|

|

市場調査レポート

商品コード

1801150

ポイントオブケア診断の市場規模、シェア、動向、予測:製品タイプ、プラットフォーム、処方形態、エンドユーザー、地域別、2025年~2033年Point-of-Care Diagnostics Market Size, Share, Trends and Forecast by Product Type, Platform, Prescription Mode, End-User, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| ポイントオブケア診断の市場規模、シェア、動向、予測:製品タイプ、プラットフォーム、処方形態、エンドユーザー、地域別、2025年~2033年 |

|

出版日: 2025年08月01日

発行: IMARC

ページ情報: 英文 147 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

ポイントオブケア診断の世界市場規模は2024年に531億1,000万米ドルとなりました。今後、IMARC Groupは、2033年には1,024億米ドルに達し、2025~2033年のCAGRは7.6%になると予測しています。2024年の市場は現在、北米が支配的です。より迅速で利便性の高い診断ソリューションに対する需要の高まり、世界の感染症の流行、技術と小型化の進歩が市場を牽引する主な要因となっています。

世界市場は、効果的な管理のために迅速で正確な診断ソリューションを必要とする慢性疾患や感染症の流行が主な要因となっています。これに加え、緊急時や遠隔地での迅速検査キットに対する需要の高まりが、ポイントオブケア診断の採用を拡大し、ヘルスケアサービスへのアクセスを促進しています。さらに、診断を合理化するためのプロセスにバイオセンサーやマイクロ流体工学などの高度な技術が統合され、効率性と信頼性が向上していることも、市場を後押ししています。さらに、ヘルスケアのインフラストラクチャーが継続的に改善され、タイムリーな介入のために病気の早期発見にますます焦点が当てられていることも、市場の見通しを明るいものにしています。このほか、革新的な診断ソリューションのための研究開発費も、ポイントオブケア技術の成長を後押ししています。また、診断におけるデジタルプラットフォームやコネクティビティに対する需要の高まりは、データ管理を容易にし、結果として患者の転帰全体を改善しています。さらに、腫瘍学、心臓病学、感染症管理などの分野でポイントオブケア診断の応用が増加していることも、この市場の成長を強化しています。

米国は主要地域市場として際立っており、大衆の間で慢性疾患や感染症が増加していることがその要因となっています。また、ホームベースやポータブルの検査機器に対する需要が加速していることも、患者の利便性を高めることでポイントオブケア診断市場を後押ししています。また、診断におけるAIやバイオセンサーなどの先端技術の利用が増加していることで、プロセスが合理化され、精度と効率の向上に役立っています。さらに、技術革新を促進し、あらゆるヘルスケア環境での製品の利用可能性を高める積極的な規制政策が、市場を刺激しています。2024年2月22日現在、FDAのDiagnostic Data Programは、従来の検査室以外で実施された検査から診断データを収集、調和、伝送、分析する革新的な方法の開発を支援することを目的としたイニシアチブを開始しました。これは、公衆衛生の意思決定を改善するために、非検査室ベースのデータストリームと検査室ベースのデータストリームを統合するのに役立ちます。また、NIHのITAPやRADxプログラムのような連邦機関との戦略的協力は、標準化された評価プロトコルやデータ報告メカニズムを開発することにより、在宅検査の認可を促進しています。さらに、ヘルスケアインフラへの投資の増加は、高度な診断ソリューションへのアクセスを大幅に拡大し、市場の成長を促進しています。

ポイントオブケア診断市場動向:

慢性疾患の増加

世界保健機関(WHO)によると、慢性疾患とも呼ばれる非伝染性疾患により、毎年4,100万人が死亡しており、これは世界全体の死亡者数の74%に相当します。同様に、HIVなどの感染症も依然として健康上の大きな課題であり、WHOによれば、2022年には推定3,900万人がHIVに感染し、同年に世界で約130万人がHIVに感染すると推定されています。慢性疾患の世界の増加は、POC診断サービスの需要を促進しています。糖尿病、心血管疾患、呼吸器疾患などの慢性疾患は大衆の間でますます蔓延しつつあり、世界中のヘルスケアシステムに大きな課題を突きつけています。POC診断は、これらの健康合併症の自発的な検出と継続的なモニタリングのための貴重なツールを提供し、タイムリーな介入と効果的な疾病管理を促進します。POC検査の利便性と容易な利用可能性は、特に従来の検査施設へのアクセスが制限されていたり、利用できなかったりする遠隔地や農村部での慢性疾患の管理にさらに貢献します。

様々な技術の進歩

技術革新と統合は、ポイントオブケア診断市場の成長を支える重要な役割を果たしています。小型化、バイオセンサー、コネクティビティにおける取り組みや調査により、様々なスマートでポータブルな診断デバイスやシステムが生み出されています。これらのPOC機器は、従来の検査室ベースの方法ではしばしば実現できなかった幅広い検査を高い精度で行うことができます。また、複数の機器を必要とせず、検査結果を得るまでの所要時間を短縮するために、拡張された検査メニューと統合されていることも多いです。例えば、Huwel Lifesciences社は2023年2月、複数のウイルスを検査できるポータブルRT-PCR装置を開発しました。同社は、この検査にかかる時間は約30分で、血液や消化管サンプルを用いて呼吸器感染症やその他の感染症を特定できると述べています。同様に、アボットは2020年に世界最速の分子POC検査であるID NOWを発売しました。わずか13分でCOVID-19の結果が得られます。この装置は、医院や急患診療所など分散したヘルスケア環境で広く使用されています。2023年5月、ダナハーコーポレーションは、1時間当たり最大215件の検査が可能なDxl 9000 Access Immunoassay Analyzerを発表し、同社のPOC診断サービスを大幅に拡大した。各社はまた、コンパクトなサイズで包括的な検査設備を提供するPOC診断システムの製造も計画しています。市場の主要企業は、ヘルスケア提供に革命をもたらすユニークで信頼性の高い診断ソリューションを提供するために、他の企業とも提携しています。モルビオダイアグノスティックスは2023年にSigTuple社との提携を宣言し、多くのルーチン検査や診断検査用の次世代AI対応ポータブルデバイスを開発します。

高まる個別化医療の重視

大衆の間で個別化医療へのニーズが高まっていることが、市場の成長を後押ししています。米国国立がん研究所(NCI)は、様々な新規薬剤の組み合わせによる小児および成人の治療効果を検証するため、大規模な精密医療がんイニシアチブを立ち上げました。さらに、ヘルスケア部門がより患者中心のアプローチに移行しつつある中、個別化医療の受け入れが患者のニーズに応じた治療計画の作成を促進しています。世界保健機関(WHO)の報告によると、2020年にはあらゆる所得水準で政府の保健医療支出が急増し、世界の保健医療支出は過去最高の9兆ドルに達し、世界GDPの約11%を占めるといいます。このような投資の増加は、精密医療を含む高度なヘルスケアソリューションへの注目の高まりを反映しています。POC診断薬は、正確な疾病の特定とモニタリングに役立つ迅速で的を絞った診断ソリューションを提供するため、この手順において極めて重要な役割を果たしています。POC診断薬は、治療や健康全般に関して患者に安心感を与えるものであり、これが患者から高い支持を得ている理由でもあります。さらに、コリエルライフサイエンス社の調査によると、精密医療は世界の採用の転換期に達していることが確認されています。

目次

第1章 序文

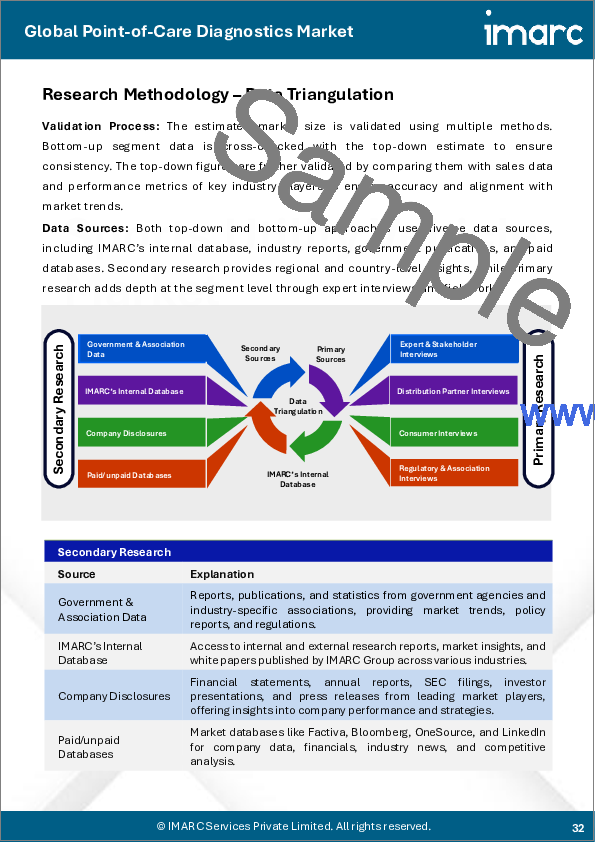

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界のポイントオブケア診断市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:製品タイプ別

- 血糖値モニタリングキット

- 心臓代謝モニタリングキット

- 妊娠・不妊検査キット

- 感染症検査キット

- コレステロール検査ストリップ

- 血液検査キット

- その他

第7章 市場内訳:プラットフォーム別

- ラテラルフローアッセイ

- ディップスティック

- マイクロ流体工学

- 分子診断

- 免疫測定

第8章 市場内訳:処方形態

- 処方箋に基づく検査

- OTC検査

第9章 市場内訳:エンドユーザー別

- 専門診断センター

- ホームケア

- 調査室

- その他

第10章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第11章 SWOT分析

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

第14章 価格指標

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Abbott Laboratories

- Beckman Coulter Inc.

