENT MOISTURE-RELATED SPOILAGE TO ACCELERATE SEGMENTAL GROWTH

- 9.10 BUILDING & CONSTRUCTION

- 9.10.1 GROWING FOCUS ON INDOOR AIR QUALITY MONITORING TO BOOST SEGMENTAL GROWTH

- 9.10.1.1 Indoor air quality monitoring

- 9.10.1.2 Smart building climate control

- 9.10.1 GROWING FOCUS ON INDOOR AIR QUALITY MONITORING TO BOOST SEGMENTAL GROWTH

- 9.11 LOGISTICS & SUPPLY CHAIN

- 9.11.1 RISING NEED TO ENSURE OPTIMAL CONDITIONS FOR TEMPERATURE-SENSITIVE PRODUCTS TO SPUR DEMAND

- 9.11.1.1 Cold chain transportation & monitoring

- 9.11.1.2 Perishable goods storage & transport

- 9.11.1 RISING NEED TO ENSURE OPTIMAL CONDITIONS FOR TEMPERATURE-SENSITIVE PRODUCTS TO SPUR DEMAND

10 HUMIDITY SENSOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rapid technological advances and industrial development to foster market growth

- 10.2.3 CANADA

- 10.2.3.1 Rising implementation of stringent energy efficiency regulations to drive market

- 10.2.4 MEXICO

- 10.2.4.1 Increasing vehicle manufacturing and export activities to contribute to market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Growing emphasis on complying with medical guidelines and regulations to augment market growth

- 10.3.3 GERMANY

- 10.3.3.1 Rising implementation of smart HVAC systems to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Increasing deployment of smart building technologies to fuel market growth

- 10.3.5 NORDICS

- 10.3.5.1 Growing focus on sustainable farming practices to augment market growth

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rising consumer electronics manufacturing to boost market growth

- 10.4.3 JAPAN

- 10.4.3.1 Increasing focus on optimizing irrigation practices and reducing water usage to foster market growth

- 10.4.4 INDIA

- 10.4.4.1 Mounting demand for energy-efficient solutions to bolster market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Rising adoption of precision farming technologies to accelerate market growth

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Rapid industrialization and technological advances to fuel market growth

- 10.5.3.2 GCC countries

- 10.5.3.3 Rest of Middle East

- 10.5.4 AFRICA

- 10.5.4.1 Increasing need for effective environmental monitoring solutions to boost market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Type footprint

- 11.7.5.4 Measurement technique footprint

- 11.7.5.5 End-use application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- 12.1.1 AMPHENOL ADVANCED SENSORS

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths/Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses/Competitive threats

- 12.1.2 HONEYWELL INTERNATIONAL INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 TEXAS INSTRUMENTS INCORPORATED

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 SETRA SYSTEMS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 SENSIRION AG

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 TE CONNECTIVITY

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 SIEMENS

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.8 TERACOM

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.9 BOSCH SENSORTEC GMBH

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 SCHNEIDER ELECTRIC

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.11 RENESAS ELECTRONICS CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.1 AMPHENOL ADVANCED SENSORS

- 12.2 OTHER PLAYERS

- 12.2.1 B+B THERMO-TECHNIK GMBH

- 12.2.2 E+E ELEKTRONIK GES.M.B.H.

- 12.2.3 IST AG

- 12.2.4 HUNAN RIKA ELECTRONIC TECH CO.,LTD

- 12.2.5 DICKSON

- 12.2.6 GALLTEC MESS- UND REGELTECHNIK GMBH

- 12.2.7 PCE HOLDING GMBH

- 12.2.8 SETRA SYSTEMS

- 12.2.9 SUNSUI PROCESS SYSTEM

- 12.2.10 PRESSAC COMMUNICATIONS LIMITED

- 12.2.11 SMART FOG

- 12.2.12 WINSEN

- 12.2.13 KELE PRECISION MANUFACTURING

- 12.2.14 RAYSTEK PROCESS INSTRUMENTS

- 12.2.15 AHLBORN

- 12.2.16 SHANDONG RENKE CONTROL TECHNOLOGY CO.,LTD.

- 12.2.17 AVTECH SOFTWARE, INC.

- 12.2.18 NOVOSENSE

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS