|

|

市場調査レポート

商品コード

1746666

日本のタイヤ市場の分析:設計別、最終用途別、車種別、流通チャネル別、季節別、地域別(2025~2033年)Japan Tire Market Report by Design, End Use, Vehicle Type (Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road ), Distribution Channel, Season, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 日本のタイヤ市場の分析:設計別、最終用途別、車種別、流通チャネル別、季節別、地域別(2025~2033年) |

|

出版日: 2025年06月02日

発行: IMARC

ページ情報: 英文 120 Pages

納期: 5~7営業日

|

全表示

- 概要

- 目次

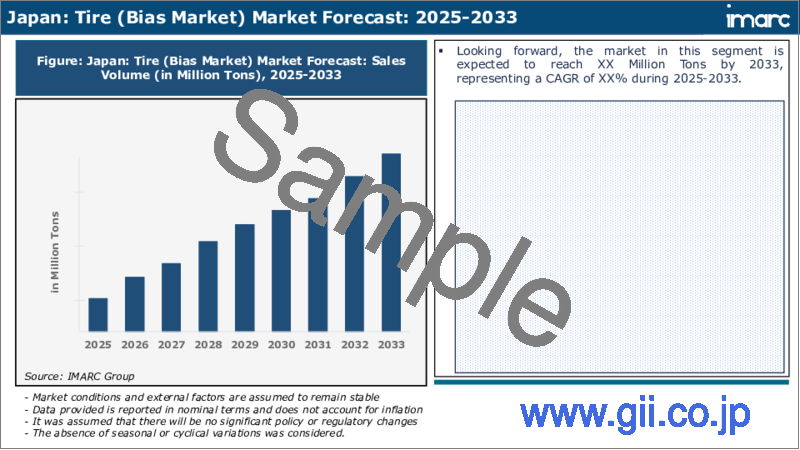

日本のタイヤ市場規模は2024年に110万トンに達しました。IMARCグループは、2033年には140万トンに達し、2025~2033年の成長率(CAGR)は2.1%になると予測しています。快適な運転体験に対する需要の高まり、安全機能を備えた最新車両の採用増加、電気自動車(EV)の台数増加が市場を牽引する主な要因のひとつです。

当レポートで扱う主な質問

- 日本のタイヤ市場はこれまでどのように推移し、今後どのように推移するのか?

- COVID-19が日本のタイヤ市場に与えた影響は?

- 日本のタイヤ市場の設計別の内訳は?

- 日本のタイヤ市場の最終用途別の内訳は?

- 日本のタイヤ市場の車種別の内訳は?

- 日本のタイヤ市場の流通チャネル別の内訳は?

- 日本のタイヤ市場の季節別の内訳は?

- 日本のタイヤ市場のバリューチェーンにおける各ステージとは?

- 日本のタイヤの主要な促進要因と課題は?

- 日本のタイヤ市場の構造と主要企業は?

- 日本のタイヤ市場における競合の程度は?

目次

第1章 序文

第2章 分析範囲・手法

- 分析目的

- ステークホルダー

- データソース

- 市場推定

- 分析手法

第3章 エグゼクティブサマリー

第4章 日本のタイヤ市場:概要

- 概要

- 市場力学

- 業界動向

- 競合情報

第5章 日本のタイヤ市場の情勢

- 過去・現在の市場動向(2019~2024年)

- 市場予測(2025~2033年)

第6章 日本のタイヤ市場:設計別の内訳

- ラジアル市場

- バイアス市場

第7章 日本のタイヤ市場:最終用途別の内訳

- OEM市場

- 交換市場

第8章 日本のタイヤ市場:車種別の内訳

- 乗用車

- 小型商用車

- 中型・大型商用車

- 二輪車

- 三輪車

- オフロード(OTR)

第9章 日本のタイヤ市場:流通チャネル別の内訳

- オフライン

- オンライン

第10章 日本のタイヤ市場:季節別の内訳

- オールシーズンタイヤ

- 冬用タイヤ

- 夏用タイヤ

第11章 日本のタイヤ市場:競合情勢

- 概要

- 市場構造

- 市場企業のポジショニング

- 主要な成功戦略

- 競合ダッシュボード

- 企業評価象限

第12章 主要企業のプロファイル

第13章 日本のタイヤ市場:業界分析

- 促進要因・抑制要因・機会

- ポーターのファイブフォース分析

- バリューチェーン分析

第14章 付録

Japan tire market size reached 1.1 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 1.4 Million Tons by 2033, exhibiting a growth rate (CAGR) of 2.1% during 2025-2033. The growing demand for a comfortable driving experience, increasing adoption of modern vehicles that are equipped with safety features, and rising number of electric vehicles (EVs) represent some of the key factors driving the market.

A tire is a crucial component that provides the necessary traction and support to vehicles and allows them to move efficiently and safely on roads. It is manufactured from rubber compounds, fabric or cord, steel belts, inner liner, tread compound, beads, filler materials, and chemical adhesives. It is widely available in all season, winter, summer, all-terrain, performance, mud-terrain, run-flat, and touring tires. It has cylindrical structures and is fitted onto the wheels of automobiles, serving as the point of contact between the vehicle and the road surface. It is designed to endure various road conditions, temperatures, and loads while offering optimal grip and performance. It is crucial for maintaining control during acceleration, braking, and cornering. It plays a vital role in ensuring vehicle stability, maneuverability, and overall road safety. It absorbs shocks and impacts from uneven road surfaces, potholes, and obstacles while providing a smoother and more comfortable ride to passengers. It assists in enhancing the stability of a vehicle, reducing body roll, and maintaining overall control during driving. It aids in lowering the risks of accidents and reducing road noise inside the vehicle while offering a more peaceful and comfortable driving environment. As it is beneficial in minimizing rolling resistance and improving fuel efficiency, the demand for tire is rising in Japan.

Japan Tire Market Trends:

At present, the increasing utilization of high-quality tires that reduce the frequency of replacements represents one of the major factors supporting the growth of the market in Japan. Additionally, there is a rise in the demand for tires with low rolling resistance to maintain fuel efficiency. This, coupled with increasing preferences for eco-friendly tires that reduce carbon emissions and contribute to a greener and more sustainable driving experience, is bolstering the market growth in Japan. Apart from this, the growing adoption of tires on account of the rising number of electric vehicles (EVs) is positively influencing the market in the country. In addition, advancements in tire technology, including run-flat tires, self-inflating tires, and smart tire monitoring systems, are contributing to the market growth in Japan. In line with this, the growing demand for tire replacements in rental fleets due to the thriving tourism sector, along with the increasing need for specialized winter tires during colder months, is offering a positive market outlook. Moreover, the wide availability of tires through online and offline distribution channels is providing lucrative growth opportunities to industry investors. Besides this, the rising adoption of modern vehicles that are equipped with safety features like anti-lock braking system (ABS) and electronic stability control (ESC) that rely on tire performance for optimal functionality, is strengthening the market growth in the country.

Japan Tire Market Segmentation:

Design Insights:

- Radial Market

- Bias Market

End Use Insights:

- OEM Market

- Replacement Market

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

Distribution Channel Insights:

- Offline

- Online

Season Insights:

- All Season Tires

- Winter Tires

- Summer Tires

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Key Questions Answered in This Report:

- How has the Japan tire market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan tire market?

- What is the breakup of the Japan tire market on the basis of design?

- What is the breakup of the Japan tire market on the basis of end use?

- What is the breakup of the Japan tire market on the basis of vehicle type?

- What is the breakup of the Japan tire market on the basis of distribution channel?

- What is the breakup of the Japan tire market on the basis of season?

- What are the various stages in the value chain of the Japan tire market?

- What are the key driving factors and challenges in the Japan tire?

- What is the structure of the Japan tire market and who are the key players?

- What is the degree of competition in the Japan tire market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Japan Tire Market - Introduction

- 4.1 Overview

- 4.2 Market Dynamics

- 4.3 Industry Trends

- 4.4 Competitive Intelligence

5 Japan Tire Market Landscape

- 5.1 Historical and Current Market Trends (2019-2024)

- 5.2 Market Forecast (2025-2033)

6 Japan Tire Market - Breakup by Design

- 6.1 Radial Market

- 6.1.1 Overview

- 6.1.2 Historical and Current Market Trends (2019-2024)

- 6.1.3 Market Forecast (2025-2033)

- 6.2 Bias Market

- 6.2.1 Overview

- 6.2.2 Historical and Current Market Trends (2019-2024)

- 6.2.3 Market Forecast (2025-2033)

7 Japan Tire Market - Breakup by End Use

- 7.1 OEM Market

- 7.1.1 Overview

- 7.1.2 Historical and Current Market Trends (2019-2024)

- 7.1.3 Market Forecast (2025-2033)