- Becton, Dickinson and Company

- F. Hoffmann-La Roche AG

- Instrumentation Laboratory

- Johnson & Johnson

- Nova Biomedical Corporation

- Pts Diagnostics

- Qiagen

- Siemens

- Trinity Biotech

List of Figures

- Figure 1: Global: Point-of-Care Diagnostics Market: Major Drivers and Challenges

- Figure 2: Global: Point-of-Care Diagnostics Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Point-of-Care Diagnostics Market: Breakup by Product Type (in %), 2024

- Figure 4: Global: Point-of-Care Diagnostics Market: Breakup by Platform (in %), 2024

- Figure 5: Global: Point-of-Care Diagnostics Market: Breakup by Prescription Mode (in %), 2024

- Figure 6: Global: Point-of-Care Diagnostics Market: Breakup by End-User (in %), 2024

- Figure 7: Global: Point-of-Care Diagnostics Market: Breakup by Region (in %), 2024

- Figure 8: Global: Point-of-Care Diagnostics Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 9: Global: Point-of-Care Diagnostics (Blood-Glucose Monitoring Kit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 10: Global: Point-of-Care Diagnostics (Blood-Glucose Monitoring Kit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 11: Global: Point-of-Care Diagnostics (Cardio-Metabolic Monitoring Kit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Point-of-Care Diagnostics (Cardio-Metabolic Monitoring Kit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Point-of-Care Diagnostics (Pregnancy and Fertility Testing Kit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Point-of-Care Diagnostics (Pregnancy and Fertility Testing Kit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Point-of-Care Diagnostics (Infectious Disease Testing Kit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Point-of-Care Diagnostics (Infectious Disease Testing Kit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Point-of-Care Diagnostics (Cholesterol Test Strip) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Point-of-Care Diagnostics (Cholesterol Test Strip) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Point-of-Care Diagnostics (Hematology Testing Kit) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Point-of-Care Diagnostics (Hematology Testing Kit) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Point-of-Care Diagnostics (Other Product Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Point-of-Care Diagnostics (Other Product Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Point-of-Care Diagnostics (Lateral Flow Assays) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Point-of-Care Diagnostics (Lateral Flow Assays) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Point-of-Care Diagnostics (Dipsticks) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Point-of-Care Diagnostics (Dipsticks) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Point-of-Care Diagnostics (Microfluidics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Point-of-Care Diagnostics (Microfluidics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Point-of-Care Diagnostics (Molecular Diagnostics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Point-of-Care Diagnostics (Molecular Diagnostics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Point-of-Care Diagnostics (Immunoassays) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Point-of-Care Diagnostics (Immunoassays) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Point-of-Care Diagnostics (Prescription-Based Testing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Point-of-Care Diagnostics (Prescription-Based Testing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Global: Point-of-Care Diagnostics (OTC Testing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Global: Point-of-Care Diagnostics (OTC Testing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Global: Point-of-Care Diagnostics (Professional Diagnostic Centers) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Global: Point-of-Care Diagnostics (Professional Diagnostic Centers) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Global: Point-of-Care Diagnostics (Home Care) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: Global: Point-of-Care Diagnostics (Home Care) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Global: Point-of-Care Diagnostics (Research Laboratories) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Global: Point-of-Care Diagnostics (Research Laboratories) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Global: Point-of-Care Diagnostics (Other End-Users) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Global: Point-of-Care Diagnostics (Other End-Users) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: North America: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: North America: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: United States: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: United States: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Canada: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: Canada: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: Asia Pacific: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: Asia Pacific: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: China: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 54: China: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 55: Japan: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 56: Japan: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 57: India: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 58: India: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 59: South Korea: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 60: South Korea: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 61: Australia: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 62: Australia: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 63: Indonesia: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 64: Indonesia: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 65: Others: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 66: Others: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 67: Europe: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 68: Europe: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 69: Germany: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 70: Germany: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 71: France: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 72: France: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 73: United Kingdom: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 74: United Kingdom: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 75: Italy: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 76: Italy: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 77: Spain: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 78: Spain: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 79: Russia: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 80: Russia: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 81: Others: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 82: Others: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 83: Latin America: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 84: Latin America: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 85: Brazil: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 86: Brazil: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 87: Mexico: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 88: Mexico: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 89: Others: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 90: Others: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 91: Middle East and Africa: Point-of-Care Diagnostics Market: Sales Value (in Million USD), 2019 & 2024

- Figure 92: Middle East and Africa: Point-of-Care Diagnostics Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 93: Global: Point-of-Care Diagnostics Industry: SWOT Analysis

