|

|

市場調査レポート

商品コード

1642559

骨移植片・代替物の市場レポート:材料タイプ別、用途別、エンドユーザー別、地域別、2025年~2033年Bone Graft and Substitutes Market Report by Material Type, Application, End User, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 骨移植片・代替物の市場レポート:材料タイプ別、用途別、エンドユーザー別、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界の骨移植片・代替物の市場規模は、2024年に34億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに52億米ドルに達し、2025年から2033年にかけて5%の成長率(CAGR)を示すと予測しています。同市場は、骨関連疾患の増加、移植片材料の急速な技術進歩、整形外科手術の増加、低侵襲(MI)手術手技への選好の高まり、研究開発(R&D)における政府支援イニシアチブの実施などにより、力強い成長を遂げています。

骨移植片・代替物の市場分析:

市場の成長と規模:同市場は、整形外科手術や高度な骨移植材に対する需要の高まり、高齢者人口の増加、急速な技術進歩、骨関連疾患の増加などを背景に、安定した成長を遂げています。

主な市場促進要因:市場成長に影響を与える主な促進要因には、骨・関節疾患の有病率の上昇、移植片材料の進歩、整形外科手術件数の増加、低侵襲手術(MIS)への選好の高まり、政府による支援策の実施などがあります。

主要市場動向:主な市場動向には、従来の移植片における疾病トランスミッションや一貫性に対する懸念から、合成骨移植片や生体適合性骨移植片、細胞ベースのマトリックスを使用する方向へのシフトが進行していることが含まれます。さらに、移植片製造における三次元(3D)プリンティングとナノテクノロジーの統合が市場の成長を後押ししています。

地理的動向:北米は高度なヘルスケア・インフラ、高い医療費、主要な市場企業の存在により市場をリードしています。その他の地域も、医療費の増加やヘルスケア・インフラの改善によって大きな伸びを示しています。

競合情勢:市場の特徴は、研究開発、戦略的M&A、世界展開に注力する主要企業が積極的に関与していることです。さらに、各社は製品の認知度と普及率を高めるため、マーケティングや啓蒙活動に投資しています。

課題と機会:市場は、厳しい規制環境、先端移植片材料の高コスト、特定の移植片の使用に関する倫理的懸念など、さまざまな課題に直面しています。しかし、新興国市場における革新的で効果的な骨移植ソリューションに対する需要の高まりや、個別化された高度な移植材料の開発が、市場成長の新たな機会を生み出しています。

骨移植片・代替物の市場動向:

骨・関節障害の発生率の増加

骨粗鬆症、変形性関節症、脊椎疾患などの骨・関節疾患の有病率の上昇は、市場成長を後押しする主な要因の1つです。これに伴い、脊椎固定術、関節再建術、外傷手術に関連する手術に不可欠であるため、骨移植片・代替物を含む効果的な治療オプションに対する需要の高まりが、市場成長を後押ししています。さらに、関節障害の影響を受けやすい高齢者人口が世界中で増加していることも、市場の成長を後押ししています。これとともに、運動量の減少や栄養不良などのライフスタイル要因による骨・関節障害の罹患率の上昇も市場成長に寄与しています。これに加えて、様々な疾患に対する認識や診断率の高まりによる骨移植片・代替物に対する需要の高まりも、成長を促す要因として作用しています。

急速な技術進歩

骨移植に使用される生体材料の進歩の高まりは、市場の成長を後押しする主な要因です。これに伴い、骨の再生と治癒を効率的に助けるリン酸カルシウムセラミック、生体活性ガラス、各種ポリマーなどの合成材料や生体適合性材料の開発が市場成長を後押ししています。これらの材料には、疾患伝播リスクの低減、安定した品質、特定の臨床ニーズに合わせた材料特性の調整能力など、いくつかの利点があります。さらに、3次元(3D)プリンティングのような先進技術が広く統合され、外科手術の結果を改善しながら患者の解剖学的構造に完全に一致するカスタマイズされた移植片の作成が可能になったことが、市場の成長を促進すると予想されています。これに加えて、骨移植材にナノテクノロジーを急速に活用することで、自然の骨構造をより忠実に模倣し、骨伝導性と生体適合性を向上させることが、市場成長を刺激しています。