- 7.2 Replacement Market

- 7.2.1 Overview

- 7.2.2 Historical and Current Market Trends (2019-2024)

- 7.2.3 Market Forecast (2025-2033)

8 Japan Tire Market - Breakup by Vehicle Type

- 8.1 Passenger Cars

- 8.1.1 Overview

- 8.1.2 Historical and Current Market Trends (2019-2024)

- 8.1.3 Market Forecast (2025-2033)

- 8.2 Light Commercial Vehicles

- 8.2.1 Overview

- 8.2.2 Historical and Current Market Trends (2019-2024)

- 8.2.3 Market Forecast (2025-2033)

- 8.3 Medium and Heavy Commercial Vehicles

- 8.3.1 Overview

- 8.3.2 Historical and Current Market Trends (2019-2024)

- 8.3.3 Market Forecast (2025-2033)

- 8.4 Two Wheelers

- 8.4.1 Overview

- 8.4.2 Historical and Current Market Trends (2019-2024)

- 8.4.3 Market Forecast (2025-2033)

- 8.5 Three Wheelers

- 8.5.1 Overview

- 8.5.2 Historical and Current Market Trends (2019-2024)

- 8.5.3 Market Forecast (2025-2033)

- 8.6 Off-The-Road (OTR)

- 8.6.1 Overview

- 8.6.2 Historical and Current Market Trends (2019-2024)

- 8.6.3 Market Forecast (2025-2033)

9 Japan Tire Market - Breakup by Distribution Channel

- 9.1 Offline

- 9.1.1 Overview

- 9.1.2 Historical and Current Market Trends (2019-2024)

- 9.1.3 Market Forecast (2025-2033)

- 9.2 Online

- 9.2.1 Overview

- 9.2.2 Historical and Current Market Trends (2019-2024)

- 9.2.3 Market Forecast (2025-2033)

10 Japan Tire Market - Breakup by Season

- 10.1 All Season Tires

- 10.1.1 Overview

- 10.1.2 Historical and Current Market Trends (2019-2024)

- 10.1.3 Market Forecast (2025-2033)

- 10.2 Winter Tires

- 10.2.1 Overview

- 10.2.2 Historical and Current Market Trends (2019-2024)

- 10.2.3 Market Forecast (2025-2033)

- 10.3 Summer Tires

- 10.3.1 Overview

- 10.3.2 Historical and Current Market Trends (2019-2024)

- 10.3.3 Market Forecast (2025-2033)

11 Japan Tire Market - Competitive Landscape

- 11.1 Overview

- 11.2 Market Structure

- 11.3 Market Player Positioning

- 11.4 Top Winning Strategies

- 11.5 Competitive Dashboard

- 11.6 Company Evaluation Quadrant

12 Profiles of Key Players

- 12.1 Company A

- 12.1.1 Business Overview

- 12.1.2 Product Portfolio

- 12.1.3 Business Strategies

- 12.1.4 SWOT Analysis

- 12.1.5 Major News and Events

- 12.2 Company B

- 12.2.1 Business Overview

- 12.2.2 Product Portfolio

- 12.2.3 Business Strategies

- 12.2.4 SWOT Analysis

- 12.2.5 Major News and Events

- 12.3 Company C

- 12.3.1 Business Overview

- 12.3.2 Product Portfolio

- 12.3.3 Business Strategies

- 12.3.4 SWOT Analysis

- 12.3.5 Major News and Events

- 12.4 Company D

- 12.4.1 Business Overview

- 12.4.2 Product Portfolio

- 12.4.3 Business Strategies

- 12.4.4 SWOT Analysis

- 12.4.5 Major News and Events

- 12.5 Company E

- 12.5.1 Business Overview

- 12.5.2 Product Portfolio

- 12.5.3 Business Strategies

- 12.5.4 SWOT Analysis

- 12.5.5 Major News and Events

13 Japan Tire Market - Industry Analysis

- 13.1 Drivers, Restraints, and Opportunities

- 13.1.1 Overview

- 13.1.2 Drivers

- 13.1.3 Restraints

- 13.1.4 Opportunities

- 13.2 Porters Five Forces Analysis

- 13.2.1 Overview

- 13.2.2 Bargaining Power of Buyers

- 13.2.3 Bargaining Power of Suppliers

- 13.2.4 Degree of Competition

- 13.2.5 Threat of New Entrants

- 13.2.6 Threat of Substitutes

- 13.3 Value Chain Analysis