- Figure 94: Global: Point-of-Care Diagnostics Industry: Value Chain Analysis

- Figure 95: Global: Point-of-Care Diagnostics Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Point-of-Care Diagnostics Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Point-of-Care Diagnostics Market Forecast: Breakup by Product Type (in Million USD), 2025-2033

- Table 3: Global: Point-of-Care Diagnostics Market Forecast: Breakup by Platform (in Million USD), 2025-2033

- Table 4: Global: Point-of-Care Diagnostics Market Forecast: Breakup by Prescription Mode (in Million USD), 2025-2033

- Table 5: Global: Point-of-Care Diagnostics Market Forecast: Breakup by End-User (in Million USD), 2025-2033

- Table 6: Global: Point-of-Care Diagnostics Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 7: Global: Point-of-Care Diagnostics Market: Competitive Structure

- Table 8: Global: Point-of-Care Diagnostics Market: Key Players

The global point-of-care diagnostics market size was valued at USD 53.11 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 102.4 Billion by 2033, exhibiting a CAGR of 7.6% during 2025-2033. North America currently dominates the market in 2024. The increasing demand for faster and more convenient diagnostic solutions, rising prevalence of infectious diseases across the globe, and advancements in technology and miniaturization represent some of the key factors driving the market.

The global market is majorly driven by the prevalence of chronic and infectious diseases requiring faster and accurate diagnostic solutions for effective management. In addition to this, increasing demand for rapid testing kits in emergency and remote settings is augmenting the adoption of point-of-care diagnostics, thereby promoting the accessibility of healthcare services. Furthermore, the integration of sophisticated technologies, including biosensors and microfluidics, into the processes for streamlining diagnosis, resulting in increased efficiency and reliability, is propelling the market. Moreover, continual improvements the healthcare infrastructure, along with an increasing focus on early detection of diseases for timely intervention, are creating a positive market outlook. Besides this, research and development (R&D) expenditures for innovative diagnostic solutions are encouraging the growth in point-of-care technologies. The increasing demand for digital platforms and connectivity in diagnostics is also making it easier to manage data and consequently improving overall outcomes for the patient. Furthermore, the increased applications of point-of-care diagnostics in such areas as oncology, cardiology, and infectious disease management have strengthened the growth of this market.

The United States stands out as a key regional market, driven by the increasing prevalence of chronic and infectious diseases among the masses. Besides, the accelerating demand for home-based and portable testing devices is also propelling the point-of-care diagnostics market by facilitating greater patient convenience. Also, the increasing usage of advanced technologies such as AI and biosensors in diagnostics has streamlined the process and helped in better accuracy and efficiency, which is creating lucrative opportunities in the market. In addition, positive regulatory policies driving innovation and increasing the availability of products in all healthcare settings is impelling the market. As of February 22, 2024, the FDA's Diagnostic Data Program launched an initiative that aimed to support the development of innovative methods for collecting, harmonizing, transmitting, and analyzing diagnostic data from tests performed outside traditional laboratories. This will help integrate non-laboratory-based data streams with lab-based ones to improve public health decision-making. Also, strategic collaborations with federal agencies, such as NIH's ITAP and RADx programs, are facilitating the authorization of at-home tests by developing standardized evaluation protocols and data reporting mechanisms. Furthermore, increased investments in healthcare infrastructure is significantly expanding access to sophisticated diagnostic solutions, which is driving market growth.

Point-of-Care Diagnostics Market Trends:

The Growing Prevalence of Chronic Diseases

According to the World Health Organization (WHO), non-communicable diseases, also called chronic diseases, kills 41 million people each year, which is equivalent to 74% of all deaths globally. Similarly, infectious diseases such as HIV remain a major health challenge, with an estimated 39.0 million people living with HIV in 2022 and approximately 1.3 million acquiring the infection globally that year, according to WHO. The global rise in chronic diseases is driving the demand for POC diagnostic services. Chronic conditions, such as diabetes, cardiovascular diseases, and respiratory disorders, are becoming increasingly prevalent among the masses, posing substantial challenges to healthcare systems worldwide. POC diagnostics offer a valuable tool for spontaneous detection and continuous monitoring of these health complications, facilitating timely interventions and effective disease management. The convenience and easy availability of POC testing further contributes to the management of chronic diseases, especially in remote or rural areas where access to traditional laboratory facilities is limited or not available.