整形外科手術の増加

スポーツ外傷や事故の増加、高齢者人口の増加により、世界中で整形外科手術の件数が増加していることが、市場成長を促進する主な要因となっています。さらに、脊椎固定術、四肢救済手術、再建手術などの手術で骨移植片・代替物の利用が増加していることも、市場成長に明るい見通しをもたらしています。これとともに、糖尿病や関節リウマチのような筋骨格系に影響を及ぼす慢性疾患の有病率の上昇による整形外科手術の増加が、市場の成長を後押ししています。これとは別に、新しい手術手技の登場や手術適応の拡大など、整形外科手術の多様化が進んでいることも市場の成長に寄与しています。

低侵襲(MI)手術への選好の高まり

外科的外傷の軽減、入院期間の短縮、回復時間の短縮など、さまざまな利点があることから、患者や外科医の間で低侵襲手術(MIS)への選好が高まっていることが、成長を促す要因として作用しています。さらに、低侵襲手術に適した骨移植製品の開発と採用が、同種移植片、脱灰骨マトリックス、合成移植片の需要を促進し、市場成長を大きく後押ししています。さらに、より精密で効率的な手術を可能にする手術器具や画像技術の急速な進歩も、成長を促す要因として作用しています。これに伴い、手術の効率と成功率を高めるために、骨移植材に適合する特殊なMISツールの開発が市場成長を促進しています。

政府による支援策の実施

骨移植片・代替物の研究開発(R&D)に対する政府機関やヘルスケア組織による支援の増加は、市場成長を促進する主な要因です。これには、革新的な骨移植ソリューションの開発を支援する、資金援助、助成金、新製品および先端製品の規制承認の促進などが含まれます。さらに、技術革新と臨床転帰の改善につながる研究機関と業界プレイヤーの協力関係の高まりが、市場成長の原動力となっています。これに伴い、新製品の有効性と安全性を検証するための臨床試験や研究のためのプラットフォームを提供する官民パートナーシップの高まりが、市場の成長を促進しています。これとは別に、新製品の承認プロセスを合理化し、新製品開発に関連する時間とコストを大幅に削減する政策の実施が、市場の成長に寄与しています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

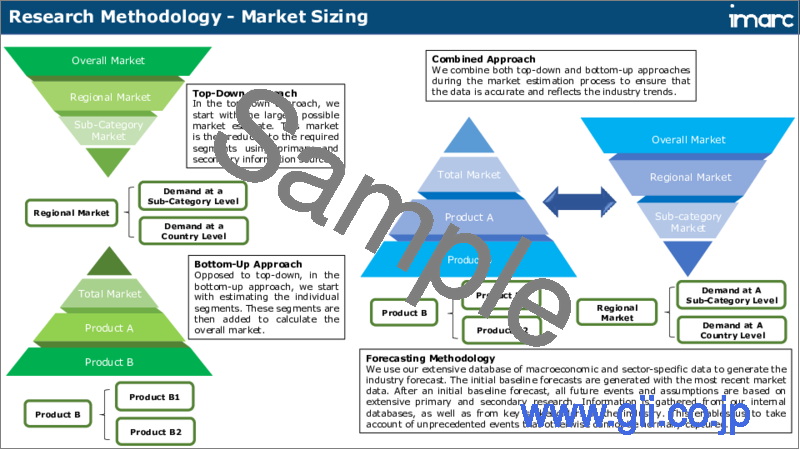

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の骨移植片・代替物市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:材料タイプ別

- 市場内訳:用途別

- 市場内訳:エンドユーザー別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:材料タイプ別

- 同種移植

- 市場動向

- 市場内訳:タイプ別

- 機械加工同種移植

- 市場動向

- 市場予測

- 脱灰骨基質(DBM)

- 市場動向

- 市場予測

- 機械加工同種移植

- 市場予測

- 骨移植代替品

- 市場動向

- 市場内訳:タイプ別

- 骨形成タンパク質(BMP)

- 市場動向

- 市場予測

- 人工骨移植

- 市場動向

- 市場予測

- 骨形成タンパク質(BMP)

- 市場予測

- 細胞ベースのマトリックス

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:用途別

- 脊椎固定術

- 市場動向

- 市場予測

- 外傷

- 市場動向

- 市場予測

- 関節再建

- 市場動向

- 市場予測

- 足・足首

- 市場動向

- 市場予測

- 歯科骨移植

- 市場動向

- 市場予測

- 頭蓋顎顔面

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:エンドユーザー別

- 病院

- 市場動向

- 市場予測

- 外科センター

- 市場動向

- 市場予測

- クリニック

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- 北米

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- アジア太平洋

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Zimmer Biomet Dental

- DePuy Synthes

- Wright Medical Technology

- Medtronic Plc.

- Stryker Corporation

- NuVasive Inc.

- Arthrex Inc.

- Integra LifeSciences

- Baxter International Inc.

- Musculoskeletal Transplant Foundation

- Bacterin International Holdings

- SeaSpine

- LifeNet Health

List of Figures

- Figure 1: Global: Bone Graft and Substitute Market: Major Drivers and Challenges

- Figure 2: Global: Bone Graft and Substitute Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Bone Graft and Substitute Market: Breakup by Material Type (in %), 2024

- Figure 4: Global: Bone Graft and Substitute Market: Breakup by Application (in %), 2024

- Figure 5: Global: Bone Graft and Substitute Market: Breakup by End User (in %), 2024

- Figure 6: Global: Bone Graft and Substitute Market: Breakup by Region (in %), 2024

- Figure 7: Global: Bone Graft and Substitute Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Bone Graft and Substitute Industry: SWOT Analysis

- Figure 9: Global: Bone Graft and Substitute Industry: Value Chain Analysis

- Figure 10: Global: Bone Graft and Substitute Industry: Porter's Five Forces Analysis

- Figure 11: Global: Bone Graft and Substitute (Allografts) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Bone Graft and Substitute (Allografts) Market: Breakup by Type (in %), 2024

- Figure 13: Global: Bone Graft and Substitute (Machined Allografts) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Bone Graft and Substitute (Machined Allografts) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Bone Graft and Substitute (Demineralized Bone Matrix-DBMs) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Bone Graft and Substitute (Demineralized Bone Matrix-DBMs) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Bone Graft and Substitute (Allografts) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Bone Graft and Substitute (Bone Graft Substitutes) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Bone Graft and Substitute (Bone Graft Substitutes) Market: Breakup by Type (in %), 2024

- Figure 20: Global: Bone Graft and Substitute (Bone Morphogenic Proteins-BMPs) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Bone Graft and Substitute (Bone Morphogenic Proteins-BMPs) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Bone Graft and Substitute (Synthetic Bone Grafts) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Bone Graft and Substitute (Synthetic Bone Grafts) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Bone Graft and Substitute (Bone Graft Substitutes) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Bone Graft and Substitute (Cell-Based Matrices) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Bone Graft and Substitute (Cell-Based Matrices) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Bone Graft and Substitute (Other Material Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Bone Graft and Substitute (Other Material Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Bone Graft and Substitute (Spinal Fusion) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Bone Graft and Substitute (Spinal Fusion) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Bone Graft and Substitute (Trauma) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Bone Graft and Substitute (Trauma) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Bone Graft and Substitute (Joint Reconstruction) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Bone Graft and Substitute (Joint Reconstruction) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Global: Bone Graft and Substitute (Foot and Ankle) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Global: Bone Graft and Substitute (Foot and Ankle) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Global: Bone Graft and Substitute (Dental Bone Grafting) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Global: Bone Graft and Substitute (Dental Bone Grafting) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Global: Bone Graft and Substitute (Craniomaxillofacial) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Global: Bone Graft and Substitute (Craniomaxillofacial) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Global: Bone Graft and Substitute (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Global: Bone Graft and Substitute (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Global: Bone Graft and Substitute (Hospitals) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Global: Bone Graft and Substitute (Hospitals) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: Global: Bone Graft and Substitute (Surgical Centres) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: Global: Bone Graft and Substitute (Surgical Centres) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: Global: Bone Graft and Substitute (Clinics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: Global: Bone Graft and Substitute (Clinics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Global: Bone Graft and Substitute (Other End Users) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: Global: Bone Graft and Substitute (Other End Users) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: North America: Bone Graft and Substitute Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: North America: Bone Graft and Substitute Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: Europe: Bone Graft and Substitute Market: Sales Value (in Million USD), 2019 & 2024

- Figure 54: Europe: Bone Graft and Substitute Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 55: Asia Pacific: Bone Graft and Substitute Market: Sales Value (in Million USD), 2019 & 2024

- Figure 56: Asia Pacific: Bone Graft and Substitute Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 57: Middle East and Africa: Bone Graft and Substitute Market: Sales Value (in Million USD), 2019 & 2024

- Figure 58: Middle East and Africa: Bone Graft and Substitute Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 59: Latin America: Bone Graft and Substitute Market: Sales Value (in Million USD), 2019 & 2024

- Figure 60: Latin America: Bone Graft and Substitute Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

- Table 1: Global: Bone Graft and Substitute Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Bone Graft and Substitute Market Forecast: Breakup by Material Type (in Million USD), 2025-2033

- Table 3: Global: Bone Graft and Substitute Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 4: Global: Bone Graft and Substitute Market Forecast: Breakup by End User (in Million USD), 2025-2033

- Table 5: Global: Bone Graft and Substitute Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Bone Graft and Substitute Market: Competitive Structure

- Table 7: Global: Bone Graft and Substitute Market: Key Players

The global bone graft and substitutes market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5% during 2025-2033. The market is experiencing robust growth, driven by the rising incidence of bone-related disorders, rapid technological advancements in graft materials, increasing incidences of orthopedic surgeries, growing preference for minimally invasive (MI) surgical techniques, and the implementation of supportive governmental initiatives in research and development (R&D).

Bone Graft and Substitutes Market Analysis:

Market Growth and Size: The market is witnessing stable growth, driven by the rising demand for orthopedic surgeries and advanced bone graft materials, growing geriatric population, rapid technological advancements, and the increasing incidences of bone-related diseases.

Major Market Drivers: Key drivers influencing the market growth include the rising prevalence of bone and joint disorders, advancements in graft materials, increasing number of orthopedic surgeries, growing preference for minimally invasive surgeries (MIS), and implementation of supportive government initiatives.

Key Market Trends: The key market trends involve the ongoing shift towards using synthetic and biocompatible bone graft substitutes and cell-based matrices due to concerns over disease transmission and consistency in traditional grafts. Additionally, the integration of three-dimensional (3D) printing and nanotechnology in graft manufacturing is bolstering the market growth.

Geographical Trends: North America leads the market due to its advanced healthcare infrastructure, high healthcare spending, and the presence of major key market players. Other regions are also showing significant growth, fueled by increasing healthcare expenditure and improvements in healthcare infrastructure.

Competitive Landscape: The market is characterized by the active involvement of key players who are focusing on research and development (R&D), strategic mergers and acquisitions, and global expansion. Furthermore, companies are investing in marketing and educational efforts to increase product awareness and adoption.

Challenges and Opportunities: The market faces various challenges, such as stringent regulatory environments, high cost of advanced graft materials, and ethical concerns regarding the use of certain grafts. However, growing demand for innovative and effective bone graft solutions in emerging markets and the development of personalized and advanced graft materials are creating new opportunities for the market growth.

Bone Graft and Substitutes Market Trends:

Increasing incidence of bone and joint disorders

The rising prevalence of bone and joint disorders, such as osteoporosis, osteoarthritis, and spinal disorders, is one of the major factors boosting the market growth. In line with this, the growing demand for effective treatment options, including bone grafts and substitutes, as they are crucial in surgeries related to spinal fusions, joint reconstruction, and trauma surgeries, is favoring the market growth. Moreover, the increasing geriatric population across the globe, who are susceptible to joint disorders is propelling the market growth. Along with this, the rising incidence of bone and joint disorders due to lifestyle factors, including reduced physical activity and poor nutrition, is also contributing to the market growth. Besides this, the heightened demand for bone grafts and substitutes due to the growing awareness and diagnosis rates of various conditions is acting as a growth-inducing factor.

Rapid technological advancements

The rising advancements in biomaterials that are used for bone grafting are major factors bolstering the market growth. In line with this, the development of synthetic and biocompatible materials, such as calcium phosphate ceramics, bioactive glasses, and various polymers that efficiently aid in bone regeneration and healing, is providing a thrust to the market growth. They offer several advantages, such as reduced risk of disease transmission, consistent quality, and the ability to tailor the material properties to specific clinical needs. Moreover, the widespread integration of advanced technologies like three-dimensional (3D) printing that enable the creation of customized grafts that perfectly match the patient's anatomy while improving surgical outcomes is anticipated to drive the market growth. Besides this, the rapid utilization of nanotechnology in bone grafting materials to mimic the natural bone structure more closely, offering improved osteoconduction and biocompatibility, is stimulating the market growth.

Increasing cases of orthopedic surgeries

The increasing number of orthopedic surgeries performed across the globe due to the rising prevalence of sports injuries, accidents, and the growing geriatric population, is a major factor propelling the market growth. Moreover, the increasing utilization of bone grafts and substitutes in procedures such as spinal fusion, limb salvage surgeries, and reconstructive surgeries is creating a positive outlook for the market growth. Along with this, the escalation in orthopedic surgeries due to the rising prevalence of chronic diseases that affect the musculoskeletal system, like diabetes and rheumatoid arthritis, is bolstering the market growth. Apart from this, the heightened diversification of orthopedic procedures, including the advent of new surgical techniques and the expansion of surgical indications, are contributing to the market growth.

Growing preference for minimally invasive (MI) surgical procedures

The increasing preference for minimally invasive surgeries (MIS) among patients and surgeons due to its various benefits, such as reduced surgical trauma, shorter hospital stays, and faster recovery times, is acting as a growth-inducing factor. Moreover, the development and adoption of bone grafting products suitable for minimally invasive applications, propelling the demand for allografts, demineralized bone matrices, and synthetic grafts, is providing a considerable boost to the market growth. Additionally, rapid advancements in surgical instruments and imaging technologies, which allow for more precise and efficient surgeries, are acting as a growth-inducing factor. In line with this, the development of specialized MIS tools that are compatible with bone graft materials to enhance the efficiency and success rates of the procedures is fostering the market growth.

Implementation of supportive government initiatives

The increasing support by government bodies and healthcare organizations for research and development (R&D) in bone grafts and substitutes is a major factor fueling the market growth. It includes funding, grants, and facilitation of regulatory approvals for new and advanced products, aiding the development of innovative bone grafting solutions. Moreover, the growing collaboration between research institutions and industry players, leading to technological innovations and improved clinical outcomes, is providing an impetus to the market growth. In line with this, the rising public-private partnerships that provide a platform for clinical trials and studies to validate the efficacy and safety of new products are enhancing the market growth. Apart from this, the imposition of policies that streamline the approval process for new products, significantly reducing the time and cost associated with developing new products, is contributing to the market growth.

Bone Graft and Substitutes Industry Segmentation:

Breakup by Material Type:

Allografts

Machined Allografts

Demineralized Bone Matrix (DBMs)

Bone Graft Substitutes

Bone Morphogenic Proteins (BMPs)

Synthetic Bone Grafts

Cell-based Matrices

Others

Allografts accounts for the majority of the market share

Allografts hold the largest market share as they are extensively used in various orthopedic procedures due to their osteoconductive and osteoinductive properties. They are favored in complex surgeries, such as spinal fusion, due to their ability to mimic natural bone structure and promote new bone growth. Moreover, allografts are available in various forms, including fresh, freeze-dried, and demineralized bone matrices, catering to a wide range of clinical needs. Besides this, the rising preference for allografts due to their effectiveness in facilitating bone healing, thus reducing the risk of patient morbidity associated with autograft harvesting is acting as growth-inducing factors.

Bone graft substitutes comprise synthetic materials or biologically derived products that are used as alternatives to traditional bone grafts. They include ceramics, polymers, and composite materials designed to provide a scaffold for bone growth and reduce the need for autografts or allografts. Moreover, their consistent quality and the elimination of risks related to disease transmission or immune rejection are enhancing the market growth.

Cell-based matrices involve the use of living cells combined with scaffolding materials to promote bone regeneration. They are seeded with a patient's cells or donor cells, making them highly biocompatible and effective in enhancing the bone healing process. Moreover, the widespread integration of stem cell technology and tissue engineering in cell-based matrices is driving the market growth.

Breakup by Application:

Spinal Fusion

Trauma

Joint Reconstruction

Foot and Ankle

Dental Bone Grafting

Craniomaxillofacial

Others

Spinal fusion holds the largest share in the industry

Spinal fusion represents the largest segment in the market, driven by the increasing prevalence of spinal disorders, such as degenerative disc disease, scoliosis, and spinal stenosis. Bone grafts and substitutes are essential in spinal fusion surgeries for facilitating the fusion of two or more vertebrae to stabilize the spine and alleviate pain. Moreover, the effectiveness of bone grafts in promoting bone growth and healing is creating a positive outlook for the market growth. Besides this, the increasing utilization of demineralized bone matrices, along with synthetic bone graft substitutes in spinal fusion surgeries, due to their osteoconductive properties and ability to integrate with the patient's bone, is supporting the market growth.