Various Technological Advancements

Technological innovations and integration play a crucial role in supporting the point-of-care diagnostics market growth. Initiatives and research in miniaturization, biosensors, and connectivity are leading to the creation of various smart and portable diagnostic devices and systems. These POC devices can perform a wide range of tests with high accuracy, which traditional laboratory-based methods often fail to deliver. They are also often integrated with expanded test menus to eliminate the need for multiple devices and reduce turnaround time for getting the test results. For instance, in February 2023, Huwel Lifesciences developed a portable RT-PCR device that can test multiple viruses. The company stated the test takes about 30 minutes and can identify respiratory and other infections using blood and gastrointestinal samples. Similarly, Abbott launched ID NOW in 2020, which is the world's fastest molecular POC test. It delivers COVID-19 results in just 13 minutes. This device is widely used in dispersed healthcare settings such as doctor's offices and urgent care clinics. In May 2023, Danaher Corporation introduced the Dxl 9000 Access Immunoassay Analyzer, capable of running up to 215 tests per hour, significantly expanding the company's POC diagnostics offerings. Companies are also planning to produce POC diagnostics systems which are compact in size and offer comprehensive testing facilities. Key market players are also collaborating with other firms to offer unique and reliable diagnostic solutions to revolutionize healthcare delivery. Molbio Diagnostics declared its partnership with SigTuple in 2023 to develop next-generation AI-enabled portable devices for many routine and diagnostic tests.

The Growing Emphasis on Personalized Medicine

The increasing need for personalized medicine among the masses is propelling the growth of the market. The National Cancer Institute (NCI) has launched a large precision medicine cancer initiative to examine the effectiveness of treating children and adults with various novel drug combinations. Moreover, as the healthcare sector is transitioning towards a more patient-centric approach, the acceptance of personalized medicine is facilitating the creation of treatment plans according to the needs of patients. The World Health Organization (WHO) reported that sharp increases in government spending on health at all income levels in 2020 underpinned a rise in global health expenditure to a new high of USD 9 Trillion, accounting for approximately 11% of global GDP. This increase in investment reflects the growing focus on advanced healthcare solutions, including precision medicine. POC diagnostics play a pivotal part in this procedure as it offers rapid and targeted diagnostic solutions that aid in precise disease identification and monitoring. They provide a sense of assurance to patients regarding their treatment and overall wellbeing, which is also responsible for their high acceptance among patients. Moreover, according to research done by Coriell Life Sciences, it is confirmed that precision medicine has reached a global tipping position for adoption.

Point-of-Care Diagnostics Industry Segmentation:

Analysis by Product Type:

- Blood-Glucose Monitoring Kit

- Cardio-Metabolic Monitoring Kit

- Pregnancy and Fertility Testing Kit

- Infectious Disease Testing Kit

- Cholesterol Test Strip

- Hematology Testing Kit

- Others

Blood- glucose monitoring kit leads the market in 2024. Blood-glucose monitoring kits are designed to be user-friendly, allowing patients to perform tests themselves without the need for specialized medical training. The simplicity and convenience of these kits are contributing to their widespread adoption, making them accessible to a broad spectrum of patients, including those in remote or underserved areas. Moreover, blood-glucose monitoring kits are often compact and portable, enabling patients to carry them wherever they go, thereby offering a favorable point-of-care diagnostics market outlook. Furthermore, based on the predictions and research by the Institute for Health Metrics and Evaluation, global diabetes cases will increase from 529 million to 1.3 billion by 2050. The US Food and Drug Administration cleared the first over the counter (OTC) continuous glucose monitoring system (CGM) in the US -- the Dexcom Stelo Glucose Biosensor System. This will help people with Type 2 diabetes who don't need insulin to track their blood sugar for nonmedical purposes.

Analysis by Platform:

- Lateral Flow Assays

- Dipsticks

- Microfluidics

- Molecular Diagnostics

- Immunoassays

Lateral flow assays lead the market in 2024. Lateral flow assays are known for their simplicity and user-friendly design. They are easy to use, requiring minimal training for both healthcare professionals and patients. The test procedure typically involves incorporating a sample such as blood, saliva, and urine to a test strip, and the results are visually interpreted through the appearance of colored lines, eliminating the need for complex laboratory equipment. They offer stability over a wide range of environmental conditions and have a long shelf life. They also require a small sample volume to conduct tests. As a result, various organizations and institutions are investing in the development of advanced lateral flow assays. For instance, iiCON announced in 2021 that it will support Liverpool SME to develop advanced lateral flow tests, which can be performed with and without the addition of the Nano Biosols reagent.

Analysis by Prescription Mode:

- Prescription-Based Testing

- OTC Testing

Prescription-based testing leads the market in 2024. Prescription-based testing involves diagnostic tests that require a healthcare professional's order or prescription before they can be performed. These tests often undergo rigorous regulatory approval processes to ensure their safety, efficacy, and accuracy. The involvement of healthcare professionals in prescribing these tests ensures appropriate medical supervision and interpretation of the results, leading to better patient care and treatment decisions. Prescription-based testing is essential for the accurate detection, staging, and monitoring of diseases such as cancer, infectious diseases, cardiovascular disorders, and autoimmune conditions. As per the reports of WHO, over 35 million new cancer cases will arise by 2050. This will further increase the need for prescription-based testing solutions.

Analysis by End-User:

- Professional Diagnostic Centers

- Home Care

- Research Laboratories

- Others

Professional diagnostics centers lead the market in 2024. Professional diagnostic centers offer a wide range of POC diagnostic tests, catering to various medical specialties and healthcare needs. These centers often have advanced equipment and well-trained personnel, allowing them to perform a diverse set of tests, including blood tests, rapid infectious disease testing, urinalysis, pregnancy tests, and more. The availability of comprehensive testing services makes professional diagnostic centers a preferred choice for both patients and healthcare providers. Moreover, professional diagnostic centers are staffed by qualified healthcare professionals, including medical technologists, clinical laboratory scientists, and physicians. For instance, according to a report by the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), from 2008 to 2021, the pharmaceutical sector received the largest share of foreign direct investment, totaling USD 32 Billion. This amount notably surpassed the FDI attracted by the medical devices sector, which stood at USD 20 billion, the biotechnology industry (USD 17 billion), and healthcare (USD 10.8 Billion) subsectors. This further increased the number of professional diagnostic centers providing comprehensive healthcare services.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share. North America has a highly developed healthcare infrastructure with well-established medical facilities, laboratories, and diagnostic centers. The robust healthcare system of the region enables widespread adoption and integration of POC diagnostics into routine medical practice, contributing to their market dominance. Besides this, the high prevalence of chronic diseases, such as diabetes, cardiovascular disorders, and respiratory conditions, is driving the demand for comprehensive testing services. POC diagnostics play a crucial role in the early detection, monitoring, and management of these chronic conditions. For instance, as per a press release by the Centers for Disease Control and Prevention, the number of Americans with diabetes will range between 1 in 3 to 1 in 5 by 2050. This will further increase the demand for point-of-care testing solutions in the region.

Key Regional Takeaways:

United States Point-of-Care Diagnostics Market Analysis

The increasing cancer incidence in the United States is a strong growth factor for the point-of-care diagnostics market in the country. Early detection of cancer improves patient outcomes and the demand for advanced diagnostic solutions is on the rise. According to Cancer.org 2021 data, approximately 1.9 million new cancer cases were diagnosed in the U.S., with 608,570 deaths reported. These alarming statistics call for some innovative diagnostic technologies that should enable timely and accurate disease detection. Moreover, the market leaders have been bringing innovative products due to growing demand for this emerging need. For instance, last October 2022, F. Hoffmann-La Roche Ltd. received its first companion diagnostic, which allows the identification of patients suffering from HER2-low metastatic breast cancer, eligible to receive ENHERTU. This diagnostic breakthrough would mark an important step ahead in cancer care, and it is the role of point-of-care diagnostics that becomes vital in providing patient-specific and targeted solutions. Such innovation will most likely propel the U.S. POC diagnostics market since they respond to the growing need for customized and accurate health care.

Europe Point-of-Care Diagnostics Market Analysis

The increasing prevalence of chronic diseases in Europe is a key growth driver for this region's point-of-care diagnostics market. The International Diabetes Federation (IDF) reports that the prevalence of diabetes in the European region is going to increase by 13%. The number of people afflicted with this disease will reach 61 million by 2045. This growing diabetes burden increases the demand for POC diagnostic solutions to monitor glucose levels and manage the disease effectively. Also, cardiovascular diseases (CVD), which are the cause of death in Europe, also drive the POC diagnostics market. The National Institutes of Health reported that CVD accounts for 45% of all deaths in the region, with over 4 million deaths annually, primarily from coronary heart disease and stroke. With a rising incidence of these conditions, there is a need for prompt, on-site diagnostic solutions to detect early, manage, and monitor. POC diagnostics offer an efficient way to address these healthcare challenges, contributing to the market's growth.

Asia Pacific Point-of-Care Diagnostics Market Analysis

One major driving force for the POC diagnostics market in Asia Pacific is the accelerating patients with chronic diseases. Notably, the OECD 2021 states that, out of 227 million people living with type 2 diabetes in the Asia-Pacific region, close to half remain undiagnosed or without realizing their long-term complications. This increase in trend is leading to an escalating demand for early detection and monitoring and thereby propelling the utilization of POC diagnostics. Additionally, the miniaturized diagnostic models and the measures undertaken in hospitals and clinics to reduce the duration of hospital and clinic stay will further propel the demand for POC devices. Moreover, improving health outcomes require accessible and efficient solutions for diagnostics, especially in rural and underserved areas. Also, the market is also being driven by rapid technological advancements, high prevalence of both chronic and infectious diseases, and continuous efforts by local companies and organizations to improve healthcare access. For instance, in January 2023, Cipla Limited launched Cippoint, a POC device capable of testing a wide range of parameters, including diabetes, cardiac markers, fertility, and infectious diseases. This innovation reflects the growing trend of comprehensive, multi-disease diagnostics in the region, further boosting the adoption of POC technologies.