Trauma surgeries involve the use of bone grafts and substitutes in the treatment of fractures and bone defects resulting from accidents, injuries, or surgeries. They help in supporting bone healing, especially in cases of complex fractures or where bone loss has occurred. Moreover, the continuous development of high-strength and biocompatible graft materials that provide structural support and enhance the natural healing process, is fueling the market growth.

Joint reconstruction surgeries, such as hip or knee replacements, often require bone grafts for better integration of implants and restoration of joint function. They help fill bone voids and promote bone ingrowth around prosthetic components to ensure the stability and longevity of the implants. Furthermore, the increasing incidence of joint disorders and the growing geriatric population are contributing to the market growth.

In foot and ankle surgeries, bone grafts are used for reconstructive procedures, treating deformities, and healing of fractures. Moreover, the growing demand for specific types of grafts that can conform to the complex anatomy of the foot and ankle, providing structural support and promoting bone regeneration, is boosting the market growth. Besides this, the rising number of sports-related injuries and conditions like arthritis are favoring the market growth.

Dental bone grafting utilizes grafts to augment the jawbone and support dental implants, especially in cases of bone loss due to periodontal disease or tooth extraction. Along with this, the growing utilization of dental bone grafts owing to the increasing popularity of dental implants for missing teeth is stimulating the market growth. Besides this, rapid advancements in graft materials that ensure better integration and stability of the implants are enhancing the market growth.

Craniomaxillofacial involves the application of bone grafts in surgeries related to the skull, face, and jaws. They are essential in reconstructive surgeries, trauma recovery, and congenital disability repairs. Moreover, the development of customized graft solutions that can adapt to the complex geometries of facial bones, ensuring functional and aesthetic outcomes, is propelling the market growth.

Breakup by End User:

Hospitals

Surgical Centres

Clinics

Others

Hospitals represents the leading market segment

Hospitals represent the largest segment due to their comprehensive healthcare services, including advanced surgical procedures that require bone grafts and substitutes. Moreover, they are equipped with advanced facilities and a wide range of medical specialties, making them the preferred choice for complex surgeries, such as spinal fusion, joint reconstruction, and trauma-related procedures. Besides this, the widespread availability of skilled surgeons, multidisciplinary teams, and advanced post-operative care in hospitals is contributing to the market growth. Additionally, hospitals have the infrastructure to support the storage and handling of various types of bone grafts, including those that require specific storage conditions.

Surgical centres are known for procedures that require bone grafting but do not necessitate the extensive resources of a hospital. They include certain types of dental bone grafting, minor joint repairs, and some cosmetic and reconstructive surgeries. Moreover, the heightened focus on minimally invasive (MI) techniques, which reduce patient recovery time and resource utilization, is boosting the market growth.

Clinics include specialized orthopedic and dental clinics that cater to specific procedures that involve bone grafting, such as dental implant placement or minor orthopedic corrections. They provide targeted and specialized care in a more personalized and accessible setting. Additionally, the rising growth in specialized clinics, along with advancements in outpatient surgical techniques, is bolstering the market growth.

Breakup by Region:

North America

Europe

Asia Pacific

Middle East and Africa

Latin America

North America leads the market, accounting for the largest bone graft and substitutes market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America holds the largest market share, due to the high prevalence of bone-related disorders, advanced healthcare infrastructure, and the presence of key market players in the region. In line with this, the increasing number of orthopedic procedures, including spinal fusion and joint reconstruction surgeries, driving the demand for bone grafts and substitutes, is boosting the market growth. Additionally, the rising medical research and innovation, with substantial investments in developing advanced graft materials and surgical techniques, is fueling the market growth. Along with this, the increasing healthcare expenditure and the presence of well-established healthcare systems is contributing to the market growth.

The Europe's market for bone graft and substitutes is driven by factors, such as the growing geriatric population, increasing incidences of osteoporosis and other bone-related conditions, and the adoption of advanced medical technologies. Along with this, the well-developed healthcare system and the presence of some of the leading players in the medical device industry, is fueling the market growth.

The Asia Pacific region is experiencing rapid growth in the market, attributed to the increasing healthcare expenditure, growing awareness of advanced medical treatments, and an expanding geriatric population. Moreover, the rising number of orthopedic procedures due to the growing middle class and improvements in healthcare infrastructure, is also acting as growth-inducing factors.