Latin America Point-of-Care Diagnostics Market Analysis

This market is gaining momentum in Latin America, primarily due to the increase in prevalence of chronic diseases, along with the growth need for early disease diagnosis. The World Cancer Research Fund International reported that nearly 101,703 cancer cases were diagnosed in Mexico in 2022, which points out the growing demand for appropriate and easily accessible diagnostic devices. POC diagnostics are highly important as early detection of a condition, such as cancer or any other dangerous disease, can lead to positive health outcomes and lessen further health burdens. The rising chronic diseases, including diabetes and cardiovascular diseases, have been stimulating the demand for POC devices as it can offer an immediate and cost-effective diagnosis that results in proper and efficient care of these patients. Also, increasing healthcare technologies and an increase in the awareness levels for preventive health are also significant growth-inducing factors for the market across this region.

Middle East and Africa Point-of-Care Diagnostics Market Analysis

The World Heart Federation says that CVD is the leading cause of death in the MENA region, accounting for more than one-third of all deaths or approximately 1.4 million fatalities annually. In 2024, the percentage of CVD deaths varies from country to country in the region, which ranges from 40 percent of total deaths in Oman to 10 percent in Somalia. High prevalence rates of cardiovascular diseases will fuel point-of-care diagnostics growth in Middle East and Africa. POC diagnostics in the management of cardiovascular disease ensure early detection, monitoring, and management of this type of disease, making a timely intervention possible. Growing cardiovascular diseases weigh much on the region. Adoption of POC technologies across the region is likely to gain momentum because of an increasing demand for accessible, rapid, and cost-effective diagnostic solutions. MENA region healthcare systems that have prioritized efficient and preventive care are also going to create an even greater need for POC diagnostics, hence accelerating market growth.

Competitive Landscape:

The competitive landscape of the market comprises a wide variety of players, which comprises established companies, emerging startups, and specialized firms. Major players are focusing significant investment on R&D innovation and development of the latest POC diagnostic solutions. Also, they are placing their emphasis on accuracy, sensitivity, and speed of the tests. Top companies expand the range of analytes and diseases detectable by POC devices. R&D activities also encompass the design of innovative technologies, such as biosensors, microfluidics, and systems that are lab-on-a-chip, in pursuit of improving the performance capabilities of POC diagnostics. In addition, they adjust the designs of their products to meet specific health needs and regulatory requirements in various countries. For instance, the company Cipla expanded its product portfolio with the launch of a point-of-care testing device for different forms of non-communicable diseases and other diseases/health conditions. The point-of-care diagnostics market statistics clearly show a very strong growth trajectory, led by higher demands for rapid testing, new technologies, and increasing attention to decentralized healthcare.

The report provides a comprehensive analysis of the competitive landscape in the point-of-care diagnostics market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- F. Hoffmann-La Roche AG

- Instrumentation Laboratory

- Johnson & Johnson

- Nova Biomedical Corporation

- Pts Diagnostics

- Qiagen

- Siemens

- Trinity Biotech

Key Questions Answered in This Report

- 1.What is point-of-care diagnostics?

- 2.How big is the global point-of-care diagnostics market?

- 3.What is the expected growth rate of the global point-of-care diagnostics market during 2025-2033?

- 4.What are the key factors driving the global point-of-care diagnostics market?

- 5.What is the leading segment of the global point-of-care diagnostics market based on the product type?

- 6.What is the leading segment of the global point-of-care diagnostics market based on platform?

- 7.What is the leading segment of the global point-of-care diagnostics market based on prescription mode?

- 8.What is the leading segment of the global point-of-care diagnostics market based on end-user?

- 9.What are the key regions in the global point-of-care diagnostics market?

- 10.Who are the key players/companies in the global point-of-care diagnostics market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Point-of-Care Diagnostics Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Product Type

- 6.1 Blood-Glucose Monitoring Kit

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Cardio-Metabolic Monitoring Kit

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Pregnancy and Fertility Testing Kit

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Infectious Disease Testing Kit