In Latin America, the market for bone graft and substitutes is growing steadily, driven by the gradual improvement in healthcare infrastructure and increasing accessibility to advanced medical treatments. Besides this, the increasing prevalence of chronic diseases that affect bone health, coupled with a growing focus on healthcare modernization, is strengthening the market growth.

The market in the Middle East and Africa is evolving due to the improving healthcare infrastructure and increasing government initiatives to modernize healthcare services. Along with this, the widespread adoption of advanced medical technologies, including bone grafts and substitutes, in the region is creating a positive outlook for the market growth.

Leading Key Players in the Bone Graft and Substitutes Industry:

The major players are engaged in various strategic initiatives to strengthen their market position and respond to the evolving medical needs in orthopedics. They are investing in research and development (R&D) to innovate and improve their product offerings by focusing on developing advanced materials that are more biocompatible, osteoconductive, and osteoinductive. Besides this, the leading firms are emphasizing creating synthetic and hybrid grafts that combine the benefits of natural bone tissue with the versatility and safety of synthetic materials. Moreover, they are expanding their reach through mergers and acquisitions, partnerships with healthcare providers, and collaborations with research institutions to enhance their technological capabilities and market access.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Zimmer Biomet Dental

DePuy Synthes

Wright Medical Technology

Medtronic Plc.

Stryker Corporation

NuVasive Inc.

Arthrex Inc.

Integra LifeSciences

Baxter International Inc.

Musculoskeletal Transplant Foundation

Bacterin International Holdings

SeaSpine

LifeNet Health

Key Questions Answered in This Report

- 1. How big is the global bone graft and substitutes market?

- 2. What is the expected growth rate of the global bone graft and substitutes market during 2025-2033?

- 3. What are the key factors driving the global bone graft and substitutes market?

- 4. What has been the impact of COVID-19 on the global bone graft and substitutes market?

- 5. What is the breakup of the global bone graft and substitutes market based on the material type?

- 6. What is the breakup of the global bone graft and substitutes market based on the application?

- 7. What is the breakup of the global bone graft and substitutes market based on the end user?

- 8. What are the key regions in the global bone graft and substitutes market?

- 9. Who are the key players/companies in the global bone graft and substitutes market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Bone Graft and Substitute Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Material Type

- 5.5 Market Breakup by Application

- 5.6 Market Breakup by End User

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

6 Market Breakup by Material Type

- 6.1 Allografts

- 6.1.1 Market Trends

- 6.1.2 Market Breakup By Type

- 6.1.2.1 Machined Allografts

- 6.1.2.1.1 Market Trends

- 6.1.2.1.2 Market Forecast

- 6.1.2.2 Demineralized Bone Matrix (DBMs)

- 6.1.2.2.1 Market Trends

- 6.1.2.2.2 Market Forecast

- 6.1.2.1 Machined Allografts

- 6.1.3 Market Forecast

- 6.2 Bone Graft Substitutes

- 6.2.1 Market Trends

- 6.2.2 Market Breakup By Type

- 6.2.2.1 Bone Morphogenic Proteins (BMPs)

- 6.2.2.1.1 Market Trends

- 6.2.2.1.2 Market Forecast

- 6.1.2.2 Synthetic Bone Grafts

- 6.2.2.2.1 Market Trends

- 6.2.2.2.2 Market Forecast

- 6.2.2.1 Bone Morphogenic Proteins (BMPs)

- 6.2.3 Market Forecast

- 6.3 Cell-based Matrices

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Others

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Application

- 7.1 Spinal Fusion

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Trauma

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Joint Reconstruction

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Foot and Ankle

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Dental Bone Grafting

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Craniomaxillofacial

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

- 7.7 Others

- 7.7.1 Market Trends

- 7.7.2 Market Forecast

8 Market Breakup by End User

- 8.1 Hospitals

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Surgical Centres

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Clinics

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Others

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Europe

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Asia Pacific

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Middle East and Africa

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Latin America

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Zimmer Biomet Dental

- 14.3.2 DePuy Synthes

- 14.3.3 Wright Medical Technology

- 14.3.4 Medtronic Plc.

- 14.3.5 Stryker Corporation

- 14.3.6 NuVasive Inc.

- 14.3.7 Arthrex Inc.

- 14.3.8 Integra LifeSciences

- 14.3.9 Baxter International Inc.

- 14.3.10 Musculoskeletal Transplant Foundation

- 14.3.11 Bacterin International Holdings

- 14.3.12 SeaSpine

- 14.3.13 LifeNet Health