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Cholesterol Test Strip

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Hematology Testing Kit

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

- 6.7 Others

- 6.7.1 Market Trends

- 6.7.2 Market Forecast

7 Market Breakup by Platform

- 7.1 Lateral Flow Assays

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Dipsticks

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Microfluidics

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Molecular Diagnostics

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Immunoassays

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

8 Market Breakup by Prescription Mode

- 8.1 Prescription-Based Testing

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 OTC Testing

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

9 Market Breakup by End-User

- 9.1 Professional Diagnostic Centers

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Home Care

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Research Laboratories

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Others

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

10 Market Breakup by Region

- 10.1 North America

- 10.1.1 United States

- 10.1.1.1 Market Trends

- 10.1.1.2 Market Forecast

- 10.1.2 Canada

- 10.1.2.1 Market Trends

- 10.1.2.2 Market Forecast

- 10.1.1 United States

- 10.2 Asia Pacific

- 10.2.1 China

- 10.2.1.1 Market Trends

- 10.2.1.2 Market Forecast

- 10.2.2 Japan

- 10.2.2.1 Market Trends

- 10.2.2.2 Market Forecast

- 10.2.3 India

- 10.2.3.1 Market Trends

- 10.2.3.2 Market Forecast

- 10.2.4 South Korea

- 10.2.4.1 Market Trends

- 10.2.4.2 Market Forecast

- 10.2.5 Australia

- 10.2.5.1 Market Trends

- 10.2.5.2 Market Forecast

- 10.2.6 Indonesia

- 10.2.6.1 Market Trends

- 10.2.6.2 Market Forecast

- 10.2.7 Others

- 10.2.7.1 Market Trends

- 10.2.7.2 Market Forecast

- 10.2.1 China

- 10.3 Europe

- 10.3.1 Germany

- 10.3.1.1 Market Trends

- 10.3.1.2 Market Forecast

- 10.3.2 France

- 10.3.2.1 Market Trends

- 10.3.2.2 Market Forecast

- 10.3.3 United Kingdom

- 10.3.3.1 Market Trends

- 10.3.3.2 Market Forecast

- 10.3.4 Italy

- 10.3.4.1 Market Trends

- 10.3.4.2 Market Forecast

- 10.3.5 Spain

- 10.3.5.1 Market Trends

- 10.3.5.2 Market Forecast

- 10.3.6 Russia

- 10.3.6.1 Market Trends

- 10.3.6.2 Market Forecast

- 10.3.7 Others

- 10.3.7.1 Market Trends

- 10.3.7.2 Market Forecast

- 10.3.1 Germany

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.1.1 Market Trends

- 10.4.1.2 Market Forecast

- 10.4.2 Mexico

- 10.4.2.1 Market Trends

- 10.4.2.2 Market Forecast

- 10.4.3 Others

- 10.4.3.1 Market Trends

- 10.4.3.2 Market Forecast

- 10.4.1 Brazil

- 10.5 Middle East and Africa

- 10.5.1 Market Trends

- 10.5.2 Market Breakup by Country

- 10.5.3 Market Forecast

11 SWOT Analysis

- 11.1 Overview

- 11.2 Strengths

- 11.3 Weaknesses

- 11.4 Opportunities

- 11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

- 13.1 Overview

- 13.2 Bargaining Power of Buyers

- 13.3 Bargaining Power of Suppliers

- 13.4 Degree of Competition

- 13.5 Threat of New Entrants

- 13.6 Threat of Substitutes

14 Price Indicators

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 Abbott Laboratories

- 15.3.1.1 Company Overview

- 15.3.1.2 Product Portfolio

- 15.3.1.3 Financials

- 15.3.1.4 SWOT Analysis

- 15.3.2 Beckman Coulter Inc.

- 15.3.2.1 Company Overview

- 15.3.2.2 Product Portfolio

- 15.3.2.3 SWOT Analysis

- 15.3.3 Becton, Dickinson and Company

- 15.3.3.1 Company Overview

- 15.3.3.2 Product Portfolio

- 15.3.3.3 Financials

- 15.3.3.4 SWOT Analysis

- 15.3.4 F. Hoffmann-La Roche AG

- 15.3.4.1 Company Overview

- 15.3.4.2 Product Portfolio

- 15.3.4.3 SWOT Analysis

- 15.3.5 Instrumentation Laboratory

- 15.3.5.1 Company Overview

- 15.3.5.2 Product Portfolio

- 15.3.5.3 SWOT Analysis

- 15.3.6 Johnson & Johnson

- 15.3.6.1 Company Overview

- 15.3.6.2 Product Portfolio

- 15.3.6.3 Financials

- 15.3.6.4 SWOT Analysis

- 15.3.7 Nova Biomedical Corporation

- 15.3.7.1 Company Overview

- 15.3.7.2 Product Portfolio

- 15.3.8 Pts Diagnostics

- 15.3.8.1 Company Overview

- 15.3.8.2 Product Portfolio

- 15.3.9 Qiagen

- 15.3.9.1 Company Overview

- 15.3.9.2 Product Portfolio

- 15.3.9.3 Financials

- 15.3.10 Siemens

- 15.3.10.1 Company Overview

- 15.3.10.2 Product Portfolio

- 15.3.10.3 Financials

- 15.3.10.4 SWOT Analysis

- 15.3.11 Trinity Biotech

- 15.3.11.1 Company Overview

- 15.3.11.2 Product Portfolio

- 15.3.11.3 Financials

- 15.3.11.4 SWOT Analysis

- 15.3.1 Abbott Laboratories